In my Quiver Quantitative review, the platform earns a solid recommendation for the right type of investor. If you’re an active trader who can handle complex data, it’s worth the subscription.

Whether you’re tracking Nancy Pelosi’s latest moves, monitoring WallStreetBets sentiment, or analyzing government contract awards, Quiver gives retail investors access to institutional-grade tools that simply weren’t available a few years ago.

But it’s not for everyone. Let me explain in more detail below:

Is Quiver Quantitative Worth It in 2026?

Quiver Quantitative delivers solid value for active traders who know how to interpret data, and its congressional trading tracker, which allows you to see what politicians are buying and selling, is unparalleled.

But it’s not for everyone. For instance, if you’re a passive investor who buys index funds and holds for decades, most of this data won’t change your strategy. You might find it interesting, but it won’t make you money. Those investors are better off with a service like Zen Investor that focuses on simple, clear recommendations.

The platform’s biggest win is democratizing alternative data that used to cost hedge funds a fortune. Throughout 2025, they’ve rolled out better visualization tools, improved backtesting features, and AI-powered insights that make sense of complex datasets.

Their congressional trading tracker remains the crown jewel. Seeing what politicians buy and sell, often weeks before the market catches on, gives you a genuine edge. The copy trading feature they launched has also been a game-changer.

You can now automatically mirror strategies built on Quiver’s data without doing the heavy lifting yourself. This is valuable if you recognize the power of alternative data but don’t have time to analyze it all day.

The platform’s AI improvements in 2025 are impressive. For example, the sentiment analysis algorithms can distinguish between enthusiasm and sarcasm on Reddit (more complicated than it sounds), and their Smart Score feature helps you make sense of all the data points.

Below, I’ll explore some of the platform’s specific features.

Straightforward stock picks for a fraction of the cost…

A Zen Investor subscription saves you precious research time by letting a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How Does Quiver Quantitative Work?

