Ray Dalio didn’t just build the world’s biggest hedge fund; he also built a portfolio that retail investors like you and me can actually use.

I’m talking about the All-Weather Portfolio — Dalio’s low-drama, sleep-well-at-night strategy that’s delivered 7–8% annual returns for decades without the rollercoaster of a stock-heavy portfolio.

This portfolio is simple, and smart … and in a world full of economic curveballs, it still holds up in 2025. Below, I’ll explain why and how it works, plus how you can DIY your own Ray Dalio portfolio tracker using low-cost tools like the Zen Ratings system — No hedge fund required.

Understanding the Ray Dalio All Weather Portfolio

Go ahead, do a quick search for “Ray Dalio net worth” (or don’t, because I did it for you — it’s about $15.5 billion). That gives you an idea of why so many people are curious about following Ray Dalio’s principles.

Core Principles

Dalio believes that the only free lunch in investing is diversification. That’s why at the heart of the Ray Dalio portfolio design is risk parity: the idea that you can tame portfolio swings by spreading risk (not dollars) evenly across very different asset classes.

So instead of letting stocks dominate your volatility budget, the Ray Dalio All Weather Portfolio mix offsets them with long-duration Treasury bonds, inflation-hedging commodities, and a dash of gold.

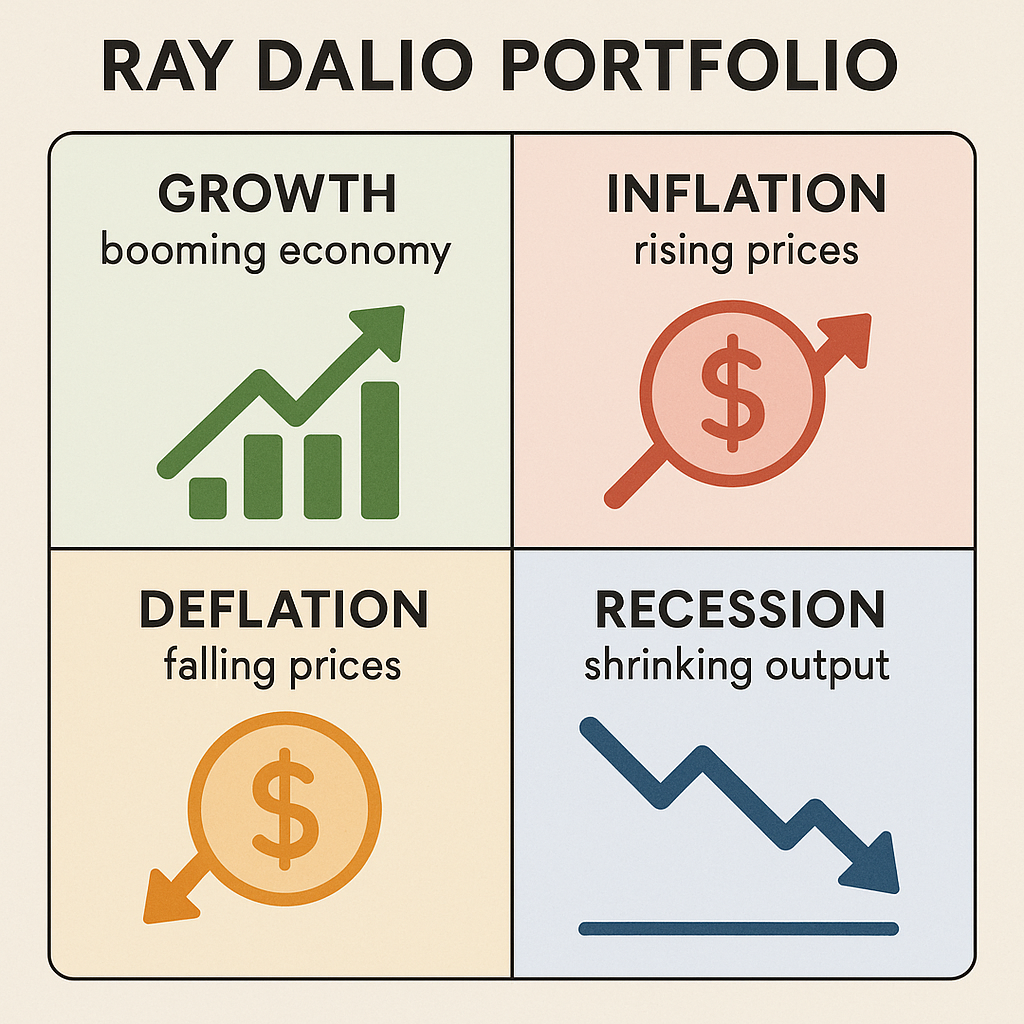

Dalio organized the allocation to thrive in all four economic “seasons”:

