The Bottom Line: Is Banyan Hill Worth It?

In my opinion? No.

The company’s aggressive marketing, inconsistent performance, service consolidations, and mixed customer experiences should raise red flags for many investors.

Additionally, the company’s 2.5-star rating on Trustpilot and numerous Better Business Bureau complaints suggest systemic issues.

Plus, it’s expensive — Ian King Strategic Fortunes, their flagship service, costs between $47-$297 annually but faces criticism for overpromising returns. A service with a proven track record and multiple services to choose from like WallStreetZen is a more cost-effective pick.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What You’ll Learn in This Banyan Hill Review

The Reality: Banyan Hill publishing reviews consistently mention frustrated customers who paid thousands for “lifetime” subscriptions, only to see their services discontinued or transferred to new editors with different investment philosophies.

Better Alternatives Exist: For most investors, platforms like WallStreetZen, offer more transparent, cost-effective solutions with proven track records and better customer service — without the high-pressure sales tactics.

This comprehensive review will examine every aspect of Banyan Hill’s offerings, from Ian King’s track record to what really happened to the Paul Mampilly Profits Unlimited service — formerly one of its biggest sellers. We’ll also explore superior alternatives that might better serve your investment goals without the aggressive sales tactics.

What Is Banyan Hill Publishing?

Banyan Hill Publishing is a financial newsletter company founded in 1998, originally focused on offshore investing and asset protection. In 2016, they rebranded and shifted toward U.S.-based investment opportunities, becoming one of the most aggressive marketers in the financial newsletter space.

The company operates under the Agora Companies umbrella — a company known for high-pressure marketing tactics and bold return promises. Today, Banyan Hill claims nearly 700,000 daily readers and positions itself as “America’s No. 1 source for smarter, safer, more profitable investing.”

Their Business Model: Banyan Hill primarily generates revenue through newsletter subscriptions ranging from $47 to several thousand dollars for “lifetime” memberships. They also earn through affiliate partnerships and upselling additional services to existing subscribers.

Looking for great investment ideas? [FREE!]👇

For regular investing ideas and Strong Buy alerts related to market-moving news subscribe to our FREE newsletter, WallStreetZen Ideas.

Banyan Hill Gurus

Ian King

Ian King serves as Banyan Hill’s current flagship analyst after taking over many of Paul Mampilly’s former services. With over 20 years of experience, King started at Salomon Brothers at age 21, later working at Citigroup before spending a decade at New York-based hedge fund Peahi Capital, where his team achieved a 339% total return in 2008 alone.

His Background: King’s credentials are legitimate — he’s a former hedge fund manager with Wall Street experience. However, his transition to newsletter publishing coincided with significant subscriber complaints about performance and communication.

Current Role: King now manages Strategic Fortunes, Extreme Fortunes, and Next Wave Crypto Fortunes, focusing primarily on technology and cryptocurrency investments.

Adam O’Dell

Adam O’Dell serves as Chief Investment Strategist and is among Banyan Hill’s top analysts. A West Virginia native whose parents were first-generation college students, O’Dell previously ran a multimillion-dollar hedge fund before transitioning to newsletter publishing.

His Specialty: O’Dell developed the proprietary Stock Power Ratings system and focuses on mega trends like AI, genomics, and renewable energy. His approach tends to be more systematic than King’s trend-focused methodology.

Services: O’Dell primarily manages Money & Markets content and contributes to the company’s daily newsletter, Banyan Edge.

John Wilkinson

John Wilkinson serves as Director of VIP Services with over 30 years of financial industry experience. As the son of a career Naval officer who spent his youth overseas, Wilkinson brings a global investment perspective to Banyan Hill’s premium publications.

Andrew Prince

Andrew Prince joined Banyan Hill in 2021 as a research analyst supporting Ian King’s services. He handles much of the behind-the-scenes analysis for Strategic Fortunes and related publications.

What Happened to Paul Mampilly’s Profits Unlimited?

