Robinhood is great for new investors who want an easy-to-use interface and a great mobile experience. However, it’s severely limiting once you pass a certain hurdle of investing competence.

It’s also only available to U.S. investors.

While it isn’t the best long-term solution for building wealth, Robinhood’s app made investing simple and free, which forced many other brokers to follow its example.

You can invest for free on the more robust Robinhood alternatives while still enjoying easy-to-use apps and desktop platforms. It’s the best of both worlds.

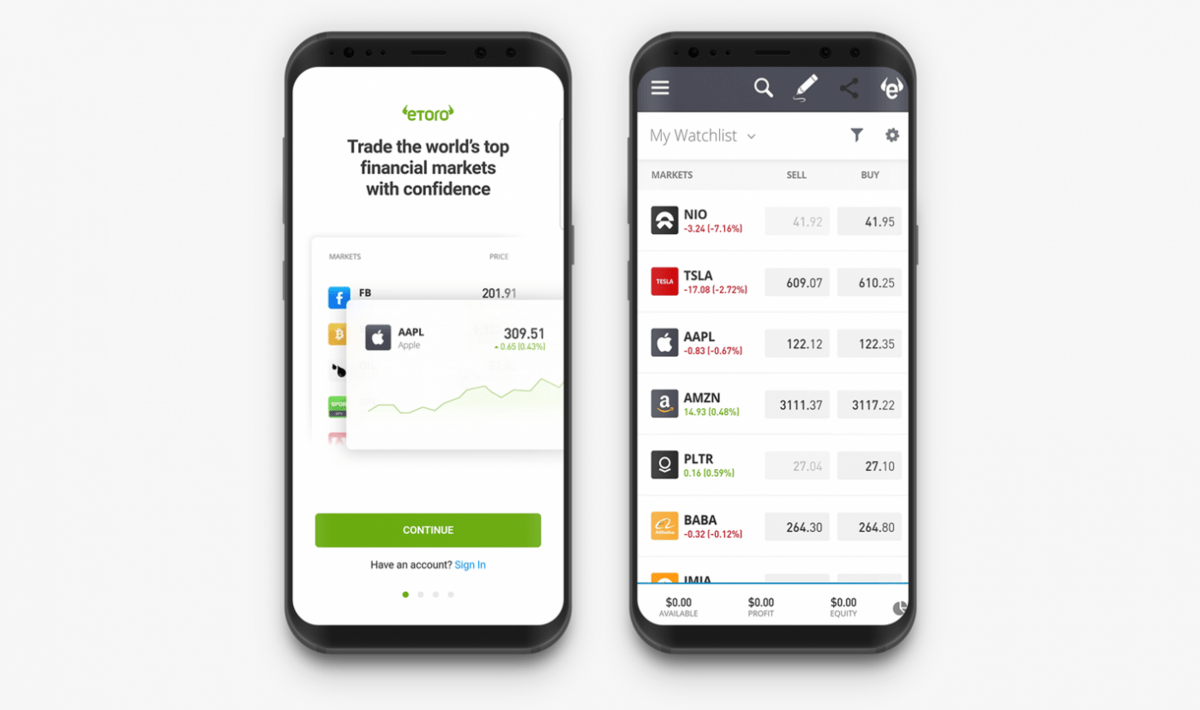

The Best Robinhood Alternative: eToro

Known for its emphasis on social investing, eToro seamlessly combines an investing app with social media, allowing you to learn from, share strategies with, and trade alongside millions of other investors.

Practice trading with a Demo Account or use CopyTrader for vetted trade ideas today on eToro.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Robinhood Overview

Before we dive into Robinhood’s alternatives, let’s quickly cover what Robinhood does best.

Robinhood is the easiest way for beginners to get started investing in stocks, ETFs, cryptocurrencies, and options from their phone. It has a sleek interface which makes its mobile app exceptionally simple to use.

However, it has many limitations.

Robinhood lacks sophisticated tools, retirement accounts, analysis, and asset classes that traders and intermediate – advanced investors need.

You can head over to our Robinhood review to determine if it’s the right platform for you.

Additionally, despite being “on a mission to democratize finance for all”, Robinhood has been known to restrict its users from trading. Most notably, Robinhood restricted trading during the GameStop short squeeze, which resulted in at least 50 federal lawsuits filed against the company.

So, what’s better than Robinhood?

The 7 Best Robinhood Alternatives (7 Better Apps than Robinhood)

1. eToro

eToro vs. Robinhood: eToro is a modern and powerful brokerage and offers a one-of-a-kind social investing experience. It’s also available worldwide.

