A half mil is serious money, so you don’t want to throw it any old place and call it a day. If you want to know where to invest 500k, you’ve come to the right place.

In this article, I’m going to break down the best way to invest 500k — including variations to help you develop a strategy that fits your needs, including how to invest half a million dollars in a way that can help set you up for financial success for the rest of your life.

We’ve got a lot to discuss, so let’s get moving.

At-a-Glance: Top Investing Platforms for Investing $500k

For art + collectibles | |

For stocks + EFTs | |

For wealth management | |

Robo-advisor | |

For real estate investing (REITs) | |

For real estate investing (fractional) | |

For private credit | |

For farmland | |

For private businesses + startups | |

For gold |

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The 9 Best Ways to Invest $500k in 2024

Let’s get right to it. (There’s more info about how to prep for investing below the list.) Here’s how to invest 500k. (Note: Don’t have 500K yet? Check out our list of ways to invest 50k here.)

1. Art and Collectibles

Art and collectibles is a massive market, recently valued by Deloitte at $2.1 trillion dollars, with them expecting it to soar to nearly $2.9 trillion by 2026. But even with $500,000, investing in the high-end art that makes headlines is prohibitively expensive.

That’s where Masterworks comes in. Masterworks makes it easy for investors to buy shares of blue-chip contemporary artwork. They offer art from legends like Picasso, Banksy, Basquiat and many others.

Masterworks has an acquisitions team sourcing and purchasing the artworks, a finance team securitizing the paintings to break them into shares, and a private sales team that aims to sell the works for a profit. If a sale is successful, the net proceeds are paid out to the investors in said painting (your net return).

Here’s an impressive stat: Every one of Masterworks’ 20 exits to date has paid out a return to investors, totaling over $49,000,000-worth of art sold.

The bottom line? Masterworks is easy to use, and the fact that they offer shares means you can invest half a million dollars (or at least part of it) and diversify into the same kind of blue-chip art that billionaires invest in.

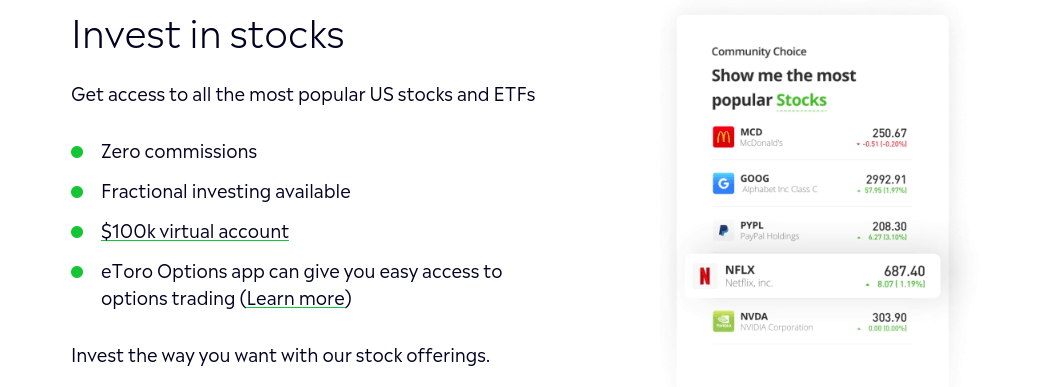

2. Stocks + ETFs

- Risk level: 4

- Potential returns: 5%–10%+

- Preferred platform: eToro

When someone asks me about the best way to invest 500k, I often start with stocks. Here’s why:

- A diverse portfolio of stocks is hard to beat in terms of risk versus reward.

- If you want to hand-pick stocks, tools like WallStreetZen make it easy to get a leg up on your due diligence process, with tons of data on any given stock that can help you make smarter investing decisions.

- You don’t have to hand-pick stocks if you don’t want to; modern index funds and sector ETFs have low expense ratios and make it easy to diversify without having to pay exorbitant fees.

I always tell people to start by putting the bulk of the money they’re going to allocate to stocks in a total market fund. It’s less stressful than managing tons of individual investments yourself.

Then take 5%–10% and use it to pick individual stocks to give yourself more risk exposure and, hopefully, capture higher returns.

If you’re looking for a new broker, I can’t recommend eToro highly enough. First, the company has low fees, an excellent user-friendly platform, and access to derivatives, like options, for people in the U.S.

