The Bottom Line: Is eSignal Worth It in 2026?

eSignal is legit and has some great features. But in my opinion, its cost of up to $466 per month is too expensive for most non-professionals. For hundreds of dollars less monthly, you can DIY an excellent (and cheaper) trading and research experience by combining TradingView (for charting) + WallStreetZen (for research) + eToro (as a brokerage).

You’ll save significant money while still gaining access to excellent tools.

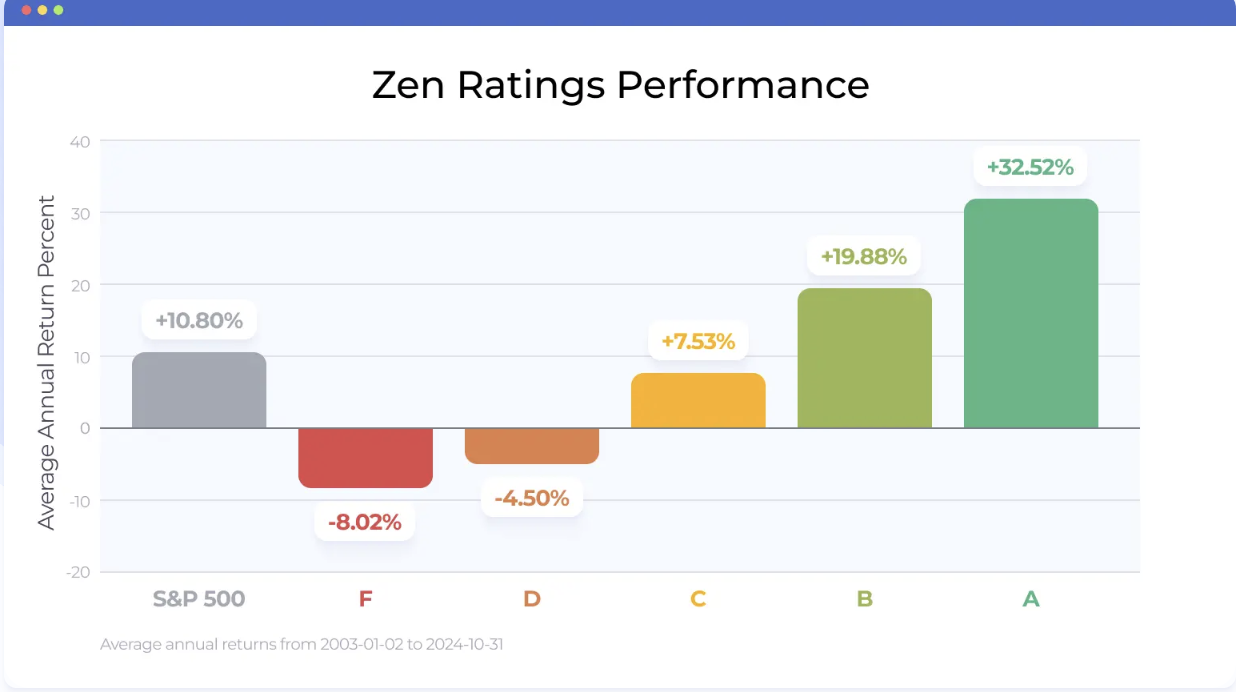

Heck, you could even add in a stock-picking service like Zen Investor and the combined monthly cost of the above would still be lower than eSignal.

Save time on stock research…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Why I Wrote this eSignal Review

If you want to get serious about trading, you need a few things: Reliable data, powerful charts, and tools that won’t crash. eSignal positions itself as a top-tier solution for all three.

The platform has been around for decades, promising institutional-quality analysis for serious traders. But here’s the catch: monthly costs can hit nearly $500.

I’ve spent time researching this eSignal platform, combing through user feedback, and comparing it to competitors like TradingView and thinkorswim.

I’ll walk you through everything about eSignal trading, which includes features, pricing, and real-world performance.

