Want to spend more time thinking about your next real estate investment — and less time comparing the best house hunting apps? You’re in the right place.

Over my years of working in real estate and investing in rental properties, I’ve used my fair share of popular house finding apps. In my learned opinion, all of the sites covered below have something to offer — it’s mostly about figuring out which service meets your specific needs.

In this article, I’ll guide you through some of the best apps for home buying — including what each one excels at, and where each one could use a little work.

By the time you’re done reading, you’ll have a much better idea of how top real estate apps work and which one is best for you.

Prefer a more passive approach to real estate investing?

Don’t want to deal with the hassle that comes after you use house finding apps — namely, buying and managing property? These crowdfunded real estate investment platforms that let you invest in property indirectly, and without assuming landlord duties:

Note: We earn a commission for this endorsement of Fundrise.

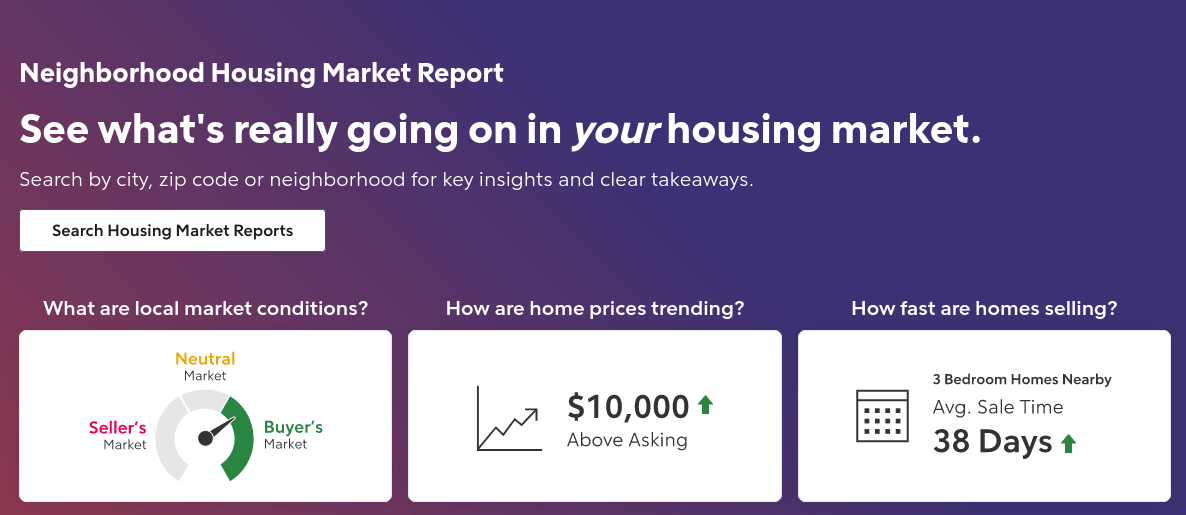

Rocket Homes – Best to Identify Trends

Rocket Homes helps home buyers make informed decisions by providing up-to-date data and analytics tools.

How? The app offers more analysis options than any of the other top real estate apps, making it the best choice for number crunchers.

I personally use this app all the time to identify good areas for rentals in my initial research phase.

Unlike most house-buying apps, Rocket Homes’ research tools offer insights into local real estate markets. You can quickly view pricing trends, average sale time, inventory changes on a month-to-month basis, and tons more.

The best part of viewing trends with Rocket Homes tooling is that you can filter everything by location, so you don’t have to worry about irrelevant data muddying the waters. I’ve found that the broad trend data most sites use is harder to use than Rocket Homes’ location-specific info.

