If you’re looking for reliable stock + market info, chances are you’ve come across Finimize.

The platform has gotten a lot of hype in the past few years, and it’s gained a strong following. But is Finimize worth it? Is it legit, and is it any good?

I took the time to find out. In this Finimize review, we’ll uncover whether Finimize can minimize your stock research time, or if it’s better to steer clear of this site.

Want to know how we find stocks before they explode?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Is Finimize Worth It? Key Takeaways:

I won’t keep you in suspense: Finimize Premium is worth it if you crave high-quality, to-the-point content on global finance.

The Finimize platform is best known for its “Briefs” detailing the latest market activity and how it relates to broader trends and stock positions. This information — plus the convenient Finimize app — are great tools for gathering fundamental analysis to make more informed decisions.

That said, Finimize is not for you if you’re looking for SPECIFIC tickers to keep on your watchlist — it’s more about staying up to date on catalysts that could move the market at large. (If you want to research specific stocks, check out WallStreetZen Premium.)

Finimize supplies proactive traders with insightful market commentary to help inform their overall strategy. Finimize is NOT ideal for investors who want someone to guide them to hidden gems (for that, check out Zen Investor).

What Is Finimize?

Finimize is a financial education platform and community that was created with the goal of helping its members become smarter investors. Finimize features educational content, market updates, as well as world news events that relate to the market.

The platform has several key features, including:

- An App

- Daily Briefings

- News & Analysis

- Education

- Community

- A business hub

It has a fun origin story: Finimize CEO Max Rofagha got the idea for the company after an unsatisfying meeting with his local bank. Instead of getting a clearer direction on where to put his money, Max felt he wasn’t being heard and didn’t have all the details to make informed choices.

This experience led Max to create Finimize in 2016 with the help of a few ex-banker buddies. Over time, Finimize grew its presence by introducing a hot newsletter and creating the Finimize app.

Today, Finimize is a super popular finance app on Google Play and the App Store, and it has a community of over one million subscribers.

Although Finimize gained a reputation as a financial content hub, it continues expanding its offerings on both free and paid accounts.

Daily Briefings

Finimize is all about providing “bite-sized” financial updates for busy investors.

Every day, people who have the Finimize app can get the latest alpha on macroeconomics and market trends by listening to the “Daily Brief” podcast or reading the newsletter.

In just a minute or two, you’ll get a TL;DR version of what’s happening in the financial world so you can stay in the loop and prep your portfolio.

Analysis & News

When Finimize first came out, it focused on offering top-tier — but also beginner-friendly — content on the latest financial news.

To this day, you can still find a treasure trove of articles on the Finimize app and website with stories that cut to the chase.

Finimize news articles have a unique style with headers like “What’s going on here?” and “Why should I care?” to get straight to the juicy details and cut out the fluff.

Here’s a specific example of how following Finimize could help give you direction in your investment decisions. After the 2024 Apple Worldwide Developers Conference, Finimize summarized the tech giant’s AI software plans, explained the subsequent stock pump, and analyzed how these announcements change the investment thesis in AAPL shares.

If you want a more thorough breakdown of market dynamics, the analysis-driven posts dive deeper into the hottest current topics and provide clues into how this could affect investors’ portfolios.

As an investor, reading stories like this might make you interested in researching a stock. Finimize isn’t the place for that, but you can do it on a platform like WallStreetZen.

Educational Resources

Besides keeping tabs on the latest market activity, Finimize has an education hub covering personal finance topics.

From refinancing debt and improving credit scores to mortgages versus rents and saving for retirement, there’s a lot of content here to help readers take control of their financial lives.

Here’s what Finimize isn’t as good for — learning trading fundamentals.

If you’re looking for an intro specific to trading, you might want to start with something more targeted, like Udemy’s “Complete Foundation Stock Trading Course,” which guides you through key concepts like order types, market psychology, and technical chart analysis.

