What is micro-investing, you ask?

In short: Investing with tiny amounts of money — in some cases, just a few dollars; in others, just a few cents. The idea is that these mini-investment can add up over time.

I invest in real estate, crypto, and big-time retirement funds, but I still work micro-investing into my portfolio.

In this article, I’ll explain it all: What is micro-investing? How do micro-investments work? Plus, I’ll give you some of my top recommendations for apps and opportunities for turning small amounts of cash into sizable accounts over time.

Our favorite micro-investing app in 2025

Fundrise gives everyday investors access to a diversified mix of real estate, private credit, and venture capital opportunities, all on a user-friendly, intuitive platform.

Typically, these types of investments require significant sums of up-front cash. Fundrise is much more accessible.

I started my Fundrise account with just $20 a couple years ago. With regular recurring investments, it’s grown to a few thousand dollars, with returns that rival the best high-yield savings accounts out there. (For more details, check out WSZ’s Fundrise review.)

But don’t take my word for it — check it out yourself.

Note: We earn a commission for this endorsement of Fundrise.

Micro-Investments: Are They Worth it in 2025?

The bottom line: There’s no specific definition for what a micro-investment is, but generally speaking, it’s a really small amount of money that you invest. In some cases, that amount could be dollars or even pennies. Over time, those tiny contributions could add up to thousands or even tens of thousands of dollars.

Will micro investing apps replace 401(k)s and other retirement accounts? No. But they do make investing more accessible, and they’re great for automated investments and portfolio diversification.

The Best Micro-Investing Apps

So … how do you go about micro-investing, and what are the best investments for beginners? There are a lot of opportunities out there, and the list of options is growing as more and more people turn to fractional investing.

I’ve personally used quite a few apps for micro-investing, and the following are the ones I recommend most.

1. Fundrise

Rating: ⭐⭐⭐⭐⭐

Minimums + fees: $10 minimum; fees vary — see the full fee schedule here

Best for: Micro-investors interested in real estate, private credit, and venture capital

How it works

Fundrise is an investing platform that allows you to invest in private real estate, private credit, and venture capital funds.

It’s one of my favorite micro-investing apps because I love investing in real estate. It has inherent value, tends to increase in value over time, and can provide some serious returns.

Fundrise offers two ways to potentially benefit from the real estate market. First, it allows you to invest in a Flagship fund, which is composed of a variety of real estate assets, including multifamily, industrial, and residential properties across the U.S.

Second, you can invest in the Real Estate Income Fund, which gives you access to private credit in the real estate market.

As a more recent addition, you can invest in innovative, pre-IPO companies through the Innovation Fund, which gives you exposure to non-public companies like Databricks, OpenAI, and more.

