As author Roy T. Bennett once said, “There is no more profitable investment than investing in yourself. It is the best investment you can make.”

Do you agree?

I do. That’s why I’ve created this blog post — to share ways to invest in yourself from a whole-person perspective.

First and foremost, I’ll dig into how to invest in yourself financially by sharing real-world tips that have worked for me (and helped me save nearly $40K in just a few short years!).

I’ll also offer suggestions for investing in yourself in other ways that can contribute to your overall well-being and security. These tips have changed my life, and I hope they’ll have an impact on yours, too.

13 Ways to Invest in Yourself Financially + Beyond

Let’s start with everyone’s favorite topic: Money.

How to Invest in Yourself Financially

Money can’t buy happiness. But it can buy a sense of safety, as well as certain freedoms, that can enhance your happiness.

That said, let’s talk about how to invest in yourself financially.

My suggestion? Read all of the tips below and work on them in the order that suits you best. For instance, if you’re currently carrying a lot of debt, you might want to start with #5.

1. Consider Your Long-Term Financial Goals

What do you want out of life (that might require money)?

Take a few minutes to consider your financial hopes and dreams for the future. Do you want to own a house? Retire at age 50? Start building generational wealth so you can leave a million dollars to your kids?

Not every wish might be realistic. But the first step toward attaining goals is establishing them. From there, you can break down the big goals into smaller, more manageable milestones.

I had a goal-setting session like this a few years ago. I decided one of the things I really wanted was to purchase a house in New Orleans, one of my favorite cities. The idea? To buy a house within 10 years, then rent it out until I am ready to retire.

OK, there’s the dream.

From there, I was able to set a concrete goal: Save up $80K for a down payment.

Armed with a goal, I was able to start working toward it.

I calculated that if I saved about $400 per month ($200/paycheck), I would have saved up roughly $50K within a decade.

If I also added extra funds when I was able, and invested the money to make it grow faster, I believed I could reach my $80K goal.

Since setting the goal a few years ago, I have already saved about $40k, thanks to the power of compounding interest and carefully considered investments.

Here’s been my approach:

2. Set Up an Investment Account

To start saving that $80K, I started saving about $200 from each paycheck. But I haven’t just locked it away in some savings account earning 0.05% interest. I started investing.

I had a few objectives:

- I knew I wanted to invest in stocks.

- But I also wanted the ability to diversify across other assets.

- I also wanted it to be simple — I didn’t want to be investing on a ton of different platforms.

I settled on a total of 3 platforms: First, Public, which allows you to invest in stocks, ETFs, and other vehicles, like bonds, high-yield savings, and Treasury bills — all within a single login.

I also started doing some more passive investing through Acorns, which also lets me save on the sly.

Finally, I diversified by investing in hard-to-access asset classes via Fundrise.

Each of these platforms offers something a little different. Let me explain…

Note: We earn a commission for this endorsement of Fundrise.

Public: Invest In a Variety of Assets on a Single Platform

I invest about $100 per paycheck on Public. There, I invest in a few things:

- Individual stocks: To choose what stocks to invest in, I use WallStreetZen’s Zen Ratings system to research investments and get stock picks through Zen Investor.

- Bonds: I have a Bond Account on Public, where I can invest in a variety of high-quality bonds within a single account. The current yield is over 7%.

- Treasury Account: I also invest in T-bills on Public, which currently offer over 4% — making it a high-quality and lower-risk way to invest.

I also maintain a balance in my high-yield cash account on Public — it’s like a high-yield savings account.

Oh, and if you’re into it, you can also invest in crypto and options on Public.

Acorns: A Simple Approach to Investing For Beginners

If you want more guidance — or just to keep things simple — I can’t recommend Acorns enough.

Acorns is a robo-investing app that meets you where you’re at.

Don’t have much to invest? You can use it as a micro-investing app through its Round-Ups feature, where you can link your debit card with your Acorns account, round up the change on everyday purchases, and have the platform automatically invest on your behalf.

You can also create an automated investment of however much you’re comfortable spending. For instance, I invest a portion of each paycheck plus Round-Ups in my Acorns account.

