The Bottom Line:

Most financial advisors recommend allocating between 5-10% of your portfolio to crypto, with younger investors potentially going up to 15-20%. The optimal crypto portfolio allocation depends on your age, risk tolerance, and investment timeline — but data shows that even small crypto allocations (5%) can significantly improve risk-adjusted returns when combined with traditional assets.

The best broker for crypto AND stock investing

eToro is our top-rated broker — and happily, it offers both commission-free trading and crypto trading.

Even better, eToro is currently offering a $10 bonus* for U.S. residents who open and fund a new account (as of March 3, 2026).

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. Additional terms and conditions apply.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Intro: Why Does Crypto Portfolio Allocation Matter?

Picture this: You’re staring at your investment portfolio, wondering if you’re missing out on crypto’s potential — or if you’re taking on too much risk.

I get it. The crypto vs stocks debate has been keeping investors up at night since Bitcoin first crossed $1,000. One day you’re reading about someone who made millions on crypto, the next you’re hearing about a market crash that wiped out portfolios overnight.

Here’s what I’m going to do in this article.

- Break down the real data on crypto portfolio allocation

- Show you how crypto performs against traditional assets

- Give you concrete allocation strategies for different risk profiles and age groups.

You’ll also learn about the best platforms to execute these strategies and get answers to the most pressing questions investors have about balancing crypto with stocks and bonds.

Let’s dive into building a portfolio that actually makes sense for your financial goals.

Understanding Crypto vs Stocks: The Fundamental Differences

When comparing crypto vs stocks, you’re essentially looking at two completely different asset classes with unique characteristics. Feel free to skip this part if you already know this stuff.

- Stocks represent ownership in companies with real revenue, employees, and business models. When you buy Apple (NASDAQ: AAPL) or Microsoft (NASDAQ: MSFT), you’re betting on their ability to generate profits and grow their business over time.

- Crypto, on the other hand, is a digital asset whose value is driven by adoption, utility, and market sentiment. Bitcoin’s value comes from its scarcity and growing acceptance as digital gold, while Ethereum derives value from its smart contract capabilities and decentralized finance ecosystem.

Crypto vs Stocks: Which is Better?

