Is Gorilla Trades Worth It?

Too Long; Didn’t Read: Ken Berman’s Gorilla Trades delivers stock picks using a breakout algorithm that’s been around since 1999. Some subscribers swear by it, others call it overpriced.

My verdict?

Gorilla Trades may prove worthwhile for disciplined technical traders. But $499 for the low tier, it costs way more than alternatives like Zen Investor ($79/year for a limited time, using this link), which focuses on fundamental research combined with cutting-edge tech to deliver market-beating results (recent picks have soared 60%, 50%, and 38%).

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How I Evaluated Gorilla Trades

To write this Gorilla Trades review, I put the service under the microscope across four key areas:

- Gorilla Trades Performance: Real subscriber results, claimed returns, and review scores from Sitejabber and Trustpilot.

- Gorilla Trades Cost: What you pay versus what you get.

- Service Pros & Cons: The good, bad, and ugly of Ken Berman’s system.

- Target Audience: Who actually benefits from this technical trading approach.

Keep reading for my comprehensive analysis.

What Is Gorilla Trades & Who Is Ken Berman?

Gorilla Trades launched in 1999 with a simple promise: give regular investors the same edge that Wall Street pros have, minus the time-consuming research. Ken Berman founded the service after turning his own trading methodology into what he calls a “breakout algorithm.”

Who is Ken Berman?

He’s a University of Michigan grad who got hooked on stocks as a teenager, managing his dad’s investment accounts while most kids were playing video games. Berman cut his teeth on biotech momentum plays before landing VP positions at Smith Barney and PaineWebber, where he managed over $100 million in client assets.

Here’s where Berman’s story gets interesting: He claims he turned $250,000 into $5.5 million in just 18 months using his system. Sounds incredible, right?

There’s a catch. This happened during the dot-com bubble, and he used margin and options — a combination he admits won’t work the same way today.

Related: Check out our High Risk, High Reward stock screener

Berman writes regularly for Forbes and Kiplinger, lending credibility to his “Gorilla” persona. After 25 years in business, Gorilla Trades has built a loyal following among technical traders who want systematic breakout opportunities served up daily.

How Gorilla Trades Works (System Overview)

