The Bottom Line: Is Range Worth It?

Yes — for a specific type of investor. If you’re a high-income household juggling complex assets, Range is a clear winner. With predictable fees, advanced tech, and end-to-end financial planning, it offers singular value for households earning $300K in total per year who have built diverse, but perhaps hard-to-manage, portfolios.

If you’re a tech-savvy professional who wants clarity and control over your wealth, Range is worth it. I’ve spent considerable time on the platform; in the below sections, I’ll explain precisely why.

Why Consider Range?

Picture this.

Your salary just hit $350,000. Stock options are vesting quarterly. You’ve got two rental properties and a taxable investment account that’s finally worth bragging about. “Champagne problems” for sure. But instead of feeling wealthy, you’re drowning in financial complexity.

Sound familiar? You’re dealing with what wealth managers call “affluent chaos,” where you make serious money but lack the systems to optimize it.

This is precisely why Range exists.

Range isn’t your typical robo-advisor that asks you three questions and stuffs your money into generic ETFs.

It’s not a traditional wealth management firm that’ll charge you 1% (or more) of everything you own, either. Range calls itself an “all-in-one wealth management AI” that promises to consolidate your complicated financial life into a single, streamlined platform, for a flat fee.

Range is not for everyone. It’s designed for high-income households that have an average household income of $300k total, with a net worth of between $1 million or higher. It’s a comprehensive financial site for tech-savvy households with complicated assets.

But how does this Range financial planner actually work? And most importantly, is Range worth the premium price tag when you could just hire a local CFP?

I’ve spent months researching Range’s services, analyzing their portfolio management approach, and reading every review I could find. Here’s what I discovered about whether Range deserves a spot in your financial toolkit.

What Is Range?

The Range wealth management platform launched in 2021 with a simple premise: High earners shouldn’t have to choose between comprehensive wealth management and reasonable fees.

CEO Fahad Hassan founded Range after witnessing friends struggle with a unique problem. Several of Hassan’s associates were earning six figures but were getting nickel-and-dimed by traditional advisors or ignored by platforms designed for average investors.

The company targets what they call “complicated money situations.” Think tech employees juggling ISOs and RSUs, real estate investors managing multiple properties, or entrepreneurs balancing business ownership with personal wealth building.

Range operates as a registered investment advisor, which means it is legally required to act as a fiduciary. They’ve raised over $40 million in funding and serve more than 2,000 clients with an average household income of $450,000 and assets between $1 million and $10 million.

