Recessions are the boogie men of investing. They keep investors up at night wondering if or when they’ll strike. Recessions are hard to predict, but it’s relatively easy to weather the storm if you’re ready. Choosing the right investments so that your portfolio is recession-resistant is the best approach.

I’d like to share the eight best investments during a recession. These are tried-and-true investments with historical data backing up their effectiveness.

The best defense against a recession is to organize your investments before the recession hits. Let me show you how.

1. Art + Collectibles

One good way to attempt to beat a recession is to invest in an asset that is completely untethered from the stock market. Here’s why. Stocks typically get hit hard during a recession, as consumer spending dips and brings the company’s revenue with it.

According to Fidelity, the S&P 500 has bottomed out a few months before just about every recession. Investing in an alternative asset like artwork is one of the best ways to preserve your portfolio’s value when the markets take a dive.

Art is uncorrelated with stocks, which means that your art investments are not likely to decrease in value at the same time as your stock investments. That’s good news during a recession because it means your total losses will most likely be lower than they would be if you just invested in stocks.

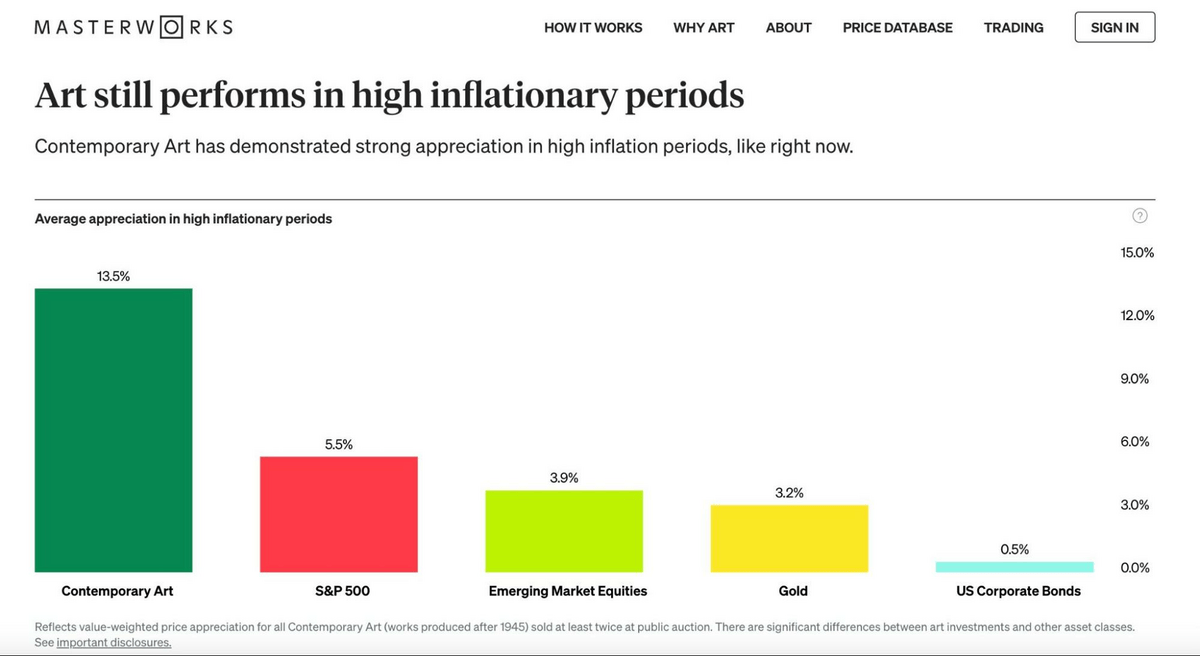

As you can see from the below chart, art also tends to perform well during high inflation periods (like the one we’re in right now)…

But let’s be real. Buying fine art as an investment takes more capital than most people have. Luckily, Masterworks makes investing in fine art about as simple as it possibly can be.

Masterworks lets you buy shares of artwork, so you can own a small piece of a painting instead of having to buy the whole thing. The goal is to give investors access to fine art.

The platform is very user-friendly and has tons of different art investments to choose from. Just a few recent examples of the artists they have invested in recently include Banksy, George Condo, and Monet.

Not only can you invest in art in the primary marketplace, but the platform also has a secondary market where you can trade shares of blue-chip art.