Pros | Cons |

|---|---|

Unmatched analysis tools | Primarily focused on single-family homes |

Modern, user-friendly interface | Lacks more detailed analytics for investors |

Great for viewing long- and short-term trends |

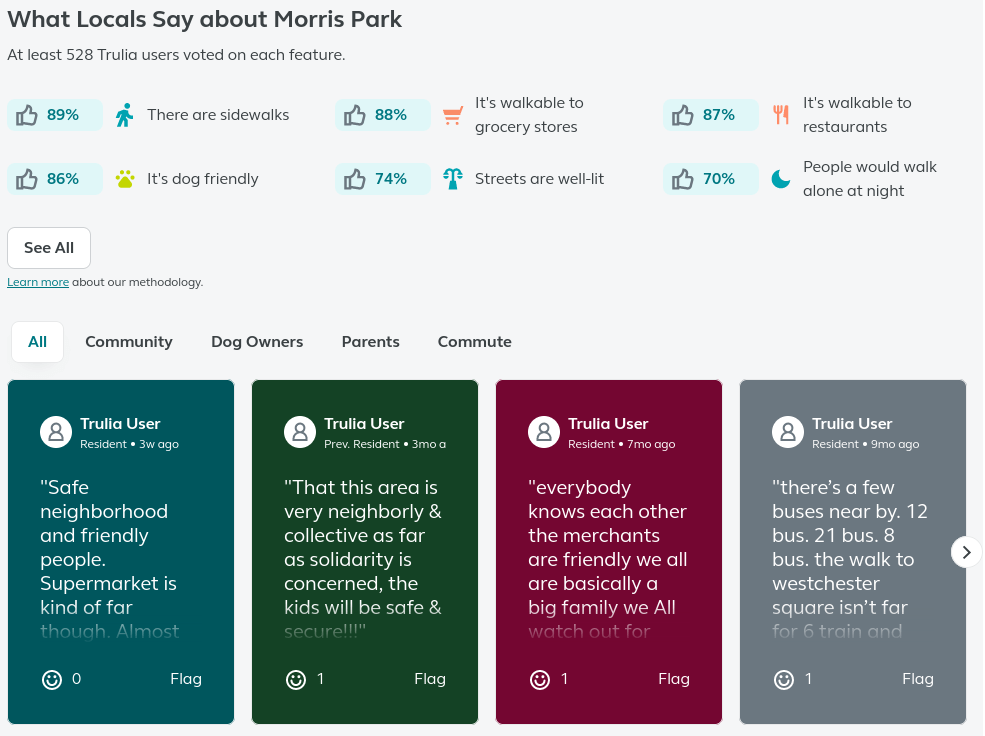

Trulia – Best App for User Polling Data

All the facts and figures in the world won’t help you learn what it’s really like living in a particular neighborhood. Trulia solves this problem by incorporating user polls into its platform alongside standard data like median sale prices and time-on-market stats.

I am a big fan of Trulia’s “What Locals Say” section. It gives me a sense of what a neighborhood is actually like, which is helpful for assessing properties in areas I haven’t visited myself.

This is a great option for investors and end-users alike to get a good sense of an area before diving into property-specific research.

Trulia’s filters also include options for single-family homes, condos, apartments, multi-family homes, land, and mobile homes, making it far more versatile than Rocket homes.

In my opinion, Trulia is best used as a first pass, so you’ll need to use other platforms to get the full picture.

Pros | Cons |

|---|---|

Outstanding local insight from user polls | Data isn’t detailed enough to use on its own |

Caters to more than just single-family homes | Geared more toward end-users than investors |

