You’re watching stocks like Amazon (NASDAQ: AMZN) and Tesla (NASDAQ: TSLA) soar to astronomical heights, and you’re wondering: how do I find the next one before everyone else does?

That’s what growth investing is all about — and I’m going to show you exactly how to do it.

In this article, I’ll break down what separates true growth stocks from pretenders, the 7 metrics I use to evaluate growth potential, and the specific strategies that can help you spot emerging industry leaders early. You’ll also learn how to manage risk in your growth portfolio and balance these high-potential investments with the rest of your holdings.

Let’s dive in.

The Top 7 Growth Stocks…

Skip the noise and fast forward to the best growth stocks (and more!) with our Zen Strategies service.

This top-tier service includes access to 11 portfolios, each aligned with a different strategy. Each contains the best 7 stocks at any given time, selected using our market-beating Zen Ratings system.

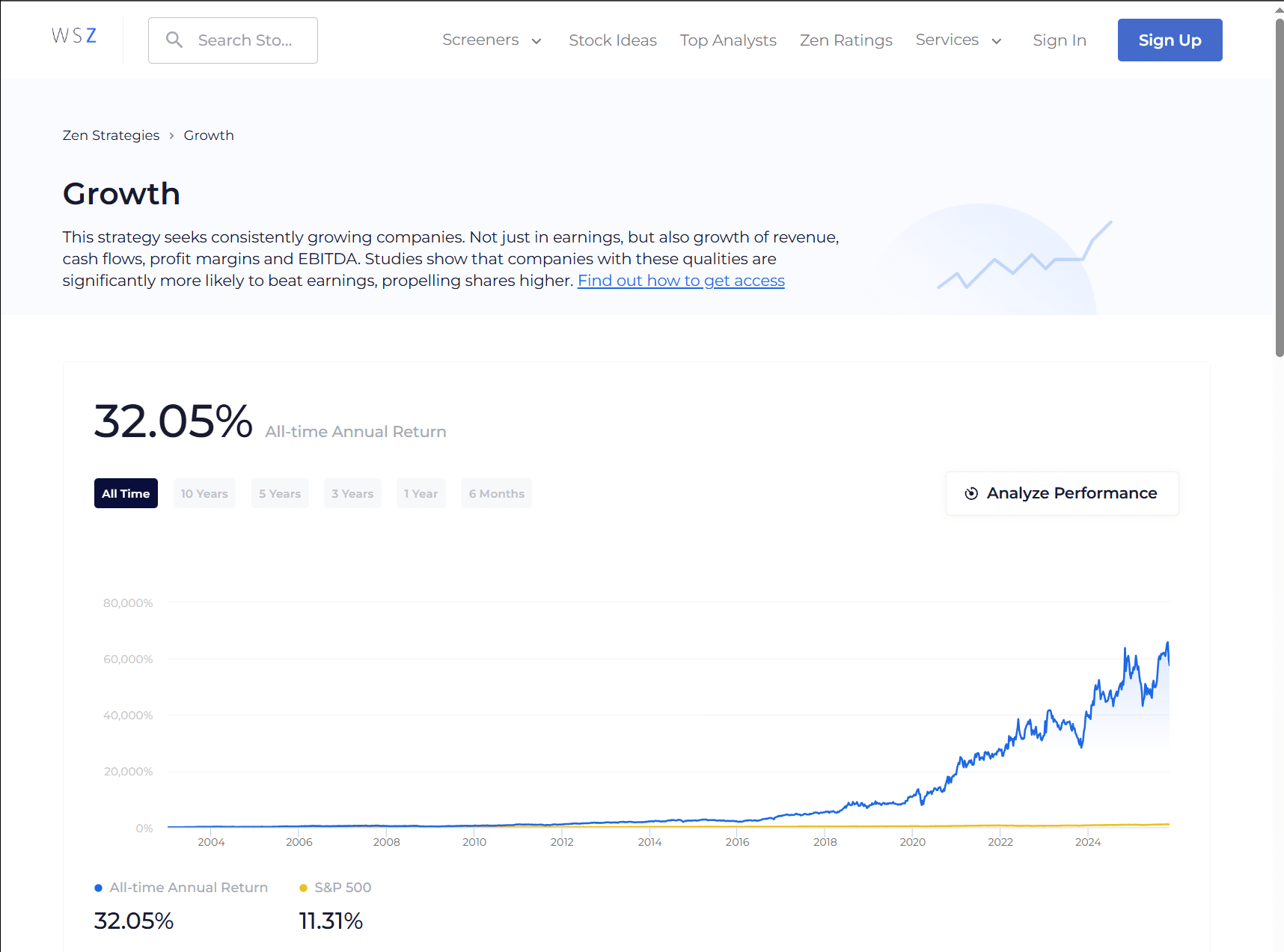

The Growth Strategy portfolio is one of the top performers, with a +37.92% average annual gain going back to 2003.

What is Growth Investing?

Growth investing is an investment strategy focused on buying shares of companies expected to grow at an above-average rate compared to the broader market or their industry peers.

Instead of looking for bargains or high dividend yields, growth investors pay a premium for companies with strong expansion potential.

When I talk about growth investing, I’m referring to a specific mindset: You’re betting on a company’s future earnings power, not its current profitability.

These companies typically reinvest their profits back into the business rather than paying dividends, fueling expansion through research and development, market penetration, or acquisitions.

The most successful growth investors — think Peter Lynch or Cathie Wood — understand that identifying growth stocks early requires looking beyond surface-level metrics. You need to spot companies with sustainable competitive advantages, expanding addressable markets, and management teams capable of executing ambitious growth plans.

Fresh investing ideas, delivered (almost) daily

WallStreetZen’s FREE newsletter provides the latest Strong Buy stocks, breaking stories, and generally great investing ideas.

Plus, you get a complimentary weekly watchlist featuring 5 high-potential stocks to watch every week.

Growth Investing vs Value Investing: What’s the Difference?

What is growth vs value investing? The core difference lies in what you’re paying for.

- Value investors hunt for underpriced stocks trading below their intrinsic value. They want companies with strong fundamentals that the market has overlooked or temporarily discounted. Think of it as buying a dollar for 50 cents. Explore value stocks here