- Growth (booming economy)

- Inflation (rising prices)

- Deflation (falling prices)

- Recession (shrinking output)

When one season punishes equities, another slice (say, long-bonds during deflation) picks up the slack, keeping the overall ride smoother.

Historical Context

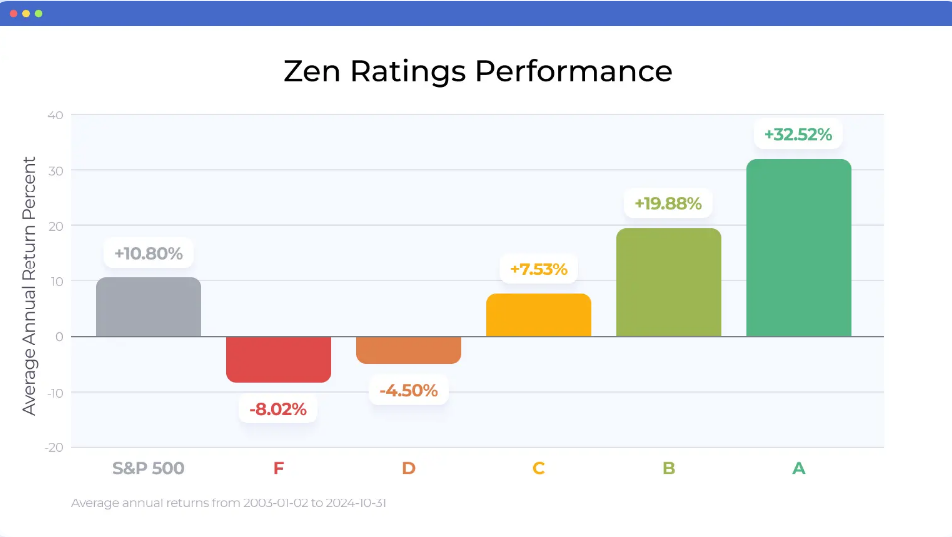

It’s been hard to beat simply holding the S&P 500 for the past few years. (Although certain systems, like our Zen Ratings system, have done it — stocks rated “A” using our system have historically delivered 32.52% annual gains.)

Dalio would argue that’s because we’ve been in a good economic season. But seasons change, and his portfolio is designed to endure these changes, hence the “All-Weather” namesake.

It’s also important to remember that building and preserving wealth isn’t only about hitting the highest growth rates possible.

It’s also about avoiding drawdowns.

Case in point: back-tests and real-world performance of the All-Weather strategy show annual returns in the high-single digits with drawdowns roughly half those of an S&P 500-only approach.

Bridgewater first assembled the All-Weather framework in 1996 for Dalio’s family trust. He later outlined the philosophy in his bestseller “Principles,” stressing that durable success comes from preparing, not predicting.

Related reading: How to Predict Stocks?

Why It Matters in 2026

Today, investors face lingering inflation risks, yo-yoing interest-rate policies, and geopolitical shocks that can whiplash a one-dimensional stock portfolio.

The All-Weather playbook is built for precisely this kind of uncertainty, using bonds to counter equity sell-offs and real assets like gold and commodities to blunt inflation spikes.

With Treasury yields finally offering real income again (at 4-5% yields) and commodity markets regaining relevance as gold hits new all time highs, Dalio’s balanced recipe feels as timely as ever.