How Range Works

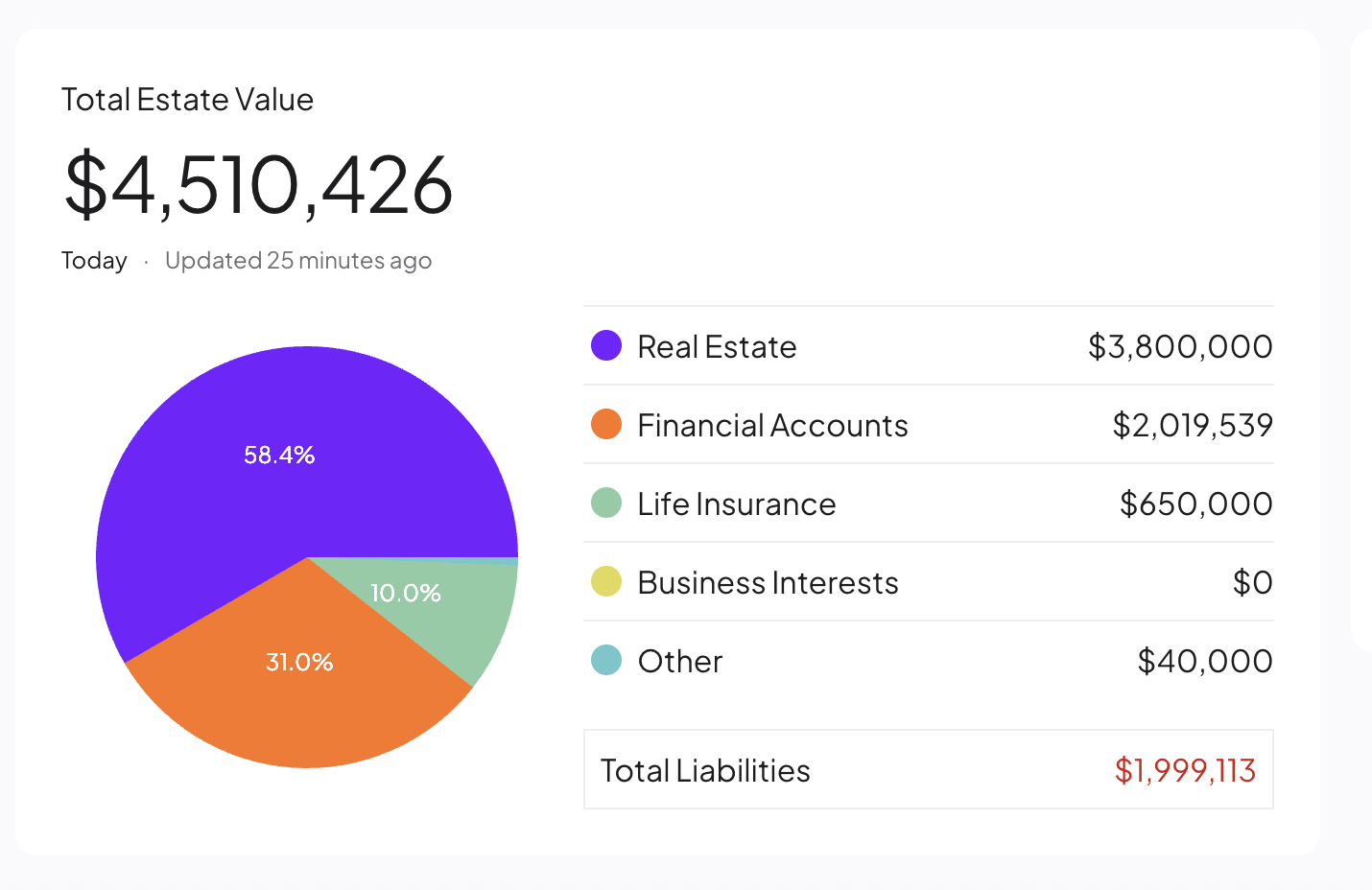

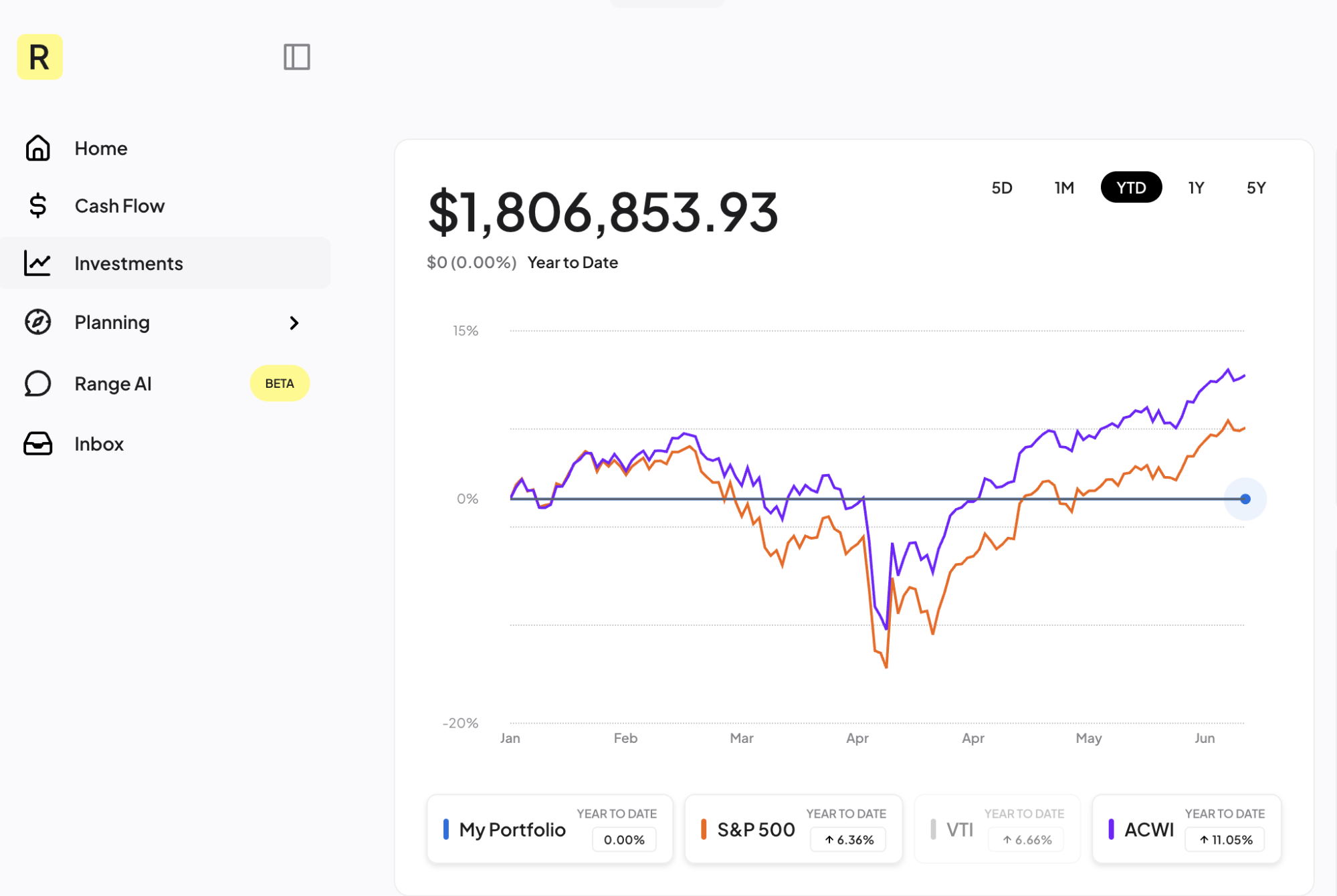

You don’t transfer assets to Range. Instead, it connects to your existing accounts such as checking, savings, 401(k)s, taxable investments, real estate, and even crypto holdings. The platform consolidates everything into one dashboard, where their team of CFPs and algorithms analyzes your situation.

Here’s a fun fact: The platform integrates an average of 37 accounts per client. That’s not just your Schwab brokerage account, we’re talking about your mortgage, your kid’s 529 plan, your HSA, those old 401(k)s from previous jobs, and that Robinhood account you opened during the pandemic (hey, no judgment).

It’s a platform that allows high earners to centralize all their finances in one place.

How Is Range Different From a Traditional Financial Advisor?

Walk into most wealth management firms and you’ll hear the same pitch: “We’ll take great care of your money for just 1% per year.”

Some legacy firms, like Fisher Investments, charge as much as 1.25%. For some investors, getting a high level of customization and advice is worth it.

For others, it’s not — particularly when you consider the math.

On a $2 million portfolio, you’re paying $25,000 annually. Every year. Forever.

Range flips this model entirely. They charge flat fees ranging from $2,355 to $8,955 annually, regardless of the size of your assets. Zero asset-based fees. Ever.

This fee structure creates different incentives. Traditional advisors benefit when your assets grow, as their fees do too. But they also have incentives to keep you invested with them and might recommend more complex products that generate higher fees. Range gets paid the same whether your portfolio doubles or stays flat.

Here’s a roundup of the biggest differences between Range and a traditional financial advisor:

Cost Advantage

Traditional advisors typically charge 0.5-2% AUM fees or $1,000-$3,000+ for comprehensive plans. Range offers flat-fee pricing with 0% AUM fees, targeting high-income earners at a “fraction of the cost” of traditional CFPs.