By the end, you’ll know whether this platform deserves your hard-earned money or if better alternatives exist.

What Is eSignal?

eSignal is a professional-grade charting and market data platform that’s been serving traders since the 1990s.

Interactive Data Corporation founded it, and Intercontinental Exchange (ICE), one of the world’s leading exchange operators, now owns it. Over the years, eSignal has built a solid reputation as a serious tool for serious traders.

Here’s what makes it different from free charting tools bundled with brokerage accounts: eSignal focuses exclusively on delivering high-quality market data and advanced technical analysis.

It’s not a broker. Think of it as a sophisticated analysis tool that connects with over 50 different brokers, letting you execute trades directly from the eSignal interface.

Who does eSignal target?

- Active traders who need institutional-quality tools.

- Day traders who make split-second decisions.

- Swing traders who conduct deep technical analysis.

- Professional traders who can’t afford data delays or platform crashes.

eSignal positions itself as a premium solution in a market flooded with free alternatives, which naturally raises the question of whether the premium price is justified.

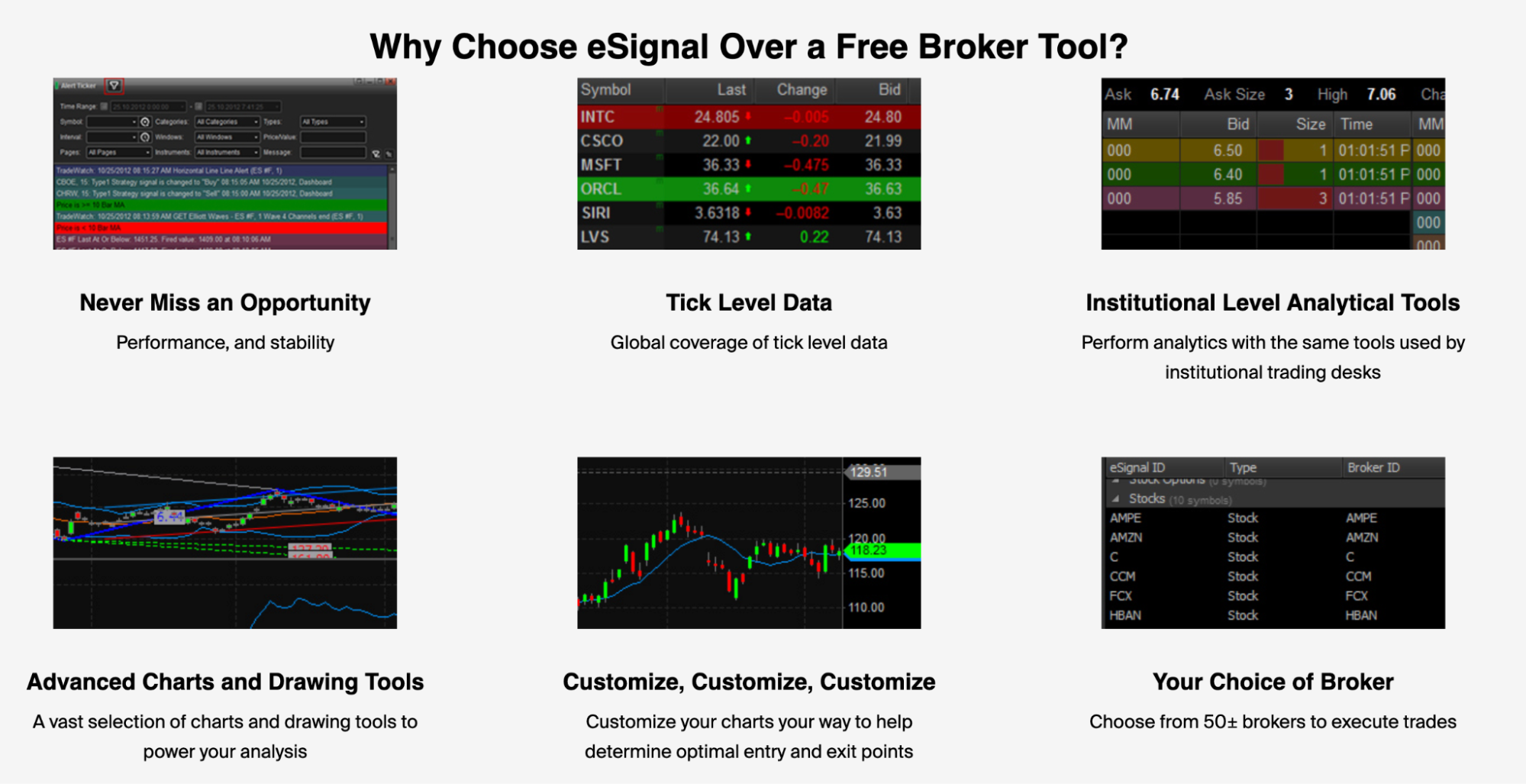

Key Features of eSignal

eSignal packs a comprehensive toolkit for traders who demand precision. Here’s what stands out:

Advanced Charting Tools

You get over 100 technical indicators and studies right out of the box.

The platform utilizes proprietary EFS (eSignal Formula Script) language, enabling you to create custom indicators tailored to your specific trading strategy.

Save multiple chart templates, apply sophisticated drawing tools, and analyze markets with detail that goes beyond what most retail platforms offer.

Real-Time Market Data