2. Defensive Sector Stocks + Funds

Even though stock indexes tend to fall during a recession, that doesn’t mean that all sectors drop by the same amount. Sectors that provide valuable services or critical products often don’t drop as much as less important sectors.

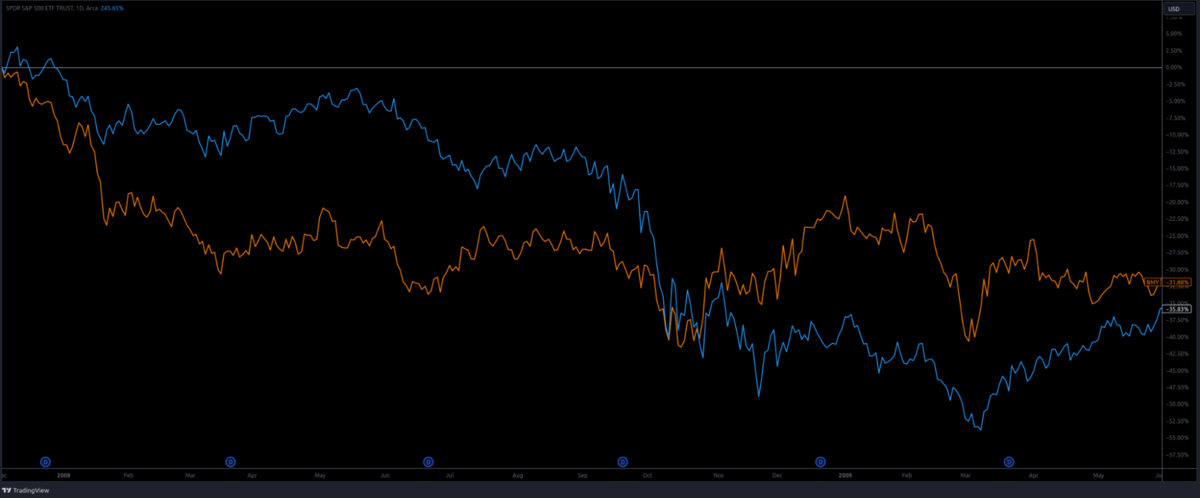

Healthcare is a good example of a sector that is better than the broad market at surviving a recession. During the Great Recession — which lasted from December 2007 to June 2009 — the S&P 500 lost 36% and fell as low as 54% at one point.

Bristol Myer Squibb (NYSE: BMY), one of the top picks on WallStreetZen’s Best Healthcare Stocks screener, lost 32% but only fell as low as 42% at its lowest point. The point? It fell, but not as hard as the market at large.

I made the following chart using my favorite online charting platform, TradingView. The blue line is SPY, and the orange line is BMY:

Another good sector to invest in during a recession is consumer staples. This sector includes food manufacturers and food packagers, farm product stocks, education-related stock, and other companies that provide essential services.

Some of the stocks on WallStreetZen’s Best Consumer Staple Stocks screener include Target Corp (NASDAQ: TGT), Coca-Cola (NYSE: KO), and J&J Snack Foods Corp (NASDAQ: JJSF).

If you want to buy and sell stocks, you need a brokerage account. One of our top picks? eToro, which supports stock investing as well as ETFs, crypto, and more.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

3. Dividend Paying Large Cap Stocks

Another one of the best investments during a recession is dividend-paying large-cap stocks or blue-chip stocks. These stocks are some of the most valuable publicly traded companies you can own. (BTW — WallStreetZen’s list of the best dividend stocks is a who’s who list of the top household names in the world.)

Besides being some of the largest companies in the world, the fact that they pay dividends means you’ll still see decent returns even if the share price drops.

Dividend stocks pay out a predetermined amount of money to shareholders on (usually) a quarterly basis. That means that you’ll still make money if you invest in these stocks, even if the stock drops.