Who’s it best for: eToro is a more robust version of Robinhood, which is why it’s chosen by over 28.5 million users worldwide.

Pros:

- Commission-free trading for stocks and ETFs

- CopyTrader allows you to copy the trades of more experienced investors

- Virtual portfolio allows you to test your skills risk free

- Mobile and desktop platforms

Cons:

- Slightly more complicated than Robinhood

eToro is best known for its emphasis on social investing, its combination of an investing app with social media. These features allow you to learn from, share strategies with, and trade alongside millions of other investors.

You can practice trading with a Demo Account or use CopyTrader for vetted trade ideas.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

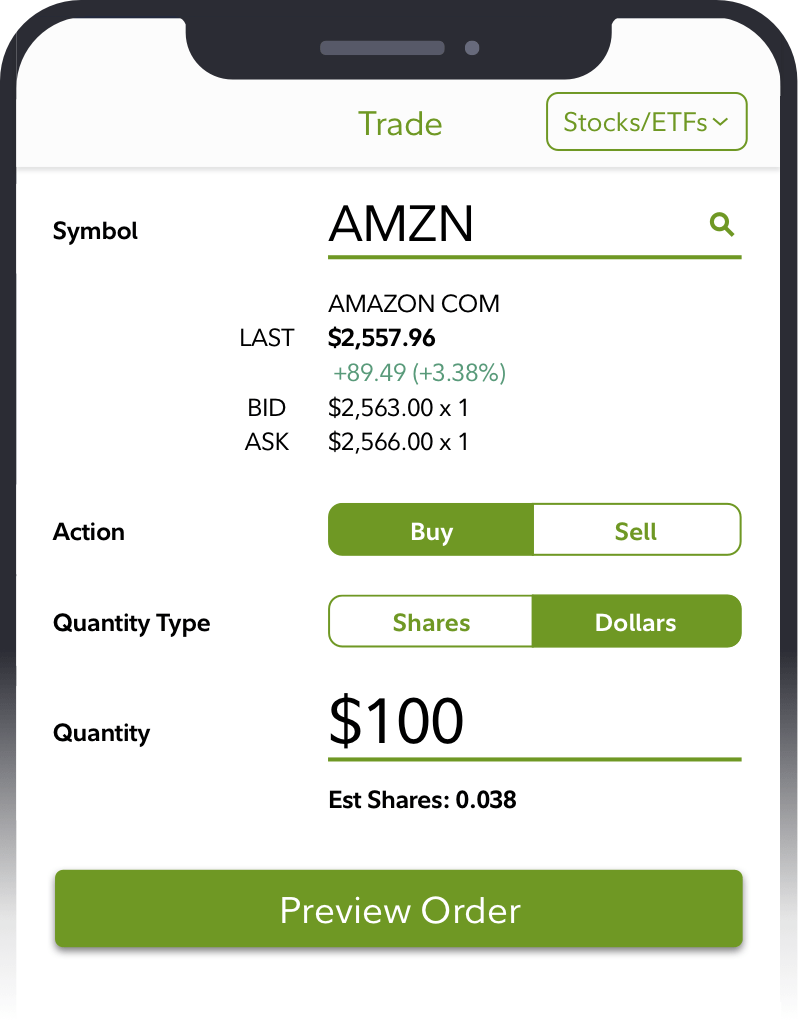

2. Webull

Webull vs. Robinhood: Webull is a stock app like Robinhood but provides more sophisticated trading tools, metrics, and functionality.

Who’s it best for: Webull offers more sophisticated trading tools geared toward intermediate and advanced traders. If your investing style is headed toward active trading, you should switch to Webull.

For a complete overview of the platform, make sure to check out is Webull safe to use?

Pros:

- Free trading for stocks, ETFs, options, ADRs

- Sleek mobile and desktop platforms

- Enhanced trading metrics

Cons:

- Its platform can be overwhelming for beginners

- Lack of educational materials

When it comes to Robinhood alternatives, Webull stands out because of its in-depth tools, especially for traders. It offers news, analysis, and research from sources like NASDAQ, Dow Jones, and Morningstar along with dozens of technical indicators, advanced order tickets, and market data. For a more in-depth comparison, here’s Webull vs Robinhood.