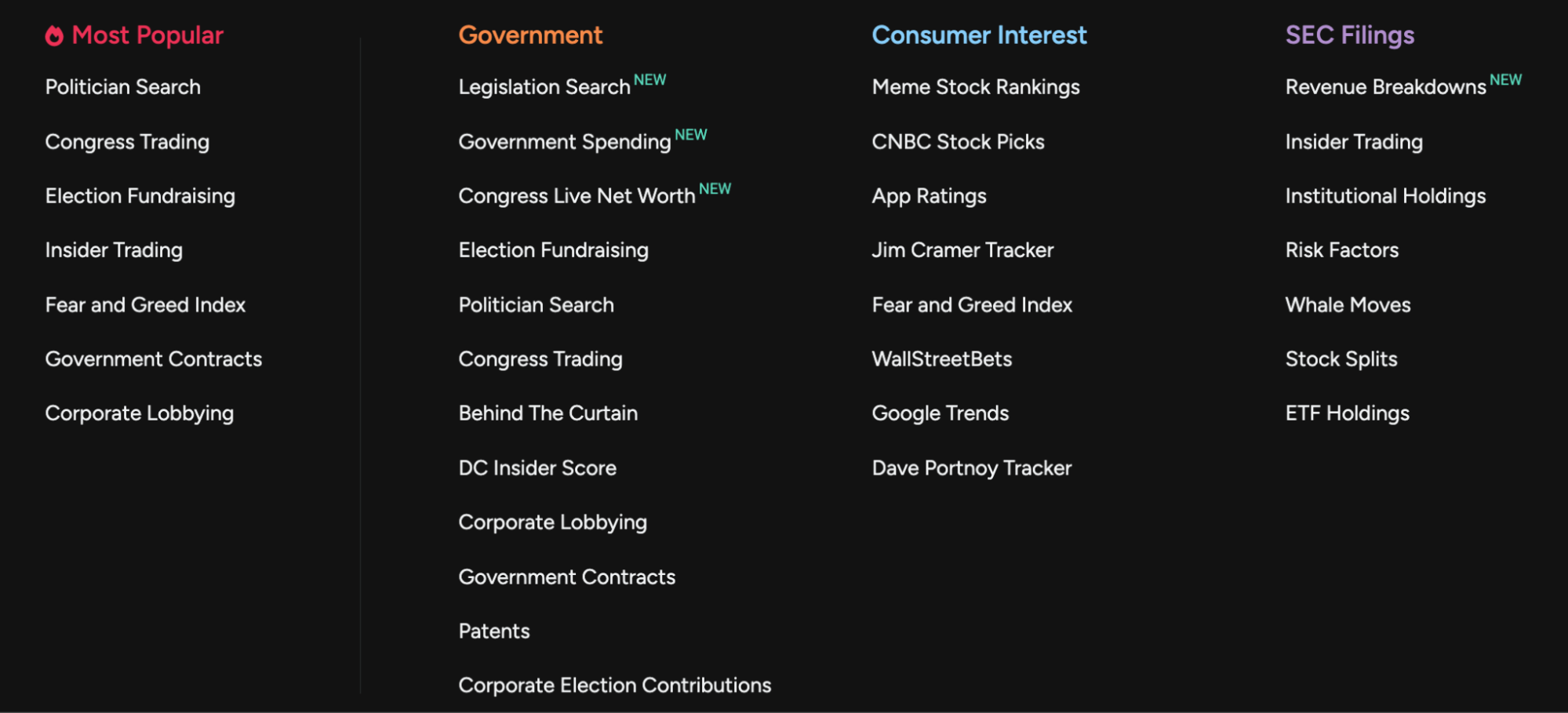

Quiver Quantitative aims to level the playing field between Wall Street and regular investors. It does this by aggregating alternative data from across the internet and making it usable.

That means that instead of focusing on standard metrics like P/E ratios that everyone already knows, Quiver specializes in unconventional datasets that can give you early warnings about market moves.

Is Quiver Quantitative Easy To Use?

Their interface looks clean and modern without being overwhelming. When you log in, you’ll find a dashboard with quick access to different data categories, trending stocks, and your watchlists.

The search function works well as you can quickly find specific companies, politicians, or datasets without getting lost.

What makes Quiver different is its focus on data outside traditional financial reports. They track everything from congressional trades to social media buzz to corporate jet movements. This stuff often signals market changes weeks before they appear in quarterly earnings.

What Do You Get With Quiver Quantitative?

Congressional Trading

This is Quiver’s most popular feature, and for good reason. It monitors every stock transaction made by Congress members and their families, pulling from mandatory disclosure filings. This data is powerful because congressional portfolios have historically crushed the broader market.

In 2025, Quiver Quant improved this feature even further. You can now see individual transactions and trends across political parties and committees. The “Congressional Alpha” metric shows exactly how well following specific politicians’ trades would have performed over time.

WallStreetBets Sentiment

Quiver tracks what’s hot on Reddit’s WallStreetBets and other retail investor communities. Their algorithms have gotten much smarter about distinguishing between real excitement and trolling (anyone who’s spent time on WSB knows the difference).

The dashboard shows heat maps of which stocks are trending, sentiment trends over time, and early detection of potential meme stocks before they explode.

As cool as this feature is, there are much simpler (and more affordable) tools available on WallStreetZen, where Sentiment is one of the key Component Grades that play into a stock’s overall Zen Rating — a quant ratings system that evaluates 115 factors proven to drive stock growth. Stocks rated “A” using this system have historically generated 32.52% annual returns.

To screen for stocks with positive sentiment, you can see the latest Strong Buy ratings from top-rated analysts:

Or you can filter by stocks that have a strong Sentiment score:

These tools can be accessed with a WallStreetZen Premium account, which is 20% less annually than the most basic Quiver Quant subscription tier. It also has a $1 trial and comes with a 90-day money back guarantee.

Insider Activity

They aggregate SEC Form 4 filings to show how company executives trade their own stock. The 2025 version helps you filter out routine transactions (like scheduled sales for tax purposes) from potentially meaningful discretionary trades.

They’ve also added an “Insider Confidence Index” that weighs factors like the insider’s seniority, transaction size relative to their holdings, and timing around company events.

Government Contracts

Quiver tracks newly awarded federal contracts, giving you early insight into potential revenue streams. In 2025, they’ve expanded coverage to include state and local contracts and some international government procurement data.

