The Bottom Line: Is MarketSurge Worth It in 2026?

In my opinion, no.

At $149.95 per month, this platform promises professional-grade analysis tools that’ll transform your investing game. But here’s the thing: most investors don’t need to spend nearly $1,800 annually on research tools to beat the market.

I’ve spent considerable time testing MarketSurge alongside cheaper alternatives, and while IBD’s platform delivers solid technical analysis and pattern recognition, it’s tough to justify that price tag unless you’re trading actively every day.

For most investors focused on long-term growth, platforms like WallStreetZen offer similar fundamental analysis at just $19.50 monthly — over $1,500 in annual savings.

This MarketSurge review will walk you through what you get for that premium price, who actually benefits from these features, and whether there are smarter ways to spend your research budget.

I’ll also dive into honest user feedback and show you how MarketSurge stacks up against more affordable options that might serve you better.

A Winning Combo For a Fraction of the Cost

The MarketSurge platform’s complexity overwhelms beginners, while experienced investors often find better value in combining specialized tools. Here’s why:

- The charts can’t be customized like TradingView, some users report scrambled earnings data, and the mobile app crashes frequently.

- Meanwhile, WallStreetZen provides comprehensive fundamental analysis for $19.50 monthly, giving you professional-grade stock ratings and research without the premium price tag.

If you’re managing a smaller portfolio or investing for the long haul, consider creating your own “stack” like the one above.

What is IBD MarketSurge?

MarketSurge represents Investor’s Business Daily’s flagship research platform, built around William O’Neil’s legendary CAN SLIM methodology. It’s designed to replicate the research process that professional money managers use when hunting for growth stocks.

The platform analyzes over 18,000 stocks using IBD’s proprietary 1-99 rating system. Every stock gets scored across multiple criteria: earnings growth, sales acceleration, profit margins, return on equity, and relative price performance.

Stocks rated 80 or higher make IBD’s elite lists. These are the companies that showcase the strongest fundamentals combined with institutional buying pressure.

What Sets IBD MarketSurge Apart?

It doesn’t just dump data on you. Instead, it interprets that information through five decades of proven investment strategies, helping you spot stocks with the highest probability of significant price moves.

The platform targets active investors and swing traders who need to quickly identify high-quality opportunities and time their entries precisely. While long-term investors can use it, the feature set and pricing are designed for those trading more frequently.

MarketSmith: A MarketSurge Predecessor

Remember MarketSmith? That was IBD’s previous premium platform, and MarketSurge is essentially MarketSmith 2.0. The transition happened in March 2024, bringing major upgrades beyond just a name change.

IBD invested heavily in modernizing the infrastructure and added several new features based on years of customer feedback. You’ll now find the Earnings Line feature that visualizes quarterly earnings trends, plus David Ryan’s Ants Indicator that flags stocks experiencing heavy institutional accumulation.

Existing MarketSmith were moved to MarketSurge with all their data intact. However, the upgrade came with a price increase, positioning MarketSurge as an even more premium offering than its predecessor.

How Does MarketSurge Work?

IBD has streamlined stock research into three core steps, eliminating much of the time-consuming analysis that typically bogs down individual investors.

Step 1: Generate ideas through curated stock lists and smart screeners. You’ll get access to regularly updated lists like Recent Breakouts, Top IPOs, and the famous IBD 50, stocks that have already passed IBD’s rigorous screening process. No more digging through thousands of mediocre companies.

This feature is comparable to WallStreetZen’s Stock Ideas page, which features helpful pre-screened lists of stocks including:

- Strong Buy Stocks From Top Wall Street Analysts

- Highest Dividend Yield Stocks to Buy Now

- Top Stocks to Sell Now

Or if you want to research a particular ticker, go ahead and enter it here and see how it fares on 115 factors proven to drive stock growth.

Step 2: Analyze stocks using integrated fundamental and technical data. Click any stock and you’ll see comprehensive charts combined with key metrics, earnings data, and IBD’s proprietary ratings. The platform’s pattern recognition technology automatically spots formations like cup-with-handle setups and gives you specific entry points, price targets, and stop-loss levels.

Step 3: Time your trades with advanced charting and market timing indicators. Buy and sell signals get overlaid directly on charts, removing guesswork from entry and exit decisions. You’ll also get market exposure recommendations and sector analysis for broader context.

The system integrates O’Neil’s CAN SLIM methodology throughout each step, providing a consistent framework that has helped professional traders for decades.