Interested in Treasury investing? Check out this post: 7 Historically Proven Ways to Invest During Recessions

Breaking Down the All Weather Portfolio Allocation

Asset Classes & Target Weights

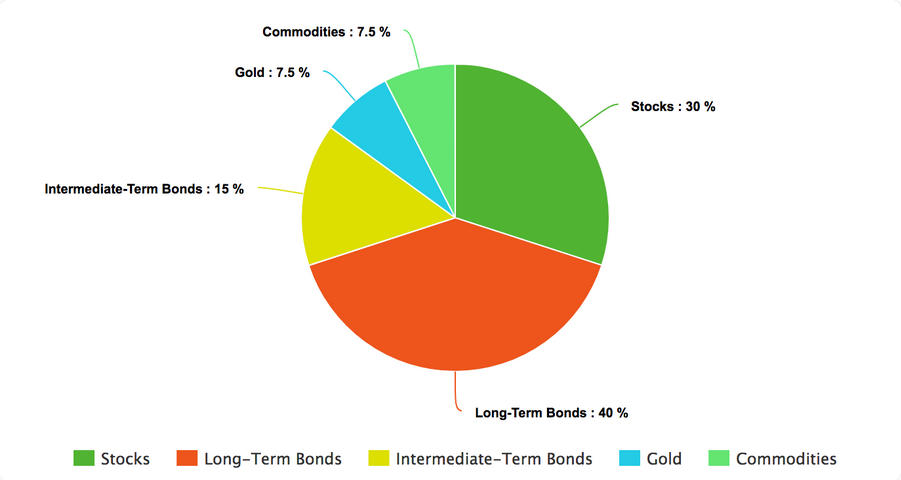

- ~30% Stocks

- ~40% Long-Term Bonds

- ~15% Intermediate-Term Bonds

- ~7.5% Gold

- ~7.5% Commodities

Dalio designed the All-Weather Portfolio with one goal in mind: to create a strategy that could perform reasonably well across all economic conditions.

Here’s how each asset class fits into that puzzle:

- ~30% Stocks: Equities are the portfolio’s main growth engine. They perform best during periods of strong economic expansion and low inflation. But because stocks are also the most volatile asset in the mix, they get a smaller slice of the pie to keep risk in check.

- ~40% Long-Term Treasury Bonds: These shine during deflationary periods or economic slowdowns, when interest rates fall. Long-term bonds are highly sensitive to rate changes, which makes them great counterweights to stock volatility in turbulent markets. They help cushion the blow when equities stumble.

- ~15% Intermediate-Term Treasury Bonds: These are more stable than long-term bonds and act as a reliable ballast during recessionary periods. They’re less volatile but still offer downside protection when growth falters.

- ~7.5% Gold: Gold protects against currency devaluation and inflation. It often performs well when real interest rates are low or negative, and when fear spikes. It also tends to zig when equities and bonds zag, adding a valuable non-correlated layer to the mix. Here’s how to invest in gold for beginners

- ~7.5% Broad Commodities: Commodities—including oil, agricultural products, and industrial metals—tend to do well during inflationary booms. By adding this slice, Dalio gives the portfolio a way to benefit from rising prices when traditional assets might suffer.

The genius of this allocation is that it’s not trying to win big in any single scenario.

Instead, Dalio is trying to survive and stay steady in all of them.

It might not always be the top performer in a given year, but it rarely crashes, and that consistency is exactly what many investors want.

Need help finding solid stocks with excellent growth prospects?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. For just $99 per year ($79 using links from this post), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How Risk Parity Works

Risk parity flips the usual investing script. Instead of focusing on how much money you put into each asset, it looks at how much risk each asset brings to the table, and spreads that out evenly:

- In a traditional portfolio, like a 60/40 stock-bond split, stocks tend to dominate the risk, even though they make up just 60% of the allocation.

- Bonds are steadier, but they barely move the needle on returns or volatility.

Dalio’s All-Weather Portfolio changes that by scaling back stocks and bulking up bonds (especially long-term bonds) to give each asset class a more equal say in how the portfolio behaves.

The idea is that different assets thrive in different economic conditions. Stocks do well in growth, bonds shine in recessions or deflation, and assets like gold and commodities protect you during inflation.

By spreading the risk across these “economic seasons,” you’re not betting everything on just one type of market environment.

Accessibility for Retail Investors

You don’t need to be a billionaire or a Bridgewater client to build the All-Weather Portfolio. There’s actually an ETF called ALLW that mirrors Dalio’s strategy in one click — just be aware it comes with a relatively steep 0.85% expense ratio, which adds up over time.