This is eSignal’s crown jewel. The platform provides real-time market data feeds covering stocks, futures, options, and foreign exchange (forex) markets worldwide.

The direct-access data infrastructure provides millisecond-level updates. When you’re trying to catch quick market moves or need to see order flow in real time, this matters tremendously.

Integrated Trading

With connections to over 50 brokers, eSignal lets you route orders directly from your charts.

This streamlines your workflow and can reduce execution time compared to switching between separate charting and trading platforms. The broker integration supports various order types and includes one-click trading for those moments when speed is everything.

Backtesting Capabilities

Test your trading strategies against historical data before risking real capital.

Optimize parameters, analyze performance metrics, and refine your approach based on actual market behavior to achieve optimal results.

A worthy alternative for

For traders seeking signals explicitly backed by quantitative analysis and backtesting data, Stock Market Guides provides a focused, statistically driven approach to systematic trading. It has a proven track record of success: Swing Trade picks have delivered a 79.4% average annualized return in backtests.

Market Scanning and Alerts

The Market Screener Plus tool scans the entire market based on technical and fundamental criteria you define.

Create customizable alerts that notify you when specific conditions are met. Never miss trading opportunities even when you’re away from your screen.

Mobile and Desktop Platforms

eSignal offers both desktop software and mobile apps for iOS and Android. The mobile platform provides a streamlined version of the desktop experience, allowing you to monitor positions and execute trades from anywhere.

