Gen Z has embraced the digital frontier, ultilizing the power of social media to get financial education. Our exploration into the topic, Where Did Gen Z Learn About Money? has unveiled a wealth of insights into this generation's financial journey.

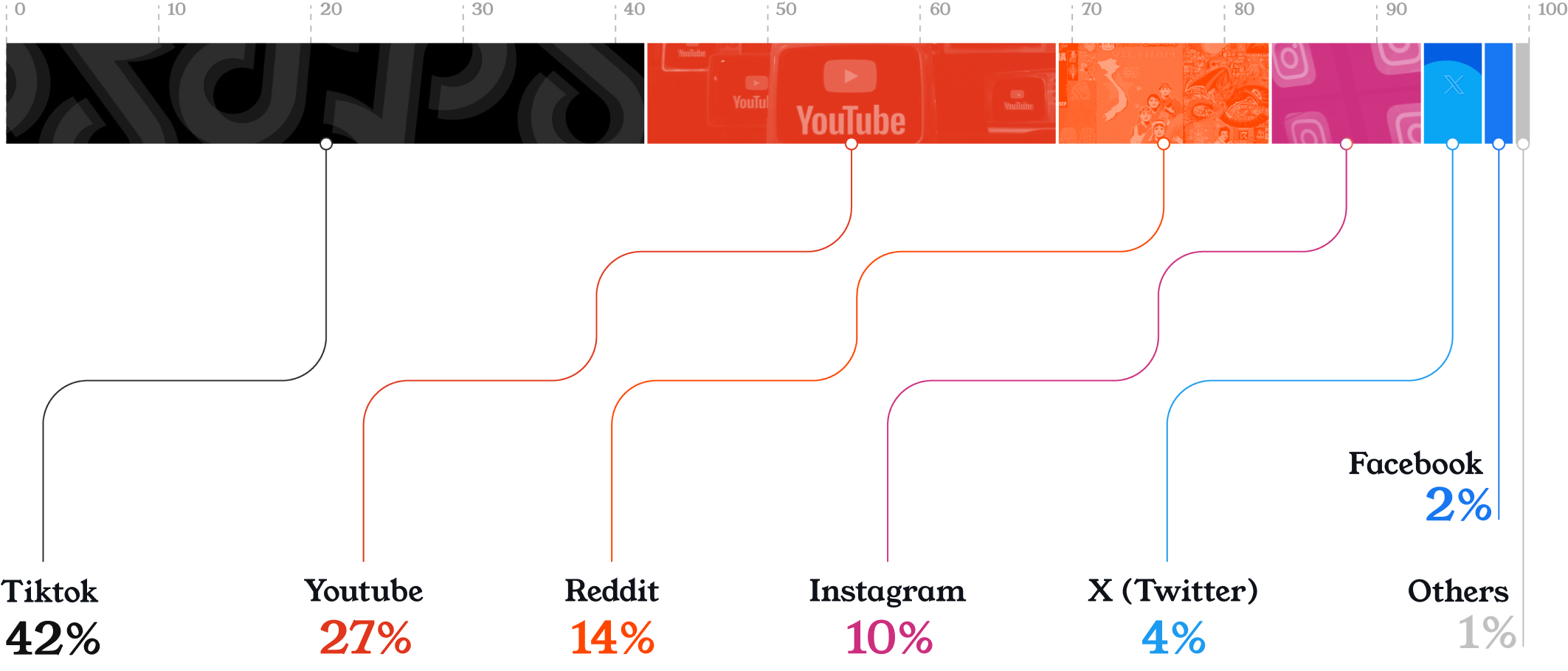

Through platforms like TikTok, YouTube, Reddit, and Instagram, Gen Z has discovered a treasure trove of financial wisdom. The content on these platforms spans saving and budgeting, investing in stocks and cryptocurrencies, retirement planning, and more.

