Not everyone wants the risk that comes with chasing high returns. If a solid 5 percent return sounds quite sufficient, you’re in the right place. This post features 10 historically proven ways to pursue 5% returns.

To be clear, there’s no such thing as a guaranteed 5% return on investment. However, the below investments offer steady historical returns that come close to 5% over long periods of time.

10 Best Ways to Get a 5% or Higher Return

1. Stocks With Solid Fundamentals

If you’re looking for a respectable 5% return on your investments, finding high-quality stocks that have solid fundamentals is a good place to start. You’ll want to find companies that have a reasonable price-to-earnings ratio (P/E), low debt load, a high profit margin, and a strong balance sheet.

Finding stocks that fit the bill can be challenging without a few handy tools. WallStreetZen makes it easier.

First, start by filtering down the thousands of stocks to find the ones that fit your criteria. You can filter by market cap, dividend, stock price … The options are practically endless.

If that seems overwhelming, go ahead and start with pre-built screeners to easily see the options available. Here are a few to try:

- Strong Buy Stocks from Top Wall Street Analysts

- Stable and Safe Stocks

- Strong Balance Sheet and Fundamentals

(You can browse even more pre-built screeners here.)

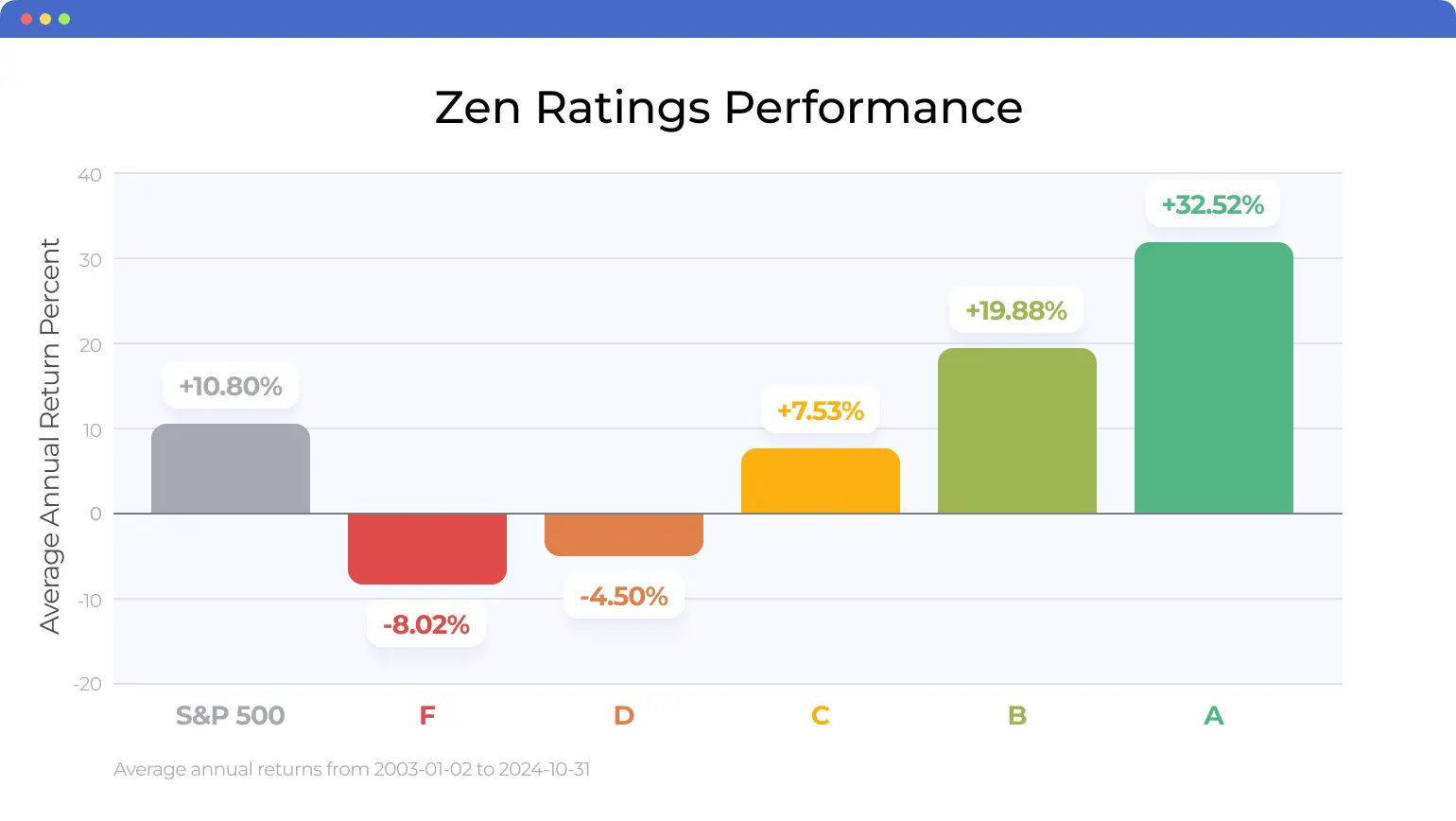

Either way, don’t miss the crowning jewel of WallStreetZen’s stock research tools — the Zen Ratings system.

