What Is the Best Swing Trading Alert Service?

After rigorous testing of dozens of platforms, we selected Stock Market Guides as the top swing trading alert service in 2026. Here’s why we like it:

First, its intelligent use of tech. It leverages advanced algorithms to identify the highest-potential swing trades based on backtested strategies — a system that has delivered a 79.4% average annual return on swing trading stock picks.

Second, it’s highly customizable. You can either manually find swing trade ideas with their scanner, or customize what types of alerts you receive based on your preferred setups or strategies.

Third, it’s affordable. Subscriptions start at just $29 per month — making it one of the more affordable options on the market.

Are Swing Trading Alerts Worth It?

Day trading requires quick reflexes, immediate actions, and can honestly be a bit stressful for most traders. And buy & hold investing is great for long-term growth, but you won’t see results for decades.

A perfect balance between those two approaches is swing trading — a short-term trading strategy that allows traders to buy and sell stocks within a few days or weeks to pick up a handsome profit.

But it’s not easy, and most beginners will lose money if they don’t research dozens of stocks, understand market conditions, and set the right entry and exit points for a trade.

Swing trade alerts take the heavy lifting out of finding the right stocks, and can give you an edge in the market.

We’ve thoroughly researched over a dozen swing trading alert services, and found the best ones based on value, price, track record, and services offered.

The Best Swing Trading Alerts in 2026

Here’s our complete list of swing trading stock picking services:

1. Stock Market Guides – Best for Backtested Trade Setups

- Overall Rating: 4.5 / 5

- Cost: Starts at $49/month

- Track record: 79.4% average annual returns on stock picks

Stock Market Guides is a stock-picking service that offers several services, including swing trade alerts and scanners. You can manually find your own swing trade setups using the swing trade scanner, or simply sign up for Swing Trade Alerts to get hand-picked trades sent to your inbox each week.

Stock Market Guides offers backtested investment strategies designed to help traders buy low and sell high in the stock market.

It provides stock and options picks by backtesting hundreds of thousands of trades using historical data. The idea is to analyze short-term swing trade setups with detailed backtesting to find patterns that can be used to pick future winners.

Stock Market Guides is best for traders that want simple alerts without an overwhelming amount of info. But you may need some experience trading so you know how to apply the alerts within your own trading software.

Entry and exit points — as well as rough dates on when to place Buy and Sell trades — make Stock Market Guides a more straightforward option than some trade alert services.

For more info, check out our Stock Market Guides review.

What You Get With Membership

- Historical backtested investment strategies

- Trade alerts from 3 days up to one year

- Exact entry and exit prices

- Complete trade setup details

- Two trading portfolios to choose from

- Access to trading experts to ask questions

2. Mindful Trader – Best for Simplicity and Transparency

- Overall Rating: 3.5 / 5

- Cost: $47/month

- Track record: 141% annual returns based on 20-year backtest

Mindful Trader is a stock-picking service and alert service that is based on personally picked stock by Eric Ferguson. Eric is an economics major from Stanford and successful stock trader that used his love for mathematics, analytical research, and the stock market to build a trade alert service for stock and options traders.

The Mindful Trader service is much more personal than most swing trading alerts. Eric shares his picks as he trades them LIVE, and members can access his live trades page at any time.

There are no email or text alerts — you have to use a third-party system to get those — but Eric does keep his trades page up-to-date. All picks come with entry/exit points and backtested success rates.

Eric is also responsive to questions via email and sends out daily email commentaries with his thoughts on the market. There’s also a “Watch List” for trade setups you can review ahead of Eric placing trades.

If you want simple swing trade alerts directly from a successful stock and options trade — Mindful Trader may be a good option.