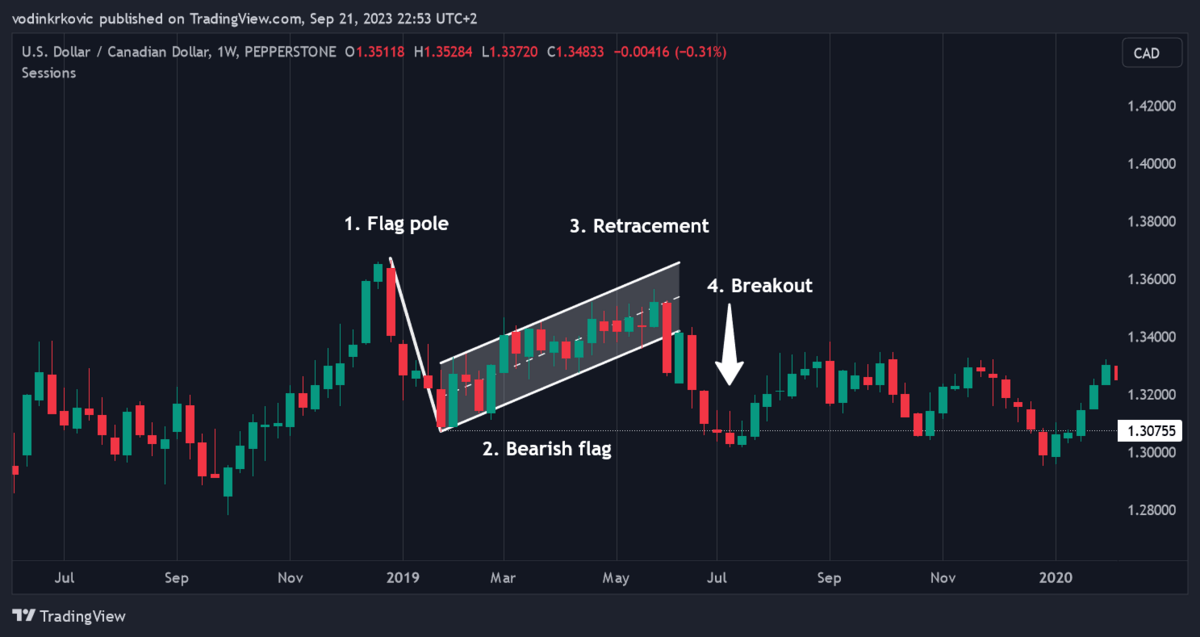

Gorilla Trades runs on Ken Berman’s proprietary Breakout Scanner that sifts through over 6,000 stocks every day. The system hunts for stocks that meet all 14 of its technical criteria. Think of it as a very picky algorithm that only gets excited about potential breakouts.

Here’s how the daily routine works: Every evening, subscribers get a watchlist with potential picks. Each stock comes with a “trigger price”, the magic number where Berman’s system says it’s time to buy.

You don’t just jump in at the market open. You wait for the stock to hit that trigger, plus other confirmation signals.

The system doesn’t leave you hanging after entry. Each trade includes stop-loss levels to limit downside risk and dual profit targets for exits. You can take some money off the table at the first target, then let the rest ride to the second target if the stock keeps climbing.

Weekly updates keep you posted on existing picks, and there’s an optional options alert service for traders who want leveraged plays on the breakout candidates.

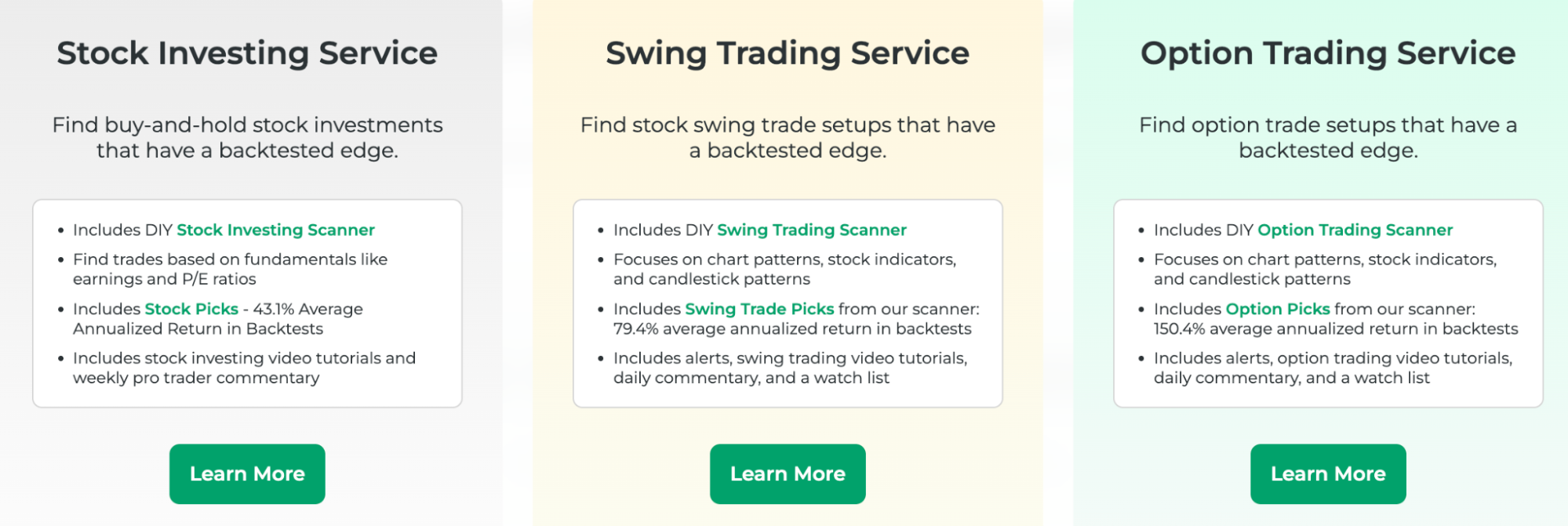

Interested in More Affordable Stock Scanners? Check Out Stock Market Guides

Stock Market Guides delivers high-quality scanners and stock alerts (you can pick and choose your preferred services) at a lower cost than most premium services — and with a 79.4% average annualized return in backtests for swing trade alerts, it’s well worth your time.

