You probably already know the benefits of investing in real estate — cashflow, appreciation, leverage, and portfolio diversity, to name a few. But the list of questions is as long as the potential benefits…

- Where should I invest?

- How can I get access to solid investments?

- How much will it cost?

- What type of real estate should I buy?

- Who’s going to manage it?

If you’re an accredited investor, have capital to invest, and want to diversify into real estate but don’t have the time to be hands-on, CrowdStreet might be a great option for you. Thanks to this platform, what used to only be accessible on Wall Street can now be a foundational piece in your portfolio.

In this CrowdStreet review, we’ll take an in-depth look at the platform, including the pros and cons, key features, and how to invest.

CrowdStreet Review: Is CrowdStreet Legit?

The Bottom Line: Yes, CrowdStreet is a legit real estate investing platform.

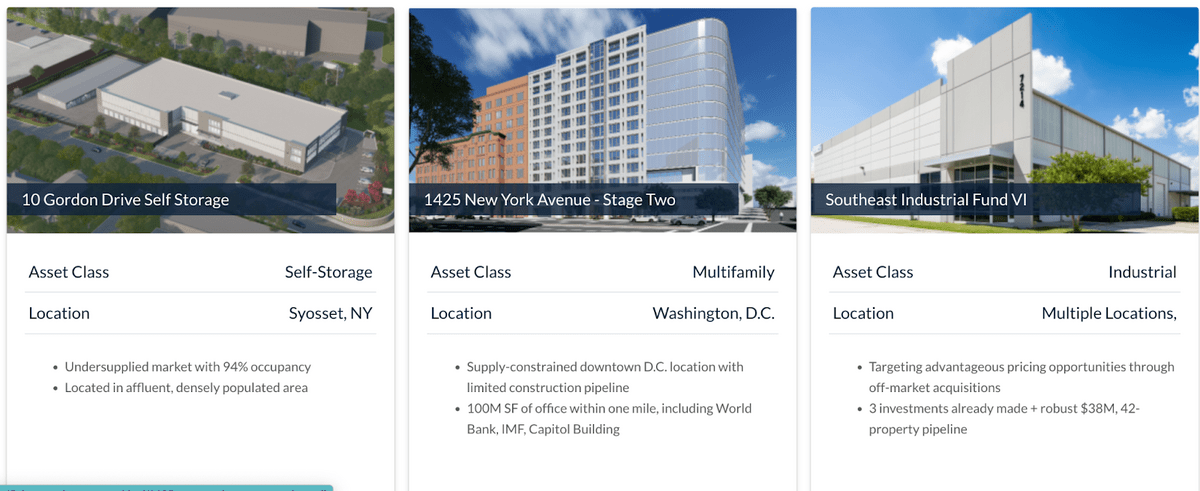

With CrowdStreet, accredited investors can leverage the power of crowdfunding to own a piece of a large commercial real estate project and earn passive income without the day-to-day hassles of operations and management. Whether you invest in a self storage development in New York or a value-add multifamily project in Texas, CrowdStreet lets you mitigate your stock market exposure and make real estate a foundational piece of your portfolio.

Plus, CrowdStreet’s deal flow opportunities are top-notch, providing many different options to make passive income through real estate.

What is CrowdStreet?

CrowdStreet is the largest online private equity real estate platform, with over 329K registered members, $4.3 billion invested, ad 790+ deals funded as of September 2024 (that’s significant growth since January 2023, when those numbers were $3.9 billion invested and 732 deals funded). With deal types ranging from Core to Value Add to Opportunistic, you have plenty of options to choose from to fit your risk tolerance and investing style.

Here’s how each investment profile differs on the risk scale:

- Core – Least amount of risk; less leverage is used, predictable cash flow.

- Core Plus – Low to moderate risk; potentially higher returns compared to Core.

- Value Add – Moderate risk; the additional risk is associated with cost of improvements.

- Opportunistic – Moderate to high risk; one step ahead of Value Add as the property may be fully vacant and require more in-depth repairs, such as the conversion of an office space to storage.

