Synchron is not publicly traded at this time. However, there are still ways for investors to gain indirect exposure.

Discover like-minded companies (and public companies with a connection to Synchron) below. If you choose to invest in any of them, consider one of our favorite brokers — eToro. (Use that link for a $10 bonus — terms and conditions apply.)

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

In 2021, a man paralyzed by ASL tweeted the words “Hello world” — using his mind.

It was all thanks to a smart stent implanted in the man’s jugular brain which translated his brain activity into inputs.

Synchron is the company that made it happen. The company has captured the interest of notable business figures like Elon Musk, and it’s got plenty of investors wondering how to buy Synchron stock.

Since Synchron is not public, it may not be as simple as buying shares on your favorite screener, but there are ways to gain exposure to the company and sector in other ways. In this article, we’ll talk about approaches for retail investors to gain exposure to Synchron.

Synchron: The Basics

Before we get to how to buy Synchron stock, let’s take a look at some important facts about the company:

- Synchron was originally founded in 2012 under the name “SmartStent” by Thomas Oxley, Nicholas Opie, and Rahul Sharma.

- The company’s flagship product, brain.io™, allows paralysis patients to control wireless devices.

- Synchron has raised around $130 million in funding through 5 funding rounds.

- The company currently holds 105 patents.

- Synchron’s COMMAND trial marked the first time a brain-computer interface (BCI) was implanted in a human patient in the United States.

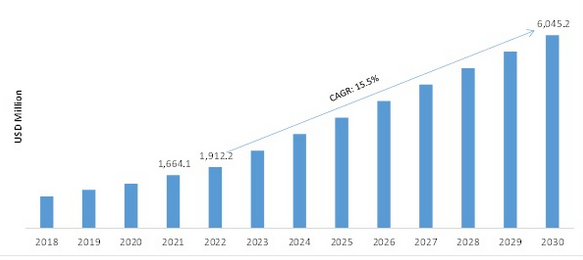

- The BCI market is expected to grow from its present $1.74 billion market cap to $6.18 billion by 2030 at a CAGR of 17.5%.

Can You Buy Synchron Stock? Is Synchron Publicly Traded?

Now, if you’re wondering how to buy Synchron stock, I have to disappoint you. You can’t, at least not at the moment.

Synchron is a private company, so for now there’s no Synchron stock symbol or Synchron stock price chart. In fact, the company hasn’t even commented on an IPO, so it’s reasonable to assume that they will take things slow.

This doesn’t mean that you’re out of options. There are several ways for investors to potentially get a slice of the action. Keep reading…

How to Buy Synchron as a Retail Investor

You can’t buy Synchron stock directly, since it is not publicly traded. However, there may be ways to invest in the company indirectly as well as the wider sector. To do that, first, a few basics:

Who Owns Synchron?

Synchron was founded in 2012 by Thomas Oxley, Nicholas Opie, and Rahul Sharma as SmartStent. The company got its present name in 2016.

The aforementioned three founders likely own the majority stake in the company, while the rest of the stock is most likely divided among the board of directors and employees.

Apart from that, various private equity and venture capital firms have invested in the company, including:

- Sigma Partners

- ARCH Venture Partners

- Khosla Ventures

- METIS Innovative

- Alumni Ventures

- Moore Strategic Ventures

Does Bill Gates Own Synchron?

Nope. The Microsoft (NASDAQ: MSFT) founder doesn’t own Synchron, though both he and Jeff Bezos of Amazon (NASDAQ: AMZN) backed the company’s C funding round.

Their ownership stakes are not known. However, the total round was $75 million and it included 15 other investors, if that gives you a little context.

How to Invest in Synchron Stock as a Retail Investor

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Investors wondering how to buy Synchron stock will have to wait for the company’s IPO. In the meantime, there are a couple of ways to gain exposure to the growth in this sector.

Going upstream and investing in the VC and private equity companies funding Synchron is a no-go – none of them are publicly traded. As far as competitors go, you’re also out of options — BCI companies are cutting-edge, few in number, and none of them have gone public.

However, there are a lot of promising, publicly-traded companies that have used implants to treat a variety of other conditions. Although not an exact equivalence, investing in them could allow you to gain exposure to the gains that this new frontier in science will bring about.

Let’s take a look at some of the more promising candidates.

