Apptronik is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Apptronik who want to sell their shares.

Sign up with Hiive here and get access to Apptronik before its IPO.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

Humanoid robots are no longer just science fiction. They’re becoming a commercial reality, and Apptronik is leading this revolution.

Founded in 2016 as a spinoff from the Human Centered Robotics Lab at the University of Texas at Austin, Apptronik has quickly positioned itself as a frontrunner in developing general-purpose humanoid robots.

With a team of 180 employees and over $375 million in funding (including their recent $350 million Series A round), Apptronik is rapidly scaling its technology to address global labor shortages.

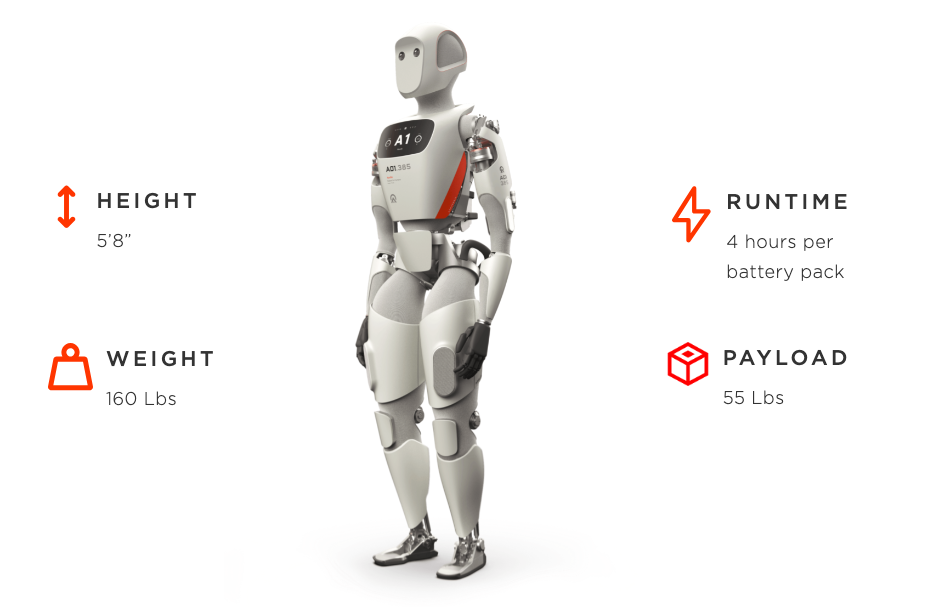

The company’s flagship robot, Apollo, is designed to work alongside humans in various environments, from warehouses to manufacturing plants.

Apptronik has secured impressive partnerships, including contracts with NASA to develop a new generation of humanoid robots for space exploration.

As humanoid robots move from fiction to reality, many investors are asking how they can invest in Apptronik stock. Are you one of them? Keep reading to find out everything you need to know.

Can You Buy Apptronik Stock? Is Apptronik Publicly Traded?

If you’re looking for the Apptronik stock symbol or searching for how to buy Apptronik stock on your brokerage platform, you won’t find it. That’s because Apptronik is not publicly traded.

Apptronik remains a privately held company, which means its shares aren’t available on stock market exchanges like the NYSE or NASDAQ.

However. While retail investors can’t currently buy Apptronik stock directly, accredited investors have options. Let’s explore.

How to Buy Apptronik Stock as an Accredited Investor

Apptronik is not publicly traded. However, accredited investors can invest in private companies, including Apptronik, through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out Apptronik, add it to your watchlist, and get notified about any new listings and trades.

How to Buy Apptronik as a Retail Investor

Unfortunately, you cannot buy Apptronik stock directly if you’re not an accredited investor. The company remains private and hasn’t announced plans for an IPO.

However, there are indirect ways to gain exposure to the robotics and automation sector in which Apptronik operates.

Let’s explore who currently owns Apptronik and then look at some publicly-traded alternatives.

Who Owns Apptronik?

Apptronik was founded by Dr. Nick Paine (CTO) and Jeff Cardenas (CEO), who spun the company out of the Human Centered Robotics Lab at the University of Texas at Austin.

