Debt is typically considered bad…

Except for the golden-pedestal bound, societally accepted concept of good debt — student loans and — relevant to this article — mortgages.

Most of us don’t buy a house without a mortgage, despite our fantasies of walking into a realtor’s office with a suitcase of money and saying “One home, please!”

In truth, buying a home usually involves decades of mortgage payments, which people naturally want to pay off early to save money.

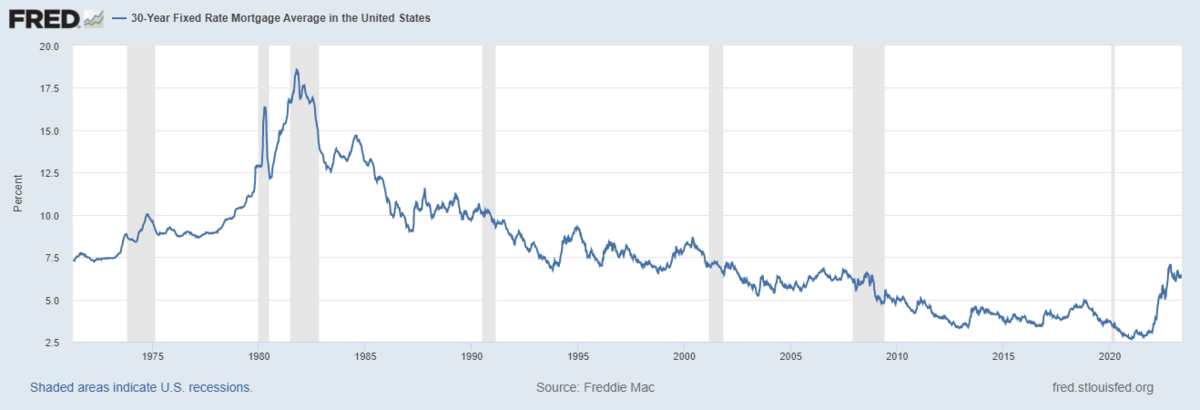

However, as you can see below, the interest rates for a mortgage are typically low, ranging from four to seven percent in the last few years (though they’re on the rise lately).

Given these low interest rates, it’s possible to get more from investing extra cash instead of paying down the mortgage early.

Does that apply to me? Is investing the way to go instead of paying extra on my mortgage?

That’s what we’re here to find out.

Prefer to invest? Consider these platforms:

- For stocks: M1 Finance

- For real estate: Streitwise, Arrived Homes, and Doorvest

- For wine investing: Vinovest

- For collectibles investing: Public

- For art investing: Masterworks

- For gold investing: Silver Gold Bull

Is it Better to Pay Off Mortgage or Invest?

“Should I pay off my house or invest?” is a question financial advisors and homeowners have been asking for years. Everyone has an opinion:

Those that recommend paying off a mortgage point to the following:

- The volatility of the market.

- The risks involved with investing.

- The equity that is getting built in your home.

Those that recommend investing point instead to:

- Better returns from investing.

- The long-term stability of a balanced portfolio, mitigating investing risks.

- Fantastic investment opportunities such as employer matching and tax breaks are potentially missed.

The bottom line: It comes down to risk. Do you want more money? Invest. Do you want more security and home equity? Pay down that mortgage. It depends on your personal and household situation.

Does Paying Off Early Actually Save Money?

Yes, at least compared to letting extra cash sit lazily in a savings account.

Let’s say you have a 30-year $500,000 mortgage and a 4.5 percent interest rate.

- If you paid the minimum amount each month for the 30 years, you’d be paying about $912,034 total over the lifetime of the mortgage.

- If you paid the mortgage off in half the time (15 years), the total payments would be $688,494.

That’s a $223,540 difference. One saves money by paying off a mortgage early. And the higher the interest rate you have, the bigger difference it will make.

However, there’s inflation to consider. Inflation isn’t likely to become deflation (otherwise, the economy is in major trouble).

Your mortgage is locked in. Inflation doesn’t change it. Are the banks and financial systems scrambling with an 8 percent inflation rate (as in 2022) compared to your 4.5 percent mortgage interest rate? That’s their problem.