Community

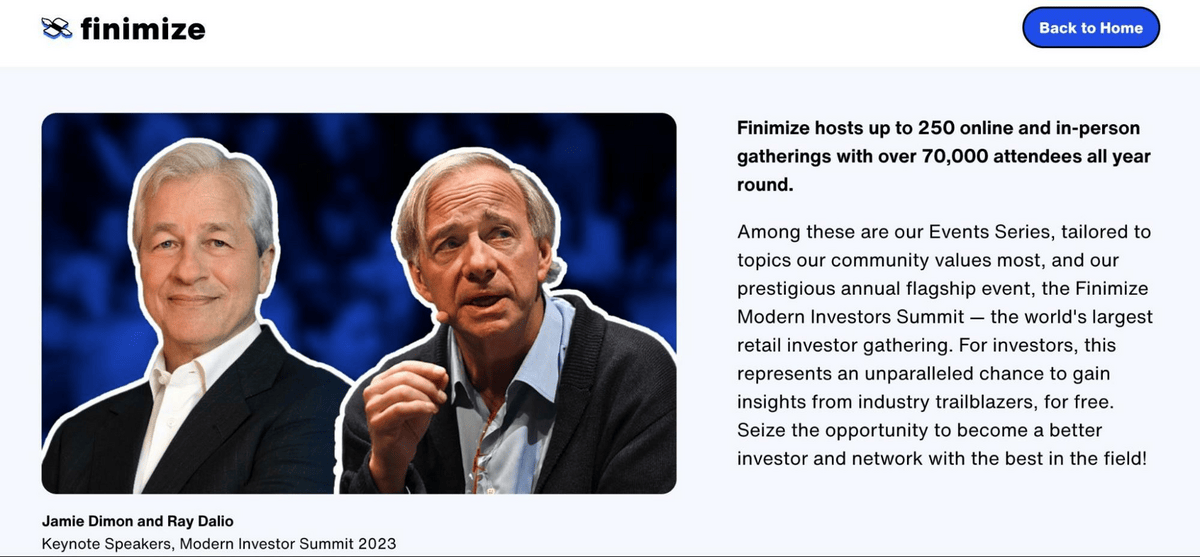

Given Finimize’s size, it’s probably no surprise this company has a robust network effect with some pretty awesome online and in-person events.

I was personally pleasantly surprised to learn that Finimize events attract huge names in the financial landscape.

Mark Cuban, Cathie Wood, and Ray Dalio are just a few luminaries who’ve participated in Finimize’s Modern Investor Summit.

Pretty impressive, right?

Thousands of Finimize members flock to these meetings to connect with like-minded investors and hear from industry leaders.

Investing can be pretty lonely — especially if your friends start rolling their eyes when you start talking about ROE. If you’re social and love to talk about investing, the Finimize community is a huge selling point. If you join the Finimize fam, check out the events calendar to maximize this opportunity.