Does Quiver Quantitative Have An App?

You can access Quiver through its website, mobile app, or API. The website is your central hub. It’s responsive and works well on desktop and mobile browsers. They’ve optimized the data visualizations to load quickly, even with complex datasets.

The mobile app has come a long way. Earlier versions were buggy, but the 2025 update fixed most stability issues. You can now get push notifications for major data updates, like large congressional trades or sudden sentiment shifts.

For the technically inclined, their API lets you integrate Quiver data into custom trading systems. In 2025, they added webhook functionality to trigger automated workflows based on specific data events.

Is Quiver Quantitative Reliable?

Based on numerous Quiver Quantitative reviews from users, sentiment around the platform’s reliability is generally positive. The platform has gained recognition in institutional research reports and academic studies examining alternative data’s predictive power.

Users consistently praise the accuracy of their data collection, especially for congressional trading and government contracts. The platform gets high marks for reliability and uptime, though the mobile app occasionally gets criticized for performance issues.

Congressional data verification shows over 99% accuracy against official records. Social sentiment data is more variable as a predictive tool, with stronger correlations for stocks with high retail participation but less consistency across different market sectors.

Alternative Data Sources

Quiver uses sophisticated web scraping to collect data from sources most retail investors can’t access independently. They constantly monitor Reddit discussions, Twitter mentions, SEC filings, and congressional disclosure forms.

But the platform goes beyond the obvious sources. Global shipping data tracks corporate jet movements (which can signal M&A activity before announcements), patent approvals across multiple countries, and supply chain disruptions.

Their 2025 improvements include better natural language processing that can interpret subtle shifts in sentiment and emerging trends that simpler keyword searches might miss.

Data Visualization

Quiver excels at turning complex data into charts that are easy to understand. Their WallStreetBets heat maps show discussion intensity over time with color coding.

Congressional trading networks display relationships between politicians’ trades and their committee work. Sentiment dashboards track mood across different platforms and timeframes.

In 2025, they introduced more interactive features. You can now customize charts, adjust time periods, and layer multiple data sources for comparison. The AI-generated annotations highlight potentially significant patterns you might miss.

Data Accuracy

Accuracy matters when making investment decisions based on this information. Quiver built its reputation on reliable, well-verified information.

They pull directly from official SEC filings for insider trading and corporate data. Congressional trading data gets cross-referenced against official Senate and House records. They continuously monitor for amendments or corrections to keep everything current.

Independent analyses show that their congressional trading database matches official records with over 99% accuracy. When discrepancies occur, they’re usually due to delayed filings, not platform errors.