You will want to consider the real interest rate when making your decision. You will also want to consider potential investments and their inflation-adjusted returns though other decisions usually aren’t locked in like a mortgage is.

Money and value are not precisely the same, but both should be considered in the pay off mortgage early or invest debate.

Consider Your Situation + Goals

Everyone has a slightly different economic situation.

- You might have a very high mortgage interest rate.

- Your career might not guarantee future high earnings.

- Your financial goals might be outside the norm.

- You may want to ensure you can pass on your home to your children.

- You may have excellent investment opportunities that could provide excellent returns.

These are just a few considerations. I’m sure you can think of more.

Pay off mortgage or invest? Before you decide, please consider your goals and where you are financially, honestly, and in-depth. I can provide some context on what to do, but you need to interpret your household situation.

Can’t make heads or tails of your finances?

Empower (formerly Personal Capital) has a slew of free calculators and tools that can help you get a better hold on budgeting and how to work toward your financial goals. Plus, if you have an account of at least $100K, they also offer financial services.

Pay Off Mortgage Early Or Invest? Let’s Explore.

There are many ways to invest and different gradients to paying off your mortgage early.

Theoretically, you can divide your extra money between paying off your house or investing in the markets at any ratio you wish.

It’s less putting all your money in one basket and more deciding which basket to put each dollar in.

You should still know your options to make the right choice with every dollar.

Pay Off Mortgage Early

What it means: You pay extra on top of your minimum mortgage payment, hoping to reduce the effective mortgage term and save money on interest.

Pros:

- There is no risk involved in paying down your mortgage early.

- It provides much more stability if you are closer to retirement and want to secure complete home ownership.

- You gain the psychological benefit of being more debt and payment free, with the financial and personal freedom that offers.

Cons:

- There may be better uses for your extra money.

- Depending on how you pay it off, there could be some tax disadvantages.

- You can refinance your mortgage for a better deal in the right economic climate.

Invest

What it means: Instead of using extra money to pay down a mortgage, you invest it, hoping to get a greater return than the extra interest paid.

Pros:

- Investing your money has the potential for greater returns.

- Depending on the accounts you use, you can get tax benefits and better prepare for your retirement.

- There are many investment options, regardless of your situation.

Cons:

- Losses are possible.

- Finding the best investments can require more effort than adding to your mortgage payment.

- There are downturns in the market. If you’re close to retirement, you don’t want to retire and start liquifying your investments during such a downturn.

Investment Options

Prefer to invest? Here are some investment options to consider…

Stocks

When you first think of investments, you think of the stock market and stocks.

They have been the main vehicle for hundreds of millions of investors, and there’s the most information and understanding of them (including here on WallStreetZen).

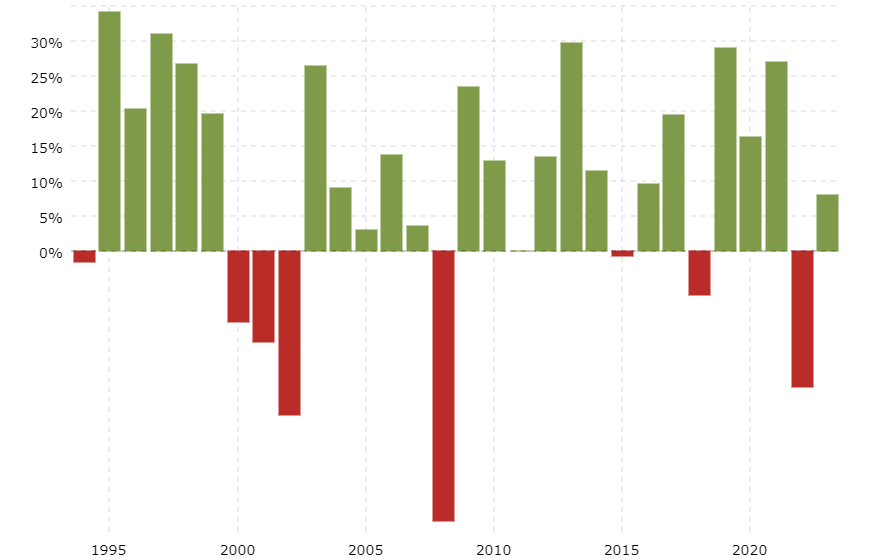

The average return of the S&P 500 has been positive, averaging 10.359 percent over the last 100 years. That’s better than your mortgage interest rate (I sincerely, sincerely hope).