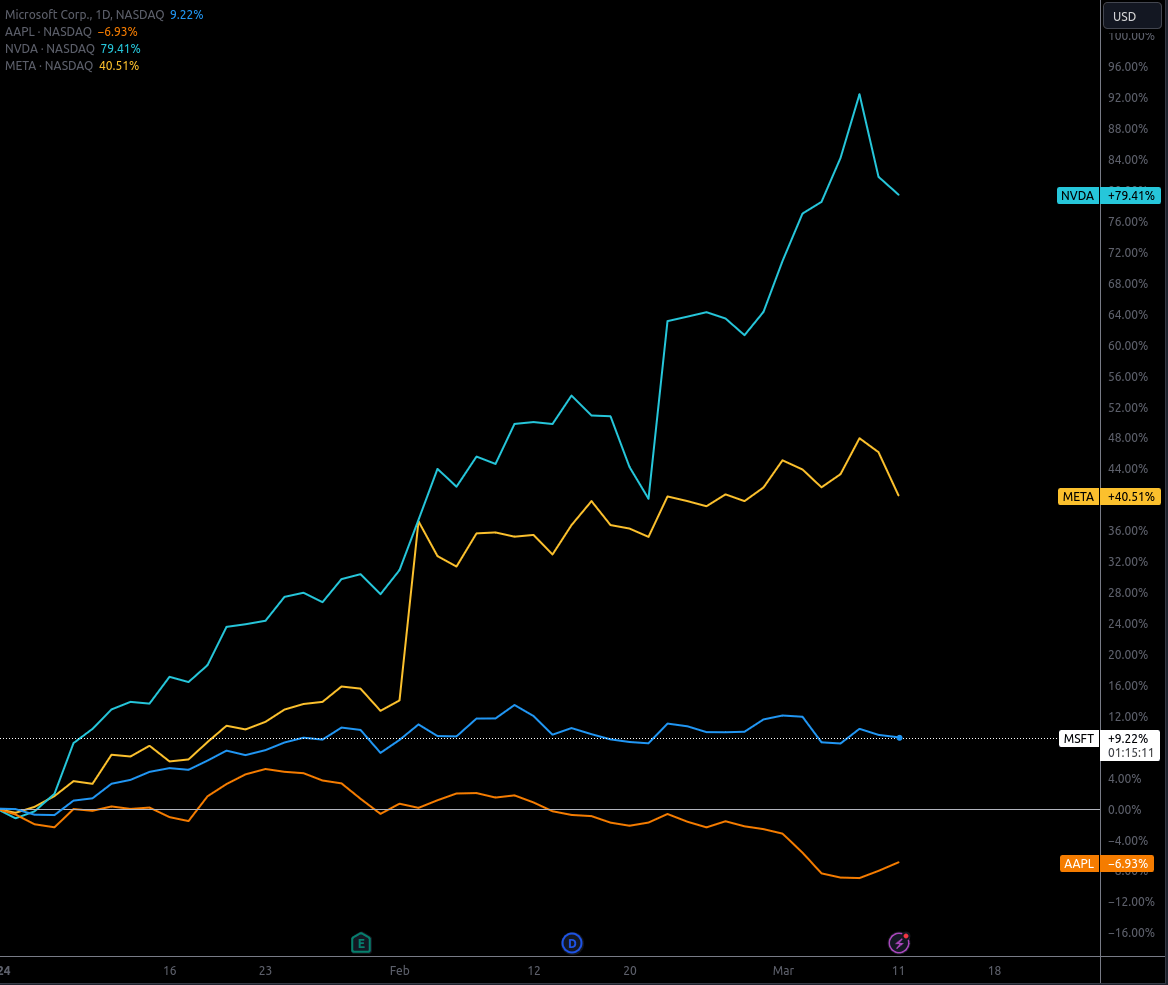

Some of the large-cap dividend stocks you can invest in today are Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), and Meta (NASDAQ: META).

In the following chart, Nvidia is teal, Meta is yellow, Microsoft is blue, and Apple is orange:

Once again, you’ll need a broker to invest in these stocks. If you need a broker, I think eToro is an excellent choice.

It’s easy to get started, has a convenient mobile app, and gives you access to all the stocks and ETFs you need to construct a recession-ready portfolio.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

4. Bonds

Bonds are another one of the best investments during a recession because they’re good at holding value. Historically, people invest in treasury bonds when they’re worried about the future since investing in the U.S. government is one of the safest investments you can make.

Bonds sometimes decrease in value when stocks drop, but they often hold their value or even increase in value, making them a good hedge for tumultuous economic conditions.

