The Bottom Line: Is EquityMultiple a Good Investment?

EquityMultiple can be a good investment platform for accredited investors seeking exposure to private commercial real estate. Historical fully-realized deals averaged around a 17% IRR.

For accredited investors seeking alternative real estate opportunities, EquityMultiple can be a valuable portfolio addition. For others, publicly traded REITs or platforms like Fundrise might be more appropriate.

Whether it’s suitable for you depends on your financial situation, risk tolerance, and investment horizon. Real estate investments on EquityMultiple are illiquid and carry risk, so you should be comfortable with the possibility of losses on individual deals.

EquityMultiple Review

As an accredited investor, you’ve likely considered real estate but balked at the hassles of direct property ownership. EquityMultiple (EM) promises a different path: access to institutional-grade commercial real estate deals without the landlord headaches.

But can this platform actually deliver the high returns and professional management it advertises? In this EquityMultiple review, I’ll cut through the marketing speak to examine what really matters—returns, fees, deal quality, and whether EM is worth your capital.

The platform’s pitch is compelling: rigorous due diligence (they reject 95% of deals), co-investment from the company itself, and access to the same commercial properties that institutional investors target. The question is whether the reality matches the promise.

Ready to explore institutional-grade real estate investments?

EquityMultiple offers accredited investors access to commercial real estate deals typically reserved for institutions. With rigorous due diligence and co-investment from the platform itself, it’s worth exploring for qualified investors.

What Is EquityMultiple?

EquityMultiple is an online real estate investing platform (founded in 2015) that connects accredited investors with professionally managed commercial real estate deals.

The company was co-founded by Charles Clinton (a former real estate attorney) and Marious Sjulsen (a real estate private equity veteran) and is backed by Mission Capital Advisors, a national real estate capital markets firm.

EquityMultiple focuses on institutional-quality commercial real estate – think apartment complexes, office buildings, and other large projects – rather than single-family flips or personal loans.

The platform’s name comes from the term “equity multiple,” a metric for total return (money returned divided by money invested).

Key facts:

- EquityMultiple is open only to accredited investors (high-income or high-net-worth individuals)

- The minimum investment is typically $5,000 for most offerings. Through the EquityMultiple platform, you can choose from a variety of real estate investment types and invest in specific projects or funds.

- The company prides itself on rigorous due diligence – they accept only ~5% of the deals they evaluate – and on aligning with investors by co-investing in every deal. EquityMultiple has facilitated over $600 million in investments from more than 50,000 investors to date.

How EquityMultiple Works

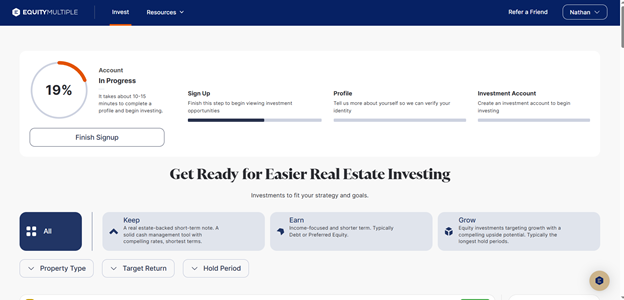

EquityMultiple’s process is straightforward and entirely online. Here’s how it works:

- Sign Up & Accreditation: Create a free account and verify your accredited investor status. Only accredited individuals can invest on EquityMultiple, per SEC rules.

- Browse Investment Opportunities: Once registered, you can browse the live offerings on the website. Deals are categorized into three broad strategies:

- Grow: Growth-oriented equity investments (higher risk, higher potential returns, ~5+ year holds).

- Earn: Income-oriented investments like debt, preferred equity, and shorter-term funds (moderate risk, regular cash flow, ~1–3 year holds).

- Keep: Capital preservation and cash management, namely the Alpine Notes (short-term notes with fixed interest).

- Deal Evaluation: Each offering includes extensive due diligence information including financial projections, market analysis, sponsor background, and risk factors.