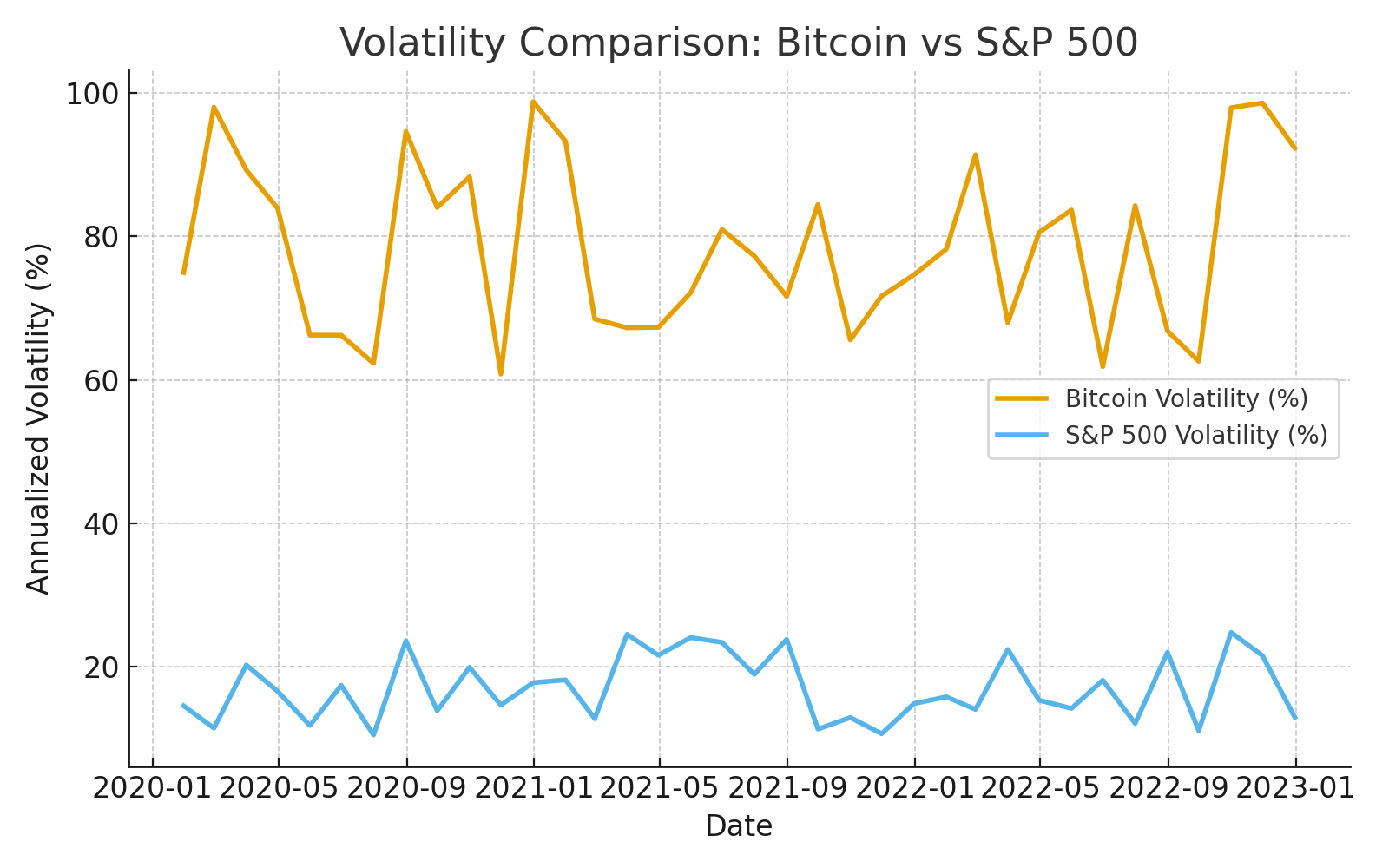

Volatility Comparison

The volatility difference between crypto and stocks is significant. Bitcoin experiences much higher day-to-day price swings compared to the S&P 500, often moving several times more dramatically than traditional stock indices.

However, this volatility cuts both ways. While crypto bear markets can be brutal (Bitcoin fell 77% from its November 2021 peak to November 2022), the upside potential is also significantly higher. The S&P 500 has delivered consistent long-term returns, but crypto has shown the potential for much larger gains over shorter periods.

Market Hours and Accessibility

Stocks vs crypto also differ in terms of market accessibility. Stock markets operate during specific hours (9:30 AM to 4:00 PM ET for US markets), while crypto markets never close. This 24/7 trading can be both an advantage and a disadvantage — you can react to news immediately, but you might also wake up to significant overnight moves.

When considering day trading crypto vs stocks, remember that crypto’s round-the-clock nature requires constant attention, while traditional stock day trading is limited to market hours.

Pro tip: If you’re new to investing in both crypto and stocks, consider starting with a platform like eToro that offers both asset classes in one place, making it easier to manage your overall allocation.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Data-Driven Crypto Portfolio Allocation Strategies

The question isn’t whether to include crypto in your portfolio — it’s how much. Let me break down the allocation strategies that make sense based on real data and different investor profiles.