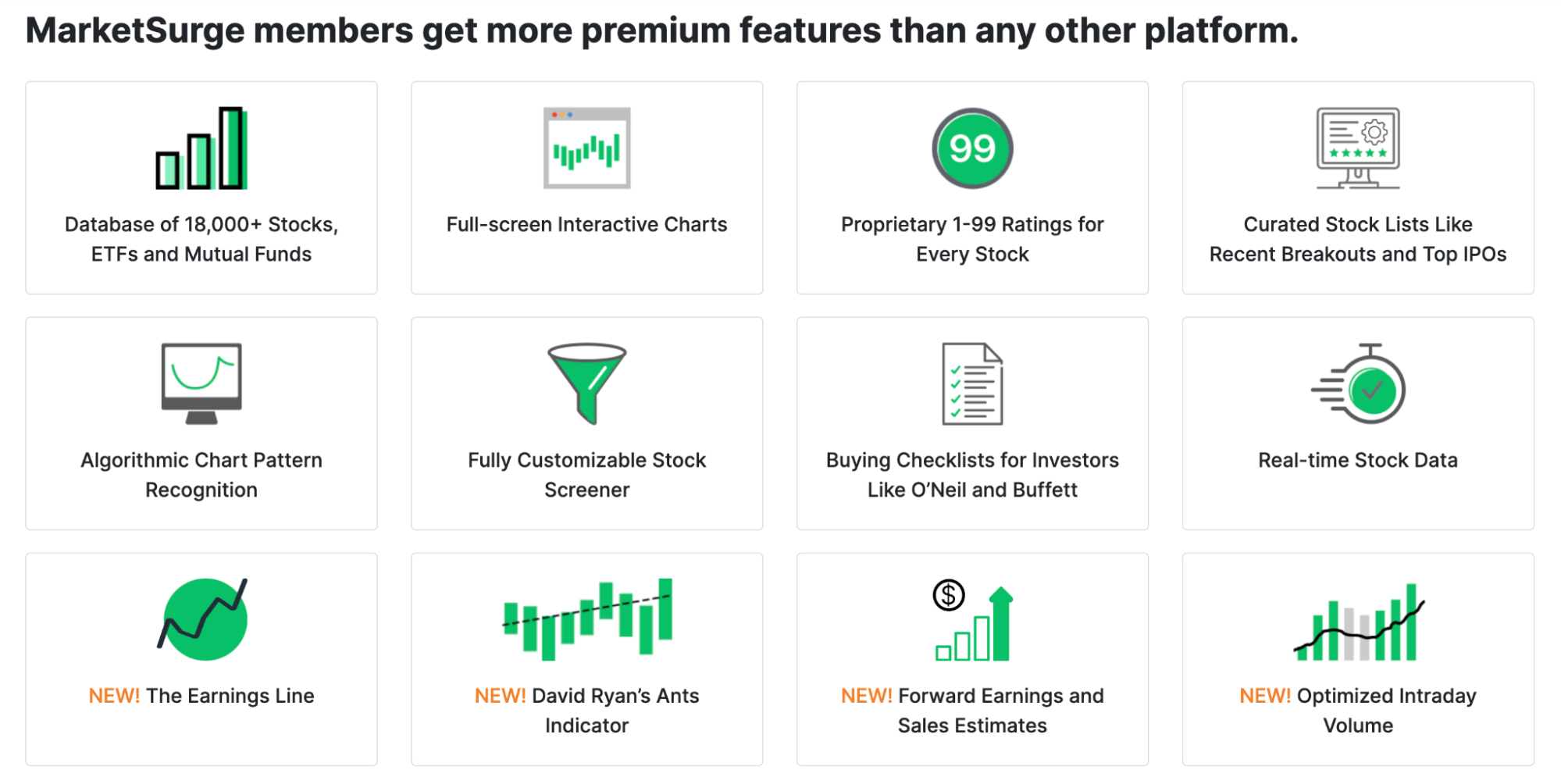

MarketSurge Features

IBD MarketSurge packs an impressive array of research tools, though whether you’ll use them all depends on your investing style.

The 1-99 Rating System forms the platform’s backbone. Each stock gets evaluated across earnings growth, sales growth, profit margins, return on equity, and relative price performance. This distills complex analysis into a simple numerical score, think of it as IBD’s way of ranking every stock in the market.