For further proof, look at the last 30 years:

Those willing to invest long-term will likely win out with a balanced portfolio.

I recommend M1 Finance if you want to buy stocks. They don’t charge fees for trading, focus on long-term wealth, and the platform’s very user-friendly.

Great for:

- Younger people who can wait out the ups and downs of the market.

- Those willing to spend time picking stocks.

- Those who have an excellent interest rate on their mortgage.

Real Estate

It might seem counterintuitive or even wrong to invest in real estate and buy another property when you have a mortgage, but many people do it and make it work perfectly for them.

If you have the money or credit to spare, you can get another property and rent it out, though you may want to work with a property manager to help you (being a landlord can be tough for people with other commitments).

If you only have a bit to invest, you can still invest in a crowdfunded real estate platform. They’ll do the heavy lifting.

There are a few real estate apps and platforms to consider:

Streitwise

Streitwise is open to all investors and advertises a dividend yield average of 7.8 percent in 2022, though it does have a $4,400 minimum.

Arrived Homes

Arrived Homes, which allows people to purchase shares of investment and rental properties starting at just $100.

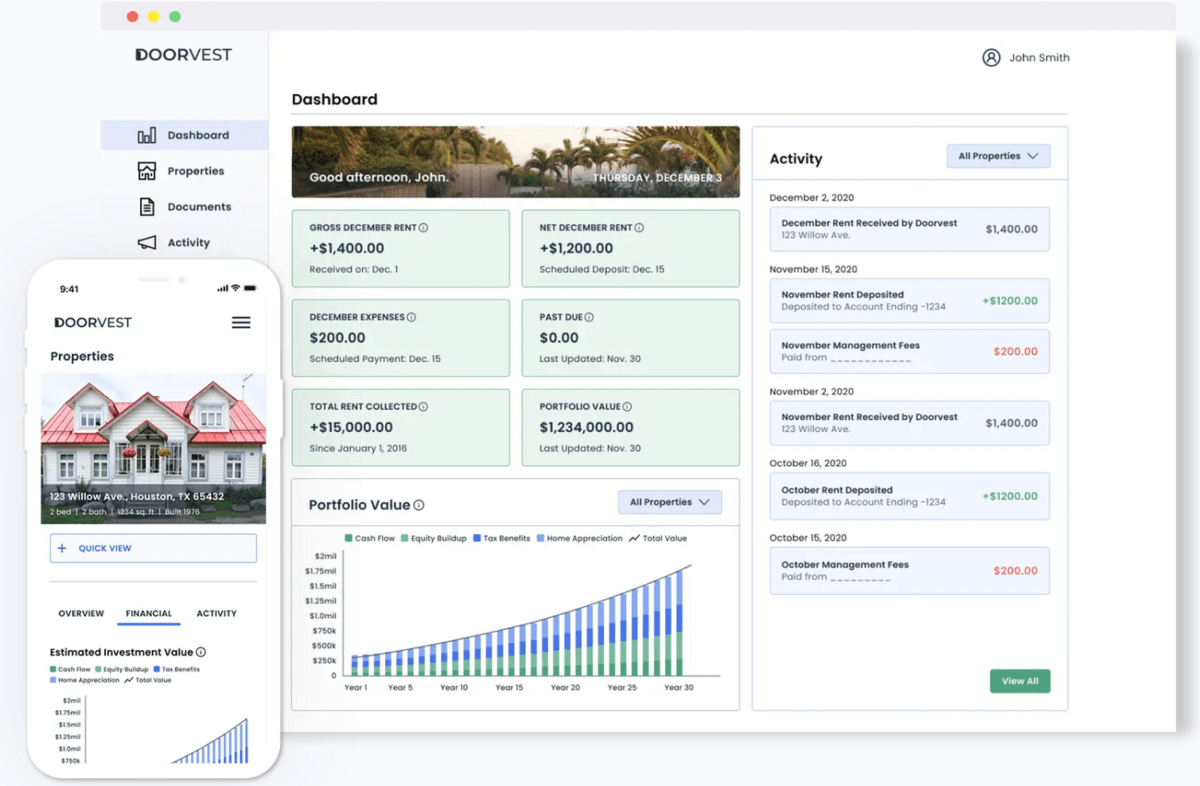

Doorvest

Doorvest is a higher-ticket investment, but allows you to invest in property without dealing with the hassles of renovations or finding renters yourself.

