Is Stocktwits Legit + Worth Your Time?

Stocktwits is a lively social media platform that can quickly help you take the pulse of what’s moving in the market. Over the years, it’s evolved from a simple, Twitter (X)-esque feed to a central hub for investors — and some features, like the ability to listen to earnings calls, make it a standout.

However, while the platform and sentiment gauge is legit, I can’t say the same for all of the user-supplied social content. Instead of making investment decisions based on largely crowdsourced material, I strongly suggest you back up any stock picks you discover on Stocktwits with analysis from WallStreetZen — or, seek out a news source with expert picks like Motley Fool.

A simpler and cheaper alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Plus, it costs less than Stocktwits’ cheapest subscription option. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is Stocktwits?

Stocktwits was founded in 2009 by Howard Lindzon and Soren Macbeth and was closely related to today’s X (what was then called Twitter) in its early years.

The platform’s key distinction was its complete focus on the world of finance, meaning its users were only commenting on and analyzing the latest developments in the stock market and recommending the best equity to buy, and the riskiest to avoid.

They were helped in this effort with the introduction of “cashtags” — $ symbols replacing the more general “hashtags” (#)—as they enabled users to track commentary on specific assets across posts and accounts. “Cashtags” eventually even expanded to modern X.

Related Reading: Where Did Gen Z Learn About Money?

Over the last decade, Stocktwits expanded to include its own newsletter and news service, artificial intelligence (AI) overviews, market-tracking tools, and even offered stock and cryptocurrency brokerages for a time.

Platforms + Usability

As could be expected from a Twitter spinoff, a large part of Stocktwits’ appeal stems from the fact that you can use it on your computer or check it on the go through its mobile app.

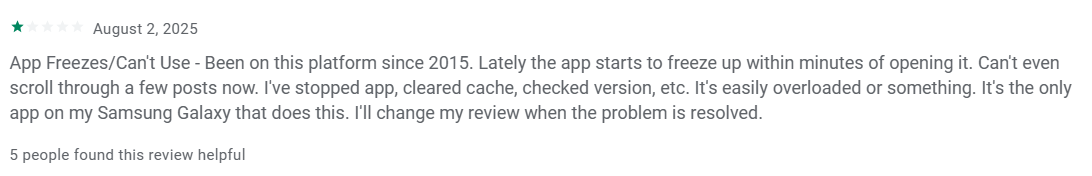

Historically, users praised the platform to the high heavens for its accessibility, simplicity, and intuitive design in most Stocktwits reviews.

Stocktwits might once more receive such praise. As of 2025, however, you might want to avoid the smartphone app.

Earlier in 2025, users began reporting that the application had become exceedingly buggy and prone to crashing, with many claiming they could spend anything between seconds and minutes before Stocktwits shuts down.

Additionally, the issues hit ticker information well, as stock and cryptocurrency data tend to remain unchanged until the page is reloaded.

Fortunately, the issues with the tablet and smartphone apps are likely temporary and the desktop and browser versions remain unaffected.