A cheaper alternative…

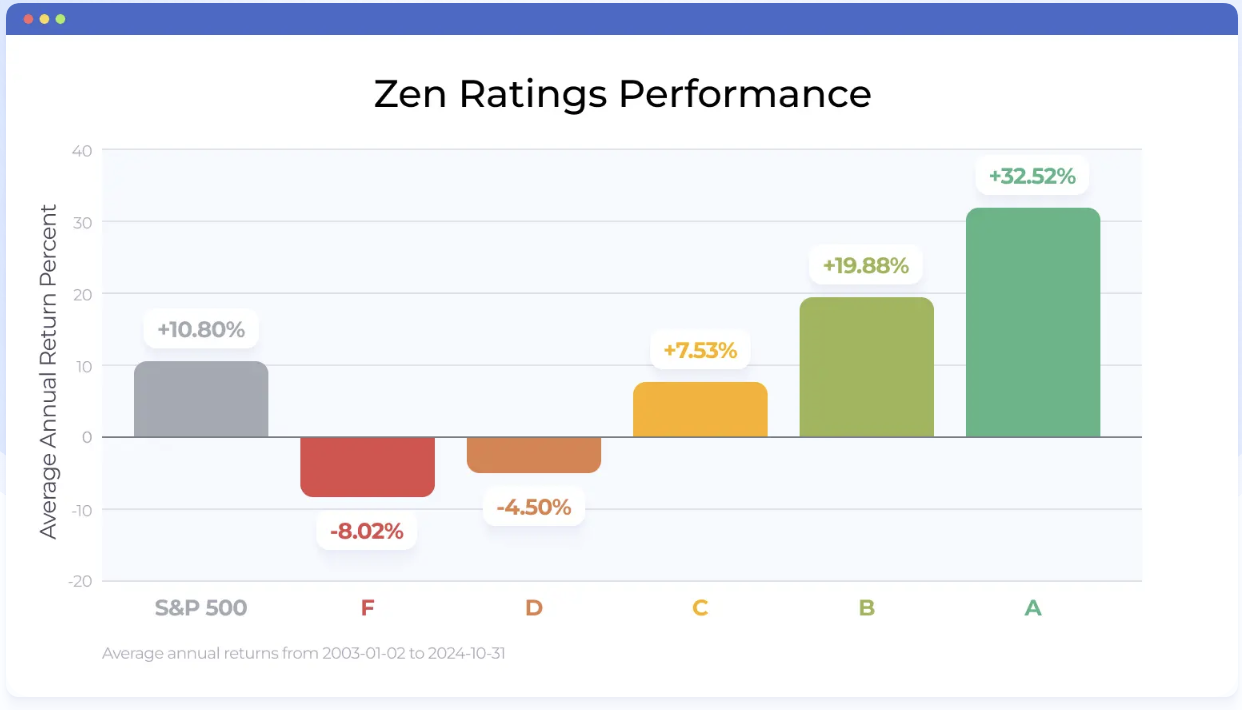

WallStreetZen’s Zen Ratings system distills 115 factors proven to drive stock growth into a simple, easy-to-read letter score. You can run any stock through the system and view not only the overall letter grade, but drill deeper into key areas with Component Grades for factors like Value, Growth, Safety — and even a proprietary AI factor that detects subtle patterns that the human eye can’t.

The result of this rigorous screening? Market-beating potential. Stocks rated “A” using this system have historically generated 32.52% annual returns.

Best of all, it’s free to get started — and if you find the features are worth it, you can try a 2-week trial for just $1.

Pattern Recognition Technology automatically identifies classic chart formations like cup-and-handle, flat base, and double bottom patterns. You get specific pivot points and price targets for each pattern, essentially having a technical analyst built into the software.

Comprehensive Database covers 18,000+ stocks, ETFs, and mutual funds with real-time pricing data. The screening tools let you create highly customized searches based on fundamental criteria, technical indicators, or IBD’s unique metrics.

Recent Additions include the Earnings Line for visualizing quarterly trends, David Ryan’s Ants Indicator for spotting institutional accumulation, and four quarters of forward earnings estimates. The platform also optimized intraday volume data to help identify unusual trading activity.

For a simpler method of seeing what stocks are trending, check out WallStreetZen’s Zen Ratings Upgrades and Downgrades screener.

Buying Checklists based on strategies from legendary investors like O’Neil and Warren Buffett helps you evaluate stocks against proven criteria. This “reverse screening” approach ensures your picks align with time-tested principles rather than gut feelings.

