What’s The Best Way to Invest Your Inheritance?

Ultimately, the best way to invest inheritance money will depend on your specific situation. However, the process of investing and allocating an inheritance should generally go like so:

- Start by assessing your financial situation.

- If applicable, pay off high-interest debt

- Focus on a diversified investment strategy including stocks, fixed income, and alternative assets that suit your risk tolerance. For larger inheritances, a professional financial advisor is suggested.

And remember, it’s crucial to carefully consider fees and taxation to keep the most of your inheritance.

In this post, I’ll address the most common questions about investing an inheritance — you’ll learn all about allocation, safe investments, investment options for accredited investors (depending on your inheritance size!) and common pitfalls to avoid.

#1 tip BEFORE you buy stocks…

Do your due diligence.

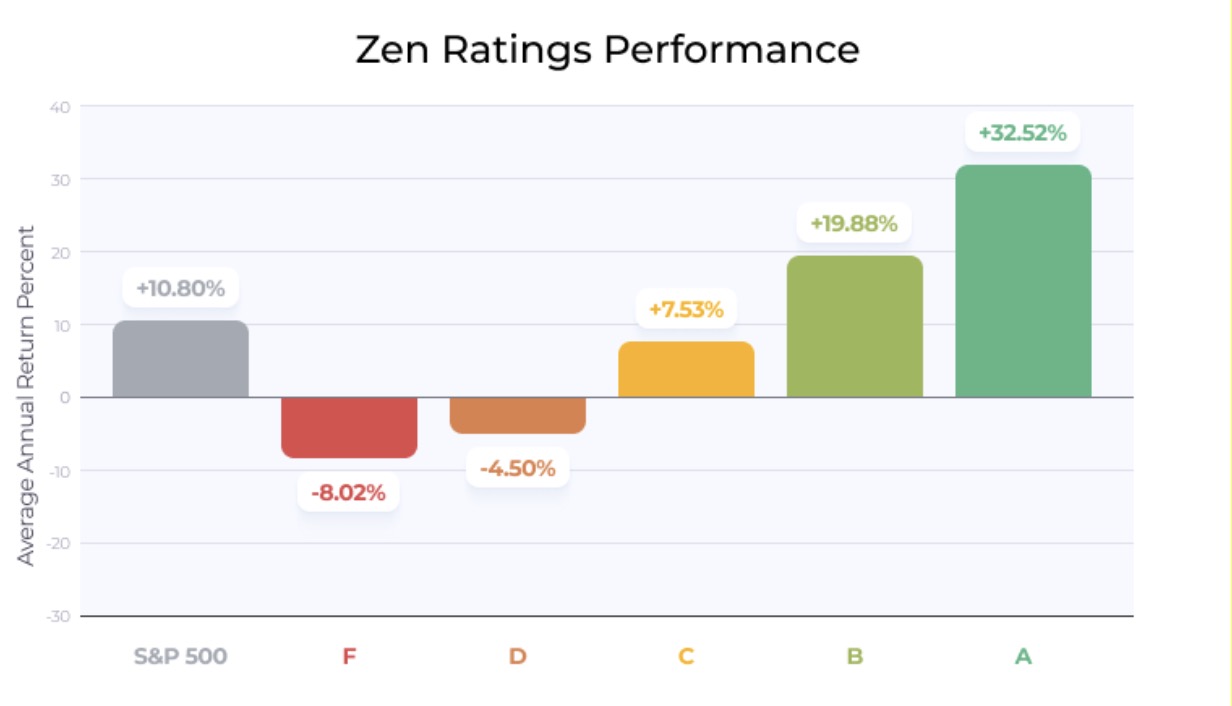

- WallStreetZen’s Zen Ratings simplifies stock research by distilling 115 factors proven to drive stock growth into a simple, easy-to-read letter grade for each stock we track. Go ahead — enter any ticker here and see how it works.

- Need more guidance? Join Zen Investor, our stock-picking newsletter, and get a portfolio of stocks hand-picked by a 40+ year market veteran.

What Should I Do First After Receiving an Inheritance?

If you just received an inheritance, first things first: Take a long, deep breath! In fact, run through a guided box breathing sesh until your mind stops buzzing.

Receiving an inheritance — especially a large one — can be an overwhelming experience. You need time to process such a massive change to your finances.

If you don’t take the time to relax, you might make impulsive decisions that don’t suit you in the long run.