What You Get With Membership

- Thoroughly researched and backtested trades

- Trade alerts in real-time

- Direct access to Eric Ferguson via email

- 1 – 3 stock picks per day

- Stock and options picks

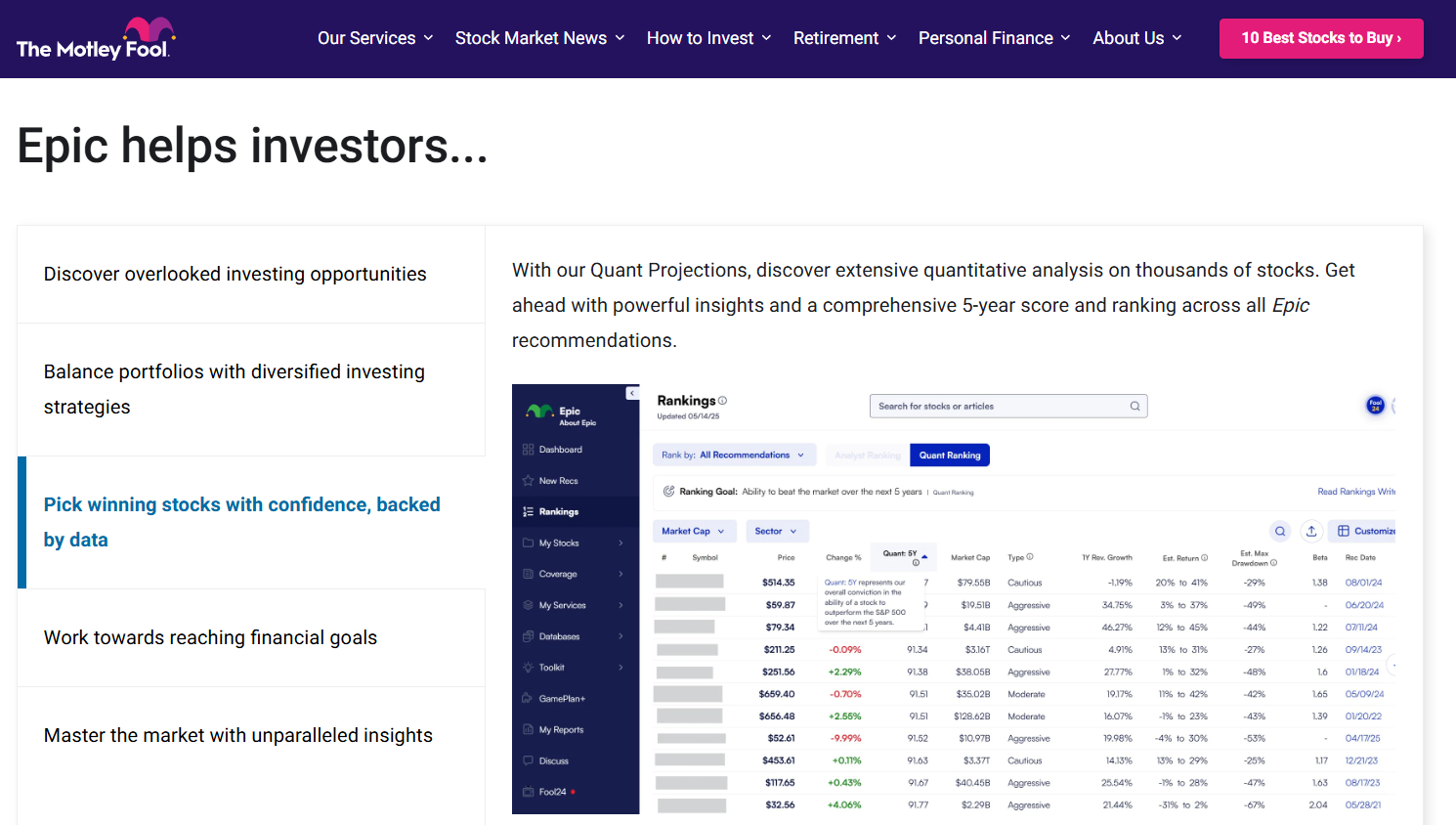

3. Motley Fool Epic – Best for Fundamental Momentum Plays

- Overall Rating: 4 / 5

- Cost: $499/year (Get $200 off for a limited time using links in this post)

- Track record: Varies by strategy, up to 881% annually on some picks

Motley Fool is a huge name in the investing world, and their Motley Fool Epic trading alerts services offers data-backed alerts on 5 new stocks each month. The “Epic” service focuses on longer-term swing trades based on strong fundamentals.

As part of your subscription, you also get access to four stock ranking lists including Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor.

You also can access Motley Fool’s 5-year Quant score for every publicly traded company, and estimated returns and drawdowns for each company as well.

Motley Fool offers a huge quite of tools and analysis all within the Epic package, and every monthly alert comes with the following:

- The ticker symbol

- The company name

- Suggested action (Buy/Hold/Sell)

- Type (Cautious / Moderate / Aggressive)

- Service (SA / RB / HG / DI)

- Date recommended

If you want access to long-term swing trade alerts and a whole lot of useful trading tools, Motley Fool Epic may be worth a look. For more information, check out our detailed Motley Fool Epic review.

What You Get With Membership

- 5 picks/month

- Monthly recommendations and rankings from Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor

- A robust toolkit including Cautious, Moderate, and Aggressive Portfolio Strategies with specific stock allocation, FoolIQ research tools, simulators, and more

- Access to full historical financial data, max drawdown, and projected annualized returns for all publicly traded companies in Fool IQ

- Access to Motley Fool’s GamePlan+ financial hub and financial planning articles

- Access to Motley Fool’s proprietary stock scoring system, driven by their Quant team (Quant 5Y)

- Premium access to Epic Opportunities, a members-only podcast

- Articles and earnings coverage on an expanded universe of stocks

4. Seeking Alpha’s Alpha Picks – Best for High-Conviction Trades

- Overall Rating: 4 / 5

- Cost: $499/year (Get $50 off for a limited time using links in this post)

- Track record: 163.27% since service launch (July 2022)

Seeking Alpha is another stock research and analysis platform that offers a wide range of services and alerts. Seeking Alpha’s Alpha Picks is a long-term trader alert service that focuses on high-conviction trades for swing traders and buy-and-hold investors.