Second, let’s talk about all of the available assets:

- Stocks: You have access to 2,074 of the top U.S. companies and invest with zero commissions, plus access to fractional shares, which means you can get started investing with as little as $10.

- Cryptocurrencies: You can buy 24 leading cryptocurrencies and avoid the hassle of buying a separate crypto wallet by using the eToro Money crypto wallet.

- ETFs – Exchange-traded funds let you invest in many assets with a single purchase. Choose from 222 stock, bond, and other ETFs on eToro to instantly have a well-diversified, balanced portfolio.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

3. Wealth Management

- Risk level: 4

- Potential returns: 5%–10%+

If you’re not sure how to invest 500k and want some hands-on professional help, consider hiring a wealth management consultant.

Most wealth management companies cater to high-net-worth individuals, so even $500,000 might not qualify you for the best rates and lowest fees.

My favorite wealth management company is Empower (formerly Personal Capital) offers wealth management services at significantly lower fees than some of the top “legacy” wealth management services.

Fees start at 0.89% for up to the first million dollars invested, but go down to as low as 0.49% depending on account size. That’s significantly less than the typical 1-2% fees with other wealth managers. Over months and years, this can add up to serious savings.

Empower’s wealth managers do all the hard work of diversifying your portfolio, rotating sectors, and maximizing your tax advantage for you, so all you have to do is sit back and watch your account grow.

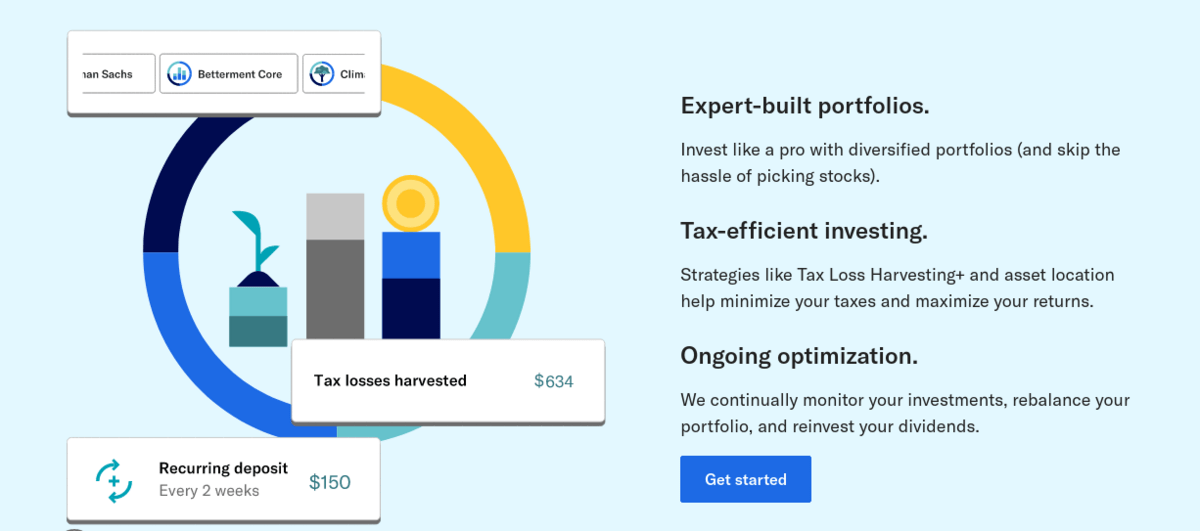

4. Robo-Advisor

- Risk level: 4

- Potential returns: 5%–10%+

A nice middle-ground between managing your investments yourself and hiring a full-blown wealth management company is to go with a robo-advisor; it’s where to invest 500k if you don’t want the hassle of self-management but also don’t want to pay top dollar for an expert wealth manager.

My favorite robo-advisor is Betterment’s automated investor program. The company uses a unique combination of portfolios built by experts with automated rebalancing strategies to give you the best of both worlds.

Betterment also offers tax loss harvesting and asset location to reduce your tax burden and maximize your gains.

5. Real Estate

- Risk level: 3

- Potential returns: 8%–12%

How to invest $500,000 in real estate is entirely a matter of personal preference. With that amount of capital, you can afford a variety of options:

1. Purchase a rental property. This gives you the purest exposure to real estate but comes with the most work. You could hire a property manager so you don’t have to do it yourself, but that will cost you between 8% and 12% of your monthly revenue.

