What’s the Best Ultra High Net Worth Asset Allocation in 2026?

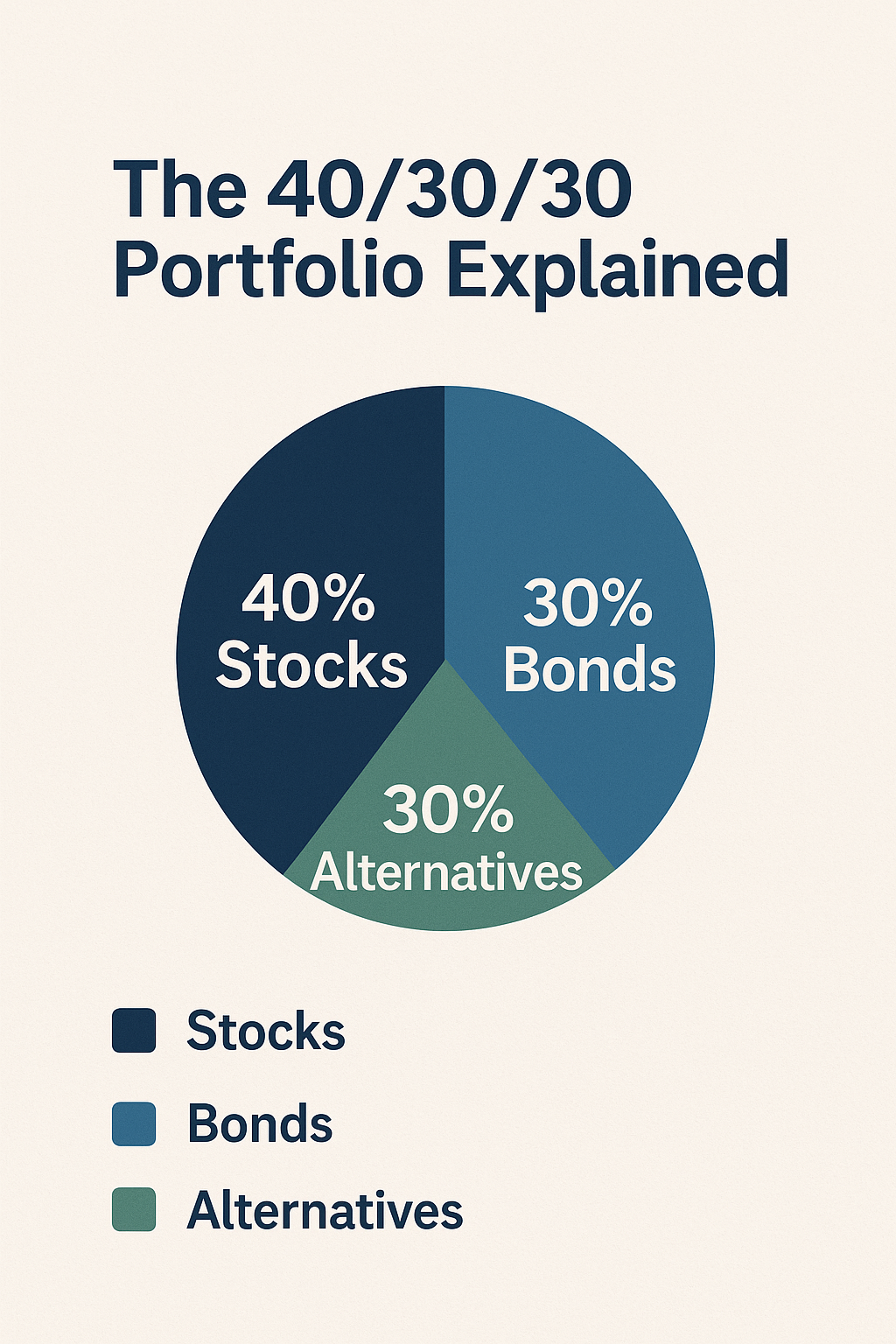

It’s not the traditional 60/40 portfolio. As you’ll see in this post, more diverse allocation, such as a 40/30/30 portfolio (40% stocks, 30% bonds, and 30% alternatives), may be more effective in helping you maintain and build wealth.

A great financial advisor and top-notch alternative investment platforms designed for wealthy investors like DLP Capital and Masterworks make it easier to get the ball rolling.

