There’s no such thing as a “risk-free” investment. But that doesn’t mean you need to go hardcore YOLO to be successful.

There are degrees of risk in investing. Today’s investors have access to more assets than ever to create a dynamic and diversified portfolio.

If you’re looking for a “best of both worlds” approach, consider adding moderate-risk investments to your holdings. While they may not have the stability of CDs or high-yield savings, medium-risk investments have the potential to provide impressive returns, making them worth considering if you can handle slightly higher uncertainty.

In this article, I’ll share the 11 best medium-risk investments for potential long-term returns:

One of the best ways to mitigate risk? Diversify.

moomoo makes it easy to diversify by giving new account holders up to $1000 in NVDA stock — plus a groovy 8.1% APY on uninvested cash.

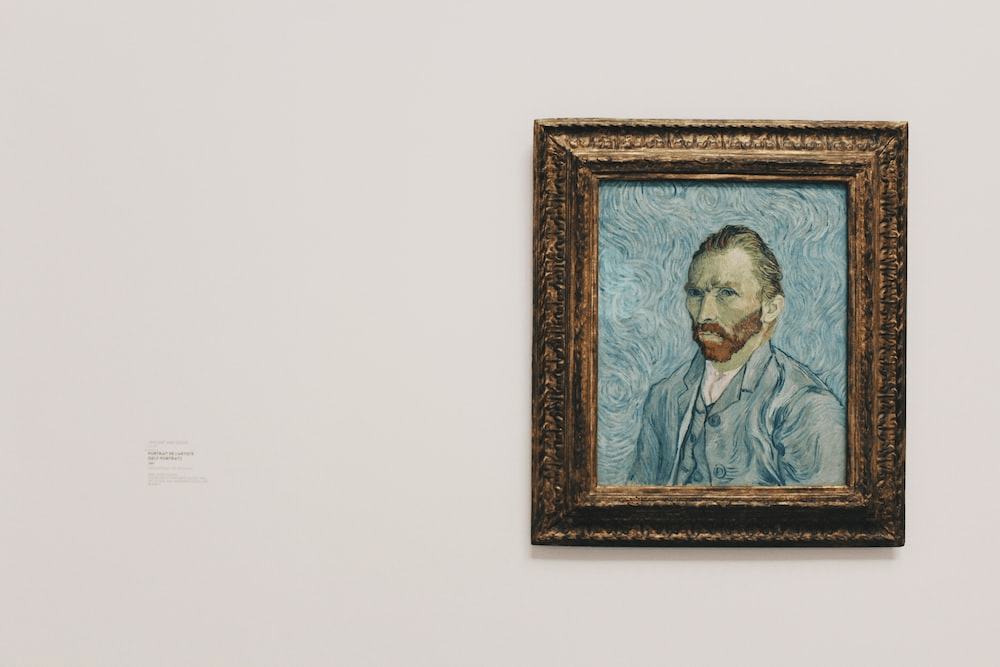

1. Fine Art Investing with Masterworks

Risk level: 6/10

Forget “aesthetic arrest” and “experiencing the sublime.” For investors, fine art is all about status and financial stability.

Get this: High-quality fine art appreciated over 250% versus the Standard & Poor’s Index between 2000 and 2018. Although past performance can’t predict the future, in recent memory, masterpieces have appreciated to the tune of 13.8% per year for the past 25+ years — higher than both stocks and real estate, respectively.

Thankfully, you don’t have to be Monty P. Moneybags to invest in artistic brilliance.

True, buying an original painting by Pollock is outside the reach of many investors. But it’s now possible for anyone to get involved in the fine art field through fractional fine art investing platform Masterworks.

On Masterworks, investors can buy SEC-approved “shares” in pieces by artists like Warhol, Monet, and Bansky. Once you hold a slice of a masterpiece, you can sell it on the secondary market or hold it until Masterworks liquidates it from its portfolio.

(Curious about its track record? Recently, Masterworks has delivered 14%, 17%, and 21% net annualized returns to investors.)

Worth noting — Masterworks does currently have a waitlist. Good news — we’re connected. Use this link to skip the waitlist.