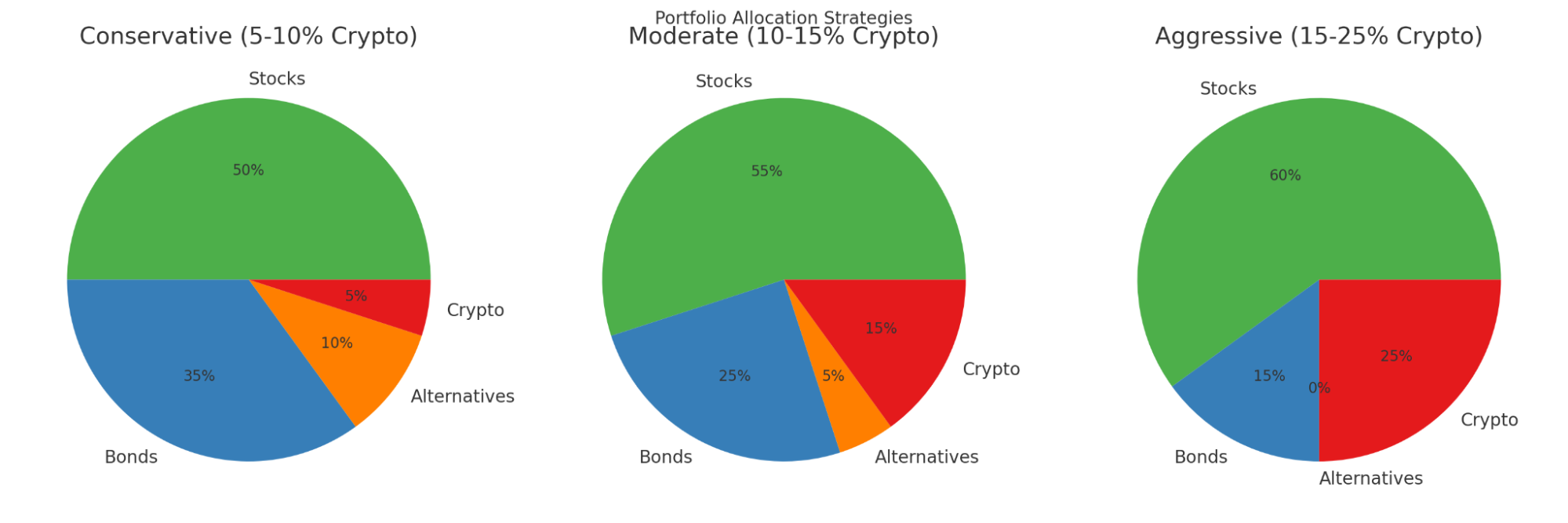

The Conservative Approach: 5-10% Crypto Allocation

For investors prioritizing capital preservation with modest growth potential, a 5-10% crypto allocation has shown to improve risk-adjusted returns without dramatically increasing portfolio volatility.

Research from Bitwise Asset Management analyzing over a decade of Bitcoin data found that adding Bitcoin to a traditional 60/40 stock/bond portfolio contributed positively to returns in 74% of one-year periods, 93% of two-year periods, and 100% of three-year periods since 2014. This creates what analysts call “convexity” — asymmetric upside with limited downside.

Here’s what a conservative crypto portfolio allocation might look like:

- 50% Stocks (mix of domestic and international)

- 35% Bonds and fixed income

- 10% Alternative investments

- 5% Cryptocurrency

Intelligent stock investing in just 10 minutes a month

Need help choosing stocks for the “stock” portion of your portfolio?

With Zen Strategies, you gain access to 11 stock portfolios spanning a variety of investment styles and objectives.

Each portfolio contains backtested proprietary quantitative trading strategies fine-tuned to identify a portfolio of the very best 7 stocks to maximize performance, from aggressive to highly conservative.

Did I mention there’s a money-back guarantee if you’re not happy with the service? Give it a try today…

The Moderate Approach: 10-15% Crypto Allocation

Investors with moderate risk tolerance and longer time horizons can potentially benefit from a 10-15% crypto allocation. This strategy works particularly well for investors in their 30s and 40s who have steady income and at least 10-15 years until retirement.

The moderate crypto asset allocation strategy:

- 55% Stocks

- 25% Bonds

- 5% REITs or commodities

- 15% Cryptocurrency

Within that 15% crypto allocation, I recommend:

- 60% Bitcoin (established store of value)

- 30% Ethereum (smart contract platform)

- 10% Other altcoins (higher risk/reward)

Smart stock picks for moderate portfolios

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

The Aggressive Approach: 15-25% Crypto Allocation

Young investors (under 35) with high risk tolerance and long investment timelines might consider a more aggressive crypto portfolio allocation of 15-25%. This strategy makes sense if you have steady income, minimal debt, and won’t need the money for at least 10 years.

However, even aggressive investors should be strategic. Don’t just throw money at random altcoins. Focus on established cryptocurrencies with strong fundamentals and growing adoption.

Important: Remember that higher crypto allocations require more active management and rebalancing. Consider using dollar-cost averaging to build your position over time rather than investing a lump sum.

Looking for high-reward stocks?

Check out our High risk, High reward stocks screener.