- Growth investors, on the other hand, willingly pay premium valuations for companies with exceptional growth prospects. They are comfortable paying 50 times earnings for a company that could 10x its revenue in five years. Value investors would run screaming from that same stock. Explore growth stocks here

Here’s a practical example: In 2015, value investors avoided Amazon because its P/E ratio exceeded 900. Growth investors saw the company’s explosive revenue growth and dominant market position. Amazon went on to deliver 600%+ returns over the next seven years.

The investing for growth approach prioritizes future potential over current bargains. You’re paying for what the company will become, not what it is today.

Related Reading: What is a Good P/E Ratio?

7 Fundamental Metrics Every Growth Investor Should Track

After analyzing hundreds of growth stocks over the past decade, I’ve identified seven core metrics that consistently separate winners from flameouts. Let me walk you through each one.

1. Revenue Growth Rate

This is your starting point for any growth investing strategy. I look for companies growing revenue by at least 15-20% annually, with acceleration over time being even better.

But here’s the critical part — sustainable revenue growth matters more than one-time spikes. Netflix (NASDAQ: NFLX) demonstrated this perfectly, maintaining 20%+ revenue growth for nearly a decade as it expanded globally.

2. Gross Margin Expansion

Growing revenue means nothing if a company loses money on every sale. I want to see gross margins either holding steady or expanding as the company scales.

Software companies like Salesforce (NYSE: CRM) excel here, with gross margins above 70%. As these businesses grow, their marginal costs decrease, creating powerful operating leverage.

3. Return on Invested Capital (ROIC)

ROIC tells you how efficiently a company converts capital into profits. Growth stocks with ROIC above 15% demonstrate they’re not just growing for growth’s sake — they’re creating real value.

Companies like Apple (NASDAQ: AAPL) maintained ROIC above 30% even as they scaled to massive size, proving their competitive moat remained intact.

4. Total Addressable Market (TAM)

I need to see a massive runway for growth. A company might be growing rapidly today, but if it’s already capturing 50% of its addressable market, where does it go from here?

The best growth stocks target TAMs in the hundreds of billions. When Shopify (NYSE: SHOP) went public, global e-commerce represented a multi-trillion dollar opportunity that was only 10% penetrated.