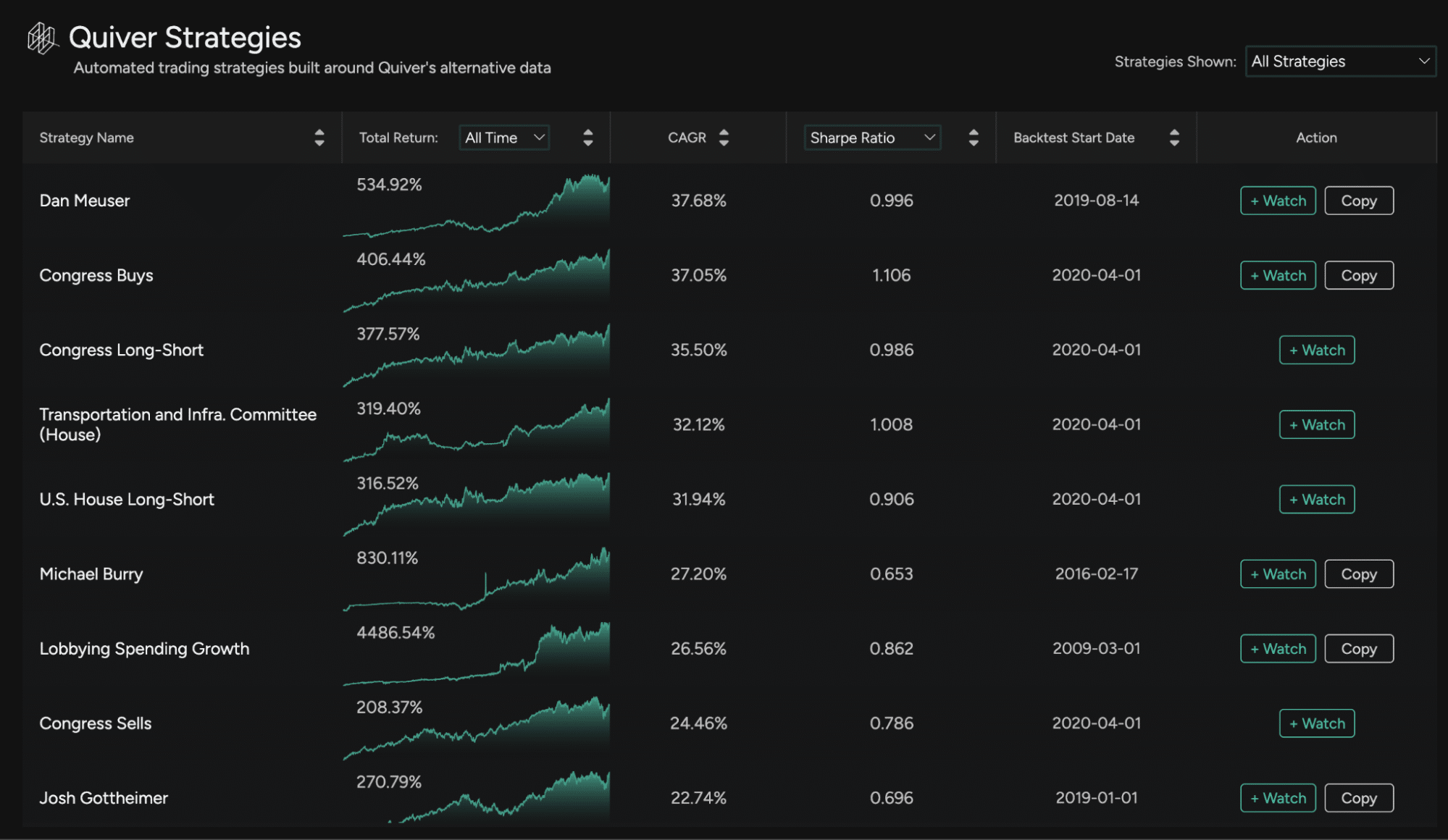

Backtested Strategies

Quiver’s backtesting tools show how different alternative data signals would have performed historically. This isn’t just academic, it helps you understand which signals work.

The Congressional Trading Backtester lets you simulate strategies based on politicians’ disclosed trades. You can filter by party, committee membership, transaction size, and other variables to see which patterns historically generated the best returns.

Their Social Sentiment Backtester tests strategies triggered by changes in social media discussion and sentiment around specific stocks. You can test immediate execution versus waiting for the price impact to settle.

Results show that specific congressional trading patterns have generated alpha over market benchmarks, though the results vary significantly based on your filtering criteria.

Interested in backtested strategies? Check this out…

Stock Market Guides is one of our favorite stock-picking services, built on backtested strategies. Designed to help traders buy low and sell high in the stock market, it provides stock and options picks by backtesting hundreds of thousands of trades using historical data.

It employs cutting-edge technology to deliver superior stock picks, to the tune of 79.4% average annual returns. (Check out our Stock Market Guides review to learn more.)

Quiver Quantitative Pricing

Subscription Tiers

Quiver keeps pricing simple with three tiers:

The free tier gets you basic congressional trading data, limited historical sentiment metrics, and simplified dashboards. It’s enough to get a feel for the platform without spending money.

The premium tier costs about $25 per month (or $250 annually for a 17% discount). This unlocks everything: complete access to all datasets, full historical archives, advanced filtering, backtesting tools, copy trading functionality, API access, and custom alerts.

The enterprise tier offers custom pricing for institutions and includes dedicated support, custom datasets, and advanced API access.

They offer a 30-day free Premium trial with no restrictions, which is generous compared to most platforms.

Cost Effectiveness

At $25 monthly, the Premium plan is a steal if you’re an active trader who can use alternative data effectively. Institutional investors pay thousands for similar datasets. Even one well-timed trade based on congressional data could cover your annual subscription many times over.