You can only buy treasury bonds directly from the U.S. Treasury on its website. If you want to purchase corporate bonds or invest in a bond ETF, M1 Finance offers top-of-the-line bond investing tools.

5. Treasury Bills

Treasury Bills are similar to bonds in that they hold up well during a recession, but they’re different from bonds in a few important ways.

First, Treasury Bills (sometimes called T-Bills) have shorter terms to maturity than T-Bonds. T-Bills can mature in just a few days, but usually mature in six months to one year. Having shorter term lengths makes T-Bills more flexible than T-Bonds, so you can repurpose your money sooner if the recession ends earlier than you expected.

Second, T-Bills don’t pay periodic interest. Instead, you purchase the bills at a discount compared to their full value. You receive the full value at the maturation date.

The difference in price between the discounted price you pay to purchase the bill and the full amount you receive when it matures is how much you make.

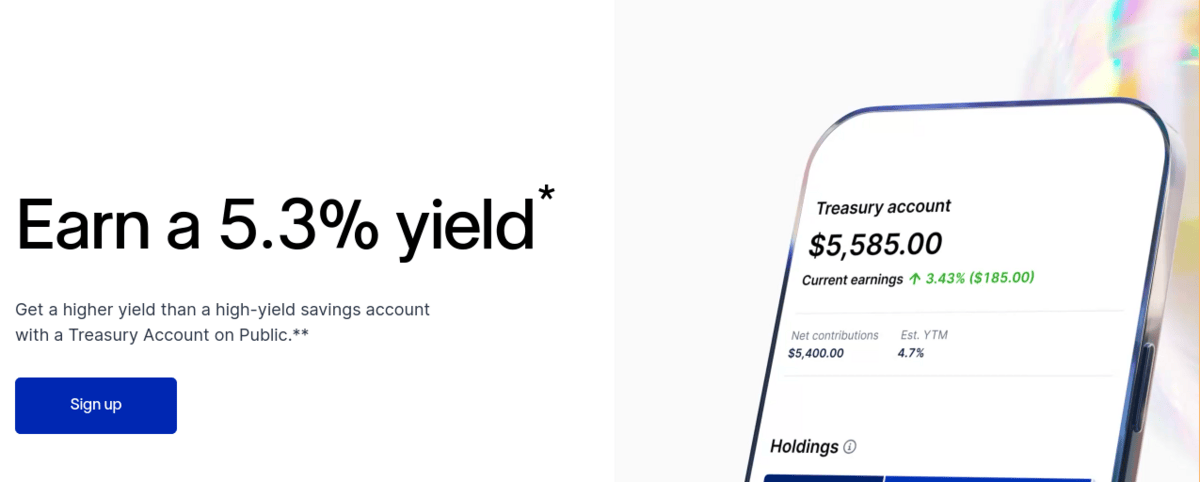

Public is one of the best online platforms for investing in T-Bills. The company offers a Treasury account where you can invest in Treasury Bills.

The bills you purchase are safely stored in the Bank of New York Mellon and the money you make is automatically reinvested upon maturity if you don’t explicitly sell the bill, which makes it easy to roll your investment over.

6. Gold

Gold is the traditional recession hedge. Even though crypto enthusiasts will tell you that Bitcoin is the new gold when it comes to insulating your investments from a market downturn, gold still has its place.

You could invest in a gold ETF if you don’t want the hassle of buying and storing physical gold. Or you could purchase actual gold from a reputable online retailer. But be vigilant: the risks of buying gold online are something you need to be aware of if you decide to purchase physical gold.

If you understand the risks and buy from a reputable dealer, gold can potentially be one of the best investments during a recession.

We like Augusta Precious Metals, which has a long track record and a good reputation as a gold IRA provider.

The platform also offers direct gold and silver sales, and is known for its excellent customer support. If you click the link below, you could be eligible for zero gold IRA fees for up to 10 years!

7. Real Estate

Real estate is another classic hedge if you think a recession is coming. Recessions can affect the housing market, but the real estate market doesn’t move in lockstep with the stock market. There are a few reasons for this, but one compelling one is that real estate is viewed as a safer investment.

People looking to shelter their money during a recession sometimes turn to real estate as a safe bet. Having some money in real estate offers diversification and is part of an effective all-weather portfolio.