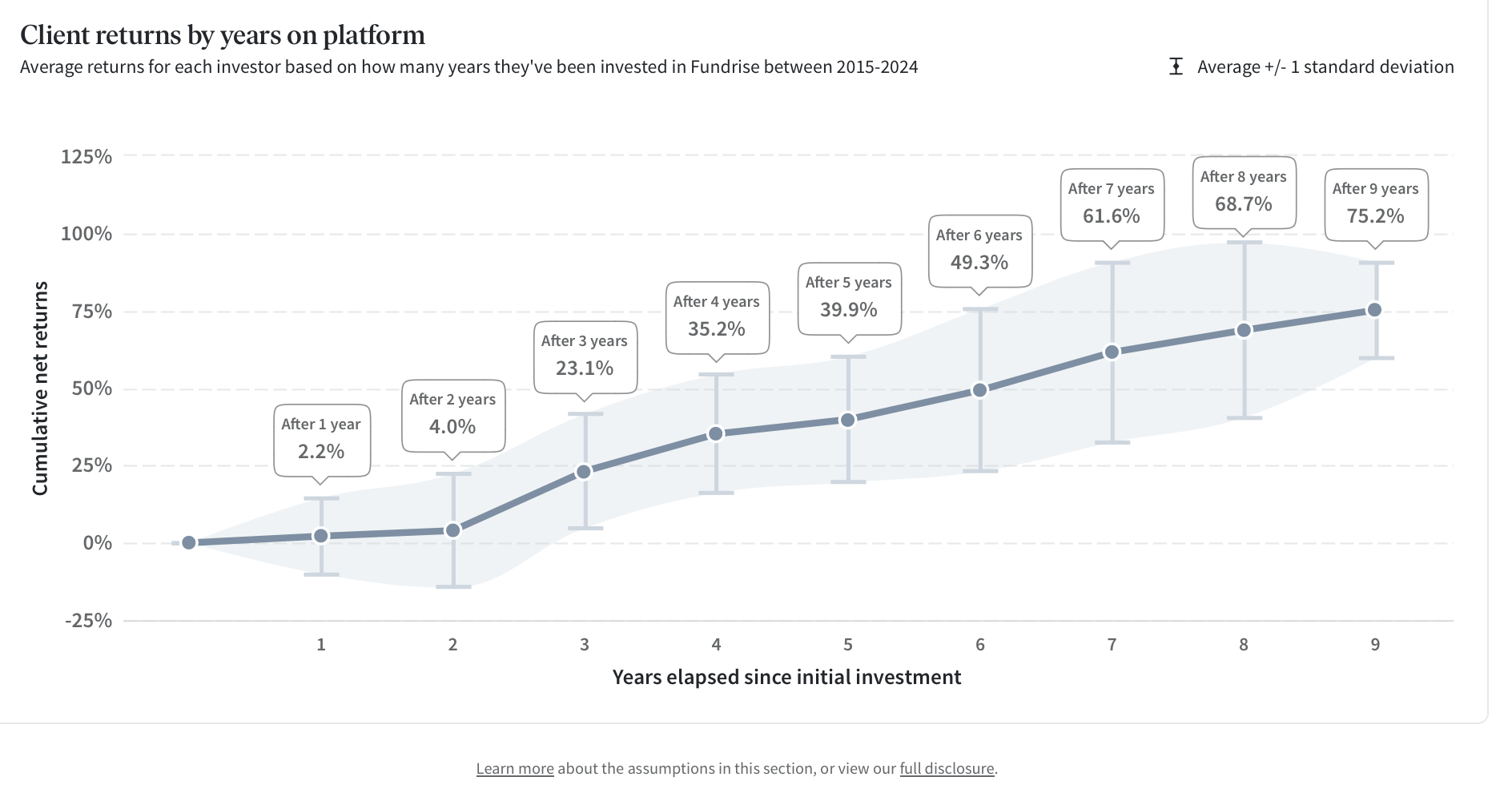

Need a little more inspiration? Here’s a chart detailing client returns by years on the platform:

The bottom line? I think Fundrise offers a fantastic opportunity to invest in asset classes that typically require a large initial investment.

Note: We earn a commission for this endorsement of Fundrise.

2. Acorns

Rating: ⭐⭐⭐⭐⭐

Minimums + fees: $5 minimum, fees starting at $3/month

Best for: Automatic micro-investing

How it works

Acorns allows you to start investing with ease.

To start, you link your account to your banking app to set up manual or automatic deposits. From there, the platform will automatically invest your cash based on a strategy that fits your objectives and risk profile.

Here’s a cool added feature: You can also enable round-ups, which allows you to round up purchases on your chosen credit or debit card and invest that “rounded up” cash.

I use Acorns for round-ups, and I’m continuously surprised by how quickly money adds up. I have it set up so that every purchase I make with my Chase cards gets rounded to the nearest dollar.

I never notice the money coming out of my Chase account, and at the end of every month, I have an extra $100 to $200 sitting in my account earning dividends and interest.

I strongly recommend Acorns for the beginner investor. The best way to invest and save money, in my opinion, is to do it automatically, and I think Acorns is the perfect medium to do that.

As an added bonus for WallStreetZen readers, you can get a $20 bonus when you set up your first recurring investment!

3. Robinhood

Rating: ⭐⭐⭐⭐

Minimums + fees: Minimums based on stock prices, regulatory fees only (none under $500)

Best for: Investing in specific stocks or cryptocurrencies

How it works

You fund your Robinhood account using your bank account. You then use the search function to find your preferred stocks, ETFs, options, and cryptocurrencies to purchase.

I also personally use Robinhood to invest in particular stocks and cryptocurrencies. It’s what I used to earn a few thousand dollars on the Gamestop (NYSE: GME) fiasco and to invest in Bitcoin and Dogecoin when they were super hot commodities.

Robinhood doesn’t have any options for automatic investing like Acorns does, so I recommend this for more seasoned investors who know specifically which stocks, ETFs, crypto coins, or stock options they want.

Robinhood does have the benefit of minimal fees. Fees only apply when you sell over $500 worth of an asset, and those fees are mandated by the Securities Exchange Commission (SEC).

4. M1 Finance

Rating: ⭐⭐⭐⭐

Minimums + fees: $100 minimum, regulatory fees only

Best for: Investors who have a little more cash to spend

How it works

Much like with Acorns, you fund your M1 Finance account using a checking or savings account. You can then use the funds to invest automatically — in indices or individual stocks — all without paying company-specific commissions.

M1 Finance is not as user-friendly as Acorns, in my opinion, and the significantly higher minimum will keep some investors from using the app.

However, the total lack of fees, other than regulatory fees, makes M1 a great option for beginner investors with a little extra money to start with.

While M1 Finance offers robo-investing, which is automated, it doesn’t currently have a round-up feature like Acorns, so you’ll still have to fund your account manually. This is a pretty significant downside, in my opinion.

5. Public

Rating: ⭐⭐⭐⭐

Minimums + fees: No minimums, only regulatory fees on standard services

Best for: Investors looking for alternative investments

How it works

You can fund your Public account manually using a checking account, and then you can purchase individual stocks, fractional stocks, cryptocurrencies, and more using your funds.