Stocktwits Core Offerings

Trending

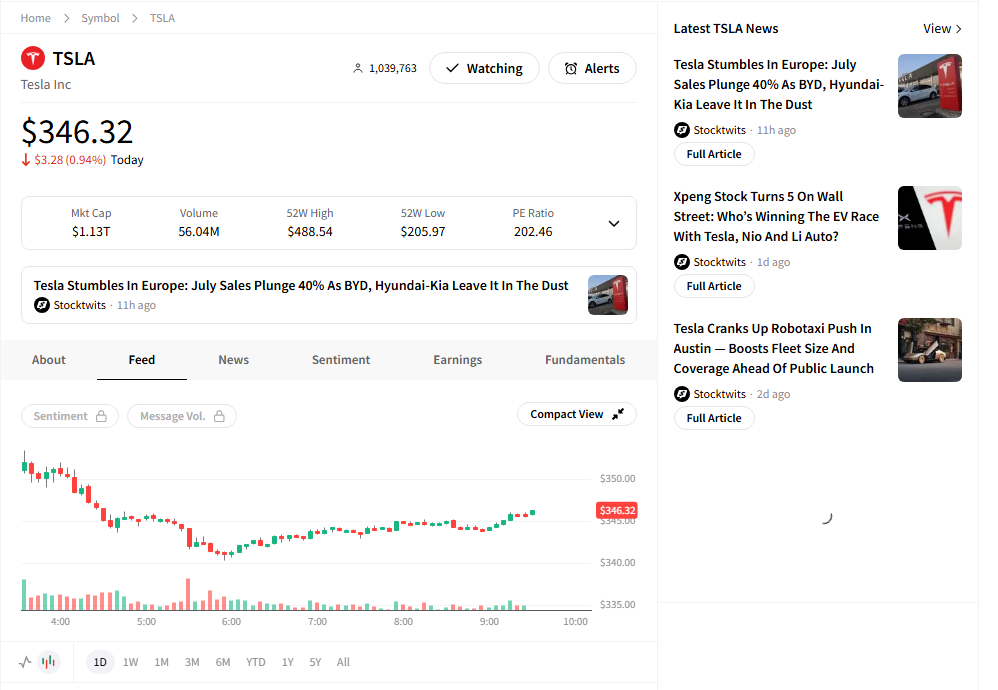

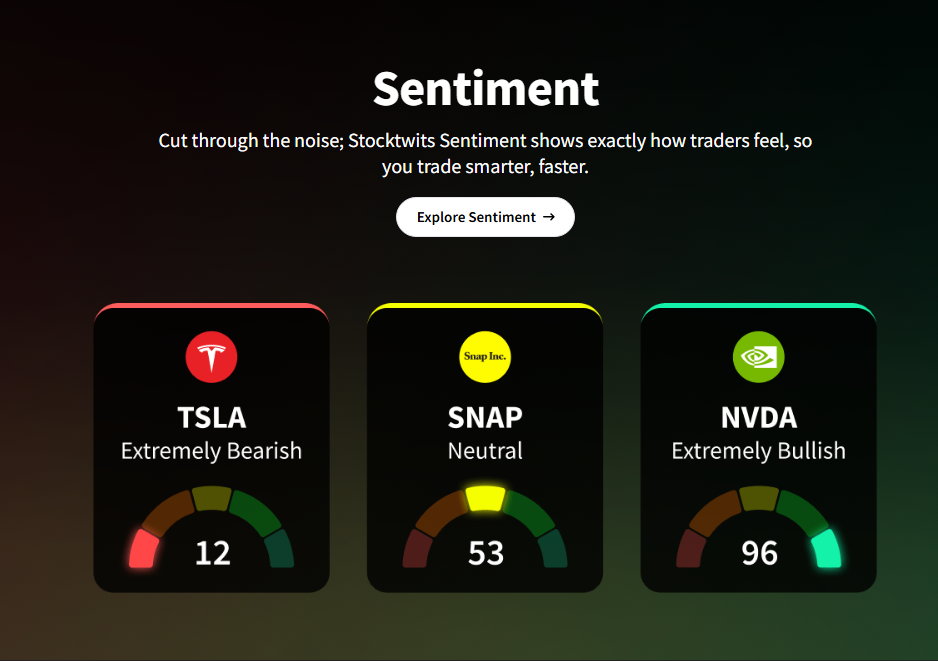

For all of the simplicity, the “Trending” page and the sentiment gauges are among Stocktwit’s best features.

They give an easy-to-use overview of the most interesting assets by ranking them based on the amount of platform chatter, as well as on the overall tone of the posts on a scale from 1 to 100—from “extremely bearish” to “extremely bullish.”

Considering the massive number of data points arising from the vast userbase, it’s little wonder that checking out the Stocktwits trending page is a daily ritual for many traders.

Still, the way Stocktwits set up this feature leaves room for caution. Specifically, Stocktwits determines which stocks are trending and the sentiment surrounding them based on the volume and tone of posts using the relevant cashtags.

While this does provide a fairly accurate gauge of what the platform’s community is saying, it runs the risk of being manipulated by intentional pump-and-dump posts. Similarly, the sheer popularity of certain stocks — for example, in recent years, companies like Tesla (NASDAQ: TSLA) and Nvidia (NASDAQ: NVDA) have seen disproportionate attention — might muddy the waters.

For example, analysts and outlets often choose to cover such assets even when nothing particularly interesting is happening simply because they tend to rank well at any given time.

As an alternative, you could knock out two birds with one stone and check out WallStreetZen’s Zen Ratings + Top Analysts screener. This screener lets you see stocks that both rank highly on its Zen Ratings quant rating system AND have positive sentiment from top-rated analysts. It’s kind of like getting the buzz and doing a little preliminary due diligence at once. And since the list is updated daily, it’s a constant source of new stock ideas.

News

Stocktwits news is pretty much what you’d expect: a high-volume service covering the most important and breaking developments in the stock, commodity, derivatives, and cryptocurrency markets.

Although convenient for gathering information quickly, you should not rely on it for in-depth analysis or detailed updates. Most Stocktwits articles are under 100 words, and sourcing can be circular: these pieces occasionally use user posts for context.

Related Reading: 11 Best Stock News Apps & Sites

Despite its shallowness, you can find much use in the news service as it covers a wide range of relevant topics, from pre-market moves in New York to corporate deals and investments in New Delhi, and much more.