Let’s dig in a little deeper…

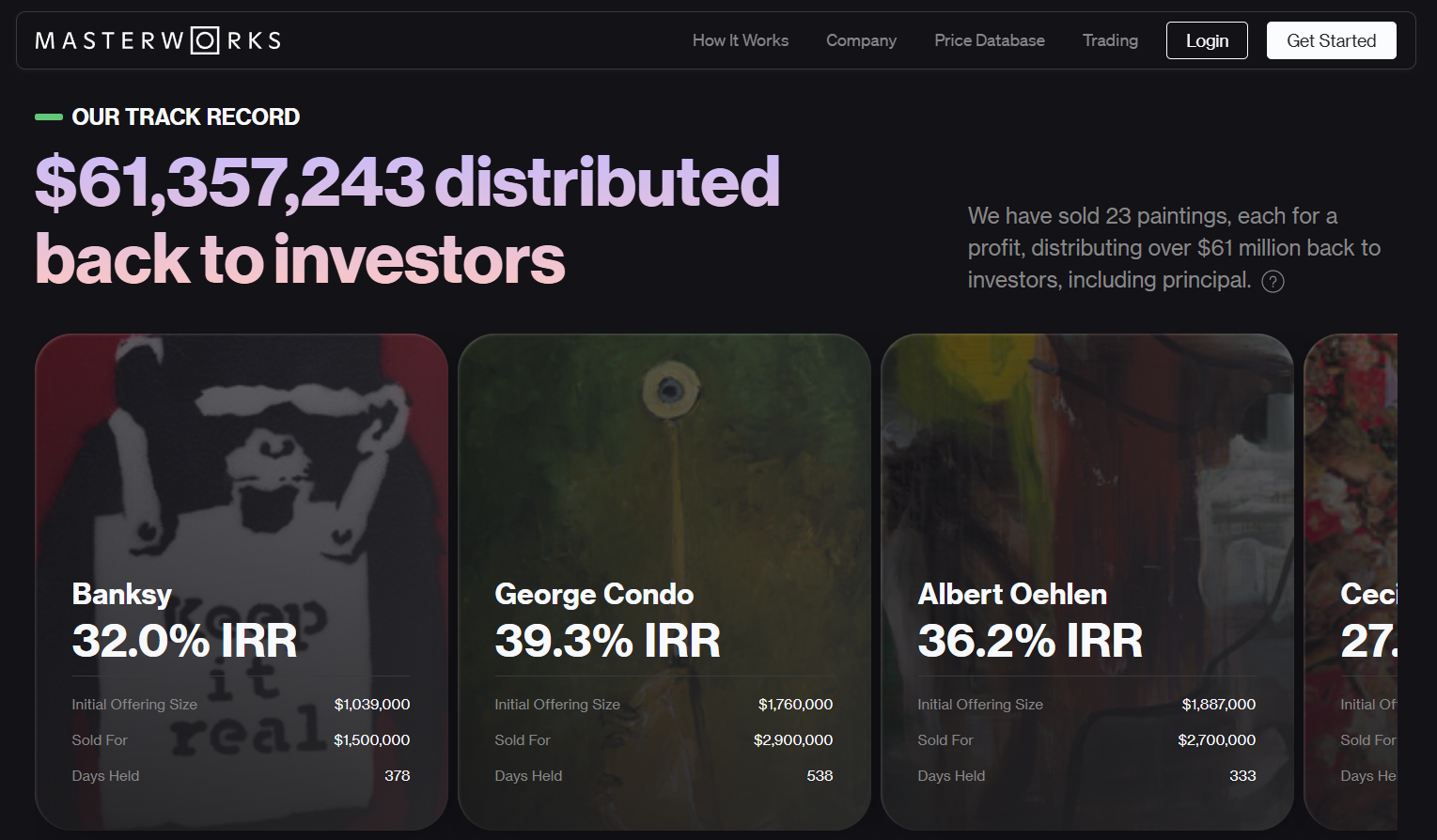

FEATURED OFFER: Masterworks

Want an investment that’s fueled by the ultra-wealthy? Try art.

Since 1995, contemporary art has appreciated 11.4% annually on average. That’s 43% more than the S&P over the last 30 years (1995-2024). After all, there’s a reason why many HNW individuals can invest almost an entire 10%+ of their wealth in art.