Gorilla Trades Performance

Let’s talk numbers. Gorilla Trades claims a 21.7% average annual return since inception, crushing the S&P 500’s 8.9% over the same period. But claimed returns and real-world results don’t always match up.

Gorilla Trades reviews from actual users paint a mixed picture. On Sitejabber, the service scores 3.8 out of 5 stars from 62 reviews. Trustpilot users are slightly more generous, giving it 4.2 out of 5 stars across 366 reviews.

Some long-term subscribers love the systematic approach. One user reported selling 75% of a position at the first target with gains hitting 48%. These fans praise the discipline-focused system and clear risk management rules.

But not everyone’s singing Berman’s praises. Critics slam the customer service and question how performance gets calculated. Some base returns on trigger prices rather than actual entry points, which can inflate results. A few frustrated subscribers have called it a “total waste of money.”

The truth lies somewhere in the middle. Gorilla Trades performance seems to depend heavily on how well you follow the system’s rules. Disciplined traders report better results than those who freelance with the recommendations.

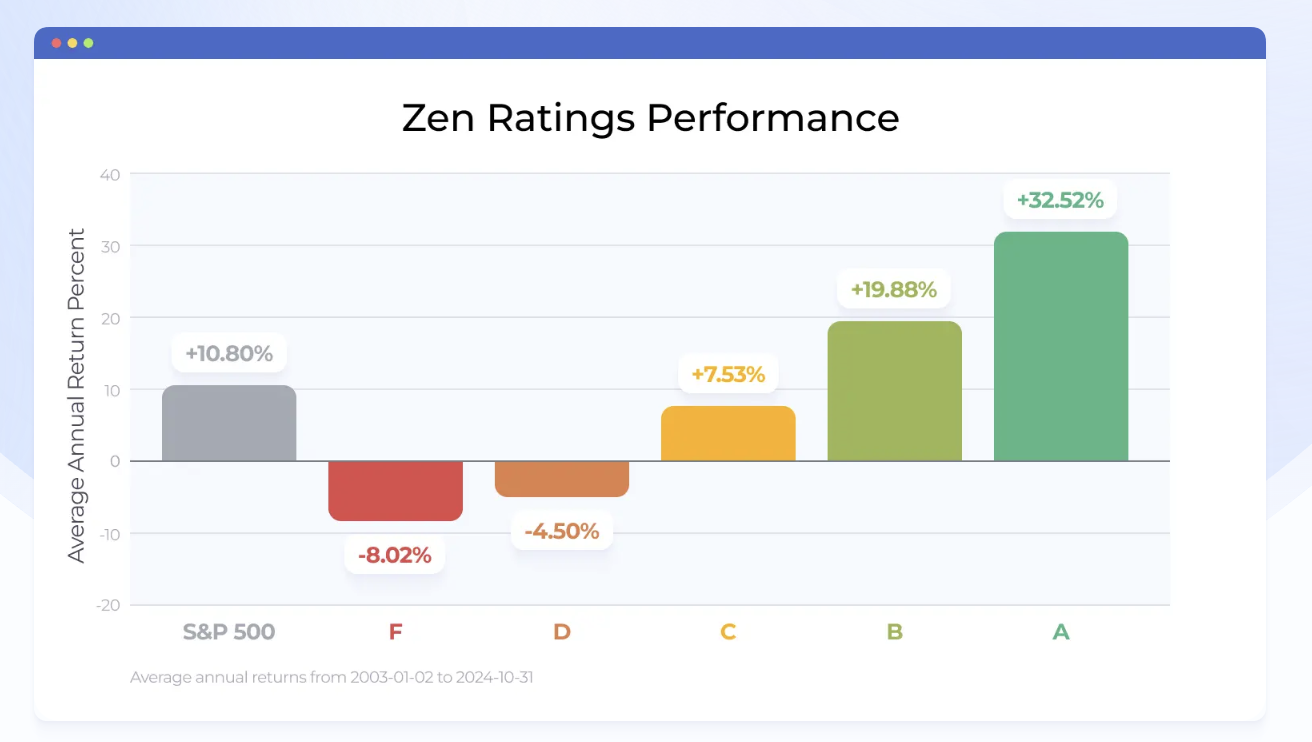

I’d be remiss if I didn’t point out that WallStreetZen’s Zen Investor relies on the proven Zen Ratings system, a quant ratings system in which stocks are assigned a letter grade based on 115 factors proven to drive stock growth.

Stocks with an A rating have historically generated 32.52% annual returns.

Gorilla Trades Cost & Value

Here’s what you’ll pay for access to Ken Berman’s algorithm:

- One-Year Subscription: $499.95

- Two-Year Deal: $795 (saves you about $200)

Gorilla Trades throws in a 30-day free trial, which is smart — you can test the system before committing real money.

The Gorilla Trades cost puts it in premium territory compared to fundamental research platforms. Zen Investor, for example, costs just $99 per year ($79 for new subscribers) and offers comprehensive stock analysis based on 115 proven factors.

Does the price justify the value? That depends on your trading style and portfolio size. Active swing traders who can capitalize on multiple alerts per month might easily cover the subscription cost.

But if you’re a buy-and-hold investor or working with a smaller account, that $500 annual fee could eat into returns fast.

Pros & Cons of Gorilla Trades

