The Bottom Line: Is Mauldin Economics Worth It?

Mauldin Economics is legit, but it isn’t for everyone.

Its content is pretty specialized, so most modern investors may not find it all that useful — especially with today’s fast-paced, digital-first media landscape.

That said, its contrarian approach still stands out. With a strong focus on macro trends, income strategies, and niche areas like biotech — all backed by a seasoned editorial team — Mauldin offers a perspective you won’t find in most mainstream investing content.

In my opinion, most investors would probably be better off opting for more modern and lower-cost alternatives like WallStreetZen’s Zen Investor (an excellent stock-picking newsletter that costs less than $100/year, versus Mauldin Economics subs (hundreds or even thousands per year).

I’ll explain everything in more detail below…

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is Mauldin Economics?

Mauldin Economics is a platform run by finance industry professionals. Its primary output is its numerous newsletters, edited and written by the same economic and market veterans.

The finance advisory firm Mauldin Economics achieved rapid success after launching its website in 2012, swiftly surpassing one million newsletter subscribers.

The major reason for such success can be traced to the decades-long experience and a strong professional network brought to the table by its co-founder, John Mauldin.

Indeed, the newsletter, including its free portion spearheaded by “Thoughts From the Frontline,” positioned itself as bringing exclusive knowledge, information, and research to its readers, thereby elevating everyday traders closer to the playing field of professionals.