Simpler access to the news that matters

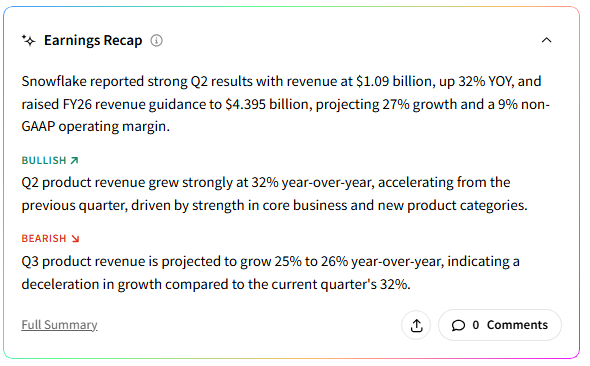

WallStreetZen makes it easy to cut through the noise. Just take a look inside your Watchlist, and you’ll see a Feed with the most recent News, Analyst Ratings, and Upcoming Events.

Earnings

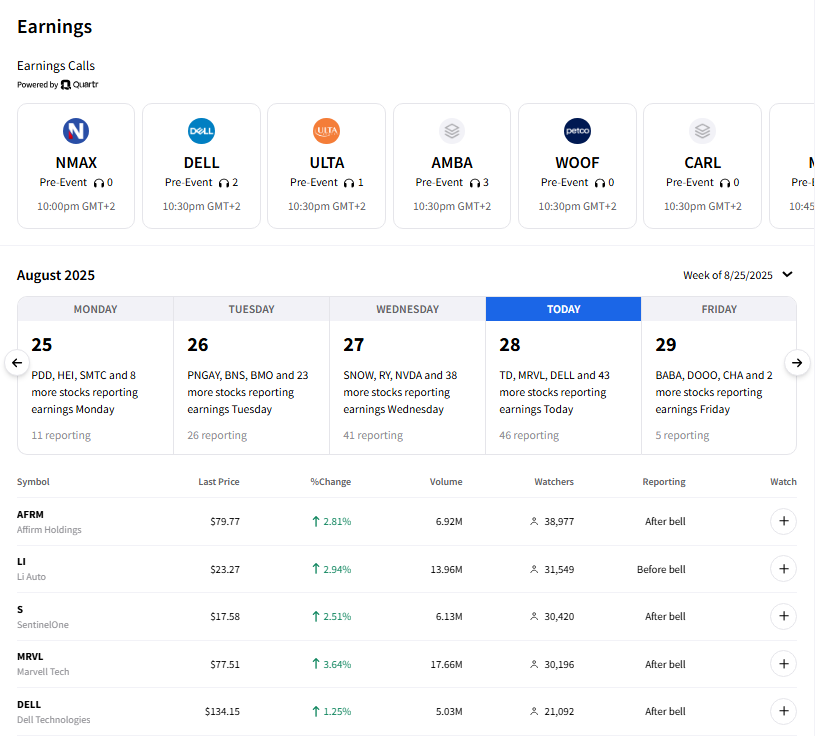

Stocktwits’ Earnings Calendar is one of the platform’s best efforts to establish itself as the primary hub for investors.

Its concept is rather simple, as it is an earnings calendar that shows, in chronological order, which publicly traded companies are scheduled to publish their quarterly results.

The page simultaneously enables users to keep track of which equity is “most watched at any given time.” Underneath the calendar, there is a spreadsheet filled with stock information as it tracks its performance, volume, price, whether it reports in pre-market or after-hours trading, and how many “watchers” it has.