Here’s a guru you won’t see anymore at Banyan Hill — Paul Mampilly. So where did he go, and what happened to his Profits Unlimited newsletter?

The Timeline: Paul Mampilly retired from Banyan Hill in 2022. Ian King took over the Profits Unlimited portfolio, which has been merging into his Strategic Fortunes newsletter.

Subscriber Impact: Customers who “paid thousands of dollars for lifetime subscriptions to four Paul Mampilly products” found that “Paul left Banyan Hill just three years after I purchased the … subscription.” Many services lasted less than a year after purchase.

The Substitution: Upon Mampilly’s departure, “without any discussion, Banyan Hill substituted two services, Extreme Fortunes by Ian King, and 8 Figure Fortunes by Charles Mizrahi for the four original Mampilly services.

Customer Reaction: Reviews indicate subscriber anger: “I am done with BH. In my opinion they are only interested in selling subscriptions, even if they have to lie.” Many customers followed Mampilly to his new venture at ATG Digital.

Key Services

Free Newsletter

Banyan Hill recently consolidated their four daily newsletters into “Banyan Edge,” where experts share their best weekly ideas to reduce email overload for subscribers.

What You Get: Market commentary, occasional stock picks, and aggressive promotions for paid services.

The Reality: The free content serves primarily as a lead generation tool. Expect frequent sales pitches for premium services.

Strategic Fortunes

What it is: Ian King’s flagship monthly newsletter focusing on “tipping-point trends” in technology sectors.

Track Record: Banyan Hill claims Strategic Fortunes delivered a “90% annualized return compared to just 28% in the S&P 500 over the last year.” However, independent verification of these claims is difficult, and customer reviews mention Ian King having “only a 44% win rate way below 50%.”

Cost: Strategic fortunes is priced at $79 for basic annual access.

Is Strategic Fortunes Worth It?

The mixed reviews suggest caution. While some subscribers report gains, others express frustration with performance and customer service. Complaints include “aggressive marketing practices” and “mixed subscriber experiences” with some reporting “poor-performing picks or difficulty accessing promised refunds.”

Strategic Fortunes Pro

What it is: The upgraded version of Strategic Fortunes with additional quarterly picks, live calls with Ian King, and exclusive educational content.

Track Record: No independently verified performance data available.

Cost: $199-$297 will get you Strategic Fortunes, plus additional features and bonus reports.

Is Strategic Fortunes Pro Worth It?

The lack of transparent performance data and numerous customer complaints about upselling tactics suggest most investors should consider alternatives.

If you want expert-guided investment advice, WallStreetZen’s Zen Investor service costs just $99/year ($79 for a limited time, using links in this post) and focuses on established companies — without crypto’s extreme volatility.

Next Wave Crypto Fortunes

What it is: Ian King’s cryptocurrency-focused service targeting “America’s top crypto expert” status, claiming his “top performing trade transformed $1,000 into a $120,000 windfall within a year.”

Track Record: Crypto-focused services face inherent volatility challenges, and customer reviews mention significant losses during market downturns.

Cost: remium pricing ranging from $995 to $2,995 annually — significantly more expensive than most newsletter services.

Is Next Wave Crypto Fortunes Worth It?

For most investors, probably not. At $995-$2,995 annually, you’re paying premium prices for advice in the most volatile asset class, with crypto markets trading 24/7 making timing-sensitive newsletter advice particularly challenging.

Most investors would benefit more from starting with established platforms like Coinbase, sticking to major cryptocurrencies, and educating themselves through free resources like Coinbase Learn rather than expensive newsletters.

Extreme Fortunes

What it is: King’s small-cap focused service targeting companies with “enormous potential” for “500%, 1,000% — or more” gains.

Track Record: Small-cap investments carry high risk, and subscriber reviews indicate significant losses alongside occasional winners.

Cost: Premium pricing structure similar to other King services.

Is Extreme Fortunes Worth It?

