Is Google Gemini good for investment advice? TL;DR Version:

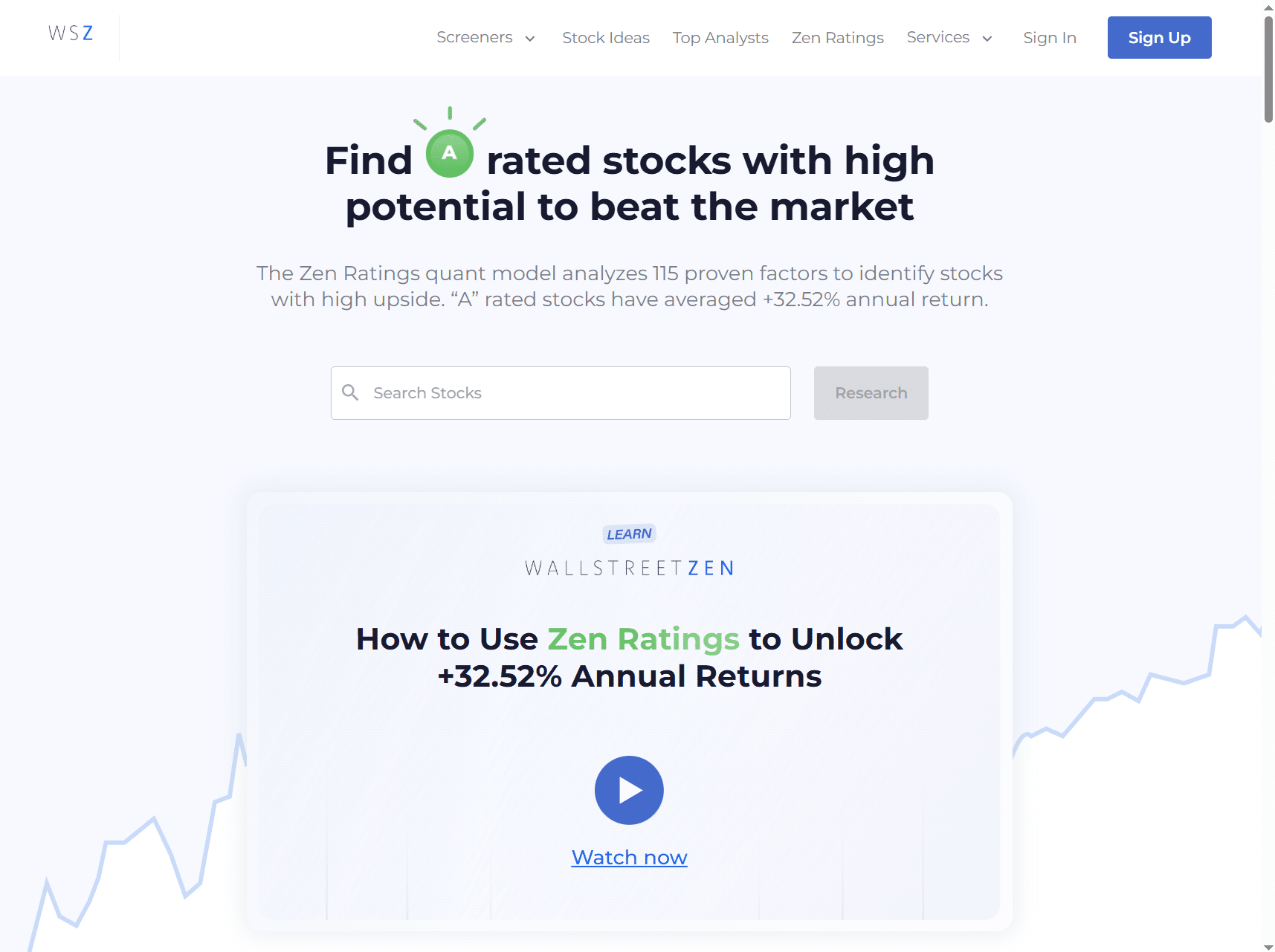

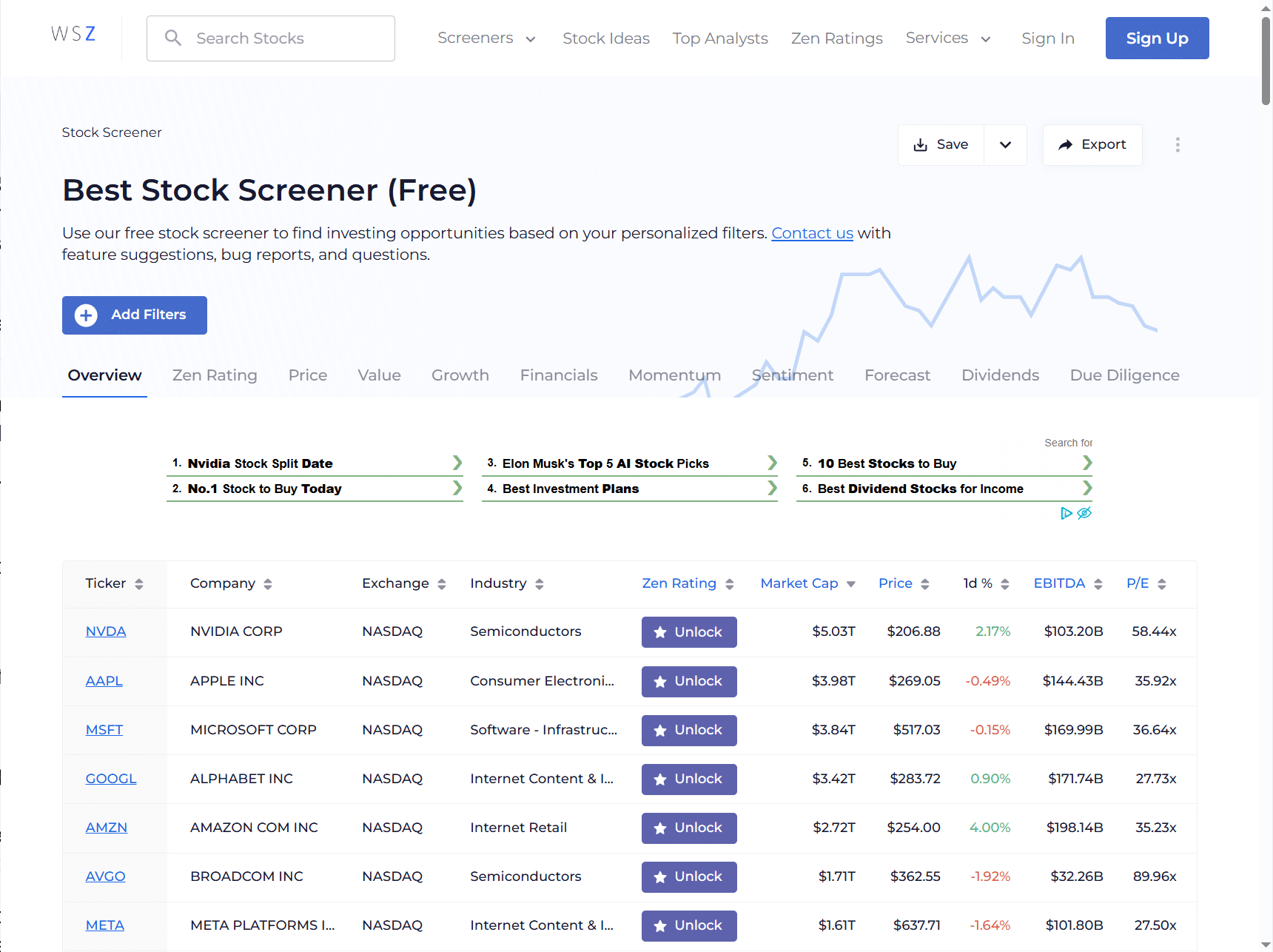

Yes. Google’s Gemini can absolutely help with your investment research. But here’s the critical part — you shouldn’t blindly follow Gemini stock picks without verification. Be sure to back up any Gemini-sourced stock picks using tools like like WallStreetZen’s Zen Ratings.

The Longer Version…

Gemini excels at explaining financial concepts, summarizing complex information, and generating initial stock ideas. What it cannot do is provide real-time market data or personalized financial advice tailored to your specific situation.