Service Parity

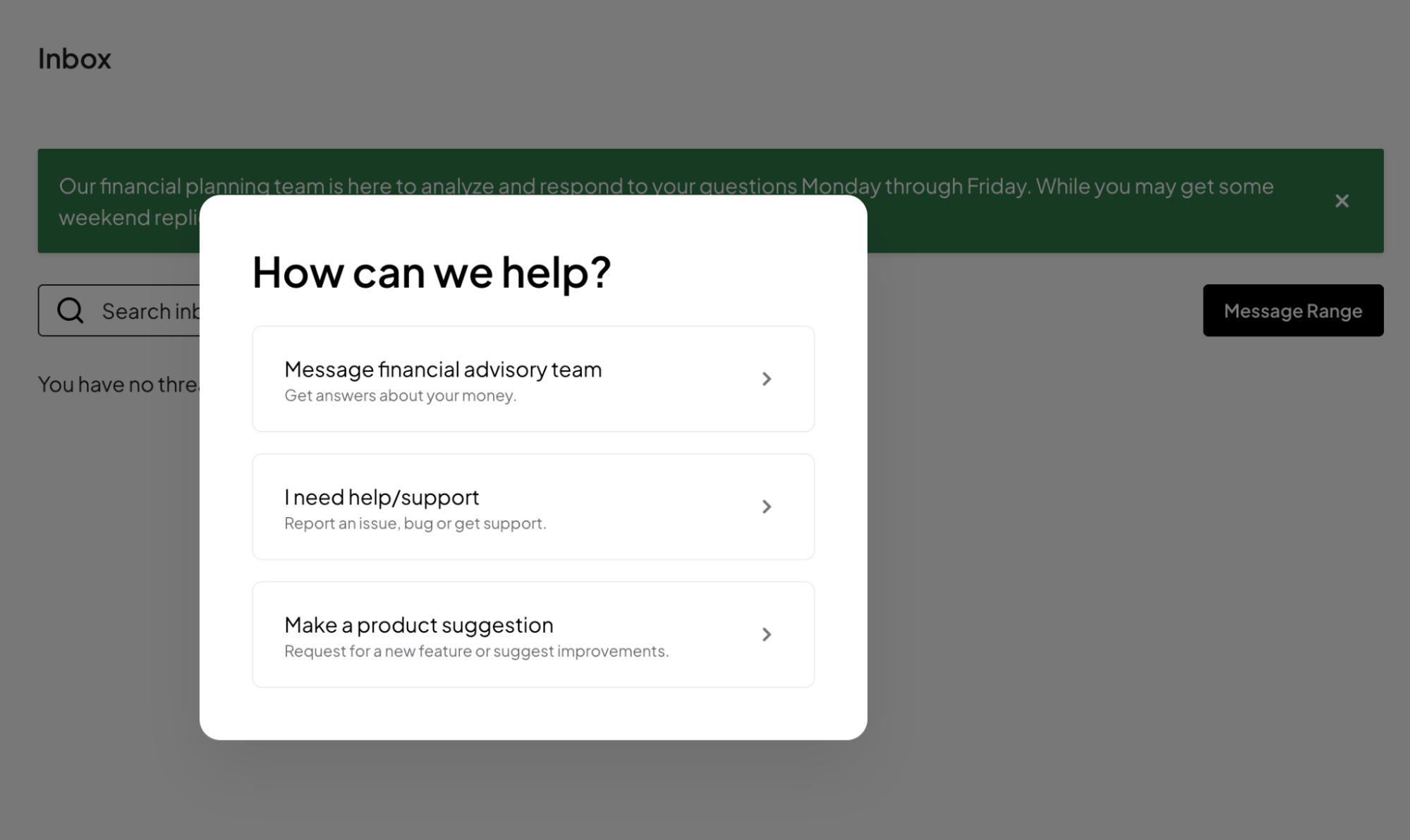

Traditional wealth management moves at a slower pace. You might get quarterly reviews, formal presentations, and scheduled check-ins. Range provides 24/7 dashboard access, unlimited messaging with advisor teams, and on-demand video calls. You can check your net worth at 2 AM or send a tax question on Sunday.

Range offers comprehensive wealth management services, including investment management, tax planning, estate planning, and equity compensation planning, provided by a team of CFPs who are fiduciaries. This matches traditional advisor services but with modern tech integration.

Target Market

Range specifically targets high-income households, including executives, entrepreneurs, doctors, and tech professionals who make over $300,000 (combined household), competing directly with traditional advisors’ affluent client base.

Range also specializes in modern wealth complexities that many traditional advisors struggle with. They understand startup equity, alternative investments, multi-state tax issues, and cryptocurrency. Try explaining your ISO exercise strategy to a traditional advisor who’s been managing retiree portfolios for 30 years.

