Pave is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Pave who want to sell their shares.

Sign up with Hiive here and get access to Pave before its IPO.

For many companies, human resources is a costly and often opaque part of their business. Compensation, in particular, can be a challenging area for companies to get right.

Thankfully, this traditionally costly and cloudy segment is receiving a breath of fresh air in the form of an easy-to-use and straightforward data-driven compensation platform.

Introducing Pave, the latest software making waves across HR departments.

So how do you get a piece of the action? Here’s what you need to know about how to buy Pave stock…

Pave: The Basics

Pave is paving the way in transparent compensation data, so it’s hardly surprising investors are eager to back this up-and-coming startup.

The problem is, Pave is a private company. You can’t buy Pave stock on your favorite trading platform. So how do you actually invest?

Luckily, we have all the answers you need.

Before we begin, let’s take a closer look at this San Francisco-based startup.

- Pave was formed in 2019 by Matt Schulman.

- The platform focuses on providing real-time tools that allow companies to benchmark, plan, and communicate compensation.

- The company’s mission? o build the world’s best compensation tools and easily accessible market data.”

- Pave has raised $163 million from 19 investors, the latest being a Series C funding round that closed on June 28, 2022.

- The HR technology industry is expected to hit $35 billion by 2028, according to Fortune Business Insights.

Can You Buy Pave Stock? Is Pave Publicly Traded?

No. Sadly, you cannot purchase Pave stock because it is not publicly traded.

That said, in place of publicly traded Pave stock, there might be some suitable alternative options that we’ll cover:

- How to access indirect exposure to Pave as a retail investor

- How to gain exposure to the sector

How to Buy Pave Stock as an Accredited Investor

Nope — you can’t buy Pave stock on the public market.

However, if you’re an accredited investor, you can invest in Pave through Hiive, a secondary marketplace where users can buy and sell shares of over 2,000 private, pre-ipo companies — including Pave (and many more).

As long as you’re an accredited investor, you can complete a Hiive profile and connect with insiders who already own shares of Pave and want to make a deal. At writing, there are 2 listings for Pave on Hiive:

Beyond Pave stock, Hiive’s intuitive interface offers access to other exciting VC-backed private companies in a variety of sectors, such as Binance, Juul, and OpenAI. Here are just a few more examples of what you’ll find on Hiive:

Serious about adding Pave stock to your portfolio? Sign up for Hiive using this link.

How to Buy Pave Stock: Options for Retail Investors

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

We already know that there are no publicly traded shares of Pave to purchase.

Does that mean you’re out of luck?

Not even close.

Retail investors can capture the benefits of privately held companies indirectly. For example, you can…

- Invest in other HR companies.

- Invest in companies whose business is directly tied to the industry where Pave operates, companies that benefit when the HR industry performs well.

- Invest broadly in the sector where Pave operates.

Let’s dive deeper into each of these opportunities. But first, a few basics:

Who Owns Pave?

Pave is a privately owned company with 19 investors. Pave’s roster of investors spans the “who’s who” of venture capital. Some notable investors include Andreessen Horowitz and the Y Combinator Continuity Fund.

Does Andreesen Horowitz Own Pave?

While Andreessen Horowitz is not an outright owner of Pave, they are one of the very first private investors in the startup.

Andreessen Horowitz is a massive venture capital firm founded by Marc Andreessen and Horowitz in 2009. As of March 2022, the Menlo Park, California-based firm held an incredible $35 billion in assets.

How to Invest in Pave: Retail Investors

Now, let’s get to the heart of the matter. If there’s no way how to buy Pave stock, consider these alternative approaches:

Invest in Pave Competitors

It’s possible you’re not too concerned with direct exposure to Pave. Perhaps, instead, you simply believe the company is operating in a space that will be profitable in the coming years. As a result, you may be content merely gaining exposure to similar companies.

Here are a couple of publicly traded companies that can give you similar industry exposure as Pave:

- Paycom (NYSE: PAYC): An online HR and payroll technology provider. It boasts the title of one of the first fully only payroll providers.

- Oracle Workforce Rewards Cloud (NYSE: ORCL): A platform that allows organizations to “plan, allocate, and communicate compensation using the most complete solution in the market,” according to their website.

Parent company Oracle was crowned the third-largest software company globally by revenue and market capitalization in 2020.

Invest in Pave-Adjacent Companies

Maybe you don’t necessarily care if you are exposed to a similar company. Instead, perhaps you’re just concerned with exposure to any company that may benefit when Pave does well.