To develop a solid game plan, you need to sit down and strategize with a cool and logical mind. Typically, you’ll want to start with these important steps:

- Start by assessing your financial situation. In a nutshell, this means defining your long-term goals against your current income, assets, and liabilities.

Specifically, focus on your existing debt, as this should be your first area of focus.

- With debt cleared, you can spend more time figuring out your risk tolerance and which investments make the most sense.

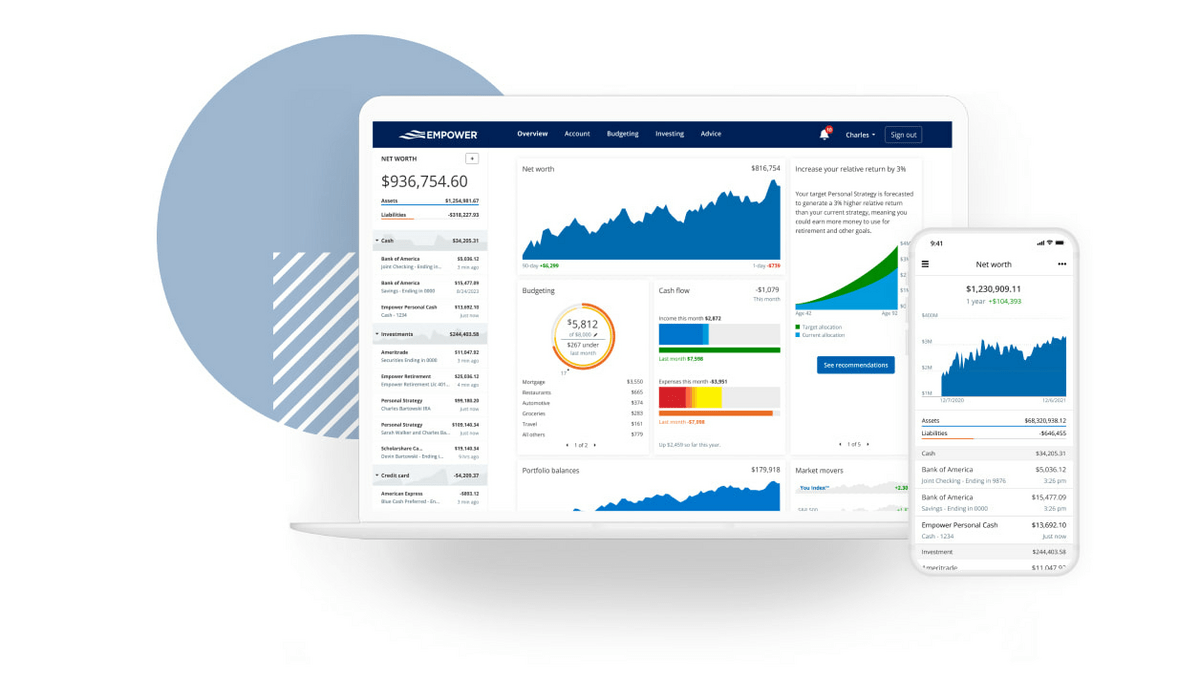

Admittedly, this is a lot of information to sift through on your own, and it’s easy to feel stressed over how to invest an inheritance. Luckily, a free online dashboard can lend you a helping hand.

Empower is one of the most comprehensive (and complimentary!) wealth management tools where you can plug in all of the deets on savings, investments, and debt, to get a full sense of your financial picture.

Crunching the numbers on Empower will help you make data-driven decisions with that inheritance.

Plus, you don’t have to go full-on DIY mode. Depending on the size of your inheritance, if you feel like you could use personalized assistance, Empower offers personalized wealth management — with significantly lower fees than legacy brokers like Fisher Investments.

Should I Pay Off Debt or Invest My Inheritance?

When considering how to invest an inheritance, debt is the first dragon to slay. While some cases may be exceptional, paying off high-interest debt is typically the wisest first move.

Sure, eliminating debt won’t yield an ROI like buying stocks, but the guaranteed “return” from eliminating this burden tends to outperform potential investment gains — especially in volatile markets.

Plus, with this stress out of the way, you can make more clear-headed decisions about your investment portfolio.

Ready to crunch some numbers and figure out how to get past debt? Empower has a nifty Debt Payoff Calculator, so you can literally see the impact of paying off your debts.

Is It Better to Invest an Inheritance All at Once or Over Time?