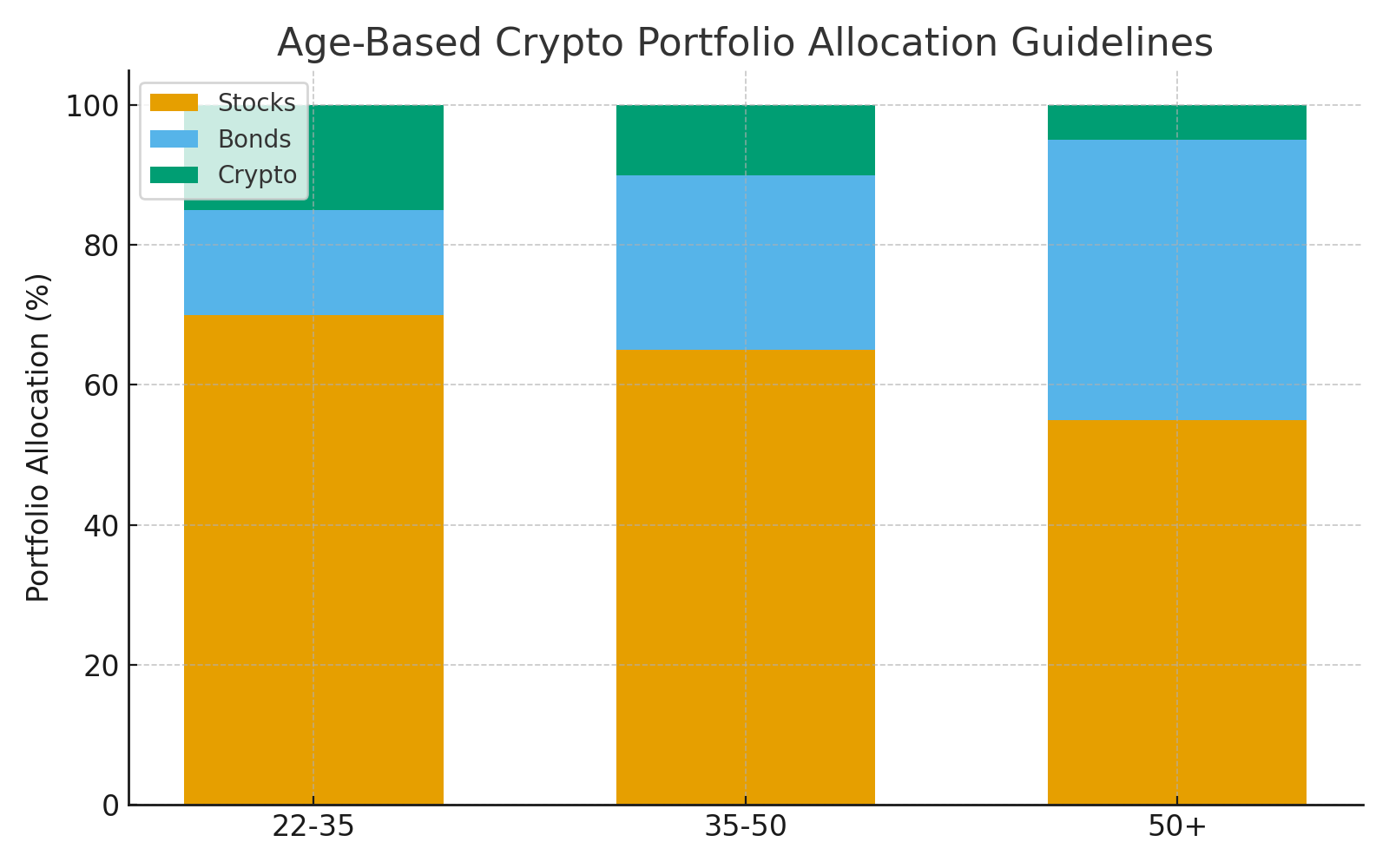

Age-Based Crypto Portfolio Allocation Guidelines

Your age should play a significant role in determining your crypto portfolio allocation. Here’s how different age groups should think about balancing crypto with traditional investments.

Ages 22-35: The Growth Phase

Young investors have the luxury of time, which is crypto’s best friend. The ability to wait out multiple market cycles means you can potentially weather crypto’s volatility and benefit from its long-term growth potential.

Recommended allocation:

- 15-20% cryptocurrency

- 65-70% stocks

- 10-15% bonds and alternatives

At this age, focus on building positions in Bitcoin and Ethereum while experimenting with smaller amounts in promising altcoins. The key is starting early and staying consistent with your investment strategy.

As a side note, if you’re younger/newer to investing, you might be wondering where to buy crypto.

Earlier, I recommended eToro as an all-in-one brokerage where you can buy both stocks and crypto. I stand by that recommendation.

However, if you think you’d like to uplevel your crypto investments or you want more variety of coins to choose from, I recommend using a platform like Coinbase for its user-friendly interface and strong security measures, especially if you’re new to crypto investing.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Ages 35-50: The Accumulation Phase

Mid-career investors should balance growth potential with increasing stability needs. You likely have more income to invest but also more financial obligations like mortgages, children’s education, and growing retirement account needs.

Recommended allocation:

- 10-15% cryptocurrency

- 60-65% stocks

- 20-25% bonds and stable investments

Focus on established cryptocurrencies and avoid speculative plays. This is the time to be methodical about your crypto asset allocation rather than chasing trends.

What about stock trends?

Likewise, you shouldn’t just chase trends with stocks.

If you’re looking to see what stocks are vibing in the market, be sure to check out our free newsletter. With a subscription, you gain access to the latest analyst ratings, a 3x-weekly roundup of “Hot or Not” stocks, plus a weekly list of 5 stocks to watch.

Ages 50+: The Preservation Phase

Older investors should generally limit crypto exposure, though completely avoiding it might mean missing out on portfolio diversification benefits. The focus shifts from growth to capital preservation and income generation.

Recommended allocation:

- 5-10% cryptocurrency

- 50-55% stocks

- 35-40% bonds and income-generating assets

Even conservative investors can benefit from small crypto allocations. Bitcoin’s performance during periods of monetary expansion has made it an interesting hedge against currency debasement.

Platform recommendation: For investors managing both crypto and traditional assets, eToro‘s copy trading feature lets you follow successful investors who balance both asset classes effectively.