- Invest & Fund: When you decide to invest, enter the amount (meeting at least the minimum), complete the online checkout, e-sign the legal documents, and link your bank account to fund the investment.

- Portfolio Management: After funding, the deal will close and your investment is active. You’ll receive regular project updates and distribution notifications via your dashboard. Income distributions are paid directly to you.

- Exit: Real estate investments have a set holding period (e.g. 2–5+ years). Upon a successful exit, you receive your original principal back plus any remaining profits. While early exits are not guaranteed, some offerings have liquidity options through private transfers or secondary markets.

When you invest in an EquityMultiple deal, you actually purchase shares in a special purpose LLC that then invests in or lends to the underlying real estate project. This structure provides added protection by isolating each deal in its own legal entity.

The EquityMultiple real estate investing approach differs from traditional methods by eliminating many of the headaches associated with direct property ownership. You won’t need to worry about midnight maintenance calls, tenant disputes, or property management issues.

Instead, you can focus on reviewing deals and building a diversified portfolio of institutional-quality assets with professional management already in place.

How EquityMultiple works with different property types and investment structures is crucial to understand when building a well-balanced portfolio.

The platform offers exposure to various commercial real estate sectors including multifamily, office, retail, industrial, and hospitality, allowing investors to diversify across geography and asset class based on their outlook and risk tolerance

Not accredited yet? Start with accessible real estate investing

While EquityMultiple requires accreditation, you can still invest in real estate through platforms open to all investors. Fundrise offers diversified real estate portfolios with a $10 minimum investment.

Note: We earn a commission for this endorsement of Fundrise.

EquityMultiple Investment Types Explained

EquityMultiple offers several investment types to choose from:

1. Common Equity Investments (Growth Deals)

These are “Grow” opportunities where you buy an ownership stake in a real estate project. Common equity has higher risk but unlimited upside.