If your debt is already squared away, you might be wondering how to invest: all at once? Or over time?

Let’s talk about timing the market.

On this subject, there are two categories you should know about: Lump sum versus dollar-cost averaging (DCA).

- A lump sum investment means throwing all your money in the market once and calling it a day.

- By contrast, DCA investors sprinkle their purchases over a long period, either at specific intervals (e.g., once per month) or when their investments fall by a certain percentage.

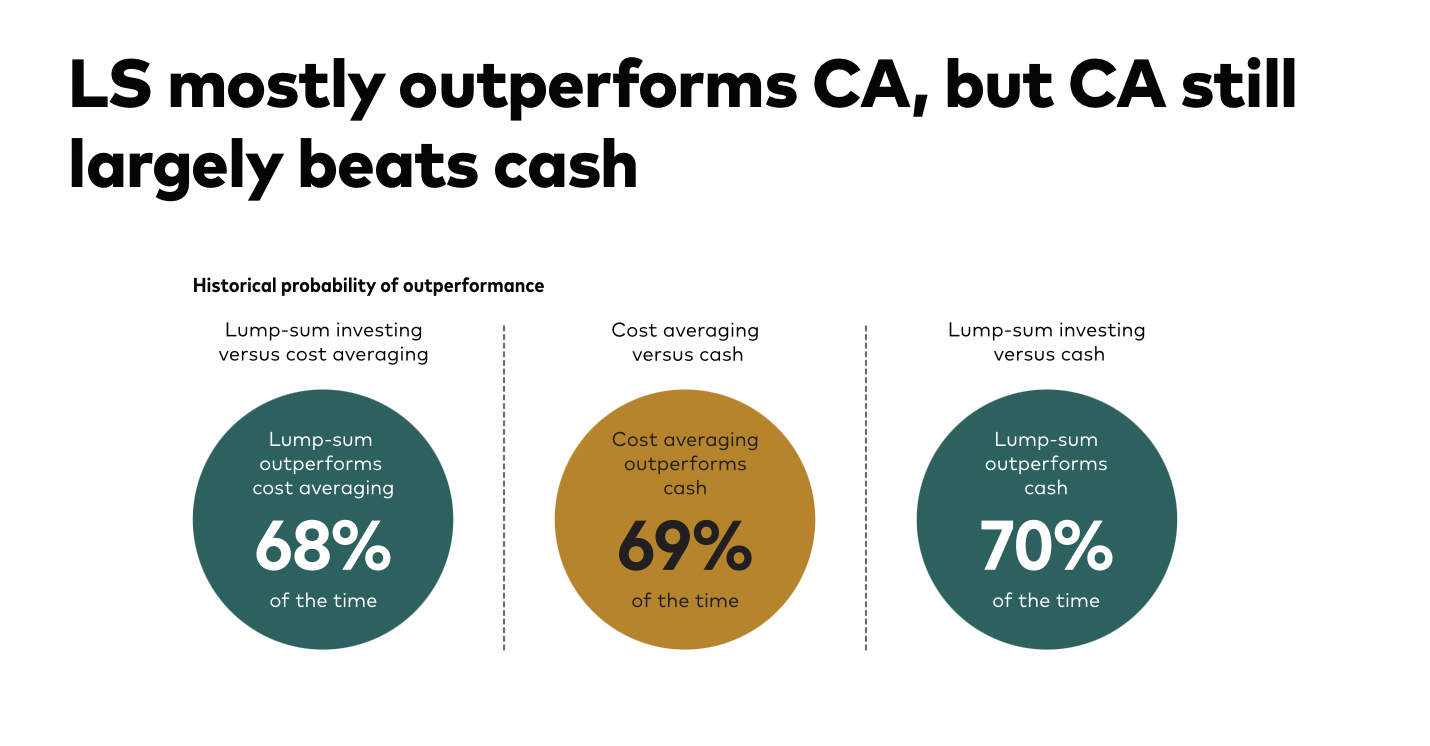

On paper, DCA investing seems like the “safer” option, right? Interestingly, many studies show that lump sum investing tends to produce better results on average.

But that doesn’t mean there’s no value in DCA, even if it’s purely from a psychological perspective. If you feel more comfortable spreading risk rather than taking one shot at timing the market, DCA will make you sleep easier at night.

Also, although lump sum investing tends to work in the long run with major indexes, you might see some hair-raising volatility in the short term.