While it’s not guaranteed, other supporting sectors, like banks, might see outperformance at the same time as Pave. In other words, there may be a correlation between their fortunes.

If, for example, you want exposure to a financial institution, here are some potential options to consider.

- JPMorgan Chase (NYSE: JPM)

- Bank of America (NYSE: BAC)

- Morgan Stanley (NYSE: MS)

- Wells Fargo (NYSE: WFC)

- Capital One (NYSE: COF)

Want to buy shares of Pave-adjacent companies? You need a broker. Don’t have one? We recommend eToro.

It’s one of the world’s most popular investing platforms, with over 28.5 million users.

Plus, eToro is currently offering a $10 bonus* for U.S. residents.

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. New accounts only. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Invest in the Sector

We told you there are options, and we weren’t kidding.

Consider broad exposure to the industry where Pave operates. In this case, you’d target the technology sector, specifically the software industry.

Great! We know the general area we’d like to invest in. Now what?

Now you can choose from the numerous exchange-traded funds that offer exposure to these corners of the market.

Here are a few potential options to consider:

- Invesco QQQ Trust Series 1 ETF ($QQQ): One of the most popular tech-centered ETFs. The product exposes you to a “diverse group of cutting-edge Nasdaq-100 companies.” This easy-to-access fund is an excellent choice for many investors seeking broad tech sector exposure.

- iShares Expanded Tech-Software Sector ETF ($IGV): An ETF with a software-specific focus.

- SPDR S&P Software & Services ETF ($XSW): like IGV, XSW similarly focuses on software, with exposure to internet software and services companies, data processing firms, and others.

How to Buy the Pave IPO

Here are the steps on how to buy Pave stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Pave

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

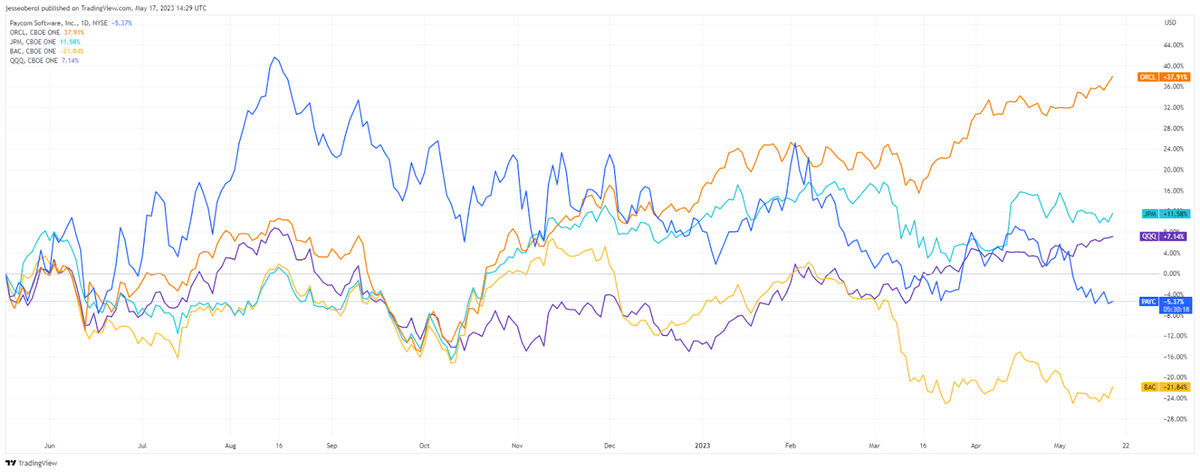

Pave Stock Price Chart

Since Pave is not publicly traded, there is no pave stock price chart.

As an alternative to a pave stock price chart, here is a chart with the following:

- Oracle (NYSE: ORCL): A publicly traded potential Pave competitor.

- JPMorgan (NYSE: JPM) and Bank of America (NYSE: BAC): Businesses in potentially correlated industries (financial services).

- Invesco QQQ Trust Series 1: ETF focused on the broad industry that Pave operates in (tech)

All in all, Pave is a company worth watching. If you’re an accredited investor, consider checking out Pave on Hiive. If you’re a retail investor, consider some of the approaches discussed in this article.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy Pave stock?

If you want to know how to buy Pave stock, you’re out of luck. Since Pave is not publicly traded, you can not buy Pave stock.

How much is Pave stock?

Since Pave is not publicly traded, there is no Pave stock price.

What is the Pave stock symbol?

Pave is a private company, there is no pave stock symbol.

Who owns Pave stock?

Since Pave is a private company, no one owns Pave stock. That said,19 investors, including Andreessen Horowitz, are major investors in Pave.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.