See any stock’s fundamentals FAST…

5. Customer Acquisition Cost (CAC) vs Lifetime Value (LTV)

This ratio determines whether a company’s growth is sustainable or burning cash. I look for LTV:CAC ratios of at least 3:1, meaning each customer generates three times what it costs to acquire them.

SaaS companies obsess over this metric. When Zoom (NASDAQ: ZM) was growing explosively, its viral product-led growth model meant extremely low CAC, creating a powerful growth engine.

6. Rule of 40

Here’s a simple but powerful metric for evaluating growth companies: add the revenue growth rate and the profit margin. If the sum exceeds 40, you’ve found a high-quality growth business.

For example, if a company grows revenue by 30% and has 15% profit margins, that’s 45 — a strong Rule of 40 score indicating both growth and profitability.

7. Cash Flow Trajectory

Finally, I track free cash flow trends. While early-stage growth companies may burn cash, I want to see a clear path to positive cash flow within a reasonable timeframe.

Amazon burned cash for years, but the trajectory was always improving. By contrast, many unprofitable growth stocks show deteriorating cash flow as they scale — a massive red flag.

Want to analyze these metrics efficiently?

Check out WallStreetZen’s Growth Component Grade, which evaluates stocks across multiple growth factors as part of our comprehensive Zen Rating system.

How to Spot Emerging Industry Leaders Before They Explode

Finding the next Amazon or Tesla requires looking where others aren’t. Here’s my framework for identifying emerging leaders early.

Look for Disruptive Business Models

True growth stocks don’t just compete — they fundamentally reshape their industries. I’m looking for companies that make existing solutions obsolete or create entirely new markets.

When Uber and Lyft entered the market, they didn’t just compete with taxis — they changed how people think about transportation. That’s the kind of disruption that creates multi-bagger returns.

Identify Network Effects and Competitive Moats

The best growth stocks build increasingly defensible businesses as they scale. Network effects create this perfectly: the more users join, the more valuable the platform becomes, attracting even more users.

Meta, AKA the artist formerly known as Facebook (NASDAQ: META), demonstrated this brilliantly. As more people joined, it became impossible for friends and family to leave because everyone else was there. That’s an unassailable moat.

Follow the Smart Money

I pay attention to venture capital investments and insider buying. When top VCs like Sequoia or Andreessen Horowitz back a company, they’ve done extensive due diligence.

Similarly, heavy insider buying — especially by CEOs and founders — signals confidence in the company’s growth trajectory. These insiders have access to information we don’t.

Monitor Industry Tailwinds

The easiest way to find growth stocks is to invest in the right sectors at the right time. I focus on industries with strong secular tailwinds: artificial intelligence, cloud computing, renewable energy, biotechnology.

Companies operating in these spaces can grow rapidly simply by capturing market share in expanding industries. It’s much easier than trying to grow in mature, declining markets.

Ready to find high-potential growth stocks?