- Development – High risk, high leverage; refers to more ground-up developments than Opportunistic.

Within these deal types, you can invest in a number of property types in different regions of the country:

- Self-storage

- Industrial

- Hospitality

- Land

- Medical office

- Multifamily

- Residential

- Retail

- Senior housing

- Student housing

- Parking garage

The platform leverages the power of crowdfunding — investors pool their money together with others to purchase property (or a share of property). Traditionally, if you wanted to buy a multifamily property, you’d have to source the deal, come up with the funds, work with a lender for financing, get the deal to the closing table, THEN stabilize it afterwards.

CrowdStreet gives accredited investors access to deals normally set aside for Wall Street. You can take advantage of the real estate without the landlording and management hassle.

What Makes CrowdStreet Different?

You may have heard of other real estate crowdfunding platforms in the past few years. What makes CrowdStreet stand out?

I’m a huge fan of utilizing platforms like CrowdStreet to invest in real estate. The first thing I want to know is how their deals are vetted.

CrowdStreet’s Capital Markets team scours every region of the United States looking for viable sponsors and potential deals. These deals are put through a three-step vetting process, where only 5/100 deals ever make it to the Marketplace for CrowdStreet investors.

Here’s a breakdown of CrowdStreet’s deal screening process:

- Sponsor Review – Background check and review of a successful track record in prior deals. Includes examining licenses, banking relationships, capital sources, and more.

- Deal Review – Ensure the project is within the sponsor’s core competency. Does the deal match the preferences of CrowdStreet investors?

- Document Review – Legal document review to confirm numbers and terms. Documents include the purchase and sale agreement, title search, property management agreement, construction budget, and more.

Needless to say, CrowdStreet differentiates itself from other platforms by offering a deep selection of highly-vetted commercial real estate projects across the country.

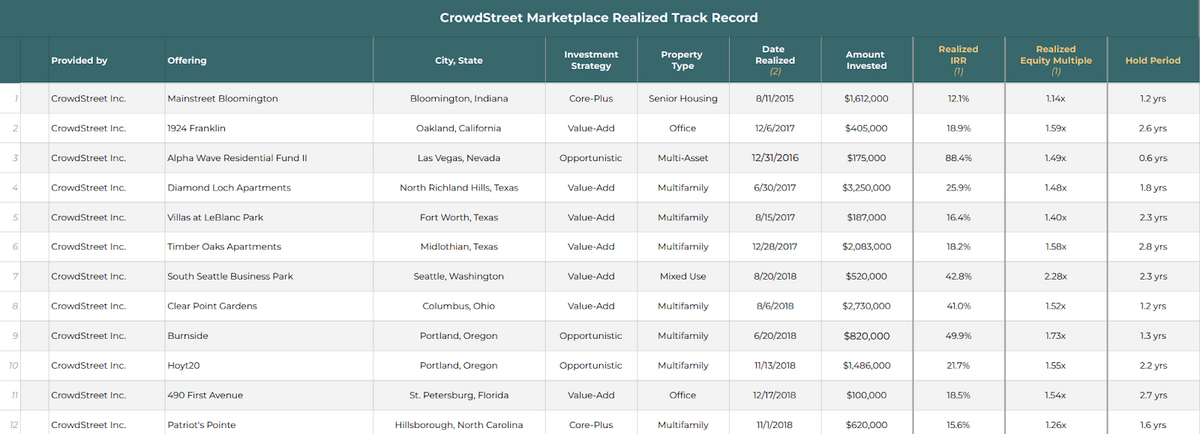

CrowdStreet’s Key Numbers

- CrowdStreet minimum investment – Varies, but most investments start at $25,000

- Average holding period – 3 years

- Average equity multiple – 1.59x (total return paid back to an investor)

- CrowdStreet returns – 19.7% realized IRR (return on investment while taking timing of cash flow into consideration)

- 732 deals launched from 337 sponsors, across 17 property types in 44 states

Below is a CrowdStreet review of key figures from recent deals:

CrowdStreet Fees & Pricing

Investors can open an account for free. So how does CrowdStreet make their money?