Pros | Cons |

|---|---|

25-Year Track Record: Gorilla Trades has survived multiple market cycles since 1999. | Premium Pricing: Costs more than most alternatives. |

Clear Trade Signals: No guessing games as you get specific entry points, stops, and targets. | Mixed User Reviews: Success stories exist alongside disappointed subscribers. |

Risk Management Focus: Built-in stop losses help protect capital. | Requires Strict Discipline: System only works if you follow it exactly. |

Proprietary Scanner: 14-indicator algorithm finds stocks others might miss. | Technical Analysis Only: Won’t appeal to fundamental investors. |

Free Trial Available: Test drive the platform before you subscribe. | No Get-Rich-Quick Guarantees: Requires patience and realistic expectations. |

Educational Content: Blog and tutorials help you understand the methodology. | Past Results Don’t Guarantee Future Success: Berman’s big wins came during unique market conditions. |

Who Should Use Gorilla Trades?

Gorilla Trades works best for specific types of traders:

Gorilla Trades is Best if You:

- Trade actively and understand technical analysis

- Can follow rules without second-guessing the system

- Want clear entry and exit signals instead of vague recommendations

- Have enough capital to justify the subscription cost through potential gains

Gorilla Trades is NOT a Good Choice If You:

- Prefer buy-and-hold investing over swing trading

- Focus on fundamental analysis rather than chart patterns

- Get tempted to modify recommendations based on your “gut feeling”

- Work with a small portfolio where the subscription cost matters more than potential returns

New traders should think twice. While Gorilla Trades provides specific signals, you still need to understand risk management and position sizing to succeed.

Alternatives

Gorilla Trades occupies a specific niche in the technical breakout space. But if you’re open to different approaches, these alternatives might better match your investing style and budget.

Zen Investor

Cost: $79/year

Why It’s Different: Zen Investor takes the opposite approach from Gorilla Trades. Instead of technical breakouts, it relies on fundamental analysis.

With Zen Investor, you gain access to a portfolio of 20-30 stocks (at any given time) that are hand-picked by 40+ year market veteran Steve Reitmeister using a 4-step process that employs the Zen Ratings system.