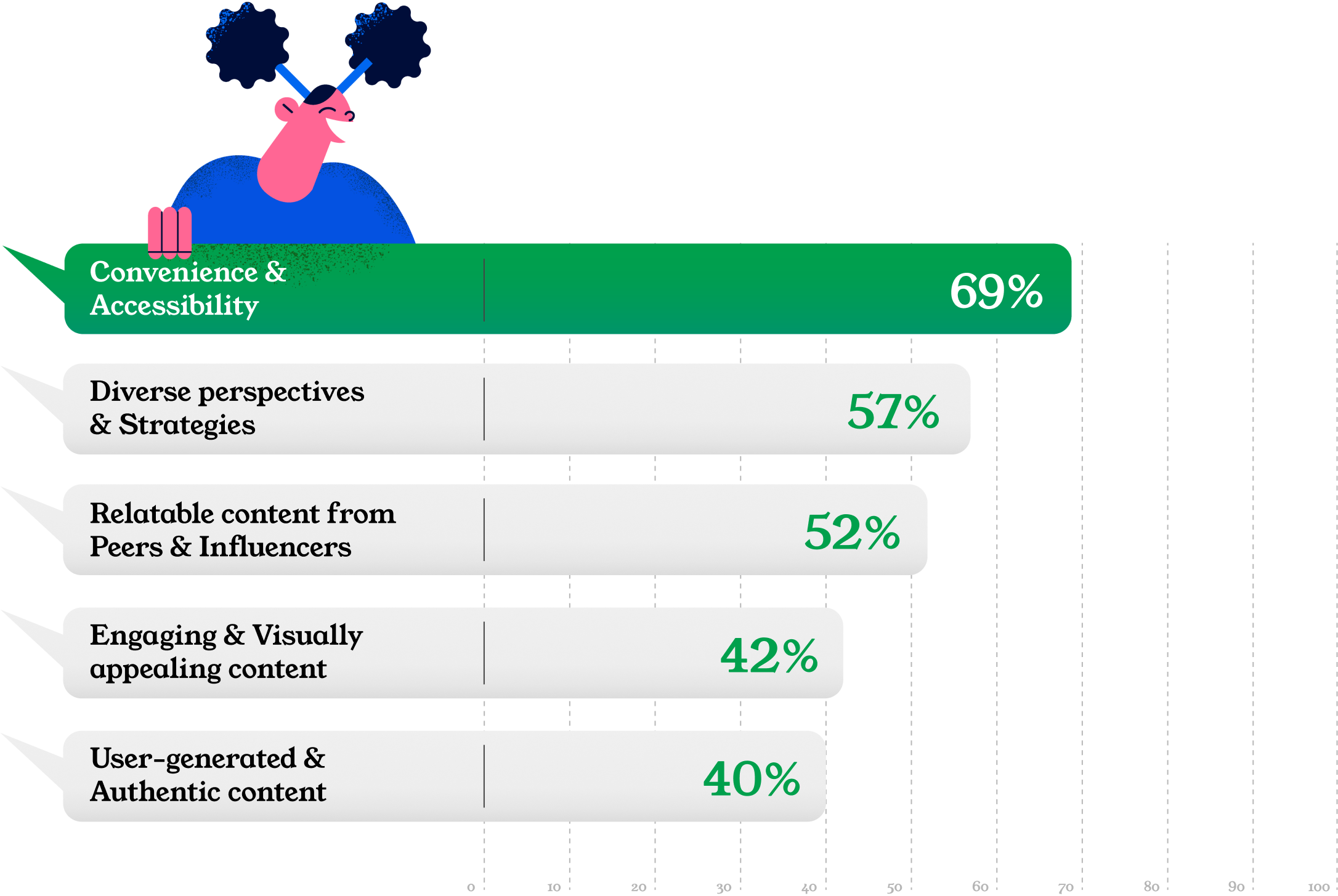

The accessibility, diverse perspectives, and relatable content offered by social media have transformed the way Gen Z approaches financial education.

However, it's important to approach this digital revolution with a discerning eye. The survey data reminds us that not all content on social media is reliable, and misleading information can be prevalent.

The short format of some content can lead to oversimplification, potentially leaving knowledge gaps. Moreover, personalized financial advice and guidance are often lacking in the social media sphere.

In conclusion, it is evident that Gen Z's financial education should be a blend of digital and conventional financial learning. Combining the strengths of both worlds—leveraging the accessibility and diversity of social media alongside the depth and expertise of established financial institutions and educators—is key to achieving the financial success that this generation seeks.