- Sponsor fees – Technology and service fees related to the sponsor’s offering.

- CrowdStreet advisory fees in the Tailored Portfolio option – Fees vary by the fund and agreement. They are charged in the form of basis points – 1/100 of 1% (100 bps = 1%, 20 bps = 0.2%).

CrowdStreet fees vary based on the deal complexity and the sponsor involved. Sponsor compensation typically takes the form of a promote or profit fee. The promote means profit is realized once the project meets certain criteria. This incentivizes the sponsor throughout the deal.

Sponsors charge fees at different stages of a deal. Here are the sponsor-related fees in a typical commercial real estate offering:

- Acquisition/Disposition – These relate to the purchase and sale and can be up to 2%. The purpose is to incentivize the sponsor to find the best deal possible. Dozens of deals can be evaluated to find one worth pursuing.

- Property management – Day-to-day management, operations and upkeep of the property. Sponsors may keep this in house or contract it to a third party management company. Market rates range from 3-4% of gross revenue.

- Asset management – Ongoing investment management fee, typically 1-2% of annual gross revenue. These are assessed monthly or quarterly.

- Construction management – One-time fee for projects involving significant renovation as part of the business plan. Fees average 5%.

- Development – One-time fee for building process costs including zoning, hiring, permits, environmental testing, etc. Fees average 3-5%.

Sponsor fees depend on the complexity of the project. Each project requires a fair amount of legwork, including sourcing and managing the deal and executing on the business plan for shareholders. These are all common fees in the crowdfunding model, but can vary based on the deal.

Pros and Cons of CrowdStreet

Pros | Cons |

|---|---|

Invest in fund or individual deals | Accredited investors primarily |

Wide variety of commercial real estate deals | No retirement accounts available |

Rigorous deal review process | No alternative investments |

Tailored portfolio option (subject to advisory fees) | Lack of liquidity |

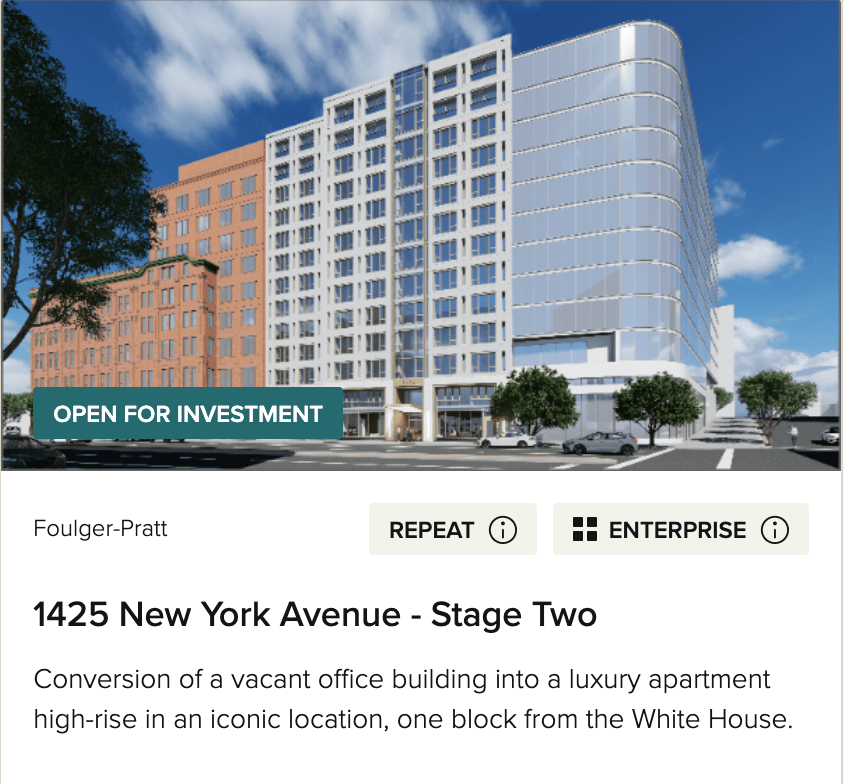

Example Investment on CrowdStreet

A typical individual deal on CrowdStreet has a minimum investment starting at $25,000 with an investment period of 2-4 years. Here’s an example of a recently-opened multifamily property for investment:

- Location – Washington D.C.