So I do recommend using it — but only as a research companion alongside dedicated financial tools — not as your sole investment advisor.

For superior AI-assisted stock analysis, you need platforms specifically designed for finance.

Tools like WallStreetZen’s Zen Ratings system and Fiscal.ai combine AI intelligence with comprehensive financial analysis. These platforms use AI models trained specifically on financial data and proven investment factors.

I’ll show you exactly how to use Gemini effectively below — plus where to verify everything with real financial data.

Market-Beating AI Stock Picks — Verified By a Veteran (Human) Investor

With a Zen Investor subscription, you gain access to an AI-powered stock-picking system — with picks that are further vetted and hand-picked by a human expert. For just $99 per year (or $79 for a limited time, using this link), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com

✅ Each selection undergoes a careful review of 115 factors proven to drive growth in stocks, including proprietary AI algorithms, using our Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary

Why Use Gemini for Investing?

Here’s what makes Gemini valuable for stock market research:

Speed and accessibility. You can explore different investing strategies — value, growth, dividend, momentum — in minutes rather than hours. I often use it to decode analyst jargon or quickly compare companies side-by-side.

Educational powerhouse. Whether you’re new to investing or experienced, Gemini can explain concepts at your level. Need to understand what the P/E ratio is? Curious about emerging sectors like renewable energy? It provides a comprehensive overview.

Idea generation. Stuck in analysis paralysis? Ask Gemini for stocks that meet specific criteria. It’s excellent for getting your creative juices flowing and exploring new investment themes.

However — and this is crucial — don’t accept what Gemini says blindly. Always back it up with research using trusted platforms like WallStreetZen, where a 115-factor quant ratings system lets you quickly perform due diligence and get a pulse check on any stock.

Found a stock on Gemini? Go ahead — see how it fares on WSZ’s 115-factor review. Enter any ticker here.

Understanding Gemini’s Limitations With Stocks

Gemini excels at explaining complex financial concepts in plain English. Need to understand price-to-earnings ratios? It’ll break them down perfectly. Want to know the difference between growth and value investing? Gemini can explain both strategies clearly.

But here’s what Gemini for investing cannot do: access live market feeds, provide personalized advice, or replace proper due diligence.

Due to the nature of AI language models, information may be outdated or require verification. Think of it as a knowledgeable research assistant, not a licensed financial advisor.

Fortunately, there are specialized AI-assisted platforms that focus specifically on financial analysis and stock research. Let’s explore them.

(P.S. For daily market insights including a weekly list of 5 Strong Buy Stocks, subscribe to our FREE newsletter, WallStreetZen Ideas)

How to Use Gemini for Stocks: Best Prompts & Examples

Getting good results from Gemini for stocks depends on asking the right questions. The more specific your prompts, the better your results.

Instead of “give me good stocks,” try “suggest 3 dividend-paying stocks with low payout ratios and strong balance sheets.”

Here are some powerful prompts that deliver value for both beginner and advanced investors:

1. Summarize Business Models

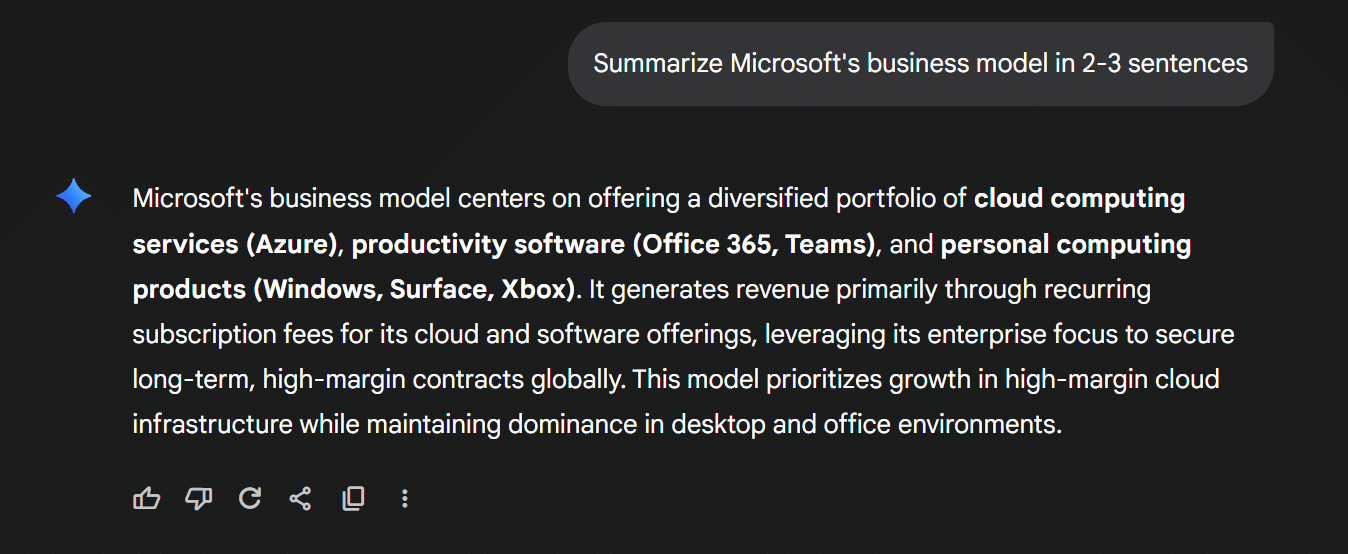

Prompt: “Summarize Microsoft’s business model in 2-3 sentences”

This type of prompt helps you quickly understand what a company actually does and how it makes money. I use this constantly when exploring new stocks in unfamiliar sectors.

Gemini excels at distilling complex business operations into digestible explanations. Perfect for building your initial understanding before diving deeper into financials.

