Autopilot Review Findings: Is It Worth It?

The Autopilot app is really only worth it if you’ve got serious cash to play with.

Autopilot works well for what it promises: Automated copy trading that functions well. The platform serves over 100,000 users who’ve executed $2 billion in trades since 2023. That 4.6-star App Store rating isn’t fake either; people genuinely like the experience.

But here’s the kicker: at $100 yearly per portfolio with $500 minimums, you need at least $2,000 to make the math work. And that’s on the low end. For example, if you opted to follow 3 portfolios, you’d be looking at over $1800 per year.

To put that in perspective, a service like Zen Strategies lets you follow 11 portfolios with 7 stocks each for a fraction of the price, making it easy to dip into different strategies or diversify without breaking the bank.

You should try Autopilot if:

- You’ve got $2,000+ sitting around

- Copy trading interests you

- You don’t mind paying premium prices for convenience

- You’re fascinated by politician stock picks

Skip it if:

- You’re penny-pinching on fees

- You prefer controlling your own trades

- Your investment budget is under $2,000

- You’re happy investing in index funds and mutual funds

High-Quality Portfolios Without Hype

Following one prominent investor can be like putting all your eggs in one basket. If you prefer a more diversified approach, consider Zen Strategies.

With one subscription, you can follow 11 different backtested, proprietary quantitative trading strategies — pick and choose from aggressive, highly conservative, and many different strategies in between.

Each one has been fine-tuned to identify portfolios of the very best 7 stocks per strategy (so that’s 77 stocks total) to maximize performance.

Why Is Autopilot So Popular?

The rise of copy trading has revolutionized how everyday investors approach the stock market. Instead of spending hours researching stocks, you can now literally copy the portfolios of successful investors, politicians, and hedge fund managers with just a few taps on your phone. The Autopilot investment app even automates it for you.

Autopilot represents a different approach to investing. Instead of picking stocks yourself or trusting a robo-advisor’s algorithms, you mirror the portfolios of politicians, hedge fund managers, and other proven investors. Every trade they make, you make automatically and proportionally.

But here’s what nobody tells you upfront: the fees can eat you alive if you’re not careful, and those headline-grabbing returns? They aren’t guaranteed.

As someone who’s analyzed countless investing platforms, I’m going to give you the complete breakdown of this Autopilot app review. You’ll learn exactly how it works, what it costs, who’s using it successfully, and most importantly, whether it’s the right fit for your investment goals.

By the end of this article, you’ll know whether Autopilot’s automated investing approach can help you build wealth or if you’re better off with alternatives.

So, let’s dive deeper.

What is the Autopilot App + How Does It Work?