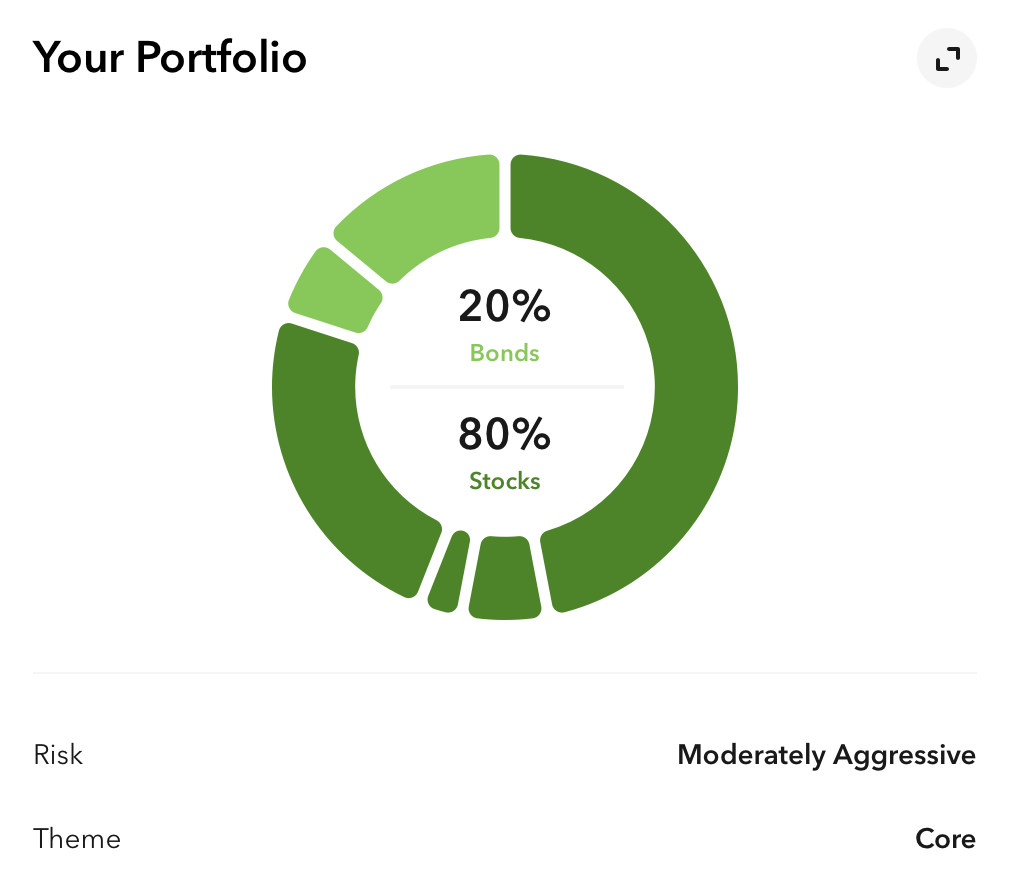

What do you invest in on Acorns? Depends on your risk tolerance. When you set up your account, you’ll take a quiz to assess your goals and risk tolerance.

From there, Acorns will automatically invest the funds for you. For instance, I have a “Moderately Aggressive” profile, which has a balance of 80% stocks and 20% bonds. Most of the stock investments are via ETFs.

All that small change and regular investing, plus a few random one-time lump sums I’ve deposited, has added up. In about 2 years, I’ve “grown my oak” on Acorns into several thousand dollars.

Need practice before you start investing?

Once you’re bitten by the investment bug, you may be interested in venturing into stock picking or other types of stock market investing. Here’s how to learn about stocks.

If you are interested in stock investing but nervous about putting your money on the line, I strongly recommend eToro’s demo account. It’s a “paper trading” account where you can test out executing trades without putting real money on the line. It’s powerful training!

Related reading: The Best Stock Market Simulators

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

3. Explore Alternative Investments

To diversify further, I also set up an automated investment plan on Fundrise, where I invest in real estate, private credit, and the Fundrise Innovation Fund. Occasionally, if I have a little extra cash, I add a one-time deposit.

If you’re new to investing, you might not realize how unique Fundrise is. The assets available are typically pretty hard to access — particularly private credit and venture capital.