If you cannot stomach volatility or are new to the market, DCA may be the way to go. Just keep in mind that there is historical precedent for diversified lump sum investing in the long run.

How Do I Invest a Lump Sum Inheritance Wisely?

Are you thinking about taking the plunge with a lump sum investment?

Since you’re only going to press the “buy” button once, you need a clear plan on how to allocate your funds. A few common-sense tips?

- Be sure you’re well-diversified across multiple asset categories to avoid any one sector dragging your inheritance down. (Need inspiration? Take a cue from high net worth asset allocation strategies to build your nest egg)

- If you’re concerned about how to invest a large inheritance, it’s probably better to seek professional help for a tailored strategy. I recommend Empower’s wealth management services.

What Are the Best Investments for Inherited Money?

When it comes to how to invest inheritance, there’s one word I want to drill into your mind: Diversification.

No matter how much you love Nvidia (NASDAQ: NVDA) or any other stock, you shouldn’t YOLO your whole account into one strategy. Spreading your inheritance to different places significantly lowers your volatility and ensures a good balance of growth and passive income.

In terms of the specific assets for how to invest inheritance, there are a few standards to start off exploring:

- Stocks: Buying shares of public companies — say Microsoft (NASDAQ: MSFT) or Tesla (NASDAQ: TSLA) — can offer significant potential for growth. However, since each of these stocks is company-specific, you also have a greater risk of unique issues triggering volatile movements.

You also need to do your own due diligence — and that requires a trustworthy research tool. WallStreetZen’s Zen Ratings simplifies stock research by distilling 115 factors proven to drive stock growth into a simple, easy-to-read letter grade for each stock we track. Go ahead — enter any ticker here and see how it works. - Exchange-Traded Funds (ETFs): To capture growth without as much volatility, ETFs offer a collection of assets like stocks rather than a single investment. Firms like Fidelity manage these funds on your behalf for a fee, and you’ll enjoy broader market exposure plus easy trading during regular market hours.

- Bonds: These are IOUs to companies or governments, and they generally have a lower risk profile. While the yields on bonds might not match the potential rewards for stocks, they’re more reliable. For easy entry into the bond market, consider Public’s Bond Account.

- Mutual Funds: These are pretty similar to ETFs, but they only trade once daily rather than during regular trading hours.

The above assets are the most accessible in traditional finance, but don’t let that scare you away from alternative investments. And don’t think that “alternative” automatically means “more risky.”

For instance, precious metals, fine art, and real estate are “alternative” assets with long track records for growth.