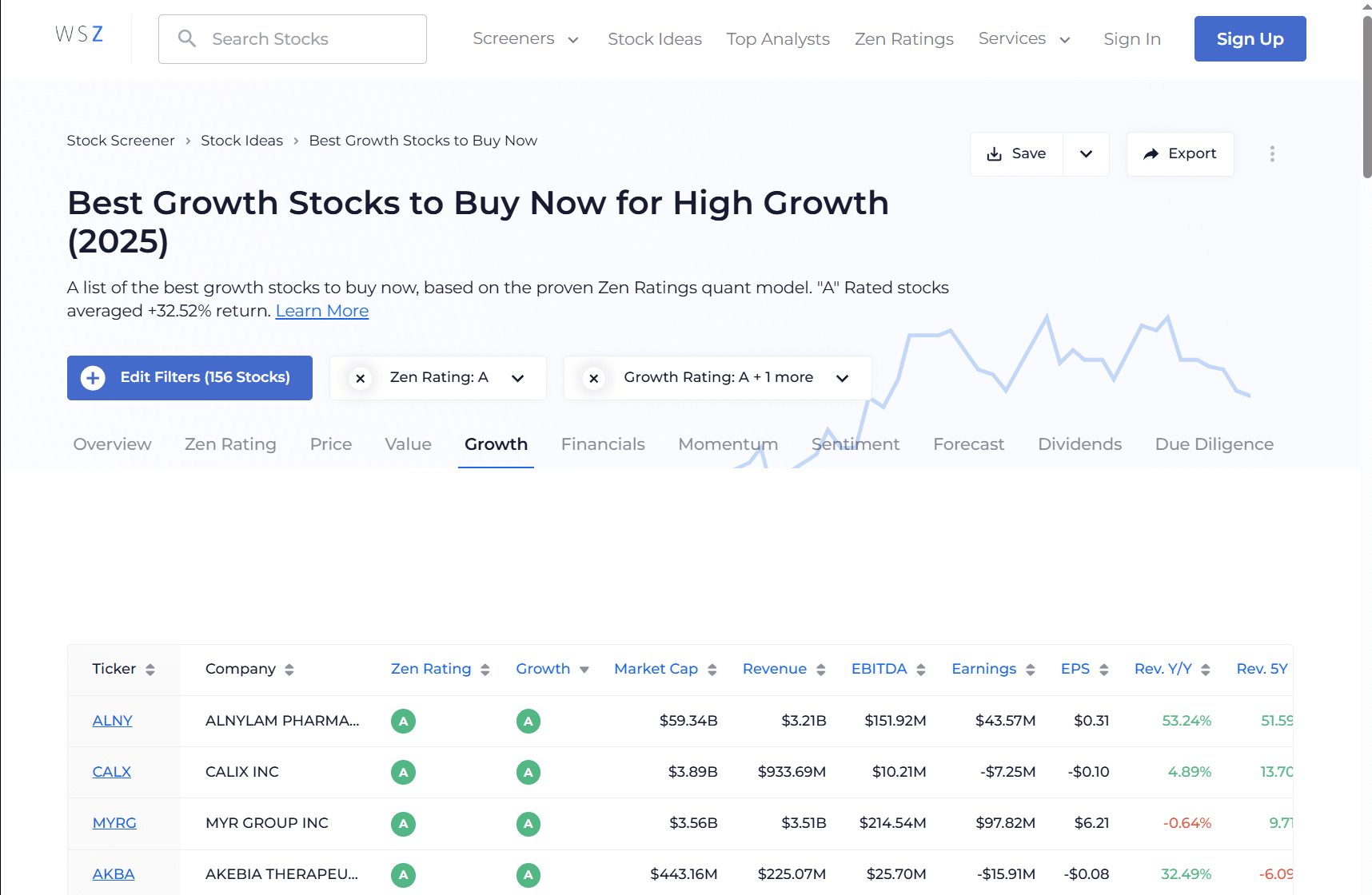

Use WallStreetZen’s Best Growth Stocks screener to identify companies with strong growth characteristics based on analyst forecasts and fundamental metrics.

Growth Investing Strategy: Different Approaches for Different Goals

What is the best growth investing strategy? It depends on your risk tolerance, time horizon, and financial goals. Let me break down four proven approaches.

Pure Growth Strategy

This is growth investing in its purest form — buying high-growth companies regardless of valuation. You’re betting entirely on future earnings power.

I’ve used this strategy with companies like Nvidia (NASDAQ: NVDA) when AI adoption was accelerating. The stock looked expensive at 60 times earnings, but the growth thesis was so compelling that valuation became secondary.

This approach works best when you have high conviction in a company’s growth runway and can stomach significant volatility. You need nerves of steel and a long time horizon.

Check out WallStreetZen’s Growth Strategy to see how this approach selects stocks based on momentum and growth metrics.

Growth at a Reasonable Price (GARP)

This is my preferred approach for most investors. You’re looking for growth stocks that aren’t outrageously expensive — the sweet spot between growth and value investing.

The key metric here is the PEG ratio (Price/Earnings to Growth). I target companies with PEG ratios below 2, meaning I’m not paying more than twice the growth rate for earnings.

For example, if a company is growing earnings by 25% annually and trading at a P/E of 40, that’s a PEG of 1.6 — reasonable for a quality growth stock.

Explore opportunities with WallStreetZen’s Growth at a Reasonable Price screener to find growth stocks that won’t break the bank.

