Prop trading is an interesting proposition: there is less of the risk of trading a large account but a fair portion of the reward (if you’re a good trader).

And if you’re reading this, you’ve likely heard that Take Profit Trader is one of the top options. And other Take Profit Trader reviews might have mentioned that it was especially good for beginners.

Yet is it the best choice? Is prop trading for you? We’ll help you answer both questions, as well as tell you what to look out for with our takeprofittrader review.

Should You Try Take Profit Trader? Key Takeaways:

If you’re looking to get right to the point of this or other Take Profit Trader reviews, read the following:

- Prop trading is a risky proposition and is prohibited for larger institutions for a reason. It is highly speculative by nature, and no investor will be right all of the time.

- If you are a new or inexperienced investor, Take Profit Trader is not for you, and you will likely waste your money trying to qualify if you still insist on signing up. Less than 20% of people with accounts succeeded in their tests.

- If you want to work with Take Profit Trader, we strongly recommend supporting your subscription with additional investment tools such as Tradingview Pro or Benzinga Pro. (Yes, this will drive up the cost considerably, but they can help keep you safe.)

A simpler (and less costly) way to invest…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How Does Take Profit Trader Work?

Take Profit Trader is a prop trading firm or funded account program that allows users to sign up to qualify to manage a funded account (which is not their money).

If they quality after trading with their test account, they can upgrade their account and then withdraw a portion of the profits on that account for themselves.

The target audience is technically advanced traders, but after reviewing the site, Take Profit Trader appears to often be targeting people who think they could “make it” with day trading.

Typically, you can expect the following steps:

- You sign up for Take Profit Trader, typically paying a monthly fee until you get a pro account. This fee can be reduced by using a Take Profit Trader promo code, if one is available.

- You work to create your test account and invest according in order to pass the examination period.

- Assuming you pass, you move onto a paid account and start trading.