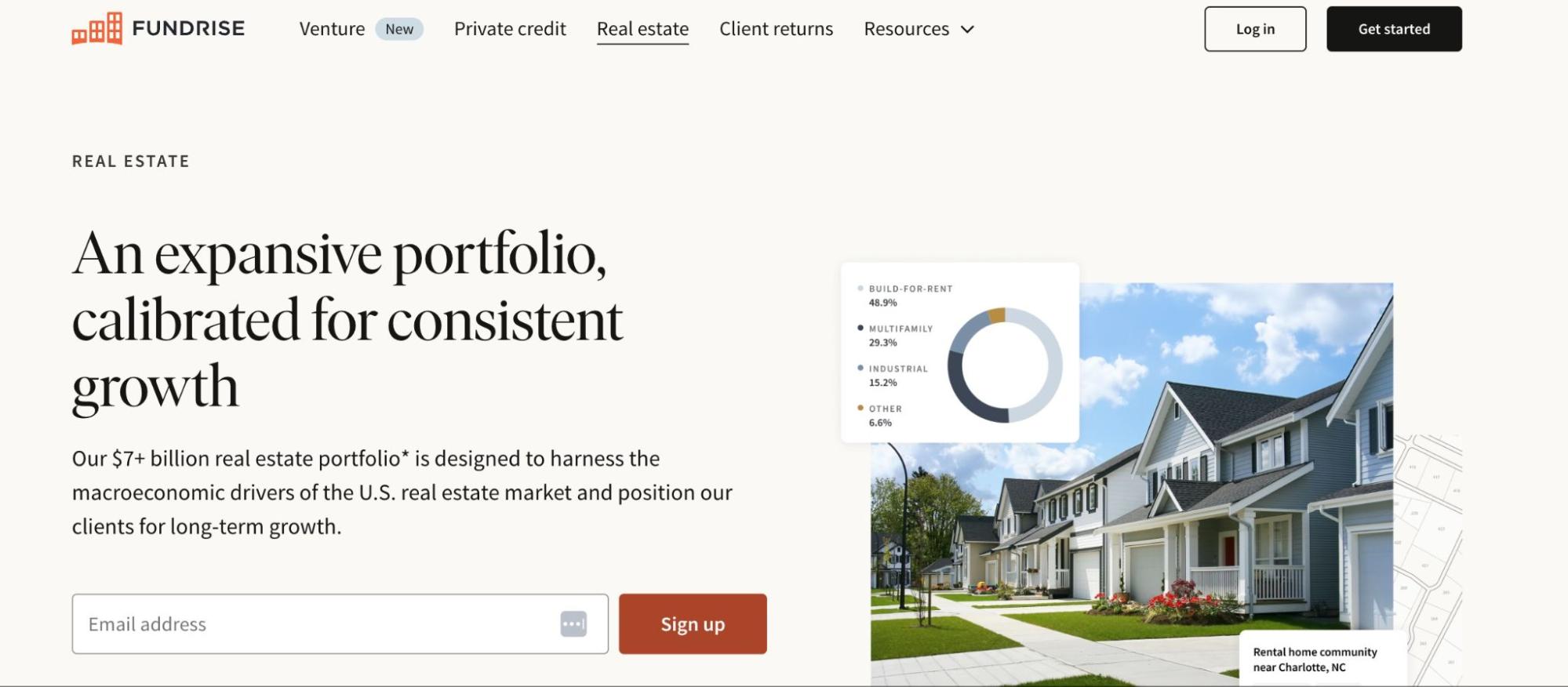

Plus, thanks to crowdfunding platforms like Fundrise (a fantastic resource for real estate, private credit, and pre-IPO company investing) and Masterworks (a resource for buying and selling shares of fine art for retail investors), getting involved in these sectors has never been easier.

Depending on your inheritance, you may also have access to investments only available to accredited investors.

Whatever way you choose how to invest inheritance, the importance is to assess the risk of each option and allocate in multiple places. That way, you’ll have the greatest odds of creating a portfolio that continues forward despite market fluctuations.

Note: We earn a commission for this endorsement of Fundrise.

Should I Work With a Financial Advisor After Receiving an Inheritance?

If you’re wondering how to invest a large inheritance, working with a certified financial advisor is often a good call. The bigger the inheritance amount, the more complex things get for DIY investors.

But no matter the amount, you should always gauge your comfort level with finances. Many people more comfortable working with someone who has experience.

If you’re looking for a place to start, Empower offers comprehensive wealth management services that can be an excellent option for professional guidance.

Check out more about Empower’s wealth management here.

If you still prefer a DIY approach, or you want to do some if it yourself, the right research tools can help you make informed DIY investment decisions.

For example, Zen Investor is our own (great!) stock-picking newsletter. Members receive research-backed stock picks using a combination of a proven AI-powered ranking system and the expertise of Wall Street veteran Steve Reitmeister — who boasts 40+ years investing experience and who also spent years as Editor-In-Chief of Zacks.com.

As part of his 4-step stock-picking methodology, Reitmeister uses the Zen Ratings system to sniff out the best potential plays.

On average, Zen Ratings stocks with an “A” rating have historically returned 32.52% annually. (You can also take a DIY approach and use Zen Ratings — it’s free to get started! Enter any ticker here.)

How Much of My Inheritance Should I Keep in Cash?

Depending on your risk tolerance, you might feel tempted to keep all of your inheritance in cold hard cash. Conversely, some people proudly proclaim that “cash is trash” and want to dump everything into investments.

So, who’s right here?

The rule of thumb is that you should have enough cash stashed for emergency scenarios. A good number to shoot for is about 6-12 months of expenses.

Anything more than that, and you’re probably missing out on growth or passive income opportunities.

But don’t just keep this cash under your mattress — or in a typical savings account that only racks up a few pennies per month.

It’s way smarter to take advantage of high-yield savings so you’re earning more without sacrificing liquidity.

Right now, there are a bunch of high-yield savings accounts and high-yield cash accounts that can help you maximize safer returns without sacrificing access to your funds.

One solid pick? CIT Bank — an online bank with FDIC insurance, so you’re covered up to $250K.

Additionally, Public is a brokerage that also offers a high-yield cash account where you can park uninvested cash.

Find more details on Public’s high-yield option here.