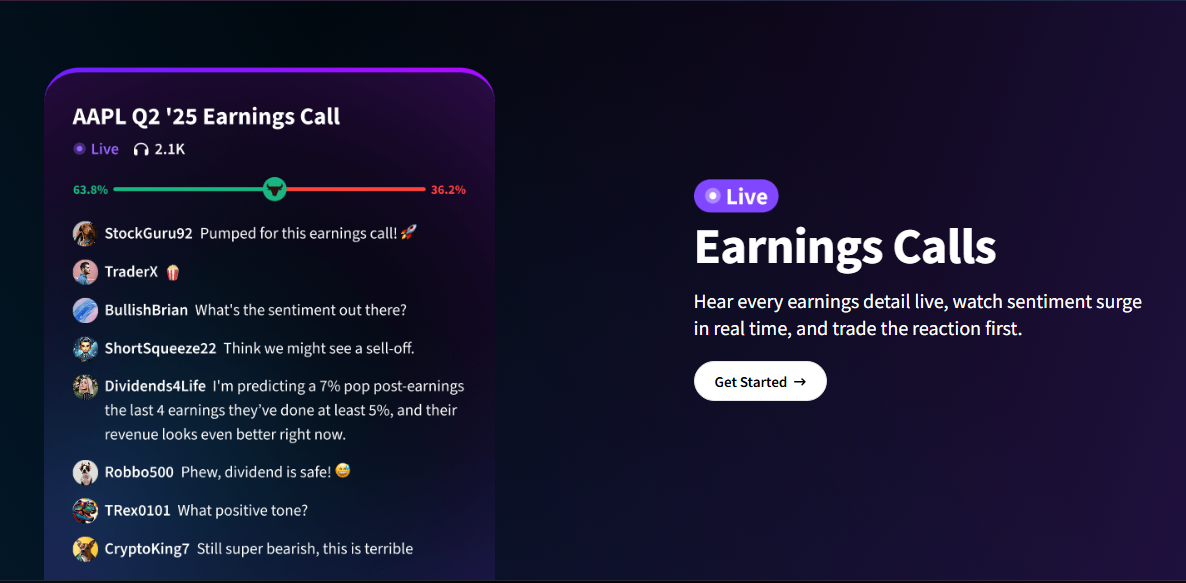

The feature is especially compelling, as you can listen in on the earnings call and see how sentiment about the company is changing in real-time during the live event by tracking the latest Stocktwits posts.

Live Events

Stocktwits also offers live events, both in-person gatherings and online streams. For example, the platform hosts a wealth of community events across North America in locations such as Boston (MA), Detroit (MI), Houston (TX), San Diego (CA), Las Vegas (NV), Toronto (Canada), and many others.

These happenings tend to be varied, but you can expect various social interactions with other traders, round tables, discussion, and similar social and experience-sharing activities.

In July 2025, Stocktwits bolstered its premium video offering with live on-air shows, including “Daily Rip Live,” hosted by Shay Boloor and Jordan Lee of Wolf Financial, and “Weekend Rip” with Ben & Emil from the “Trillionaire Mindset” and the comedy series “Ben & Emil Show.”

The new additions expanded the existing offerings, such as “The Daily Rip” and the aforementioned earnings calls.

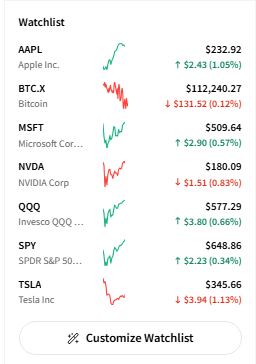

Market Lists

Lists are a pervasive feature as they encompass many of the ways Stocktwits help you track individual or groupings of stocks.

The basic idea is both simple and intuitive, as you can choose to track curated, user-made, or their own lists of assets to monitor their performance, the sentiment surrounding them, and the momentum they are gaining or using.

Indeed, the lists explicitly mentioned by Stocktwits in its promotional material rank assets by their daily gains and losses, volume, and the attention they receive from the community.

Furthermore, engaging with lists also offers a live feed — akin to how X works — of posts made about the relevant assets, usually thanks to the “cashtags.”

Another great thing about the feature is that it is dynamic and will reflect the actual and almost real-time state of the market, ensuring you’ll often want to check what is on the Stocktwits watchlist today.

As an alternative, WallStreetZen’s free watchlist feature lets you track a variety of securities; you’ll receive a daily digest on their progress and can easily see headlines related to your stocks, including news stories, events, and insider and analyst activity.

AI Insights

Like almost every other company under the sun, Stocktwits has been working on developing, integrating, and enhancing AI on its platform. A result of this effort is AI insights, a tool that uncovers critical information about an asset from the website’s vast base of fundamental, technical, and community data.

Related Reading: How to Use AI to Trade Stocks: 8 Proven Ways

In a way, Stocktwits can greatly benefit from this AI tool as it, similar to other social media platforms with a finance section, suffers from an overabundance of noise: posts made by people who do not quite know what they are talking about.

The company is actively working on upgrading its AI, as seen with the July 2025 acquisition of an artificial intelligence startup called Thematic.

Interestingly, Stocktwits commented on how its own platform delivers critical information faster than most artificial tools in the May 2025 press release unveiling the launch of the digital assets-focused Cryptotwits.

Community Interaction

Community interactions are the original lifeblood of Stocktwits, given that the platform is, first and foremost, a social media website.

It is both the most useful and the most perilous part of Stocktwits, offering similar benefits to those found on finance Twitter — or X — and many of the same pitfalls.

Here, you can share your market insights and analyses in small posts—up to 1,000 characters after the 2019 increase—and engage in conversations with others through comments, the practice of “@ing”—using @ along with a username like in many other social networks—or direct messages.

Along with offering some of the fastest news and most unique perspectives, this side of the platform is often filled with inaccuracies, pump-and-dump attempts, trolling, and all manner of hogwash.

It also clearly presents why using Stocktwits in tandem with a more data-focused platform like WallStreetZen can work wonders: one can flag interesting and hyped-up stocks and the other will help you discern if good “vibes” are accompanied by good fundamentals.