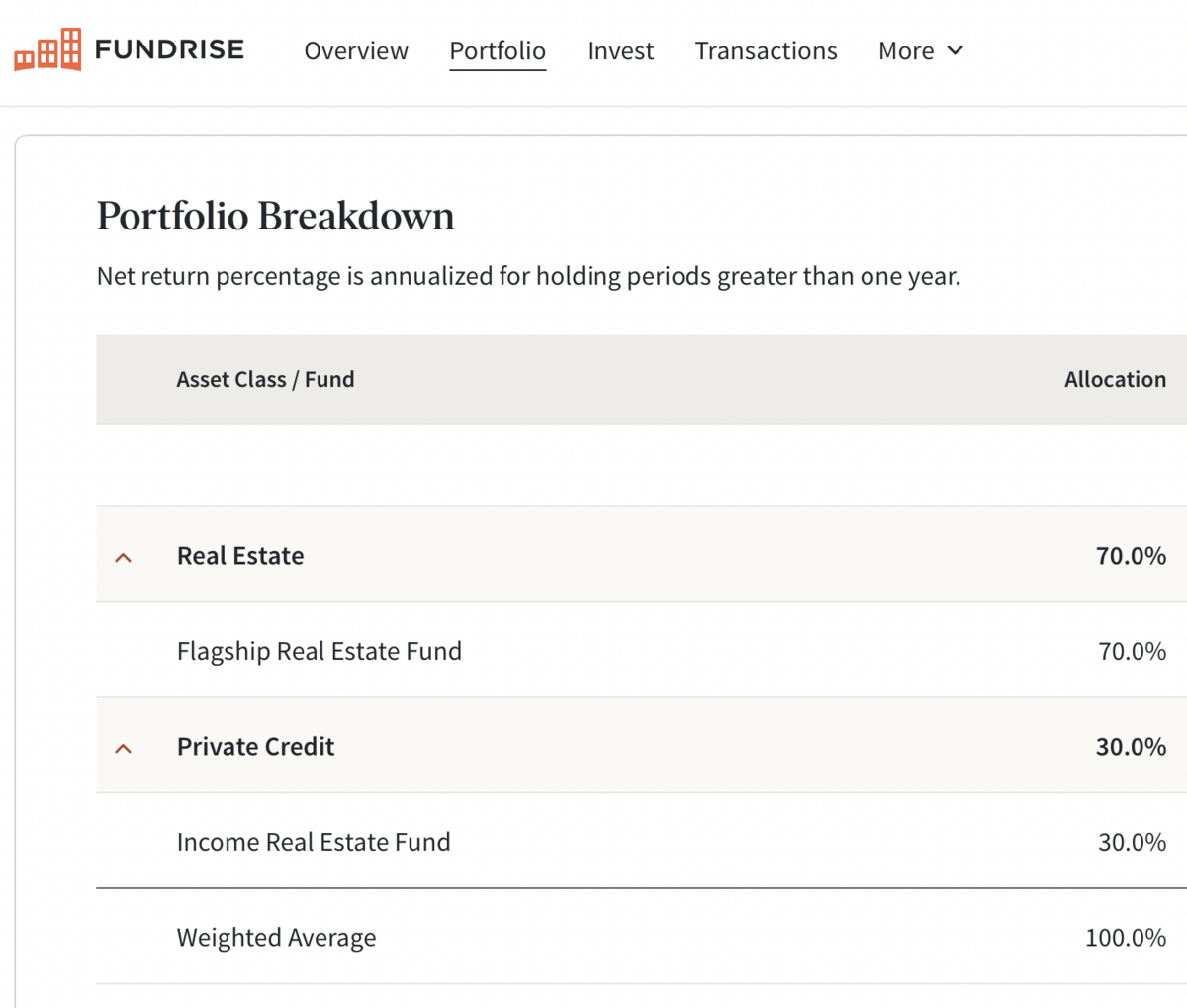

2. Crowdfunded Real Estate

Risk level: 5/10

Shelter is one of the necessities of life, so it makes sense real estate is such a sensible investment.

On average, real estate returns roughly 10% per year to property holders, which could be even higher in high-demand areas.

But real estate can be expensive. If you’re looking for the best way to invest $50K or less, for instance, you might think it’s not accessible to you. Wrong.

While taking out a mortgage is the standard way to break into real estate, investors now have access to crowdfunded real estate sites that offer shares in desirable properties. And they come in all styles.

For instance, Arrived Homes lets you invest in fractional shares of residential rental properties — so you can potentially reap some of the benefits of collecting rental income without being a landlord. With a minimum investment of just $100, it’s accessible to a wide range of investors. (P.S. — Jeff Bezos of Amazon fame was an early investor in Arrived Homes.)

Fundrise is another platform that can give you access to real estate — in addition to other assets like private credit. Fundrise allows you to personalize your portfolio on the platform to reflect your goals.

That might include buying shares in multi-family homes, industrial properties, and vacation rentals to take advantage of long-term growth potential and consistent rent.

Note: We earn a commission for this endorsement of Fundrise.

3. Farmland

Risk level: 4/10

There’s a lot of money to be made in fertile fields and farmland. Hey, farmers don’t use the phrase “cash crops” for nothing!

Historically, farmland returns investors about 11% annually, making it a fantastic potential portfolio diversifier.