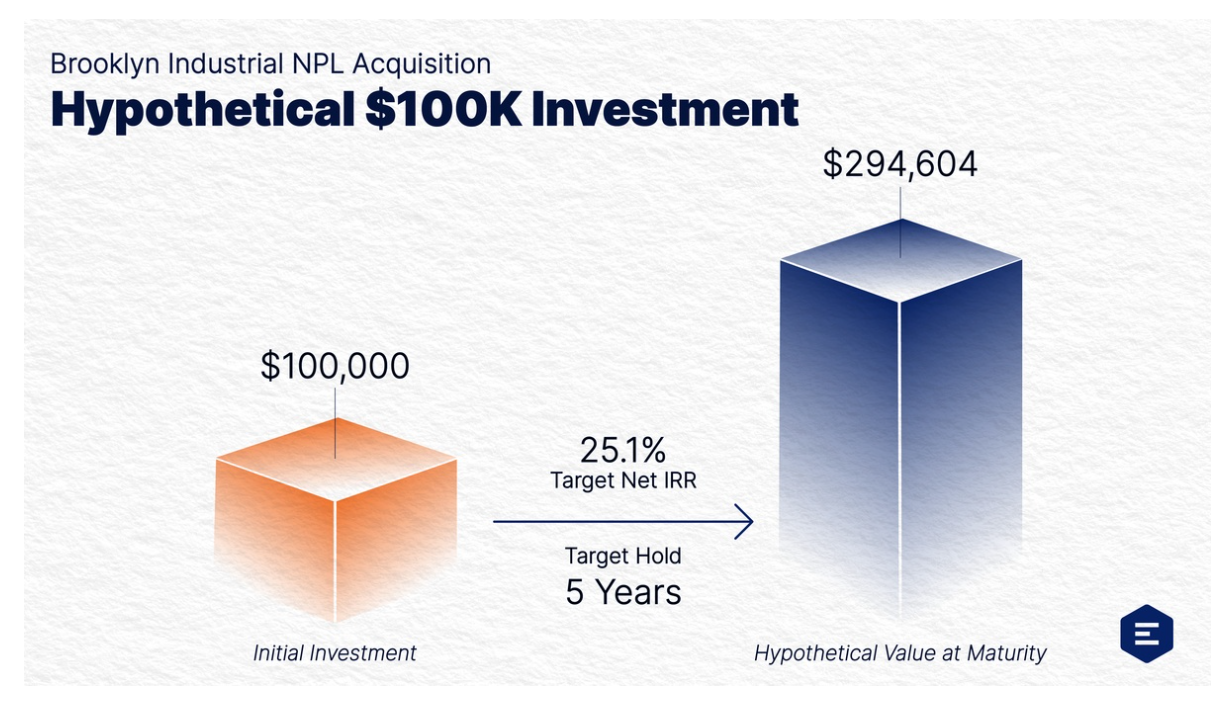

EquityMultiple’s equity deals target internal rates of return (IRRs) in the mid-teens or higher. You may receive quarterly cash flow, but a large portion of returns usually comes upon sale or refinance.

EquityMultiple typically charges a 10% carry (profit share) on equity deals after investors have received their initial investment back. These deals often have multi-year hold periods (3–7 years).

2. Preferred Equity Investments

Preferred equity deals offer a fixed preferred return rate (e.g. 8–12%) with priority over common equity in payouts.

These provide more stable returns than common equity, but with slightly more risk than senior debt. Many preferred equity deals pay fixed monthly or quarterly distributions with additional returns at exit. A typical offering might target ~10% annual return with a 2-3 year term.

3. Senior Debt Investments (Real Estate Loans)

These “Earn” strategy investments have the lowest risk because they’re secured by the property with first claim on assets.

Debt investments offer fixed interest payments (typically 8–12% annually) with set terms (often 6 to 24 months). Interest is paid regularly (monthly or quarterly) with principal returned at maturity. Notably, no platform fees are charged on short-term note or debt investments.