Nonetheless, it remains Stocktwits’ core appeal and one of the most important parts of the website, as many of its other offerings, such as the trend-identifying feature, depend directly on user posts.

Newsletters

As I mentioned above, Stocktwits bolsters its already substantial offering with a large selection of newsletters that are produced both natively and via a partnership with Beehiiv Creator Network.

Related Reading: 20 Best Financial Newsletters in 2025

Stocktwits Newsletters

In addition to “The Daily Rip”—a daily newsletter that helps you track the market in a fun way—and its associated podcasts, Stocktwits actually produces a large variety of other newsletters.

“The Daily Rip India” is pretty much exactly what you would expect: “The Daily Rip,” but with a focus on the Indian markets. Similarly, “The Litepaper” attempts to keep to the witty style and data-filled substance in its regular coverage of digital assets.

“Chart Art,” on the other hand, leverages Stocktwits’ vast user base to compile all the most interesting community insights and trade ideas every evening.

Lastly, “Trends with Friends” and “Trends with No Friends” track the biggest trends in the market, whether they are getting attention or not.

Did you know that WSZ offers a free newsletter?

Get regular Strong Buy alerts, a weekly watchlist of stocks, and more. Did I mention it’s free? Click below to subscribe.

Beehiiv Creator Network

The Beehiiv Creator Network newsletters are an expansion of the base offering and the result of a partnership between Stocktwits and Beehiiv—a network created in 2021 by several former employees of the Morning Brew.

In a nutshell, the offering represents a set of more specialized but still market-focused newsletters with some of the standouts being “The Street Sheet” — which provides a single trading idea every day—and the “WSO Weekly Wrapup” — a wrap-up of the top ideas from the Wall Street Oasis forum.

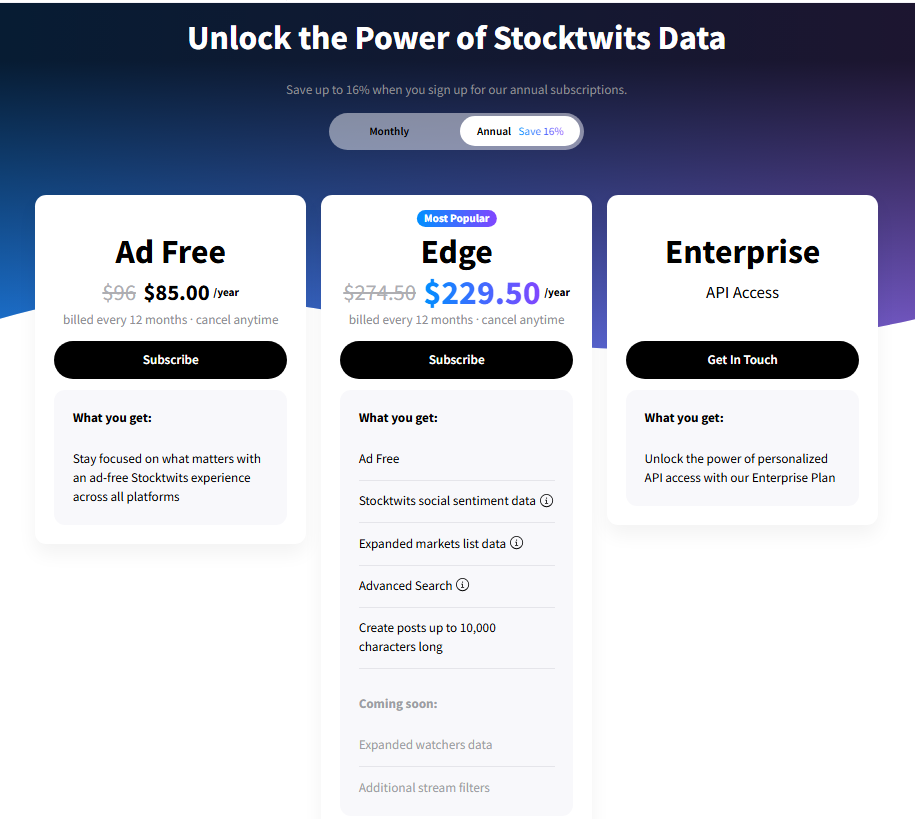

How Much Does Stocktwits Cost?

It’s free to get started with Stocktwits. However, more features are unlocked with paid subscriptions.

Ad Free

Stocktwits’ most basic premium plan offers the lowest value. In fact, for $8 per month or $85 per year with an annual commitment, it will simply remove advertisements from your feed.

Although having your workflow broken by companies screaming for attention can be irritating, it is difficult to believe that most internet users have not, by 2025, learned to just ignore the annoyance, and, at $8/month, it is a tough sell with no extra benefits.

Edge

Edge is the flagship plan offered by Stocktwits, and its most popular offering.