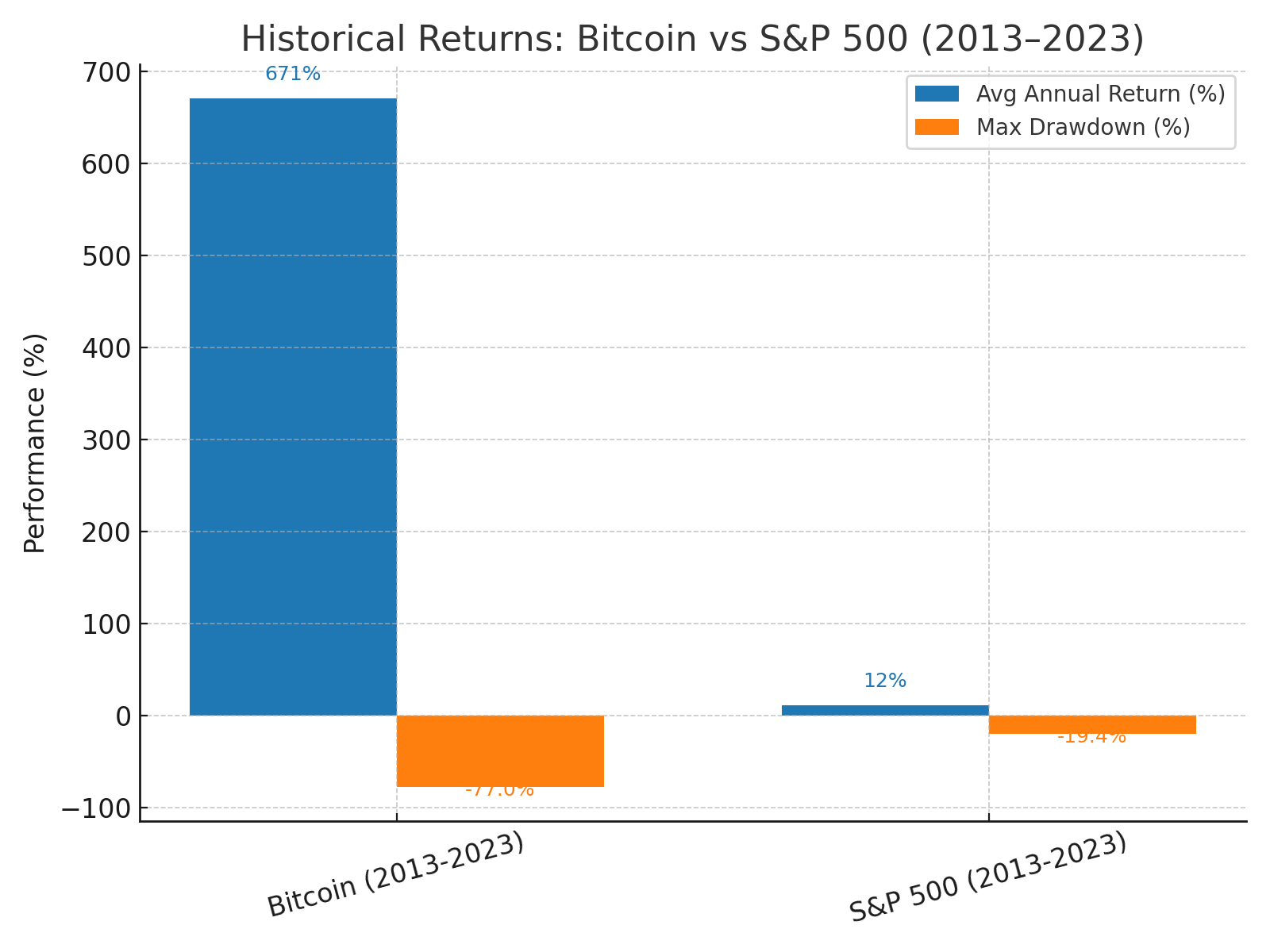

Crypto vs Stocks: Performance Analysis and Risk Assessment

Understanding how crypto performs relative to stocks is crucial for optimal portfolio allocation. Let me break down the key performance metrics and risk factors you need to consider.

Historical Returns Comparison

Over the past decade, crypto has significantly outperformed stocks, but with much higher volatility:

Bitcoin (2013-2023):

- Average annual return: ~671% per year

- Most volatile periods: 2017-2022 cycle with 80%+ drawdowns

- Best year: Over 5,000% (2013)

- Significant bear market: -77% decline (2021-2022)

S&P 500 (same period):

- Average annual return: ~11.5%

- Generally positive with occasional corrections

- 2022 correction: -19.4% (during inflation/rate concerns)

- Consistent long-term growth trajectory

These numbers highlight crypto’s double-edged nature — massive upside potential coupled with severe downside risk.