2. Another option is to use a broker like eToro to purchase shares of a real estate investment trust (REIT). REITs let you invest in real estate by purchasing shares of a company that owns income-generating properties. This is a great option if you don’t want to allocate all of your 500k to real estate since you can invest as little or as much as you want.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

4. Private real estate investing is how to invest 500,000 dollars if you’re a bit more risk-tolerant. Platforms like Yieldstreet make it easy to invest in income-generating properties directly without having to own and operate the rental yourself.

Some potentially lucrative examples include multi-family equities and REITs, which allow you to invest in just a fraction of what would otherwise be multi-million dollar properties.

6. Private Credit

- Risk level: 4

- Potential returns: 10%–15%

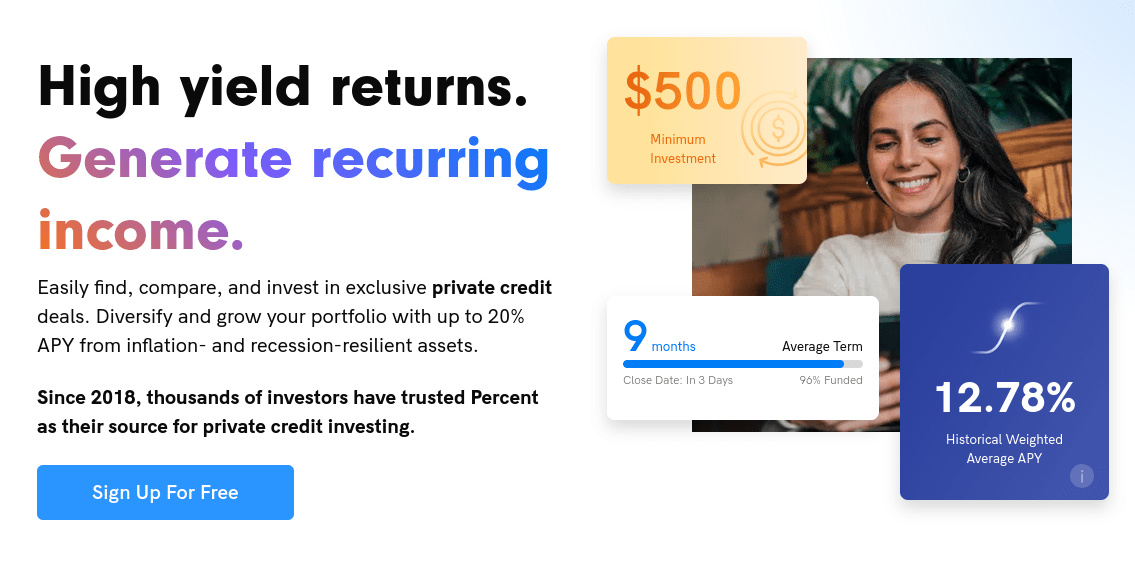

If you’re looking for how to invest 500k and want something a little more off the beaten track than what I’ve covered so far, consider private credit investing. My favorite way to invest in private credit is through a company called Percent.

Percent lowers the barrier to entry for private credit investing, making it accessible to virtually all accredited investors.

Private credit investing has higher average returns than investing in a safer option like an index fund or REIT, but it also exposes you to more risk.

Some options for investment through Percent include consumer loans, corporate loans, and even venture debt, and its historical weighted average APY weighs in at an impressive 12.78%.

I recommend allocating a small amount of the total amount of money you plan to invest in private credit, approximately 5%–10%.

7. Farmland

- Risk level: 3

- Potential returns: 10%–12%

Investing in farmland is a great way to diversify your portfolio since it is loosely correlated with other asset classes.

Farmland investing has a lot in common with other types of real estate investing, but the returns vary a bit more due to factors like weather and crop yields.