Investing in these assets often requires accreditation and/or a hefty initial investment. Fundrise lets you invest starting at $10, making it accessible to most investors.

Fundrise allows for easy diversification.

Diversifying into alternative assets can help round out your portfolio when the stock market is down — like it has been recently as of early 2025.

And the diversification has been good for my portfolio: February and March, when the stock market looked scariest, I was actually up in Fundrise:

On Fundrise, your funds are invested on your behalf in various portfolios: Private Credit, Real Estate, and Venture Capital. You can choose one of their pre-built allocations or you can make individual investments into the different accounts. To find out a whole lot more, check out my Fundrise review.

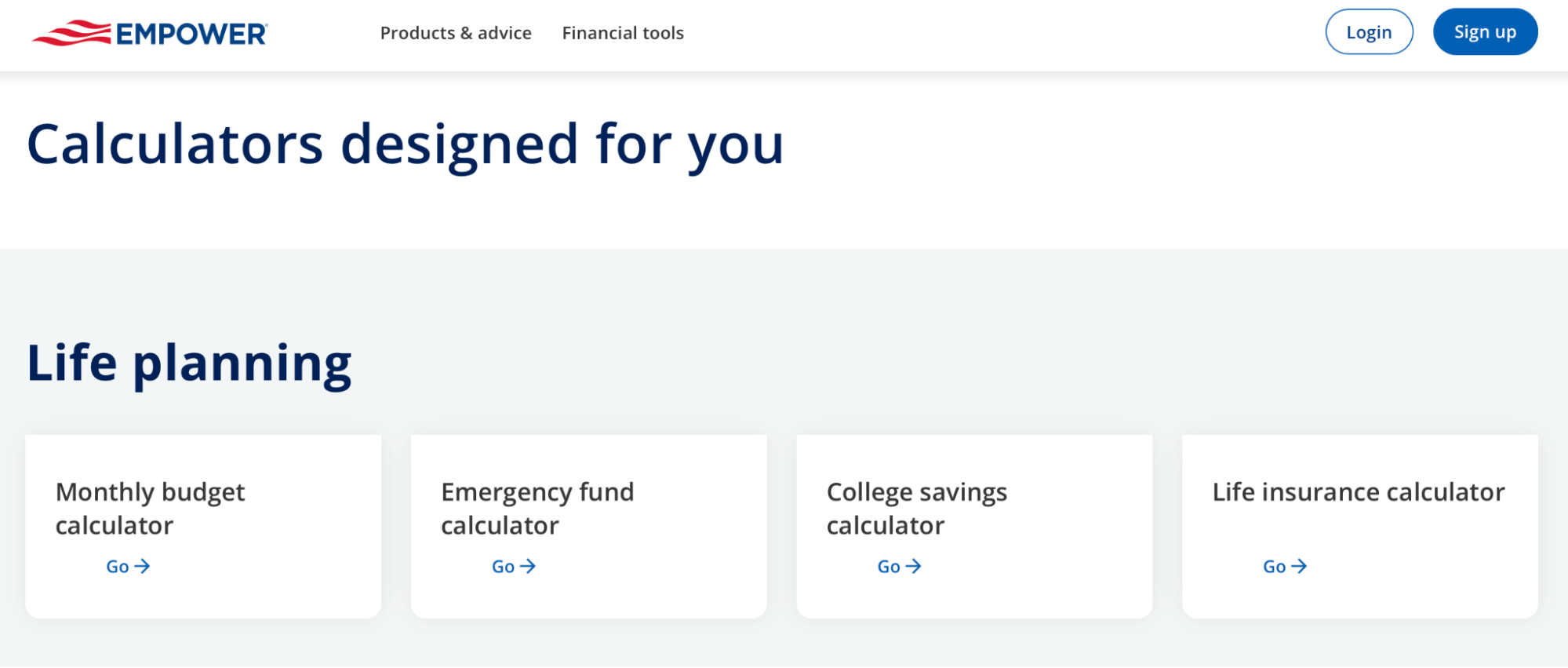

4. Understand Your Finances

To most efficiently work toward your goals, it’s important to assess the current state of your finances. This can help you allocate your resources in the most intelligent way possible.

For instance, if you have a lot of high-interest debt, it may make more sense to pay that off before you start investing or saving.