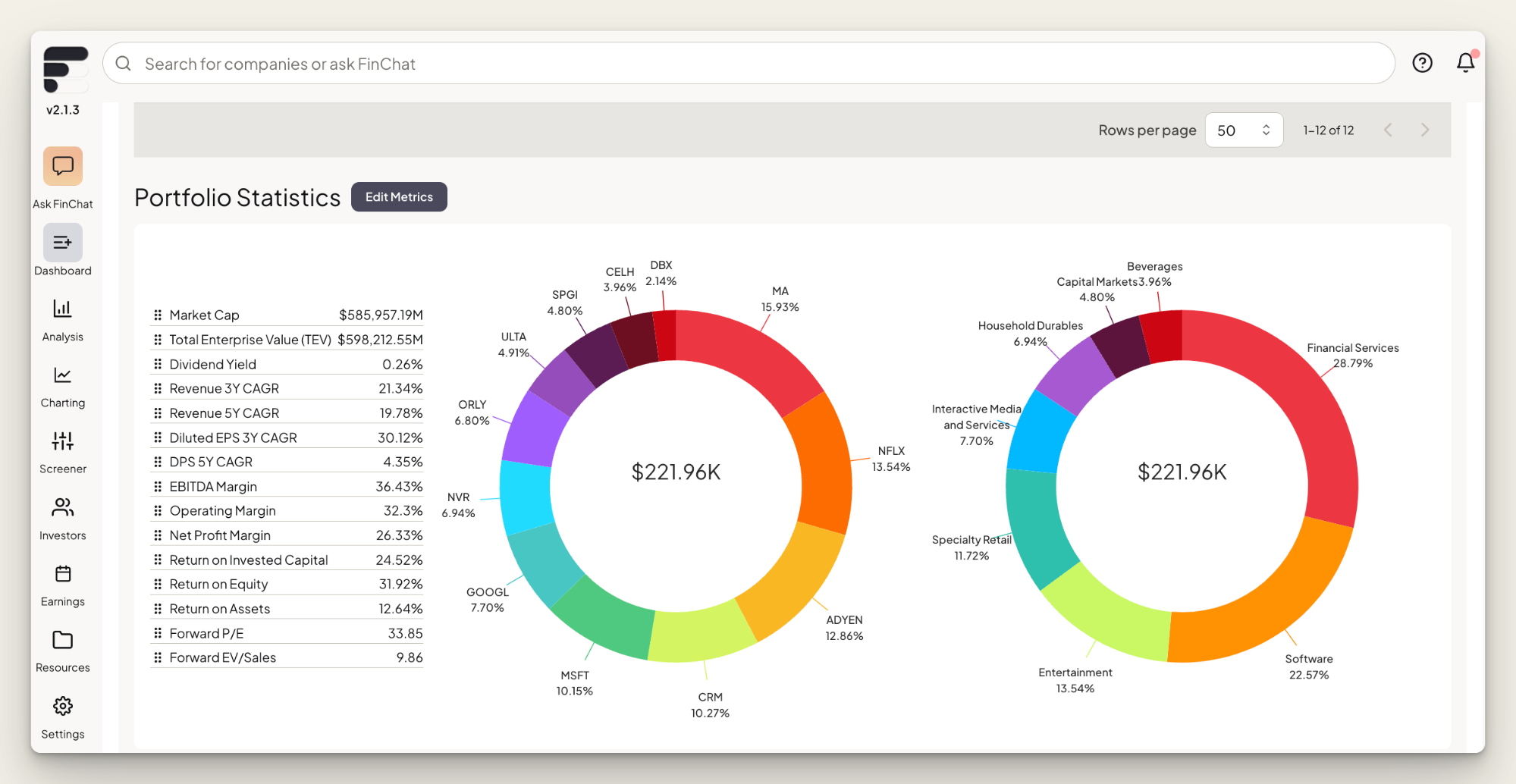

Tech-Forward

The technology gap is massive. Most traditional firms use planning software from the early 2000s. Range’s platform generates thousands of financial projections and models complex scenarios in real-time. When you’re considering major decisions like exercising stock options or buying investment property, Range can show you exactly how different choices affect your taxes, net worth, and long-term goals.

Range is recognized as a “Wealthtech 100 leader” with advanced algorithms that “generate thousands of projections and calculate multiple scenarios” — more sophisticated than traditional advisors’ tools.

Flat-Fee Innovation

Range emphasizes that flat fees provide “transparency, alignment of interests, and you keep more of your returns as every dollar compounds fully in your favor,” directly competing against AUM-based models.

Is Range a Fiduciary? Yes.

Yes. Range Advisory, LLC is an SEC-registered investment advisor operating under fiduciary standards.

They’re legally required to act in your best interests, which provides additional protection compared to brokers or insurance-based advisors who operate under lower “suitability” standards.

Bottom Line: Range occupies the “premium hybrid” space, offering traditional advisor-level services with modern technology at robo-advisor-style predictable costs, specifically targeting affluent, tech-savvy professionals who want comprehensive planning without AUM fees.

Currently In Beta: Range AI

Range AI, currently in beta, represents the company’s biggest technological bet. CEO Hassan describes it as “supercharging wealth advisers” rather than replacing them.

Right now, Range AI operates behind the scenes. When you log in, you’re not chatting with a robot. Instead, the AI helps human advisors analyze your situation more quickly and thoroughly than traditional methods allow.

Here’s a practical example: Let’s say you’re considering exercising ISOs, buying a rental property, and doing a Roth conversion, all in the same tax year.

A traditional advisor might spend days manually calculating different scenarios. Range AI can model hundreds of combinations considering variables like:

- Tax bracket implications across different income timing scenarios

- Alternative Minimum Tax triggers and optimization strategies

- State tax considerations if you’re planning to move

- Market volatility impact across asset classes

- Estate planning consequences of various strategies

The AI generates these projections in minutes, then human advisors review and interpret the results. This hybrid approach combines computational power with human judgment.

Range AI (which is still in beta) also monitors your accounts for optimization opportunities. It may identify tax-loss harvesting opportunities, suggest rebalancing moves, or alert you to time-sensitive decisions, such as upcoming equity compensation deadlines.

The long-term vision? Hassan believes AI will eventually handle routine financial planning tasks, freeing human advisors to focus on complex strategic decisions and relationship management.

However, we’re not there yet as Range AI remains a behind-the-scenes tool that enhances, rather than replaces, human expertise.

Range’s Key Services

Range structures their services around seven key areas that work together rather than as isolated offerings.

Investment Management

Range’s approach to portfolio management starts with analyzing all your accounts. Range will then review your current holdings to ensure they align with your risk tolerance, time horizon, and tax situation.

Unlike traditional advisors who charge 0.5% to 1.5% annually for portfolio management, Range includes investment oversight in their flat fee structure. They can actively manage your investments through integrated custodial partners without additional asset-based charges.

The investment process considers your entire financial picture, not just your investment accounts. If you own rental properties or have employer stock, Range factors these into your overall asset allocation. The platform also optimizes for tax efficiency, placing tax-inefficient investments in retirement accounts and tax-efficient holdings in taxable accounts.

Tax Planning and Preparation

Range’s tax services go beyond basic preparation. They start by analyzing your previous year’s return to identify missed opportunities and future optimization strategies.

For higher-tier clients, Range provides forward-looking tax projections that model your likely tax liability based on current-year activities. These projections take into account RSU vesting schedules, bonus timing, investment gains and losses, and potential deductions.

