Klarna is not publicly traded, but accredited investors can still buy its stock.

Hiive is a marketplace where accredited investors can buy shares of private companies before they go public.

Sign up with Hiive and get access to Klarna before its IPO.

Like many tech companies, Klarna, a pioneer in the BNPL (“buy now, pay later”) sector, has experienced a rough few quarters. So why should investors care about Klarna?

Here’s why. Signs point to a potential turnaround soon, which may have you wondering if it’s a good time to invest — and if so, how to buy Klarna stock.

While Klarna stock is not publicly traded at this time, that doesn’t mean that you can’t get exposure to this exciting company and sector. Keep reading to learn everything you need to know about Klarna stock:

Klarna: The Basics

Before we talk about how to buy Klarna stock, let’s cover the basics.

Founded in 2005, Klarna is one of the best-known companies in the BNPL sector. Their signature product is a payment plan that allows customers to pay for purchases in a series of zero-interest installments.

Klarna’s growth has been exponential:

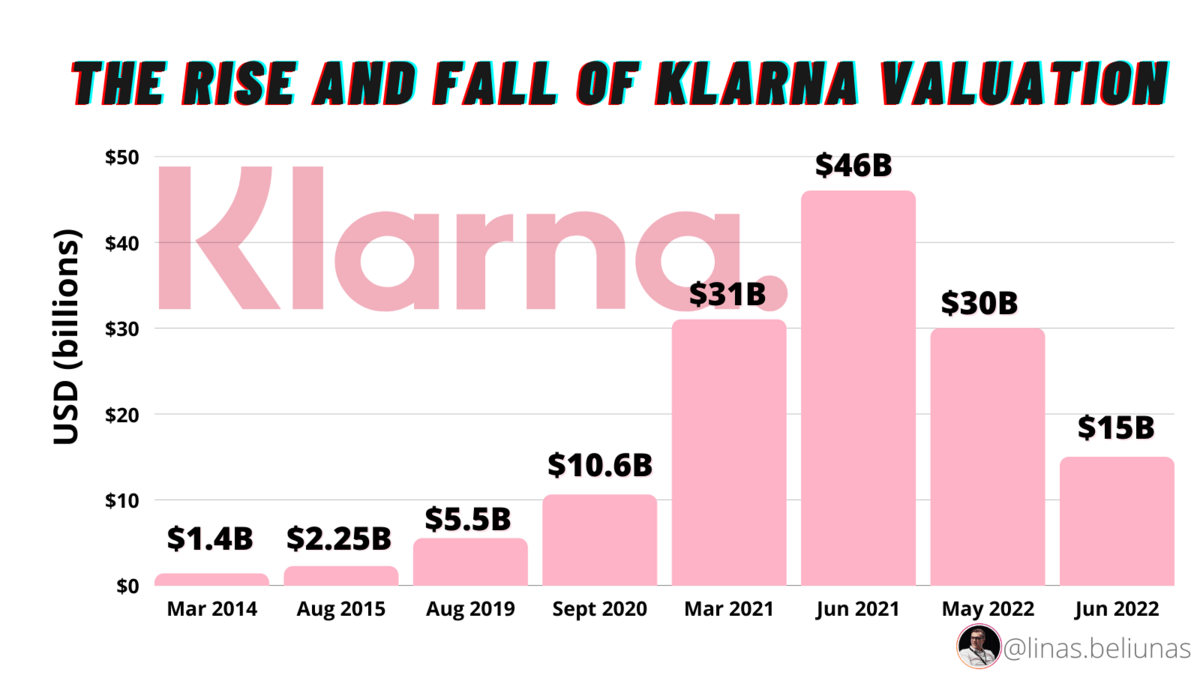

- In 2019, Klarna was valued at $5.5 billion.

- In 2020, Klarna was valued at $10.6 billion.

- By 2021, the company was valued at $46.5 billion.

But like many other tech companies, Klarna experienced serious setbacks in 2022. A mere year after the aforementioned valuation, the company had a whopping 85% drop in valuation to $6.7 billion.