But you don’t need to drop everything and go to agriculture school to start earning a yield in this field. Heck, you don’t even need a green thumb to collect some green on a few acres.

Acretrader is a farmland-focused platform that allows accredited investors to buy land throughout the USA.

Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

Read our full Acretrader Review and visit the Acretrader site to find out more about how this innovative platform works.

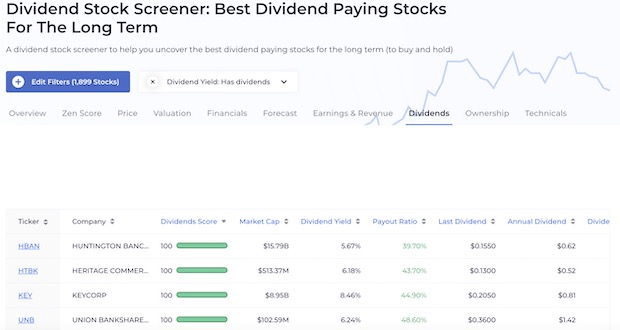

4. Dividend Stocks

Risk level: 6/10

In terms of risk, stocks range from wildly speculative to relatively secure investments.

On the one extreme, there are exotic penny stocks and SPACs, but plenty of “tried and true” diversified mutual funds and ETFs appeal to conservative investors.

So, what are moderate-risk investments in the stock market?

While every analyst has a different opinion on the “riskiness” of an equity, dividend stocks often fit the mold of “medium-risk investments.” Why? Well, since these stocks offer consistent payouts, it cushions potential losses should the stock drop in value.

On the flipside, the stock could sink, and there’s always the potential for a dividend cut — hence the higher risk.

If you’re curious about adding dividend stocks to your portfolio, check out WallStreetZen’s Dividend Stock Screener. Here, you’ll find the dividend deets on publicly traded companies, including historical payouts, average yields, and ex-dividend dates.

Once you know what dividend stocks meet your risk criteria, sign up for a brokerage platform like moomoo to start stocking up on shares.

5. Corporate Bonds

Risk level: 4/10

If you want the consistent returns of a dividend stock without the risk of actually investing in a company, corporate bonds may be a better fit.

With a corporate bond, you don’t own a company’s equity. Instead, you buy an IOU, which entitles you to interest payments until your bond reaches maturity.

Since bonds are legally binding contracts, it’s less likely a company will stop paying interest versus cutting a dividend. Even if a company goes bankrupt, bondholders have more legal rights to a company’s assets than shareholders.

It’s also easier to gauge the “riskiness” of a corporate bond compared with dividend stocks because companies like Moody’s put out helpful creditworthiness ratings.

The tradeoff with buying corporate bonds versus stocks is the former offers a fixed rate, while a company’s equity has the potential for significant upside. Also, bonds are a multi-year commitment, so you won’t realize your full gains till they reach maturity.

If you’re curious about building your bond portfolio, financial service companies like M1 Finance offer easy access to many corporate bond strategies.

6. Private Companies

Risk level: 8-10/10

Historical data from 1980 to 2020 shows shares of new IPO companies rose approximately 18% on their first trading session.

Believe it or not, there are a few platforms investors can use to scoop up equity in private companies before they IPO, if investors are comfortable accepting the significant risks involved. The best one is Hiive.

Hiive lets accredited investors buy stock options for multi-million-dollar pre-IPO companies, including big names like Waymo and OpenAI.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out companies you like, add them to your watchlist, and get notified about any new listings and trades.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

7. Private Credit

Risk level: 6/10

Private loans aren’t as easy to buy as standard bonds, but they’re a super popular option for investors. In fact, estimates suggest the private credit market ballooned to $1.2 trillion in 2021 — 25% up from the market size in 2020.

Why are so many companies and investors jumping into private credit? Although private credit is riskier than government or corporate bonds, they tend to offer higher interest rates and shorter repayment schedules.

The tricky part about investing in private credit is finding a way into this niche. Thankfully, a few alt-financial platforms like Percent are filling this void.

Accredited investors with a Percent account get access to single and “blended” private credit deals with various rates, maturity dates, and risk profiles.

To learn more about how Percent works, check out WallStreetZen’s complete Percent Review. You can also set up your Percent portfolio using this link.

8. Peer-to-Peer Lending

Risk level: 6/10

The Internet is opening up a new “sharing” economy where everyone has the freedom to borrow or lend. Instead of working through a traditional financial institution, some borrowers want to work directly with a lender to set more flexible terms and avoid the hassle of extra fees or official paperwork.

On a peer-to-peer (P2P) lending platform, investors can loan money and collect interest similar to a traditional loan. While P2P loans often carry a higher risk of default, the more flexible rates and maturity times may be worth it in a moderate-risk investment strategy.

