Dylan Jovine positions himself as a great stock picker and wants you to join his “Behind the Markets” subscription for insider info. But should you trust him with your money?

There are plenty of Dylan Jovine reviews out there, but this is the only one you need. Keep reading to learn everything you need to know about Jovine’s Behind the Markets stock-picking service.

Is Behind The Markets Worth It? Key Takeaways

The bottom line: Dylan Jovine is a legit investor, and Behind the Markets may be worthwhile for investors who want to invest in mid-cap growth stocks.

However, with more affordable services with a proven track record like Zen Investor ($99/year, or $79 using the links in this post) and Motley Fool’s Stock Advisor ($199/year) out there, you may want to consider other options unless Jovine’s strategy really speaks to you.

I have three main reservations about Behind the Markets:

First, while the service does deliver a decent number of picks per week, there isn’t much transparency into its success rate.

Second, the price is steep ($196 per year for the lowest tier service) versus better-established competitors.

Finally, third-party reviews on Trustpilot indicate that Behind the Markets could use some improvement in the customer service arena.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Who Is Dylan Jovine?

First things first. Who is this Dylan Jovine, and why should you listen to him?

Dylan Jovine is a legit trader, who literally worked on Wall Street. He got his start with the brokerage Lexington Capital Partners.

From the 1990s to the early 2000s, Jovine experienced firsthand what it means to make markets, and he earned a reported $25 million per year.

If the name Dylan Jovine is ringing a bell but you can’t quite place it, perhaps you ran across his work at Tycoon Publishing, which he founded in 2004.

This free investment newsletter focuses on educating the everyman on financial-related topics.

(Side note: Did you know we offer a no-cost newsletter too? Free stock picks 3x per week + a weekly list of stocks to watch = worth your time. Subscribe here.)

By the time Dylan Jovine sold Tycoon Investing to the finpub conglomerate Agora, Inc., it had gained a readership of over 500,000 in almost 30 nations.

While Dylan Jovine admits he’s camera shy after a bumbling interview on Fox, he has been credited with calling big market turnarounds, particularly in 2008 – 2009.

With all of these accolades on his resume, it’s safe to say Dylan Jovine is for real — but what about his products?