But if you’re a passive investor buying index funds and holding forever, this data will not provide you with $300 worth of value annually. It’s interesting, but it will not change your investment approach.

Quiver Quantitative vs. Competitors

eToro CopyTrader

eToro lets you copy other traders’ moves automatically. While both platforms offer copy trading, their approaches differ completely. eToro relies on human traders’ decisions, while Quiver’s strategies are built on data algorithms.

Quiver gives you more transparency about what drives the performance, whereas eToro traders might not share their full methodology.

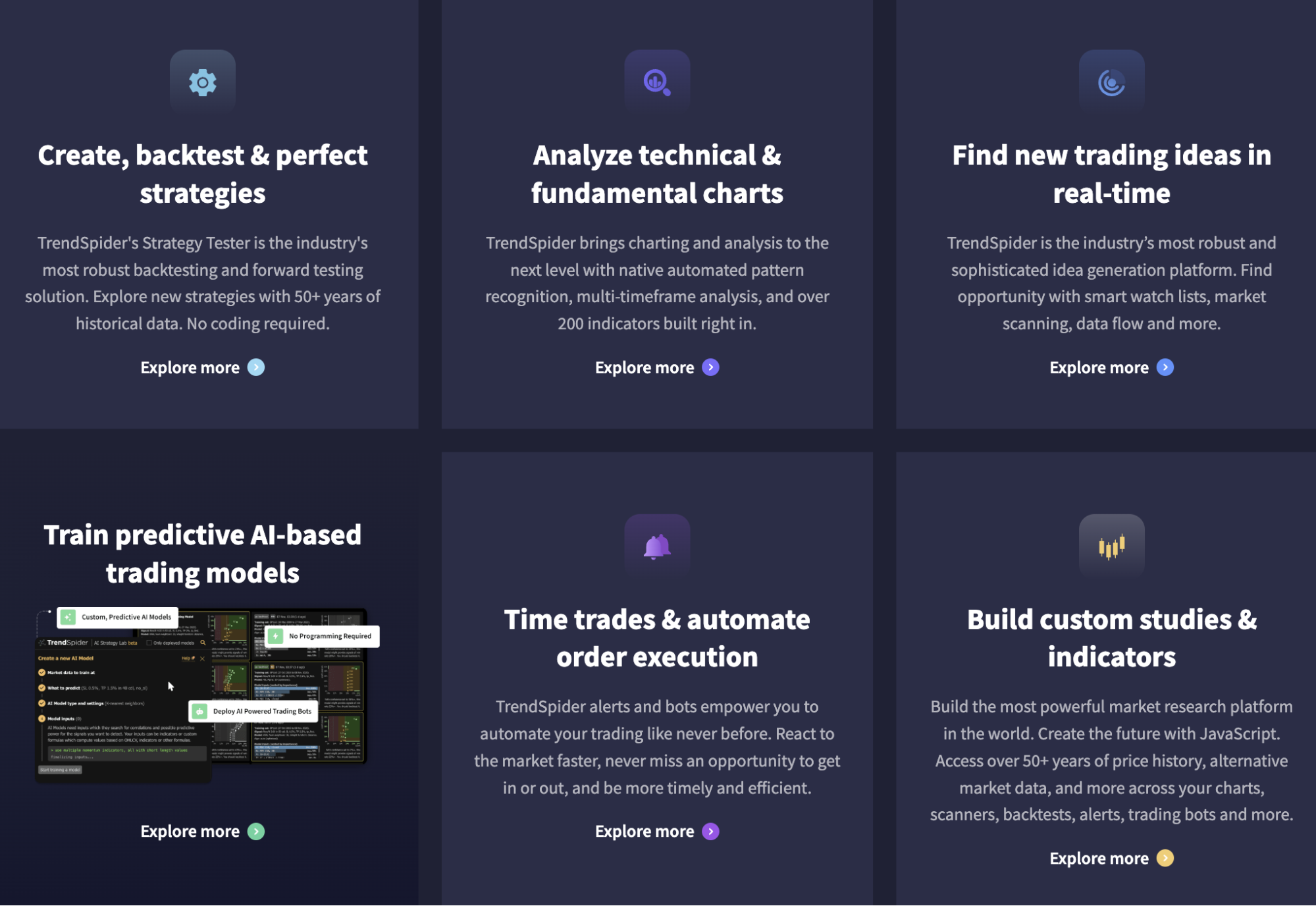

TrendSpider

TrendSpider focuses on automated technical analysis with advanced charting and pattern recognition. It’s all about price patterns and technical indicators, while Quiver is about alternative data beyond price action.