Want in? You can invest in shares of million-dollar painting offerings with Masterworks, the world’s first art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

Step 1: Understand the Best Asset Allocation For a High Net Worth

As noted above, the traditional 60/40 portfolio could leave potential returns on the table. Most ultra-high net worth individuals should diversify — one key example is the 40/30/30 portfolio.

The 40/30/30 Portfolio Explained

While the traditional 60/40 portfolio (60% equities, 40% fixed income) has been the gold standard for decades, investors with a higher net worth are starting to shift away from this model.

With inflation eroding the effectiveness of bonds and equities on a rollercoaster the last few years — high net worth investors are looking to alternative assets to spread their risk and (potentially) generate higher returns.

The 40/30/30 portfolio has emerged as an alternative for wealthy investors to gain access to markets outside of just equities and fixed income — adding a layer of diversification and investing in assets that are uncorrelated with public markets.

The 40/30/30 portfolio consists of:

- 40% public equities

- 30% fixed income

- 30% alternatives (real estate, infrastructure, fine art, private credit)

Here’s how the 40/30/30 portfolio works, and why you should consider it for your portfolio.

30% Alternatives – The Secret Weapon for UHNW Portfolios

You probably already know a thing or two about stocks and bonds, so let’s start with the “other” 30%.

Here’s why you should consider investing in alternative assets:

- Lead with the benefits: low correlation to public markets, inflation hedging, and potential outsized returns.

- Introduce subcategories and platforms:

This part of the 40/30/30 portfolio is the key to true diversification and the potential to outperform traditional asset allocation models. You’ll invest 30% of your money into alternative assets, such as real estate, infrastructure, fine art, private credit, and cryptocurrency. Here are some trusted platforms to consider…

Step 2: Invest in Real Estate & Infrastructure

One of the most popular alternative assets to invest in is real estate — specifically, commercial real estate. New platforms have emerged to offer private access to large commercial investment portfolios and individual real estate projects.

Some are even designed with HNWIs in mind.