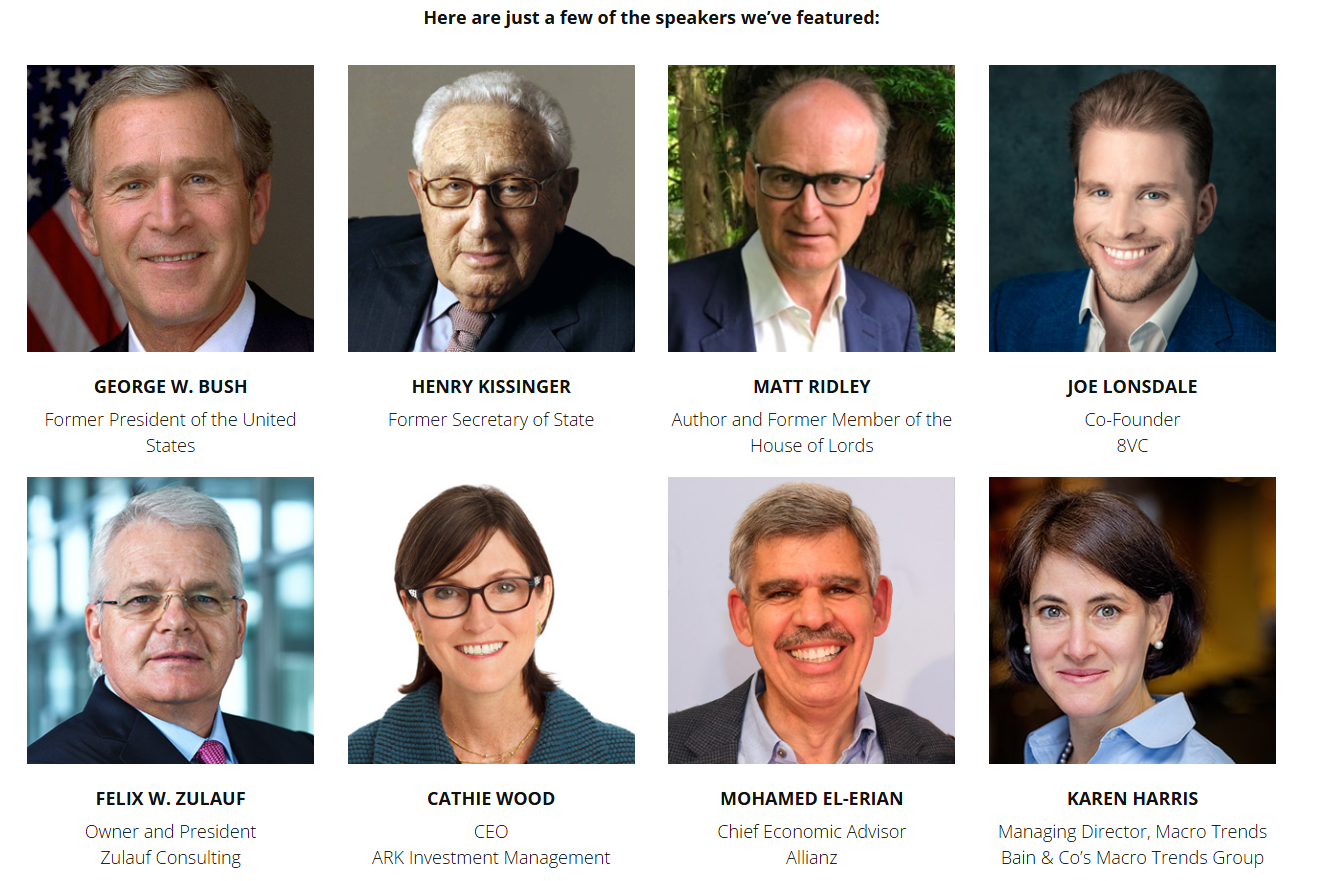

The three-decade tenure of John Mauldin is evident both in his nickname — “The Best Rolodex in the Business” — and the impressive list of speakers at Mauldin Economics’ annual Strategic Investment Conference (SIC): George W. Bush, Henry Kissinger, Mohamed El-Erian, Cathie Wood, and many others.

Along with the network, Mauldin himself is a prominent industry figure and a New York Times best-selling author, with his analysis featured on many notable platforms, including CNBC, Bloomberg, MarketWatch, and Forbes.

Related Reading: 10 Best Investment Newsletters in 2026

Despite this, the brand and website are both showing their age.

Although Mauldin Economics made a splash on the web in 2012, there is relatively little organic chatter on the platform and its services in digital gathering spaces like Reddit, and major outlets have offered relatively little coverage in recent years.

What Does Mauldin Economics Have to Offer?

Free Products Overview

Mauldin Economics’ free products offer a broad overview of the topics covered in more depth and, in some cases, with more actionable insights within premium newsletters.

Nonetheless, they are well worth at least a cursory read as their authors are industry experts, and the price (free) is right.

Thoughts from the Frontline

- Editor: John Mauldin

- Focus: Macroeconomic conditions and developments

- Price: FREE

Thoughts from the Frontline is arguably Mauldin Economics’ flagship product. It is a weekly newsletter, delivered every Saturday, that focuses on global macroeconomic conditions and developments.

Throughout its decades-long history, it has been among John Mauldin’s chief finance writings. Its insights are generally consistently interesting, and the famed finance author has a knack for writing. However, it can be rather meandering.

Despite its occasional flaws — or, perhaps, precisely thanks to them — Thoughts from the Frontline provides a solid view of the big picture and is rife with historical context.

Hey! WallStreetZen has a free newsletter, too.

For regular investing ideas and Strong Buy alerts related to market-moving news, subscribe to our FREE newsletter, WallStreetZen Ideas.

Global Macro Update

- Editor: Ed D’Agostino

- Focus: Macroeconomic news

- Price: FREE

Edited by Mauldin Economics’ partner and COO Ed D’Agostino, the Global Macro Update is, in fact, a series of weekly interviews. The free newsletter is something of a variety show geared toward keeping its readers and listeners up-to-date with the latest developments that could potentially have a major impact on any portfolio.

Similar to Thoughts from the Frontline, Global Macro Update provides invaluable historical context, while also not shying away from more cutting-edge or speculative topics, including the dollar’s future global standing and potential profits from flying taxis.

Dividend Digest

- Editor: Kelly Green

- Focus: Dividend investing

- Price: FREE

As the name implies, Dividend Digest is a free newsletter written by long-time researcher and mathematical economics expert Kelly Green, centered on income investing.

Overall, the publication focuses on providing insights into how investors can maximize their dividend gains while ensuring their strategy is both effective and sustainable.

As a side note while we’re on the topic of dividends — did you know that we have a High Yield Dividend stock screener?

Connecting the Dots

- Editor: Patrick Watson

- Focus: Market trends

- Price: FREE

Connecting the Dots is another free newsletter with a macroeconomic focus, albeit with a primary emphasis on geopolitics and their impact on investing.

Specifically, the publication’s author, Patrick Watson, strives to make global links between news and developments to help his readers identify the trends dominating the market in any given week.

Despite this, the analysis can be somewhat tardy, as seen in the late May observation that President Donald Trump’s frequent tariff shifts have generated a climate unfavorable for business. However, some of these deficiencies are offset by interesting perspectives and a clear line of historical memory.

Another side note here — if you’re looking for market-moving news, check out the News portion of our site.

Guest Content

- Editor: Various Editors

- Focus: Varied

- Price: FREE

Along with the regular newsletter lineup, Mauldin Economics also offers a selection of periodic guest content. As can be expected from such a publication, the actual quality of the insights can vary, though all is generally made up for by the price: it is free.