To get a good handle on your financial situation, I strongly recommend the tools on Empower’s free dashboard enough. It has a budget planning tool, an investment check up tool, a retirement planning tool … and more.

I also love their calculators. Empower’s free dashboard features calculators to help you make sense of all aspects of your personal finances, including a budget calculator, emergency fund calculator, college savings calculator, life insurance calculator, and more.

If you’re confused about how much you should be saving for what, these calculators are the perfect starting point.

5. Pay off Debt

If you have high interest debt, it should be your priority to pay it off — or at least down. This is one of the most powerful ways to invest in yourself. Empower’s free dashboard tools can help in this area, too. It has a Debt Payoff calculator so you can pay down debt and focus on more “fun” investments.

6. Create a “Rainy Day” Account

Emergency fund, rainy day fund, whatever you want to call it, it’s important to have some money sacked away in case of emergency. But just because you’re saving it doesn’t mean it can’t work for you.

I don’t park my money in a savings account that makes 0.45% interest — put it in a high yield savings account to maximize compounding interest. Currently, the high-yield cash account on Public offers 4.1% interest. Here’s a blog post listing out other high-yield savings and cash accounts.

Say that you have a “rainy day” fund of 10k. In a year, you’re going to grow that by over $400 when you factor in compounding interest. Every bit counts!

7. Start a Retirement Account

Did you know that more than a third of Americans say they’ve never had a retirement account? Dont’ be one of them. Investing in yourself means in vesting in your future!

You can open a traditional IRA account with many financial institutions, but you can also invest in retirement through investment apps like the aforementioned Acorns, which has “Acorns Later.” If you upgrade to an Acorns Gold account, they even do a 3% match.

If you want to include some alternative assets in your retirement account, Fundrise’s retirement account lets you diversify with private real estate through a tax-advantaged retirement account, allowing you to reduce risk and improve stability.

But those are just a couple of the many excellent options out there. Check out our 12 best retirement investment strategies here.

Invest in Knowledge

As Benjamin Franklin once said, “An investment in knowledge pays the best interest.” By committing to lifelong learning, you can position yourself financially and personally at an advantage. Here are just a few ways to do it:

8. Gain Financial Literacy

As you might have gathered from the first part of this post, I’m a big believer in gaining financial literacy. Happily, there are plenty of places to learn.

eToro’s Demo Account: Personally, I like to learn by doing. I love stock investing, but sometimes committing to a stock is scary. eToro’s demo account is the perfect testing ground for various investment thesis.

Yeah, it can kind of suck to see an idea you have be very profitable and to know you were only trading “paper” money, but it can also help you build confidence so you’r ready to see opportunities in your real account when you’re ready.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Take a class: To develop a new skill, sometimes you need to learn from someone who knows more than you. This might be in a formal classroom setting, on YouTube, or online.

To explore great classes related to investing, check out our list of the best Stock Trading Courses.

(BTW — if you’re interested in an options trading class, my friend Lincoln offers a great one at a great price.)

“Class” can also refer to other methods of live learning. For instance, it’s not technically a class, one of the resources where I’ve learned a lot is the members-only webinars that come with a Zen Investor membership.

They’re run by the Zen Investor Editor-in-Chief, Steve Reitmeister, former Editor-in-Chief of Zacks.com and 40+ year veteran investor.

Reitmeister has seen a thing or two in the market, and always has a great take on current market conditions.

Here’s one of his webinars where he introduces how to use WallStreetZen’s Zen Rating system.

Books: Obvi. If you’re a book learner, there are a ton of great finance books out there — start with our list of the best investment books for beginners.

Podcasts: Likewise, there are a lot of great personal finance podcasts out there, and you can find an episode on just about any topic you’re interested in, from retirement planning to investment platform reviews and more. Start with our list of the best financial podcasts.

Newsletters: There are plenty of free and paid financial newsletters out there. Find a few that speak to you, and get regular updates. The compounding interest of learning a little each day about the markets can be incredible.

I know that I talked up Zen Investor above. However, I’ve got to mention it again. And let me qualify this by saying Zen Investor is where I discovered one of the best stocks in my portfolio right now, Kinross Gold Corp (NYSE: KGC) — a stock that is up 40% since it was initially alerted. I bought it a little bit later, and my position is up about 30%.