Risk-Adjusted Returns Analysis

Despite crypto’s higher volatility, its risk-adjusted returns have been competitive with stocks over longer time periods, particularly during Bitcoin’s growth phases. However, investors should note that crypto’s risk profile differs significantly from traditional assets, and past performance doesn’t guarantee future results.

The key takeaway is that crypto’s higher returns have historically compensated for the additional risk, but this relationship may change as the market matures and institutional adoption continues.

- Looking for high volatility stocks to complement your crypto? Check out our Extreme Volatility stock screener.

- Want to balance out the volatility with some stability? Check out our Strong Balance Sheet and Sound Fundamentals screener.

Best Platforms for Executing Your Crypto Portfolio Allocation Strategy

Choosing the right platform is crucial for implementing your crypto portfolio allocation effectively. Here are the best options for different investor types:

For Beginners: User-Friendly Platforms

Coinbase remains the gold standard for crypto beginners. Its intuitive interface, educational resources, and regulatory compliance make it ideal for investors new to cryptocurrency. The platform offers both basic buying/selling and more advanced trading features as you grow more comfortable.

Pros:

- Excellent security track record

- User-friendly mobile app

- Educational content and resources

- Wide selection of cryptocurrencies

Cons:

- Higher fees than some alternatives

- Limited advanced trading features on basic platform

For Active Traders: Advanced Features

Kraken offers more sophisticated trading tools and competitive fees for active crypto traders. If you plan to actively manage your crypto allocation or trade frequently, Kraken’s advanced order types and charting tools provide better execution capabilities.

Key features:

- Competitive trading fees

- Advanced order types

- Margin trading capabilities

- Strong security measures

For Diversified Investors: Multi-Asset Platforms

eToro stands out for investors who want to manage both crypto and traditional assets in one place. This is particularly valuable for implementing the portfolio allocation strategies discussed earlier.

Unique advantages:

- Trade stocks, ETFs, and crypto on one platform

- Copy trading feature to follow successful investors

- Social trading community

- Fractional investing available

The copy trading feature is especially useful for crypto portfolio allocation — you can follow investors who successfully balance crypto with traditional assets and learn from their strategies.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Pro tip: Many successful investors use multiple platforms — a user-friendly option like Coinbase for regular purchases and dollar-cost averaging, plus a more advanced platform for active trading and portfolio rebalancing.