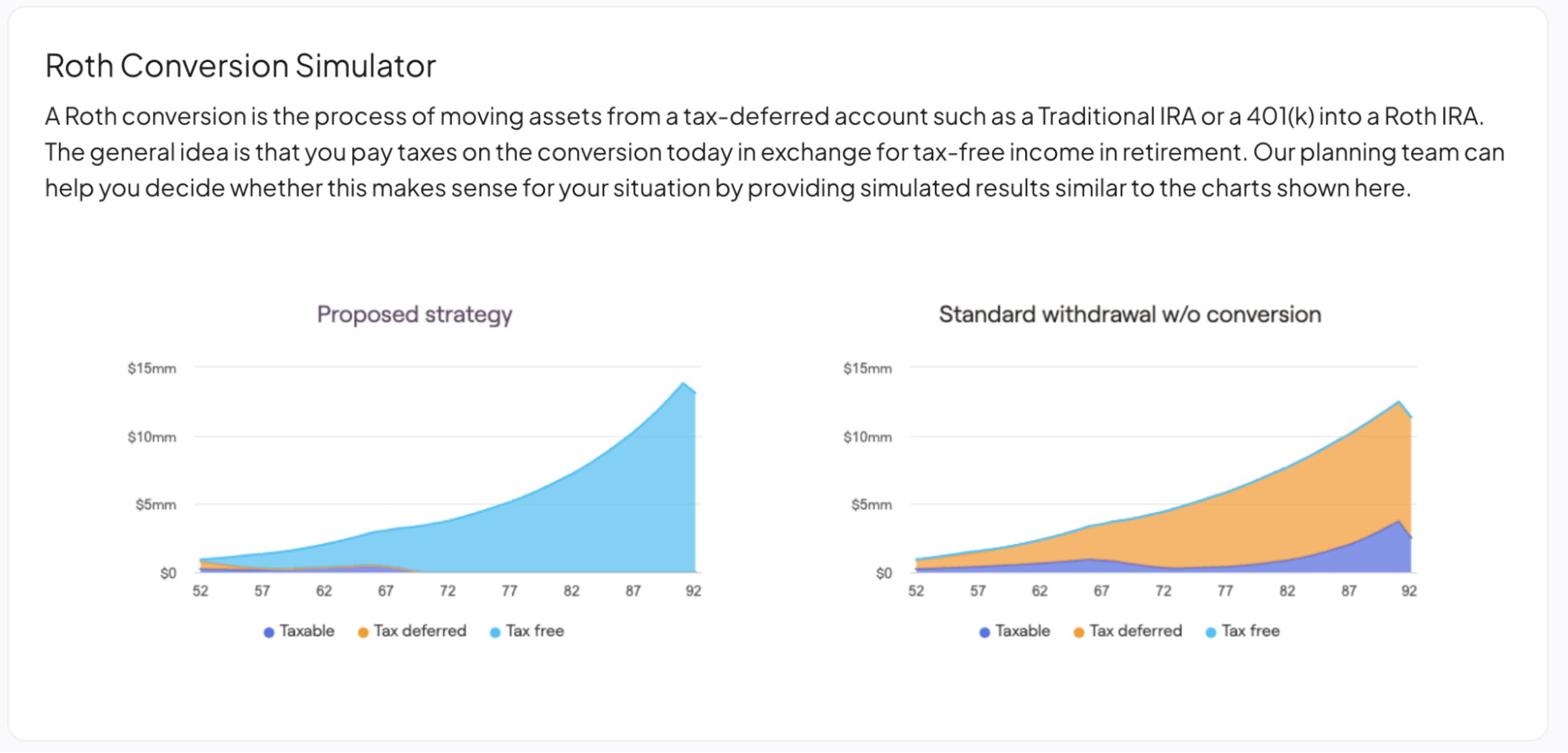

Tax optimization happens year-round, not just at filing time. Range continuously monitors your accounts for tax-loss harvesting opportunities and suggests strategic moves, such as Roth conversions, during lower-income years.

For clients with complex situations that involve multiple states, K-1 partnerships, or international income, Range provides specialized expertise that exceeds what most CPAs offer.

Retirement Planning

Range focuses on “financial independence” rather than traditional retirement. Their analysis determines how much you need to maintain your desired lifestyle, whether that’s retiring at 65 or achieving financial freedom in your 40s.

The retirement planning process stress-tests your strategy against different market scenarios and economic conditions. Range doesn’t just assume 7% annual returns; they model various outcomes to ensure your plan works in multiple environments.

Long-term tax planning is integrated into retirement strategies, guiding the timing of Roth conversions, tax-efficient withdrawal sequencing, and Social Security optimization.

Estate and Legacy Planning

Range evaluates existing estate planning documents to ensure they meet your current needs and identifies gaps or outdated provisions. While Range isn’t a law firm, they coordinate with qualified estate planning attorneys when you need new documents.

Education savings planning helps optimize funding strategies for children’s educational expenses, analyzing different vehicles such as 529 plans and Coverdell ESAs based on your income level and state tax situation.

Insurance optimization involves reviewing your coverage across life, disability, property, and liability insurance to ensure adequate protection without over-insuring.

Real Estate Planning

Range addresses both primary residence decisions and investment property strategies. For home purchases, they help you understand financing options and the impact on cash flow.

Investment property analysis includes cash flow projections, tax benefit modeling, and total return calculations. Range also provides guidance on ownership structures, financing strategies, and tax optimization for rental properties.

For clients with multiple properties across different states, Range handles complex multi-state tax planning to minimize overall tax burden while ensuring compliance.

Equity Compensation Planning

Range’s expertise in stock-based compensation sets them apart from generalist advisors. They provide a comprehensive analysis of ISOs, NSOs, RSAs, and RSUs, helping you understand both potential value and tax implications.

Equity planning becomes particularly valuable around major events, such as early exercise decisions, setting up a 10b5-1 trading plan, or upcoming IPOs. Range can model different scenarios to help optimize timing and strategy.

Tax projections for equity compensation help you plan for potentially large tax bills from ISO exercises or RSU vesting, suggesting strategies to minimize the overall burden.