Understanding how real estate investing works is essential before you get started. There’s a lot that goes into real estate investing. You need to understand how to find and value properties, learn about property management, make competitive offers, and much more.

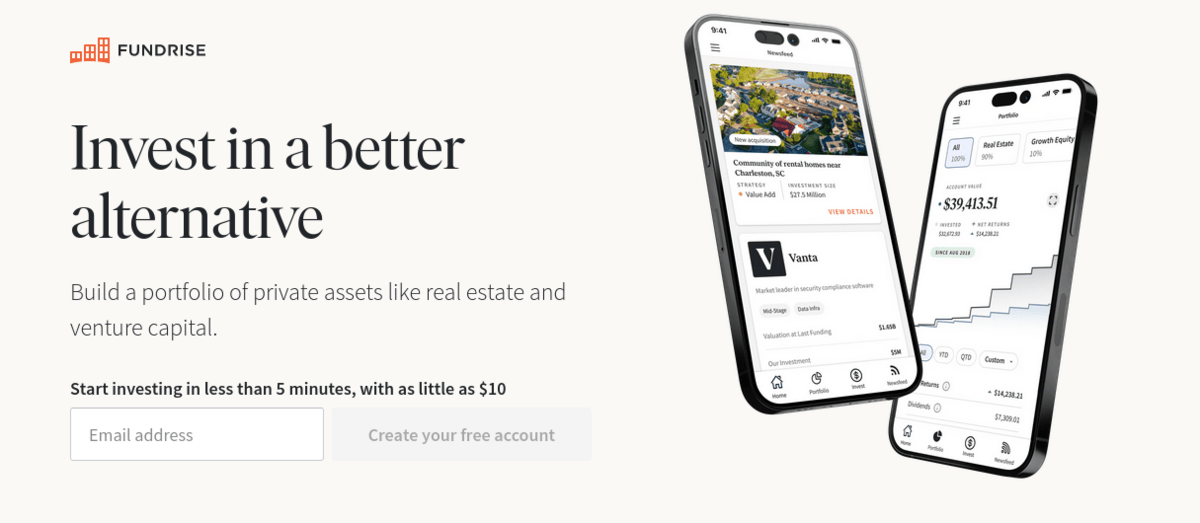

If that sounds like too much work, using a platform like Fundrise might be an easier way to get started. Fundrise allows you to invest in real estate funds so you can get exposure to real estate without buying a property all by yourself.

It’s easy to get started on Fundrise, and the experience is user-friendly, including an easy-to-use mobile app that lets you invest in real estate right from your phone.

Note: We earn a commission for this endorsement of Fundrise.

8. Cash + Cash Equivalents

I know this isn’t as exciting as the other investments. But it is a valid way to hunker down during a recession and protect your money. Cash and cash equivalents are safe ways to preserve your capital when the economy grinds to a halt.

They won’t lead to the biggest returns and won’t make you rich, but they’ll leave you with more money than you started with to reinvest in other assets when the recession is over.

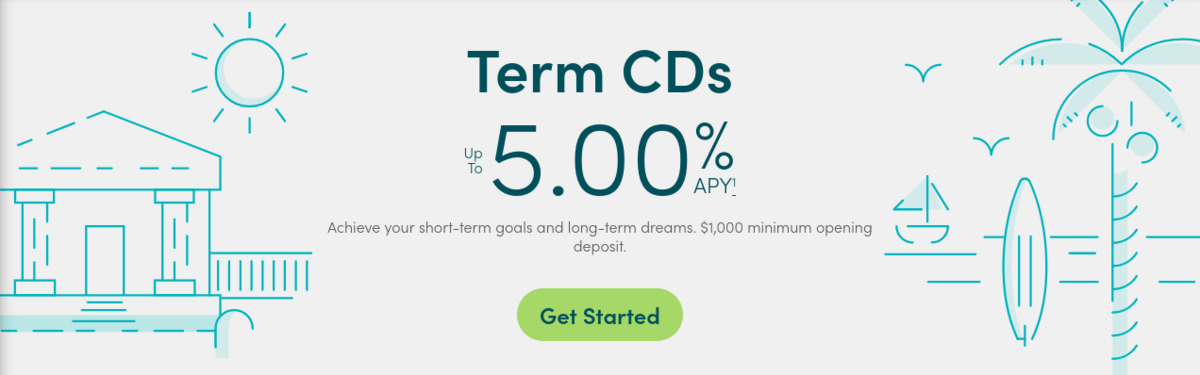

CDs and money market accounts are perfect vehicles to use during a recession. They come with FDIC backing, which means your money is protected up to $250,000. Most CDs and money market accounts return between anywhere from 1% to 5% in the current interest rate environment.