This quant ratings system is the fastest way to find companies that have the possibility of outperformance, with a proprietary 115-factor review (including a proprietary AI factor) that specifically seeks out proven growth characteristics in stocks. Those factors are distilled into an easy-to-understand letter grade, A through F (just like school report cards).

You can quickly browse through to find “A-rated” stocks that have strong fundamentals, low valuations, and the potential to breakout.

Of course, this still might be too much handpicking to find stocks you want to invest in. If you really want to get serious about building a portfolio that can deliver solid returns over time, consider a stock-picking service like Zen Investor (more info below) or curated portfolios that find a handful of undervalued stocks.

This lets you build a small portfolio that could return 5% (or hopefully even more!) in the coming years.

Solid stock picks for the long term

If you’re looking for solid stock picks poised to deliver returns over the long term, you may want to consider subscribing to our stock-picking newsletter, Zen Investor, where a 40+ year market veteran does the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

2. High-Quality, High-Dividend Stocks

If you’re looking to achieve a 5% steady return, you might consider investing in companies that pay dividends. A dividend is when a company pays out some of the quarterly profit to shareholders in the form of a cash payment.

What you’d want to focus on is high-quality companies that pay a high dividend. This means companies that have a history of paying dividends for years — or even better — have a history of raising their dividend each year.

Companies that raise dividends each year for 25+ years are known as Dividend Aristocrats, and companies that raise dividends for 50+ years are known as Dividend Kings.

Some well-known Dividend Kings include:

Or once again, go ahead and use a screener like this Dividend stock screener.

Some of these solid companies can pay around 2% to 4% per year in dividends. Combined with modest price appreciation of the stock, you might be able to achieve 5% returns year after year investing in these high-quality companies.