Sleek UI that I prefer to other similar apps |

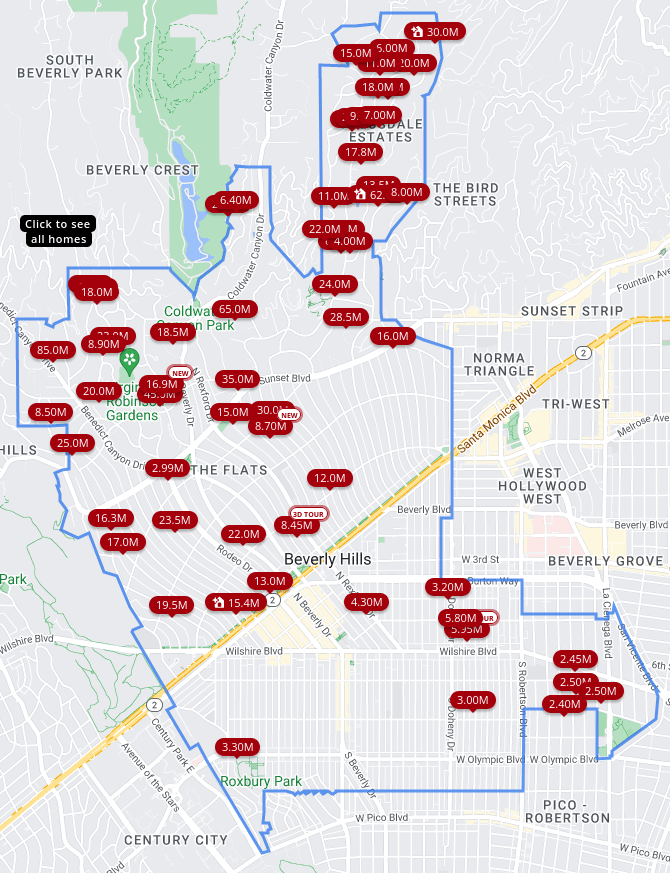

Zillow – Best App to Look for Houses

Zillow became a household name on the back of its sheer volume of property listings. People fell in love with Zillow’s map feature and value estimator, which is how it became the most downloaded real estate mobile app.

I know what you’re thinking: don’t most house-finding apps have a map? That’s true, but that’s only because they’re following in Zillow’s footsteps.

Zillow’s now-iconic map, with its filters and draggable boundaries, makes it still one of the best apps for home buying, even among the sea of imitators.

Zillow’s data isn’t always the most up-to-date, since it really aims to draw buyer attention and sell leads to real estate agents. This is one pretty major downside of Zillow: you’ll need to verify information using other sites.

You also shouldn’t take its Zestimates too seriously, but its massive database gives you access to more listings than other top real estate apps. Enough said.

Pros | Cons |

|---|---|

Extensive listings database | Data is sometimes out-of-date |

Zestimates can be helpful | Zestimates aren’t always accurate |

Convenient, full-featured mobile app |

Redfin – Best for Low Commissions

If you’re looking for the lowest commissions you can find to save a little money on your purchase, check out Redfin. Redfin’s biggest draw is that it offers lower commissions than the competition by using in-house certified agents that accept lower payments in exchange for leads.

Redfin charges a 1.5% listing fee and drops that rate to 1% if you buy through the company. Redfin also doesn’t charge for services like photos and digital marketing, which can help lower your upfront costs, leaving you room for a more competitive down payment.

Another reason to use Redfin is its real-time updates, which means Redfin’s data is much less likely to be out-of-date than, say, the information on Zillow.

Pros | Cons |

|---|---|

Low 1.5% listing fee | The Redfin database is notably lacking compared to Zillow |

All the bells and whistles of a modern real estate app | If you want to buy through Redfin, you have to use their in-house agents |

Data updates extremely quickly |

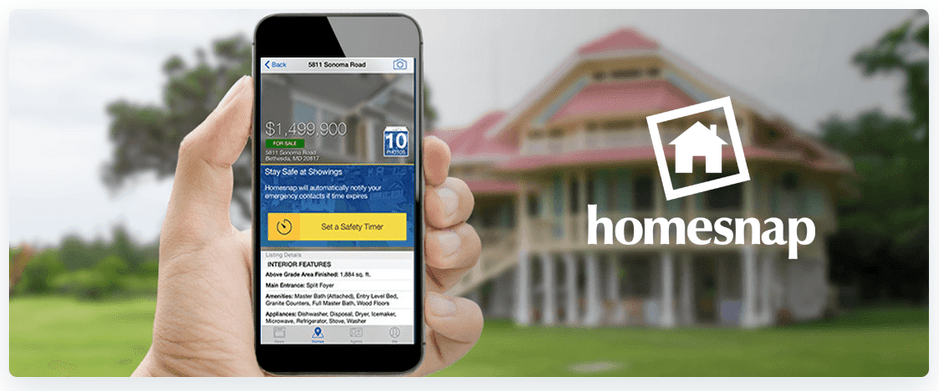

Homesnap – Best Features

Are you ready for me to blow your mind? Homesnap’s app lets you take a picture of a home and instantly see property details. How cool is that?!