Small-Cap Growth Strategy

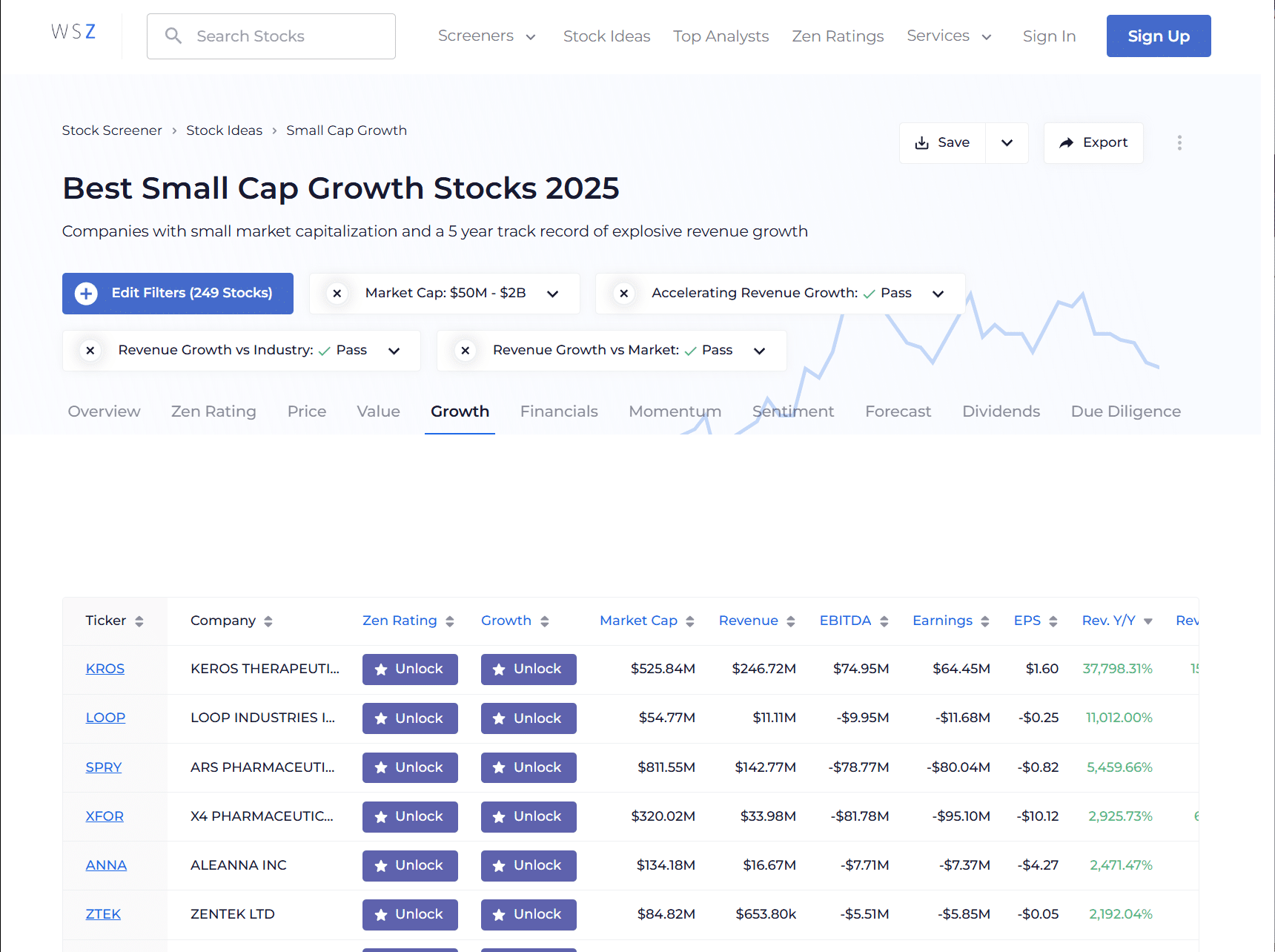

Want higher potential returns? Small-cap growth stocks offer explosive upside because they’re starting from a smaller base.