Depending on the P2P lending site and the type of deal a lender enters, earning upwards of 8% APY in this sector is possible.

These gains increase even further if people venture into the volatile crypto industry. The decentralized finance (DeFi) space has dozens of blockchain-based lending platforms like Aave offering attractive rewards on crypto-backed loans.

However, you don’t have to be a Bitcoin believer to participate in the P2P lending market. Sites like Prosper and LendingClub are a few ways to research this unique investment opportunity.

9. Low-volatility Index Investing

Risk level: 3/10

More beta isn’t necessarily better in a long-term stock index portfolio. In fact, studies comparing the S&P 500 Index and the S&P 500 Low-Volatility Index suggest you’d get the same, if not better, returns with the latter option without taking on as much risk.

Monitoring a deliberately low-volatile portfolio may not be exciting, but this option is often a great defensive move if you have a multi-year horizon.

As more investors demand medium-risk investments, it’s getting easier to find ETFs and mutual funds designed to track the least volatile equities in a given sector. Fidelity, Vanguard, and Invesco are just a few of the big names in finance now offering low-volatility options to clients.

With a brokerage account (we suggest moomoo), you’ll find plenty of ways to add low-volatility indexes to your moderate-risk investments. Alternatively, you could pick your favorite stocks with historically low price fluctuations and craft a personalized portfolio.

Plus, check out the stocks on WallStreetZen’s Low Beta Stock screener to find some low-volatility options.

10. Robo-Advisor

If thoughts of advanced cyborgs fill you with dread, robo-advisors may not be the right move for your sanity. However, those on board with AI advancements often love the convenience robo-advisors provide in managing their medium-risk investments.

While robo-advisors don’t have the human touch of a personal wealth manager, they handle the same tasks in managing your money. Input your financial goals and risk tolerance, and watch as the algorithms work their magic.

The advantage of going the robo-advisor route is the cost. Since these platforms have less overhead, they typically charge lower fees than if you were to work with a traditional financial firm.

If you’re interested in allocating some funds in the hands of a robo-advisor, Betterment is one name worth checking out. With a Betterment account, you’ll get access to dozens of financial features, including automated investing and AI-generated suggestions.

11. Wealth Management

If you’d prefer to ship the stress of managing a portfolio to the pros, consider working with a wealth management firm.

With over $100 trillion under management, global wealth advisors know a thing or two about building winning portfolios. Once you find a firm that clicks with your investing goals, all you need to do is keep in touch and monitor your performance.

While hiring a wealth manager may cost more in fees, there are few better options for a hands-off investor.

Anyone interested in hiring a wealth manager should check out the platform Empower. With a history dating back to the 1890s, Empower is an indisputable leader in the retirement planning industry. Plus, their fees are significantly lower than some of the “legacy” firms like Schwab or Fisher Investments.

Even if you don’t have the funds for wealth management with Empower (financial services require a $100K account minimum; wealth management requires $250K), they have a FREE dashboard that has plenty of tools that make it worthwhile to sign up.

What Does “Medium Risk Investment” Mean?

Medium-risk investments are any assets or financial services with a track record for reliable gains, but a moderate risk profile.

Honestly, everyone has a different definition of what constitutes a “moderate risk investment.” But overall, you should expect these assets to be slightly volatile — especially when compared with traditionally conservative investments like CDs, high-yield savings accounts, and precious metals.

Benefits of Medium-Risk Investments

Medium-risk investments allow investors to add volatility to their portfolios without going wild with high-risk plays like penny stocks or speculative cryptocurrencies.

While moderate-risk investments don’t offer the security of low or no-volatility options, they also offer a higher reward potential. The even balance of risk and return makes these investment ideas attractive for many investors, even if they’re not the cornerstone of someone’s portfolio.

Final Word: Moderate-Risk Investments

Every investor has a different opinion on what “moderate risk investments” are. But most people agree these assets are a great way to add a touch of spice to your portfolio.

The volatility from moderate-risk investments won’t match high-beta growth stocks, but these ideas aren’t as stable as conservative plays. So, people who can stomach a bit of risk for potentially higher gains may want to consider adding medium-risk investments to their strategy.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

What are considered moderate-risk investments?

Moderate-risk investments have average volatility higher than a bank account, but less intense price fluctuations and better track records versus smaller and more speculative assets.

What percentage is a medium-risk investment?

Medium-risk investment portfolios typically have at least 40 - 60% invested in moderately volatile assets.

What is an example of a medium investment?

A few common examples of medium-risk investments include real estate, fine art, and private equity in a profitable company.

What is a low to medium-risk investment?

Low to medium-risk investments might include high-quality corporate bonds, blue-chip dividend stocks, and a low-volatility stock index fund.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.