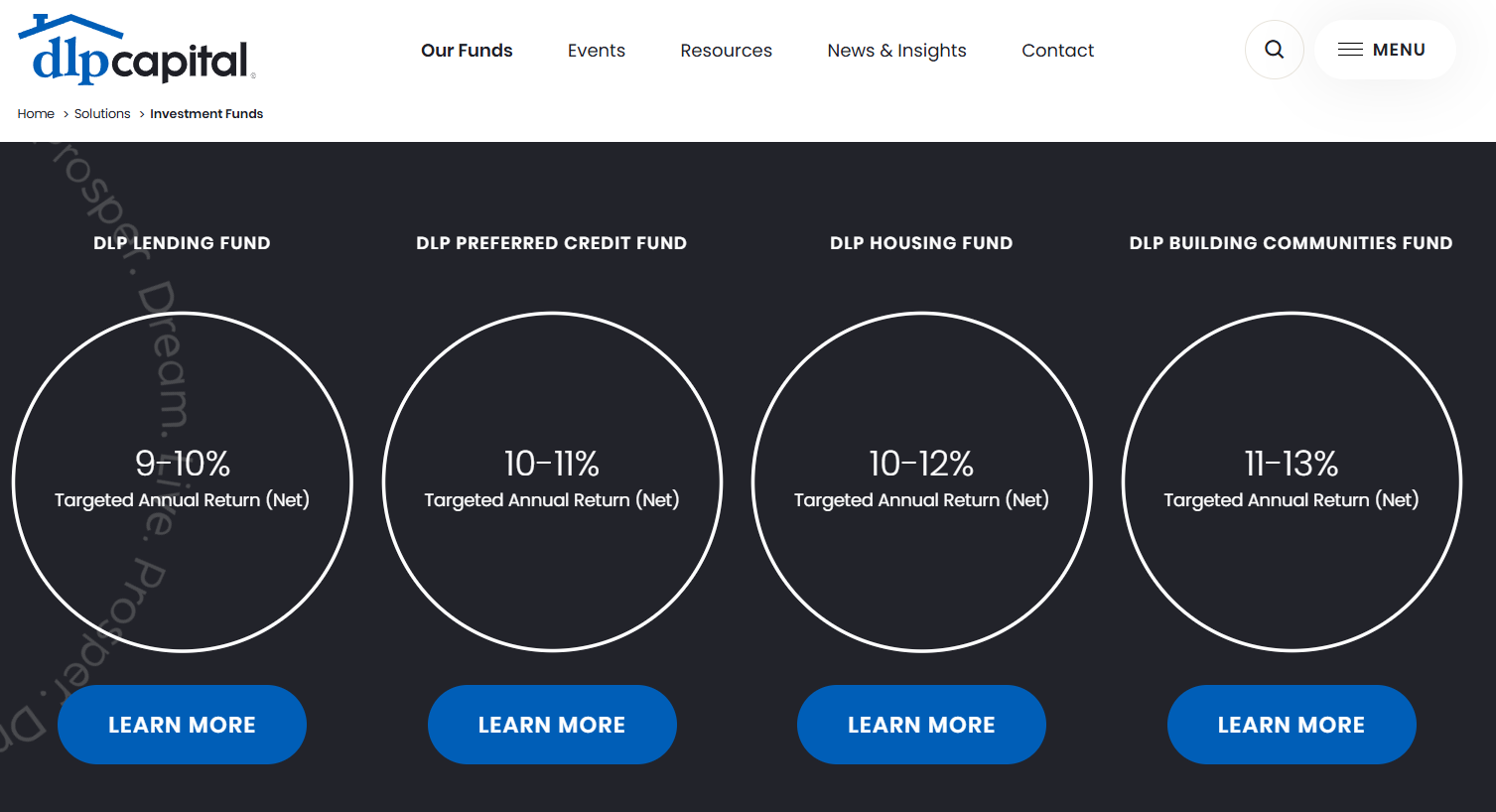

For example, DLP Capital allows you to invest in real estate funds that own rental real estate, or help financing real estate projects.

The equity funds own and operate commercial rental real estate (such as multifamily housing), while the lending funds provide capital to real estate build projects and community building projects.

Founded in 2006, DLP Capital is far from a flashy upstart. It has a well-established track record, serving thousands of investors and managing over 18,000 housing units with more than $5.25 billion in assets under management.

DLP Capital primarily serves high-net-worth individuals through a range of real estate funds:

- DLP Housing Fund: Focused on build-to-rent and multifamily communities.

- DLP Building Communities Fund: Invests in equity and preferred equity positions, as well as senior and mezzanine loans for new rental developments.

- DLP Lending Fund: Offers exposure to debt investments supporting the construction, acquisition, and repositioning of affordable rental housing.

- DLP Preferred Credit Fund: Targets senior loans, mezzanine debt, and preferred equity in RV resorts, manufactured housing, and vacation rentals.

The flexibility and ability to choose an investment that aligns with your interest is a big benefit. But here’s what else makes the platform unique:

- Mission-driven approach: DLP emphasizes impact investing — seeking strong returns while addressing housing needs and benefiting communities. That kind of social focus is rare among platforms serving affluent investors.

- Transparent fees: A 2.0% management fee is standard, but rebates are available for larger investments.

- Compelling performance: The DLP Housing Fund has posted a 19.47% compounded DRIP IRR since its 2020 inception (as of December 31, 2023), with a current target of 10–12% annual net returns. Other funds show similarly strong historical IRRs of 12.28%, 13.10%, and 10.99%.