Beyond the newsletter network available on the Mauldin Economics website, the team also publishes some of its analysis on social media platforms, such as X, and operates a YouTube channel of the same name.

Related Reading: Where Did Gen Z Learn About Money?

Premium Products Breakdown

In many ways, Mauldin Economics’ premium newsletters are more timely and detailed upgrades compared to the free selection. This, however, also makes many of them overwhelmingly less worthwhile unless their niches align exactly with your investment goals.

Over My Shoulder

- Editors: John Mauldin & Patrick Watson.

- Focus: Curated macro and micro-economic research.

- Price: $14.95/month

The primary strength of Over My Shoulder, edited by John Mauldin of Thoughts from the Frontline and Patrick Watson of Connecting the Dots, is that it delivers key economic information to its readers approximately 3 times a week, as curated by two acclaimed professionals with decades of experience.

Though it frequently boasts insights from exclusive sources, its appeal has somewhat diminished since 2012, given the sharp increase in outlets publishing data and research that was once reserved only for insiders.

Still, it is not without merit, as it helps investors who prefer not to spend their days researching keep track of the most important developments, while giving DIY traders an opportunity to cross-reference their conclusions with those of established professionals.

Yield Shark

- Editor: Kelly Green.

- Focus: dividend income stocks, proprietary indices.

- Price: $499/year + 90‑day refund

Mauldin Economics’ Yield Shark, edited by Kelly Green, much like the other income-focused publication, is the website’s premium offering for dividend investors.

Overall, its main focus is finding strong and sustainable investments in companies that are not only likely to generate a reliable and above-average yield, but also preserve an investor’s wealth.

A major selling point of Yield Shark is the proprietary Dividend Sustainability Index and Equity Evaluation System, but the actual appeal comes from the combination of decent overall performance — picks tend to be relatively strong, though somewhat belated — and the 90-day refund: no trivial matter given the annual $499 price tag.

Much like many of Mauldin Economics’ offerings, Yield Shark is a strong newsletter for investors who prefer to stay in the loop, boast a reasonable margin for error, but also avoid making market-tracking a full-time job.

Macro Advantage

- Editor: Ed D’Agostino.

- Focus: Thematic macro investment ideas with additional alerts.

- Price: $249/quarter

Macro Advantage stands out as one of Mauldin Economics’ most interesting offerings, as it aims to identify and help investors based on “Themes” — factors and forces greater than trends.

In its mission statement, it is clear that Macro Advantage is geared toward identifying the critical sectors of the 21st century, as it explicitly states it is looking for firms that utilize Artificial Intelligence as more than just a buzzword, new energy sources, and are working on quantum computing.

Related Reading: Discover the Best Stocks in the Best Industries

Nonetheless, Macro Advantage’s relative youth, paired with the tumult increasingly evident in the 2020s, makes it a risky investment.

Furthermore, the appeal of the product could ultimately be determined by one’s political stance more than actual economic factors. Some of the core Themes identified are “US Productivity”, “American Resiliency”, and “Volatility as Opportunity” – historically sound yet uncertain in the current climate

Transformative Age

- Editors: Chris Wood and Patrick Cox

- Focus: Biotech and healthcare investing

- Price: $1,795 per year

The Transformative Age of Mauldin Economics is a newsletter focused on the frontier field of biotech.

Despite being marketed as medium risk, it is perhaps best to view the newsletter as a form of venture capital investing: by the very nature of the field it focuses on, the investments tend to carry a great risk for a possible massive reward.

The notion that the newsletter is more risky than it appears, despite the credentials of its editors, is also backed by the fact that biotech is one of John Mauldin’s areas of personal interest, as evidenced by his quote about the newsletter itself:

“I think we finally have the right team to turn my passion for longevity and biotech into something truly groundbreaking.”

And his other website, Health & Wealth Research, having a kindred focus. Lastly, the relatively high annual price point makes it one of the harder sells on Mauldin Economics.

Related Reading: Biotech Investing: Risks, Benefits, and How to Avoid Losses

Jared Dillian’s Strategic Portfolio

- Editor: Jared Dillian.

- Focus: Diversified portfolio, core long-term investing.

- Pricing structure: $249–$399/year

Jared Dillian’s Strategic Portfolio is positioned as a “let the expert do it” type of portfolio, as the author, Jared Dillian, formerly of Lehman Brothers’ fame (or infamy), works to send out signals to his readers.

The “Awesome Portfolio,” as it is frequently referred to, is rigidly diversified, comprising equal parts of equity, bonds, real estate, gold, and cash.

Historically, such an approach to diversification has earned Dillian some criticism; however, the recent surge in gold prices and post-pandemic increases in interest rates have done much to vindicate the selection.