If you’re cost-conscious, you can DIY the portfolio using low-fee ETFs that track the individual asset classes. A DIY All-Weather portfolio would look something like this:

- 30% Vanguard Total Stock Market ETF (VTI)

- 40% iShares 20+ Year Treasury ETF (TLT)

- 15% iShares 7 – 10 Year Treasury ETF (IEF)

- 7.5% SPDR Gold Shares ETF (GLD)

- 7.5% PowerShares DB Commodity Index Tracking Fund (DBC)

The best part? Platforms like M1 Finance make it easy to customize your portfolio, automate rebalancing, and even buy fractional shares to match Dalio’s weightings.

How to Copy the All Weather Portfolio

Choose a Platform

With M1 Finance, you build your portfolio using a “Pie” system. Each “slice” of the pie represents an ETF or asset class (like stocks, long-term bonds, gold, or commodities) and you assign a percentage to each based on Dalio’s recommended weights (e.g., 30% stocks, 40% long-term bonds, etc.). Once you set those percentages, M1 handles everything else.

Every time you deposit funds or reinvest dividends, M1 automatically allocates your money across the slices to maintain the correct proportions. And if your portfolio drifts from the target (say, stocks surge and throw off the balance), you can click one button to instantly rebalance everything back to the original targets; no spreadsheets or manual trades needed.

This makes M1 Finance an ideal choice for a long-term, risk-balanced strategy like Dalio’s. It removes the friction from staying disciplined, saves you from constantly tweaking allocations, and helps you stick to the plan through any market weather.

Alternative Assets

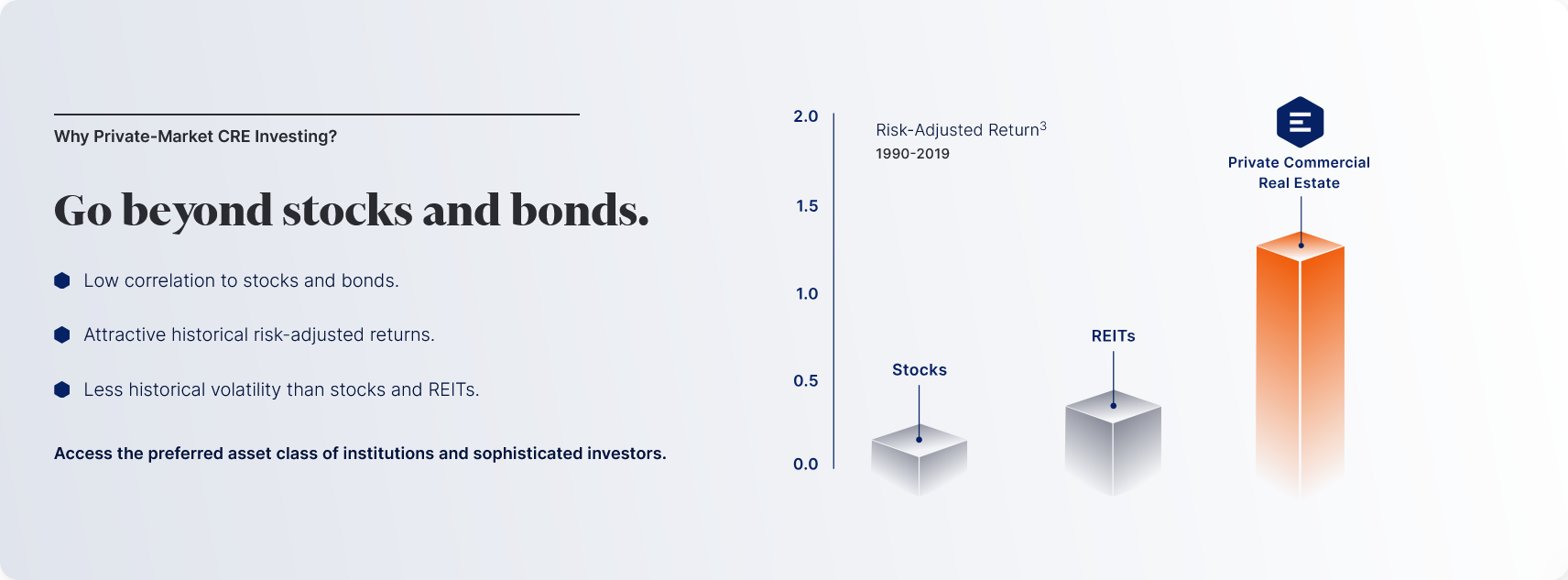

Dalio’s original All-Weather Portfolio leans heavily on bonds as roughly 55% of the total allocation when you combine both bond categories. Bonds are still valuable for stability, but with inflation risks and rising-rate environments, they might not offer the same protection they used to. So some modern versions of the All-Weather strategy swap part of the bond or commodity allocation for alternative assets.