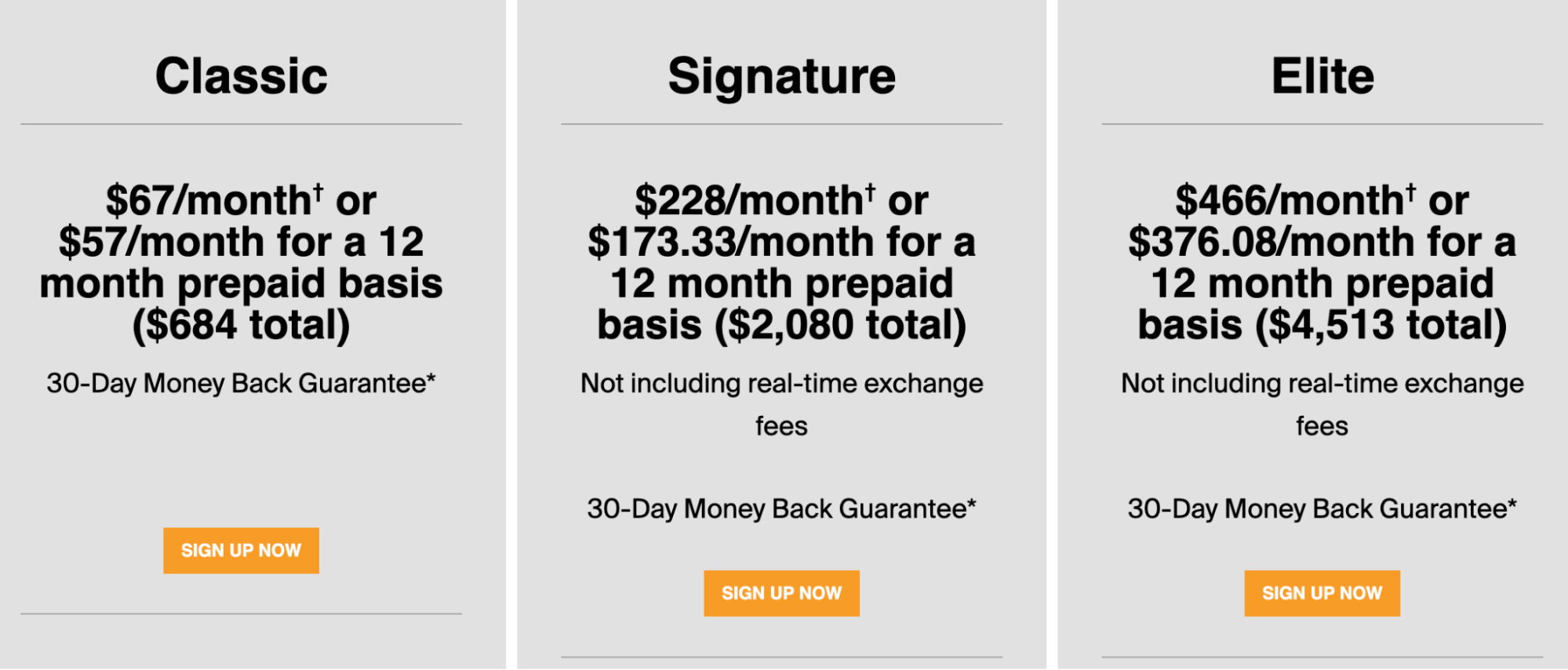

eSignal Pricing & Plans 2026

Let’s discuss eSignal pricing, as this is where costs can become significant.

The platform offers three tiers, with both monthly and annual payment options available.

These base prices don’t include exchange fees, which incur additional costs.

Feature | Classic | Signature | Elite |

|---|---|---|---|

Monthly Price | $67 | $228 | $466 |

Annual Price | $57/month ($684 total) | $163.58/month ($2,080 total) | $376.08/month ($4,513 total) |

Real-Time Data | No (15-min delay) | Yes | Yes |

Advanced Charting | Yes | Yes | Yes (with Advanced GET Studies) |

Backtesting | No | Yes | Yes |

Options Data | No | Yes | Yes |

Market Screener Plus | Yes | Yes | Yes |

Broker Integration | Yes | Yes | Yes |

The Classic plan, priced at $67 per month, is the entry-level option. However, it only provides delayed data with a 15-minute lag, making it suitable primarily for end-of-day analysis, rather than active trading.

The Signature plan, at $228 per month, is the most popular choice. It includes real-time data and the full suite of charting and analysis tools that active traders need. If you’re doing day trading or active swing trading, this is the minimum tier I’d recommend.

The Elite plan, at $466 per month, is designed for professional traders. It includes everything in Signature plus Advanced GET studies, proprietary technical analysis tools based on Elliott Wave theory, and other advanced methodologies.