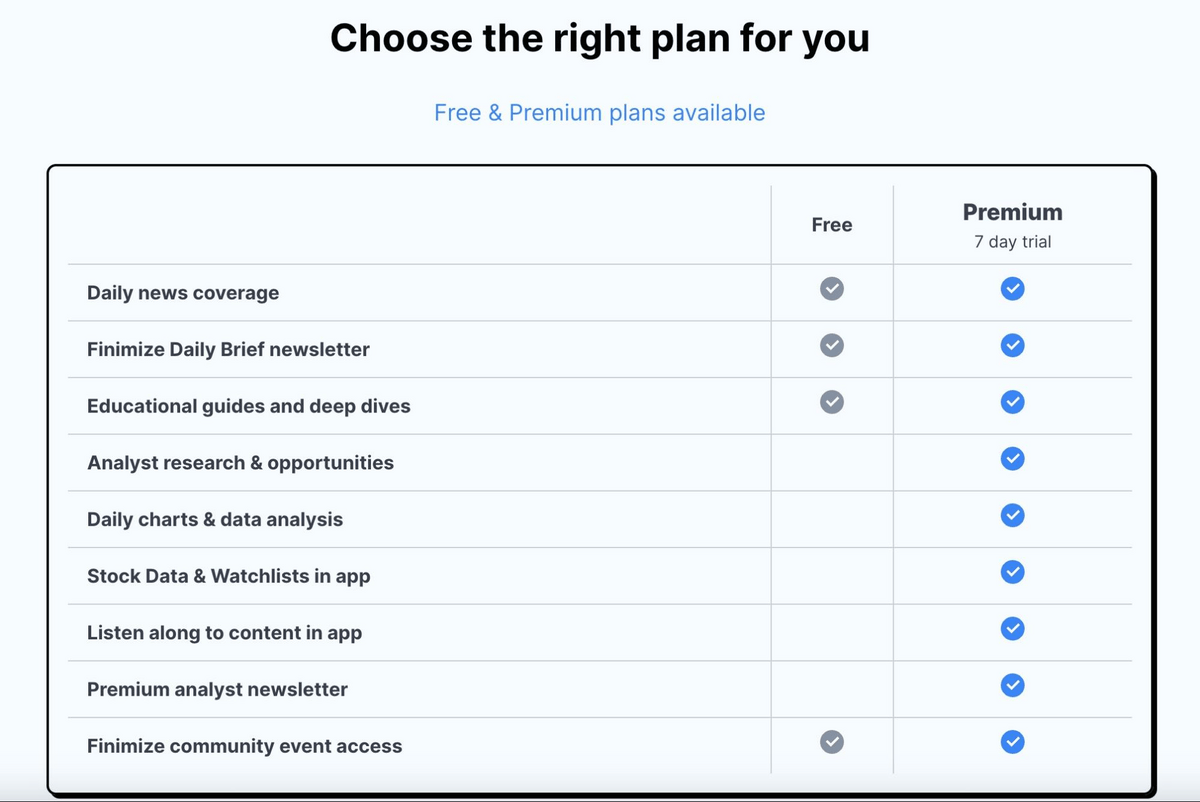

Finimize Premium Features

While you can access some of Finimize’s signature features for free (e.g., the Daily Brief and community events), you need Premium access to take things to the next level.

This paid subscription gives exclusive access to more market-focused content, including analysis and a premier newsletter. Finimize Premium also makes it easier to customize your news feed with stock watchlists, as well as data analytics and price charts.

Lastly, for those who easily get eyestrain, Finimize Premium can save your peepers from that dreaded blue light exposure with “listen along” content.

Is Finimize Premium worth it? Overall, I vote yes. At just $79 per year (after a 7-day free trial) or $9.99 per month, Finimize Premium offers a lot of value if you prioritize fundamental analysis and breaking news.

What Do Finimize Users Say?

I’ve said a lot about Finimize. But I’m one person. Let’s cast a wider net.

Overall, Finimize reviews are high on portals like the App Store, Google Play, and Trustpilot.

For instance, the current average star rating for a Finimize review on Apple and Android devices is between 4.5 and 4.8 stars.

The standard Finimize review on Trustpilot also has an overall “excellent” rating of 4.3 stars, with many Finimize reviewers praising the consistent quality of its content.

I poked around to see what people were saying elsewhere on the web, and learned that Redditors also appear to like Finimize, with one user writing:

“Finimize is great to start reading about the stock market every day. However, it’s smart to use other sources too for a more complete understanding, like WSJ, FT, Bloomberg, etc.”

However, a few negative Finimize reviews on Trustpilot complain about issues with getting refunds and the lack of customer service.

For example, Patrick on Trustpilot wrote this in his Finimize review:

“The app has no contact function whatsoever but even the email they’ve got on their website seems to be not monitored by anyone. Comments and messages on Instagram are also ignored.”

Of course, the fact that the overall ratings are good speaks volumes about the satisfaction level of Finimize customers.

How Much Does Finimize Cost?

You can use Finimize’s core features for free, but you’ll have to pay a subscription for Premium access. Personally, I found that after a few days of poking around for free, I was using it enough to warrant the membership fee — or at least try out the free trial.

Speaking of which, I love that Finimize offers a free trial, because you can actually try out the features before you buy. Once your trial is up, you can maintain a Finimize Premium account for either $79.99 per year, or $9.99 per month.

Finimize Pros + Cons

Finimize Pros

- Free 7-day trial

- Affordable after the trial: At $79/year (or $9.99 a month), Finimize is one of the more affordable services of this type out there.

- Easy-to-digest market insights: Finimize’s claim to fame is its Daily Brief newsletter and concise market news articles and analysis. If you want the latest scoop but are always pressed for time, you’ll love how Finimize gets straight to the point.