Step 3: Invest in Private Credit

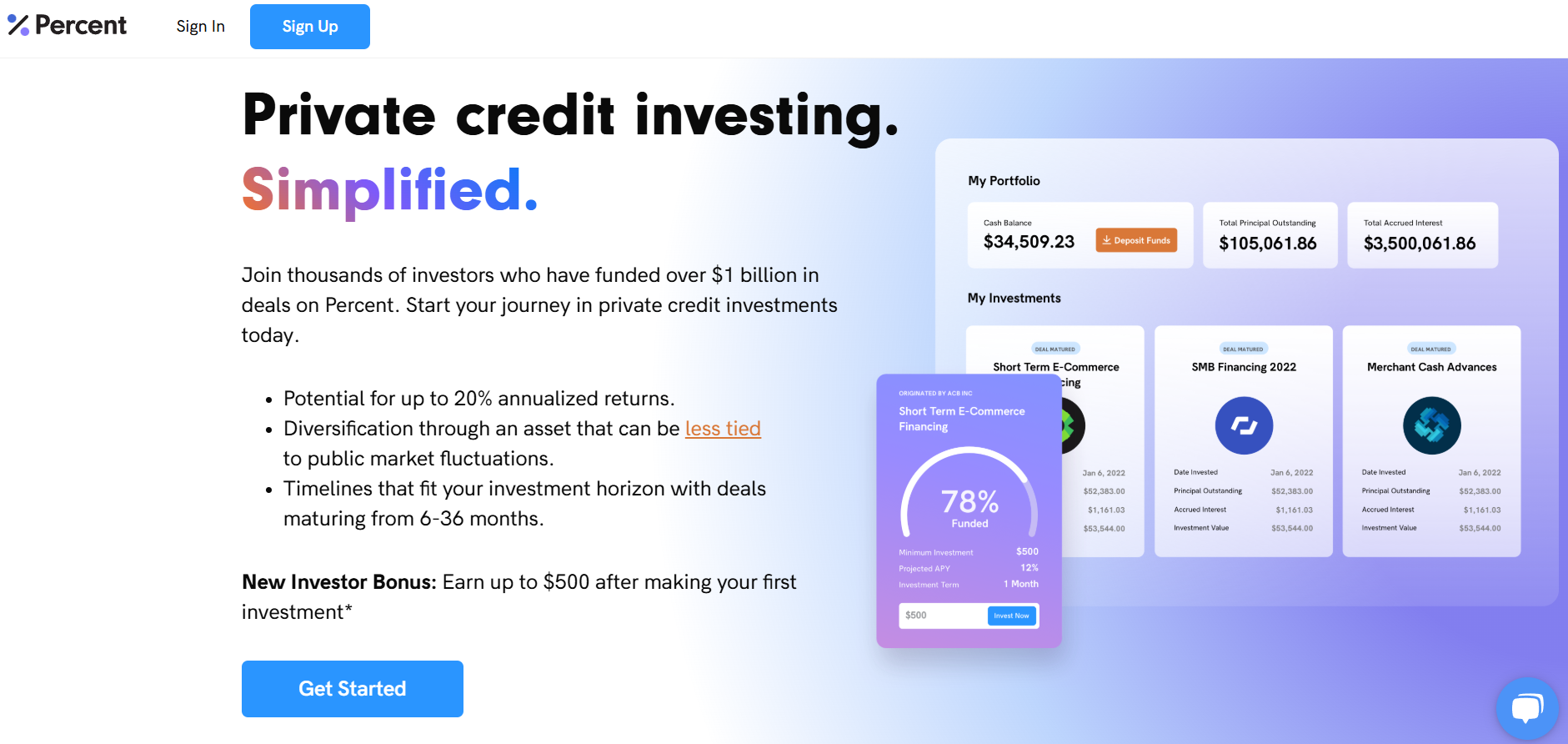

Private credit investments allow you to lend money to businesses for higher yields than traditional loans. Private credit often yields returns as high as 10% (or higher) and has shorter durations than a traditional business loan (think: 9 months instead of 10 years).

Private credit offers regular payments and high yields — though there is higher risk than bonds or other fixed income investments. Private credit was once reserved for institutional funds only, but you can now directly invest in private credit deals.

Platforms like Percent allow accredited investors to invest in private credit deals with as little as $500. You can invest in individual deals, or choose Blended Notes — essentially a private credit fund — giving you exposure to multiple borrowers and asset classes within a single investment vehicle.

Step 4: Invest in Fine Art

Fine art has always been an interesting asset class — usually reserved for the ultra wealthy ($100 million+ net worth). Fine art requires a bit of research and knowledge to find the right piece that has the ability to appreciate over time — but can produce returns that far exceed traditional markets.

But you can now access investing in world-famous fine art pieces through platforms like Masterworks — who essentially crowdfund the purchase and management of high-end art pieces.

With Masterworks, you can pick several pieces of art to invest in, but you’re simply buying equity in the art itself. Your shares of ownership can appreciate over time, and when the art is sold, you’ll get a payout for the percentage of the art piece you own.

If you don’t want to drop $200k+ on a piece of art and then hassle with storing it, insuring it, and re-selling it to realize your gains — a platform like Masterworks may be worth considering.

One thing you should know about Masterworks — there’s a waitlist. Luckily we have a relationship with them, so if you use the link below you can skip the wait:

Understanding the Benefits of Alternative Investments For Accredited Investors

The majority of the above platforms are only available to select investors.

As a high net worth individual, you have access to more investment opportunities because you qualify as an accredited investor.

This means you can invest in more alternative assets, such as collectibles, fine art, rare wine, real estate syndications, and private credit (though some platforms now offer access to regular investors).