Alternatives like art, private credit, real estate, and physical gold can offer uncorrelated returns, inflation resistance, and access to historically exclusive markets.

Related reading: The 11 Best Alternative Investments in 2026

Suggested Platforms for Alternative Asset Investing

Art — Masterworks

Masterworks lets everyday investors (no need to be accredited) buy fractional shares of high-end artwork from artists like Banksy, Basquiat, and Picasso. Art has historically outpaced inflation and shown low correlation to stocks and bonds, making it an attractive diversifier.

Instead of paying millions for a painting, you can invest a few hundred dollars and get access to SEC-qualified offerings and curated blue-chip pieces.

Private Credit — Percent

Percent opens the door to private credit investing: something that used to be reserved for hedge funds and ultra-wealthy individuals. It lets you invest in short-term, asset-backed private debt with yields often north of 8–10%.

It’s a strong addition to a modern All-Weather allocation, offering fixed income with much higher potential returns than government bonds (but naturally with higher risk too, as private credit has higher default risk than government bonds). Note: Percent is currently only accepting accredited investors.

EquityMultiple — Real Estate

EquityMultiple gives you access to commercial real estate investments (multifamily, industrial, and infrastructure deals) without needing to buy or manage property yourself.

You can invest passively in real estate debt, equity, or preferred shares, often with income-generating potential and long-term appreciation. It’s a solid substitute for commodities or bonds when you’re seeking inflation protection and yield. Just note you must be accredited.

Noble Gold — Precious Metals

Noble Gold specializes in physical gold and silver IRAs, giving you tangible protection against currency debasement, systemic risk, and inflation.

While ETFs like GLD offer better liquidity, physical gold gives you an extra layer of long-term security … especially if you’re concerned about financial system instability.

Noble makes it easy to buy, store, and manage metals without the complexity of self-custody.

Advanced: Implementing a Risk Parity Approach

In a traditional All-Weather setup, bonds (especially long-term Treasury bonds) are less volatile than stocks or commodities. That means they contribute less risk overall, even if they take up more of the allocation.

To truly balance things out, some investors use leverage to increase their exposure to lower-risk assets like bonds. For example, instead of holding regular TLT (a long-term Treasury ETF), you might use 2x leveraged bond ETFs to match the volatility of stocks more evenly, bringing actual “risk weight” into parity.

But let’s be real: leverage cuts both ways. It can amplify returns and losses. Leveraged ETFs are designed for short-term tracking and can behave unpredictably if held too long without monitoring. That’s why, if you’re going to go this route, you need to watch your positions like a hawk and rebalance consistently.