MarketSurge Platform Accessibility

You can access MarketSurge through web browsers on any computer as there are no software downloads required. The platform runs smoothly on standard internet connections and loads quickly when switching between features.

Mobile apps are available for iOS and Android devices, maintaining most desktop functionality. You can monitor watchlists, receive alerts, and conduct basic research on the go. However, the mobile experience has limitations, especially for detailed charting and complex screening.

Several users report stability issues with the mobile app, including frequent crashes that require uninstalling and reinstalling to fix. While IBD’s customer service responds to these problems, the recurring nature suggests the mobile platform needs further development.

The web interface targets users familiar with financial research tools, though newcomers will face a learning curve. IBD provides free coaching and weekly webinars to help maximize the platform’s capabilities.

IBD MarketSurge Performance

From a technical standpoint, MarketSurge performs well as a web-based platform. Loading times are fast, interfaces respond quickly, and the real-time data feeds work reliably for active trading decisions.

However, data quality concerns have emerged among users. Some report “scrambled” earnings information that’s unreliable for screening purposes. For a premium research tool, accuracy issues with fundamental data represent a serious problem that could undermine user confidence.

Investment performance ties closely to IBD’s overall research methodology, which has shown strong results over decades. The IBD 50 stock list has historically outperformed broader market indices, though individual results vary based on market conditions and execution.

The platform’s pattern recognition and timing signals get mixed reviews. Many appreciate automated chart pattern identification, but experienced traders often prefer more customizable tools. MarketSurge’s static charts feel limiting compared to platforms like TradingView that allow extensive personalization.

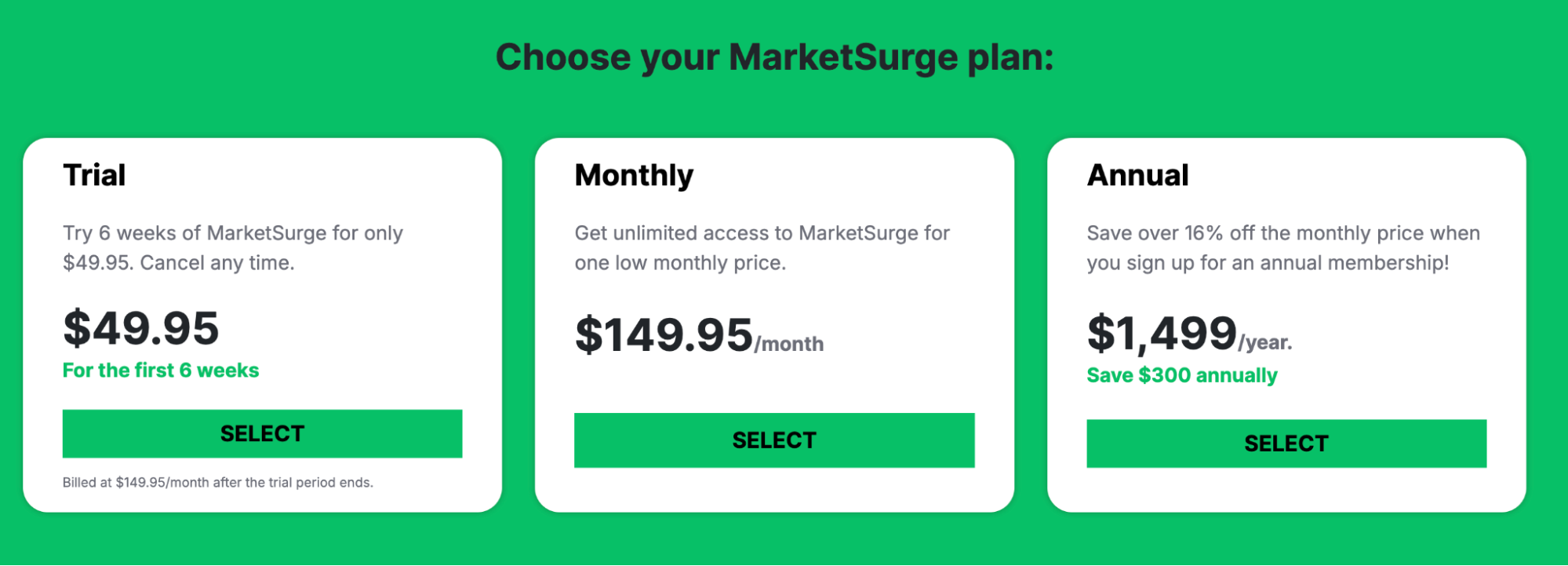

MarketSurge Pricing

MarketSurge uses straightforward pricing with three options:

- 6-week trial: $49.95 (full platform access)

- Monthly subscription: $149.95/month

- Annual subscription: $1,499/year (saves $300 vs. monthly)

The pricing reflects IBD’s premium positioning, which is significantly higher than basic research platforms but competitive with other professional tools. Unlike some services that nickel-and-dime you with data fees, MarketSurge includes everything in the base price.