2. Generate Screening Ideas

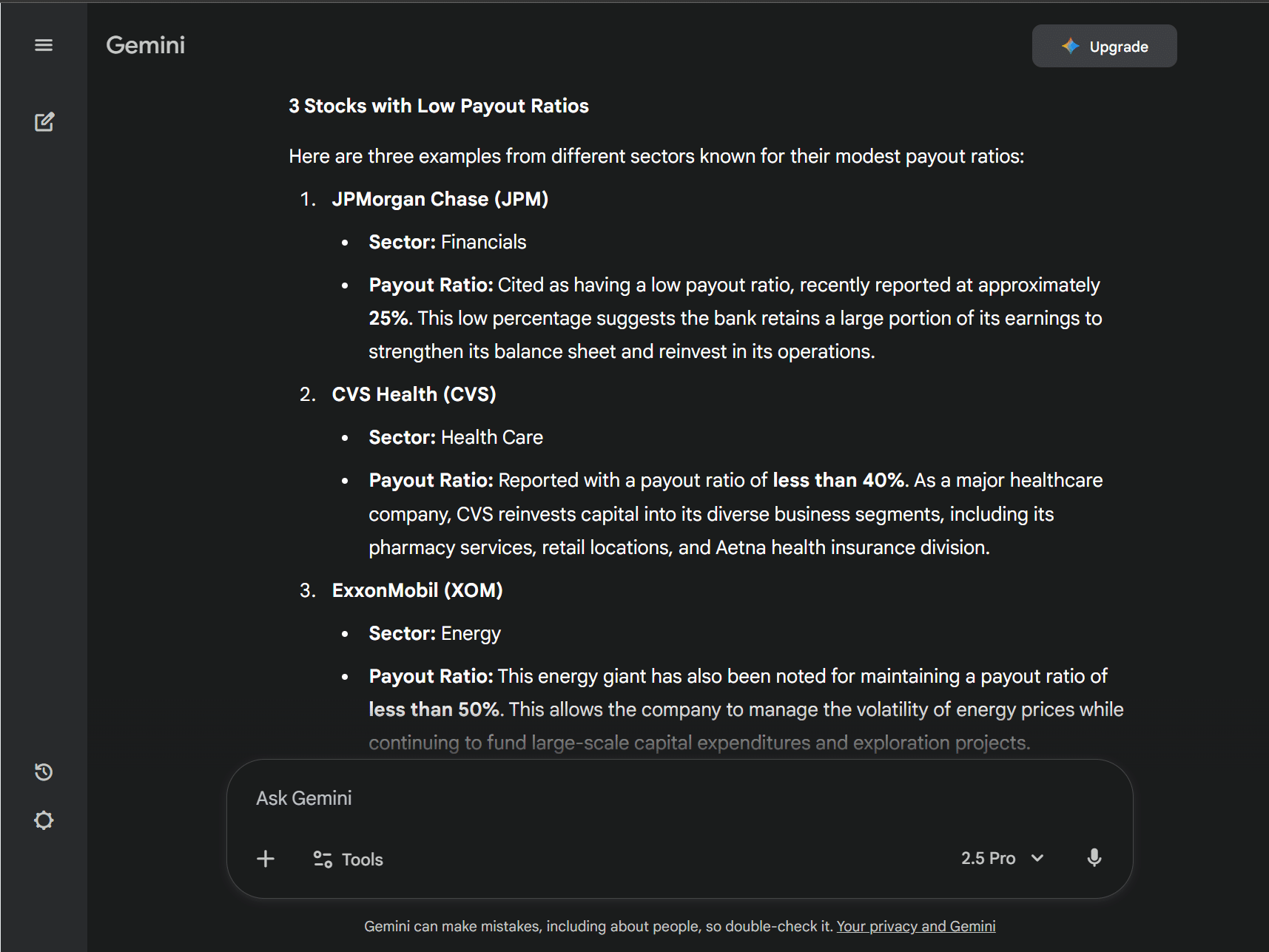

Prompt: “List 3 dividend-paying stocks with a payout ratio under 50%”

This screening approach helps you generate investment candidates based on specific criteria. Gemini can quickly identify stocks that meet your requirements, giving you a starting point for further research.

Remember — these are conversation starters, not final recommendations. Always verify the dividend data and payout ratios through platforms like WallStreetZen.

3. Compare Companies

Prompt: “Compare Tesla and Ford’s financials and valuation metrics”

Comparative analysis is where Gemini really shines. It can quickly summarize key differences between competitors, helping you understand relative strengths and weaknesses.

This type of analysis saves hours of manual research — though you should still verify the specific numbers through reliable financial data sources.

4. Explain Industry Trends

Prompt: “What are the main growth drivers for semiconductor companies in 2025?”

Understanding industry-level trends helps you identify which sectors might outperform. Gemini can explain complex market dynamics in accessible language.

I use this type of prompt when exploring new sectors or trying to understand macro factors that could impact my portfolio.

Pro Tip: Ask follow-up questions to drill deeper. If Gemini suggests a stock, follow up with “What metrics should I check to verify this analysis?” or “What recent developments might affect this company’s prospects?”

Gemini Stock Picks: Can You Trust Them?

Here’s the uncomfortable truth about Gemini stock picks: They’re conversation starters, not investment recommendations.

I’ve tested Gemini’s stock suggestions extensively. Sometimes they’re insightful — identifying companies with solid fundamentals and reasonable valuations. Other times, they’re based on outdated information or miss crucial recent developments.

The fundamental problem: Gemini isn’t a licensed financial advisor or real-time data provider. It can’t know that a company just missed earnings, announced major management changes, or faces new regulatory challenges.

What you’ll often find is that the reasoning behind suggestions is sound, but the current financial metrics or stock performance might tell a different story.

I treat Gemini stock picks like tips from a smart friend — worth investigating, but never worth buying blindly.

Try this: Ask Gemini for 3 undervalued tech stocks, then check those names on WallStreetZen to verify the actual data, ratings, and recent developments.

A stock-picking service with a proven track record like Zen Investor will outperform unverified AI suggestions almost every time.

Zen Investor is the best of both worlds. It leverages stocks chosen using a proprietary AI factor trained on a 20-year neural network (it’s getting better all the time!) but is managed by a real, live, 40+ year investing veteran who looks at every potential stock through the lens of experience.

The difference? Human expertise combined with AI analysis, plus real-time data verification.

Pairing Gemini With the Right Tools

The real power of investing with Gemini comes when you combine it with specialized financial platforms. Here’s my recommended toolkit:

WallStreetZen — My go-to for fundamental research. The Zen Ratings system includes AI in its 115-factor evaluation but also employs dozens of “traditional” due diligence checks. Perfect for verifying Gemini’s suggestions with comprehensive data. And it works — stocks rated “A” using this system have historically delivered 30%+ annual returns.