Are There Tax Implications When Investing an Inheritance?

Let’s be upfront: We aren’t accredited accountants.

(Also, the intricacies of tax laws and legal lingo give us headaches.)

But when we’re talking about how to invest an inheritance, this topic is super important to consider with the guidance of a professional.

In general, the inheritance money itself is not subject to a tax.

However, if you use your inheritance to generate income or sell for a profit, that money is taxable. This includes capital gains, interest payments, and dividends.

Keep in mind that these laws vary between different states, so it pays to work with a professional certified in your area.

As a bonus, a personal accountant can tell you about legitimate strategies like tax-loss harvesting that could save you significant cash.

As a part of your inheritance game plan, consider working with tax pros. We’re fans of H&R Block — a firm that’s been synonymous with taxes for decades for good reason: They do good work.

Can I Put My Inheritance Into a Retirement Account?

If you have a tax-advantaged plan like a traditional or Roth Individual Retirement Account (IRA), you can use inheritance money as a contribution.

Just remember that there are annual contribution limits on IRAs. Even though you’ve got extra money, you can’t go over these pre-set caps.

The pro of using IRAs or 401(k)s is that you get tax advantages in deductions or free withdrawals, so they’re definitely worth taking advantage of.

Plus, many platforms let you invest with retirement accounts into alternative assets.

For example, Fundrise welcomes IRAs and 401(k)s for crowdfunded real estate, private credit, and pre-IPO companies.

You could also look into Acorns to add ESG investing and Bitcoin ETFs to more standard stocks and bonds.

What’s the Safest Way to Invest an Inheritance?

We know we’re repeating ourselves, but diversification is the key to safe investing.

While there are never guarantees on how to invest inheritance, it’s far less risky to spread your money into multiple sectors. You may miss outsized gains, but you’ll also reduce the risk of feeling pain during volatile periods.

As a starting point, look into traditional assets like stocks, ETFs, and bonds since these are widely accessible and offer a mix of growth and passive income.

You can then add a bit more “spice” to your investing life with alternatives.

For example, the crowdfunding platform Masterworks makes it possible to own shares in artistic masterpieces like Picasso paintings, which gives you exposure to a historically high-performing category.

If you’re looking for more choices, some multipurpose platforms like Yieldstreet offer way more alternatives to check out.

In addition to art, Yieldstreet has funds with exposure to everything from crypto and private equity to transportation and venture capital.

While the majority of opportunities on Yieldstreet are only available to accredited investors, the Yieldstreet Alternative Income Fund is a notable exception.

One of their most popular offerings, it gives you the opportunity to invest in a “basket” of alternative assets within a single investment.

Should I Buy a House With My Inheritance?

Buying a house isn’t just about shelter. Beyond keeping us safe against Mother Nature, property has a reputation as a high-performing asset.

But does that make it a no-brainer to splurge your inheritance on a dream home?

Well, that depends.

Remember that buying a house isn’t just a one-time fee. This investment comes with ongoing expenses like property taxes and maintenance.

Be sure to weigh these costs against your inheritance — as well as other factors like your goals and the current housing market — to determine whether it’s right for you.

FYI: There are crowdfunding platforms like Arrived where you can buy pieces of residential properties. So if your goal is investment income, this Jeff Bezos-vetted platform offers exposure to this market without a massive commitment.

How Do I Avoid Wasting an Inheritance?

Every sound investment plan has to consider potential pitfalls. When you’re figuring out how to invest inheritance, this primarily means reviewing your risk tolerance and insurance policies.

Look at the long-term track record of different asset categories and spread out the volatility with (you guessed it!) diversification.

Also, ensure you have insurance protections like FDIC on cash or SIPC for equity trading accounts so you’re covered should a bank or broker fail. Both of the high-yield accounts I mentioned earlier — CIT Bank and Public — offer FDIC insurance.

It’s also important to consider fees and taxes when investing your inheritance.

Maxing accounts like a 401(k) gives you significant tax savings, and opting for the lowest fee platforms could save you thousands.

Remember how I told you about Empower’s free dashboard earlier? They can also help you detect hidden fees with their IRA fee calculator and more.

What Are Important Tax Considerations For an Inheritance?

There are many nuances to inheritance tax law, but generally, you don’t have to pay taxes just on the inheritance transfer.

Also, you often receive a step-up in cost-basis for non-cash assets, meaning the new average price is what you receive it at.