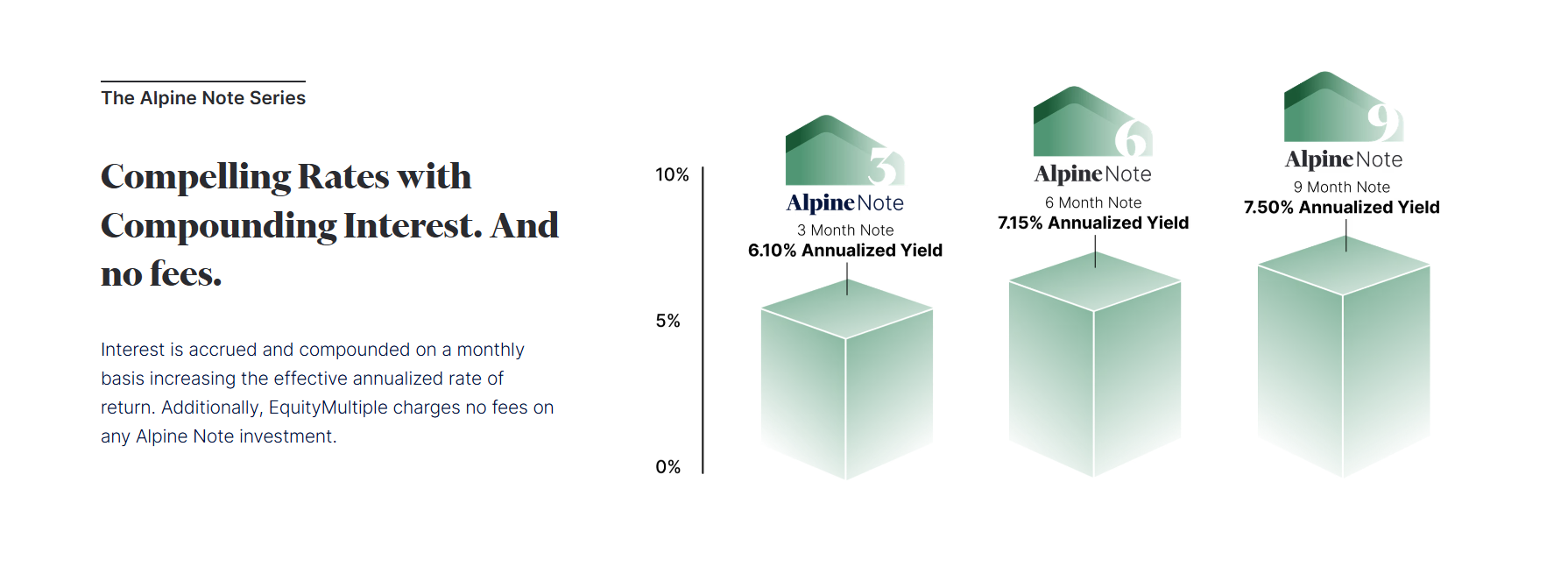

4. Short-Term Notes (Alpine Notes “Keep” Strategy)

Alpine Notes are short-term, pooled investments with term options of 3, 6, or 9 months and interest rates around 6% to 7.4% APY.

They offer monthly compounding interest and you can redeem early (usually after an initial 30-day lock-up). They include a first-loss protection where EquityMultiple covers an initial amount of loss if any underlying asset defaults.

Alpine Notes function as a diversified pool of short-term real estate loans for those who want to earn passive interest with minimal risk.

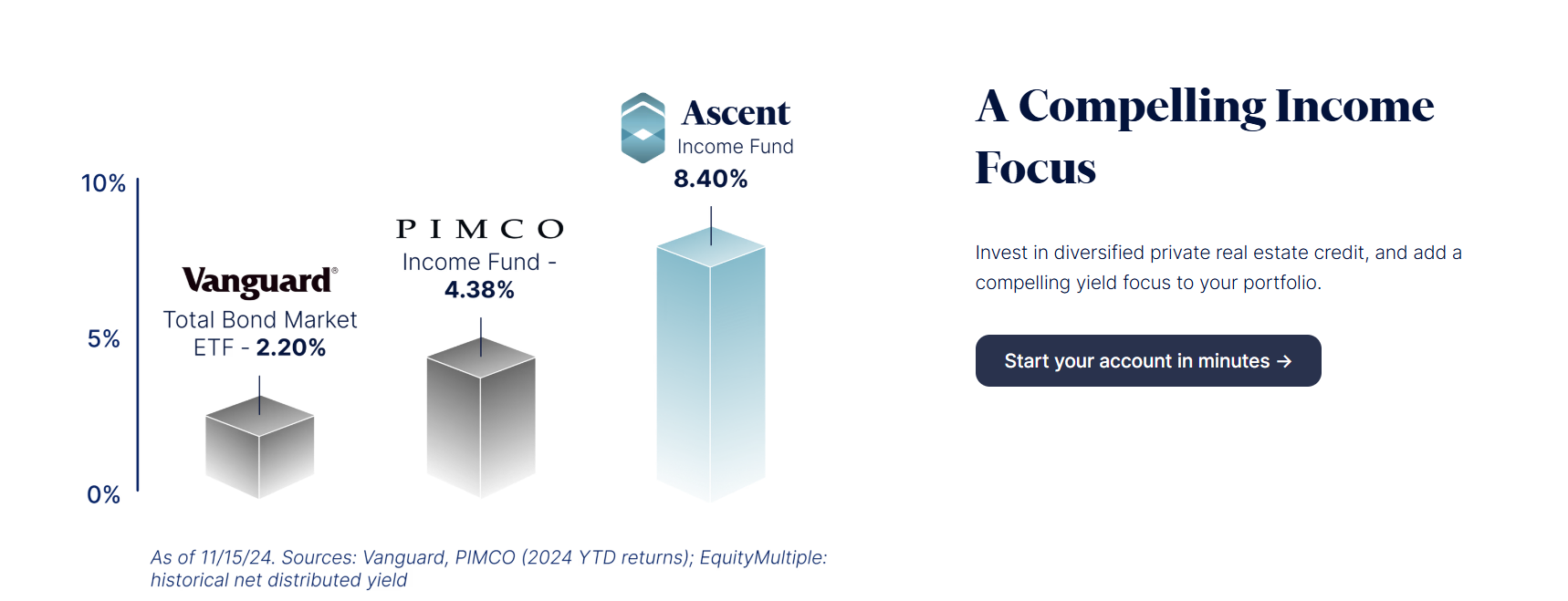

5. Ascent Income Fund (Diversified Fund)

The Ascent Income Fund pools investor money into a portfolio of real estate debt and income-oriented assets, primarily first-lien mortgage loans with conservative loan-to-value ratios.