For individual investors managing smaller portfolios, that monthly cost can eat into potential returns. You’ll need to generate enough profit from the platform’s recommendations to justify the expense.

A free alternative…

It’s free to get started with WallStreetZen. And if you decide to upgrade to Premium, you’ll be looking at $19.50 per month — a fraction of the cost of MarketSurge.

MarketSurge Customer Service

IBD’s support generally gets positive feedback. You’ll receive free product coaching with your subscription, which is valuable given the platform’s complexity and learning curve.

Customer service operates through phone support and email, with reasonable response times. The support staff knows the platform well and can help with both technical issues and investment methodology questions.

Free weekly webinars for members stand out as a nice touch. These sessions help you maximize platform features and stay updated on new capabilities. You’ll also get ongoing education about IBD’s investment philosophy.

However, users express frustration with recurring technical problems, particularly mobile app issues. While support responds to these problems, the fact that users frequently need to reinstall the mobile app suggests underlying technical issues remain unresolved.

Monthly Stock Picks AND Members-Only Webinars…

…Are just two of the perks you get with a subscription to WallStreetZen’s Zen Investor stock-picking newsletter. And at $99 per year ($79 for a limited time, using links in this post), you can invest in both WallStreetZen Premium and Zen Investor for less money than a MarketSurge subscription.

IBD MarketSurge Reviews: What are Customers Saying?

Customer feedback reveals a platform that delivers value for its target audience while frustrating users who don’t match that profile.

Positive IBD MarketSurge reviews consistently praise the platform’s ability to generate quality stock ideas through its integration of technical and fundamental analysis. Active traders and swing investors tend to be most satisfied, reporting that MarketSurge helps them spot profitable opportunities they’d miss otherwise.

One YouTube reviewer called MarketSurge “really cool” and “powerful,” praising how it combines annotated technical charts with deep fundamental data in one interface. Reddit users in the CANSLIM community frequently mention that they can “easily make their money back quickly” despite the high cost.

Negative feedback reveals consistent pain points:

- The steep learning curve tops the complaint list as users feel overwhelmed by the platform’s complexity and poor explanation of acronyms and indicators. Chart customization limitations frustrate experienced traders accustomed to platforms like TradingView.

- Data quality concerns appear frequently, with multiple users reporting scrambled earnings information that’s unreliable for screening. Mobile app stability problems are frequently mentioned, with many experiencing crashes requiring frequent reinstallation.

- Cost concerns dominate many reviews. While active traders report recovering the subscription cost through successful trades, casual investors struggle to justify spending nearly $1,800 annually on research tools.