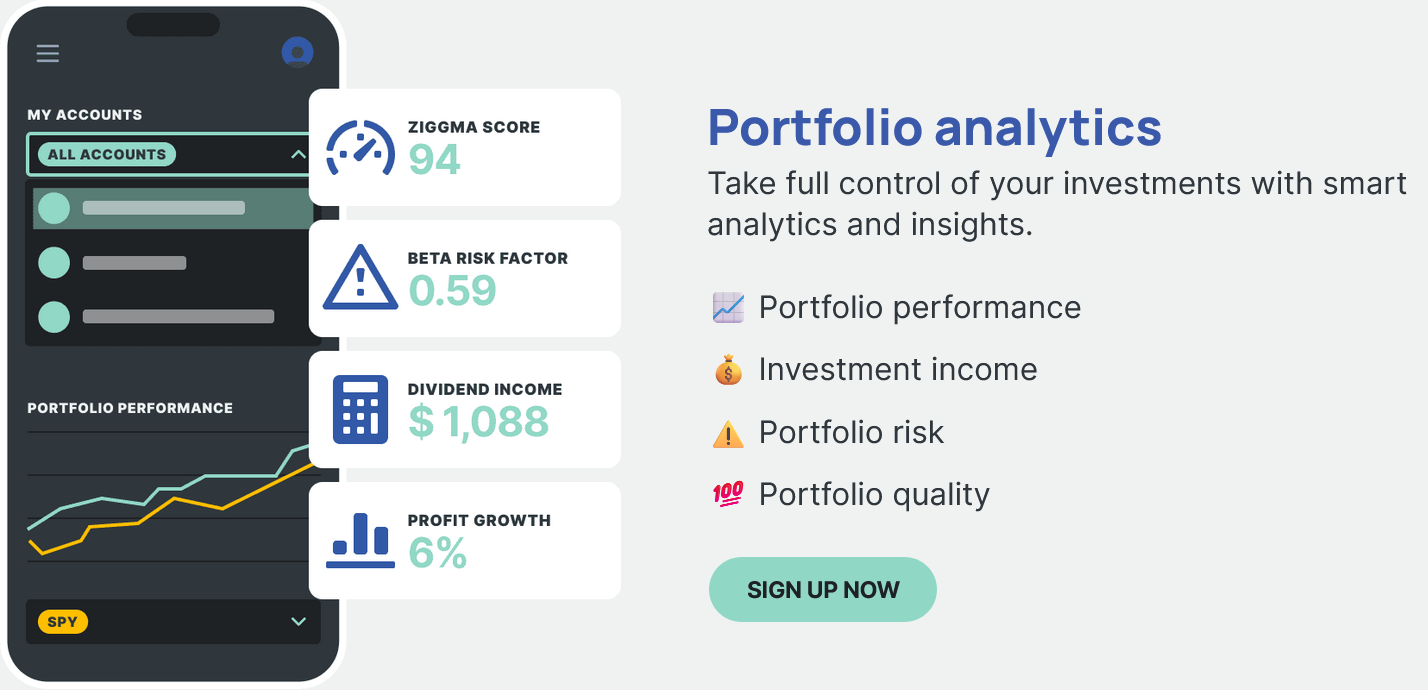

Tools like Ziggma can help here. Ziggma lets you backtest portfolio allocations, model different risk-weighted mixes, and track performance over time. You can see how your leveraged portfolio would have held up in 2008, 2020, or even in today’s choppy 2025 landscape, before putting real money on the line.

Rebalancing Frequency

Rebalancing is essential to keep the All-Weather Portfolio functioning as designed. Why?

Because markets move. If stocks rally hard while bonds fall, your 30% stock allocation might turn into 40% before you know it, shifting your risk profile.

Most investors rebalance quarterly or annually, depending on how actively they monitor their portfolios. With M1 Finance, rebalancing is simple: just click one button and the platform brings your “pie slices” back into alignment.

If you’re using a more DIY brokerage or dealing with alternatives, a tool like Ziggma can automate tracking and alert you when you’re out of balance.

Challenges and Risks

Complexity

For some, the All-Weather Portfolio is too complex to be plug-and-play. Risk parity, leveraged bond strategies, and quarterly rebalancing all sound great … until you’re knee-deep in spreadsheets, ETF tickers, and allocation math.

If you want a diversified, intelligent portfolio without the mental overload, Zen Investor offers a smarter shortcut. Built by the experts here at WallStreetZen, it uses a 4-step system that filters through thousands of Wall Street analyst picks, applies a 115-factor Zen Ratings model that combines classic technical and fundamental checks with AI, and runs every stock through a rigorous due diligence screen.

Stocks rated “A” using this system have historically delivered annual returns of 32.52%.

The result is a hand-selected portfolio managed by veteran investor Steve Reitmeister, whose track record includes buying Amazon at 43 cents and Priceline at $14. If you want long-term upside without micromanaging your strategy, Zen Investor is a clean, data-backed way to simplify complexity.

Lower Returns in Bull Markets

The whole idea is to smooth out the ride, not max out your gains.

So when the S&P is on a tear, this portfolio’s heavy bond allocation will hold it back. That’s not necessarily bad, especially if you value capital preservation and hate drawdowns, but it’s a tradeoff worth knowing.

Costs and Fees

Diversification sounds great until you realize it comes with baggage. Gold ETFs charge more than index funds. Leveraged bond products? Even pricier. And again, the ALLW ETF, a one-stop shop for Dalio’s portfolio, charges 0.85% … not egregious, but enough to add up over the years.

If you’re mixing in alternatives like real estate, private credit, or physical gold, you’ll need to factor in platform fees, liquidity constraints, and storage costs. So keep an eye on your expense ratios and make sure your portfolio is working hard enough to earn its keep.