The alerts narrow in on small-cap to mid-cap stocks with catalyst-driven upside, making them perfect for swing trade opportunities as well.

A new stock pick is issued every two weeks, and a watchlist of current top-rated buys is always available for you to find hidden gems in the market. The service differs from Seeking Alpha Premium, which offers stock ratings and research. Seeking Alpha Picks

The stock picks are based on Seeking Alpha’s proprietary quant-driven stock ratings, and though the service is fairly new, the picks have far outperformed the market.

In fact, in just three years since the service launched, the picks have achieved a 163.27% return, while the S&P 500 has returned just over 55%.

The alerts are mostly focused on entry points, but if the analysis changes on a given stock, Alpha Picks will issue a “sell” alert. Or you can set your own take-profit and sell points on your trade.

Related reading: Check out our Seeking Alpha review

What You Get With Membership

- Two stock picks per month based on quant models

- Detailed analysis and explanation of each pick

- Watchlist of other potential top stock picks

5. Benzinga Pro – Best Real-Time News Alerts for Swing Traders

- Overall Rating: 3.5 / 5

- Cost: $37/month up to $147/month

- Track Record: Stuff

Benzinga Pro is an all-in-one investing research and stock picking platform that can help you spot swing opportunities early.

Benzinga Pro offers a real-time news feed, audio squawk available in the background with real-time market updates, daily stock picks from professional day traders, and a robust stock scanner.

If you need just-in-time data and LIVE news feed to help you execute on your trades, Benzinga Pro is made for you. The mobile app gives you instant access on the go, and real-time push notifications to get trade alerts as they happen.

The real-time news feed has built in filters and is searchable — it reads like a LIVE chat and is updated 24/7. This allows you to find headlines that can impact your trades, and execute on those trades before the market has time to react.

Benzina Pro is best for active traders who rely on catalysts as part of their swing trading strategy.

What You Get With Membership

- Daily trade picks

- Exclusive stock market stories in real time

- Background stock market audio feeds

- Robust stock scanner

- Stock alerts & mobile app

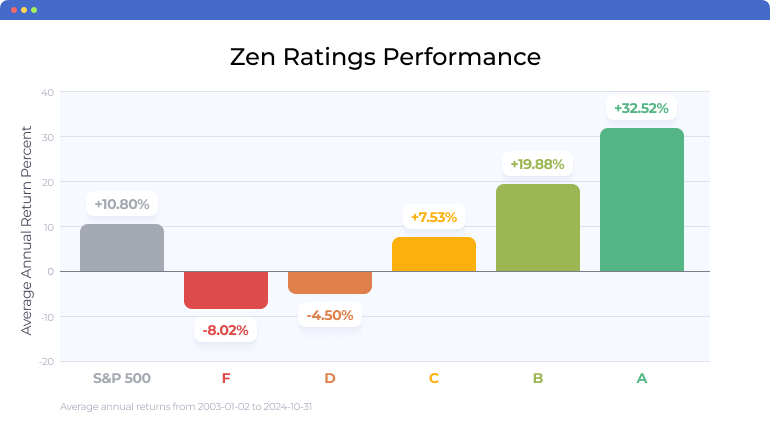

6. Zen Investor (WallStreetZen) – Best for Fundamental + Technical Ratings

- Overall Rating: 4.5 / 5

- Cost: $99/year (get it for $79/year for a limited time using links in this post)

- Track Record: 32.52% returns on A-rated stocks since 2003

Zen Investor is a stock-picking service that gives swing traders best of both worlds by leveraging both artificial intelligence and a human touch.

If you’re a swing trader looking to narrow down momentum trades and companies with great fundamentals, Zen Investor offers picks that can benefit from medium and long-term trends.

The newsletter and portfolio are managed by Steve Reitmeister, former Editor in Chief of Zacks.com and a market veteran with 40+ years of stock trading experience.

But the service doesn’t rely on his experience alone. There’s powerful tech behind his process.

Before a stock gains a coveted spot in the Zen Investor portfolio, it goes through the ringer via a four-step selection process.

As part of that process, each potential stock is screened through the Zen Ratings system, a proven model that boasts a track record of average annual returns of 32.52% for A-rated stocks.

How does Zen Ratings work? Simply put, it screens every stock to look for 115 factors proven to drive stock growth.

One of the most innovative factors? The Artificial Intelligence (AI) factor.