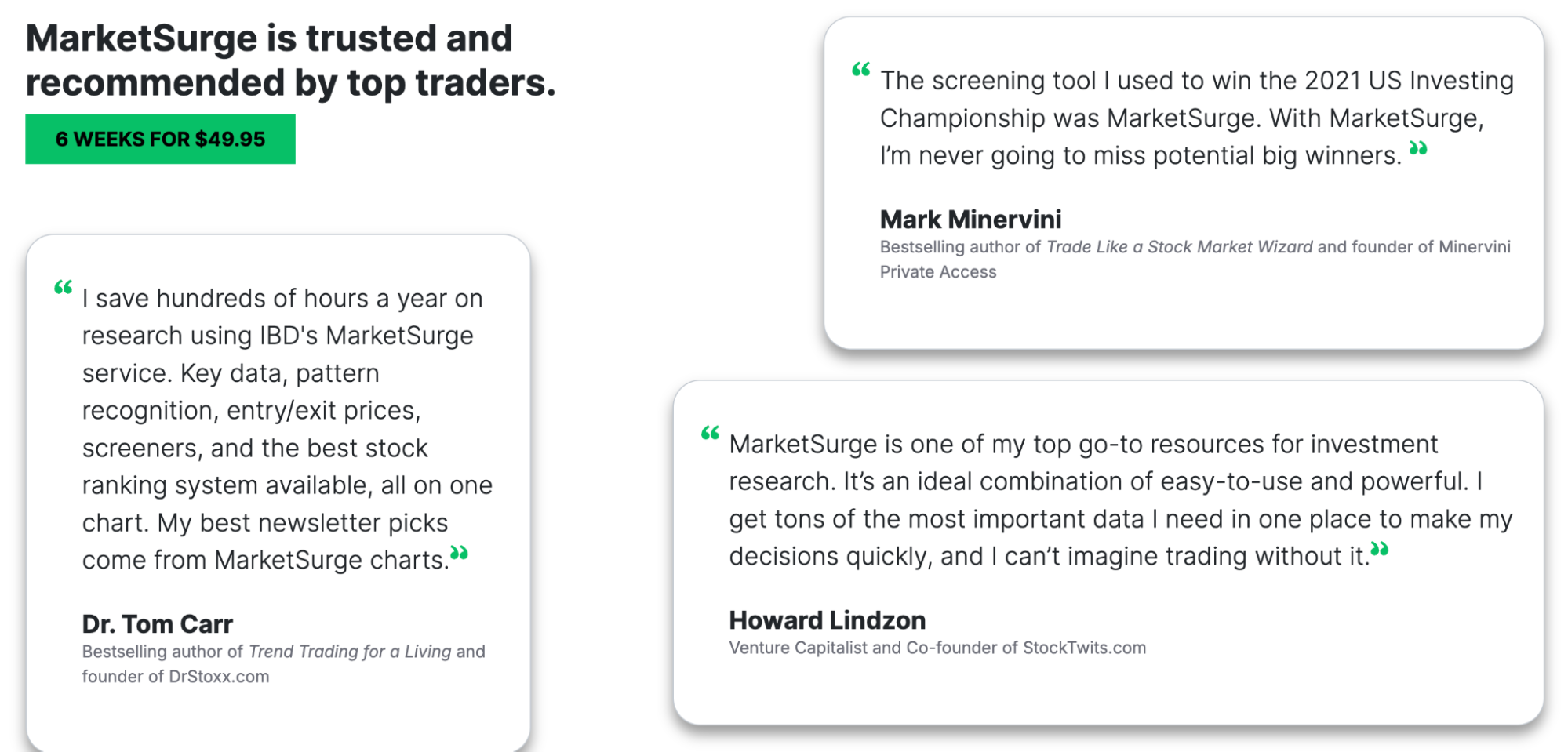

Is MarketSurge Legit?

Yes. MarketSurge is legitimate, backed by Investor’s Business Daily’s 40+ years of market analysis experience. IBD’s credibility in the investment community is well-established, with its research methodology respected by both individual and institutional investors.

The platform’s legitimacy gets further support from respected traders like Mark Minervini, winner of the 2021 U.S. Investing Championship, who publicly credits MarketSurge’s screening tools as instrumental in his success. Other notable users include Dr. Tom Carr and venture capitalist Howard Lindzon.

MarketSurge operates with proper regulatory compliance and provides real-time market data through established financial providers. The company doesn’t make unrealistic promises about guaranteed returns or “get rich quick” schemes common with questionable investment services.

IBD maintains transparency about pricing, features, and limitations while providing trial periods for evaluation. They operate proper customer service channels and educational resources to help users understand platform capabilities.

But legitimate doesn’t automatically mean valuable for every investor. While MarketSurge functions as advertised, whether it provides sufficient value depends on your circumstances, goals, and skill level.

MarketSurge Vs. the Competition…

Pricing | What you get | Who it’s best for | |

|---|---|---|---|

MarketSurge | $149.95/month or $1,499/year | Proprietary 1-99 ratings, 18,000+ database, pattern recognition, curated lists, real-time data | Active traders needing comprehensive technical/fundamental analysis |

$19.50/month (yearly) or $29/month | Zen Ratings analyzes 115 factors, an analyst database, a stock screener, and portfolio tools | Long-term investors wanting professional research affordably | |

$299/year Premium, $2,400/year PRO | Expert content, Quant Ratings, earnings transcripts, community insights | Investors valuing diverse opinions and comprehensive analysis | |

$13.99-$199.95/month | Advanced charting, 400+ indicators, social community, backtesting | Technical analysts prioritizing customizable charting |

MarketSurge Vs. WallStreetZen

This comparison highlights two platforms serving similar fundamental analysis needs but targeting different investor segments.