Homesnap is the only company that offers this feature — as far as I know — and it’s a total game-changer. It makes it so easy to pull up info that you’ll find yourself doing market research whenever you come across a property for sale in your day-to-day life.

Homesnap is more than just a novelty. The data it pulls is accurate and up-to-date, although mostly geared toward people looking to purchase or rent a primary residence.

Pros | Cons |

|---|---|

Cutting-edge tech makes home research a breeze | The listing database is not as extensive as some of its competition |

Reliable, up-to-date data from MLS | Some users complain that the app is not very user-friendly |

In-app messaging makes communication between buyers and agents easy |

Loopnet – Best for Commercial Real Estate

Not interested in residential home-buying apps? Let’s segue from the best apps for home buying and into commercial real estate for a moment.

Loopnet is a real estate app that’s mainly focused on commercial real estate.

Obviously, Loopnet is not one of the best house-hunting apps if you’re looking to buy a residential property. But it should be at the top of your list if you’re looking to invest in office space, a retail location, or an industrial property.

One of the best parts of using Loopnet is that it has a more extensive suite of tools aimed at investors, like tools for estimating cap rates and cash flow. This is helpful for the experienced real estate investor, but the steep learning curve can intimidate some people.

Pros | Cons |

|---|---|

Best option for commercial properties | Steeper learning curve |

Unmatched tools for real estate investors | Not great for residential properties |

Expansive database of office, retail, and industrial properties |

Top Real Estate Apps for Crowdfunded Real Estate

I know firsthand what a hassle managing an investment property can be.

If you’re not the kind of person who wants to deal with managing a property, don’t worry! There are other ways to invest in real estate that give you plenty of upside with none of the headaches.

One of the best ways to get into real estate is through a crowdfunded real estate app. These apps work sort of like investing in the stock market, allowing you to purchase a small share of a property to receive a piece of the rental income.

Let’s take a quick look at three of my favorite crowdfunded real estate apps.

Arrived Homes | Fundrise | RealtyMogul | |

|---|---|---|---|

Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

Types of investments | Single-Family homes | REITs | Commercial (direct and funds) |

Minimum investment | $100 | $10 | $5,000 |

Fees | 3.5-5% of purchase price, plus 0.125%-0.15% quarterly (0.5%-0.6% per year) | 1.00% total per year (0.15% advisory, 0.85% management) | Varies |

Expected returns | Varies | 5% | 15% |

Arrived Homes

Rating: 5/5

Arrived Homes is a crowdfunded real estate app that gives people with less capital the opportunity to invest in rental properties.

I think the best thing about Arrived Homes is how easy it makes real estate investing for people with less experience. It also has a low minimum investment of $100, which makes it a low-risk way to dip your toe in the rental property pool.