Related Reading: 7 Diversified Stock Portfolio Examples For Beginners

Still, some investors could see the lack of cryptocurrencies in the portfolio as quaint, possibly even antiquated.

Lastly, it is noteworthy that Dillian now operates his own website, which hosts all of his writings, although he appears to have remained on good terms with Mauldin Economics.

But since his name is so connected to Mauldin, let’s dig into some of his other offerings too, as they may be of interest.

Street Freak

- Editor: Jared Dillian

- Focus: Contrarian trading ideas

- Price: $1,795 per year

- Bonus: 30-day money-back guarantee

Street Freak is another Jared Dillian newsletter, meaning it now operates outside the Mauldin Economics ecosystem. It gives readers insight into the experienced trader’s investments.

Generally, Dillian focuses on sharing his most contrarian trades—meaning the service is not for the risk-averse—but also includes some economic analysis. Overall, it is an interesting package as both the trades and the writing tend to be, at the very least, interesting and can help readers spot otherwise overlooked opportunities.

On the other hand, it is certainly not for everyone, which is why the 30-day money-back guarantee is particularly welcome, especially given the $1,795 annual price tag.

The Daily Dirtnap

- Editor: Jared Dillian

- Focus: Daily curated market news and developments analysis

- Price: $795 per year

- Bonus: 30-day money-back guarantee

The Daily Dirtnap is the final major part of the Jared Dillian ecosystem. In a nutshell, it is a high-frequency, delivered every business day, roundup of finance news, curated by the experienced trader himself.

Along with offering a generally unique and, much like Street Freak, contrarian perspective, it tends to be an entertaining read. As a final bonus, the fact that the 30-day refund period features two dozen newsletters makes it one of the more consumer-friendly offerings.

As the product’s own promotional material says: “Enough said.”

Other Paid Services

Mauldin Economics has also been host to a series of other services over the years, including:

- Biotech Millionaire (Chris Wood & Jake Weber): small‑cap biotech, C.A.S.H. system

- Possibly Transformational Technology Alert, Rational Bear, etc., via Alpha Society section (optional, niche).

- Additionally, at one time it offered a Mauldin Alpha Society package for all‑in one VIP access

Is Mauldin Economics Legit?

Yes. Mauldin Economics a legitimate website and network of newsletters. But there are some important things you should know.

To begin with, the sheer number of different products, each with its own separate price tag, makes it an expensive offering — a particularly damning fact given that every individual newsletter is rather niche and, in most cases, of limited utility to most investors.

Simultaneously, the entire website appears dated and lacks vibrancy. John Mauldin’s own nickname — “The Best Rolodex” — is equally a testament to a storied career in finance and in politics, and a sign of age.

Still, the artifact nature of the website is a merit of its own and generally tends to offer a different pace and perspective to most competitors.

The institutional credentials of the newsletters’ authors are themselves a boon for a certain kind of investor, given the Huxlean abundance of trivial information prevalent in modern online spaces.

Simpler Alternatives DO Exist…

Elsewhere, more affordable and vibrant alternatives are available. WallStreetZen’s mix of premium and free offerings presents a compelling alternative, boasting a wealth of educational resources and its own newsletter.

If you’re looking for excellent stock picks, Zen Investor is a worthy alternative.

This is a stock-picking newsletter helmed by Steve Reitmeister, former Editor in Chief of Zacks.com who previously managed the Reitmeister Total Return portfolio.

Zen Investor is Reitmeister’s newest project — a curated portfolio of medium-to-long-term hold stocks that he has hand-picked using a rigorous 4-step screening process.

One of the portfolio’s recent winners is Kinross Gold (NYSE: KGC), which has returned over 60% at writing since being added to the portfolio.

Since Reitmeister issues frequent buy (and when applicable, sell) updates, I wouldn’t exactly call it “Set and forget” but not far off. Basically it’s like letting someone else do the heavy lifting — all you have to decide is which stocks you choose to add to your portfolio and execute the trades in your brokerage account.

And it’s priced $99 per year ($79 for a limited time, using links in this post), especially when paired with discount opportunities and a money-back guarantee.

If you prefer to do the DIY thing, you can actually access one of the key tools Reitmeister uses to locate and vet potential stock picks: The Zen Ratings system.

The Zen Ratings system takes an immense amount of data and detail and distills it into an easy-to-understand letter grade. Just like school report cards, an A rated stock is excellent (stocks with this rating have historically delivered 32.52% annual returns), a B is above average (19.88% annual returns), and so on. Behind the grade is a detailed review of 115 factors proven to drive growth in stocks, including the powerhouse AI factor, which takes mountains of data and sifts through them to find potential in stocks that you might not otherwise notice.