Beyond these base prices, you’ll need to factor in exchange fees for the specific markets you trade. These can add anywhere from $10 to over $100 monthly, depending on your needs.

eSignal Pros and Cons

Pros | Cons |

Industry-Leading Data Quality | High Cost |

Powerful and Customizable Charting | Poor Customer Service |

Platform Stability | Steep Learning Curve |

Extensive Broker Integration | Expensive Add-Ons |

User Reviews & Community Feedback

To understand how eSignal performs in real-world use, I analyzed feedback from Trustpilot, Reddit, and trading forums.

On Trustpilot, eSignal has a rating of 1.2 out of 5 stars based on 66 reviews. That’s classified as “Bad.”

Many negative reviews center on issues with customer service. Users report problems with billing, difficulty canceling subscriptions, and challenges obtaining refunds even during the advertised trial period.

One longtime customer mentioned that their service was terminated without warning after a credit card issue, despite over 20 years of loyalty.

The feedback isn’t entirely negative, though. On Reddit and specialized trading forums, some users defend eSignal passionately.

One Reddit user called eSignal the “gold standard when it comes to charts” and noted that professional traders often use eSignal exclusively for charting while executing trades through a separate broker.

This highlights the platform’s strength in its core competency: providing institutional-quality charting and data.

The common thread in positive reviews is an appreciation for data quality and charting power. Alternatively, users are frustrated with costs, complexity, and customer service issues.

How Does eSignal Compare to Competitors?

Let me compare eSignal to three major competitors: TradingView, thinkorswim, and NinjaTrader.

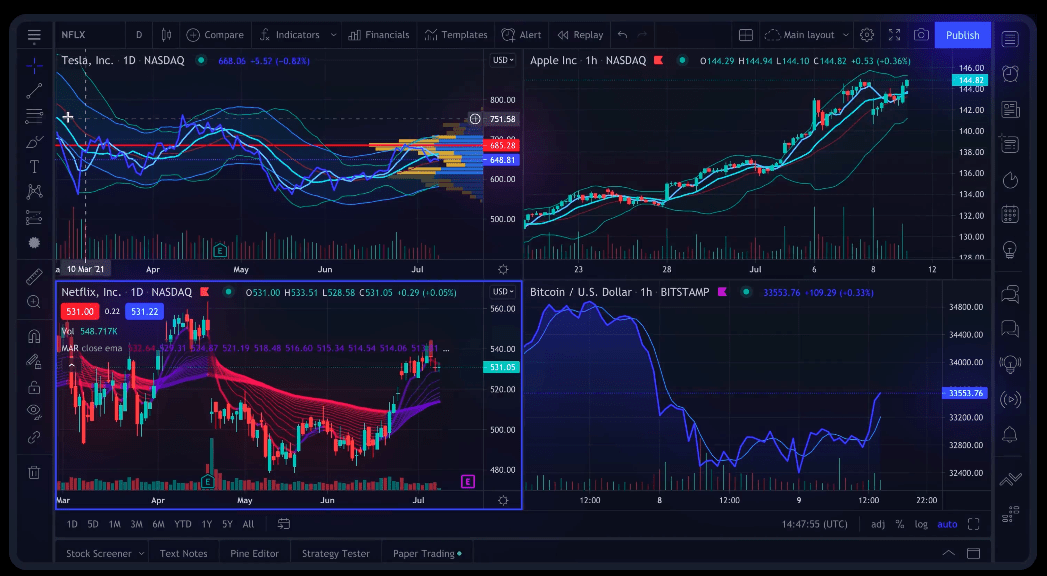

eSignal Vs. TradingView

TradingView has experienced explosive growth in popularity over the past few years. Millions of traders worldwide now use it as their go-to charting platform.