What You Get With Behind The Markets

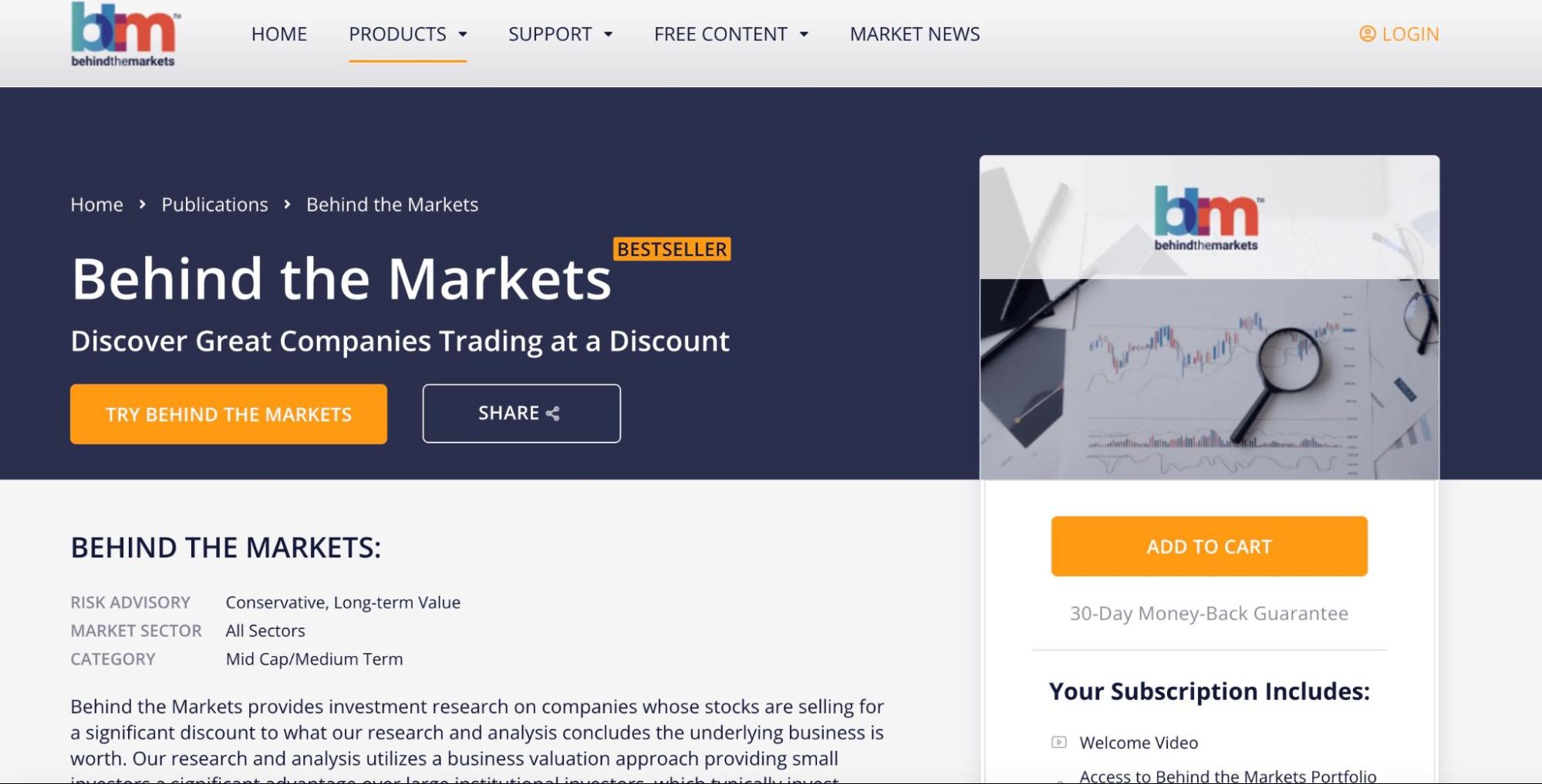

Dylan Jovine’s best-known brainchild is Behind The Markets, which is a stock-picking subscription with a few bonuses.

While there are differences between the Behind the Markets tiers, the core feature is a monthly newsletter in which Jovine shares his insights into the market.

You’ll also get stock recommendations every week in three different categories that use all-caps so you know Jovine means business.

- Stocks LEGENDS are buying

- Stocks WALL STREET is buying

- Stocks INSIDERS are buying

There aren’t many details on the differences between these categories, but the gist is that these are supposed to be great buys that Jovine believes have support on Wall Street.

While cross-referencing investment ideas against “Smart Money” sentiment is always a good idea, there are easier ways to do it.

For instance, WallStreetZen’s Zen Ratings system makes it easy to get an idea of a stock’s overall excellence with an easy-to-read letter grade based on 115 factors — including 14 Sentiment factors. The Positive Investor Sentiment screener even lets you filter A-rated stocks with excellent Sentiment ratings:

But I digress.

With Behind the Markets, beyond these standard features, you might also get bonus reports on sectors Jovine is wild about, but that depends on the version of Behind the Markets you opt for.

The more you pay per year, the more reports you’ll get. However, even at the base level (aka Bronze), you’ll get access to the nine weekly stock ideas and monthly newsletter.