The high-risk nature of small-cap investing combined with mixed subscriber feedback suggests this service appeals to a very specific risk-tolerant audience.

Premium Bundle: Profits Reserve

What it is: Access to multiple Ian King services bundled together for subscribers wanting comprehensive coverage.

Track Record: Combined performance data is not transparently available.

Cost: Multi-thousand dollar annual fees, often marketed as “lifetime” deals with annual “maintenance” charges.

Is Profits Reserve Worth It?

Customer reviews warn: “Don’t buy the lifetime membership. I did only to see services change with new managers, new strategies, and new services that you must purchase to receive.”

Premium Bundle: Total Wealth Fellowship

What it is: Banyan Hill’s “most exclusive level of membership” providing “VIP access” to all services plus annual symposium access and conference recordings.

Track Record: No specific performance data available for the bundle approach.

Cost: The highest-tier membership with costs reaching several thousand dollars annually.

Is Total Wealth Fellowship Worth It?

The exclusive nature and high costs target wealthy investors, but reviews consistently warn about service changes that undermine “lifetime” value propositions.

Banyan Hill Alternatives

For investors seeking reliable research without aggressive marketing tactics, several superior alternatives exist:

1. WallStreetZen – Zen Investor

Cost: $99 annually ($79 using the links in this post) — significantly less than most comparable services.