It includes the features of the previous two tiers, but also offers data on social sentiment, expanded market lists, improved research tools, and, much like X’s paid variant, significantly expands the post character limit.

It is relatively competitively priced at $22.95 per month, or $229.50 per year—comparable to many other premium stock research services on the web.

Apple App Store Subscriptions for Stocktwits

Stocktwits also has a slightly different (and not always better) pricing on the App Store compared to the website.

Specifically, the Ad Free tier is converted into the Plus tier and is slightly cheaper at $7.99 per month, or $84.99 per year.

The added functionality is minimal; along with removing ads, the key additional features are the ability to switch between light and dark modes at will, or to enable Market Mode, which automatically switches between the two depending on whether the market is open or closed.

Related Reading: How to Buy Apple Stock

Interestingly, the 2019 announcement of Plus positions a one-time lifetime access priced at $399 as a limited offer, but it is still listed in the App Store for $399.99.

The App Store offering also features more generalized premium plans for $11 per month or $109 per year, while the Edge becomes somewhat more expensive at $29.99 per month or $299.99 annually.

Is Stocktwits Worth It?

Many of Stocktwits’ major selling points are easy to find elsewhere, with the investing part of X being a direct competitor.

Simultaneously, X is, by virtue of being the larger platform, often faster in delivering breaking developments than Stocktwits. On the other side, investor Reddit can be better in terms of analysis as long as you stick to the more reputable subs.

TradingView, for its part, is another investing-only platform with a social media side that is much loved and used for its powerful charting tool—a boon for testing ideas before making the final commitment.

Despite this, Stocktwits is not a particularly difficult platform to recommend. Because it is a laser-focused social media platform, unrelated doomscrolling is less of a direct attention thief, and the many user-based metrics can help you a lot.

Similarly, the ability to listen in on earnings calls is a rarer feature, and for the right user, it can be the single biggest selling point of Stocktwits, possibly making the subscription worth it on its own.

Ultimately, it is definitely worth checking out with a free account, and deciding based on direct experience if dropping the $200 on Edge makes sense.

Pros and Cons of Stocktwits

Pros | Cons |

|---|---|

Social media focused on investors | User commentary is not subject to editorial review, reducing reliability |

~10 million strong user base to exchange ideas | Abundant pump-and-dump “gangs” |

Wealth of learning and news resources | Overflow of often trivial information |

Live on-air and in-person events, including the ability to listen to earnings calls | Insufficient focus on non-social factors |

A vast array of stock analysis tools with a focus on investor sentiment | Only enticing premium tier is pricey |

What is Better Than Stocktwits?

Stocktwits’ strength lies in the fact that there is no platform quite like it.

While numerous other websites do parts of the offering better—X can be faster in terms of news, Seeking Alpha is more detailed and reliable, etc.—none provide the community and sentiment-driven package enriched by live events and expert insights like Stocktwits.

Related Reading: 10 Best Stock Research Websites & Tools

Despite this, many premium platforms are well worth a subscription, either in tandem or instead of the investors’ social media network.

1. WallStreetZen

Considering the volume of “social cue” information Stocktwits provides, its biggest shortcoming may be the obfuscation of more fundamental information, even though the platform does provide key company metrics.

With this in mind, WallStreetZen’s Zen Ratings provide a complementary research tool to dedicated Stocktwits users.