If you’re primarily a technical trader, TrendSpider makes more sense. If you want informational edges, go with Quiver.

TradeStation

TradeStation is a full-service brokerage with integrated analysis tools. It provides traditional market data and execution capabilities, while Quiver specializes in alternative data you can’t find elsewhere. Most serious traders would use TradeStation for execution and add Quiver for unique insights.

Zen Investor

Zen Investor simplifies investing with guided approaches and clear recommendations. It’s designed for ease of use, while Quiver gives you raw data to interpret yourself.

Beginners and passive investors would prefer Zen Investor’s hand-holding approach. Active, data-driven investors would get more value from Quiver’s analytical depth.

Quiver Quantitative’s Niche

Quiver occupies a specific niche: providing institutional-quality alternative data to research-oriented retail investors. They focus on leading indicators, including data that might signal market movements before traditional metrics catch them.

This forward-looking approach differentiates them from platforms that focus on lagging indicators like quarterly earnings or technical price patterns. If you want to identify opportunities before they become apparent, Quiver’s alternative data can give you that edge.

Who Should Use Quiver Quantitative?

Investor Type | Good Fit? | Key Benefits | Limitation |

|---|---|---|---|

Data-driven swing traders | Excellent | Congressional data, signals | Needs technical analysis integration |

Tech-savvy investors | Excellent | API access, customization | Learning curve required |

Research-focused investors | Very Good | Early warning signals | Must integrate with traditional analysis |

Day traders | Limited | Real-time sentiment | Better for longer timeframes |

Passive Investors | Limited | Educational interest | Limited actionability |

Beginning | Limited | Data exposure | Potential overwhelm |

Final Word

After extensive testing and reading through countless Quiver Quant review articles, here’s my take:

Quiver Quantitative has created a unique and valuable position in the financial tools landscape.

Their most significant strength is making alternative data accessible that was once exclusive to Wall Street’s elite. Tracking everything from congressional trades to social sentiment provides different lenses for viewing potential investments, ones that can identify opportunities before they become obvious through traditional analysis.

For active traders who can incorporate alternative signals into their research process, Quiver offers tremendous value at current pricing. The platform continues evolving with better tools and AI-powered insights that help rather than add complexity.

But it’s not for everyone. If you’re a passive investor or lack the analytical background to interpret complex data effectively, you might find limited practical application.

The ideal Quiver user is active, research-oriented, and has the technical skills to translate data patterns into investment decisions.

As alternative data becomes more mainstream in investment research, Quiver’s pioneering role positions it well for continued relevance.

FAQs:

Can Quiver Quant Be Used for Crypto Trading?

Quiver has expanded into crypto territory in 2025, but it's not its primary focus. They now track social sentiment across crypto communities, congressional cryptocurrency holdings, and some institutional adoption metrics.

Is Quiver Quantitative’s premium plan Worth It?

This depends entirely on your investing style and portfolio size. If you're an active trader who can effectively use alternative data signals and manage a decent-sized portfolio, the $25 monthly fee is a bargain.

The insights from congressional trading alone could pay for the subscription multiple times over with one good trade.

Can you track Nancy Pelosi’s trade on Quiver Quant?

Absolutely. Quiver provides comprehensive tracking of Nancy Pelosi's disclosed trading activity, which has become one of their most popular features.

You can see all her stock purchases, sales, and options trades with details like dates, securities involved, and approximate value ranges.

Is Quiver Quantitative good for day traders?

Given the Quiver Quant review, it isn't ideal for pure day trading. Their alternative data signals work better for medium-term predictions than intraday movements.

Day traders need real-time technical indicators and immediate market sentiment, areas where Quiver isn't specialized.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.