Zen Ratings is a quant ratings system that identifies potential winners using 115 factors proven to drive stock growth. Those factors are distilled into a simple, easy-to-understand letter grade (though you can dig deeper by looking at the Component Grades for key areas like Momentum, Value, and even a proprietary AI factor).

Stocks with an overall A rating from this system have historically outperformed the market:

Recent picks in the Zen Investor portfolio have delivered 60%, 50%, and 38% returns.

Best For: Investors who prefer fundamental analysis over chart reading and want comprehensive research at an affordable price.

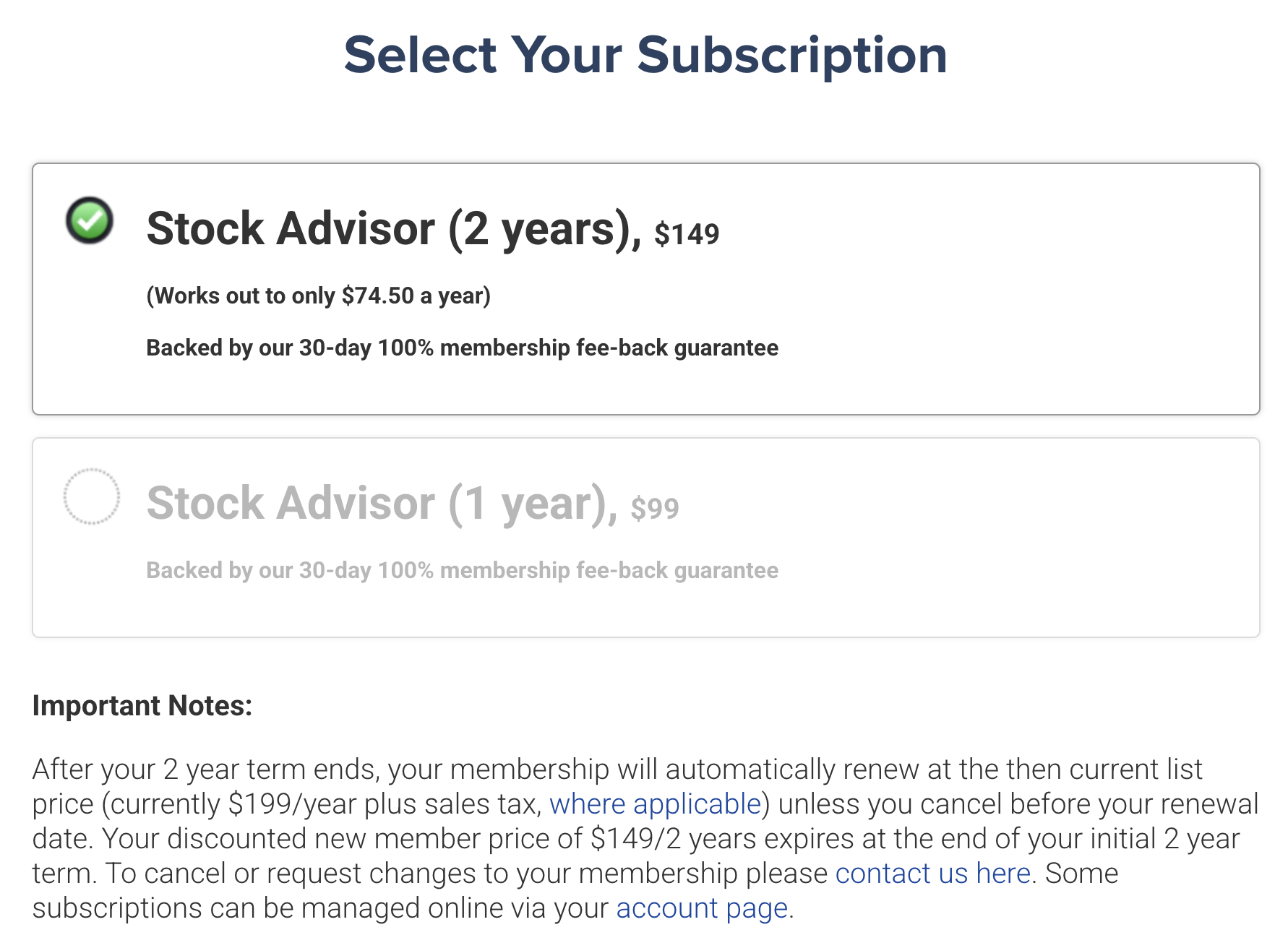

Motley Fool Stock Advisor

Cost: $99 first year, then $199 annually (premium services up to $3,999/year)