Here’s how the eSignal vs TradingView comparison shakes out:

Feature | eSignal | |

|---|---|---|

Cost | High ($67-$466/month) | Freemium ($0-$60/month) |

Target Audience | Professional Traders | All Levels (Beginner to Advanced) |

Data Quality | Excellent (Direct-access) | Good (Varies by plan) |

Ease of Use | Steep Learning Curve | Very User-Friendly |

Community | Limited | Large and Active |

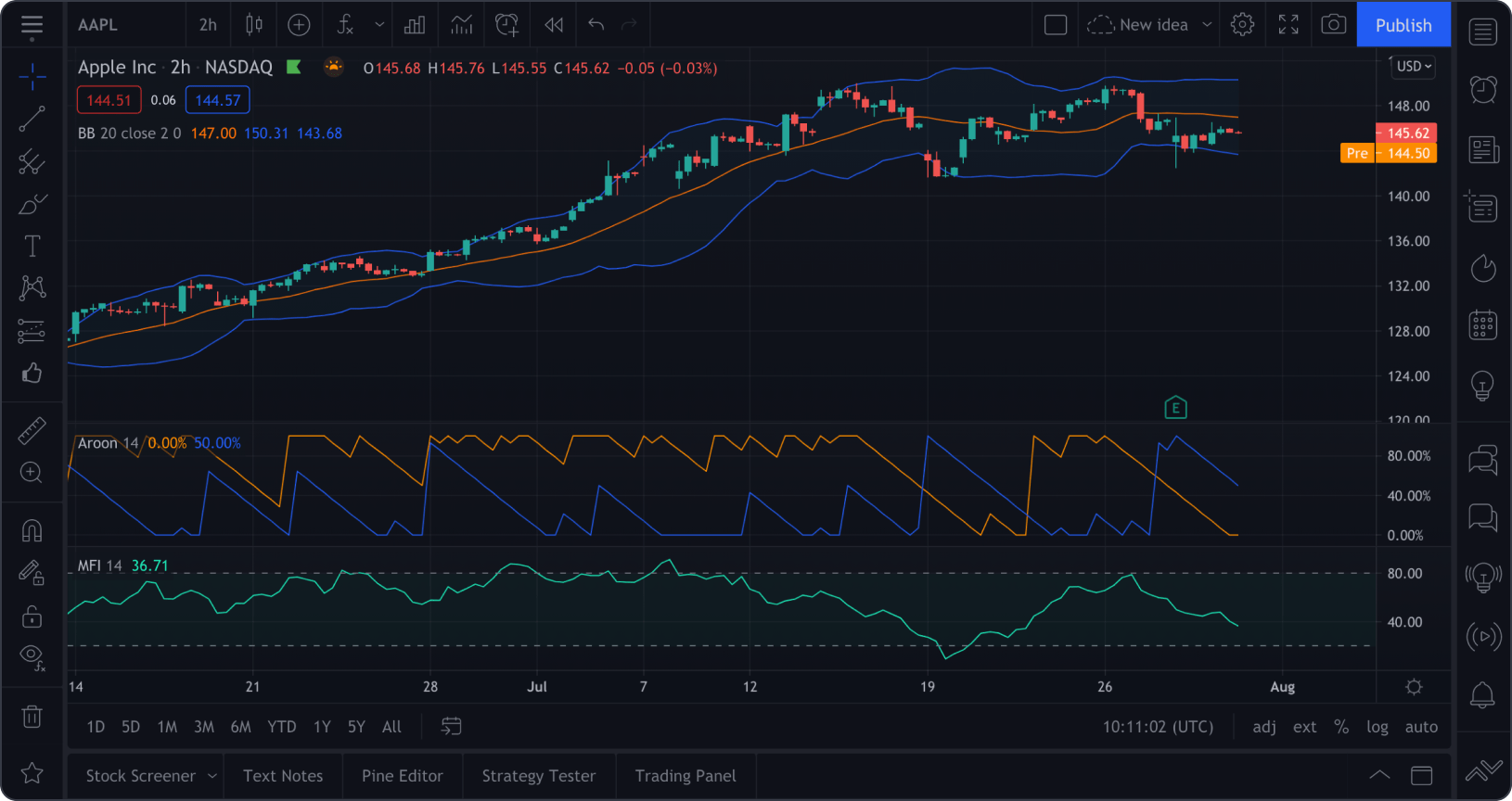

TradingView offers tremendous value at a fraction of the cost of eSignal. The free plan is surprisingly robust, while the premium plan caps out at $60 per month.