There are a few advantages to putting 30% of your money into alternative assets:

- Low correlation with public markets: Alternative assets don’t march to the same beat as traditional investments — and the returns often have very little correlation with public markets. This means you might still see returns when the stock market is crashing, or see the value of your assets rise, even in uncertain political environments.

- Effective hedge against inflation: Inflation erodes the returns of all investments, but alternative assets might actually grow more in value due to inflation. Investing in fine art, for example, actually benefits from inflation, as prices rise during times of inflation.

- Potential for outsized returns: Alternative assets usually have a higher upside than traditional investments. This means you might see much higher returns in a short amount of time (though with increased risk in some cases).

- Asset diversification: Investing outside of public markets means you increase your diversification to add in assets most portfolios don’t. This actually lowers your overall investment risk.

Step 5: Invest in Stocks

Now that we’ve covered alternatives, let’s explore the other parts of a 40/30/30 portfolio.

40% Stocks – Growth Engine of Your Portfolio

Investing in stocks is the core of most portfolios, but the 40/30/30 portfolio dials it back to only 40% of the overall portfolio.

Investing stocks should be part of any high net worth asset allocation — but it’s important to pick companies that have a proven track-record and are poised for growth.

To build a diversified portfolio of equities, you’ll want to look outside the U.S. as well. Global diversification gives you access to markets all over the world, with much less correlation to U.S. political and economic performance — giving you true diversification.

As a HNWI, you might choose to have a trusted financial advisor do this for you. But you may also want to do some of your own legwork and stock-picking, too.