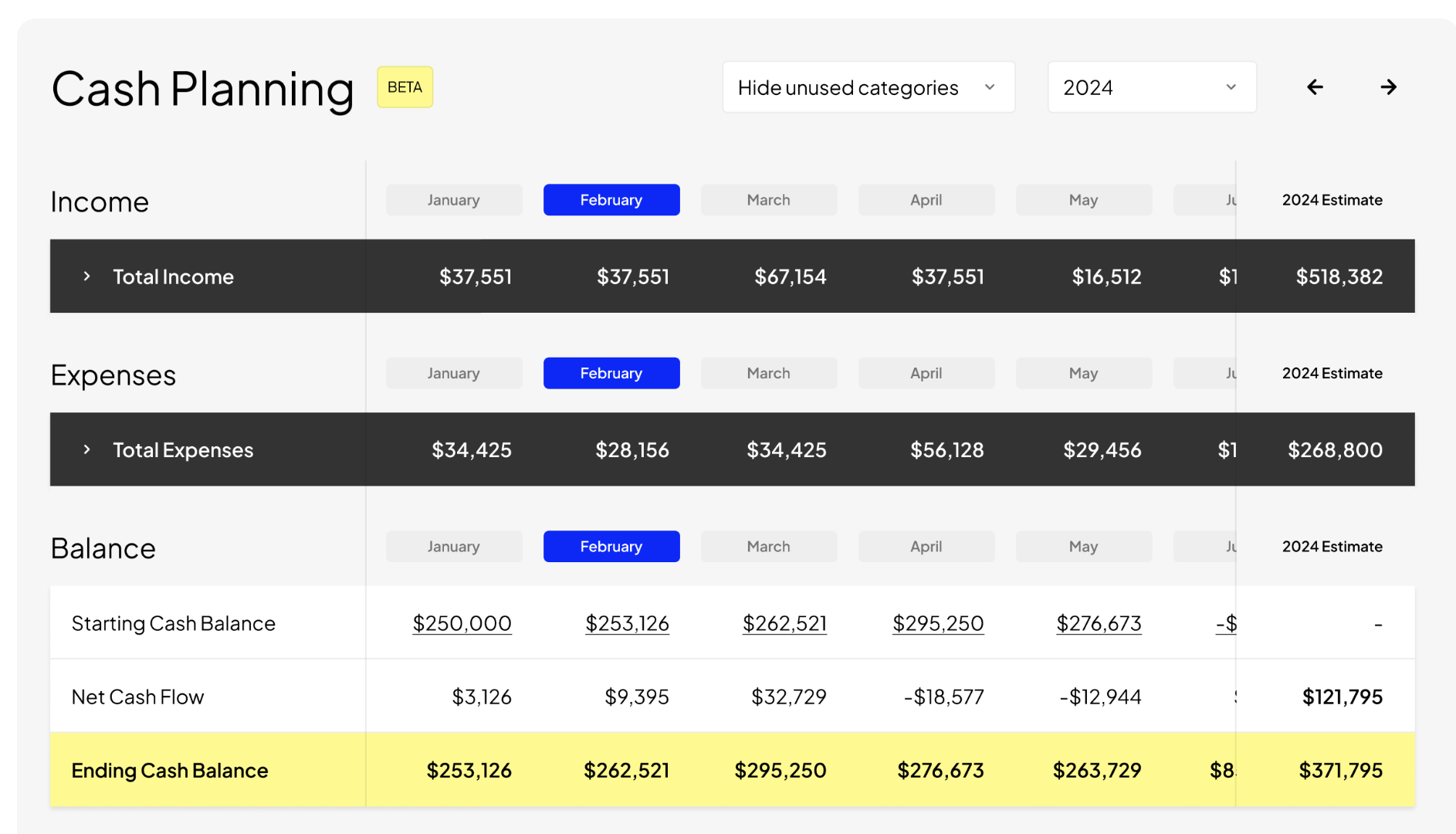

Cash Flow Management

Range provides comprehensive income and expense analysis, identifying opportunities to improve financial efficiency. This goes beyond basic budgeting to include debt optimization, expense analysis, and income timing strategies.

Cash flow projections help you model the impact of major financial decisions like home purchases, job changes, or business investments before you commit.

Key value propositions

- Comprehensive wealth management Range offers a holistic approach to wealth management, covering multiple areas of financial planning in one integrated platform. Unlike traditional advisors who may specialize in only one or two areas, Range provides expertise across investment management, tax optimization, startup equity, estate planning, and more.

- Technology-driven engagement Range leverages its proprietary AI to put control in members’ hands, developing tools that allow for active participation in wealth management. This contrasts with the traditional hands-off approach often taken by many financial advisors.

- Fiduciary Responsibility As a true fiduciary, Range is committed to acting solely in the best interest of our members. This commitment, combined with their fee structure, means they have no incentive to upsell unnecessary services or products.

- Transparent, Flat-Fee Structure Range utilizes a transparent, flat-fee pricing model, rather than the traditional assets under management (AUM) fee structure. This aligns our interests more closely with those of our clients and eliminates potential conflicts of interest.

- Integrations: Zillow, Trust & Will, Engineered Tax Services, LongAngle

Other Resources Range Offers

Beyond core advisory services, Range offers a comprehensive suite of educational resources and tools designed to help you make informed financial decisions and gain a deeper understanding of your options.

Educational Resources

The educational content is valuable for clients who want to be actively involved in their financial planning process rather than simply delegating everything to advisors. Range’s approach encourages client education and engagement, which can lead to better economic outcomes over time.

Blog

Range maintains an active blog that covers topics relevant to their target audience of high-earning professionals. The blog’s content focuses on practical financial strategies, tax optimization techniques, and insights into complex financial planning topics, such as equity compensation and alternative investments.

These resources help clients stay informed about best practices in financial planning and understand the reasoning behind Range’s recommendations.

Financial Calculators

Range offers several specialized financial calculators that provide immediate insights into key financial decisions. These tools are designed specifically for their target market of high earners with complex financial situations:

- College Savings Calculator: This tool helps you determine how much you need to save for your children’s educational expenses, considering factors such as current college costs, inflation rates, and your timeline. The calculator can model different savings strategies, including 529 plans, Coverdell ESAs, and taxable investment accounts, to help you choose the most tax-efficient approach.

- Financial Advisor Fee Comparison Calculator: This calculator helps you understand the actual cost of traditional asset-based advisory fees compared to Range’s flat-fee structure. You can input your current assets and see how much you’d pay over time with different fee structures, making the cost comparison transparent and concrete.

- Home Affordability Calculator: This calculator takes into account factors such as equity compensation, variable bonuses, and investment income to determine realistic home purchase budgets.

- Equity Compensation Calculator: This specialized tool helps tech professionals and executives understand the value and tax implications of their stock options, RSUs, and other equity compensation. The calculator can model different exercise strategies, tax scenarios, and timing decisions to help optimize equity compensation decisions.

Pricing + Fees: How Much Does Range Cost?