- App is user-friendly: The Finimize app has high ratings on Google Play and the Apple App Store for its straightforward user interface and convenient functions. Thanks to this pocket-friendly mobile offering, you can easily take Finimize’s news and analysis on the go.

- Opportunity for live events: Finimize emphasizes community building with its yearly events, especially the Modern Investor Summit. If you’re into networking IRL with fellow investors, becoming a Finimize member will give you some serious contacts.

Finimize Cons

- Tailored for DIY investors: A Finimize account isn’t ideal for investors who want someone else to tell them what to do with their money. If you’re not hands-on with your investments, poring through the resources on Finimize may not be the best fit.

- Focus on fundamental analysis: If day or swing traders want a quick technical breakdown of stock prices, Finimize won’t deliver the goods. Although Finimize Premium includes charts, this site’s shining features revolve around fundamental analysis.

- Customer service complaints: Some Finimize reviews point out that customer service is slow and challenging. To this day, the primary way to reach Finimize is via email ticketed support rather than a direct phone call.

The Competition: Alternative Stock News & Analysis

Platforms

Still trying to decide if Finimize is worth it? Consider the differences between a Finimize Premium account and other stock news and analysis subscriptions before committing.

WallStreetZen: WSZ Premium + Zen Investor

At WallStreetZen, we actually offer two relevant services — one for DIY investors (WallStreetZen Premium) and one for investors who want a pro to do the heavy lifting and select the stock for them (Zen Investor).

Choose your own adventure — or get the best of both worlds with both services.

Many investors find that Zen Investor and WallStreetZen work best in tandem. WallStreetZen Premium offers powerful resources for DIY investors; with Zen Investor, you gain access to someone with experience in the market to do some of the heavy lifting for you, which can give you additional focus in your investing and free up your time.

Zen Investor

(Cost: $99 per year, or $79 introductory rate for charter members) is a stock picking newsletter. As a member, you receive stock picks, commentary, portfolio updates, and webinars from stock market veteran Steve Reitmeister, who hand-selects stocks through a proprietary 4-step process using WallStreetZen tools.

Oh, and we should mention — we also offer a no-questions asked, money-back guarantee for all Zen Investor members. Why not give it a try?

WallStreetZen Premium

WallStreetZen Premium (cost: $19.50 per month, billed annually) is a suite of stock research and analysis tools for “Do It Yourself” investors. As a member, you gain full access to due diligence checks, stock screeners, forecasts and recommendations from top-performing analysts, one-sentence explanations of why a stock moved, important email updates for stocks on your watchlist, and more.

For instance, say you’re on the fence about buying Chewy (NYSE: CHWY) stock, but you’re not sure if it’s a doggone good stock or a total dog. You can check out its page on WallStreetZen and learn all about the company’s finances, earnings, price targets, and more — including access to what Wall Street’s top-rated analysts are saying about the stock.

WallStreetZen can’t make the trade for you, but it can help you build a lot more confidence and conviction in your choice. The goal is to give you the tools needed to find, research and select your own stocks.