Alternatives to the All Weather Portfolio

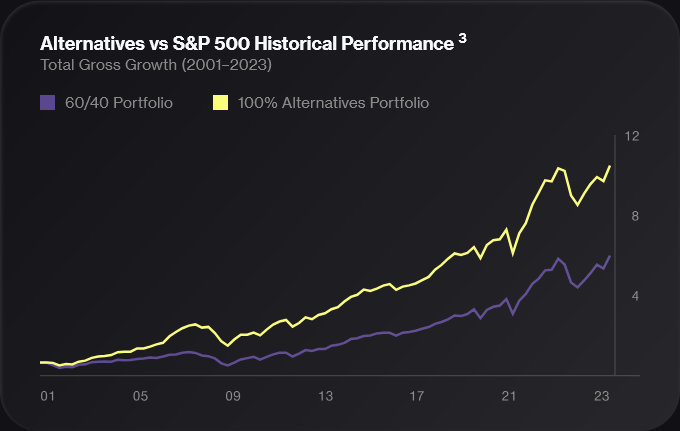

60/40 Portfolio

Sometimes simpler really is better. The classic 60/40 portfolio (60% stocks, 40% bonds) is a time-tested approach that offers decent returns with moderate volatility.

Unlike Dalio’s approach, which tries to hedge against every possible macroeconomic condition, the 60/40 leans into long-term economic growth. It’s easier to set up, requires less rebalancing, and works well for investors who don’t want to overthink it.

40/30/30 Portfolio

This version takes the balanced spirit of All-Weather and adds a modern twist: 40% stocks, 30% bonds, and 30% alternatives.

The idea is to maintain a core foundation while diversifying into assets like private credit, real estate, or even crypto.

For investors who want exposure beyond traditional equities and fixed income, this format gives you more flexibility without going all-in on complexity.

DIY Portfolio

Want full control? You can always build your own portfolio from the ground up … just be ready to do the homework. Researching and picking individual stocks, for example, takes time and diligence.

Tools like Motley Fool Stock Advisor can help by offering curated stock picks and ongoing insights from seasoned analysts.

But if you want that same level of intelligence without the heavy lifting, Zen Investor combines human expertise with AI to deliver actively monitored, risk-rated portfolios tailored to your style.

Final Word: Is the All-Weather Portfolio Strategy a Good Option in 2025?

The Ray Dalio Portfolio is still one of the most thoughtful, research-backed approaches to long-term investing.

But it’s not for everyone. If you’re chasing aggressive growth, the high bond allocation will feel like a wet blanket. And while they smooth out the ride, the Ray Dalio principles behind the portfolio don’t always keep up in raging bull markets.

There’s also a bit of maintenance involved unless you use something like M1 Finance, which automates your rebalancing with “pies” and fractional shares.

If you like the All-Weather philosophy but want a more modern spin with higher growth potential and less hands-on setup, Zen Investor could be a better fit. It filters Wall Street analyst data, runs it through a powerful AI-driven rating model, and delivers a curated portfolio of 20–30 high-upside stocks … minus the asset-allocation gymnastics.

Bottom line? The All-Weather Portfolio is still a great choice in 2025 if your priority is resilience over raw returns. If you’re ready to get started, M1 Finance is your best bet for building it on autopilot. And if you want expert help finding the next wave of winning stocks, Zen Investor is well worth a look.

FAQs:

What Is the Ray Dalio All Weather Portfolio?

The Ray Dalio All Weather Portfolio is a diversified, risk-parity investment strategy designed to perform well in any economic environment including inflation, recession, and growth cycles. Created by Ray Dalio, founder of Bridgewater Associates and author of Principles, it balances stocks, bonds, gold, and commodities to smooth out volatility over time.

Can I Build the Ray Dalio Portfolio with ETFs?

Yes, you can build the Ray Dalio All Weather Portfolio entirely with ETFs, including options for stocks, treasury bonds, commodities, and gold. See the full post for specific ETFs.

Is the Ray Dalio Portfolio Safe for Beginners?

Yes, the Ray Dalio Portfolio is considered beginner-friendly because of its broad diversification and focus on risk reduction across asset classes.

How Often Should I Rebalance the Dalio Portfolio?

Most investors rebalance the Ray Dalio All Weather Portfolio quarterly or annually to maintain the target asset weights and manage risk effectively. Using tools like M1 Finance or backtesting platforms, you can stay disciplined without needing to follow a more active approach like the Jim Simons trading strategy.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.