The Zen Rating AI factor stands out among AI investing tools by merging key elements — earnings, cash flow, price movement, and industry trends — into a single, actionable insight.

This factor employs machine learning using a Neural Network trained on 20+ years of fundamental and technical data. It can detect patterns beyond human capability, offering a deeper view of not only past performance but potential for future price movements. (Read more about the AI Component here.)

Plus, with advanced cross-validation, the artificial intelligence avoids overfitting, ensuring it adapts to the market today and in the future, adjusting for things like market volatility rather than just past market trends.

But what truly makes Zen Investor stand out in the AI stock picking space is the fact that it incorporates human expertise — Reitmeister’s process also considers top analyst selections and leverages his decades of market experience to further refine stock selection.

What You Get With Membership

- AI-powered stock picking with Zen Ratings with an AI score for each stock

- Fundamental and technical analysis reports

- Human-vetted stock recommendations

- Weekly stock market insights

- Portfolio management tools and webinars

- Educational resources and investing tutorials

Additionally, WallStreetZen just launched a new premium subscription — Zen Strategies.

Zen Strategies features curated portfolios of 7 stocks for 11 respective, proven trading strategies. (So – you get access to 77 stocks total.)

Currently, one of the most popular strategies revolves around the Zen Ratings AI Factor, which leverages AI to create + manage an entire portfolio of stocks that have passed AI stock analysis from a neural network trained on 20+ years of data.

It’s a strongly-performing portfolio, with 48%+ all-time annual returns.

If that sounds interesting to you, now’s the time to check it out. As for peace of mind? There’s a 90-day money-back policy and a 100% performance guarantee. Why not give it a shot?

Comparison Table: At-a-Glance Breakdown

Service | Best For | Alert Frequency | Backtested? | Pricing | Ideal For |

Stock Market Guides | Backtested scanners | Multiple Alerts Daily | ✅ | $$ | Intermediate traders |

Mindful Trader | Simplicity | Daily | ✅ | $$ | Part-time traders |

Motley Fool Epic | Long-term swing trades | Biweekly | ✅ | $$$ | Fundamental investors |

Alpha Picks | High-conviction plays | 2x/month | ✅ | $$$ | Value-driven swing traders |

Benzinga Pro | Catalyst alerts | Real-time | ✅ | $$$ | Active traders |

Zen Investor | Smart ratings | Monthly | ✅ | $ | Value/momentum traders |

Final Thoughts: Which Swing Trading Alert Service Is Right for You?

In my opinion, Stock Market Guides is the best overall swing trading alert service.

But all of the services listed in this post are top-notch — it’s all about figuring out what aligns with your strategy.

For instance:

- If you’re a beginner, platforms like Mindful Trader and Motley Fool Epic give you handpicked trade alerts you can execute on easily.

- For more experienced traders, getting real-time alerts from Benzinga Pro can give you an edge in your trades.

- And longer-term swing traders that want fundamental and technical analysis backed by an experienced stock picker, Zen Investor is your best bet.

Many of these services offer a free trial or lower-cost option, so pick one you think will be a good fit and give it a try.

Swing trading requires patience, analysis, and the ability to move when the market does. Offloading your research and analysis to a trusted stock picking service can help save you hours per day, as well as show you opportunities you may never have thought of.

If you’re a serious swing trader that needs an edge in the markets, picking a service that fits your trading style can help you increase your success rate (and your overall profit).

FAQs:

What are swing trading alerts?

Swing trading alerts are platforms that send you an alert signal then a stock is picked for a specific trade position. Swing trades can be made on stocks and options trades, and usually involves an entry price to purchase the stock at, a holding period, and exit price (and date).

Alerts can help you find stocks that have the chance to go up (or down) in value over the coming days or weeks, and give you the ability to place and trade to take advantage of that price swing.

How do I choose a good swing trade alert service?

The best swing trade alert services are backed by mountains of research, are fully backtested, and have a high success rate and track record.

You also want to find a service that makes it easy to understand the trade details. Knowing when to purchase a stock, at what price to buy and sell, and when to exit can help you become more profitable in your trades.

Are paid swing trade alerts worth it in 2025?

In most cases, probably not. But there are a handful of services that have taken advantage of AI and quant-driven data to still give you an edge in the market.

Services like Zen Investor and Motley Fool Epic have impeccable track records, Benzinga Pro brings you alerts and investor news in real time, and Mindful Trader is based on personal picks from a successful swing trader.

Can I use multiple alert services together?

Yes, you can use multiple stock picking services to your advantage when you’re trying to build a swing trading strategy.

For example; Using Zen Investor to find A-rated stocks based on fundamental and technical analysis, and combining that with real-time news from Benzinga Pro can help you narrow down your Buy and Sell points for a specific stock.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.