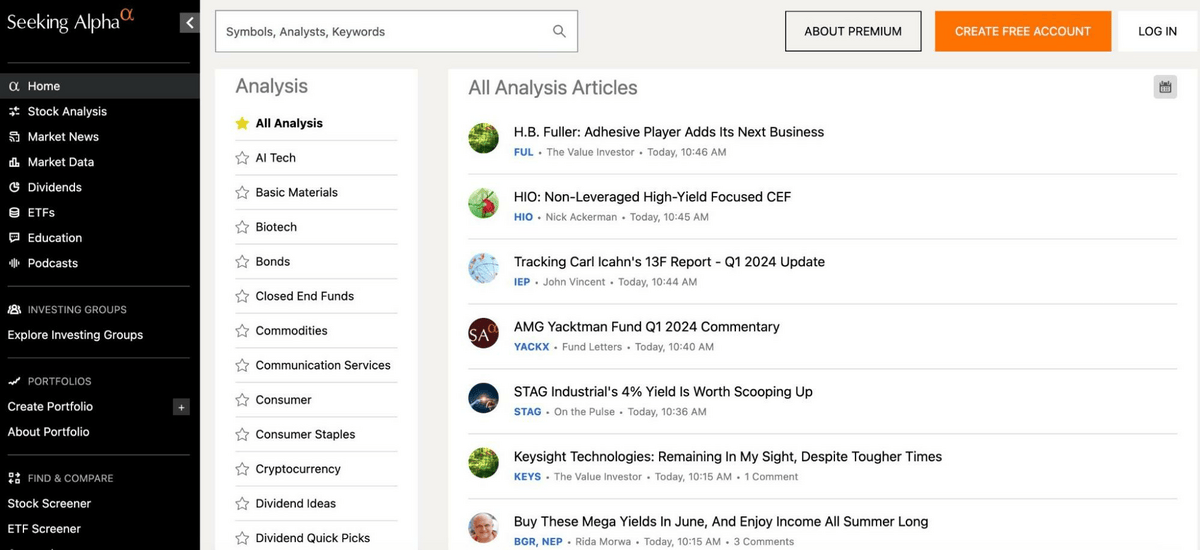

Seeking Alpha

Cost: $239 per year (Premium) – Get 20% off with this link!

What you get: Seeking Alpha is a terrific site for traders who love fundamental analysis. With millions of readers and over 10,000 new articles monthly, this behemoth has plenty of analysis reports to help you form your opinions and spark ideas.

Seeking Alpha also has a proprietary Quant Score and grading system to evaluate the health of a company and help you determine whether it’s a buy, sell, or hold. For more in-depth analysis, you can also use your Seeking Alpha Premium membership to dive into financial reports, news, and portfolio analysis.

Read our complete “Seeking Alpha Premium Review” for more information on Seeking Alpha.

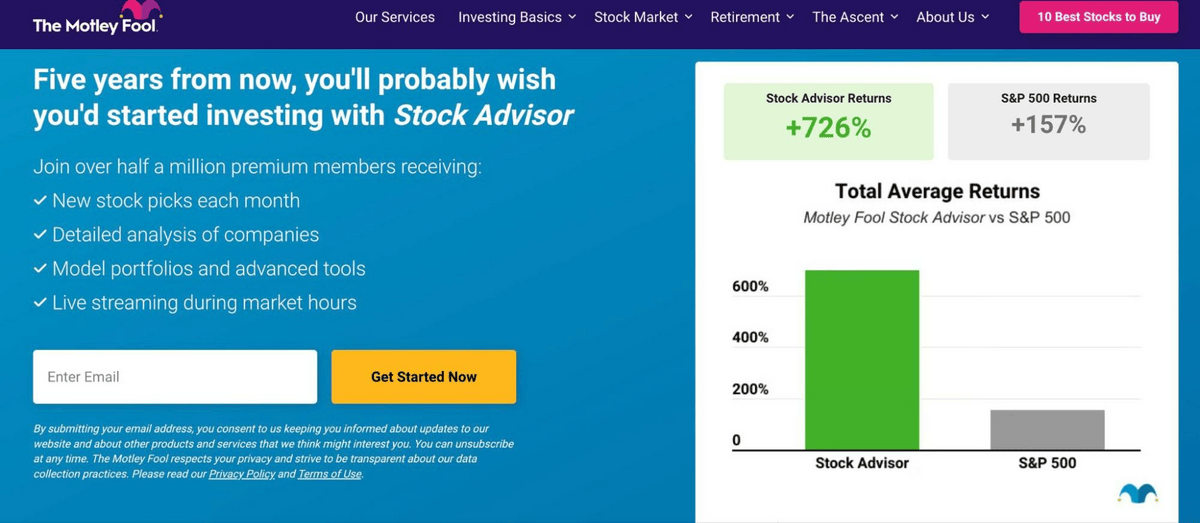

Motley Fool Stock Advisor

Cost: $199 per year (Using this link, get your first year for $99*)

What you get: The Motley Fool has been around since 1993, attracting millions of followers with its legendary stock picks.

Although the Motley Fool now offers multiple paid options for investors, its signature “Stock Advisor” newsletter remains its iconic offering. With this plan, you’ll get two new stock picks every month, as well as educational and community resources with the firm’s latest research. There’s also a 30-day membership-fee-back guarantee.

Read our in-depth review of “Motley Fool Stock Advisor” for more details on this legendary service.