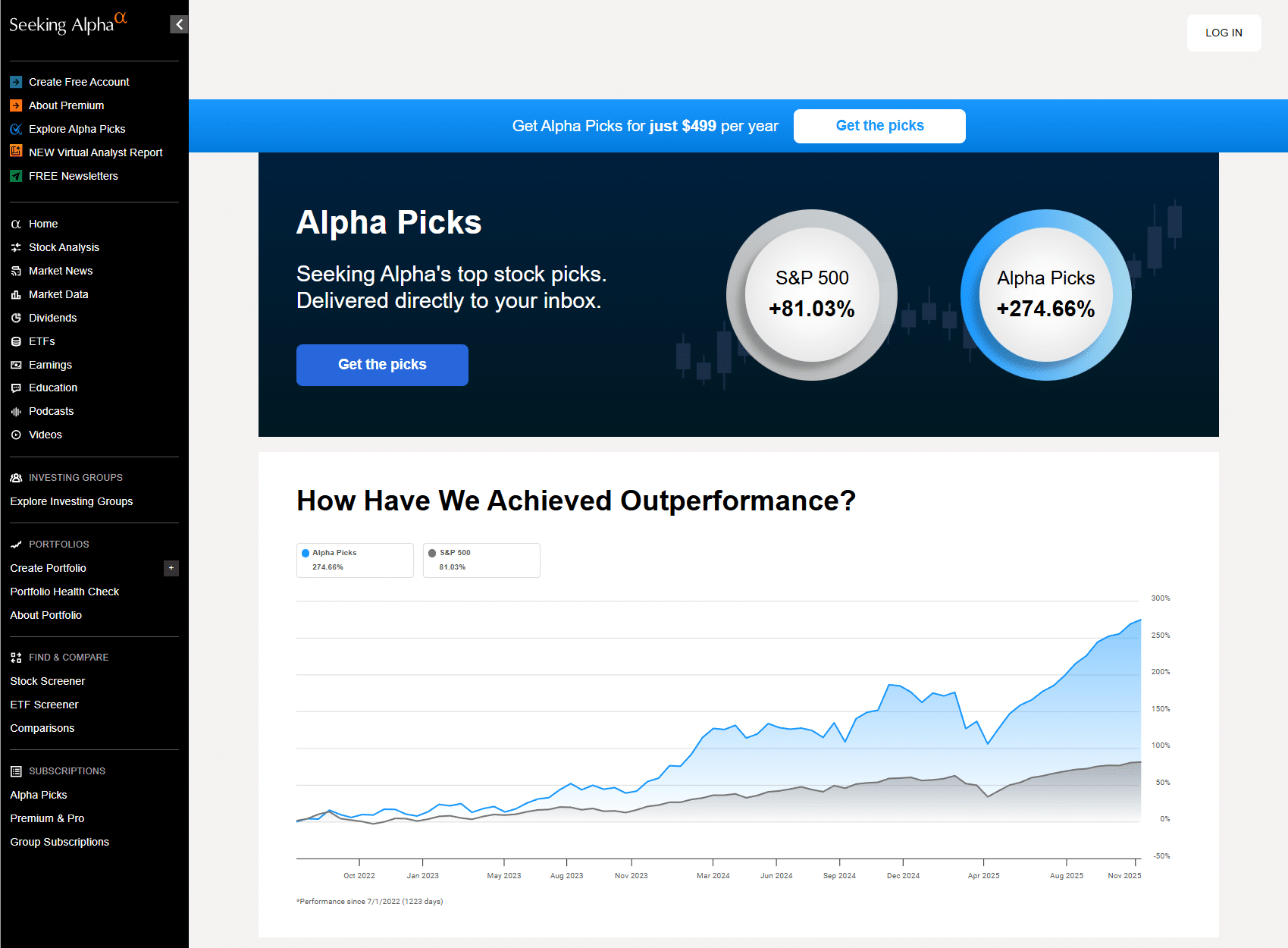

Seeking Alpha — Essential for analyst commentary, earnings transcripts, and quant ratings. When Gemini suggests a stock, I always check what professional analysts are saying on Seeking Alpha. Their relatively new stock-picking service, Alpha Picks, is also excellent, already boasting a 274% return since inception.