Yes, you get stock picks and a professionally-chosen portfolio of stocks with membership. But you also get some awesome market insights.

For instance, I feel like I have learned a lot from his monthly members-only webinars and market commentary emails (check one out here).

9. Never Stop Learning

Don’t just commit to learning about finance — commit to learning in general.

Stay on top of the news. Read books. When you hear a word you don’t know, look it up. Sign up for Duolingo and learn a new language.

By adopting the mindset of a lifelong learner, you keep yourself nimble and young. You may also pick up ideas for how to advance yourself — or your portfolio.

For example, I was so impressed with Duolingo (NASDAQ: DUOL) when I signed up that I decided to buy the stock — see the chart below, courtesy TradingView. I just sold my shares last week for a 60% gain. It paid for my Duolingo membership and then some!

10. Invest in Your Career

This is really just reiterating some of the above concepts but applying it to your chosen career.

I think of this as a targeted type of learning that can increase your worth at the workplace (direct financial benefit) and give you greater satisfaction on the job by deepening your expertise and knowledge (emotional benefit).

So how can you invest in your career?

Take a class — even if it’s just to review the basics.

Get a mentor.

Learn how to use AI targeted to your field.

Pick up a new skill related to your field.

For instance, as a finance writer, I’m constantly investing in my career by learning about stocks and investing, reading books on writing and editing, and simply talking to more experienced people (mentors).

Invest in Your Health & Wellbeing

I’ve talked a lot about investing in yourself financially. Before we hit the road, let me get a bit more esoteric:

11. Seek Work-Life Balance

You’ve heard the saying “all work and no play makes jack a dull boy.” You might not find yourself in a situation like “The Shining,” but don’t let life become dull. After all, nobody ever says “I wish I’d worked more” on their deathbed. Enjoy your family. Make time for friends.

Believe it or not, taking time off of work can make you a more effective worker — which could benefit you financially in the long run. Yes — taking time off of work can lead to better performance! Win-win!

12. Tend To Your Physical Body

Your body is your gateway to doing things in the world, so be sure to take care of it. That whole “body is your temple” idea holds water — so be sure to adequately hydrate and feed yourself daily.

Get exercise to keep your joints healthy and supple. Wear sunblock to avoid UV rays that can advance signs of aging. You know, the stuff you probably know you should be doing.

How can this benefit you financially?

Here’s a quick example of the power of taking care of your body. Exercise has been scientifically proven to enhance memory and thinking skills, which could contribute to smarter decisions in everything, including money.

13. Tend To Your Emotional Well-Being

Don’t just pay attention to your external self — look inward, too.

Do things that uplift you. Take up a sport. Strike up a conversation. Contribute to your community.

Why consider your emotions? Because once again, it’s been scientifically proven — emotions can lead to bad investment decisions. By cultivating a peaceful mind, it can ultimately lead to more solid investing.

Final Word: How to Invest in Yourself

There you have it: 13 ways to invest in yourself financially, both directly and indirectly.

I hope these tips from my own journey have helped you on yours.

That said, my experience with the platforms and stocks mentioned above is unique. Your investments are your decisions, so it’s crucial to do your own due diligence before choosing an investment platform or assets.

Here’s to a successful and financially sound future!

FAQs:

How do you start investing in yourself?

Investing in yourself can start right this instant. Some ways to easily invest in yourself are to begin saving money for the future, take care of your physical and emotional body, and to commit to learning new things every day.

What does it mean to invest in ourselves?

Investing in yourself means engaging in activities that enrich you. The benefits might be emotional, financial, physical, or some other benefit entirely.

The over-arching idea is that you’re working on growing yourself in some way.

How can I learn to invest on my own?

There’s a way to learn how to invest for any type of thinking and learning style. There are countless educational books and podcasts. There’s a YouTube channel for just about every type of investing.

And if you like to learn by doing, a stock market simulator can help you learn how to execute trades without putting real money at risk. One smart way to start?

Consider what you’re interested in and look around for resources that seem aligned with your style.

What is the best investment you can make in yourself?

Depends on your objectives, but some of the best investments you can make in yourself are

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.