Target returns are around 11%–13% annually with regular distributions.

The fund allows redemptions after a 1-year lockup period, providing some liquidity. The minimum investment is higher (often $20K+). This option is ideal for those who want a “hands-off” diversified approach.

When evaluating EquityMultiple returns, it’s important to understand how each investment type contributes to your overall portfolio performance.

Equity investments typically offer the highest potential upside but come with longer hold periods and greater volatility.

Debt and preferred equity investments generally provide more predictable EquityMultiple returns through regular interest payments, making them suitable for investors prioritizing current income over long-term appreciation.

EquityMultiple Features and Benefits

EquityMultiple offers several notable features and benefits:

- Access to Institutional-Grade Deals: The platform provides access to commercial real estate investments typically available only to institutional investors or private equity firms.

- Rigorous Due Diligence: Only ~5% of potential deals make it onto the site. EquityMultiple’s team underwrites each offering and co-invests in every deal to ensure “skin in the game”.

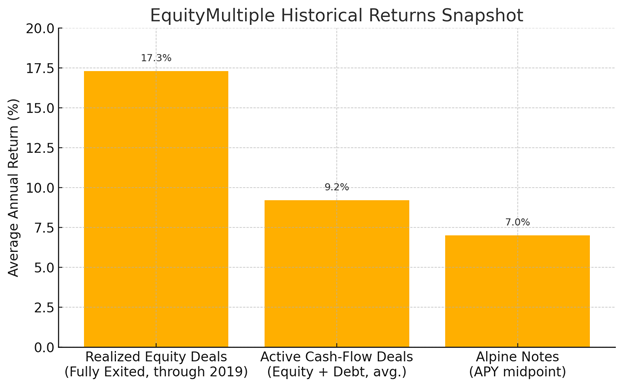

- High Return Potential: Private real estate can potentially earn higher returns than public markets. EquityMultiple’s equity deals often target double-digit IRRs (12–20%+). As of 2019, fully realized investments had an average 17.3% IRR.

- Diverse Investment Offerings: You can invest in equity, preferred equity, senior debt, short-term notes, or a fund across various geographies and asset classes.

- Low Minimum (for the Space): The $5,000 minimum investment is relatively low for private commercial real estate.

- User-Friendly Platform: The website is intuitive and information-rich with detailed offering pages and an easy-to-use dashboard for tracking investments.

- Dedicated Customer Service: EquityMultiple offers multiple support channels (phone, email, live chat) with the option to schedule calls with the team. 24/7 service is available for urgent matters.

- Passive Income & Cash Management Options: Unlike many real estate platforms, EquityMultiple offers shorter-term options with the Alpine Notes and Ascent Income Fund providing more flexibility.

- Self-Directed IRA & 1031 Exchange Support: You can invest through a Self-Directed IRA or via 1031 exchanges for eligible deals.

- Transparent Track Record: EquityMultiple publishes information about its performance and deals, providing quarterly updates and deal-level performance data.

Another advantage worth highlighting is the transparency each EquityMultiple investment provides. Unlike some competitors that pool funds into opaque portfolios, EquityMultiple gives you detailed information about each property, including location, photos, financial projections, and the track record of the sponsoring real estate company.

This level of disclosure helps investors make more informed decisions about where to allocate their capital.

What Are EquityMultiple Fees and Costs?

EquityMultiple’s fee structure varies by deal type:

- Annual Management Fee (0.5% – 1.5%): Typically charged on equity and preferred equity deals. For example, a $10,000 investment with a 1% fee would cost $100 per year, deducted from distributions.