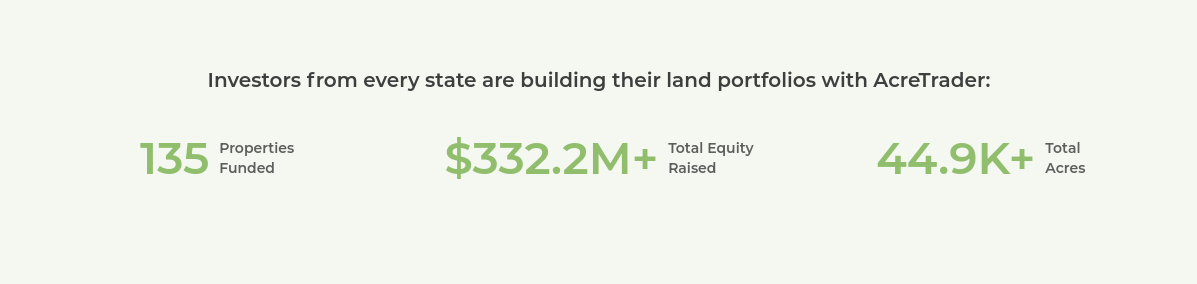

How to invest $500,000 in farmland if you don’t actually want to milk cows? Through AcreTrader. AcreTrader specializes in farmland investing, helping potential investors find the right investments for their portfolios.

All farmland on AcreTrader is carefully vetted by the company’s expert personnel, so you don’t have to worry about weeding out bad investments yourself.

The company also manages the day-to-day stuff for you, so all you have to do is supply capital. (Want to know more? Check out our AcreTrader review.)

8. Invest in Businesses

- Risk level: 5

- Potential returns: -100%–100%+

If you’re interested in investing some of your 500k in a business — and want no part of starting your own — Equitybee is a great way to get into investing in private businesses and startups.

Equitybee’s platform is very user-friendly, which makes it easy to find high-growth opportunities that are otherwise inaccessible to most investors. I should mention that investing in private businesses is not for everyone.

The potential is there for outsized gains, sure, but it’s just as possible for a company to fail and for you to be left with nothing. Additionally, Equitybee is only open to accredited investors. (Want to know more? Check out our Equitybee review.)

9. Gold

- Risk level: 4

- Potential returns: 5%–20%

Gold is the classic asset to use to hedge your portfolio against inflation. Diversifying your investments is essential for reducing your overall risk and insulating your portfolio from long-lasting drawdowns.

If you ask 100 people how to invest 500k in gold, you’ll get 100 different answers. My answer is through an online vendor like Silver Gold Bull.

The company offers investment-quality gold bullion, bars, and coins; AND it provides access to a gold IRA which lets you invest in gold and could help come tax season.

It can also send your gold directly to a secure storage facility for safekeeping if you don’t want to store it yourself. In my opinion, gold should only make up a small percentage of your total investment; no more than 5%–10%.

Need more gold investing inspiration? Check out more of our favorite gold IRAS:

Before You Invest:

We’ve talked about how to invest $500,000. But we haven’t talked about how to prep before you put your money out there. Here are some important steps you should consider taking before you invest:

Pay off Debt

Investing aggressively when you have debt is like building a house on a crumbling foundation. It’s a recipe for disaster.

The good news is that you almost certainly can pay off any high-interest debt you have with your 500k. Take care of credit card loans, car loans, and student loans first, as these tend to have the highest interest rates.

Whether or not you want to pay off your mortgage depends on how much you have left to pay and your rate. If you have a low mortgage rate, investing in something that’s expected to return more than that rate is a better use of capital than paying it off.

If you want help managing your debt and coming up with a plan to eliminate it, platforms like Rocket Money can help you get organized and create a plan of attack with tools that can help you save more, spend less, and get a great overview of how your money is being spent.

I mentioned Empower earlier as a resource for wealth management, but I didn’t properly mention all of their other great (and FREE) services. Even if you don’t plan on using the platform for money management, it’s well worth signing up for their free dashboard.

It’s loaded with free resources and calculators like a budget planner, net worth calculator, and more that can help you manage your assets and liabilities responsibly. And like I said, it’s free — why not give it a try?

Build an Emergency Fund

Another thing I have to mention before I can tell you how to invest 500k is that you should make sure you have an emergency fund in place before you even think about riskier investments.

I recommend having at least six months’ worth of expenses in a safe place like a savings account.

M1 Finance’s high-yield savings account (HYSA) is a great place to park your emergency money. It will grow more quickly than it would in an ordinary savings account but is still FDIC-insured and relatively low-risk. Of course, you have to be an M1 Plus member to get this rate — not a big deal if you’re already using the platform for automated investing.