Fiscal.ai (formerly FinChat.io) — This AI-powered platform provides real-time financial modeling with actual market data. It’s like Gemini’s more sophisticated cousin for serious financial analysis. A great companion when using Gemini for investing.

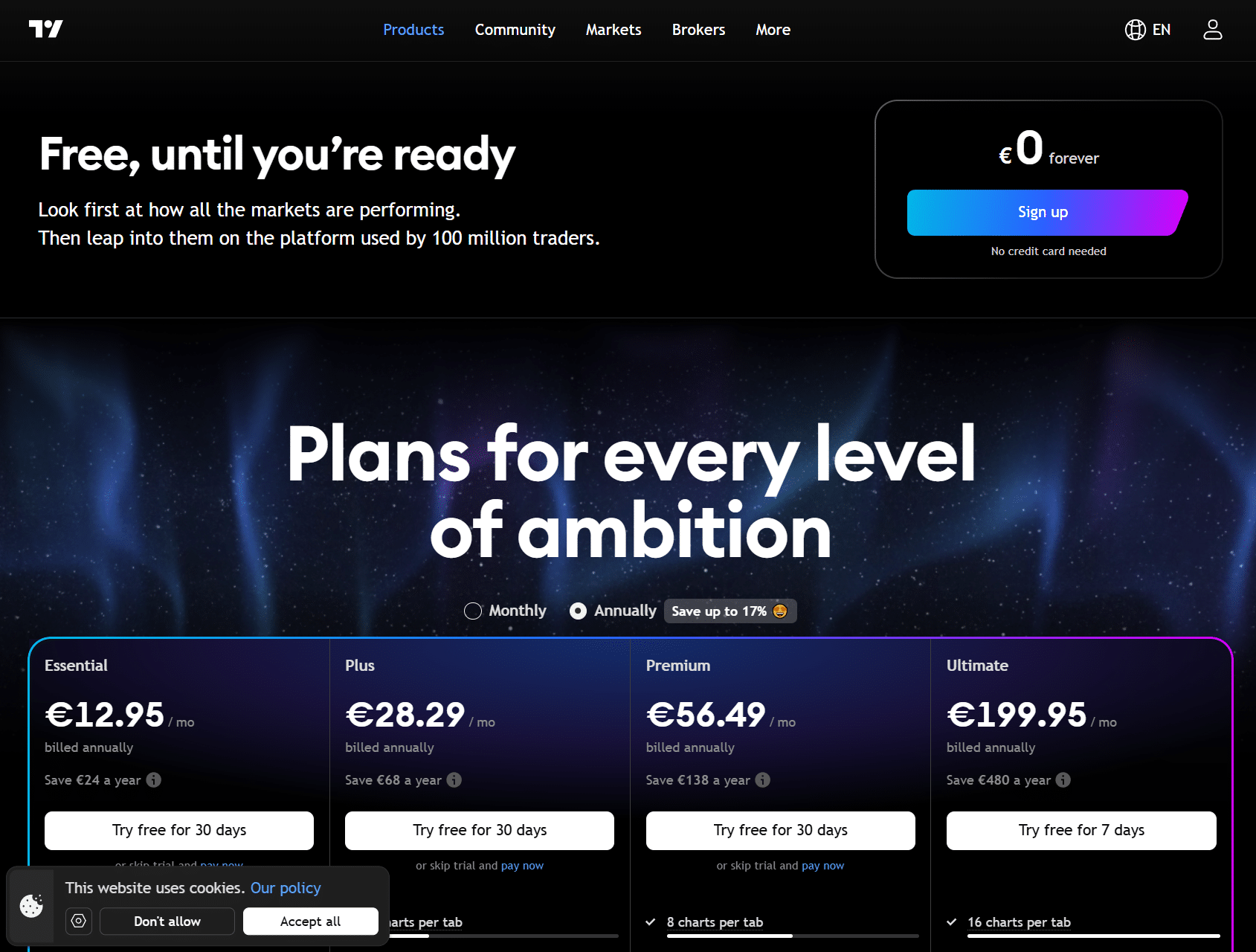

TradingView — Critical for technical analysis and charting. If you’re timing entries or exits, this complements Gemini’s fundamental insights perfectly.