Why It’s Different: The Motley Fool focuses on long-term growth stocks rather than short-term breakouts. Their “buy and hold forever” philosophy contrasts sharply with Gorilla Trades’ swing trading approach. They provide detailed research reports and maintain model portfolios for different investor types.

Motley Fool has been around a long time, and it’s one of the most beloved platforms out there for one key reason…

Motley Fool’s no-nonsense approach has resulted in many winners over the past decades, making it one of our top overall picks for investors.

Best For: Long-term investors with larger portfolios who want growth stock recommendations backed by thorough research.

Stock Market Guides

Cost: $69/month for stock alerts or options alerts separately, $95/month for both (40% discount on annual plans). You can also access scanners for a more DIY approach starting at $29/month. See plans here

Why It’s Different: Stock Market Guides competes directly with Gorilla Trades in the alerts space but structures pricing differently. You can choose stock-only alerts or add options alerts based on your preference.

Stock Market Guides is one of the best services out there for alerts — whether you’re looking for stocks or options. With the ability to customize alerts or simply subscribe to the DIY scanners, it’s one of the easiest-to-use and best-performing services out there:

- Swing trading stock picks have delivered 79.4% average annualized return in backtests

- Options picks have delivered 150.4% average annualized return in backtests

Check out our detailed Stock Market Guides review to find out more.

Best For: Traders who want focused alert services and prefer monthly pricing over annual commitments.

Final Verdict & Recommendation

After digging deep into this Gorilla Trades review, here’s my take: Ken Berman built a solid technical system that’s survived 25 years of market changes. The algorithm provides clear signals, and disciplined traders report consistent results.

But the Gorilla Trades cost creates a high bar for success. At $500 per year, you need to generate meaningful profits to justify the expense. The mixed Gorilla Trades reviews suggest the system works well for some traders while disappointing others.

My Recommendation: Gorilla Trades suits active traders who live and breathe technical analysis and have the discipline to follow systematic rules. If you’re that type of trader and can afford the subscription, the 30-day free trial offers a risk-free way to test the breakout scanner.

However, most investors will find better value in fundamental research platforms like Zen Investor, which costs a LOT less while providing comprehensive analysis tools.

Before committing to Gorilla Trades, ask yourself: Am I ready to trade actively, follow technical signals religiously, and pay premium prices for systematic breakout opportunities? If you answered yes to all three, Ken Berman’s algorithm might work for you.

FAQs:

What’s included with Gorilla Trades?

You get daily stock alerts with specific entry points, stop-loss levels, and profit targets. The service includes evening watchlists, weekly updates on active picks, and optional options alerts. Everything runs through Ken Berman's 14-indicator technical screening software.

How much is Gorilla Trades?

Annual subscriptions cost $499.95, or you can save money with a two-year plan for $795. The service includes a 30-day free trial so you can test the system before paying.

What performance can I expect with Gorilla Trades?

Gorilla Trades claims 21.7% average annual returns since 1999, beating the S&P 500's 8.9%. Real subscriber experiences vary widely, some report consistent profits while others struggle. Your results will depend heavily on how well you follow the system's rules.

Is Ken Berman legit?

Yes, Ken Berman has legitimate Wall Street credentials. He worked as VP of Investments at Smith Barney and PaineWebber, managing over $100 million in client assets. He writes regularly for Forbes and Kiplinger and has run Gorilla Trades since 1999.

How do I cancel Gorilla Trades?

Check your subscriber agreement or the FAQ section on Gorilla Trades' website for specific cancellation procedures. You can also contact their customer support directly for the most current cancellation process.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.