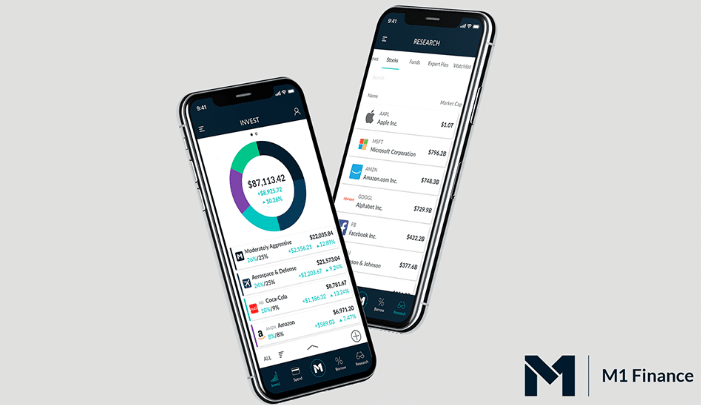

3. M1 Finance

M1 Finance vs. Robinhood: Whereas Robinhood is focused on getting people to start investing, M1 Finance is focused on helping people build long-term wealth.

Who’s it best for: M1 Finance is best for people who want to grow their net worth over the long run. It offers retirement accounts, tax-efficient automations, checking/saving accounts, and more. If Webull is the better Robinhood alternative for traders, M1 Finance is the better alternative for long-term investors.

Pros:

- Offers a wide range of financial tools in addition to investing

- Offers access to IRAs (Traditional, Roth, and SEP) and Trusts

- A high-yield savings account that offers 4.5% APY (launching in 2023)

Cons:

- Not designed for traders

M1 Finance is a holistic money management tool designed to build your long-term wealth. Its approach to investing allows you to focus on long-term returns, instead of short-term price fluctuations. M1 Finance also has many built-in automations for investing which save you time and money.

Plus, you can use its checking and savings accounts, credit cards, and more.

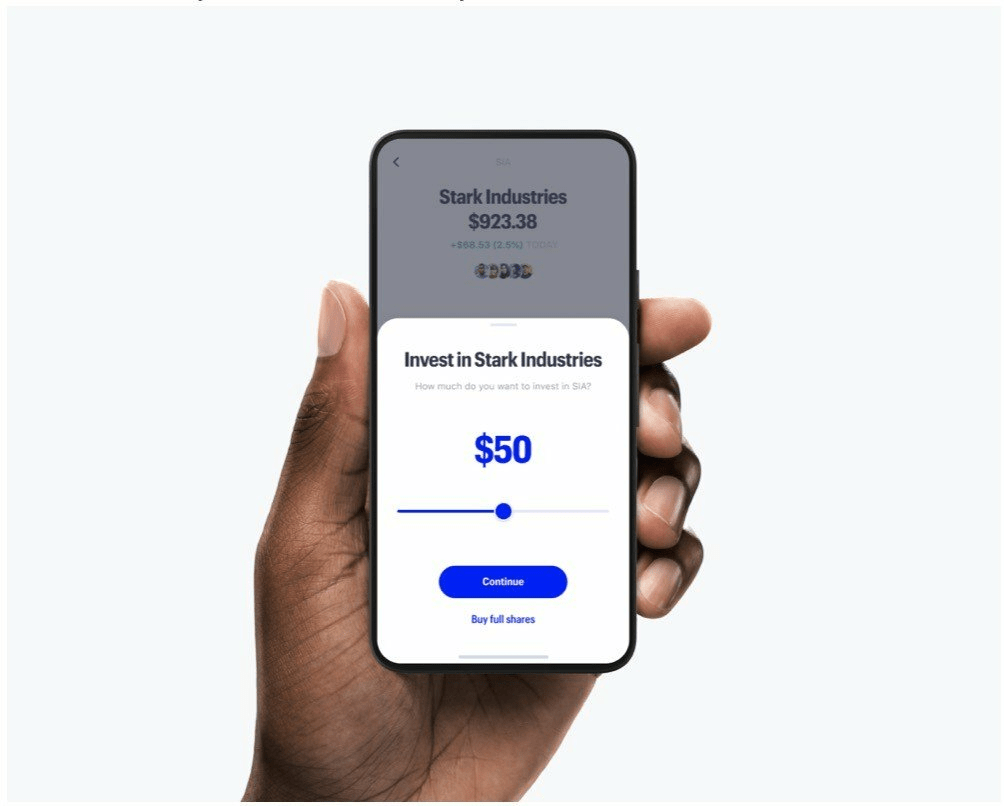

4. Stash

Stash vs. Robinhood: Stash’s main platform focuses on automated investing that allows you to buy shares in its pre-built portfolios.

Who’s it best for: Stash is the best app for someone looking for a stock app like Robinhood but wants to take a hands-off approach to their investing.