Its ownership structure includes:

- Founders and executives

- Employees with equity compensation

- Venture capital investors, including B Capital and Capital Factory

- Strategic corporate investors

The ownership percentages aren’t publicly disclosed, as is typical for private companies. However, after the recent $350 million Series A funding round, it’s likely that venture capital firms hold significant stakes in Apptronik.

Does Google Own Apptronik?

No, Google (NASDAQ: GOOGL) doesn’t own Apptronik, but Alphabet (Google’s parent company) is a strategic investor. Google participated alongside other investors in Apptronik’s recent $350 million Series A funding round.

Additionally, Apptronik has partnered with Google DeepMind to integrate advanced AI capabilities into its humanoid robots.

While Google has a vested interest in Apptronik’s success, the latter remains independently operated by its founders and leadership team.

3 Alternatives to Apptronik for Retail Investors

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

1. Nvidia Corporation (NASDAQ: NVDA)

Nvidia (NASDAQ: NVDA) isn’t just a leader in AI chips — it’s also a key enabler of robotics through its Jetson platform and Isaac Sim robotics simulator. Virtually every advanced robot, including humanoids like those from Apptronik, relies on powerful GPUs for AI processing.

The Nvidia Jetson platform delivers powerful AI computing in compact modules, enabling developers to create intelligent edge devices and autonomous robots with local processing capabilities.

Complementing Jetson, Nvidia Isaac Sim provides a comprehensive robotics simulation environment where developers can test applications in virtual settings before deployment.

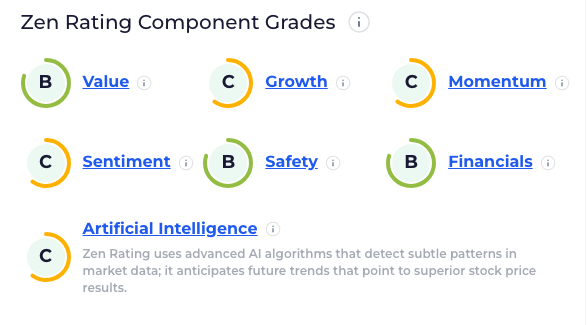

Nvidia also scores highly according to our quant ratings system, Zen Ratings. It earns an overall grade of B (Buy), which is reached through a rigorous 115-factor review. Stocks with an overall B rating have historically outperformed the market, delivering an average of 19.88% annual returns.

2. Intuitive Surgical (NASDAQ: ISRG)

A publicly listed company that competes with Apptronik is Intuitive Surgical (NASDAQ: ISRG). Founded in 1995 and headquartered in Sunnyvale, California, Intuitive Surgical is a biotechnology leader specializing in robotic-assisted surgical technology.

Its flagship da Vinci Surgical System enables surgeons to perform minimally invasive procedures with enhanced precision across urological, gynecological, thoracic, cardiac, and general surgeries.

It provides specialized instruments and accessories compatible with their systems, alongside comprehensive training programs for medical professionals.

With a global presence spanning the Americas, Europe, and Asia — including over 100 systems in India alone — Intuitive Surgical continues to pioneer advancements in surgical technology that improve patient outcomes and recovery times.

Similar to Nvidia, Intuitive is also rated a “B” and should be on the radar of Apptronik investors.

3. Alphabet (NASDAQ: GOOGL)

If you are wondering how to invest in Apptronik, then Alphabet (NASDAQ: GOOGL) remains a top investment choice.

Google’s collaboration with Apptronik centers on two key relationships: a strategic partnership with Google DeepMind to integrate advanced AI into humanoid robots, and participation in Apptronik’s $350 million Series A funding round.

The partnership leverages DeepMind’s Gemini AI model to enhance Apptronik’s Apollo humanoid robot with spatial reasoning, multimodal interaction capabilities, and real-world adaptability.

This integration enables Apollo to master complex tasks that require cognitive and physical skills. The collaboration aims to create more intelligent, versatile robots for manufacturing, logistics, and healthcare applications.

Unlike Nvidia and ISRG, GOOGL currently has a C (Hold) rating, according to Zen Ratings. This is largely due to a Component Grades of C for Sentiment, Growth, and Momentum, which considers factors like insider buying activity, analyst upgrades and downgrades, revenue and earnings estimates and more.