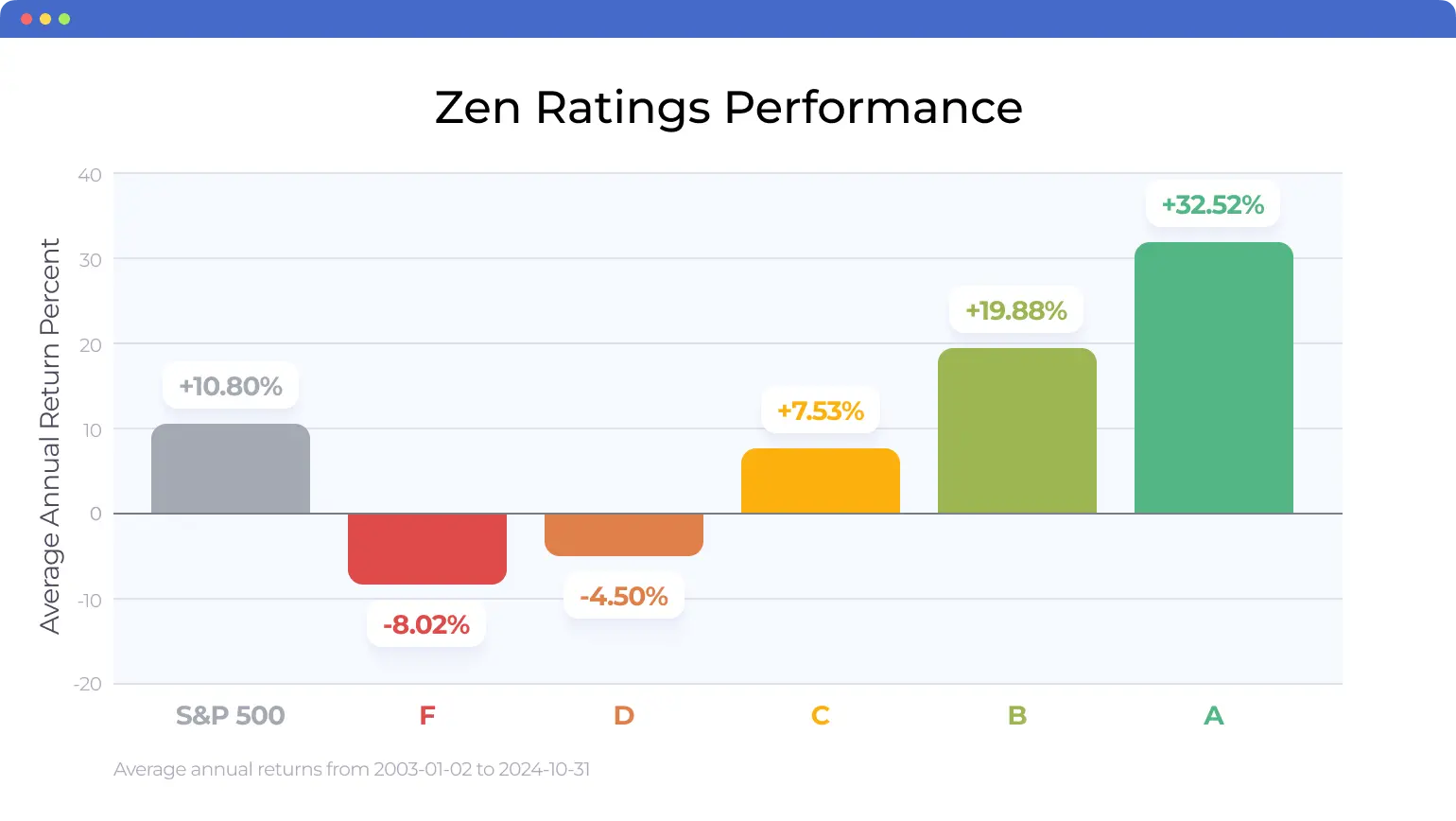

Track Record: Reitmeister chooses stocks using the Zen Ratings system; stocks rated as “Strong Buy” using this quant ratings system have historically delivered 32.52% annual returns.

What it is and who it might be better for:

WallStreetZen’s Zen Investor is led by Steve Reitmeister, a 40+ year market veteran and former editor-in-chief of Zacks.com. Unlike marketing-heavy stock picking services, Reitmeister follows a disciplined 4-step process to identify high-potential stocks:

- Track Top-Performing Analysts: Monitors the best Wall Street analysts to ensure only high-quality recommendations make the cut

- Screen with Zen Ratings: Filters stocks through WallStreetZen’s proprietary system that analyzes 115 proven factors and provides easy-to-understand A-F grades

- Deep-Dive Analysis: Evaluates growth potential, focusing on earnings surprises, attractive valuations, and robust growth prospects

- Expert Selection: Handpicks 20-30 stocks using decades of investment experience to navigate market conditions

Subscribers gain access to a focused portfolio, monthly market commentary, sell alerts, and members-only webinars—all backed by data-driven insights rather than aggressive upselling.