Behind The Markets Cost

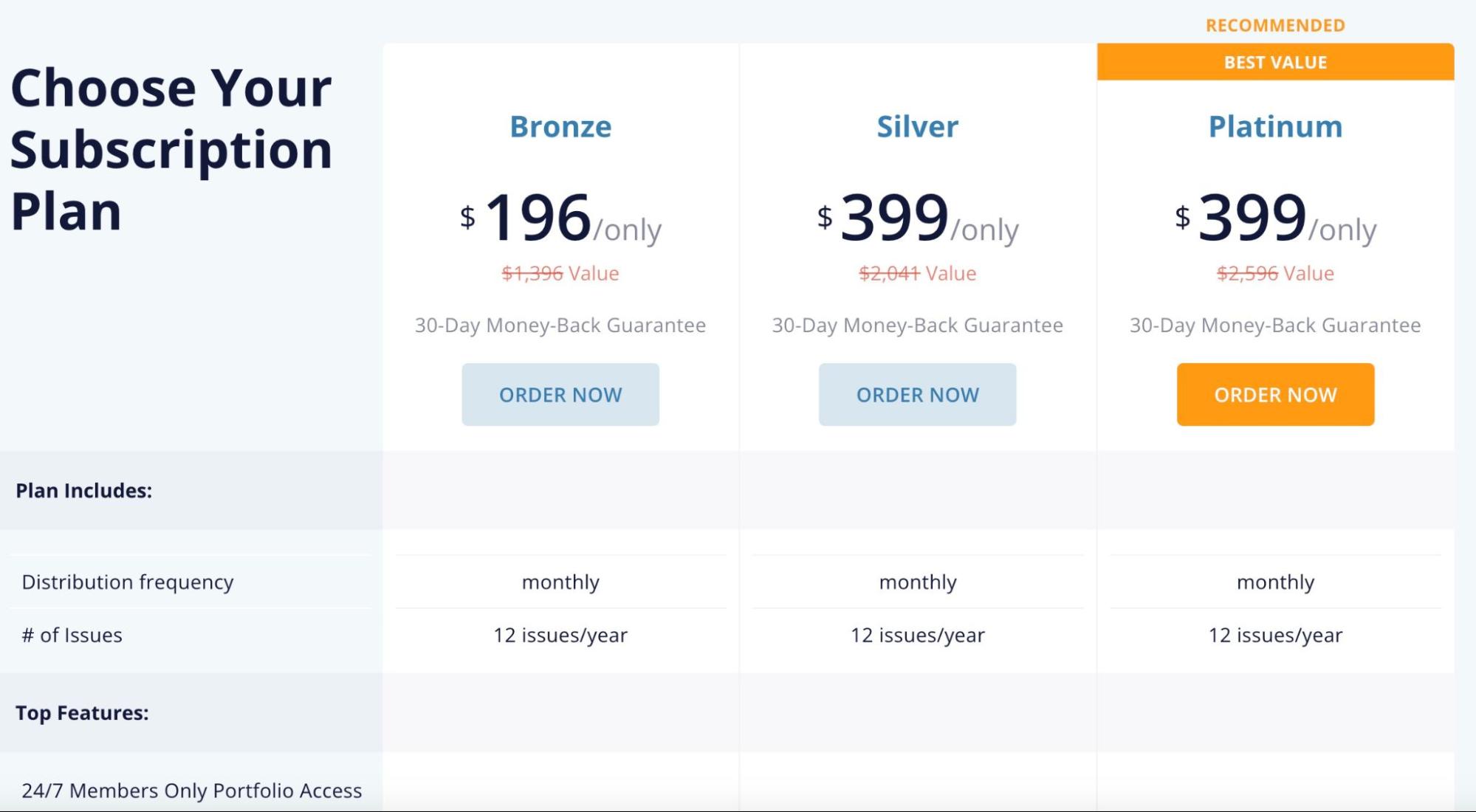

To make Behind the Markets more budget-friendly, Dylan Jovine offers this subscription at three price points depending on how much info you want.

On the bottom “Bronze” level, you’ll pay $196 per year to access the weekly nine stock picks, one bonus report, and the monthly newsletter.

To put that in perspective, our own Zen Investor is currently over $100 less per year and delivers more stock picks — check it out here.