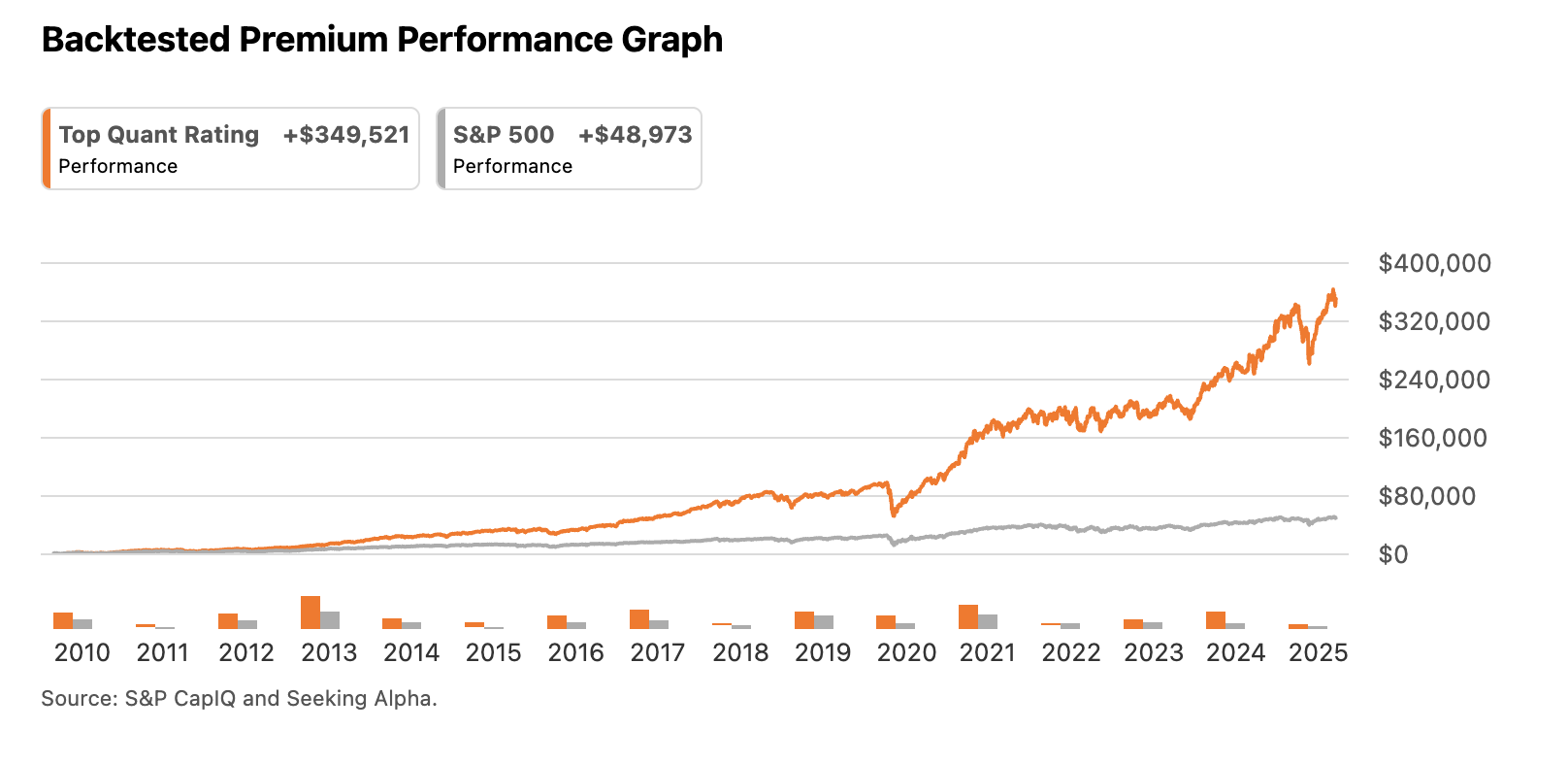

WallStreetZen positions itself for “serious part-time investors” who want professional-grade research without the complexity and cost of full-time trader platforms. The Zen Ratings system analyzes 115 proven factors to identify exceptional upside potential, with “A” rated stocks averaging +32.52% annual returns since 2003.

The pricing difference is dramatic. WallStreetZen costs $19.50 monthly when billed annually versus MarketSurge’s $149.95 monthly fee. That’s over $1,500 in annual savings, making professional research accessible for smaller portfolios.