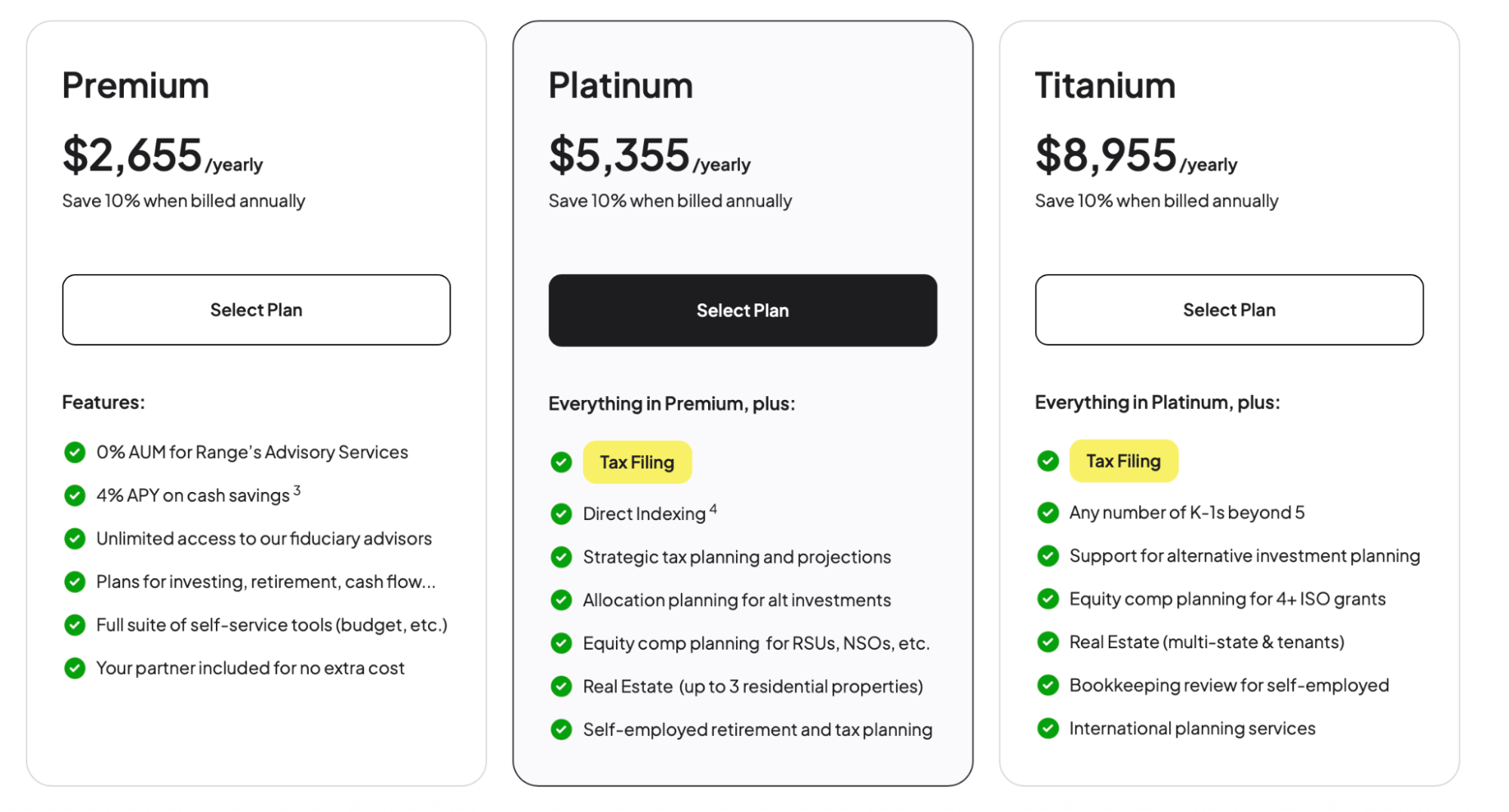

Range offers three pricing tiers designed to match different levels of financial complexity. All plans require semi-annual commitments (though the best pricing comes with an annual commitment) and include your partner at no extra cost.

Premium Plan: $2,655 Annually

The entry-level Premium plan includes comprehensive financial planning, investment oversight, basic tax guidance, and 24/7 access to an advisor. You’ll get portfolio analysis, goal tracking, cash flow optimization, and insurance planning guidance.

This plan works well for high earners with relatively straightforward situations, such as high income, standard investment accounts, and basic tax needs.

Platinum Plan: $5,355 Annually

The Platinum plan adds complete tax preparation (federal plus two state returns), strategic tax planning with forward-looking projections, support for up to 5 K-1 partnerships, and equity compensation planning for RSUs and NSOs.

Platinum also includes direct indexing for tax optimization, alternative investment guidance, and real estate planning for up to 3 properties.

This tier targets clients with moderate complexity, as they may hold equity compensation, own rental properties, or have partnership investments.

Titanium Plan: $8,955 Annually

The top-tier Titanium plan provides unlimited K-1 Support beyond the first 5, multi-state tax planning and filing, international planning services, and comprehensive alternative investment support.

Titanium clients receive advanced equity compensation planning for four or more ISO grants, multi-state real estate planning, business entity structure guidance, and priority access to senior advisors.

This plan serves clients with highly complex situations such as income from multiple states, significant equity compensation, extensive real estate holdings, or international considerations.

Cost Comparison

Range’s value becomes clear when compared to traditional advisor fees. A 1% AUM fee on $2 million costs $20,000 annually, which is double the highest tier at Range. For clients with $3 million in assets, traditional fees amount to $30,000 annually, which is three times the maximum cost of Range.

Note: The prices listed above reflect 10% discounts for annual payment versus semi-annual payment.

Real Reviews: What Are People Saying About Range?

I analyzed dozens of user reviews across multiple platforms to gain insight into real experiences with Range.

Positive Experiences

Many users praise Range’s organizational capabilities. Noah, a Trustpilot reviewer, noted: “The biggest value I get from Range is the organization of all my accounts, and having access to professionals that can give advice based on my specific situation.”

Mark shared his experience after 9 months: “Has been an excellent first 9 months working with Range as an all in one wealth management, tax planning, and financial consultant support. I was reluctant to get a CFP for years and I so regret not doing it sooner.”

Users consistently highlight the comprehensive approach and flat-fee structure as major advantages over traditional advisors.

Critical Feedback

However, not all experiences have been smooth. Some users reported significant issues with both technology and service quality.

Brian experienced serious problems: “Range seems convenient… That’s where it stops. Their financial advisory team is terrible. I’ve lost more money due to their lack of guidance… I haven’t heard from an advisor in over 8 months.”

His tax experience was particularly concerning: “When they finally completed my taxes, we discovered they’d made a mistake and it reduced my refund by $40k! They owned up to making the mistake, but not once did anyone reach out or offer an apology.”

However, it’s clear from overall reviews that experiences like this are in the minority.

Professional Reviews

Benzinga awarded Range its “Best Wealth Hub” designation with a 9.6/5 rating. Finder rated Range “Best for High Earners” with a 9.4/5 “Excellent” score.

Common Themes

Users love: Comprehensive organization, professional advisor access, modern platform interface, and predictable flat-fee pricing.