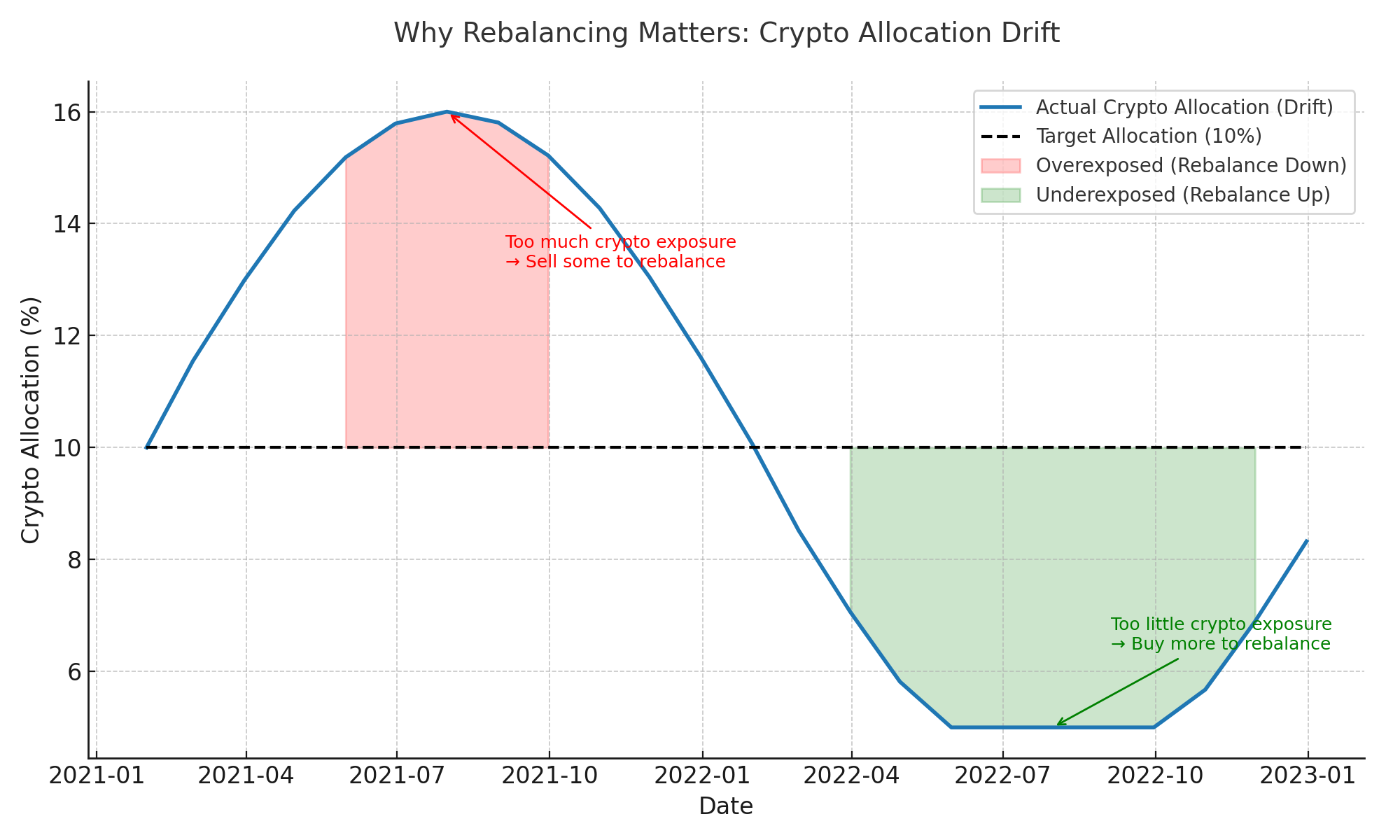

Rebalancing Strategies for Optimal Crypto Portfolio Allocation

Maintaining your target crypto portfolio allocation requires regular rebalancing, especially given crypto’s volatility.

Here’s how to do it effectively:

Time-Based Rebalancing

Review and rebalance your portfolio quarterly or semi-annually. Crypto’s high volatility means your allocation can drift significantly from your targets. If your target is 10% crypto and it grows to 15% due to strong performance, you should consider taking some profits and rebalancing.

Threshold-Based Rebalancing

Set specific percentage thresholds that trigger rebalancing. For example, if your crypto allocation deviates more than 5% from your target, it’s time to rebalance. This method helps you “buy low, sell high” automatically.

Dollar-Cost Averaging for Crypto Accumulation

Rather than trying to time the market, use dollar-cost averaging to build your crypto positions over time. Invest a fixed amount monthly regardless of price movements. This strategy helps smooth out crypto’s volatility and reduces the impact of timing decisions.

Most major platforms offer automatic recurring purchases, making dollar-cost averaging easy to implement and maintain.

Building a Complete Investment Strategy: Beyond Crypto vs Stocks

While crypto allocation is important, it’s just one piece of a complete investment strategy. Here’s how to think about your entire portfolio:

The Role of Traditional Assets

Don’t let crypto excitement make you neglect traditional investments. Stocks still provide the foundation of most successful investment portfolios. Yes, WallStreetZen’s stock research tools can help you identify quality companies for the equity portion of your portfolio.

Core stock allocation should focus on:

- Large-cap growth and value stocks

- International diversification

- Dividend-paying stocks for income

- Sector diversification across technology, healthcare, financials, and consumer goods

Fixed Income and Alternatives

Bonds and other fixed-income investments provide stability and income, especially important as you age. Consider:

- Government and corporate bonds

- Treasury Inflation-Protected Securities (TIPS)

- Real Estate Investment Trusts (REITs)

- Commodities for inflation protection

Unlock 48%+ Returns with 7 AI-sourced stocks

A great portfolio starts with great stock picks. Join Zen Strategies now and be up and running in 10 minutes a month — with a 90-day money-back and performance guarantee. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48.01%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund. Plus, there’s a 50% off launch offer.

Regular Portfolio Review and Adjustment

Your crypto portfolio allocation should evolve as your circumstances change. Major life events, changes in income, market conditions, and proximity to financial goals should all trigger portfolio reviews.

Review triggers include:

- Annual salary increases or decreases

- Marriage, divorce, or having children

- Major market movements (20%+ in either direction)

- Approaching retirement or other major goals

Resource: WallStreetZen’s curated stock strategies can help you build the traditional asset portion of your portfolio while maintaining your optimal crypto allocation.

Common Mistakes in Crypto Portfolio Allocation

Avoid these frequent mistakes that can derail your investment strategy:

Mistake 1: Emotional Allocation Decisions

Don’t let FOMO (fear of missing out) drive your crypto allocation decisions. Stick to your predetermined percentages based on your risk tolerance and financial goals, not the latest crypto news or social media hype.