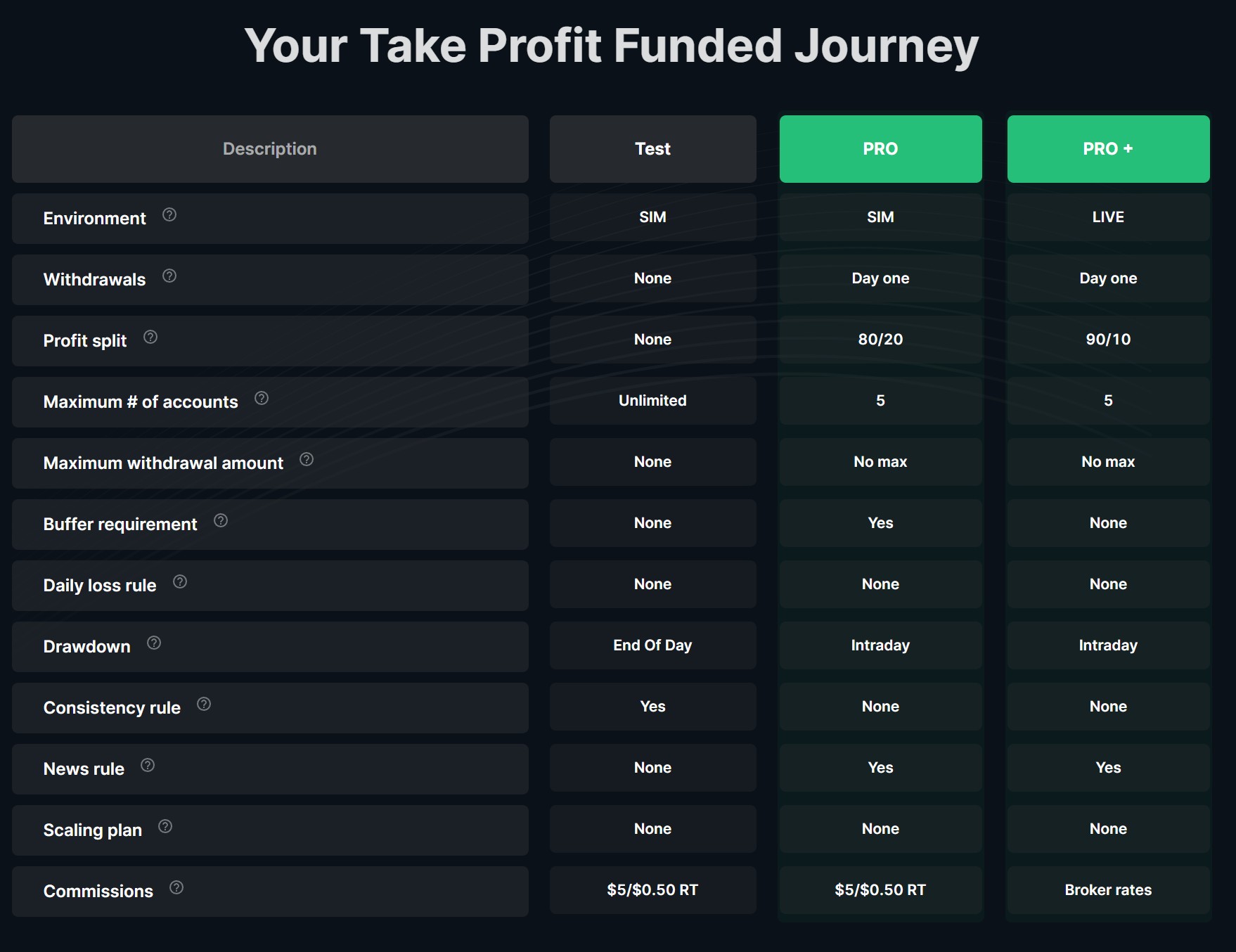

There are also different types of accounts. After the trial account, there is the pro account, and the pro plus account, with some differences between them.

Are Funded Account Programs Legit?

Funded account programs are legit, but riskier to the user than they would seem at first glance. Strictly speaking, you won’t lose money trading. If the account loses money, you don’t lose that money.

However, that isn’t to say that Take Profit Trader and similar programs only make money from their share of user’s trading profits.

There are typically fees to consider, a subscription fee for all or some of the time the user is trading (depending on the program), and fees if the account is frozen because the trader lost too much money at once and the user wants to reactivate or reset the account.

Risks Associated With Funded Account Programs

Key risks include:

Limitations: While prop trading firms typically state that you can get money whenever after you’ve made a profit for them, there’s typically limits and you might have to jump through a few hoops to do so.

Additionally, if your account does too poorly (and you can’t control the results of every last trade), your account could get locked, and you’ll either lose out on the account or have to pay $100 for a reset.

Fees: There are not necessarily any trading fees for each individual trade that you need to pay, but you should note that there are fees Take Profit Trader charges.

If your account gets cancelled (perhaps due to poor performance or not following their exact guidelines), it will cost you to reactivate the account.

There is also a one-time $130 activation fee for a pro account. There may be costs involved in getting approved, depending on how long you take.

Taxes: While expected, we do want to remind you that taxes can come into play depending on your investments, withdrawals, etc. It is a factor that you will need to take into account in determining whether a funded account program is worth looking into or a potentially profitable enterprise for you.

Essentially, funded account programs are legit, but they are a lot more complicated than most of them may let on, and will have more strings than if you were trading on your own using your own money.

Consider not just the savings you might have by not investing your own money. Day trading takes time. Following the restrictions takes time.

And while there is less risk for you, there is also less reward, and you’re paying the opportunity cost of everything else you could be doing while stressing over an account that you only receive a portion of the profits of.

While it is not gambling, this is a case that the house will always win in the end. Take Profit Trader must remain profitable and will manage risk to itself accordingly. How do you think it does so?

Looking for A Simpler Way to Start Investing? Try Zen Investor

If you are looking at prop trading because you are looking for a lower-risk option, or want more of a guiding hand, there are better options.

For less experienced investors or those who want strong recommendations, or alternatively, those who don’t want to engage in day trading and instead have long-term considerations, WallStreetZen has Zen Investor.