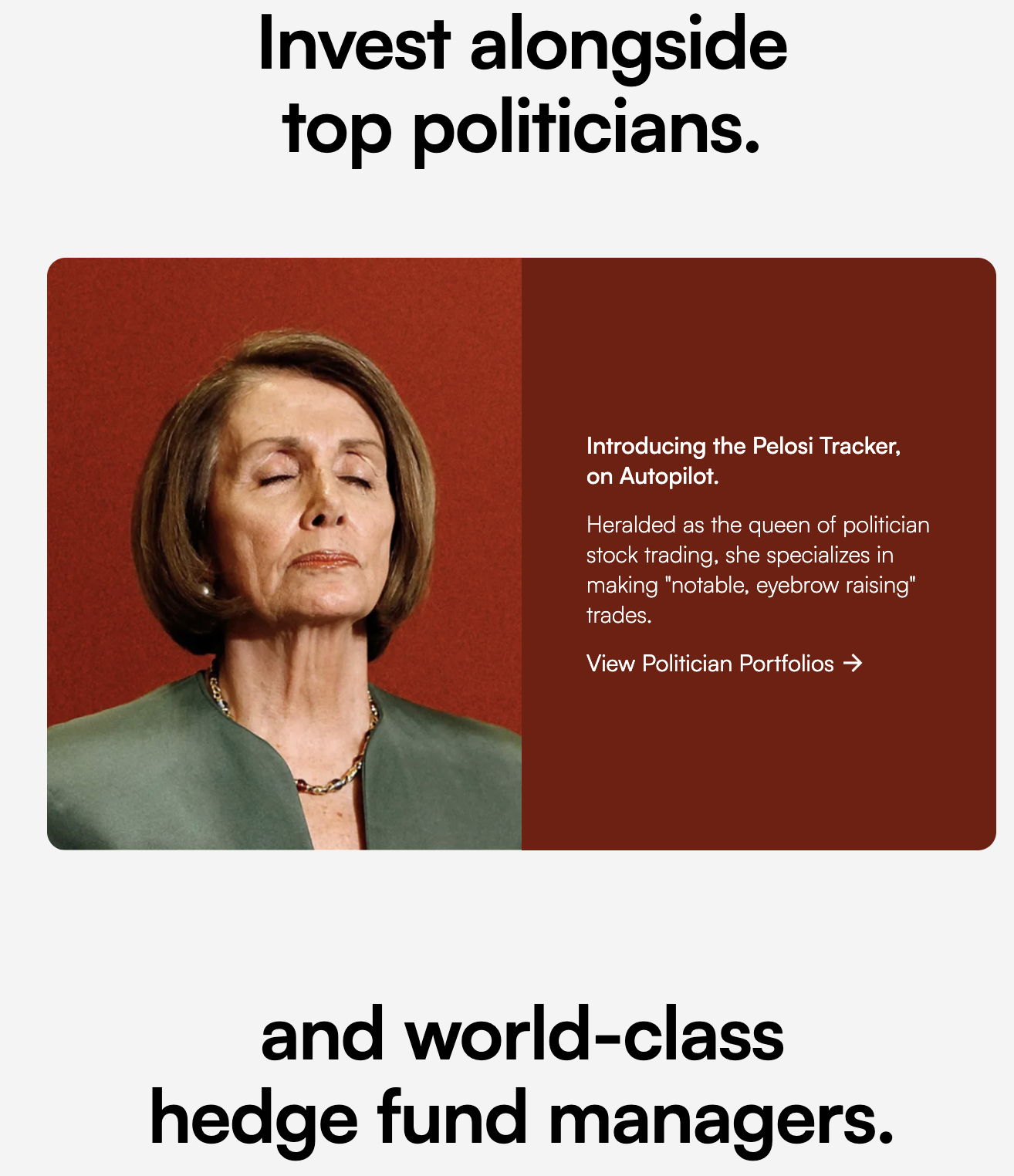

Autopilot lets you copy successful investor portfolios in real-time. Think Instagram for stock trades, except instead of liking photos, you’re automatically buying the same stocks as Nancy Pelosi or top hedge fund managers.

The company launched in 2023 from Irvine, California, built by the same crew behind those viral Pelosi Tracker social media accounts. They basically turned internet memes about politicians trading into a legitimate business.