TipRanks — Tracks analyst forecasts, insider trades, and hedge fund activity. Great for seeing what the smart money is actually doing with Gemini’s suggestions.

Pro Tip: Ask Gemini for initial ideas — then plug the tickers into these tools to verify earnings, valuation, and trends. This workflow combines AI speed with verified financial data.

My Investing Workflow

Here’s exactly how I use Gemini in my research process:

- Gemini generates ideas — I ask for stocks meeting specific criteria or explore sector themes

- WallStreetZen for fundamental analysis — Verify financials, check Zen Ratings, review key metrics

- TradingView for technical confirmation — Analyze charts, identify entry points

- Final decision — Synthesize all information and make informed choice

- Execute trade — Use my preferred broker

This systematic approach ensures I’m not relying solely on AI-generated suggestions while still leveraging Gemini’s speed and accessibility.

Pros and Cons of Investing With Gemini

Let me be straight with you about where Gemini shines and where it falls short:

Pros | Cons |

|---|---|

Available 24/7 for instant research help | No access to real-time market data |

Excellent at explaining complex concepts | May provide outdated or incomplete information |

Great for brainstorming and idea generation | No legal or fiduciary responsibility |

Helps beginners explore investing themes | Requires verification through other tools |

Free to use with detailed explanations | Cannot execute trades or provide timing advice |

Can analyze multiple scenarios quickly | May miss recent company-specific developments |

The Reality Check

I’ve been experimenting with AI tools for investing for years now, and here’s my honest assessment: the pros definitely outweigh the cons — when you use Gemini for investing correctly.

The biggest advantage? It democratizes financial education. Complex investing concepts that used to require expensive courses or financial advisors are now accessible to anyone.

The biggest risk? Overconfidence. Gemini can make you feel like an expert quickly, but relying on unverified AI information without proper analysis tools is dangerous in the stock market.

The sweet spot is using Gemini for education and idea generation while relying on specialized financial platforms for actual investment decisions.

Final Thoughts: Is Gemini a Good Investing Companion?

Gemini for investing is an excellent research assistant and learning tool — not a replacement for thorough analysis.

After using it extensively, I can say it’s valuable for exploring new concepts, generating stock ideas, and explaining complex financial topics. The speed and accessibility are genuinely impressive.

But — and this is crucial — it works best when paired with verified data from trusted platforms like WallStreetZen, Seeking Alpha, and TradingView.

My recommendation? Start with a few simple prompts today. Ask Gemini to explain an investing concept you’ve always wondered about or generate some stock ideas based on your interests. Then take those ideas and run them through proper analysis tools.

The combination of Gemini’s flexibility with real financial data is powerful. Just remember: in investing, verification is everything.

Next step: Try asking Gemini for 3 stocks in a sector you’re curious about, then use WallStreetZen to check their actual fundamentals, ratings, and recent developments.

FAQs:

What is the best way to use Gemini for investing?

The best way to use Gemini for investing is as a research assistant and educational tool, not a source of final investment decisions. Use it to generate stock ideas, explain financial concepts, and explore different investing strategies. Always verify its suggestions with reliable financial data platforms like WallStreetZen or Seeking Alpha before making any investment decisions.

Can Gemini predict the stock market?

Gemini cannot reliably predict the stock market. While it can discuss market trends and analyze historical patterns, it lacks real-time data and cannot account for sudden market changes or company-specific developments. Use Gemini to understand market concepts and generate research ideas, but never rely on it for market predictions or timing decisions.

Does Gemini give personalized financial advice?

Gemini does not provide personalized financial advice and is not a licensed financial advisor. When using Gemini for investing, treat its responses as educational information and general ideas rather than advice tailored to your specific financial situation, risk tolerance, or investment goals. Always consult with qualified financial professionals for personalized guidance.

Is Gemini good for picking stocks?

Gemini can generate stock ideas and explain investment reasoning, but you shouldn't rely on Gemini stock picks alone. Its suggestions are based on general knowledge that may be outdated and don't include real-time financial data. Use Gemini for initial ideas and learning, then verify everything through comprehensive financial analysis tools like WallStreetZen before investing.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.