It’s free to access Zen Ratings; for even more features and unlimited searches, you can upgrade to $19.50 per month for the premium version.

Pricing & Value Comparison

Mauldin Economics Products at a Glance

Product | Editor(s) | Price | Frequency | Risk Focus | Best For |

Over My Shoulder | John Mauldin and Patrick Watson | $14.95 per month ($179.40 per year) | 2-3 issues per week | Varies | Traders curious about the pulse of institutional investors |

Yield Shark | Kelly Green | $499 per year ($41.59 per month) + 90-day money-back guarantee | 12 monthly issues | Low | Dividend-focused investors |

Macro Advantage | Ed D’Agostino | $249 per quarter ($83 per month / $996 per year) + 90-day money-back guarantee | N/A | Medium | Long-term investors who want to identify critical industries of the future early |

Transformative Age | Chris Wood and Patrick Cox | $1,795 per year ($149.58 per month) | 12 monthly updates + special alerts | Medium/high | Investors are enthusiastic about biotech and healthcare, and have a high risk appetite |

Jared Dillian’s Strategic Portfolio | Jared Dillian | $249 per year ($20.75 per month) | 12 monthly issues | Low/Medium | Investors who prefer professionals decide on allocation |

Street Freak | Jared Dillian | $1,795 per year ($149.58 per month) | 12 monthly issues | Medium | Contrarian investors who prefer professionally curated trades |

The Daily Dirtnap | Jared Dillian | $795 per year ($66.25 per month) | A new newsletter issue every business day | Varies | Active investors with reasonably deep pockets |

Mauldin Economics: Pros & Cons

Pros | Cons |

Institutional-level insights | Can be pricey |

Wide topic range | Some overlap between newsletters |

Reputable authors | Niche newsletters |

Archive access | Mixed user feedback |

Refund options | Refund options limited |

Who Should Use Mauldin Economics?

Each of the Mauldin Economics newsletters has a specific, though slightly overlapping, audience in mind.

Investors interested in the macroeconomic conditions can find much value in Over My Shoulder and Macro Advantage.

Similarly, Yield Shark is entirely focused on dividend-seeking investors with a preference for sustainability and wealth preservation, while the Transformative Age can help traders with a risk appetite.

Lastly, the three Jared Dillian products are all meant for traders who value professional insights and experience, and the main differentiator stems from how often readers wish to engage with the market.

Still, such a fragmentation, paired with the high price tag of many of the products, makes the overall value proposition somewhat less than the sum of its parts.

Therefore, investors who seek to keep tabs on the comings and goings of the economy and the market, while receiving actionable signals backed by a strong track record, might find more value in less costly and more modern WallStreetZen products such as Zen Investor and Zen Ratings.

Conclusion

As with almost any similar product, the value of Mauldin Economics is intrinsically tied to the goals and preferences of every individual investor. Nonetheless, the website itself is well worth a visit, as even its free content gives a glimpse into the thought process of industry veterans.

Furthermore, many of the premium newsletters offer a money-back guarantee, meaning that traders interested in one of their focuses—whether it be macroeconomics or dividend investing—can take advantage of the offer and see for themselves if the writing is worth the price.

Still, Mauldin Economics is not a suitable platform for those who lack exceptionally deep pockets and are seeking a holistic view, due to the newsletter’s atomized nature. They could, instead, find more value in the lower-cost and broader offerings like those on WallStreetZen.

FAQs:

Is Mauldin Economics legit or a scam?

Mauldin Economics is a reputable and established finance website run by professionals who have been active in the industry for decades. There is no indication that the platform ever engaged in fraudulent activity.

Is Mauldin Economics worth it?

Mauldin Economics’ newsletters are separately priced and cover relatively niche topics, making it difficult to gauge their value holistically. Overall, investors seeking professional coverage of narrow topics can find much to appreciate about the newsletters; however, most are likely better off subscribing elsewhere.

What’s the best Mauldin Economics newsletter?

There is no single best Mauldin Economics newsletter, as every single one has a specific focus. Over My Shoulder, for example, offers insights into macroeconomic conditions, curated and interpreted by an expert. At the same time, Yield Shark is considered a worthy tool for enhancing a trader’s dividend investing strategy.

How much does Mauldin Economics cost?

Mauldin Economics offers numerous disparate products with price tags ranging from free on the low end to nearly $1,800 per year. The flagship premium newsletter, Over My Shoulder, is priced at $14.95 per month.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.