A company growing from $100 million to $500 million in revenue is much easier than one growing from $10 billion to $50 billion. The mathematics of compounding work in your favor.

However, small-caps come with higher risk. These companies typically have less analyst coverage, lower liquidity, and greater vulnerability to market downturns. I limit small-cap exposure to 10-15% of my growth portfolio.

Find promising small-cap opportunities with WallStreetZen’s Small Cap Growth screener.

Dividend Growth Investing

What is dividend growth investing? It’s a more conservative approach that combines growth with income.

You’re buying companies that consistently increase their dividends over time — typically mature growth companies that have transitioned from reinvesting everything to returning capital to shareholders.

Companies like Microsoft (NASDAQ: MSFT) and Apple exemplify this strategy. They still grow revenue and earnings at healthy rates while paying rising dividends.

This approach provides downside protection during market downturns since dividend income cushions the blow. It’s perfect if you want growth exposure with less volatility than pure growth stocks.

Risk Management for Growth Investors: Key Tips

Growth stocks can be volatile, so you need a solid risk management framework. Here’s how I protect my portfolio while maintaining upside potential.

Position Sizing Matters

I never put more than 5% of my portfolio into a single growth stock, no matter how compelling the thesis. With my highest-conviction ideas, I might go to 7-8%, but that’s my absolute ceiling.

This prevents any single position from destroying my portfolio if the thesis breaks down. I’ve seen too many investors lose everything by concentrating in one or two growth stocks that imploded.

Use Stop Losses Strategically

I set mental stop losses at 25% below my purchase price. If a stock drops that far, I reassess whether the original thesis remains intact.

Sometimes, growth stocks face temporary setbacks that create buying opportunities. Other times, they’re signaling fundamental problems. The key is distinguishing between noise and real deterioration.

Diversify Across Sectors and Stages

Don’t put all your growth capital into one sector. I spread my growth investments across technology, healthcare, consumer discretionary, and industrial sectors.

I also balance early-stage growth companies with more established growth names. Mixing speculative small-caps with proven large-cap growth stocks creates a more resilient portfolio.

Rebalance Regularly

When growth stocks soar, they can become oversized positions in your portfolio. I rebalance quarterly, trimming winners that exceed position limits and reallocating to other opportunities.

This forces me to take profits systematically rather than holding forever and riding positions all the way back down during corrections.

Have an Exit Strategy

I determine my exit criteria before buying every growth stock. This might be hitting a price target, the company reaching market saturation, or competitive threats emerging.

Having predetermined exit rules prevents emotional decision-making during volatile periods. I know exactly when to sell before panic or greed cloud my judgment.

How to Balance Growth Stocks With Other Portfolio Holdings

Growth stocks shouldn’t represent your entire portfolio unless you’re very young with high risk tolerance. Here’s how I think about portfolio construction.

The 60/30/10 Framework

For most investors, I recommend allocating 60% to core holdings (index funds, blue-chip stocks), 30% to growth stocks, and 10% to speculative plays or alternatives.

This creates a diversified portfolio that captures growth opportunities while maintaining stability through market cycles. Your core holdings provide ballast when growth stocks get hammered.

Age-Based Allocation

Your growth allocation should decrease as you approach retirement. A 30-year-old can comfortably hold 50% in growth stocks, while a 60-year-old should probably limit it to 20-30%.

The logic is simple: younger investors have time to recover from bear markets, while retirees need stability and income. Adjust your growth exposure accordingly.

Pair Growth With Dividend Stocks

I like pairing aggressive growth stocks with stable dividend payers. When growth stocks crater during corrections, dividend stocks typically hold up better, smoothing your portfolio’s volatility.

This combination also ensures you’re generating some income even when growth stocks cut dividends to fund expansion.

Tactical vs Strategic Allocation

My strategic allocation — my long-term target — remains consistent. But I make tactical adjustments based on market conditions.

When growth stocks become extremely expensive relative to history, I trim exposure. When they’re beaten down and pessimism peaks, I overweight growth. This contrarian approach has served me well.

Where to Buy Growth Stocks

If you’re ready to start investing for growth, you need a broker that supports your strategy.