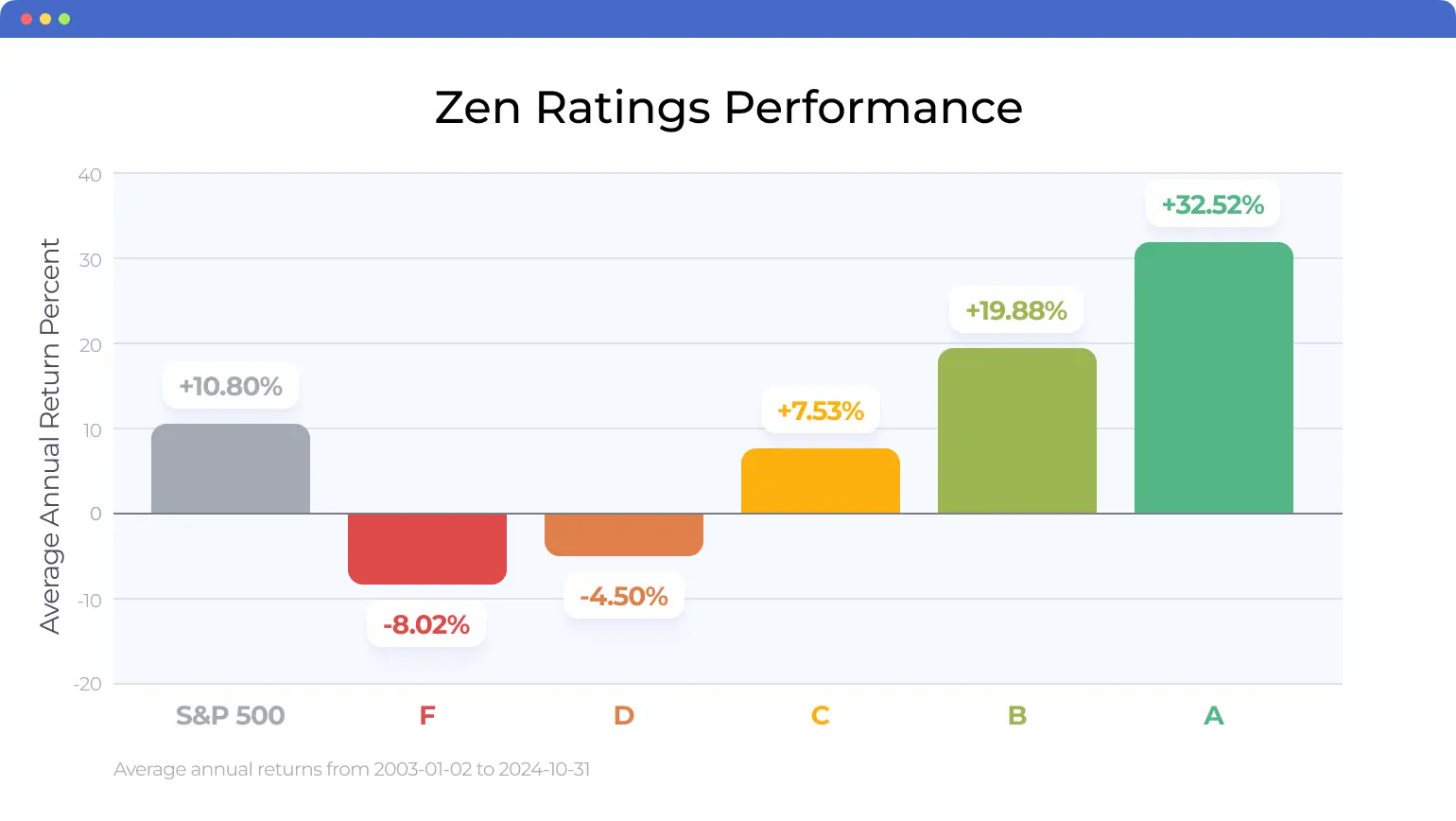

Zen Ratings serves as an all-in-one stock rating service that reviews 115 factors proven to drive stock growth by culling thousands of data points to score equity. That sounds complicated, but it’s all distilled into an easy-to-understand letter grade (A-F, like in school) and 7 “Component Grades” for key areas that play into the overall grade, like Growth, Momentum, Value, and even a proprietary AI algorithm.

Why should you care about this system? Because stocks rated A (Strong Buy) have historically delivered 32.52% annual returns. Not bad.

This makes it an excellent and quick corroboration tool for verifying the trend and sentiment data from the investor social media platform, as well as to check the interesting yet far-fetched trading ideas swiftly.

Related Reading: How Zen Ratings Can Help You Beat The Market

Lastly, Zen Ratings can help you gauge if an obvious hype train from Stocktwits might be worth an investment after all, or if the company’s fundamentals and technicals are simply so poor that no amount of enthusiasm will prevent losses.

Want more portfolio guidance?

If building an intelligent portfolio is your objective, you could be up and running with Zen Strategies in 10 minutes a month. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48.01%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund. Plus, there’s a 50% off launch offer.

2. Benzinga Pro

- Price: Available for free with premium coming in tiers: Basic at $27/month, Essential at $197/month, and Options Mentoring at $457/month.

- What you get: High-speed news service, a portfolio-managing service

- Why it’s a good alternative: Less sentiment-driven and more attuned to high-speed traders

At the surface level, Benzinga Pro is similar to Stocktwits as it gives rapid-fire news developments and significant online access to a large investor community. However, the content is of a higher caliber.

Furthermore, Benzinga Pro is more tailored to day traders and other types of investors who need lightning-fast information, both through the famously quick news service, and features like the Audio Squawk: a way to get actionable information without switching tabs to scroll through the latest developments.

3. Motley Fool Epic

- Price: $499 per year (but you can save $200 when you use this link and the code EPICSALE*).

- What you get: Professional stock picks with a strong track record, research, and learning tools

- Why it’s a good alternative: Well-suited to long-term investors with an eye for massive gains

Despite featuring a social component, Motley Fool Epic is primarily suited for investors who are in it for the long haul. With your subscription, you get 5 stock picks per month and monthly recommendations and rankings from 4 of Motley Fool’s top scorecards: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor.

Stock Advisor alone has an incredible track record:

Indeed, much of the platform’s offering centers on reliable and long-term — yet still immediately actionable — stock picks, professional analysis, and top-level tools for uncovering an asset’s critical financial metrics.