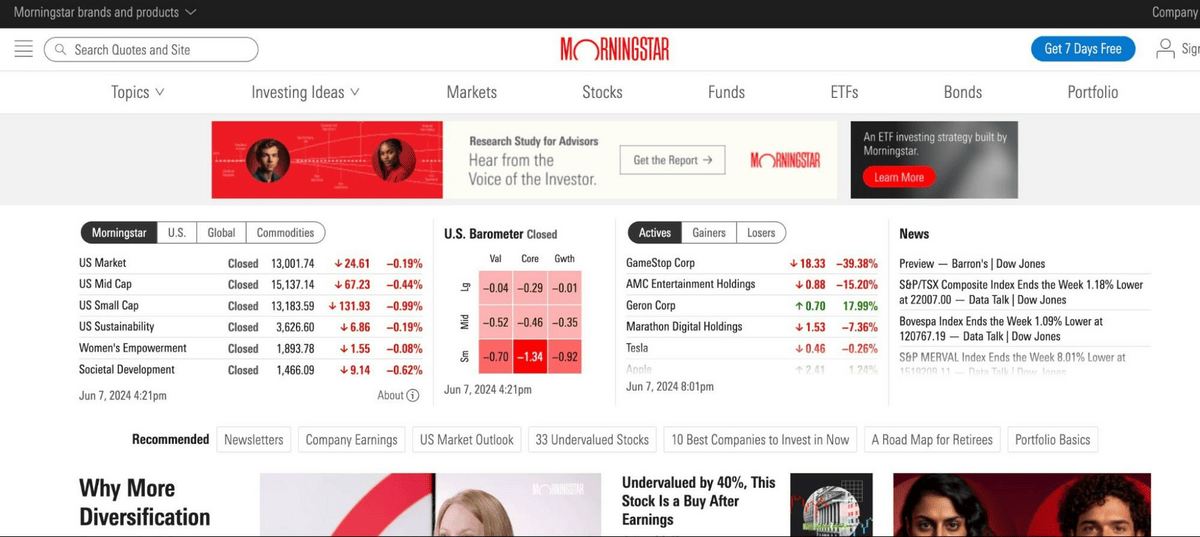

Morningstar

Cost: $34.95 monthly, $249 annually.

What you get: Since 1984, Morningstar has built a reputation for offering top-tier independent analysis for stocks, ETFs, and mutual funds.

A premium account — called “Morningstar Investor” — gives you access to the latest stock rankings and rationale from Morningstar analysts, as well as portfolio screeners, tools for personal finance, and the option for a review from a licensed financial advisor.

Want more details? Check out our detailed Morningstar Review, or click below to get started with Morningstar.

TickerNerd

Cost: $199 per year

What you get: TickerNerd is a relatively new company that has gained a reputation for its detailed stock reports and newsletters. With a TickerNerd Premium membership, you’ll get access to 12 new reports yearly, including two “exclusive stocks” for each report.

TickerNerd also grants Premium users access to its library of previous stock reports and official Wall Street analyst ratings.

Final Word: Who is Finimize Premium Good For?

So, is Finimize worth it? For many investors, I vote yes.

Finimize has built a solid reputation for its high-quality news, analysis, and educational guides, all in an easily-digestible and accessible format.

Extra features like listening to Briefs plus gated content make Finimize an excellent resource for investors who like to conduct their own research and want a fast feed from market pros.

However, Finimize is not best for investors looking for specific information about specific stocks. For that, I recommend WallStreetZen — in particular, WallStreetZen Premium for DIY investors, and Zen Investor for investors who want or need a little help choosing stocks.

FAQs:

Is Finimize Worth The Cost?

At $79 a year or $9.99 per month, Finimize is worth it if readers are interested in using fundamental news and analysis to inform long-term investing decisions. A Finimize membership is also a great way to get more involved with finance thanks to its yearly events.

Is Finimize Good For Beginners?

Finimize is a good platform for beginners who want easily digestible market news, analysis, and personal finance primers.

What is Finimize?

Finimize is a financial education platform focused on publishing market news and analysis for everyday investors.

How Much Does Finimize Cost?

After a 7-day free trial, a Finimize Premium membership costs $79.99 per year or $9.99 monthly.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.