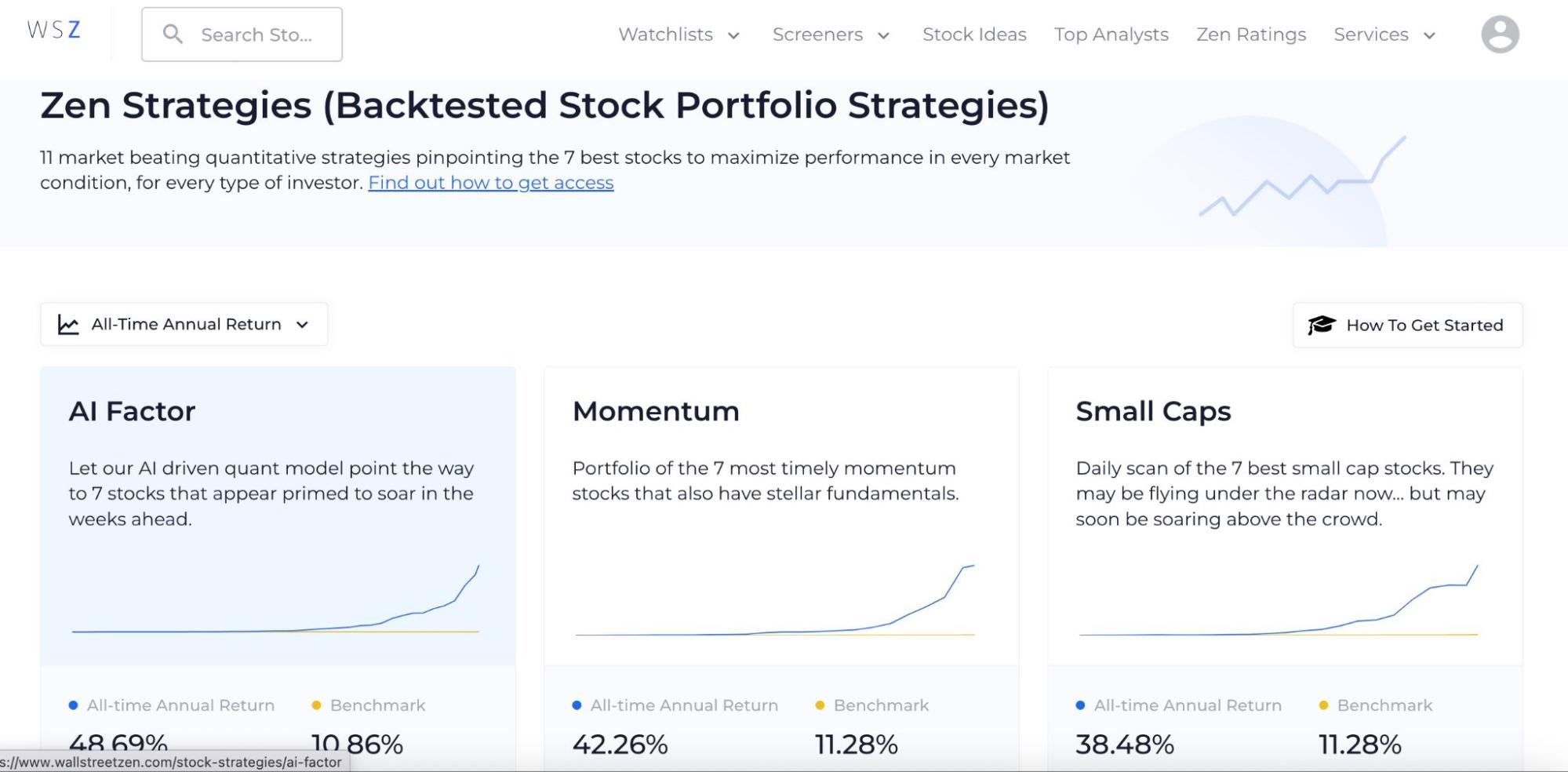

2. WallStreetZen – Zen Strategies

Cost: Starting at competitive pricing compared to Banyan Hill’s premium services, with a 90-day money-back guarantee and 100% performance guarantee.

Track Record: Multiple portfolios have delivered exceptional returns—AI Factor +48.01%, Momentum +42.17%, and Under $10 +35.02% all-time annual returns. These results are based on backtested quantitative strategies refined from over 115 proven factors.

What it is and who it might be better for:

Zen Strategies gives you insider access to a variety of backtested proprietary quantitative trading strategies and curated stock picks. Within each of the 11 strategies, a theme or investing style has been fine-tuned to identify a portfolio of the very best 7 stocks (so that’s 77 high-potential stocks total that you can choose from).

Each subscription includes:

- 11 backtested quantitative portfolios, each containing 7 carefully selected stocks (77 total high-potential stocks)

- Diverse strategy themes including AI Factor, Momentum, Small Caps, Under $10, Value, Dividend Growth, and more

- Weekly insights and updates from Editor-in-Chief Steve Reitmeister

- Quick Start Guide designed to be implemented in as little as 10 minutes per month

- 90-day money-back guarantee plus a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund

With several of the portfolios racking up 48%, 42%, and 35% all-time annual returns, it’s not hard to see why it’s quickly become WallStreetZen’s most popular offering.

3. Motley Fool – Stock Advisor

Cost: $1.43 a week for your first two years*

Track Record: Since launching in 2002, Stock Advisor’s average stock pick has returned 1,068% compared to the S&P 500’s 184% over the same period—outperforming the market by nearly 6x.