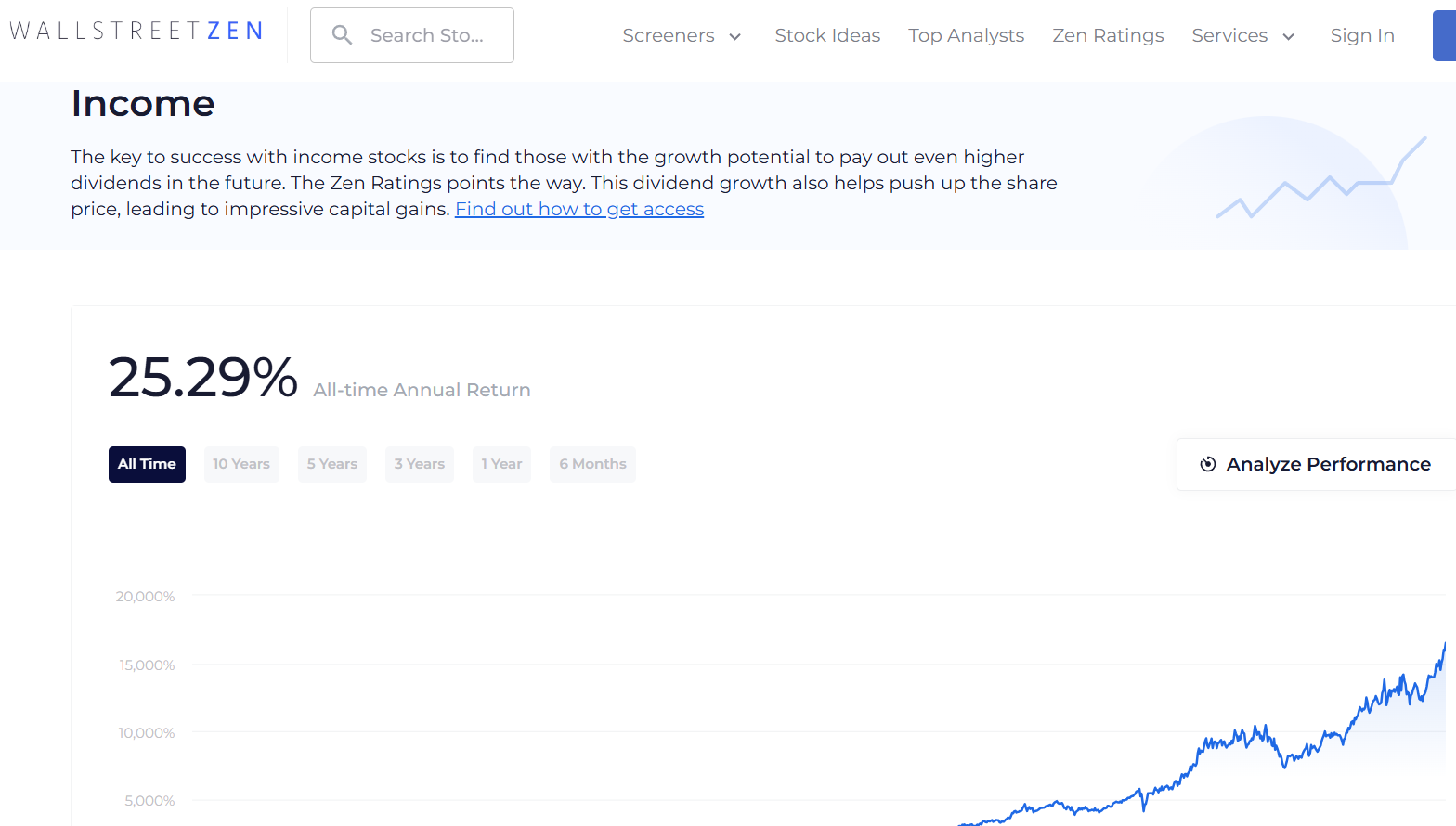

With the aforementioned Zen Strategies service, you can also find curated portfolios with a selection of income-focused stocks to maximize your yield over time.