Thus, Motley Fool Epic is less of a straight replacement for Stocktwits, though your trading style could very much make one or the other irrelevant—and you can use it to complement the more community-driven insights.

The price can be a barrier to some. But with the $200 discount on the first year, it becomes a lot more accessible. You can get that discount using the link below.

4. Seeking Alpha

- Price: Seeking Alpha Premium costs $299/year when billed annually, but you can try it for Free for 7 days with this link

- What you get: A vast library of in-depth analysis, research tools

- Why it’s a good alternative: More comprehensive analysis with less overall “noise”

Seeking Alpha is another platform that combines a wealth of insights and analysis coming from thousands of contributors with a very strict, even exclusive offering of expert recommendations.

Indeed, it is, for many, the go-to platform to learn about the most important comings and goings in the market, and can be, on average, seen as containing more exhaustive and more reliable analysis than the less-vetted Stocktwits.

Despite this, it is not a platform for everyone, as many high-level investors view it more as a starting point for thorough research than the final destination, despite how Seeking Alpha sometimes positions itself in its marketing.

What Do Customers Say About Stocktwits?

In 2025, it is unfortunately impossible to avoid mentioning the bugs plaguing Stocktwits’ smartphone and tablet application, which have made the service, at least for users suffering from the glitches, nearly unusable.

By far the most common complaint is that the application tends to crash after either seconds or minutes of use, making anything other than a cursory glance at the latest developments impossible.

Still, barring the bugs that the developers will hopefully fix swiftly, the overall attitude toward the platform is positive.

Many users praise it for its unique and exclusive offerings, such as earnings calls, while finding community commentary and real-time feeds, which you can access through features like cashtags, highly useful.

While the reported presence of bots, scammers, and pump-and-dump “gangs” is unfortunate, it is also almost unavoidable on modern platforms that do not only feature carefully curated content.

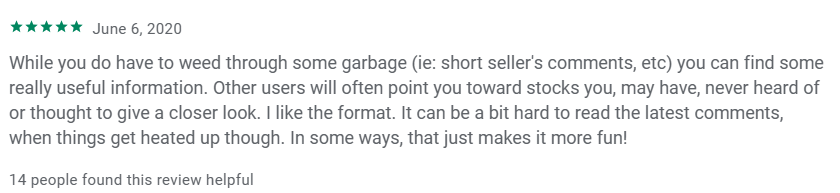

Furthermore, as at least one user noted in their Stocktwits review, the resulting drama is entertaining to watch as long as you maintain your guard and exercise due diligence.

Fortunately, the bugs widely reported since the spring of 2025 are not present on the web version of the platform, meaning desktop and laptop users can still enjoy the benefits without the hassle typically found on mobile.

Final Word:

All in all, Stocktwits presents a compelling case for potential users as a strong and social-focused investing platform.

The platform’s large offering bolsters the value proposition, and this is doubly the case for features such as earnings calls with built-in real-time sentiment gauges.

Still, the deluge of recent bug reports ensures that any hopeful users should spend time with the free version before committing to the paid tiers. Additionally, it’s a smart idea to back up any stock picks you discover through Stocktwits with a trusted stock research resource like WallStreetZen.

FAQs:

Is Stocktwits reliable?

Stocktwits is filled with reliable information. Still, as a social media platform, it is important to always do your due diligence no matter how compelling a case you read, as misinformation and even intentional scamming can always be hiding between legitimate analysis.

What is better than Stocktwits?

Stocktwits fills a unique niche as an investor-focused social media platform filled with specialized tools. Nonetheless, platforms like X have been known to deliver breaking stories faster, while websites like WallStreetZen can offer more thorough fundamental analysis for equities you might be interested in.

What is Stocktwits used for?

As an investor social media platform, Stocktwits is primarily used as a network for traders to exchange ideas and share new and interesting developments. Furthermore, Stocktwits offers a wide array of specialized tools that help users gauge public sentiment about assets and even track corporate data through things like earnings data.

Is there a fee to use Stocktwits?

Stocktwits can be used for free in its basic form, but removing ads from your feed costs $8 per month, while access to the platform’s premium tools will set you back by $22.95 for the Edge subscription tier.

Is Twitter better than Stocktwits?

X (formerly known as Twitter) often delivers breaking market news faster than Stocktwits and boasts a larger overall community. It is, however, easier to get distracted on X as a more general social media platform, and it lacks the specialized investing tools Stocktwits is known for.

Is Reddit better than Stocktwits?

Reddit is different enough from Stocktwits that it is difficult to say one is inherently better than the other. It is easier to separate high from low-quality information on Reddit as long as you stay on a reputable subsection of the website, but it lacks many of the specialized market-tracking tools Stocktwits is known for.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.