If you’re looking for a better opportunity to invest and learn about investing, then Zen Investor is the first place you want to turn. With it, you’ll get a selected portfolio and explanations from our own Steve Reitmeister, who has more than four decades of experience in the industry.

He utilizes his own experience, as well as our Zen Ratings system, to determine the best options. A-rated stocks using the Zen Ratings system have an average annual return of 32.52%.

Take Profit Trader’s Evaluation Process: What to Expect

You cannot simply get into Take Profit Trader and get started. There is an evaluation process involved, and you will need to work with a test account before you can start making money with it.

It is their money, after all, and you need to show you can consistently make money for the account in a way that is loss-averse.

They state on their own site that “from 1/1/23 – 8/31/23. only 20.37 percent of our current registered users at Take Profit Trader have successfully passed a trading test.”

It will not be easy and, again, only experienced traders or those with unique insights will find success in the long term with Take Profit Trader.

You will also need to follow certain rules. You will need to trade for a minimum of 5 trading days. Additionally, your most profitable day cannot be more than 50% of your total profits (this is to encourage consistency instead of relying on luck). Additionally, you cannot use trading bots or trading algorithms.

Note that while Take Profit Trader does have evaluation and testing, it is relatively simpler to get approved with Take Profit Trader than most other prop trading firm. There is only one round of testing, and it is not as long as some other firms.

That doesn’t mean it will be easy, and that you can’t lose the account after the fact or need to reset it, but there are some advantages to trying with Take Profit Trader first, especially if you have a Take Profit Trader promo code that will give you a discount.

Essential Tools for Success with Take Profit Trader

If you are still looking to succeed with Take Profit Trader, you are going to need all of the tools a day trader and speculative trader needs to succeed, and a good head and experience on your shoulders on top of that.

You need to know the market, have fast access to information, and be able to see trends as easily as possible. With that in mind, we recommend the following for anyone trying out Take Profit Trader:

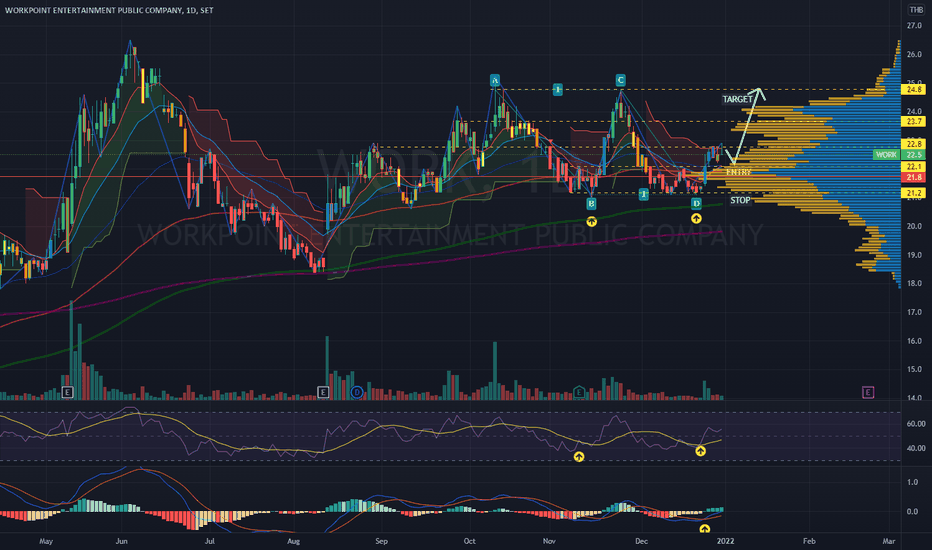

TradingView Pro

- Cost: $99.95 per month

- Why You’ll Need It: You need to keep track of current prices as accurately as possible.

Tradingview Pro is the standard in charts, tracking, and getting the information you need in real time to make key trading decisions.

And while you might find charting features on other platforms, many will say that they prefer Tradingview for charting (though you should test this for yourself with a trial).