3. High-Yield Savings Account

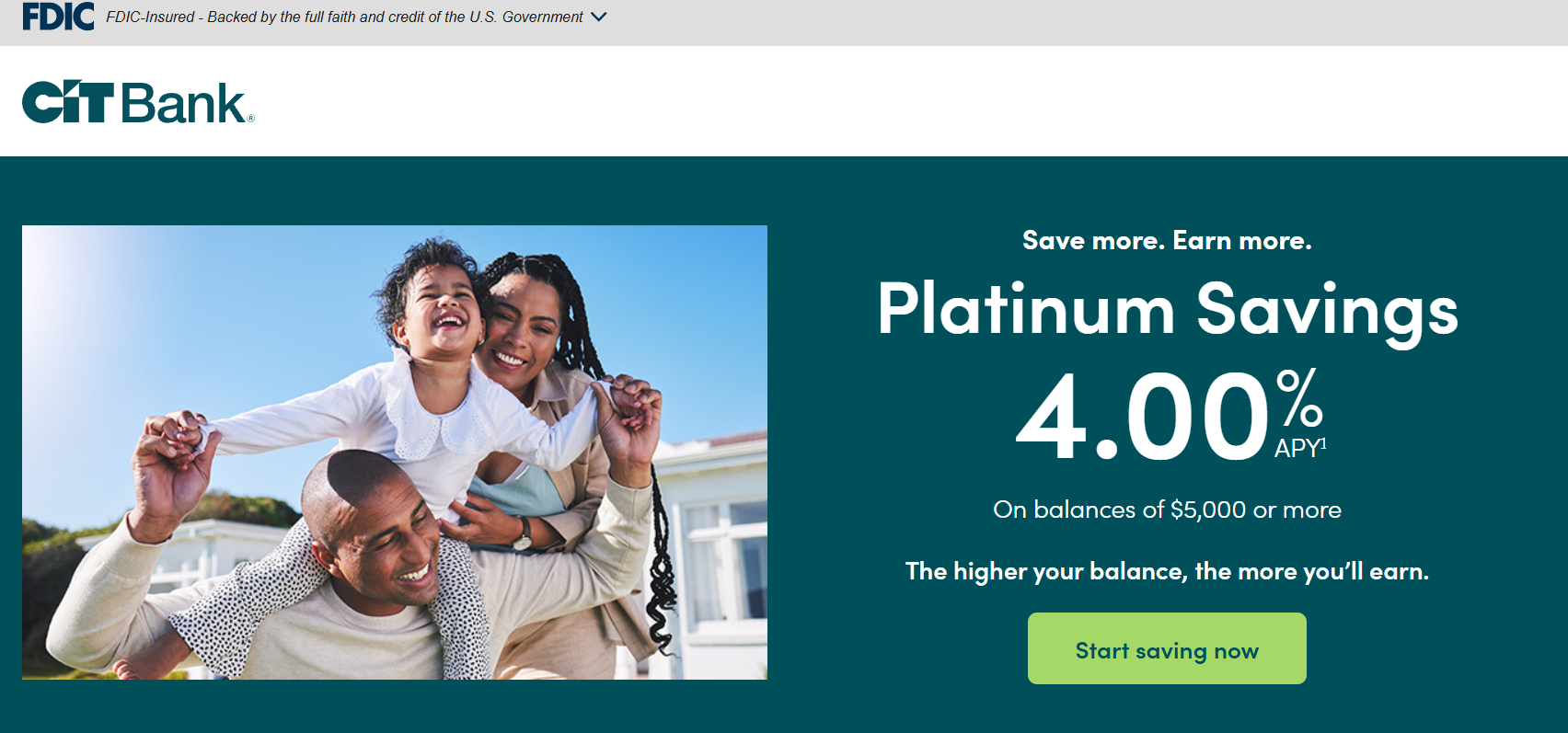

Sadly, the days of over-5% HYSAs appear to be over. However, their safety and reliability still warrants a spot on the list.

One of the safest places to park your cash and earn a decent return is in a high-yield savings account (HYSA). These accounts are similar to a regular savings account, but some offer returns over 4% APY.

High-yield savings accounts offer the same protections as a regular bank account, including FDIC or NCUA insurance (up to $250,000 per depositor), immediate access to funds, and no penalties to withdrawing money.

While interest rates have come down over the past year, you can still earn over 4% APY in some accounts, with others offering APY boosts that push your earnings over 5%.

Not all high-yield savings solutions aren’t offered through traditional banks. For instance, moomoo is a brokerage that offers a short-term boost on your APY on uninvested cash, bringing it up to 8.1% for a limited time. So if you’re in the market for a broker and high-yield savings, it might be a good fit.

Here are a few of the top high-yield savings accounts to consider:

- CIT Bank Platinum Savings: 4% APY on deposits over $5,000

- Public High Yield Cash Account: 4.10 APY on all deposits

- Moomoo Cash Account: 4.1% APY on uninvested cash (potential short-term APY boost to over 8%)

4. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are short-term savings accounts that pay high interest rates for locking up your funds for a period of time. CDs have the same protections as a bank account (FDIC/NCUA insurance), but pay high interest rates because your funds are not accessible for the duration of the CD term. If you do withdraw funds early, there’s often an early withdrawal penalty.

CDs come in various terms, with the highest-paying CDs currently having shorter durations (less than 2 years). Most CDs also have a minimum deposit requirement, so this is ideal for investors that have some cash available that they can lock away for a little while.

Some of the top CDs available today are paying over 4% APY, which, factoring in compounding interest, could bring you over the 5% mark…

- E*Trade 6-month CD: 4.45% APY, no minimum deposit

- Synchrony 15-month CD: 4.25%, no minimum deposit

- Marcus 6-month CD: 4.40% APY, $500 minimum deposit

5. Government Securities

One of the safest investments on the planet are U.S. government securities, commonly known as “U.S. Treasuries.” These investments are essentially short- or long-term loans to the U.S. government in exchange for earning interest.

The highest paying government securities right now are U.S. Treasury Bonds (T-Bonds) or U.S. Treasury Bills (T-Bills).

- T-Bills: 4 to 52-week term, bought at discount, full amount paid at maturity. Rates around 4% APY.

- T-Bonds: 20- or 30-year term, pays a fixed rate every 6 months until maturity. Rates around 4.5% APY.

The reason these investments are attractive is that U.S. Treasuries are backed by the U.S. government. This is considered the one of the safest investments around, and most experts call the U.S. Treasury return rate the “risk-free rate” when speaking of investing.

While you can’t quite achieve a full 5% return like you could just a year ago, these rates are about as close as you can get to 5% without any risk. You can purchase U.S. Treasuries from the U.S. government at TreasuryDirect.gov.