What it is and who it might be better for:

The Motley Fool Stock Advisor, led by co-founders Tom and David Gardner, provides 2 carefully selected stock picks each month—one from each team.

Their approach focuses on long-term, buy-and-hold investing (5+ year holding periods), making it ideal for patient investors who want to build wealth steadily rather than chase quick gains.

Each month, subscribers receive:

- Two new stock recommendations (24 picks per year)

- “Best Buys Now” list highlighting top opportunities

- In-depth research reports and company analysis

- Access to a supportive community of 500,000+ investors

Unlike aggressive marketing-heavy services, The Motley Fool emphasizes education, diversification (25-30 stocks), and holding through volatility. Their conservative, proven approach contrasts sharply with bold return promises and high-pressure sales tactics. For more, check out our Stock Advisor review.

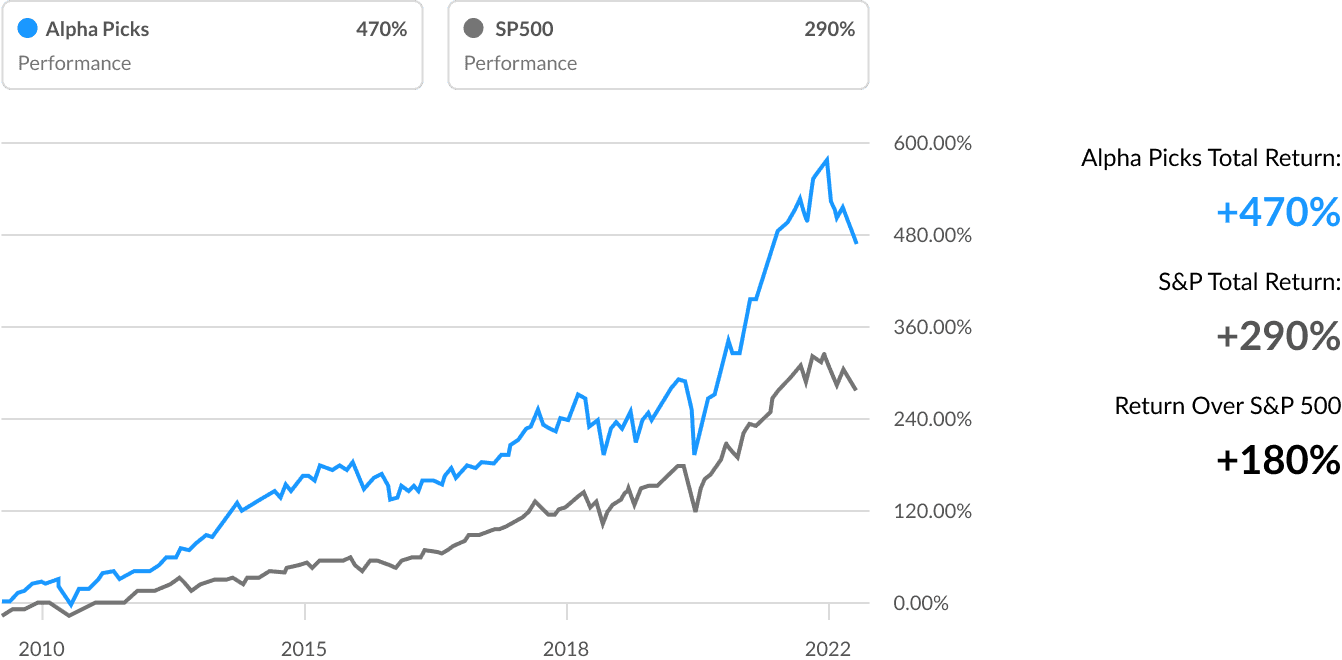

4. Seeking Alpha – Alpha Picks

Cost: $449 annually — higher than some alternatives but includes quantitative analysis.

Track Record: Strong performance with +127.70% returns versus S&P 500’s +47.21% since July 2022 launch, based on systematic quantitative methodology.