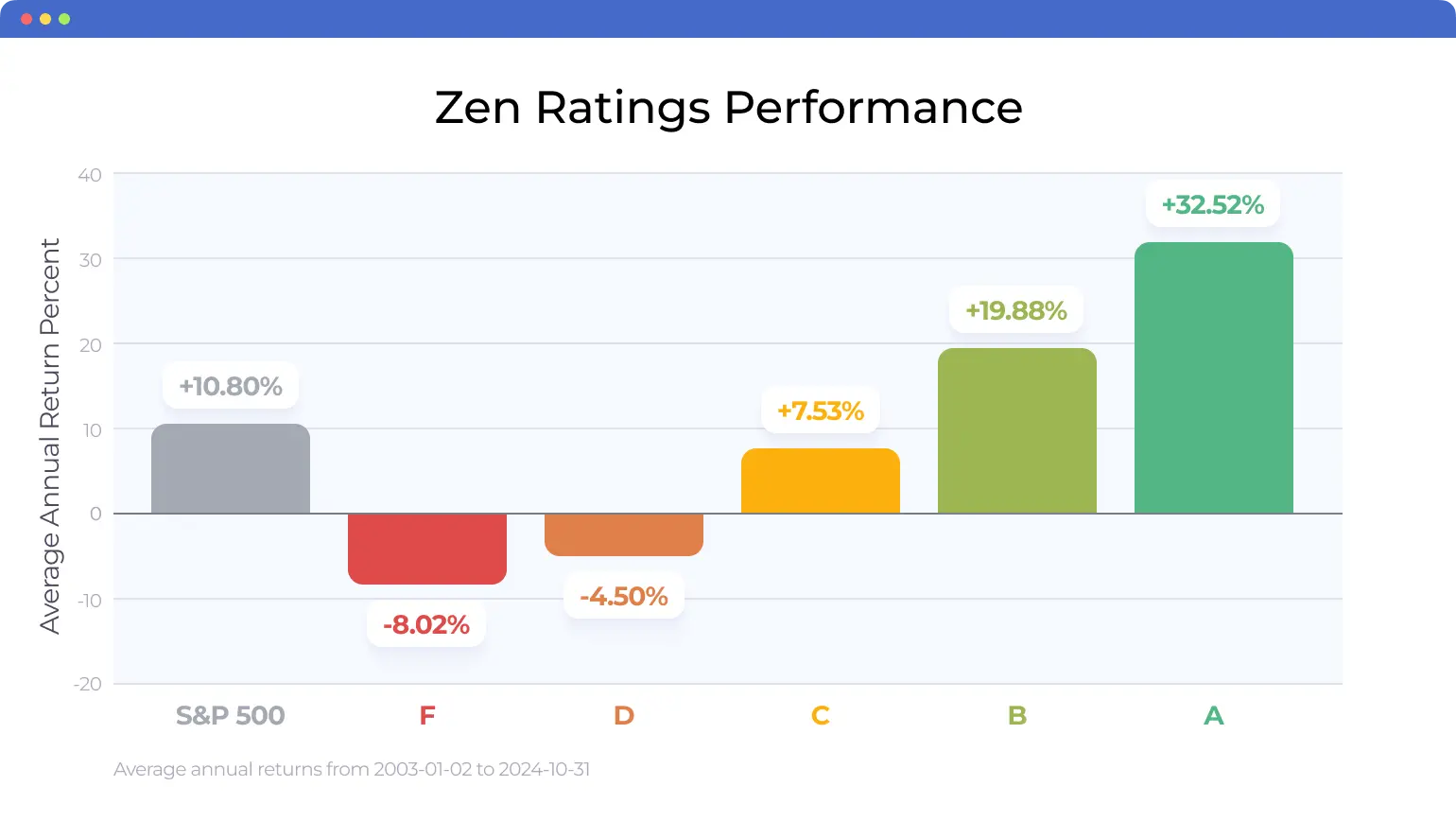

If you fall into the latter category, it’s important to do your due diligence for any company you plan on dropping hundreds of thousands of dollars into. You’ll want to research each stock with tools like WallStreetZen’s stock screener and Zen Ratings analysis before investing.

It’s worth entering a ticker in our system before you invest — our quant ratings system reviews every stock on 115 factors proven to drive growth, and it has a proven track record of 32.52% average returns for stocks rated “A” in the system.

In addition to having a trusted financial advisor, you might want to choose some stocks in an account that you manage.

If that sounds like you, be sure to choose a platform that offers domestic and global access to stocks with low fees. Online trading platforms like eToro offer commission-free stock trading so you can build a portfolio without losing money to unnecessary fees.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Step 6: Invest in Bonds

If you have a net worth north of $30 million, fixed income should be a staple in your portfolio. Which leads us to…

30% Bonds – Income and Capital Preservation

The 40/30/30 approach suggests that 30% of your portfolio be dedicated to fixed income assets that provide stable yields you can count on.

For HNW individuals, it’s important to invest in very low-risk and zero-risk fixed-income assets. This protects your capital while giving you steady returns in the form of dividends and monthly or quarterly payments.

Some popular fixed-income assets include:

- U.S. Treasuries

- Inflation-adjusted bonds (I-bonds)

- Bond Fund ETFs

- Certificates of Deposit (CDs)

- Money market funds

- Municipal bonds

These assets offer a fixed interest rate (in most cases) that is paid to you on a regular basis. For example; Bonds ETFs hold a mix of bonds and typically pay out a monthly payment. Other investments, like CDs, accumulate interest and pay it out at the end of a set term.

Fixed income is designed to bring stability to your portfolio — often with less volatility than other asset classes, and the regular payments bring in passive income.

And while most fixed-income offers lower returns than equities, bonds can offer returns more in the 7% range.

If you’re interested in testing out bond investing on a small scale before going big, check out Public. Their Bond Account lets you invest in a high-quality selection of bonds and offers an impressive yield — 6.78% as of June 2025.

Step 7: Get Smart About Rebalancing and Managing Risk Over Time

Once you expand your asset allocation into alternative assets, you still need to manage your portfolio like you would a traditional portfolio. This means rebalancing over time, assessing your risk tolerance, and understanding your cash flow and liquidity needs.

For example; If one asset class outperforms and becomes a much larger piece of your asset allocation, you might need to sell some of it off to purchase underweight assets in your portfolio. With private deals potentially locking up your investments for years, rebalancing can be tough.

And combining your assets rebalancing strategy with tax implications — and there’s a few pieces of the puzzle you may need to figure out to stay on top of your investing strategy.

Working with a qualified investment advisor can help you navigate the complexities of managing a larger and more diversified portfolio. From tax planning and asset location, to understanding tax considerations and liquidity needs — you may benefit from professional help as you make investment decisions.

Empower

Portfolio managers with experience in multiple types of asset allocation strategies and asset classes such as Empower can give you clarity in your strategy, while protecting you from risk and unnecessary taxes.

Plus, they can be the voice of reason during market turmoil to help you stay the course with your investments for long-term growth.

Empower also stands out for its lower-than-average fees.

With Empower, fees start at 0.89% for up to the first million dollars invested, but go down to as low as 0.49% depending on account size. That’s significantly less than most legacy brokers — for instance, Fisher Investments charges a 1.25% fee.