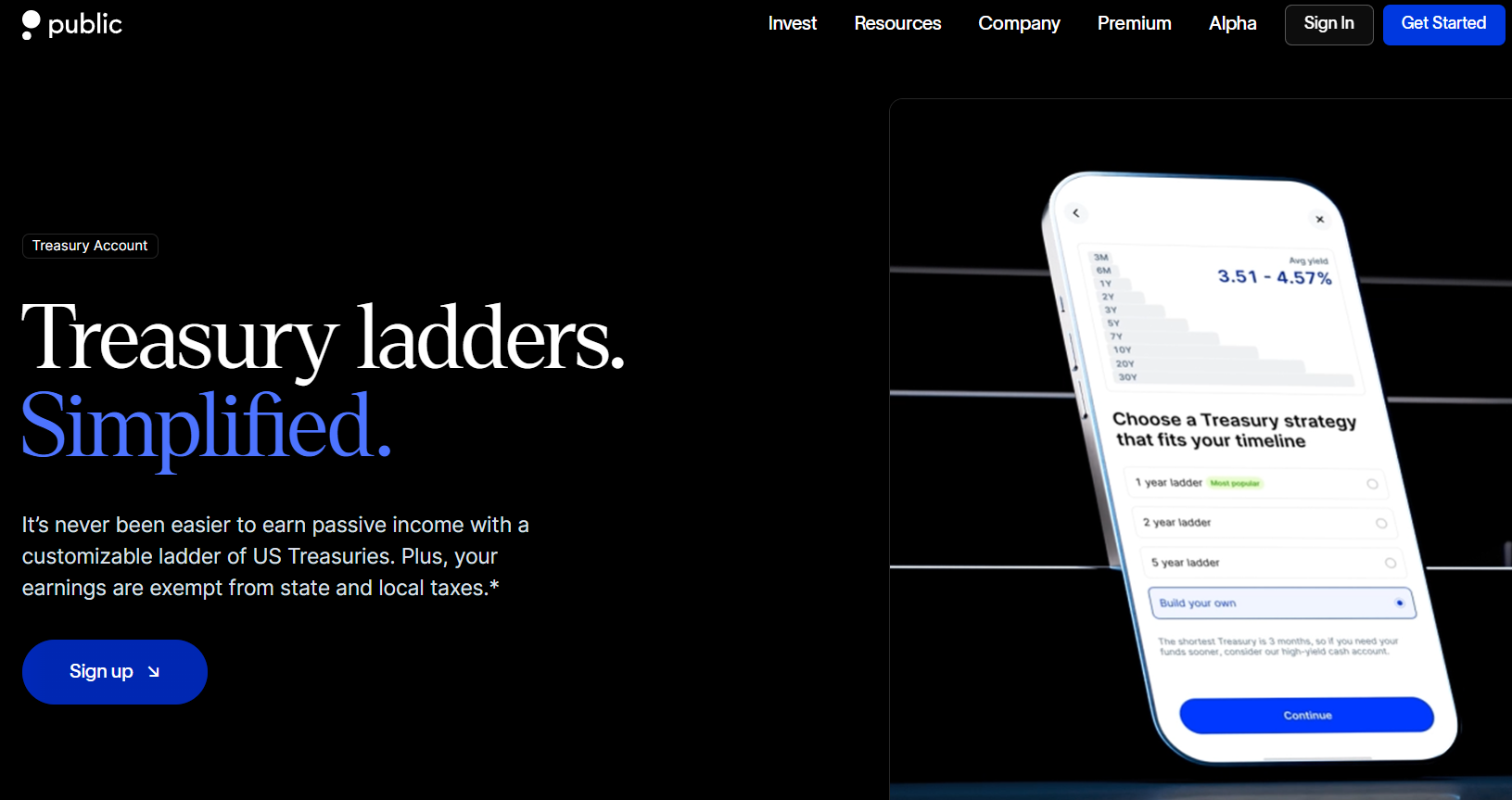

But you can also buy U.S. Treasuries through online brokers, making it easier to own and sell as needed. For example; Online broker Public offers access to a Treasury Account that lets you ladder U.S. Treasuries of different maturity lengths. You can choose a pre-built ladder, or select your own U.S. Treasuries from 3-months up to 30 years in length.

6. Investment-Grade Corporate Bonds

While lending money to the U.S. government offers risk-free returns, lending money to corporations could also offer stable (and mostly safe) returns to investors. Corporate bonds allow you to lend money to corporations for a fixed interest rate, with returns usually between 4% to 6% APY.

Investment-grade bonds are larger companies that are looking to raise capital issue corporate bonds to investors. These bonds typically pay monthly or quarterly interest payments to investors. While the yield might be lower than “junk bonds” from smaller companies, these are seen as a safer investment, because the risk of a large corporation default on bond payments is relatively low.