Want to know more? Check out our Doorvest review.

I would like to warn you now, however, not to overextend yourself. According to many, as of 2026, we are on top of a trend in the market, and there is an expectation that there will be a correction sometime soon — perhaps not as big as the Great Recession, but a correction nonetheless.

And no one can predict the real estate market perfectly. There’s risk here.

Great for:

- People who want to take advantage of a growing real estate market.

- People who want to potentially outperform the stock market during this inflation-heavy period.

Want more real estate investing ideas? Check out our roundup of the best real estate investment apps.

Alternative Investments

Stocks, ETFs, etc. aren’t your only options. If it appreciates in value and you can get a return on it, you can consider it a potential investment.

And you might be in the know or have a great interest in something that would make you well-suited to invest alternatively.

What are the best alternative investments? Click the link to find out!

Wine

Wine has long been used to store wealth as it has been enjoyed, with collectors safeguarding precious vintages more likely to be sold than drunk.

The right bottle of wine can be worth more than a car or a house. Literally. A bottle of Romanee Conti 1945 sold in 2018 fetched $558,000.

That bottle was not always worth so much. A bottle from this century might be worth that much someday.

Don’t have a wine cellar? No problem. Services such as Vinovest can handle a lot of the wine investing specifics for you, allowing you to focus more on what you’re investing, how you’re investing, and whether it’s the right choice.

Great for:

- Wine lovers and appreciators who know the market well.

- Those who want an investment that doesn’t correlate with the ups and downs of traditional investment markets.

Collectibles

While the baseball or Pokémon card collection sitting in your parents’ attic (they’re hoping you’ll pick it up one of these days, by the way) being worth millions is an exaggeration, collectibles have been an investment alternative for many years, and dare I say a fun option to get into.

In one example, a study found that Lego provided an eight percent real return annually from 1987-2015.

Platforms like Public can combine investing with your hobby, especially if you know a lot about the collectibles in question.

Just don’t let your personal preferences cloud your investing judgment.

Great for:

- People who love collectibles.

- People who want to try something else to get into.

- There is greater confidentiality in the collectibles market than in the stock market.

Art

Art has been used as an alternative investment for centuries.

You don’t need to buy an original Monet to make money. You can get shares of a piece of artwork on a platform such as Masterworks.

It is more niche than trading shares in companies, meaning it might take more time, or liquidity might be an issue, but depending on the artwork, your returns could be well beyond seven percent annually.

Great for:

- Art lovers who want to invest in their passion.

- People willing to get into a market that many wouldn’t consider.

- People looking for more asset diversification.

Precious Metals and Materials

Gold might get memed on a little, depending on your circles. And you shouldn’t invest everything you have in gold and keep it under your bed (it’s very heavy, you can stub your toe on a gold brick, and you can keep other things there).