One notch above is the “Silver” level, which costs $399 and includes three bonus reports: one focusing on evaluating a stock’s fundamentals and two others that examine making moolah in the medical sector.

The third level for Behind the Markets is (you guessed it!) “Gold,” and it includes seven reports with even more info on biotech stocks and a report on spotting high-flying cannabis companies.

Oddly, the Gold membership is currently listed at the same price as the Silver ($399) on Behind The Markets’ webpage, which may be a special promo at the time of writing.

Always check Behind the Markets’ official page for the latest details on pricing — and know that there may be discounts or coupons available at any given time.

Also, remember that Behind the Market offers a 30-day money-back guarantee.

That said … Are the services worth it?

Let’s turn to a few Dylan Jovine reviews for a glimpse into how people feel about the price of admission to Jovine’s inner circle.

Unfortunately, that’s a mixed bag.

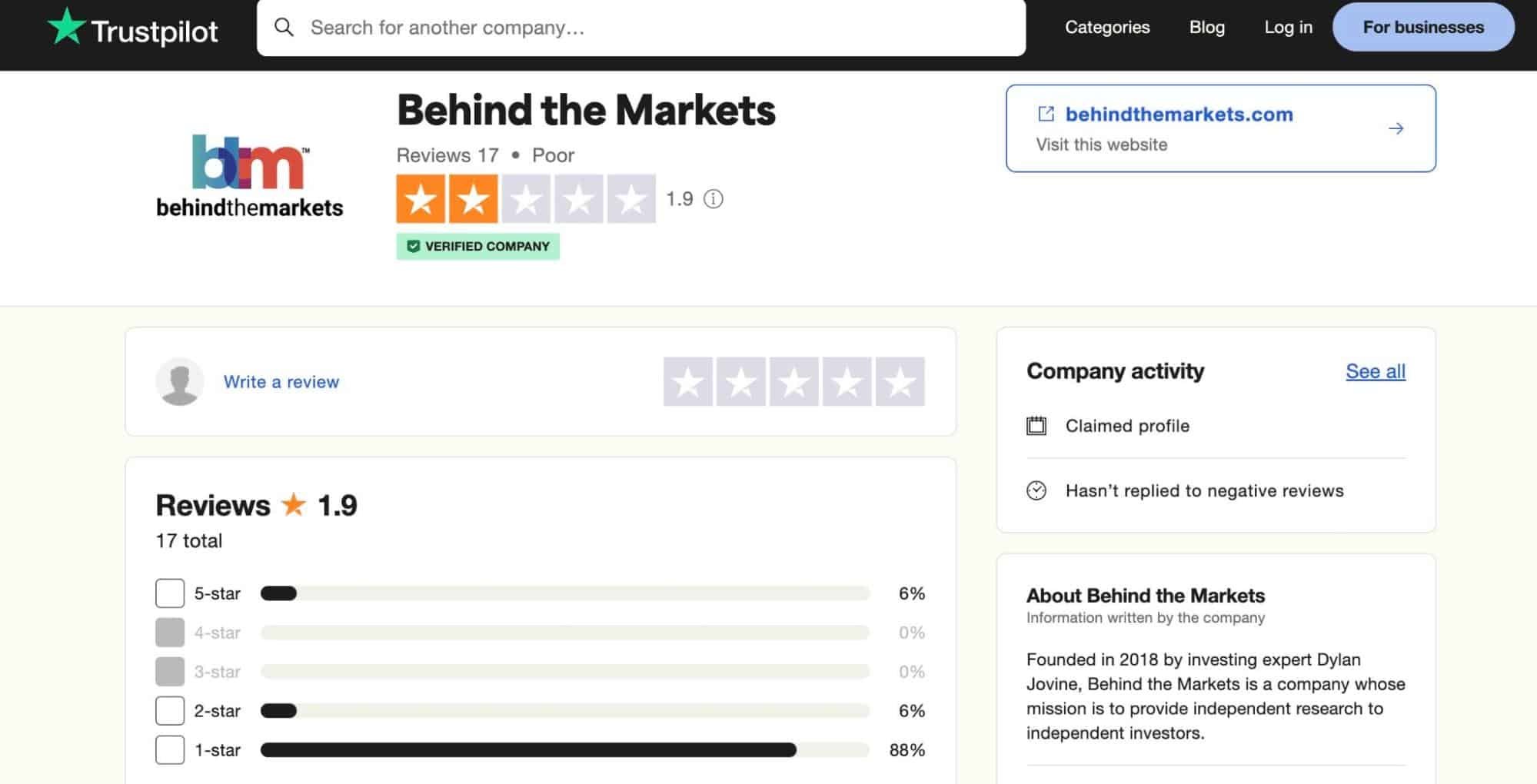

On TrustPilot, Behind the Markets gets a 1.9-star rating.

The reviews are largely negative, with this snippet being indicative of the general vibe: “I signed up for Takeover Targets in mid September and did not find it useful. I asked for this subscription to be cancelled two weeks after joining. I have been getting the run around ever since then.”

Granted, there are only 19 reviews here — but that’s not a good look. It’s even worse that there are no official responses from Behind the Markets to address concerns like a lack of customer care.