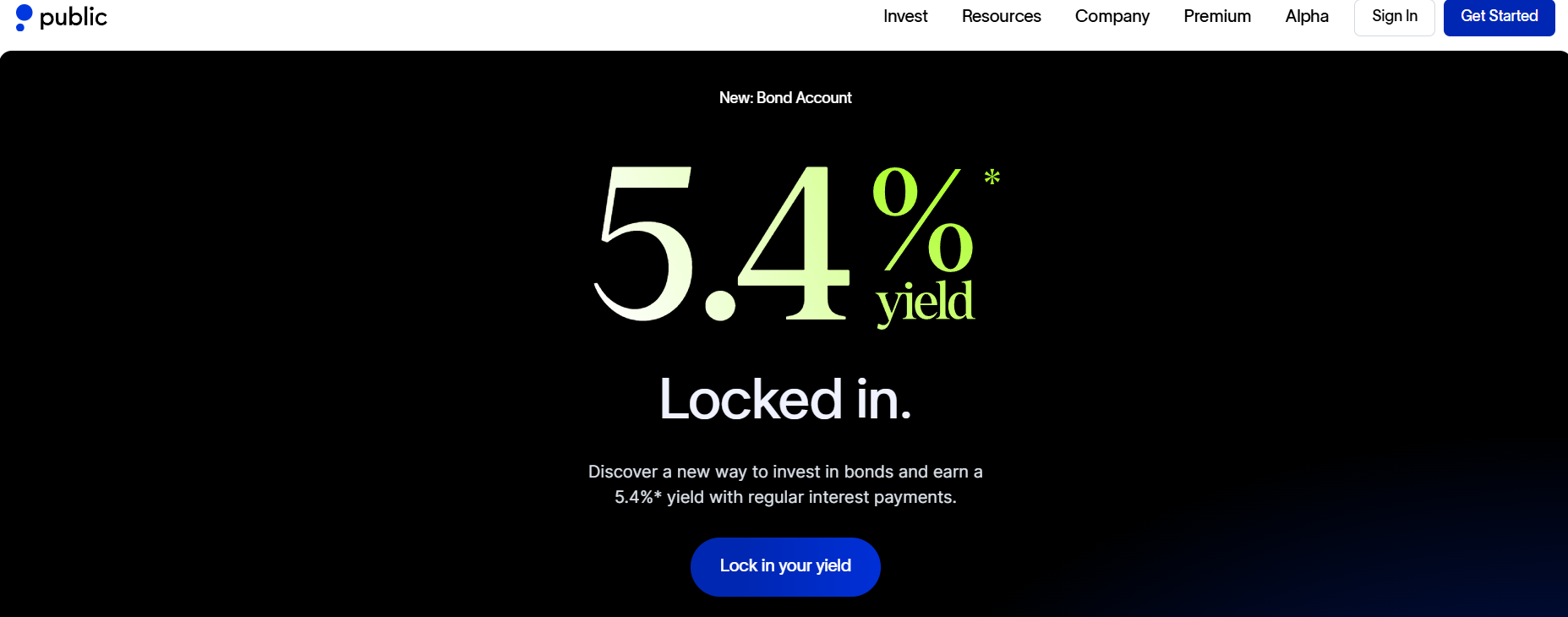

You can purchase individual investment-grade bonds from most brokers, or you might choose to invest in a corporate bond fund that holds a wide range of corporate bonds. For example; Public offers a Bond Account that holds 10 bonds and pays a current yield of 5.4% APY. This can be a more stable way to earn 5% returns vs. the stock market.

7. REITs (Real Estate Investment Trusts)

If you’ve wanted to invest in real estate without the hassle of becoming a landlord, handyman, and/or property manager, there’s a simpler way. Real Estate Investment Trusts (REITs) are investments that own and operate commercial real estate and pass on a majority of the profit to investors.

You can invest in REITs through most major brokers, and purchase them as individual stocks or as ETFs. REITs pay investors dividends from the income from operating real estate investment properties, and can potentially yield from 4% to 6% APY.

You can find solid REITs to invest in using a stock screener (like this one), and you can even filter out REITs that have higher ratings using our Zen Ratings system. Any REIT that has a “B” or “A” rating is considered a Buy, and may even yield higher returns in the future.

For example, I used WallStreetZen’s Best Real Estate Stocks to Buy Now screener (it’s not all REITs, but there are quite a few of them) and filtered by stocks rated A or B with the Zen Ratings system that also have a 5%+ dividend. I found three:

From here, I might go to each individual stock page to see how the fundamentals look. For instance, I clicked on the stock page for Postal Realty Trust (NYSE: PSTL) and discovered that not only does it have an overall B (Buy) rating, but it has excellent scores for some of the Component Grades that shape the rating, such as Sentiment, Growth, and the proprietary AI factor (read more about that here).

As you can see, WallStreetZen makes it a lot simpler to locate stocks and do your due diligence without sacrificing too much of your time.

8. Dividend ETFs / Mutual Funds

If you’re a fan of steady dividends, but aren’t sure about picking the right individual dividend stocks, you might consider investing in a dividend ETF or mutual fund instead. These dividend funds hold dozens (or even hundreds) of dividend stocks and you collect the average dividend yield across all holdings in the fund.

There are different dividend funds for different types of investors. Some offer maximum yield that pay well over 5%, but have a higher risk of dropping in value. Others hold only stable dividend stocks that have a history of increasing dividends over time. And others offer a mix of growth and dividends, giving you the best of both worlds.