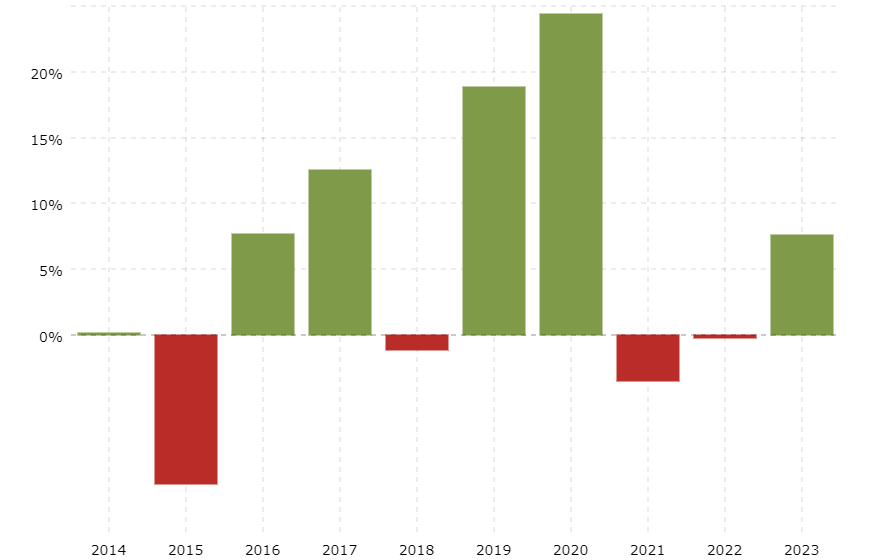

But take a look at how gold has increased in price per oz. over the last decade:

Gold, precious metals, and other commodities are perfectly reasonable investment vehicles that often show great returns for investors. They just have their risks (volatility, primarily) like any other.

Great for:

- Those willing to take on more risk and regularly consider the prices of commodities.

- Those that want to save for retirement in an account such as an IRA but still want to invest in metals (Gold IRAs, like those offered through Silver Gold Bull, are a thing).

Check out more of our top gold IRAs:

What About Refinancing?

While considering your mortgage, financial plan (investments or otherwise), and the question of “pay off mortgage or invest,” now might be a good time to look at potentially refinancing your mortgage.

There is little harm in asking about it; you don’t have to go through with any offer until you know all the details.

Remember the example I shared earlier — a $500,000 mortgage at a 4.5 percent interest rate that led to $912,034 after 30 years?

With a 3.5 percent interest rate, that becomes $808,279.20.

If you plan on paying off your mortgage aggressively, you can possibly refinance your mortgage to reflect that, getting a better interest rate in the process.

Just be sure not to bite off more than you can chew.

Should I Pay Off My House or Invest?

“Is it better to pay off mortgage or save money” is a question with a few answers, but one that can be quickly determined.

Paying off your house might be best if:

- You already have a healthy investment account.

- You are risk-averse.

- You want to secure your living space for the rest of your life.

Investing might be best if:

- You are willing to take more of a risk.

- You are sure you’ll pay off your mortgage regardless.

- You have extremely good investing opportunities open to you.

The Middle Option: Why Not Both?

Depending on your income, you can only contribute so much to an IRA each year. Employer matching for your 401k typically has a limit as well.

So after taking advantage of these opportunities, paying off your mortgage early can be the right call to determine your answer to “Is it better to pay off mortgage or invest?” especially if you value financial security and home equity.

Final Word: Pay Off Mortgage or Invest?

Deciding “Is it better to pay off mortgage or save money?” is a question that millions of families have answered for themselves. With the information above, you can make the right choice for yourself.

Consider your options, reevaluate your mortgage (refinance if it helps), and then see what you can do.

If you do decide to invest, go in with the right information. Check our picks and screen potential options before deciding on a stock.

And use a broker you can trust that doesn’t charge costly trading fees — like M1 Finance.

FAQs:

Is it better to invest or pay off mortgage?

Whether to pay off your mortgage or invest depends on your options and mortgage terms. Investing in an ETF of the S&P 500 will typically provide better long-term returns. However, paying off a mortgage is a less risky proposition.

What does Dave Ramsey say about paying off your mortgage?

Dave Ramsey recommends aggressively paying off your mortgage early. He says it's a huge payment and debt hanging over a household, and paying it off early will save people lots of money in the long run.

It may not grant the greatest returns, but it minimizes household financial risk.

Should I pay off my house or invest barefoot?

It will depend on your situation, and the two ideas aren’t mutually exclusive. The barefoot investor approach prioritizes paying off debts before building wealth, so paying off your house should be the priority unless a strong opportunity comes (employer matching, etc.).

Is it a good idea to pay money off your mortgage?

Paying off your mortgage early is typically a good idea, barring better opportunities. You will secure your financial situation, save on interest, and increase your home equity.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.