Say your account is $1 million. With Empower, you could save as much as $36,000 over ten years in fees alone.

Fisher Investments

Earlier, I mentioned how Empower has lower fees than Fisher Investments.

However, HNWIs know that sometimes when you pay more, you get more. If you’re an affluent investor who wants a hands-off approach, Fisher Investments’ higher fees might be worth it. Here’s why:

- Tailored approach: You will get a highly customized investment plan at Fisher Investments. You won’t just choose Portfolio A, B, or C based on your risk tolerance. They’ll work with you to create a personalized portfolio strategy built specifically around your goals, risk tolerance, and time horizon.

- Dedicated Investment Counselor: Related to the above, you’ll always have someone you can reach out to at Fisher Investments.

- Transparency: Fisher Investments doesn’t hide commissions or fees. They have a tiered, performance-aligned management fee. Even though it’s higher than some, they’re not secretive about it, which I appreciate.

- Long-standing reputation: Fisher Investments was founded in 1979, adding a certain gravitas to their reputation. After all, if they’ve been doing this for nearly 50 years, they must be doing something right. That’s further evidenced by their stats: 185K clients, and a staggering $330+ billion in management.

High Net Worth vs. Ultra High Net Worth: What’s the Difference?

If you have a net worth of $1 million or more — you have a high net worth. But if you have a net worth of $30 million or more, you’re considered someone with an Ultra High Net Worth (UHNW).

And while the investment approach for getting to your first $1 million and beyond is largely similar — your approach will start to change once you reach UHNW status. Instead of focusing only on growth, you’ll want to consider risk, income, tax-efficiency, and your tolerance for market volatility.

Why Asset Allocation Matters for High Net Worth Individuals

When you build a massive net worth — it’s important to protect it. And while you probably built your wealth by concentrating your time and effort on building a business, you need to diversify your holdings if you want to preserve and grow your net worth in the future.

Asset allocation is how you split your money between different assets. But more than just choosing investments, you’ll want to consider the entire financial picture when building an asset allocation for your money.

This includes things like tax efficiency, estate planning, and risk — plus your need for access to your money over time. The right asset allocation protects against market volatility and maximizes long-term returns.

The 40/30/30 asset allocation model has emerged as a populate shift for high net worth investors — splitting assets into 40% stocks, 30% fixed income, and 30% alternative assets.

Private credit — a proven asset class for HNWIs

Thanks to pioneering platform Percent, private credit investments are now simple to access for accredited investors.

And you don’t have to be locked in for ages.

Percent’s average term length of an investment is around 9 months; deals are typically 6 to 36 months.

This shorter term can diminish interest rate risk. Here’s why. Interest rate risk involves the decline in the value of longer-term bonds when interest rates rise. As new bonds are issued with higher yields, the prices of existing bonds decrease. Bonds with shorter maturity dates are less susceptible to this risk.

Final Thoughts: Allocation Strategy For High Net Worth Individuals

Building the right asset allocation strategy when you have a high net worth is critical. You need to consider your risk tolerance, tax strategy, and your ultimate goals for your portfolio.

Choosing a globally-diversified mix of stocks, fixed income, and alternative assets can help you potentially get better risk-adjusted returns than a traditional portfolio.

But it’s best to work with a licensed financial advisor with experience in both public and private markets to help you put the pieces of your financial puzzle together.

And if you want to learn more about choosing the right stocks for your portfolio or explore a smarter asset allocation strategy — start with WallStreetZen today.

FAQs:

What is ultra high net worth allocation?

To be considered an Ultra High Net Worth (UHNW) individual, you need a net worth of at least $30 million or more. When you reach this net worth, you’ll usually be working with an entire investment team or family office that can help you build a strategic asset allocation for your financial goals.

What net worth puts you in the top 1%?

The top 1% of Americans have a net worth of at least $13 million or more, according to data from the Federal Reserve.

What is the best asset allocation for wealthy people?

While traditional asset allocations used to only include a mix of stocks and bonds, more modern asset allocations also include alternative assets. The 40/30/30 portfolio splits investments into 40% equities, 30% fixed income, and 30% alternative assets.

This helps wealthy individuals diversify outside of public markets and spread risk across more asset classes.

What net worth is considered ultra wealthy?

If you have a net worth of $30 million or more, you are considered “Ultra Wealthy.”

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.