Neuropace (NASDAQ: NPCE) and Livanova (NASDAQ: LIVN) provide implantable devices used in the treatment of drug-resistant epilepsy and depression.

While both stocks could be profitable in the long run, Neuropace is the riskier choice – with more potential upside and a cheaper stock, but plenty of volatility. In comparison, Livanova is a more conservative bet, but more likely to appeal to the risk-averse.

On top of those two, we also have Abbott Laboratories (NYSE: ABT) and Boston Scientific (NYSE: BSX) — chart below — which focus on implants used to treat chronic pain, Parkinson’s disease, essential tremors, and radiculopathy.

(Chart courtesy of TradingView)

Both of these stocks have been winners as of late — Boston Scientific has performed better this year, although Abbott Laboratories does boast a much larger market cap, as well as a more appealing P/E ratio.

How to Buy the Synchron IPO

Here are the steps on how to buy Synchron stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Synchron

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Synchron Stock Price Chart

Synchron isn’t publicly traded, and the company hasn’t even mentioned plans for an IPO. Because of this, we can’t provide you with the Synchron stock price (sorry).

However, I can share some relevant data that demonstrates the potential of this company and the BCI industry.

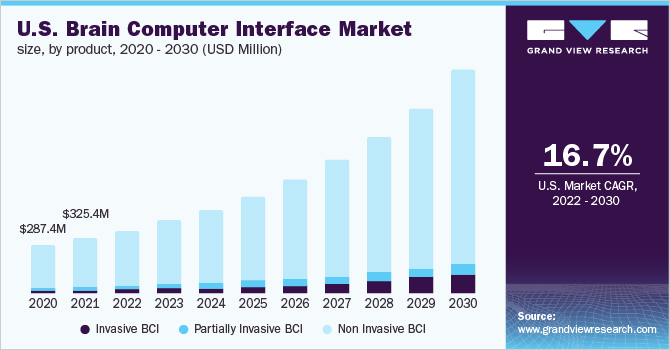

The chart above demonstrates the forecasted growth of the BCI market, which is expected to triple in size by 2030. A CAGR (compound annual growth rate) of over 15% is impressive, particularly for cutting-edge technologies.

Next, in the above image, you can see forecasts also expect non-invasive BCI to retain the lion’s share of the market, as well as absorb most of the aforementioned growth.

While estimates on exact CAGR vary, as you can see above, the figures are always above 15%.

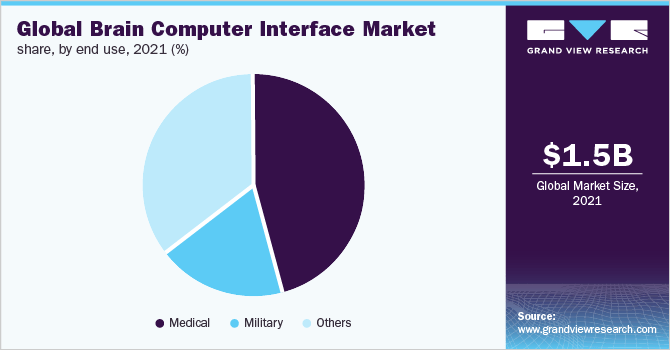

To cap everything off, medical uses of BCI are expected to remain the driving force of the industry.

Considering these factors, it’s obvious that Synchron is uniquely positioned to become a market leader. The company occupies all the right niches and has good odds of being the first to the market, which could translate to a strong economic moat.

If you’re a retail investor who is interested in how to buy Synchron stock, consider some of the approaches listed in this article.

FAQs:

How to buy Synchron stock?

As of mid-2023, Synchron stock isn’t listed on any of the world’s major exchanges, so the stock isn’t publicly traded.

However, investing in competitors, VC companies, or private equity companies that have purchased a stake in Synchron can allow you to gain exposure to the company.

How much is Synchron stock?

Synchron stock is not publicly available, so there is no current price data.

What is the Synchron stock symbol?

Synchron doesn’t have a stock symbol, as the company still hasn’t gone public.

Who owns Synchron stock?

Synchron stock is owned by its founders, Thomas Oxley, Nicholas Opie, and Rahul Sharma, as well as private equity and VC companies including Sigma Partners, ARCH Venture Partners, Khosla Ventures, METIS Innovative, Alumni Ventures, and Moore Strategic Ventures.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.