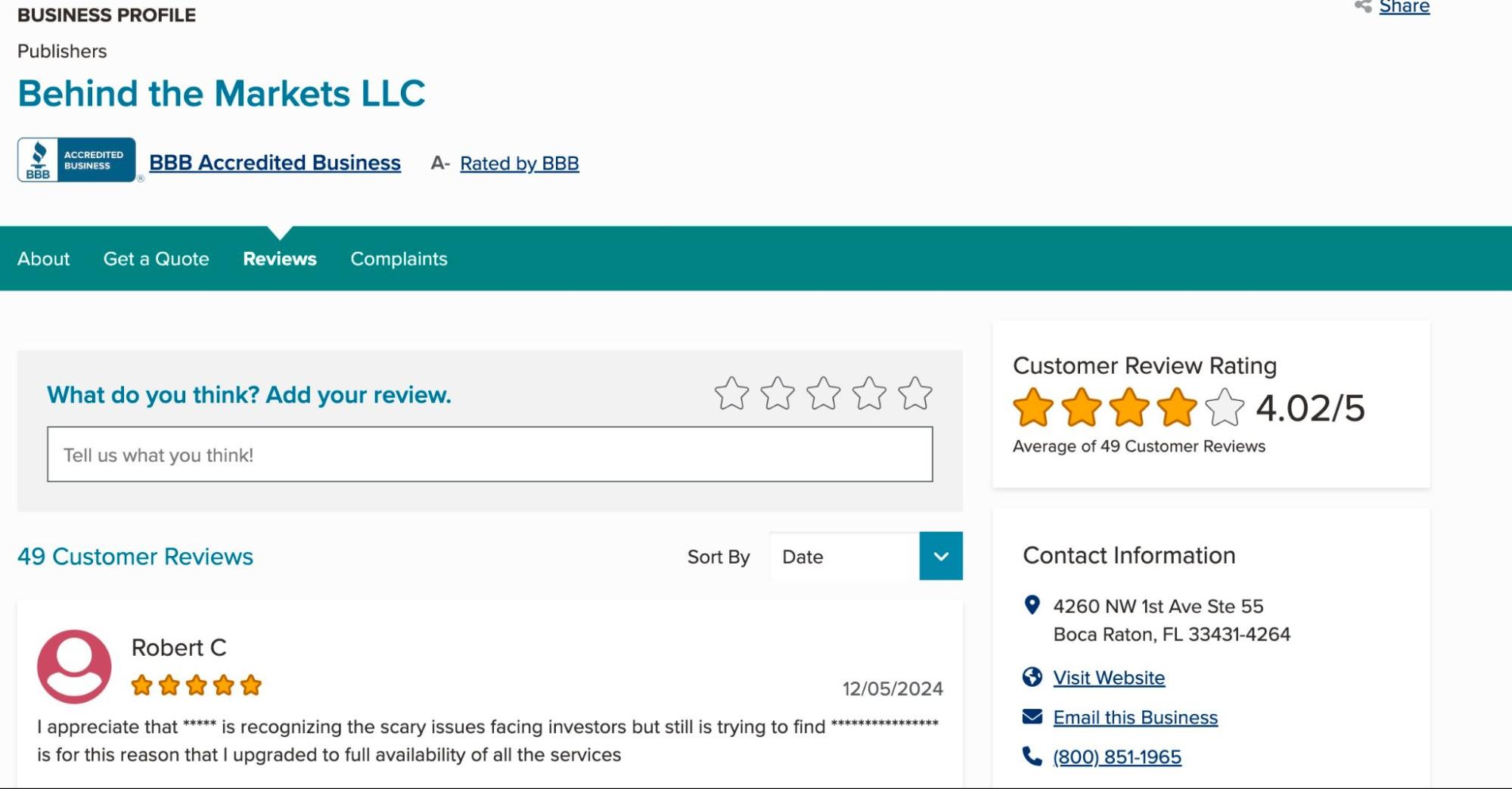

On the flip side, the Better Business Bureau (BBB) gives Behind the Markets a respectable 4.02 stars and an A- rating.

If you feel that Jovine’s strategy of focusing on mid-cap stocks with growth potential is enticing, then it may be worthwhile to give this service a shot — especially considering it has a 30-day money-back guarantee.

Dylan Jovine’s Track Record

According to some Behind the Markets reviews, Dylan Jovine’s stock picks vary significantly depending on the company, the entry price, and the broader market conditions.

For instance, Dylan Jovine’s service appears to have done well during the bull market of 2018 and 2021.

However, results in the following years were a bit sporadic, including a few 90% losses and a few 70+% wins. (Source)

Behind the Markets doesn’t publish a long-term return versus benchmarks like the S&P 500, so you need to be a member to track the performance of each stock relative to the US market. This is in contrast to a trusted provider like Motley Fool, whose Stock Advisor offering boasts verified returns of 924% since inception (as of February 2025, since February 2002).

Overall, there doesn’t appear to be a consistently high win rate across Behind the Markets’ picks, and finding the true winners depends on carefully researching Jovine’s rationales before hitting the buy button.

So, while Behind the Markets gives a place for traders to start looking for interesting plays, the best strategy is to supplement this data with further research before deciding whether it’s worth the risk.

Other Dylan Jovine Products

Although Behind the Markets gets all the ballyhoo, Dylan Jovine has a few other products available if you’re not too wild about this offering.

- Biotech Insider: Want to capitalize on potential medical breakthroughs? The Biotech Insider report will detail small to mid-cap companies nearing the end of their clinical trials that have explosive potential. (BTW — if you’re interested in biotechs, check out our article on biotech investing.)

- Takeover Targets: This subscription targets the latest M&A news to both generate gains and grab income from strategies like merger arbitrage.

- Breakthrough Wealth: Discover names of small and micro-cap companies that aren’t on fund managers’ radars yet to potentially realize hefty gains.

- Hidden Market Profits: For those more interested in the private market, Jovine offers Hidden Market Profits that details how to get involved with less liquid — but potentially more profitable — companies not on the public market.

All of these services work similarly to Behind the Markets with a three-tiered structure, newsletters, and stock picks.

However, they are significantly higher at current prices (typically around $3,000 per year at the low end).

Although these services promise greater gains versus Behind the Markets, they come with more significant risks, and it’s hard to say whether they’re worth the steep entry fee.

Alternatives to Behind the Markets

If you’re just getting started with picking stocks, Behind the Markets may be too much in terms of cost and info overload.