What it is and who it might be better for:

Seeking Alpha’s Alpha Picks uses a systematic, data-driven approach rather than individual analyst opinions. Led by Steven Cress (30+ years Wall Street experience, former Morgan Stanley trader), the service employs quantitative algorithms to analyze thousands of stocks based on factors like value, growth, profitability, and momentum.

Each month, subscribers receive:

- Two “Strong Buy” recommendations (24 picks per year)

- Performance tracking and notifications on how your investments are doing

- Clear buy/sell guidance presented in a simple, user-friendly format

- Research rationale explaining why each stock was selected based on quantitative factors

Alpha Picks delivers two stock picks monthly based on their proven quant rating system, removing human bias and emotional decision-making from stock selection.

Alpha Picks focuses on providing monthly picks based on proprietary research, allowing users to make quick investment decisions without the need for in-depth research.

This appeals to investors who prefer systematic, rules-based investing over following individual newsletter editors—and who want to avoid the risks that plagued Banyan Hill subscribers when Paul Mampilly left.

5. eToro CopyTrader

Cost: No subscription fees — costs based on trading activity and spreads.

Track Record: Transparent performance tracking for all traders you can copy.

What it is and who it might be better for:

CopyTrader allows you to automatically copy successful traders’ portfolios, eliminating the need for newsletter recommendations entirely. This approach provides direct market exposure without subscription-based intermediaries.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Final Word

Banyan Hill publishing reviews reveal a company struggling with credibility issues after key personnel departures and service consolidations. While some subscribers report positive experiences, the pattern of complaints about aggressive marketing, service changes, and inconsistent performance suggests most investors should explore alternatives.

Smart investors compare multiple research sources rather than relying on single newsletter services. Consider an alternative like WallStreetZen (free and paid tiers available) and try out the Zen Ratings system to develop your analysis skills before committing to expensive subscriptions.

FAQs:

Is Banyan Hill publishing worth it?

Based on customer reviews and track record analysis, Banyan Hill's mixed performance and aggressive marketing practices make it difficult to recommend over superior alternatives.

The company's 2.5-star Trustpilot rating and numerous service consolidations suggest systemic issues beyond normal market volatility.

What happened to Paul Mampilly's Profits Unlimited?

Paul Mampilly left Banyan Hill around 2022, and his Profits Unlimited service was merged into Ian King's Strategic Fortunes. Many subscribers who paid thousands for "lifetime" access to Mampilly's services received substitute services they didn't request, leading to significant customer dissatisfaction.

Is Ian King's Strategic Fortunes legit?

Ian King Strategic Fortunes is a legitimate service with real stock recommendations, but customer reviews indicate mixed performance and aggressive upselling tactics. Independent verification of claimed returns proves difficult, and subscriber feedback suggests a win rate below 50%.

What is better than Banyan Hill Publishing?

WallStreetZen offers superior transparency, proven analyst performance tracking, and competitive pricing without aggressive marketing tactics. Other alternatives include Motley Fool Stock Advisor, Seeking Alpha Alpha Picks, and eToro CopyTrader — all offering better value propositions than Banyan Hill's premium services.

How much do Banyan Hill Publishing subscriptions cost?

Banyan Hill subscriptions range from $47 for basic Strategic Fortunes access to several thousand dollars for premium bundles like Total Wealth Fellowship.

However, many subscribers report additional "maintenance" fees and aggressive upselling that significantly increase total costs.

Is Banyan Hill good for crypto advice?

Probably not for most investors. Ian King’s Next Wave Crypto Fortunes is marketed heavily but costs thousands per year, and newsletters in crypto face a core problem: timing. Because crypto trades 24/7, recommendations often arrive too late to capture the best entry or exit points.

On top of that, subscriber complaints about upselling and service changes raise red flags. You’ll likely get better long-term results from trying your hand with the alternatives listed above, or self-education and straightforward exposure.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.