Dividend ETFs and funds can be a great way to earn a stable yield (3% to 4% APY), and also have modest gains to earn 5% or more. But most funds do come with higher expense ratios, so it’s important to look for funds that offer good returns with low fees.

9. Bond ETFs / Income Funds

If you like the idea of investing in bonds but hate the idea of picking your own bonds, consider bond funds or ETFs. These funds hold a wide range of bonds (sometimes thousands) that pay out quarterly or monthly coupon payments from the underlying bond holdings.

Bond funds are best for inventors that want stable income and diversification, without the hassle of building your own individual bond portfolio. Bonds are seen as safe investments, and bond funds further diversify your holdings by investing in hundreds of bonds (or more) within a single fund.

Some of the best low-risk bond funds include U.S. Treasury ETFs, investment-grade corporate bond funds, and municipal bond funds (for tax-free income). These funds curate the best bonds for your investment approach, and offer low-risk returns near 5% APY.

Bond funds (like any bonds) do still have a risk of dropping in value, especially if interest rates go up. It’s important to understand the risks of investing in bonds or bond funds before putting your money into them, expecting a guaranteed return.

If you want to buy stocks or ETFs, you need a broker. We recommend eToro.

It’s one of the world’s most popular investing platforms, with over 28.5 million users.

Plus, eToro is currently offering a $10 bonus* for U.S. residents.

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. New accounts only. Additional terms and conditions apply.

10. Alternative Assets

Investing outside traditional stock and bonds markets gives you the ability to earn returns that aren’t necessarily correlated with the ups and downs of normal markets.

Assets like fine art, collectibles, precious metals, and cryptocurrency offer returns to investors that understand these markets and can hold for the long-term. Luckily, there are platforms that do the research and curation of alternative assets for you.