If becoming an M1 Plus member doesn’t interest you, we also love CIT Bank for high-yield savings accounts (and CDs, for that matter). The online bank has some of the best rates around for HYSAs, though the best rates are available if your account is over $5K. CDs start at just $1K and can go up to 5% APY for a 6-month term.

Get Smart About Saving

Let’s talk about how to invest 500000 wisely. Before you start chasing growth, come up with an overall savings plan. If you have any big purchases on the horizon, like maybe a house or a car, make a plan for how you’re going to save for it before you start investing speculatively.

Acorns is a great way to keep track of your savings. It comes with helpful tools for organizing your money into separate buckets.

It also can round up your purchases to the next dollar and put the extra money into your savings account. You’d be surprised at how quickly you can build up some money this way.

Best Way to Invest 500K: All About Allocation

If you want to know how to invest $500,000 wisely, I have one word for you: diversification. Spreading your money around and putting it in uncorrelated assets is the best way to protect yourself from big losses during market downturns.

Intelligently allocating your money will also prevent you from taking a big loss if one of your more speculative investments — like fine art or farmland — takes a hit.

Related reading: Check out our article about the 8 best alternative investment strategies.

How to Invest 500000 dollars: Tax-advantaged Accounts

It’s essential to take advantage of tax-advantaged accounts like IRAs, health savings accounts (HSAs), and 529 plans when thinking about how to invest $500000. Here are a few to consider:

- Traditional IRAs reduce your tax liability in the year you contribute, while Roth IRAs tax contributions but let your money grow tax-free (check out our article about the best investments for a Roth IRA account). Keep in mind that these accounts have income limits, so you won’t be able to contribute to them if you make too much money.

- HSAs are savings accounts for healthcare-related costs. You can invest the money you contribute and reduce your taxable income. Withdrawals from HSAs are tax-free as long as the money is being used to pay for qualifying medical care.

- Finally, 529 plans help parents save money to help pay for their children’s college education. This only applies to you if you have kids, of course, but it’s a great way to help your child pay for college when they turn 18. (Want more content related to investing for kids? Check out our article on the best stocks for kids.)

Final Word: How to Invest 500K

So, what is the best investment for 500,000? Hopefully, you can already guess my answer is that there isn’t one best way to invest 500k.

It all depends on your goals, financial situation, and risk tolerance. Where to invest 500k for retirement is going to have a very different answer than where to invest 500k for passive income.

With that said, my final answer is to diversify across uncorrelated assets. Keep most of it in relatively safe investments and keep 5%–15% to play with in riskier ventures.

FAQs:

How much income will 500k generate?

Depends on your investment vehicle. For example, a HYSA that returns 5% would generate $25,000 per year on a deposit of 500k. Now, 500k could definitely generate greater returns with riskier investments such as real estate, stocks, or ETFs.

How much interest can I make on 500k?

The interest you can earn on $500,000 depends on where you invest it. If you put it in a high-yield savings account with an interest rate of 4%, you'd earn $20,000 per year. However, if you invest it in the stock market, which has historically returned about 7% annually on average, you could potentially make around $35,000 per year.

How long will it take to turn $500 K into $1 million?

The time it takes to turn $500,000 into $1 million depends on your investment strategy and the rate of return. For instance, if you invest your money in the stock market and receive an average annual return of 7%, you would approximately double your money in about 10 years. However, this is only a rough estimate, and actual returns vary widely from year to year.

How to turn $500,000 into $1,000,000?

To turn $500,000 into $1,000,000, you need a sound investment strategy. Diversifying your investments across a mix of asset classes like stocks, bonds, and real estate can help. Historically, the stock market has provided significant returns, so investing a portion of your money in a well-diversified portfolio of stocks or in index funds could be beneficial. However, it's important to assess your risk tolerance and investment timeline.

How to invest 500,000 for cash flow?

How to invest $500,000 for cash flow depends on your risk tolerance and long-term goals, but real estate is probably your best bet. Rental properties deliver predictable returns — as long as you can keep them occupied — which makes it easier to predict and depend on than more volatile investments.

How to invest 500,000 for passive income is a similar question with a similar answer. I recommend real estate for investors looking for passive income since it has the most upside long-term.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our April report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.