WallStreetZen offers unique features that MarketSurge lacks, particularly in analyst tracking. The platform independently tracks returns of 4,000+ Wall Street analysts, letting you follow top performers who beat the market.

The “Why Price Moved” feature provides one-sentence explanations of notable price movements.

However, MarketSurge delivers comprehensive technical analysis capabilities that WallStreetZen doesn’t provide such as pattern recognition, detailed charting, and real-time trading tools.

MarketSurge works best for active traders and swing investors needing comprehensive technical analysis, real-time data, and integrated charting tools.

WallStreetZen works best for long-term investors prioritizing fundamental analysis who want professional research at affordable pricing, focusing on buy-and-hold strategies.

MarketSurge Vs. Seeking Alpha

Seeking Alpha combines professional analysis with community insights, providing thousands of articles, earnings call transcripts, and investment ideas from both professional analysts and experienced individual investors. Its strength lies in perspective diversity and qualitative analysis depth.

MarketSurge takes a more systematic, quantitative approach, focusing on IBD’s proven methodology and proprietary ratings rather than multiple opinions. This proves more efficient for investors preferring clear, actionable recommendations.

Seeking Alpha’s Premium subscription costs $299 annually, lower than MarketSurge’s $1,799 annual cost. However, Seeking Alpha’s PRO subscription costs $2,400 yearly, which is more than MarketSurge.

MarketSurge works best for investors who prefer systematic, quantitative analysis and need integrated technical capabilities with clear, actionable recommendations.

Seeking Alpha works best for investors valuing diverse perspectives who want detailed qualitative analysis and prefer understanding multiple viewpoints before making a decision.

MarketSurge Vs. TradingView

TradingView has become the gold standard for charting and technical analysis, offering unmatched customization capabilities and advanced indicators. The platform’s strength lies in its sophisticated charting engine and vibrant trading community.

MarketSurge’s charting approach is more structured and less customizable, focusing on IBD’s proprietary analysis rather than unlimited customization. TradingView offers pricing from $13.99 to $199.95 monthly, providing flexibility that MarketSurge’s single tier doesn’t match.

However, TradingView’s fundamental analysis capabilities are limited compared to MarketSurge’s comprehensive research tools and proprietary ratings.

MarketSurge works best for growth investors wanting integrated fundamental and technical analysis based on proven methodologies without needing highly customizable charting.

TradingView works best for technical analysts and active traders prioritizing advanced charting capabilities, customization options, and multi-asset analysis.

Final Word: MarketSurge Review

After extensive testing of MarketSurge’s features, pricing, and competitive positioning, this platform occupies a unique but narrow niche in stock research.

MarketSurge delivers on its promise of professional-grade research tools combining technical and fundamental analysis. For active traders who need IBD’s proven methodology integrated with real-time technical analysis, the platform offers genuine value.

However, the high cost and complexity make it unsuitable for most individual investors. At $149.95 monthly, MarketSurge represents a sizeable ongoing expense that’s difficult to justify unless you’re actively trading and generating returns exceeding the subscription cost.

More affordable alternatives like WallStreetZen make it harder to justify MarketSurge’s premium pricing for investors primarily needing fundamental analysis and stock screening. While MarketSurge offers comprehensive technical tools, many investors can achieve their research goals with less expensive platforms.

For investors considering MarketSurge, here’s my suggestion: Use the six-week trial to thoroughly evaluate whether the platform’s features align with your investment style and whether you can realistically justify the ongoing cost.

FAQs:

Is MarketSurge worth it?

MarketSurge is worth it for active traders and swing investors who can justify the $149.95 monthly cost through frequent trading and need comprehensive technical/fundamental analysis tools.

How much does IBD MarketSurge cost?

IBD MarketSurge offers three pricing options: a six-week trial for $49.95, monthly subscriptions at $149.95 per month, and annual subscriptions at $1,499 per year (saving $300 annually).

Is MarketSmith now MarketSurge?

Yes, MarketSmith was rebranded and upgraded to MarketSurge in March 2024. This transition involved more than a name change as IBD enhanced platform capabilities, adding features like the Earnings Line, David Ryan's Ants Indicator, and forward earnings estimates.

Who owns MarketSurge?

MarketSurge is owned and operated by Investor's Business Daily (IBD), a financial media and research company founded by William O'Neil in 1984. IBD is a subsidiary of News Corp, which also owns The Wall Street Journal. The platform represents IBD's flagship research offering, incorporating decades of market analysis and the proven CAN SLIM investment methodology.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.