Be sure to research alternatives to this stock-picking service before deciding what best fits your strategy.

Zen Investor

Cost: $99/year ($79 using the links in this post), $190 for 3 years, $197 for 5 years

Zen Investor bases its success on a two-pronged approach.Instead of just relying on the acumen of a Wall Street expert, we put all of our stock picks through the rigorous Zen Ratings system to deliver the highest of high-conviction names.

What is the Zen Ratings system?

It’s a proprietary review of 115 factors that assesses a company’s health relative to its peers and points out what has the best chance for outsized growth.

While that info is valuable enough, we always send these stocks to the legendary Steve Reitmeister for final approval.

Best known for his work at Zacks.com, Steve Reitmeister has been in the stock market for over 40 years, and he takes extreme care assessing each stock and explaining his reason for a Buy rating.

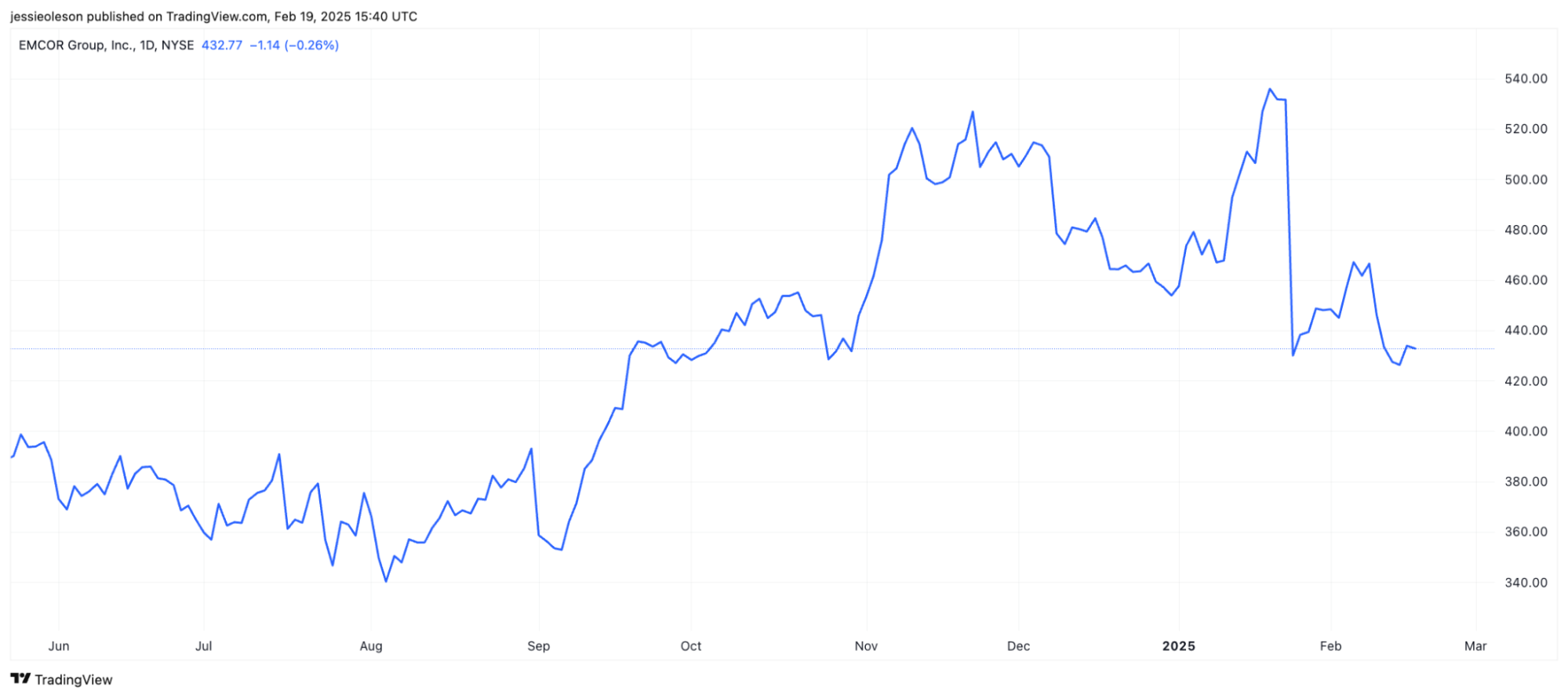

For instance, you can check out his commentary on a recent portfolio addition, Emcor Inc. (NYSE: EME), in this article. Just look at how it’s been doing in recent months:

On top of the 20 – 30 stock picks per year, Zen Investor subscribers will get a detailed market analysis and trading strategy every month.

Check out Zen Investor if you want well-researched stock ideas delivered to your inbox.

Motley Fool Epic

Cost: $499 per year ($200 off using the links in this post)

Earlier, I mentioned Stock Advisor, Motley Fool’s market-beating offering. Stock Advisor is just one of the four market scorecards you’ll get access to with a Motley Fool Epic membership, which I believe is the company’s strongest offering. (Read our Motley Fool Epic review here.)

This company has been around since the 1990s, and during that time they’ve developed some pretty awesome tools and profitable portfolios.

If you want to take advantage of the Motley Fool’s strategies, their Epic offering may be up your alley.

While this is pricey at $499 per year, you get access to tons of iconic features like their rankings in categories like Dividend Investor, Rule Breakers, and Hidden Gems.

Motley Fool Epic also lets you toggle between different portfolio examples depending on your risk tolerance and run through the GamePlan+ for tons of educational articles.

You’ll also get five stock picks each month delivered to your email.

Keep in mind that Motley Fool Epic targets people who are already familiar with the market and want to commit at least $50,000 to an investment strategy.

Stock Market Guides

Cost: Subscriptions available from $29 per month

Backtesting is the name of the game for Stock Market Guides.

This straightforward stock-picking service uses its proprietary backtesting algorithms to deliver tasty tickers monthly in easy-to-ready boxes. (For more info, read our Stock Market Guides review.)

According to Stock Market Guides, their swing trading stock picks have an average of 79.4% upside, and options trades do even better at an average of 150.4%.

While these backtesting results don’t guarantee future returns, they’re a good signal for anyone looking for a tried-and-true strategy.

As a bonus, it’s super easy to decipher all the data from a Stock Market Guides report, and you’ll get alerts in real-time so you can act ASAP.

Oh, and if the alerts are too rich for your blood, you can also take a more DIY approach by gaining access to Stock Market Guides’ scanners.

Final Word: Is Dylan Jovine Legit?

While Dylan Jovine is legit, it’s debatable whether his services are worth the money.

The unfavorable reviews on Trustpilot and lack of transparency over stock-picking performance make Behind the Markets a speculative service compared with more established names.

While Behind the Markets might deliver mid-cap winners, you have to feel comfortable taking a risk with a lesser-known product that has unknown customer service standards.

Check out an alternative like Zen Investor for a more reliable stock-picking service.

FAQs:

How Much Does Behind The Markets Cost?

Currently, Behind the Markets costs between $196 to $399 depending on the tier you choose. To put that in perspective, WallStreetZen’s Zen Investor service, which has demonstrated a market-beating rack record, costs only $99 per year, and the highly-respected Motley Fool Stock Advisor service is just $199 per year.

What Are The Best Alternatives To Behind The Markets?

Zen Investor, The Motley Fool Epic, and Stock Market Guides are examples of alternatives to Behind the Markets that offer a track record of success at attractive prices.

What stocks Does Dylan Jovine recommend?

In Behind the Markets, Dylan Jovine focuses on mid-cap names across multiple sectors that offer a blend of growth potential and security. However, Jovine is also keen on biotech and medical stock ideas.

Is Behind The Markets a scam?

No, Behind the Markets isn't a scam, and it has accreditation on sites like the BBB.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.