TradingView’s interface is intuitive and modern, with a thriving community where traders share ideas and strategies.

eSignal does have advantages for specific use cases, though. Its direct-access data feeds are faster and more reliable than TradingView’s broker-dependent data. For day traders who need to see every tick in real time, this difference matters.

For most traders, I recommend starting with TradingView. You can get a feel for the platform with their free plan and then upgrade to a paid plan as your needs grow.

eSignal vs. thinkorswim (Schwab)

Charles Schwab offers thinkorswim free. It’s a powerful platform, renowned for its options trading capabilities and comprehensive research tools.

Feature | eSignal | thinkorswim |

|---|---|---|

Cost | High ($67-$466/month) | Free (with Schwab account) |

Options Trading | Good | Excellent |

Ease of Use | Steep Learning Curve | Moderate Learning Curve |

Broker Integration | 50+ Brokers | Charles Schwab only |

If you’re focused on options trading, thinkorswim is hard to beat. Its options analysis toolkit is industry-leading. The fact that it’s completely free makes it a no-brainer for Schwab customers.

For options traders looking for professional-grade tools without the professional-grade price tag, thinkorswim is an excellent choice.

eSignal vs. NinjaTrader

Futures traders love NinjaTrader. It offers advanced charting, automated strategy development, and a robust ecosystem of third-party plugins.

Feature | eSignal | NinjaTrader |

|---|---|---|

Cost | High ($67-$466/month) | Flexible (Free, Monthly, Lifetime) |

Futures Trading | Good | Excellent |

Automation | Good (EFS) | Excellent (C#) |

Ease of Use | Steep Learning Curve | Moderate Learning Curve |

NinjaTrader’s flexible pricing model includes a free version with limited features, monthly subscriptions, and a lifetime license option. For futures traders who want to develop automated strategies, NinjaTrader’s C# programming environment is more powerful and flexible than eSignal’s EFS scripting.

If you’re a futures trader seeking advanced automation capabilities, NinjaTrader is a worthy consideration.

Who Should Use eSignal?

Given eSignal’s premium pricing and advanced feature set, it works best for specific types of traders:

Professional Day Traders: If you make your living from trading, eSignal’s cost becomes a business expense rather than a personal burden. The platform’s superior data quality, stability, and advanced tools provide an edge that justifies the investment.

Serious Swing Traders: Swing traders who rely heavily on technical analysis and need extensive customization will appreciate eSignal’s charting depth. The backtesting and strategy development features are particularly valuable for refining your approach.

Institutional Clients: Hedge funds and proprietary trading firms often choose eSignal for their trading desks. The platform handles large data loads well and offers the reliability that institutional environments require.

Who Should Look Elsewhere:

Beginner Traders: The high cost and steep learning curve make eSignal a poor choice for those new to trading. More accessible platforms will serve you better as you learn the ropes.

Long-Term Investors: If you’re buying and holding stocks for years, you don’t need real-time data or advanced charting. A basic brokerage account with simple charts works fine for your needs.

Casual Traders: If trading is a hobby or side activity rather than a profession, eSignal’s cost is hard to justify. Many free or low-cost alternatives will serve you well.

A Superior Stock Research Stack = WSZ + TradingView + Broker

Here’s what I believe: instead of paying $200-$500 monthly for an all-in-one solution like eSignal, you’re better off building a specialized “stack” of tools where each platform does what it does best.