Cit Bank has a great selection of CDs to choose from. You can park your money for anywhere from six months up to five years and enjoy peace of mind knowing that your money is safe and will grow.

Short-term CDs offer higher rates than long-term CDs, and Cit’s rates are among the best I’ve seen.

Investing During a Recession: Pro Tips

Investing during a recession doesn’t have to be stressful. Getting the most out of your money when the economy is in the tank is a skill. Here are a few of my favorite tips to help guide your investing during a recession:

- Focus on defensive sectors: Investing in safe, consistent stocks is smart during a recession. Reallocate your stock investments so that a larger fraction of your money is in consumer staples and healthcare.

- Consider alternative assets: Alternative assets like artwork are uncorrelated with the stock market, which makes them invaluable when the market is down during a recession. Artwork holds its value better than stocks and ETFs.

- Buy short-term bonds and Treasury Bills: Short-term bonds and Treasury Bills are safe investments to make during a recession. The returns you get are pre-determined, so unless the U.S. government defaults, you’ll get your money back.

- Invest in dividend stocks: Dividend stocks like Microsoft, Apple, and Meta pay dividends, which means you’ll get some return on your shares even if the stock price drops. This is a great way to guarantee income during a recession.

- Don’t be afraid of cash: Cash — and cash equivalents like CDs and money market accounts — are viable investments during a recession. You won’t gain as much as you would when the market is hot, but you won’t lose as much when things take a turn for the worse either. Choose short-term CDs and money market accounts that let you withdraw your money without restrictions. The last thing you want is to have your money tied up during the market’s recovery.

Final Word: Best Investments During a Recession

Investing during a recession is as much psychological as it is about choosing the right investments. The best advice I can give you is to make a plan and stick with it.

A portfolio with an alternative asset like art that’s skewed towards dividend stocks and defensive stocks is the best way to ride out rough patches.

Keeping some money in a short-term CD (we like CIT Bank for CDs) or money market account is also a good idea. If you have the cash to get into real estate investing, or if you use a crowd-investing platform like Fundrise instead, investing in property is also a good way to insulate yourself from broad market drops.

Whatever particular allocation you choose, stick with it. It’s easy to get cold feet when you see your account in the red, but sticking to a tried-and-true plan is the best way to ensure you don’t wind up pinballing back and forth between investments.

FAQs:

Where should I put money during a recession?

You should put your money in safe assets, like dividend stocks, CDs, and bonds, and alternative assets, like artwork and collectibles, during a recession. Safe assets will give you small returns while keeping your money safe, while alternative assets like art will give you the potential for more upside.

The art market is typically uncorrelated from stocks, so it’s a good place to invest when a recession hits.

What is the best thing to do with money in a recession?

The best thing to do with money in a recession is to spread it around in multiple safe investments. Short-term bonds, CDs, and money market accounts are all great ways to invest money when the economy is in a nosedive.

If you’re ok with a bit more risk, alternative investments like artwork are also good options. You can also consider putting some money in dividend stocks since these will generate income even if the share price decreases.

Is it smart to invest during a recession?

Yes, it is. Not investing during a recession is one of the biggest mistakes inexperienced investors make. Time in the market beats timing the market, which means that investing your money early and letting it ride is better in the long run than trying to figure out where the market bottom is.

Reallocating money to safer investments is a reasonable thing to do. Many people prioritize cash equivalent investments like CDs and money market accounts during a recession.

What stocks go up in a recession?

It’s impossible to predict what stocks may rise during a recession, but some sectors historically perform better than others during market downturns. Defensive sectors like healthcare, consumer staples, and utilities are classic examples of sectors that outperform the broad market during a recession.

Investing in these sectors doesn’t mean you’ll make money during a recession, but it does increase the odds that you’ll lose less money than you would if you kept your money in a broad market index fund.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.