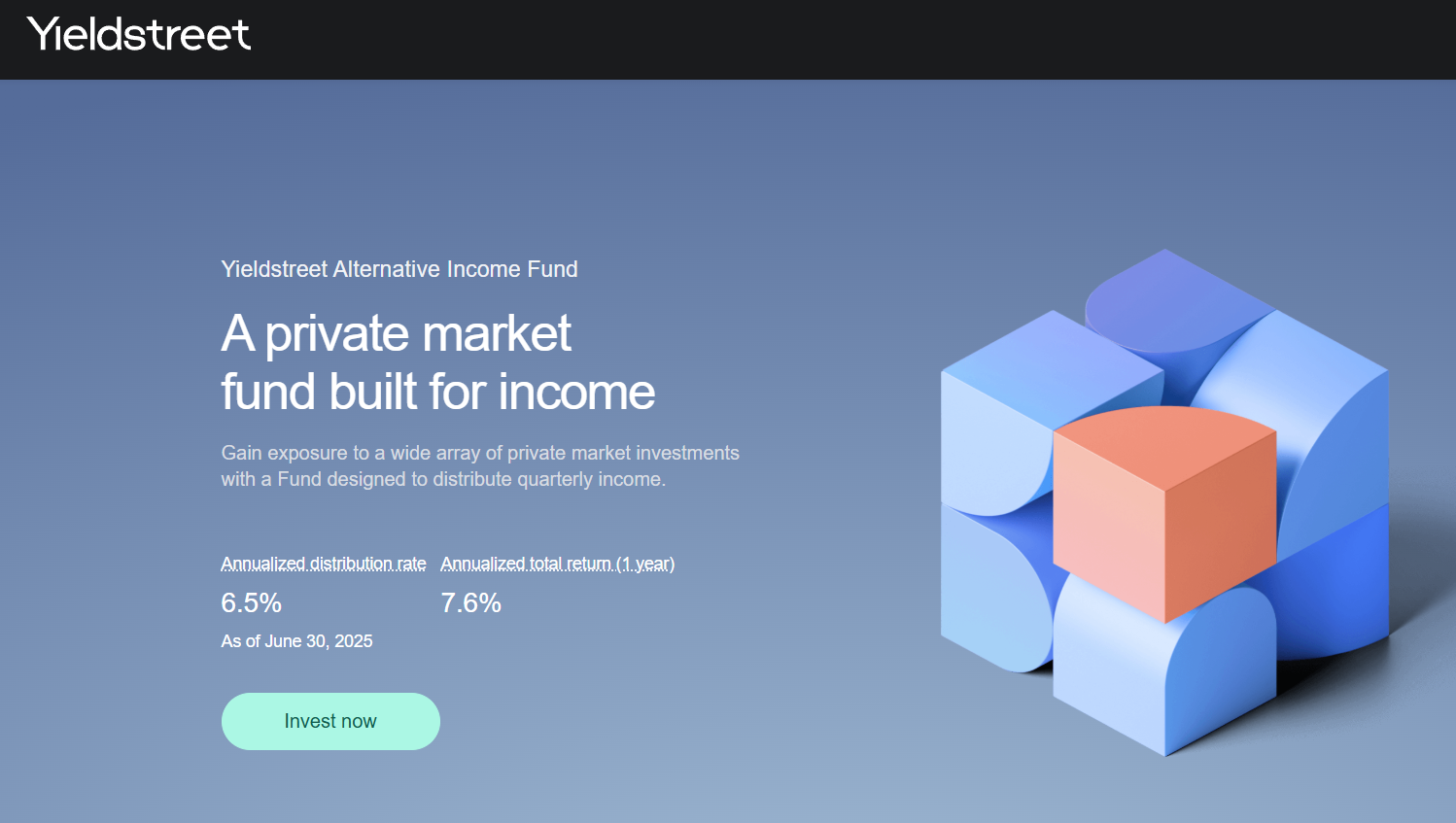

For example; Yieldstreet allows you to invest in a fund of alternative assets that offers higher yields than other fixed income investments. The current Alternative Income Fund has quarterly distributions, and an annualized total return of over 7%.

Another platform that offers alternative asset investing is Masterworks. You can buy fractional shares of ownership in world-famous art pieces. This allows you to enjoy the price appreciation of these pieces of art, and realize returns when they are sold — some outperforming the stock market altogether.

Before You Get Started: Reduce High-Interest Debt

Investing your money is important, but paying down high-interest debt is going to give you a better return on investment. High-interest debt includes things like credit cards, personal loans, and some auto loans where interest rates are 10% or higher. Tools like Empower’s free dashboard can help you on your way, but first, a few basics…

To pay down your high-interest debt, you’ll want to come up with a debt payoff plan. Here are two of the most popular methods:

- Debt Snowball: Focuses on paying off the debt with the smallest balance first. Once you pay it off, take the extra payments and then put them toward the next smallest balance. The idea is to get quick wins, and stay motivated to keep paying down debts until you’re debt free.

- Debt Avalanche: Focuses on paying down the debt with the highest interest rate first. This saves you the most amount of money while paying off your debts, but can be tougher to stick to if your highest rate debt has the largest balance.

No matter which method you choose, the most important detail is that you focus on paying down one debt at a time. After each debt is paid off, focus on the next debt, until all high-interest debts are paid off.

Alternatively, you can consider consolidating high-interest debt into a low-interest loan, such as a 0% credit card or a debt consolidation loan. But you still need to pay down your debts to achieve true financial freedom.

To track your debt payoff progress and spending, using a free tool like Empower Personal Dashboard can help you stay on track with your budget and pay off debts quicker.

The Bottom Line: How to Get 5% Return on Investment

No matter what anybody tells you, 5% is a solid return on investment. But as with any type of investment, it’s important to do your due diligence.

The methods listed in this post have historically helped investors generate 5% (or higher) returns. However, you can give yourself a boost by only choosing platforms and stocks that you’ve carefully researched yourself before you plunk down your hard-earned cash. Platforms like WallStreetZen can help simplify and streamline your due diligence process.

And remember: If you’ve got debt, be sure to take care of that first — tools like Empower can help. Don’t let it snowball into a monster that eats up all of your returns.

FAQs:

Is 5% return on investment good?

Earring 5% on an investment is considered a good return on investment for income-focused investors. If you can earn 5% in low-risk investments (such as bonds or dividend stocks), you are outpacing inflation and allowing your money to grow without too much risk. However, it’s worth noting that stock market indices (such as the S&P 500) typically return around 8% to 10% per year on average, which far outpaces a 5% return.

How can I earn 5% on my money?

To earn 5% on your money, invest in income-focused investments such as U.S. Treasuries, corporate bonds, and dividend stocks. You can also get 5% returns by investing in Real Estate Investment Trusts (REITs) and collecting income from rents on commercial real estate properties.

What is the average return on a $100,000 investment?

There is no average return on a $100,000 investment, as it all depends on what you’re invested in. For example, if you invest $100,000 in an S&P 500 index fund, you might get a 10% average return, or around $10,000 in the first year. But if you park that $100,000 into a high-yield savings account, you might only get a 4% return, or around $4,000 in that first year.

What does 5x ROI mean?

When calculating investment returns, getting a “5x ROI” means you earned 5-times the return as the money you originally invested. For example; If you make a $10,000 investment, and earn a $50,000 return, you earned a 5x ROI on that investment.

How can I get a guaranteed 5% return?

While no investment is ever guaranteed, the best way to earn close to a “safe” 5% return is through U.S. Treasuries. Current U.S. Treasury rates are around 4.875% APY on 20-year T-Bonds. U.S. Treasuries are considered one of the safest and most liquid markets in the world.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.