Mistake 2: Overreliance on Crypto for Diversification

While crypto can provide some portfolio benefits, don’t assume it will always move independently of stocks. Modern crypto markets often correlate with traditional assets during times of market stress, so maintain other diversification sources like bonds and alternatives.

Mistake 3: Neglecting Tax Implications

Crypto rebalancing creates taxable events. Consider holding crypto investments in tax-advantaged accounts when possible, or use tax-loss harvesting strategies to minimize the impact of rebalancing.

Mistake 4: Overcomplicating with Too Many Altcoins

Keep your crypto allocation simple, especially when starting out. Focus on Bitcoin and Ethereum rather than chasing hundreds of altcoins. Complexity doesn’t necessarily improve returns and often increases risk.

Final Word:

The best crypto portfolio allocation isn’t a one-size-fits-all answer — it depends on your age, risk tolerance, and financial goals. However, the data strongly suggests that most investors can benefit from some crypto exposure, typically in the 5-15% range.

Start with a conservative allocation and gradually increase it as you become more comfortable with crypto’s volatility and better understand the market dynamics. Focus on established cryptocurrencies like Bitcoin and Ethereum rather than speculative altcoins, and always maintain proper diversification with traditional assets.

Remember that successful investing is about time in the market, not timing the market. Whether you choose a 5% or 20% crypto allocation, the key is staying consistent with your strategy and rebalancing regularly to maintain your target percentages.

The platforms mentioned in this article — eToro for multi-asset portfolios, Coinbase for beginners, and Kraken for advanced traders — all provide the tools you need to implement these strategies effectively.

Your future self will thank you for taking a measured, strategic approach to crypto portfolio allocation rather than going all-in on either extreme.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs:

Is it better to invest in crypto or stocks?

Both crypto and stocks have their place in a diversified portfolio. Stocks provide stability, dividends, and represent ownership in profitable companies, while crypto offers higher growth potential and portfolio diversification benefits. Most financial advisors recommend a mixed approach, with crypto representing 5-15% of your total portfolio and stocks forming the foundation of your investments.

Is crypto still worth investing in?

Yes, crypto can still be worth investing in as part of a diversified portfolio, despite its volatility. The key is proper allocation based on your risk tolerance and investment timeline. Even a small 5-10% crypto allocation has historically improved portfolio returns without dramatically increasing risk. However, crypto should complement, not replace, traditional investments.

How much is $1000 worth in crypto?

The value of $1000 in crypto changes constantly due to market volatility. Rather than focusing on how much crypto you can buy, consider what percentage of your total portfolio you want allocated to cryptocurrency and invest accordingly.

Is $100 enough to start crypto?

Yes, $100 is enough to start investing in crypto, especially with fractional purchasing available on most platforms. Many successful crypto investors started with small amounts and gradually increased their positions through dollar-cost averaging. The key is starting with an amount you can afford to lose and treating it as a learning experience while you develop your investment strategy.

What percentage of my portfolio should be in cryptocurrency?

Most financial advisors recommend allocating 5-15% of your portfolio to cryptocurrency, with the exact percentage depending on your age, risk tolerance, and investment goals. Younger investors (under 35) might consider 15-20%, while older investors should generally stay in the 5-10% range. Never invest more than you can afford to lose completely.

Should I invest in Bitcoin or Ethereum for portfolio allocation?

For portfolio allocation purposes, Bitcoin and Ethereum serve different roles. Bitcoin acts more like "digital gold" and provides better store-of-value characteristics, while Ethereum offers exposure to the broader decentralized finance ecosystem. A balanced approach might allocate 60% to Bitcoin and 40% to Ethereum within your crypto allocation, though this can vary based on your specific investment thesis.

How often should I rebalance my crypto portfolio allocation?

Rebalance your crypto portfolio allocation quarterly or when your crypto percentage deviates more than 5% from your target allocation. Given crypto's high volatility, regular rebalancing helps you maintain proper risk levels and forces you to "sell high and buy low" automatically. Some investors prefer monthly rebalancing for more active management.

What are the best crypto portfolio allocation strategies for beginners?

Beginners should start with a conservative 5-10% crypto allocation within a diversified portfolio. Focus on established cryptocurrencies like Bitcoin (60%) and Ethereum (40%) rather than speculative altcoins. Use dollar-cost averaging to build positions gradually, and choose user-friendly platforms like Coinbase to get started. Always invest only what you can afford to lose and educate yourself continuously about both crypto and traditional investing.

How does crypto portfolio allocation change during bear markets?

During crypto bear markets, resist the urge to panic sell or abandon your allocation strategy. Bear markets often present excellent buying opportunities for long-term investors. Consider whether your original allocation still makes sense for your risk tolerance and timeline. If it does, maintain your target allocation through rebalancing, which naturally forces you to buy more crypto when prices are lower.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.