If that and extra alerts are key parts of how you make your trading decisions (short or long term), and would allow you to make better prop trading decisions, you’ll want Tradingview.

To sign up, use this link to get a 30 day free trial and a $15 bonus.

Koyfin

Cost: Free – $199/mo., depending on plan

Why You’ll Need It: It can give you a massive amount of information all in one place, and allow you to tailor the types of information you have at your fingertips, allowing for snap decision-making.

For prop traders, Koyfin will stand out as the most affordable tool to start out with, and is especially useful for its macroeconomic indicators (something any prop trader will want to at least take into consideration).

Use this link to take 10% on any plan for the first year.

Benzinga Pro

Cost: Up to $197 monthly, depending on plan.

Why You’ll Need It: Day traders and prop traders succeed or fail based on their access to information. Benzinga provides access to this information.

For many prop traders, Benzinga is the best source for near-instant news. Seconds and minutes can matter, and Benzinga users might just get those extra moments to make the best trade.

Note that Benzinga Pro has a 14-day free trial, which should be more than enough time to determine if it will be a good fit for you and your trading setup (or even determine if Take Profit Trader is right for you). If you’re interested in Benzinga, use this link.

Take Profit Trader vs. FTMO: Which Is Better?

Take Profit Trader is not the only option available for prop trading and this takeprofittrader review isn’t necessarily the only review of a prop trading firm you should be reading. FTMO is one of the other big names in the industry and has been around for longer (FTMO was founded in 2015).

While some people will have accounts with every firm they can find, we certainly don’t recommend this starting out. Instead, you’ll want to focus on one. Yet which should you choose?

FTMO is known for higher account limits, more options for types of trading (swing trading, news trading, HFT trading, and others), and allowing for things such as holding positions over nights and weekends. In essence, it allows for some level of greater flexibility in a prop trading program, and to some greater rewards.

There is a great deal more to understand about each platform, and you should investigate more yourself, but in short:

Use Take Profit Trader if:

- You are looking for a proper trader that is easier to qualify for.

- You are looking for a prop trader with fewer limitations and rules (though note that they are there).

- You don’t mind the intraday trading drawdown.

- You would like to trade futures.

Use FTMO if:

- You are looking to work with a larger maximum balance.

- You are looking to work with different types of trading.

- You want to hold positions overnight and over weekends.

The Final Word: Is Take Profit Trader Legit?

Take Profit Trader is legit, but it is not going to be the best option for everyone. Don’t take take their marketing at face value, and read other Take Profit Trader reviews with the understanding that the review might not have you as its key audience.

For starters, prop trading is not for everyone, and only experienced day traders and investors will likely last long with the account in the first place.

Additionally, there are more fees, potential monthly costs, and opportunity costs than many will first consider.

However, for experienced traders knowing what they’re getting into, Take Profit Trader can be a great option for a prop trading firm that isn’t as restrictive as some of the competition.

While Take Profit Trader might be able to provide benefits to short-term traders, those looking for a long-term investment option will not find it here.

Instead, those interested might be better served by Zen Investor or Zen Ratings, which will focus on the long-term prospects of a stock. You’ll have more time in your life and more peace of mind with them.

FAQs:

What is Take Profit Trader?

Take Profit Trader is a prop trading firm that provides an account for users to trade (typically day trade) from. Users then share in the profits from that account’s trades.

How does Take Profit Trader work?

Take Profit Trader is a prop firm that provides an account for users to invest (for a monthly fee) after they pass an evaluation. The user then day trades and gets to keep a share of the profits, if profits are made.

What are the risks of funded trading accounts?

The risks are lesser than direct investing, considering how users of funded trading accounts do not necessarily use their own money.

However, users are at risk of losing the account depending on their performance, perhaps having to pay a fee to reactivate it. Other fees and wasted time are additional risks.

What are the best tools for day trading?

The best tools for day trading are TradingView Pro, Benzinga Pro, and Koyfin. However, there are others that might be better suited depending on your strategy and needs.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.