- Profit Sharing (Carry): On equity investments, EquityMultiple takes 10% of profits after investors receive their initial investment back.

- Upfront Fees (Origination Fee): Some offerings, especially funds, may charge an origination or placement fee (around 1–2%) at the time of investment.

- Administrative Fee: A small annual fee (roughly $30 to $70 per investment) covers tax document preparation and reporting.

- Alpine Notes – No Investor Fee: These short-term notes have no annual fees for investors.

- “Double Layer” of Fees: Be aware that you might pay fees to both EquityMultiple and the underlying real estate sponsor, which can impact net returns.

Who Can Invest With EquityMultiple?

EquityMultiple is only open to accredited investors. An accredited investor is defined as an individual with annual income over $200,000 (or $300,000 with spouse) or net worth over $1 million (excluding your primary home), among other criteria.

For a comprehensive breakdown of the qualification requirements and alternative paths to accreditation, check out our guide on how to become an accredited investor.

If you don’t qualify as accredited, you cannot invest on EquityMultiple. For non-accredited investors seeking real estate exposure, alternatives like Fundrise or RealtyMogul’s REITs might be more suitable.

The platform is available to U.S. investors nationwide who are at least 18 years old and U.S. citizens or residents.

I’ve highlighted this limitation throughout this equitymultiple review because it’s a crucial consideration for many potential users. If you’re not currently accredited but are working toward that status, platforms like Fundrise might be more accessible in the meantime.

Don’t meet accreditation requirements? No problem!

Non-accredited investors can still access professionally managed real estate investments through platforms designed for everyone. Fundrise democratizes real estate investing with low minimums and no accreditation requirements.

EquityMultiple Pros and Cons

Now that we’ve covered how EquityMultiple works, its investment types, and key features, let’s weigh the platform’s strengths against its limitations. Like any investment platform, EquityMultiple has distinct advantages and drawbacks that potential investors should carefully consider before committing capital.

Pros | Cons |

|---|---|

Access to institutional-grade commercial real estate deals | Accredited investors only |

High potential returns (historical realized equity investments averaged ~17% IRR) | $5,000 minimum investment per deal |

Co-investment by platform (skin in the game) | Limited deal flow compared to larger platforms |

Rigorous due diligence – only ~5% of proposed deals get listed | Complex fee structure that can reduce returns |

Diverse offerings for different investment goals | Investments are illiquid with long hold periods |

Strong investor support and transparent communication | “Double layer” fees (platform + sponsor fees) |

Options for passive income and short-term yields | Some investors report communication issues and delays |

EquityMultiple Performance and Track Record

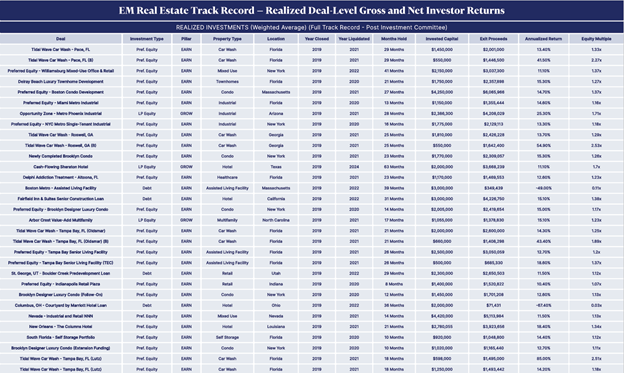

According to EquityMultiple, the platform’s investments have yielded strong returns overall. On cash-flowing equity and debt offerings, the average annual return has been just over 9%. In late 2019, the average IRR on fully realized deals was 17.3%.

As this EquityMultiple review demonstrates, past performance doesn’t guarantee future results, but the platform’s track record provides valuable context for potential investors.

While the COVID-19 pandemic and subsequent interest rate increases created challenges across the real estate sector, many of the platform’s deals have continued to deliver positive returns.

However, the 2020–2023 period presented challenges for real estate, with some investors reporting underperformance or losses on certain deals. The Alpine Notes product has maintained a flawless track record with zero defaults or late payments.