However, the tide could be turning. Recently, there have been several exciting developments for Klarna:

- The Klarna App has been hugely popular — Forbes rated it “Best Overall BNPL App of 2023,” and it currently boasts over 40 million users.

- Klarna has over 150 million users globally.

- After several troubled quarters, Klarna reduced losses in Q4 of 2022 and expects to be profitable by summer 2023.

Considering these factors, you might be wondering how to buy Klarna stock. If you’re an investor, here’s what you need to know…

Can You Buy Klarna Stock? Is Klarna Publicly Traded?

Since Klarna isn’t a publicly traded company, you can’t buy Klarna stock through your brokerage account. You won’t find a Klarna stock symbol or the Klarna stock price on your favorite screener.

However, just because there’s no Klarna stock doesn’t mean you can’t get exposure to the company and/or the BNPL sector.

In the following sections, you’ll learn how to buy Klarna stock if you’re an accredited investor as well as different approaches for retail investors.

How to Buy Klarna as an Accredited Investor

Klarna is not publicly traded. But accredited investors can invest in private companies including Klarna through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out Klarna, add it to your watchlist, and get notified about any new listings and trades.

On Hiive, each listing is made by a different seller who sets their asking price and the amount of volume offered. These sellers might be employees, venture capital firms, or angel investors.

As a buyer, you can create a watchlist of companies to watch and get notified about price changes or new listings. Once you find an offer you’re interested in, you can accept the asking price as listed, place a bid, or negotiate directly with the sellers.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

Not an accredited investor? Don’t worry. There are still ways to gain exposure to all that Klarna has to offer…

How to Buy Klarna as a Retail Investor

As noted above, Klarna is currently a private company. You’re not going to find a Klarna stock price chart or listing on major exchanges.

Unless you’re an investor, you can’t directly own a piece of the company until it IPOs.

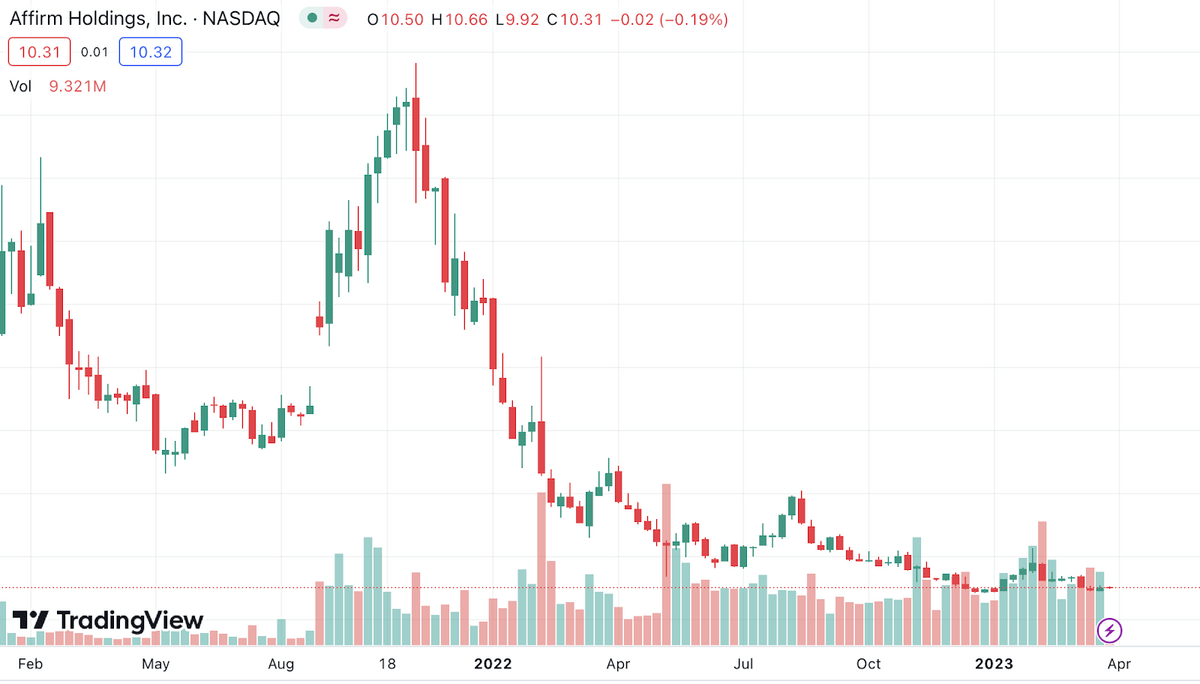

Will Klarna go public? There’s been talk — reportedly, they were considering going public in 2022, though nothing has come to fruition yet. Their competitor, Affirm (NASDAQ: AFRM) went public in 2021. After a flashy IPO, here’s what the stock’s been up to:

Who Owns Klarna?

Klarna is owned by its parent company, the Klarna Group. It was founded in 2005 in Stockholm, Sweden by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson.

Notable investors include Sequoia Capital, Ant Group (the payment affiliate of Alibaba) and Atomico, Bestseller Group, Dragoneer, Permira, Silver Lake, and Visa (NYSE: V).

Does Sequoia Capital Own Klarna?

No, Sequoia Capital doesn’t own Klarna, though it is the largest shareholder in the company. Sequoia Capital Partner Michael Moritz is also Chairman of the Klarna board.

Sequoia Capital is not publicly traded, but plenty of other companies the group has invested in are, including:

- Apple (NASDAQ: AAPL)

- Google (NASDAQ: GOOGL)

- PayPal (NASDAQ: PYPL)

- Zoom (NASDAQ: ZM)

Ready to Invest? Hot Deal for U.S. Residents

eToro is one of the world’s most popular investing platforms with over 28.5 million users.

Right now, eToro is offering a $10 bonus* for U.S. residents who open and fund a new account.

$10 bonus for a deposit of $100 or more. *Only available to U.S. residents. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

How to Invest in Klarna Stock as a Retail Investor

If you’re a retail investor, you can’t buy Klarna stock until the company goes public.

However, there are still ways to get exposure to the company indirectly, through access to companies connected to Klarna and in the BNPL sector. Here are just a few ideas:

Klarna’s Retail Partners

As the BNPL sector grows, it could have an effect on Klarna’s extensive list of retailers. Here are some notable ones:

- eBay (NASDAQ: EBAY)

- Etsy (NASDAQ: ETSY)

- Macy’s (NYSE: M)

- Sephora, which is part of LVMH Moet Hennessy Louis Vuitton SE (LVMUY:OTCPK)

Klarna’s Investors

We already talked about Klarna’s biggest investor, Sequoia Capital. While most of the biggest investors are firms, at least one of the big investors, Visa (NYSE: V), is a publicly-traded company.

Klarna’s Competitors

Stocks within a sector tend to move in packs — the same events that could drive Klarna’s business and stock could benefit competing companies.

As such, it may be worth keeping an eye on Klarna’s competitors on the market, including Affirm (NASDAQ: AFRM) and PayPal (NASDAQ: PYPL).

How to Buy the Klarna IPO

An IPO refers to the initial public offering, or when a private company first puts its shares on the stock market. As noted earlier, there has been talk of an IPO for Klarna, but it hasn’t happened yet.

Here are the steps on how to buy Klarna stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Klarna

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Klarna Stock Price Chart

Sorry, but there’s no Klarna stock price chart yet. However, you can get a look at the company’s trajectory here:

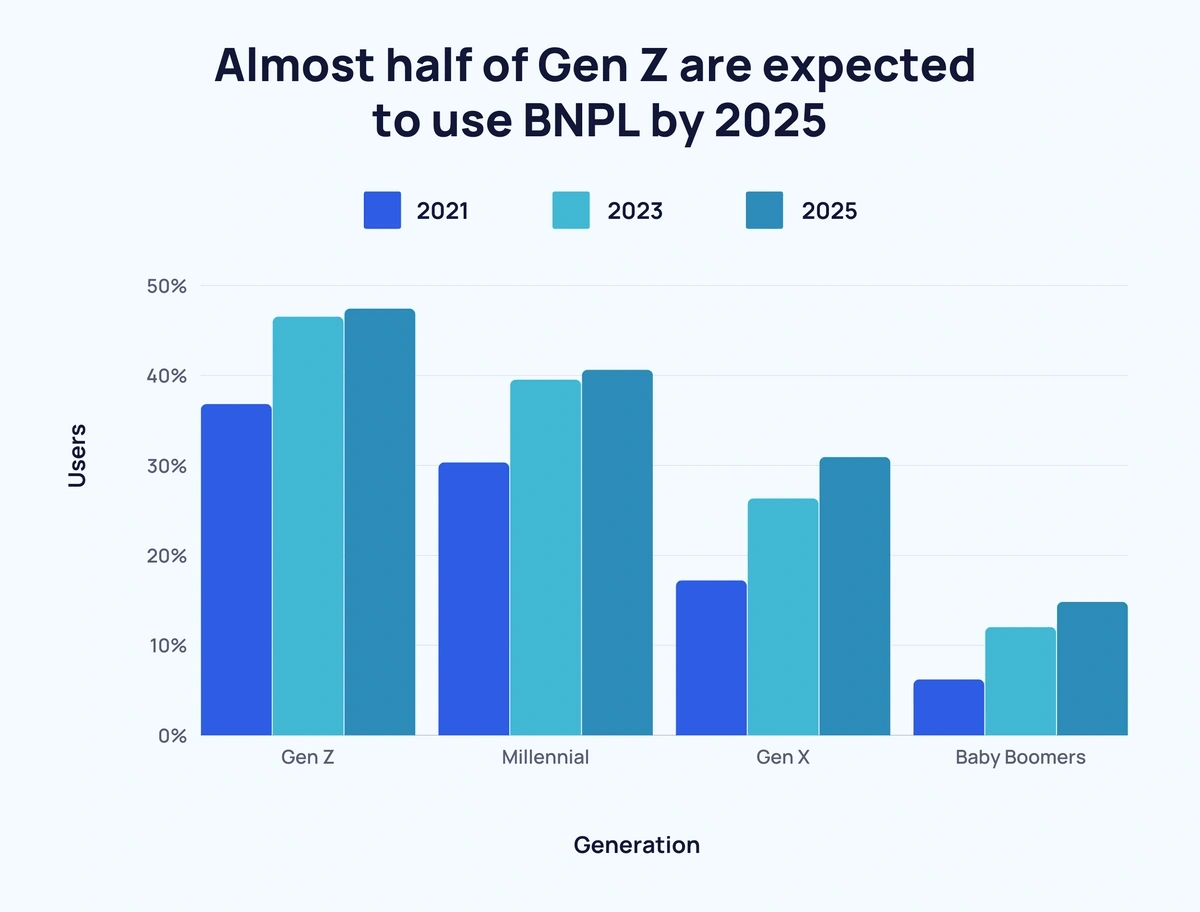

As you can see, the valuation trajectory has been downtrending. However, the company expects to profit by summer 2023 and there are some uplifting statistics about the BNPL sector in younger markets:

Whether you love or loathe the concept, it’s hard to ignore the metrics of the BNPL market and Klarna’s potential. But if you want to know how to buy Klarna stock, you won’t find it on any of the major exchanges — the company’s private.

Just because the company’s private doesn’t mean you can’t gain access to this exciting sector. Consider the platforms and approaches we’ve listed in this article to potentially gain exposure before the company goes public.

FAQs:

How to buy Klarna stock?

At this time, Klarna is a private company and retail investors cannot buy Klarna stock. However, accredited investors can invest in Klarna through Hiive. Retail investors can invest in other companies in the BNPL (“buy now, pay later”) sector, such as Affirm and Paypal.

How much is Klarna stock?

There is no Klarna stock price yet, since its shares are not traded on the stock exchange. As of 2022, the company was valued at $6.7 billion.

What is Klarna stock symbol?

Since Klarna is still privately owned, there is no Klarna stock symbol.

Who owns Klarna stock?

Klarna is owned by the Klarna Group. The company’s largest shareholder is Sequoia Capital. Other notable investors include Ant Group (payment affiliate of Alibaba), Atomico, Bestseller Group, Dragoneer, Permira, Silver Lake, and Visa.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.