- Property Type – Multifamily

- Investment Profile – Opportunistic

- Investment Period – 2 years

- Minimum Investment – $25,000

CrowdStreet categorizes each sponsor (in this case, Foulger-Pratt) based on experience and track record so investors can see who is behind the deal. Foulger-Pratt has an Enterprise status — 30+ years of leadership experience and a $5 billion portfolio value.

CrowdStreet Competitors

Who are some of the main CrowdStreet competitors? Here’s my breakdown of Yieldstreet vs CrowdStreet vs Fundrise:

CrowdStreet | Yieldstreet | Fundrise | |

|---|---|---|---|

Overall Rating | 4 | 4.5 | 4 |

Minimums | Most investments start at $25,000 | $5,000 for Prism Fund$10,000 for accredited offerings | $10 for Starter account |

Projected Returns | 12-20% annually | 8-20% annually | 4-10% annually |

Investment Options | Commercial Real Estate | Real Estate, Legal,Art, Transportation,Private Credit,Cryptocurrency | Real Estate |

Fees | 2-5% | 0-2.5% | 1% |

Retirement Accounts | Not available | Available | Available |

Mobile App | ❌ | ✅ | ✅ |

# of Investors | 100,000+ | 404,000+ | 387,000+ |

Amount Invested | $3.95 billion | $3+ billion | $4+ billion |

More Info: |

CrowdStreet is best for accredited investors who want to invest in commercial real estate.

Yieldstreet is best for accredited & non-accredited, experienced investors who want access to many private offerings in multiple asset classes like real estate, venture capital, private equity, private credit, crypto, short-term notes, structured notes, diversified funds, transportation, and art.

Fundrise is best for non-accredited investors seeking direct real estate investments.

Final Word: CrowdStreet Review

CrowdStreet is a great platform for accredited investors looking to invest passively in commercial real estate projects. Compared to other crowdfunding platforms, CrowdStreet has the most in-depth selection of commercial deals to fit your risk tolerance and comfort level.

Most investment minimums start at $25,000 and typical holding periods range from 2-4 years. This platform is not suitable for someone looking to get in the game for little money who needs liquidity.

CrowdStreet is very transparent about fee structures and sponsor track record. They have a wealth of resources to learn more about commercial real estate and host regular webinars to discuss new deal offerings.

Hopefully this was the CrowdStreet review to end all CrowdStreet reviews!

FAQs:

Can you lose money on CrowdStreet?

With any investment comes a level of risk. Individual deals will present more risk than a fund. To mitigate your risk on an individual deal you could opt for one of CrowdStreet’s more risk-averse deal types, like Core or Core Plus.

How risky is CrowdStreet?

The risk level on CrowdStreet is minimal. You can mitigate your risk on CrowdStreet based on the deal. Individual deals will be more risky than a fund. You can mitigate risk on individual deals by choosing a project in the Core or Core Plus category, as opposed to Opportunistic.

How legitimate is CrowdStreet?

CrowdStreet has an excellent track record in the real estate crowdfunding space. Since inception 732 deals have been funded with $3.9 billion invested. All sponsors must pass an in-depth three step screening process before any deals hit the CrowdStreet Marketplace. Their fee transparency, sponsor vetting process and educational resources provide a great deal of confidence to investors.

What is the minimum investment in CrowdStreet?

CrowdStreet minimum investments range from $10,000 to $50,000+. Most investment offerings on the Marketplace start at $25,000.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.