EquityMultiple does not publish a default rate, but anecdotal evidence suggests that the majority of deals are performing as expected, with a minority experiencing distress. The company has closed well over 100 deals since inception, many with positive results.

In terms of investor satisfaction, EquityMultiple states that over 70% of its customers have invested in multiple deals, with the average customer investing in 5+ projects over time.

Is EquityMultiple legit and safe?

Yes, EquityMultiple is a legitimate real estate investment platform that has been operating since 2015 with real, tangible projects – but like all private investments, it comes with risks.

The company is a registered business based in New York City that operates under SEC regulations. It’s backed by Mission Capital and received a strategic investment from Marcus & Millichap in 2023.

When you invest via EquityMultiple, your funds are initially held in an escrow account until the deal closes. Each investment is structured through a separate LLC, providing protection if something were to happen to EquityMultiple as a company.

In terms of reputation, EquityMultiple has had some mixed reviews:

- In a 2022 survey, 69% of investors rated their experience as positive versus 12% negative.

- The Better Business Bureau (BBB) gives EquityMultiple a low rating because the company failed to respond to a couple of customer complaints.

- Some reviews cite issues such as poor communication on underperforming deals, delays in getting updates or K-1s, and frustration with investments losing money.

From a safety perspective, EquityMultiple is a legitimate business with real assets behind it. Your investments are still subject to market and deal risk, but there are no indications of fraud concerns.

Is EquityMultiple legit enough to trust with large investments?

Based on its seven-year operating history, institutional backing, and transparency around both successful and troubled investments, the evidence suggests it is.

The platform maintains regulatory compliance as a Regulation D securities issuer, implements strong security measures to protect investor data, and establishes separate legal entities for each investment to mitigate counterparty risk.

EquityMultiple vs. Competitors

Understanding how EquityMultiple stacks up against other real estate investment platforms is crucial for making an informed decision.

Each platform has its own target audience, investment approach, and fee structure. Let’s examine how EquityMultiple compares to the most popular alternatives in the real estate crowdfunding space.

EquityMultiple vs Fundrise

- Investor Access: Fundrise is open to anyone with a minimum of $10, while EquityMultiple requires accreditation and a $5,000+ minimum. Check out our Fundrise review here.

- Investment Model: Fundrise pools investor money into proprietary funds where you don’t pick individual properties. EquityMultiple offers individual deals that you select yourself.

- Returns: Fundrise delivers steady returns (historically ~5-10% annually) through diversification. EquityMultiple can offer higher but more variable returns on specific deals.

- Liquidity: Fundrise offers a quarterly redemption program, making it more liquid than most EquityMultiple investments (except Alpine Notes).

Which to choose? Fundrise is better for beginners or non-accredited investors. EquityMultiple is ideal for accredited investors seeking custom commercial real estate portfolios with higher return potential.

EquityMultiple vs Yieldstreet

- Focus: Yieldstreet offers various alternative investments (litigation finance, art, marine loans, etc.) including real estate. EquityMultiple focuses exclusively on real estate.

- Investor Access: Both primarily serve accredited investors, though Yieldstreet offers the Prism Fund to non-accredited investors with a $500 minimum.

- Offerings: Yieldstreet’s real estate deals are primarily debt-focused with limited equity opportunities. EquityMultiple offers more complete real estate options including high-upside equity deals.

- Track Record: Yieldstreet has faced controversies including SEC investigations into a marine financing portfolio. EquityMultiple has had some investor complaints but no regulatory issues.

Which to choose? EquityMultiple is better for focused real estate investing, while Yieldstreet offers broader alternative asset exposure.

Want diversified alternative investments beyond real estate?

While EquityMultiple focuses exclusively on real estate, Yieldstreet offers access to unique alternative investments including art, legal finance, and structured notes. For accredited investors seeking broader diversification, it’s worth exploring.