How to find stocks before they explode…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How to Buy the Apptronik IPO

Here are the steps on how to buy Apptronik stock or how to invest in Apptronik if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Apptronik

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Apptronik Stock Price Chart

Since Apptronik is not publicly traded, there is no Apptronik stock price chart available.

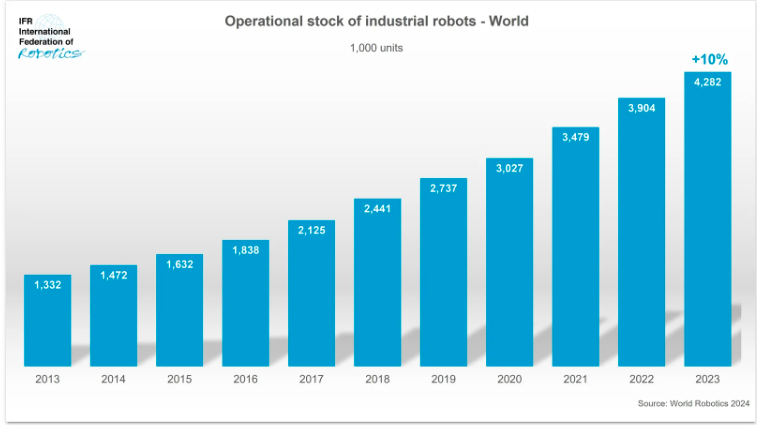

However, it’s worth noting that the robotics and automation sector has been experiencing significant growth.

According to the International Federation of Robotics, installations of industrial robots has surpassed 4.28 million units in 2023, increasing 10% year over year.

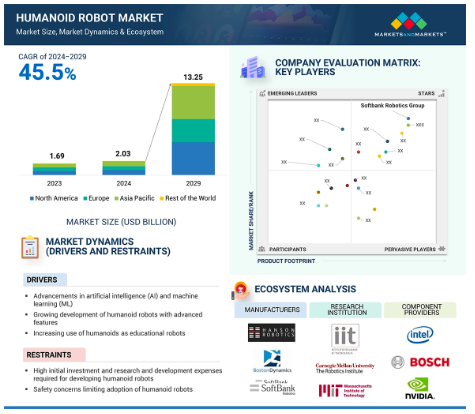

Comparatively, the humanoid robot market is projected to grow at a CAGR of over 45% through 2029, driven by applications in manufacturing, healthcare, and logistics—all areas where Apptronik is positioned to compete.

Conclusion

While you can’t directly buy Apptronik stock as a retail investor at this time, the company represents an exciting frontier in robotics and automation. Their development of humanoid robots like Apollo has attracted significant investment from major players including Google.

For accredited investors, platforms like Hiive offer potential opportunities to invest in Apptronik before any potential IPO. Retail investors can gain exposure to the broader robotics trend through publicly traded companies and ETFs.

As the robotics industry continues to evolve, Apptronik is certainly a company worth watching. Whether they eventually go public or continue as a private enterprise, their innovations in humanoid robotics are likely to have a significant impact on industries ranging from manufacturing to healthcare.

FAQs:

How can I buy Apptronik stock?

Apptronik is not publicly traded, so retail investors cannot buy its stock directly. However, accredited investors can potentially buy shares through private marketplaces like Hiive, which connects pre-IPO company shareholders with interested buyers.

How much is Apptronik stock?

Since Apptronik is a private company, there is no public Apptronik stock price. The company's valuation was reflected in its recent $350 million Series A funding round, but specific share prices are only available to accredited investors on private marketplaces like Hiive.

What is the Apptronik stock symbol?

Apptronik does not have a stock symbol because it is not publicly traded on any stock exchange. If the company decides to go public in the future, it will receive a stock symbol at that time.

Who owns Apptronik stock?

Apptronik stock is owned by the company's founders (Jeff Cardenas and Dr. Nick Paine), early employees, and investors, including B Capital, Capital Factory, and Google. As a private company, the exact ownership breakdown is not publicly disclosed.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.