Pros:

- Offers both automated investing as well as the ability to pick your own stocks

- Very easy to get started with

- Offers a debit card that rewards you with free stock

Cons:

- Very limited platform if you want control over your investments

- Stash costs $3 or $9 per month

Stash is a Robinhood competitor that focuses on automated investing. Its “Smart Portfolio” invests your money in a diversified fund once you’ve answered a few questions about your financial goals.

While it’s different from Robinhood, I don’t consider it a much better alternative from a “robustness” standpoint – Stash is still pretty limited, especially compared to the 3 alternatives listed above.

5. Acorns

Acorns vs. Robinhood: Acorns is a very similar to Stash. It invests very small sums into pre-created portfolios so you can start investing without noticing the money is gone.

Who’s it best for: Like Stash, Acorns is a stock app like Robinhood that makes your investing hands off.

Pros:

- Great way for beginners to start investing

- Acorns’ Round Ups allow you to invest spare change

- Allows you to separate investments for retirement or for your kids

Cons:

- Does not let you buy individual assets

- Very limited platform

- Acorns costs $3 or $5 per month

Acorns is perhaps the best Robinhood alternative for people who just want to put their finances on autopilot and invest their spare change. It’s also #2 on our list of the best money apps for teens.

It’s a unique angle to start investing and allows you to buy stocks with a credit card, but you’ll quickly advance beyond the app’s capabilities.

Here’s a deep dive on Stash vs Acorns.

Get a $10 new account bonus with the link below!

6. Public.com

Public.com vs. Robinhood: Public.com is one of the companies like Robinhood with a similar design but places an emphasis on alternative assets.

Who’s it best for: Public is the best app for investors that want to buy alternative assets like art, NFTs, trading cards, real estate, and more alongside their stock, ETF, and cryptocurrency investments.

Pros:

- Allows you to invest in stocks, crypto, ETFs, and alternative investments

- Sends alerts as to why your investments are moving up/down

Cons:

- Does not allow you to trade options, mutual funds, bonds, precious metals

- No margin accounts

- No IRAs

Public.com offers an impressive investment platform that lets you invest in alternative assets like luxury goods or fine arts along with your more standard investments in stocks, ETFs, and cryptocurrencies. Here’s our complete Public.com review.

It’s a unique offering and has a beautifully designed UI.

While Public doesn’t offer support for IRAs, you can find out how to buy alternative assets like crypto in your IRA in our iTrustCapital review.

7. Fidelity

Fidelity vs. Robinhood: Fidelity is the legacy broker that most resembles the Robinhood experience but has a much more comprehensive set of features.

Who’s it best for: If you want a well-rounded, legacy broker with a solid mobile experience, choose Fidelity.

Pros:

- Access to stocks, ETFs, options, and fixed income

- Advanced research

- High-quality customer service

- Both mobile and desktop trading platforms

Cons:

- More complex mobile experience

- No access to cryptocurrency

Fidelity is an established player in the brokerage world and has the largest set of features and investment options of any company on this list.

Fidelity was founded in 1946, while the other investment apps on this list were founded in the past 20 years. Fidelity has a degree of stability and robustness that the fintech companies on this list don’t have.

Final Word: Robinhood Competitors

It’s probably time you upgraded from Robinhood. While it’s a great app to start investing, its limitations become apparent in a hurry.

There are plenty of brokerages to choose from. I hope I’ve made it clear which one is the best Robinhood alternative for you, based on your investment goals and situation.

I like eToro, Webull, and M1 Finance the most.

Remember, this is just a list of Robinhood alternatives. For a more comprehensive list, see our article on the best stock market apps.

You may also be interested in:

Regardless of the broker you choose, I can almost guarantee you’ll be looking for extra analysis and research on the stocks you’re considering.

WallStreetZen is a stock research tool designed to help part-time investors make better investment decisions in less time. We offer Wall Street-level analysis in an easy-to-digest format so you don’t need a finance degree to understand it.

Open a brokerage account, then swing by WallStreetZen to start researching your favorite stocks.

Read more: How to Invest $50,000

FAQs:

What can I use instead of Robinhood?

You can use eToro, Webull, M1 Finance, or Fidelity instead of Robinhood.

You will need a more powerful investment app than Robinhood once you’re no longer a beginner investor.

What’s better than Robinhood?

eToro, Webull, M1 Finance, and Fidelity are better than Robinhood.

They’re more robust platforms and will have all the functionality you need as an investor.

Is Robinhood only for U.S. citizens?

Yes, Robinhood is only for U.S. citizens.

Additionally, you must be 18 years or older, have a valid SSN, and have a legal U.S. residential address in the 50 states or Puerto Rico.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.