EquityMultiple vs RealtyMogul

- Investor Access: RealtyMogul serves both accredited and non-accredited investors through different products. Non-accredited investors can access two REITs with a $5,000 minimum, while accredited investors can invest in private deals (similar to EquityMultiple) with higher minimums (~$25,000).

- Offerings: Both platforms offer commercial real estate equity and debt deals. RealtyMogul tends to have fewer individual deals available at once and focuses on more conservative, stabilized properties.

- Returns: Both target similar returns for comparable deal types, with RealtyMogul’s public REITs delivering modest but steady returns (5-6% range).

Which to choose? For non-accredited investors, RealtyMogul is the only option via its REITs. For accredited investors, EquityMultiple typically offers more deals with lower minimums.

Looking for both accredited and non-accredited options?

RealtyMogul offers flexibility with both public REITs for non-accredited investors and private deals for accredited investors. It’s a versatile platform worth considering for different investor types.

Final Verdict: Is EquityMultiple Worth It?

Yes – for the right investor, EquityMultiple can be an excellent addition to your investing toolkit.

EquityMultiple is worth it for:

- Accredited investors seeking higher yields and growth beyond what public markets offer

- Those who want control over selecting specific real estate investments

- Investors who value transparency and alignment of interests

- Experienced real estate investors or those willing to learn

For those new to private real estate, the EquityMultiple real estate investing platform offers educational resources to help you understand key metrics like equity multiple, IRR, and cash-on-cash return.

These tools can be valuable for investors looking to build their knowledge while simultaneously putting their capital to work in tangible assets with potential for both income and appreciation.

EquityMultiple might not be worth it if:

- You’re not accredited or can’t invest $5k+ per deal

- You need liquidity or have a short investment horizon

- You’re extremely risk-averse

- You prefer a completely hands-off approach

If you fit the accredited profile and have a long-term mindset, EquityMultiple is definitely worth exploring as part of a diversified investment strategy. The platform provides access to institutional-quality real estate without the headaches of property ownership.

Throughout this EquityMultiple review, I’ve examined the platform’s strengths and weaknesses, from its rigorous due diligence process to its limited liquidity options.

The bottom line is that for qualified investors seeking diversification through commercial real estate, EquityMultiple offers a compelling option worth considering

Ready to invest in exclusive real estate deals?

You can sign up for EquityMultiple here and browse current offerings on their platform.

FAQs:

Is EquityMultiple a good investment?

EquityMultiple can be a good investment platform for accredited investors seeking exposure to private commercial real estate. Historical fully-realized deals averaged around a 17% IRR. Whether it's suitable for you depends on your financial situation, risk tolerance, and investment horizon.

Real estate investments on EquityMultiple are illiquid and carry risk, so you should be comfortable with the possibility of losses on individual deals.

For accredited investors seeking alternative real estate opportunities, EquityMultiple can be a valuable portfolio addition. For others, publicly traded REITs or platforms like Fundrise might be more appropriate.

What are the complaints about EquityMultiple?

Some users have reported issues with communication, particularly when investments face problems. Complaints include infrequent or insufficiently detailed updates, delayed K-1 tax documents, and unresponsive customer service during troubled investments.

A few investors experienced deals that lost principal, causing them to question the platform's due diligence. EquityMultiple has an F rating with the BBB due to failure to respond to formal complaints.

The company has been working to improve communications and transparency.

How does EquityMultiple work?

EquityMultiple connects accredited investors with curated real estate investments online. You sign up (verifying accreditation), browse deals, invest (minimum $5,000), and electronically sign documents.

Your investment is structured through an LLC that invests in the underlying project. You receive regular updates and distributions based on the investment type. Upon exit (typically 2-5+ years), you receive your principal plus any remaining profits.

EquityMultiple handles all administration, including investor relations, payments, and tax documents.

What is the minimum investment for EquityMultiple?

The minimum investment is $5,000 for most deals, though some offerings require higher amounts (commonly $10,000 or $25,000). Additional investments above the minimum are usually in $5,000 increments.

The Alpine Notes also have a $5,000 minimum. Always check each deal's specific minimum on the offering page.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.