Recurring concerns include platform technical issues, inconsistent communication from advisors, variations in service quality, and occasional errors in tax planning.

Is Range Legit + Worth It?

Range Advisory is a registered investment advisor (RIA) with the Securities and Exchange Commission, which means they’re subject to strict regulatory requirements and regular examinations.

As an RIA, Range is legally required to act as a fiduciary, putting clients’ interests ahead of their own. This fiduciary standard provides important legal protections that aren’t available with all types of financial service providers.

The company has raised over $40 million in funding from reputable investors, including a $28 million Series B round led by established venture capital firms. This level of institutional investment suggests that sophisticated investors have conducted thorough due diligence on Range’s business model and growth prospects.

Range’s team comprises certified financial planners (CFPs) and other credentialed professionals, all of whom are qualified to provide comprehensive financial planning services.

Range’s fiduciary status means they’re held to the highest standard of care in the financial services industry. Unlike broker-dealers, who only need to ensure their recommendations are “suitable,” fiduciaries must ensure their advice is in the client’s best interest, even if it means recommending lower-cost alternatives or advising against profitable transactions.

Range Provides Clear Value When:

- Your current advisory fees exceed Range’s flat-fee pricing

- You have complex financial situations that benefit from comprehensive planning

- You value technology-driven solutions and real-time access to financial information

- You need specialized expertise in areas like equity compensation or alternative investments

- You want transparent, predictable pricing without asset-based fees

Range May Not Be Worth It When:

- Your financial situation is straightforward and doesn’t require comprehensive planning

- You strongly prefer dedicated, long-term advisor relationships

- You’re not comfortable with technology-first service delivery

- Your assets are below the level where Range’s fee savings become meaningful

- You require flawless service execution and can’t tolerate operational growing pains

Ideal Range Member

Every situation will differ a bit, but if you check several of these boxes, you might want to consider Range.

- Income: Your household earns over $300K+ combined

- You have or care for young children and are planning for the future/education

- You own investment properties

- You have significant equity compensation (ISOs or RSUs)

- You own alternative investments

- You’re self-employed

- Your finances are complicated — DIY management is no longer viable

- You want to maximize your potential

Pros + Cons of Range

Pros | Cons |

|---|---|

Significant cost savings for high-net-worth clients | Technology reliability issues |

Comprehensive service integration | Inconsistent service quality |

Advanced technology and AI capabilities | High cost for simpler situations |

Transparent and predictable pricing | Limited track record |

Specialized expertise for high earners | Tax planning execution concerns |

24/7 platform access and flexibility | No asset minimums may indicate service limitations |

Range Vs the Competition

Understanding how Range compares to established competitors helps clarify whether their approach offers genuine advantages or merely different trade-offs.

Range Vs. Fisher Investments

Fisher Investments represents traditional wealth management that Range aims to disrupt. Fisher charges tiered AUM fees, starting at 1.25% annually for the first $1 million. The firm requires minimum investments of typically over $500,000 and targets retirees.

For a $2 million portfolio, Fisher would charge $25,000 annually, versus Range’s maximum of $9,950, which is less than half the price.

Fisher emphasizes active portfolio management and market timing strategies. Range focuses on comprehensive wealth management, utilizing technology for efficiency rather than attempting to outperform the market.

Related Reading: Check out our Fisher Investments Review

Range Vs. Empower

Empower (formerly Personal Capital) offers hybrid robo-advisor services combining technology with human advisors. They provide excellent free financial tracking tools and charge around 0.89% annually for advisory services.

Empower excels in retirement planning and investment management, but it provides limited tax, estate, and equity compensation services compared to Range’s comprehensive approach.

Range’s flat-fee structure eliminates asset-based charges that Empower still uses, making Range more cost-effective for larger portfolios.

Related Reading: Check out our Empower retirement review

Looking for portfoli0-worthy stocks?

If building an intelligent portfolio is your objective, you could be up and running with Zen Strategies in 10 minutes a month. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48.01%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund. Plus, there’s a 50% off launch offer.

Final Word:

Range offers genuine value to its target market, which comprises high-earning professionals with complex financial lives who seek comprehensive planning at a predictable cost.

The potential fee savings, combined with advanced technology and a broad scope of services, create compelling advantages for the right clients.

However, execution challenges related to technology reliability and service consistency indicate that Range is still maturing. The mixed user reviews suggest that while many clients find value, others experience frustrating service gaps.

For high earners with complex financial situations who prioritize cost savings and modern technology over service perfection, Range deserves serious consideration. The potential benefits can be substantial for clients who match their target profile.

For those with simpler needs or strong preferences for traditional advisory relationships, established alternatives such as Vanguard Personal Advisor Services or fee-only financial planners may offer better value and more consistent service delivery.

The key is assessing whether your financial complexity aligns with Range’s comprehensive approach and whether you can tolerate their current growing pains while they continue to develop their service capabilities.

FAQs:

Is Range legit?

Yes, Range is legitimate. Range Advisory, LLC is an SEC-registered investment advisor with fiduciary responsibility to act in clients' best interests. They've raised over $40 million in funding, serve more than 2,000 clients, and operate under proper regulatory oversight.

Is Range better than a financial planner?

Range can be better for high earners with complex financial lives who want comprehensive services at predictable flat fees. Range offers 0% AUM fees, 24/7 platform access, AI-powered analysis, and specialized expertise in equity compensation planning. Traditional planners may be better for clients preferring dedicated advisor relationships or those with simpler financial situations.

How much does Range cost? Is it worth it?

When you pay semi-annually, Range charges fees of $2,950 (Premium), $5,950 (Platinum), or $9,950 (Titanium), but you can get 10% discounts for annual payment versus semi-annual payment. Range provides value for high earners with assets over $1 million where flat-fee structure offers significant savings compared to traditional 1% AUM fees. Range may not be worth it for simpler financial situations or smaller portfolios.

Is Range a broker?

No, Range isn't a broker. Range is a registered investment advisor that provides financial planning and advisory services. You don't transfer assets to Range as the platform connects to your existing accounts to provide unified analysis and advisory services.

What is Range Financial?

Range is a comprehensive wealth management platform designed for high-earning professionals making $300,000+ per household (or $250K for individuals) annually. The platform centralizes investment management, tax planning, retirement planning, estate planning, and equity compensation planning into one AI-powered dashboard using flat-fee pricing with zero asset-based charges.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.