The coolest thing about Public, in my opinion, is that it opens the door to alternative investments, like collectibles. Just take a look at some of the items you can invest in below:

While the returns might not be quite as predictable as, say, real estate, the ability to invest in an unopened copy of Super Mario Bros. is just really exciting. The company has other alternatives, too, like blue-chip art.

Public is also great because it allows for round-ups, although the automated investing you could get with Acorns is missing here.

What is Micro-Investing?

Micro-investing is when you put a small amount of money — the amount depends on whom you ask — into an account that invests your balance in stocks, index funds, ETFs, or some other asset.

In my opinion, a micro-investment would be anything under $100, but some people set lower limits of $10 or even $1.

How Micro-Investments Work

There are two main types of micro-investing opportunities: those that are manual and those that are automatic.

Manual Micro-Investing Apps

With a manual micro-investment, you log in to your account on whichever site or app you’re using for micro-investing, add funds, and that money gets invested in a designated asset.

If you’re using a real estate crowdfunding app, for example, then your money gets pooled with funds from other investors and gets used to buy and manage a piece of real estate. You can usually choose the real estate deal you’re interested in funding.

If you’re using an investment app like Robinhood, then you add funds in a similar way, and then you choose the stocks or cryptocurrencies you want to buy.

Automatic Micro-Investing Apps

In the case of an automatic micro investment app, you link your account to your bank’s app (Chase, BoA, etc). The app tracks every purchase you make with credit or debit cards, rounds up to the nearest dollar, and incrementally funds your account.

Automatic micro-investing apps typically have everything automated for you. You might be able to choose where you want your money invested, but most apps — like Acorns — ask some questions about your risk tolerance and time to invest and make choices for you.

How Much Can You Make Micro-Investing?

The amount you can make through micro-investments varies quite a lot depending on many factors, but you can earn hundreds, thousands, or even tens of thousands over years or decades of micro-investing.

As with any investment, it’s important to note that it’s also possible to lose money.

There are a few factors at play that determine how much you can make:

- How much you invest: One of the most significant factors that affect your potential earnings is the amount you invest. The more you invest, the more you stand to earn or lose over time. In the case of micro-investing, the more often you invest, the more you stand to earn since the amount you invest is usually limited. Allocating more money more often to assets that perform well will yield higher profits.

- The micro-investing app you choose: Your return (or losses) will also be determined by the micro investing app you use.

Since real estate tends to perform better than stocks, putting your small investments into a real estate investing app like Fundrise could end up earning you more than putting them into an app like Acorns.

- Asset performance: Of course, your returns are going to depend on how well the particular asset performs. For example, a particular property in Fundrise might outperform a particular index fund in Acorns.

Micro-Investing: Pros and Cons

I believe micro-investing is one of the greatest opportunities to come about in the financial industry. This is primarily because it allows everyday people who don’t have thousands of dollars to invest get into investing and lets them make their money work for them.

With micro-investing, the saying that “it takes money to make money” is no longer true!

With that being said, it’s not the be-all-end-all of investing. The table below includes some upsides and drawbacks to consider before getting started.

Pros | Cons |

Doesn’t take much to get started | Even minimal fees make a difference with small investments |

Great for portfolio diversification | Not a substitute for retirement accounts |

Often fully automated | Returns are usually small |

Helps saving become a habit | Some apps remove control over asset allocation |

Usually includes minimal fees | |

Offers a great learning opportunity for new investors |

Final Word: Micro-Investing

Micro-investing is a great way for beginner investors who have minimal capital to put their money to work for them, and it’s an easy way for seasoned investors to diversify their portfolios.

If you’re looking to get into micro-investing as a complete beginner, I’d recommend starting with Acorns. I’ve earned a few thousand dollars through Acorns over the last few years with automated investing, and I never even realized any money was being pulled from my accounts.

Want a more unique investment opportunity? Try out Fundrise to invest in real estate deals, or Public for collectibles and blue-chip art.

To quote the Acorns app: “From tiny acorns, mighty oaks grow.” With tiny investments — sometimes pennies — you can build a nice investment portfolio for yourself and earn money with your money.

FAQs:

How do micro-investments work?

Micro-investments usually involve downloading an app to handle your investments. With automated apps like Acorns, you fund your account manually or automatically, and your funds are invested for you automatically. With manual apps like Fundrise, you fund your account and then choose which assets to invest in.

Is micro-investing a good idea?

In most cases, yes! Micro-investing is one of the best investments for beginners and those with minimal capital to get into investing. It also offers experienced investors an easy and affordable means of diversifying their portfolios.

How do I start micro-investing?

You can start micro-investing by choosing an investing app and funding your account. In some cases, as with Acorns, that’s all you need to do! In other cases, like with Fundrise and Public, you fund and then choose assets to invest in. Automating the investing process is a great option, especially for beginners.

How much should I micro-invest?

The amount you put into a micro-investing account is really up to you. I personally invest around 40% of my income each year, and around 10% is allocated toward micro-investments. Invest as much as you’re comfortable with, and always remember that automating investments is a great way to boost your savings over time.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.