This approach provides you with three excellent platforms, each excelling in a specific area, at a lower overall cost than a single “jack of all trades, master of none” platform. Here’s my recommended stack:

WallStreetZen for Stock Research: For fundamental analysis and stock research, WallStreetZen offers comprehensive data and intuitive tools that often surpass those found in charting platforms.

Analyze financial statements, identify undervalued companies, see what top analysts are recommending, and understand the fundamental story behind the stocks you’re trading.

TradingView for Charting: For technical analysis and charting, TradingView offers an unbeatable combination of power, usability, and value.

The interface is modern and intuitive. The community is active and helpful. The pricing is reasonable. Create and save custom chart layouts, access thousands of technical indicators, and share your trading ideas.

eToro for Execution: For trade execution, a reliable broker like eToro offers commission-free stock trading with a user-friendly platform suitable for traders at all experience levels.

The platform is straightforward, costs are transparent, and you’re not paying for features you don’t need.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

This specialized stack approach typically costs between $50 and $100 per month, total. That’s significantly less than eSignal’s Signature or Elite plans, while giving you the best-in-class tools for research, charting, and execution.

Beat the Market in Just 10 Minutes a Month… See how WallStreetZen’s Editor-in-Chief turned a simple ‘Buy the Dip’ strategy into $68,264 in real profits in just 4 months—with full proof straight from his Schwab account. Watch the presentation now.

Final Verdict: Is eSignal Worth It in 2025?

Now that you’ve reached the end of my eSignal review (thanks!) should you go for it?

Maybe.

If trading is your livelihood and you’re generating substantial income from it, the $200-$500 monthly cost is a reasonable business expense. The platform’s reputation for data integrity and stability during critical market moments can provide value that justifies the price.

However, for the vast majority of retail traders, including beginners, casual traders, and even many experienced retail traders, eSignal is overkill.

The high cost, steep learning curve, and poor customer service create significant obstacles. When you can get excellent charting from TradingView for $60 per month or free from thinkorswim, why spend four to eight times more for eSignal, unless you have particular needs that these alternatives can’t meet?

The “à la carte” pricing model, which charges extra for many features, also feels outdated in 2026 as competitors offer more comprehensive packages at lower prices.

For most traders, a smarter (and cheaper) approach is to start with the TradingView (for charting) + WallStreetZen (for research) + eToro (as a brokerage)combination. You’ll save hundreds of dollars monthly while getting excellent tools that will serve you well as you grow your trading skills.

FAQs:

What does eSignal cost per month?

eSignal pricing ranges from $67 per month for the Classic plan (with delayed data) to $466 per month for the Elite plan. The most popular Signature plan costs $228 per month, while annual subscriptions offer a slight discount.

Does eSignal work with my broker?

eSignal integrates with over 50 different brokers, including popular options like Interactive Brokers, TD Ameritrade, and Lightspeed. Broker integration availability may vary by region, so please check eSignal's website to confirm that your specific broker is supported in your location.

Is eSignal better than TradingView?

Whether eSignal is "better" depends on your specific needs and budget. eSignal offers superior real-time data quality and is designed for professional traders. TradingView is more user-friendly, significantly more affordable, and has a larger community. For most retail traders, TradingView provides better overall value.

Can you use eSignal for options trading?

Yes, eSignal supports options trading and offers options data as part of the Signature and Elite plans. The platform also offers an Options Analytix add-on for more advanced options analysis, though this comes at an additional cost.

Does eSignal offer a free trial?

eSignal provides a 30-day money-back guarantee on monthly subscriptions, effectively serving as a trial period. However, numerous user reviews report difficulties obtaining refunds during this period, with complaints about unresponsive customer service making the cancellation process challenging.

Are eSignal charts any good?

eSignal charts are widely regarded as among the best in the industry. The platform offers over 100 technical indicators, highly customizable chart layouts, and proprietary scripting capabilities. The charts are backed by high-quality, fast, real-time data, making them a favorite among professional traders who prioritize precision and reliability.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.