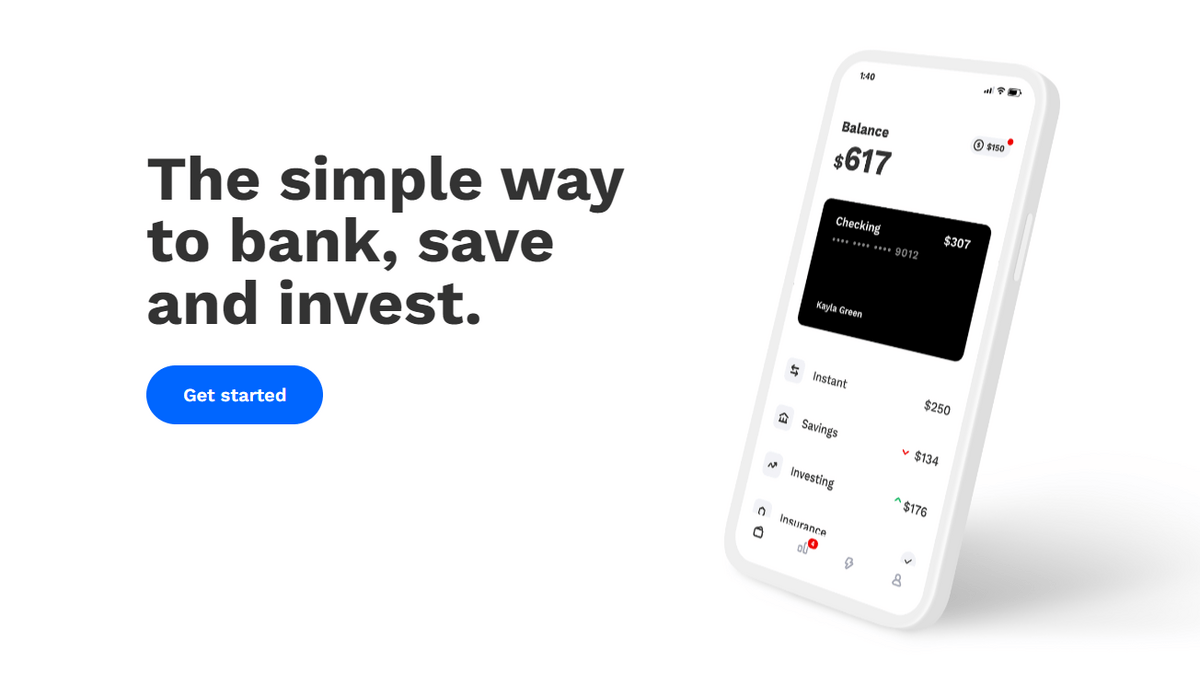

Here’s the clever part: Autopilot never touches your money. Instead, it connects to your existing brokerage (Robinhood, TD Ameritrade, etc.) and places trades based on your chosen “pilot’s” moves.

The numbers are impressive for such a young platform. Over 100,000 investors have connected $6 billion in assets, making it one of the fastest-growing fintech apps. Currently sits at #127 in the App Store’s Finance category.

This Autopilot stock app review targets three main groups: busy professionals who don’t have time for stock research, beginners wanting to learn from successful traders, and hands-off investors who prefer automation over active management.

eToro offers a CopyTrader feature — and unlike Autopilot, there’s no added fee to use it.

Getting Started on Autopilot

Setting up Autopilot is straightforward and only takes about 10 minutes. I tested the whole process myself and here’s how it works:

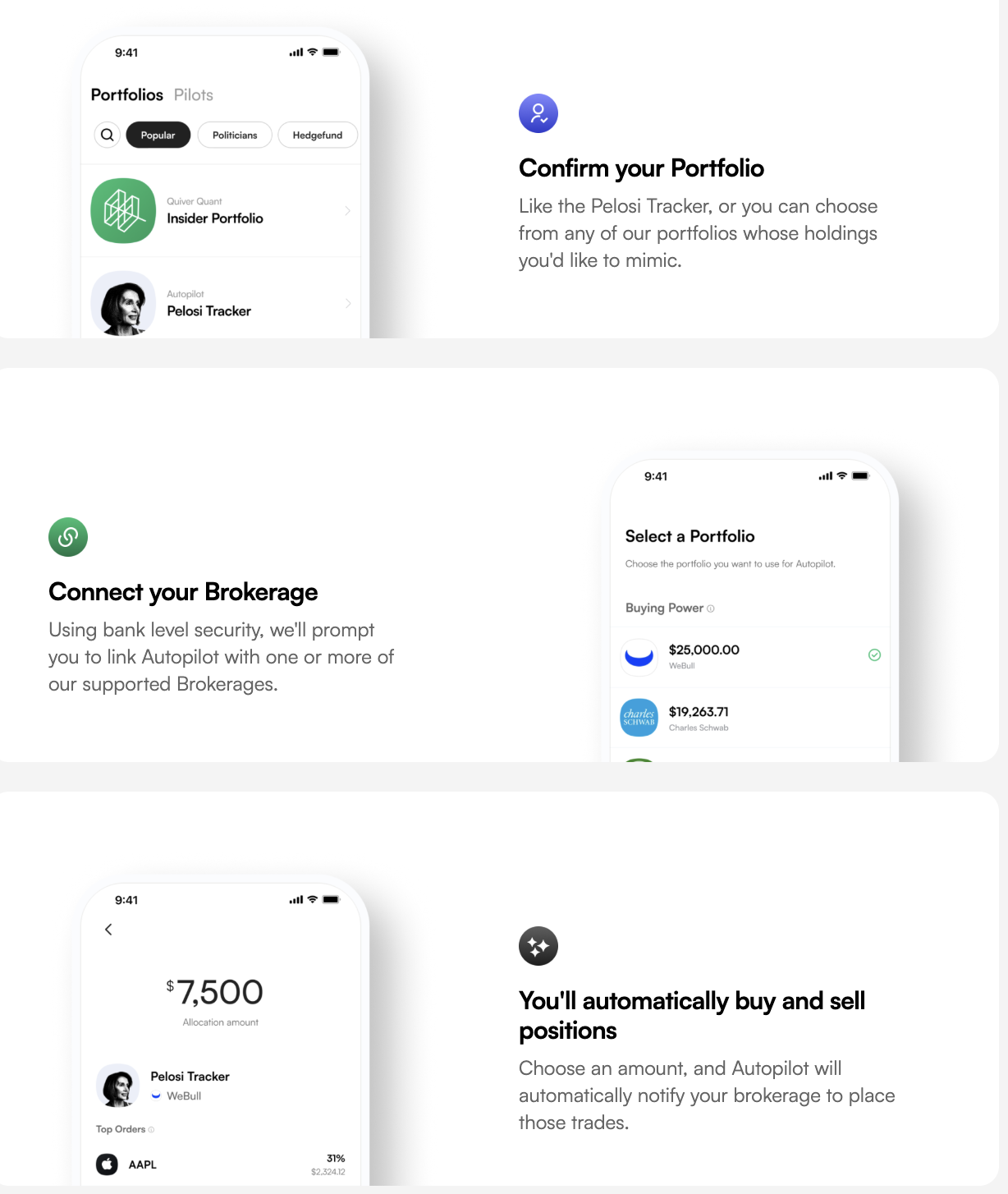

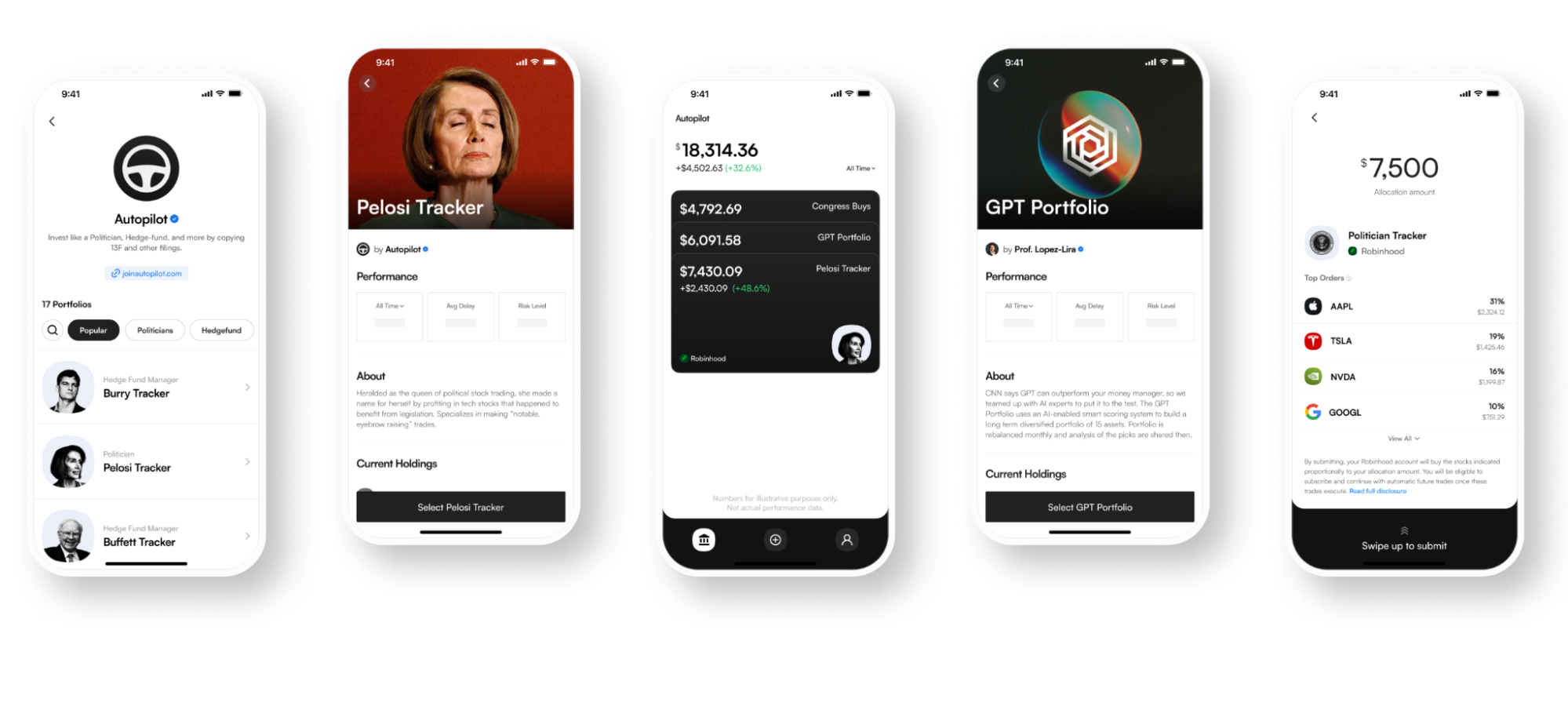

Step 1: Pick Your Pilot: You’ll see options like Pelosi Tracker, GPT Portfolio (AI-driven), and various hedge fund strategies. Each option shows historical performance and current holdings. No mystery boxes here.

Step 2: Link Your Brokerage: Autopilot uses Plaid (same tech as Venmo) to securely connect your brokerage account. Your money stays put, and Autopilot only gets permission to send trade alerts.

Step 3: Set Your Investment Amount: Choose how much to allocate ($500 minimum per portfolio). When your pilot makes a move, Autopilot calculates the proportional amount and automatically places your trade.

Real example: Nancy Pelosi buys $50,000 worth of Apple stock. You’ve allocated $1,000 to follow her. Autopilot automatically buys roughly $50 worth of Apple in your account.

The automation happens fast, usually within minutes of the original trade. This Autopilot investment review found the platform also handles automatic rebalancing and lets you customize risk levels.

Core Features

Automated Portfolios: Copy Politicians & Top Traders

The star attraction remains politician tracking, especially the Nancy Pelosi Stock Tracker. Congress members have historically beaten the market, and Autopilot makes copying their disclosed trades dead simple.

Unlike mutual funds, where you might wait months to see holdings, Autopilot shows exactly what’s in each portfolio and when trades happen. The transparency impressed me, no black box algorithms or hidden positions.