However, any gains or income you generate from an inheritance are subject to federal and state taxes.

Since there are a lot of complexities involved in inheritance taxes, it’s best to work with a certified accountant to address personal questions.

Check out how to get in touch with an H&R Block team member here.

What Are Some Mistakes to Avoid When Investing Inherited Money?

Mistakes are never fun — especially when there’s an inheritance involved.

If you’re just getting started with how to invest inheritance, be extra wary of these issues:

- Overspending Your Principal: It’s easy to get carried away when you get a big inheritance. We get it. But please avoid the temptation to go YOLOing this money by first creating a reasoned budget.

- Ignoring Fees: Seemingly small fees can erode your returns. For example, a 1% annual fee doesn’t look all that bad, but that works out to a $1,000 annual loss on a $100,000 investment. When possible, use brokerages with no or low commission fees — we like eToro.

- Not Getting Professional Advice: Handling a big inheritance is challenging even with expert tools like Empower’s dashboard. Anyone looking into how to invest a large inheritance should seriously consider working with a professional advisor.

- Not Diversifying: You know we couldn’t leave this one out! Although we’ve mentioned it multiple times, you’ll be so happy you diversified during bear markets.

Are There Special Rules for Inheriting Stocks or Real Estate?

Most often, when you inherit stocks, their cost basis is “stepped up” to the market value on the date of the decedent’s death.

This means you won’t pay capital gains tax if you sell an inherited stock based on when your decedent bought them. Instead, your average price is set to whatever it was trading at the time of transfer.

It’s the same story with inherited real estate.

However, it’s always best practice to consult a tax professional for specific guidance on inherited assets, especially if they’re extra complex.

How Should I Invest a Small Inheritance vs. a Large One?

Honestly, there’s no big difference in the basic options for investing a small or large inheritance.

In both cases, it makes sense to diversify with assets like stocks, ETFs, bonds, and mutual funds, plus alternatives like crowdfunded real estate, precious metals, and (if you don’t mind higher risk) crypto.

You just have to review your situation and risk tolerance to determine what works best in your strategy.

However, a higher inheritance could open more doors if you get an accredited investor status.

Accredited investors have access to more platforms and asset categories, which offer new avenues for growth and passive income.

For example, accredited investors can use higher interest rates with private credit deals on sites like Percent.

Find out more about Percent here.

Accredited investors could purchase shares in pre-IPO companies like SpaceX, Waymo, or Grammarly for potentially high returns on sites like Hiive.

Related reading:

- Need more tips on where to put a small or medium inheritance? Read this: “7 Best Ways to Invest $2,000 to $3,000.”

- For those wondering how to invest a large inheritance, check out our previous guide on “How to Invest $1 Million.”

- Did you get a really, really big inheritance? Check out our tips for High Net Worth Asset Allocation.

Final Word: Our Best Tips For Investing Your Inheritance

If you need the TL;DR version of how to invest an inheritance, it all boils down to a few key principles:

- Don’t rush into any decisions.

- Prioritize debt repayment.

- Create a diversified portfolio that suits your goals and risk tolerance.

- Be super mindful of fees and taxes.

- If necessary, seek professional advice.

An inheritance is a huge opportunity to strengthen your financial future, so you must approach it carefully.

If you need help getting started with how to invest inheritance, consider adding Zen Investor to your research toolbelt.

Each of these high-conviction stock picks goes through intensive AI screenings and the keen eye of Steve Reitmeister before they end up in your inbox.

You can rest assured every stock pick from Zen Investor has been through serious tests before we send them out.

Sign up for Zen Investor today.

FAQs:

How Much Inheritance Should I Invest vs. Save?

Generally, it's wise to save enough to cover six months of living expenses in an emergency fund. After that, consider investing the rest based on your goals and risk tolerance.

Can I Invest Inheritance Without Paying Taxes?

You don't pay income tax on the inheritance itself, but any earnings or capital gains you get from investing are subject to taxes. However, you can use tax-advantaged accounts like IRAs or 401(k)s to minimize tax obligations.

Should I Invest All My Inheritance at Once?

Lump sum investing has historical precedence for outperforming more gradual investing approaches like dollar-cost averaging (DCA). However, choosing between lump sum and DCA depends on personal preference and risk tolerance.

Can I Use Inheritance to Fund a Retirement Account?

You can contribute your inheritance to retirement accounts like IRAs or 401(k)s up to the annual contribution limits.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.