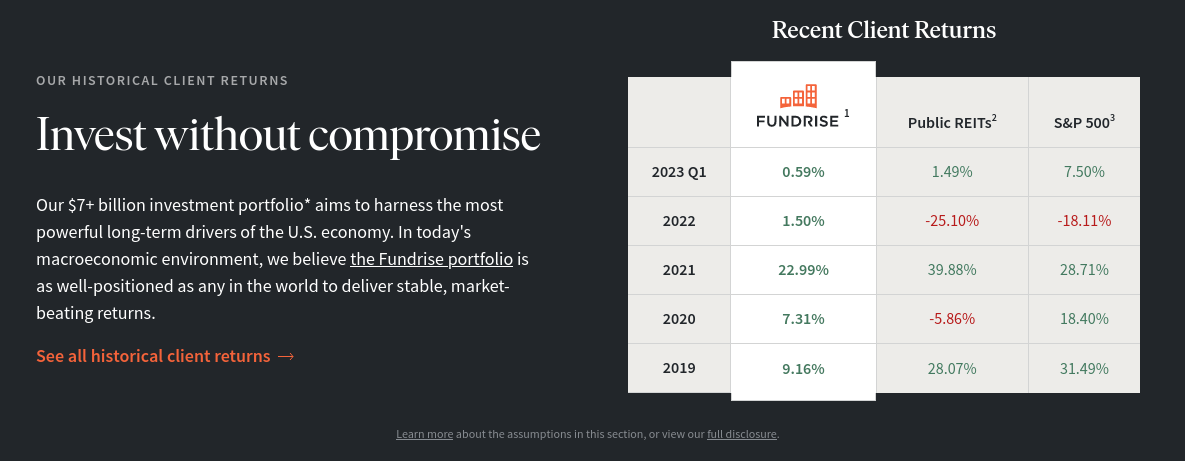

Fundrise

Rating: 5/5

If you like the sound of what Arrived Homes offers but would rather invest in a fund, Fundrise is probably what you’re looking for.

Fundrise specializes in proprietary REITs (real estate investment trusts), which are companies that let individual investors purchase shares of the company in exchange for a small chunk of the REIT’s rental income. If you’re an experienced stock investor, you’ll feel right at home with Fundrise.

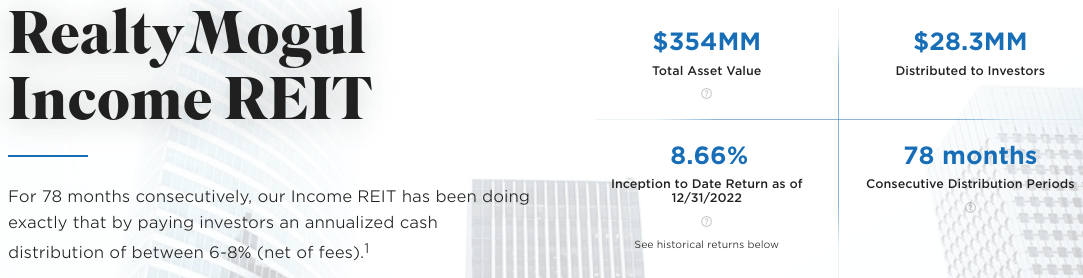

RealtyMogul

Rating: 4/5

RealtyMogul is similar to the previous two companies, but it’s more focused on giving investors access to commercial and private real estate investment opportunities.

The company’s minimums are relatively low — at $5,000 — but not as bargain-basement as Arrived Homes or Fundrise. If you have a bit more cash to throw around, I think RealtyMogul is worth your attention.

RealtyMogul has even more opportunities available to accredited investors. Check out our top accredited investor investment opportunities here.

Final Word on Top Real Estate Apps

There you have it — a complete breakdown of the best apps for home buying.

With so many options out there, it can be difficult it is to find the best real estate apps. Hopefully, this article has given you a better idea of which apps work best for specific use cases:

- If you’re looking for the best app to look for houses, I recommend you start with Zillow. It has the largest database of any online real estate tech company. For commercial properties and more sophisticated analysis tools, I recommend you check out Loopnet.

- Rocket Homes is my go-to app for digging in deep and getting unique figures and stats once you’ve found a property on a site with a larger database of properties.

- If you want to have some fun and demo some of the coolest real estate tech, download the Homesnap app and get instant property details just by taking a picture — seriously, go check it out.

And if it all sounds too hard, check out the great crowdfunded real estate apps I mentioned — Arrived Homes, Fundrise, and RealtyMogul.

FAQs:

Which housing app is most accurate?

Redfin is known for having the most accurate data. It also has real-time updating data, which means you don’t have to worry about wasting time looking at stale, out-of-date information.

Which is the best app to check properties?

Zillow is still the best app to check properties. Zillow is easy to use and convenient, which makes it perfect for quickly popping into an app to get quick info about a property. The robust map feature also makes it super easy to scan an area for properties.

Which website has most accurate home listings?

Redfin and Homesnap have the most accurate home listings because they tap into MLS directly. Zillow and Trulia have notoriously slow updates, which means they often display old, inaccurate data.

How is Homesnap different than Zillow?

The biggest difference between Homesnap and Zillow is that Homesnap offers real-time access to MLS databases. Homesnap also allows in-app messaging between agents and buyers, which makes communication much easier. Homesnap also lets you get property info just by taking a picture in the app, which is as useful as it is impressive.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.