I recommend eToro for growth investors because of their commission-free stock trading, intuitive platform, and social features that let you follow successful growth investors.

eToro’s CopyTrader feature is particularly useful for newer growth investors. You can automatically copy the trades of experienced investors who specialize in growth stocks, learning their approach while building your own portfolio.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Finding Growth Stocks: Tools and Resources

What is the best way to find growth stocks? Use the right screening tools to filter thousands of stocks down to the most promising candidates.

WallStreetZen offers several powerful screeners specifically designed for growth investors:

- Best Growth Stocks to Buy Now — identifies companies with the highest analyst-projected growth rates

- Undervalued Growth Stocks — finds growth stocks trading below their fair value

- Small Cap Growth — focuses on smaller companies with explosive growth potential

- Growth at a Reasonable Price — screens for growth stocks with reasonable valuations

These screeners save you hours of research by filtering for the specific growth characteristics you’re looking for.

Additionally, check out the Zen Ratings Growth Component Grade, which provides a detailed analysis of each stock’s growth metrics and how they compare to peers.

Putting It All Together: Your Growth Investing Action Plan

Here’s how to get started with growth investing today:

Step 1: Determine your growth allocation based on age, risk tolerance, and financial goals. Don’t overextend — start with 20-30% of your portfolio in growth stocks.

Step 2: Use WallStreetZen’s growth screeners to identify 10-15 potential candidates. Focus on companies with strong revenue growth, expanding margins, and large addressable markets.

Step 3: Conduct deeper research on your top 5 picks. Read quarterly earnings reports, understand competitive dynamics, and evaluate management teams.

Step 4: Open an account with a quality broker like eToro and begin building positions. Start with smaller position sizes (2-3% of your portfolio) until you gain experience.

Step 5: Monitor your portfolio quarterly, tracking the seven metrics we discussed. Stay informed about industry trends and competitive threats.

Step 6: Rebalance regularly, taking profits from winners and cutting losses on underperformers. Stick to your predetermined exit criteria.

Remember — growth investing is a marathon, not a sprint. The biggest winners often take years to fully play out. Stay patient, remain disciplined, and let compounding work its magic.

FAQs:

What is growth investing?

Growth investing is an investment strategy focused on buying shares of companies expected to grow at an above-average rate compared to the broader market.

Growth investors prioritize companies with strong revenue growth, expanding margins, and significant market opportunities, even if those companies trade at premium valuations.

What is dividend growth investing?

Dividend growth investing is a strategy that targets companies which consistently increase their dividend payments over time.

These are typically mature growth companies that have transitioned from reinvesting all profits into expansion to returning capital to shareholders through rising dividends.

This approach combines growth exposure with income generation and typically offers less volatility than pure growth investing.

What is value investing vs growth investing?

Value investing focuses on buying underpriced stocks trading below their intrinsic value, seeking bargains in the market.

Growth investing prioritizes companies with exceptional future growth prospects, even at premium valuations.

Value investors want to pay 50 cents for a dollar of assets, while growth investors willingly pay premium prices for companies that could 10x their earnings in the coming years.

What is the best growth investing strategy?

The best growth investing strategy depends on your risk tolerance and goals. Pure growth strategies target high-growth companies regardless of valuation, offering maximum upside but high volatility.

Growth at a Reasonable Price (GARP) balances growth with valuation metrics like the PEG ratio.

Dividend growth investing provides more stability through income. Small-cap growth strategies offer explosive potential but higher risk.

Most investors succeed by combining approaches within a diversified portfolio.

What are the best growth stocks?

The best growth stocks combine strong revenue growth (15-20%+ annually), expanding profit margins, high returns on invested capital, large addressable markets, and sustainable competitive advantages.

Current examples include companies in sectors like artificial intelligence, cloud computing, and biotechnology.

Use stock screeners focusing on analyst growth forecasts, historical growth rates, and fundamental metrics to identify the most promising candidates.

What is the best way to find growth stocks?

The most efficient way to find growth stocks is using specialized stock screeners that filter for growth characteristics like revenue growth rates, earnings growth, expanding margins, and strong return on invested capital.

Tools like WallStreetZen's growth screeners help you quickly identify promising candidates from thousands of publicly traded companies.

Follow this with fundamental research on competitive positioning, market opportunities, and management quality before investing.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.