Beyond Nancy Pelosi stocks, you can follow other politicians and hedge fund managers. Some trader identities stay private, but performance data remains public. The real-time aspect separates this from quarterly filings you’d get elsewhere.

Portfolio Variety & Strategy Access

Autopilot offers more than just politician tracking. The GPT Portfolio uses AI to analyze market trends and pick stocks, though they don’t reveal the exact methodology. From what I observed, it tends toward tech stocks and growth companies.

The Insider Portfolio tracks corporate insider trades such as executives and directors buying their own company stock. The logic makes sense: insiders know their companies better than anyone.

Risk-based portfolios let you choose conservative (dividend stocks), moderate, or aggressive (small-cap growth) strategies. Each comes with detailed performance metrics and sector breakdowns.

This would be a good time to remind you that each portfolio is $100/year to track and requires a $500 minimum — so diversifying with Autopilot can add up. You really have to commit to a few select strategies to keep costs down.

On the flip side, a service like WallStreetZen’s Zen Strategies gives you access to 11 portfolios concurrently — so you can access picks across a variety of styles.

One of the most popular portfolios so far is the AI Factor strategy, which includes stocks vetted by the AI factor of its quant ratings system, Zen Ratings, which evaluates each stock across a variety of different factors.

The stocks in this portfolio excel within the AI factor, meaning their proprietary learning model has sifted through mountains of data and determined that these are the stocks with the highest potential for outsized gains.

Does it work? As you can see, the all-time average annual return is 48.01% — pretty impressive.

Automated Trade Execution

This is where Autopilot shines. The app monitors portfolios 24/7 and executes proportional trades through your connected brokerage. The math works smoothly if you’re following a $1 million portfolio with $1,000 allocated; every trade scales down perfectly.

You get push notifications for executed trades, usually with explanations when available. Since trades happen through your brokerage, you benefit from whatever commission structure they offer (most are commission-free now).

Automated trade execution isn’t for everyone — if you prefer a more old-school “alert me and I’ll do it myself” approach, an alert service like Stock Market Guides might be more your style.

Brokerage Integration & Security

Security matters when giving trading permissions to apps. Autopilot uses Plaid connections, the same tech that powers banks and brokerage platforms. The setup ensures Autopilot never touches your money; they just send trade notifications.

Your brokerage account stays under your control. You can log in anytime, override trades manually, or disconnect Autopilot entirely. Works with major brokerages: Robinhood, TD Ameritrade, E*TRADE, Fidelity, and Schwab.

Portfolio Rebalancing & Risk Profiles

Automatic rebalancing sets Autopilot apart from basic copy trading. Markets move constantly, so portfolio allocations drift from targets. If you’re supposed to hold 20% Apple but it runs up to 25%, Autopilot automatically sells shares to restore the target allocation.

You can customize how closely you follow each pilot. For instance, you can skip risky small positions or mirror every single trade.

Real-Time Notifications

The notification system keeps you informed without going overboard. You’ll get alerts for new trades, rebalancing activities, performance updates, and relevant market news. Customize frequency from real-time to weekly summaries.

If this is the most appealing aspect of the service to you, you might not need to commit to Autopilot — once again, n alert service like Stock Market Guides fits the bill and for a lot less money. See more in our Stock Market Guides review.

Educational Support

While primarily an execution platform, Autopilot provides market analysis and trade explanations. The educational content isn’t comprehensive like dedicated learning platforms, but it helps you understand why specific trades happened.

This proves especially valuable for beginners who want to learn while their money gets managed automatically.

Pricing and Fees

Here’s where things get expensive:

- Free Version: One initial investment with no additional trades or rebalancing.

- Paid Version: $29 quarterly or $100 annually per portfolio.

- The Gotcha: Each portfolio requires separate fees. Want Pelosi Tracker plus GPT Portfolio? That’s $200 per year.

- Minimum Investment: $500 per portfolio.

Do the math: someone with $5,000 spread across multiple portfolios could pay 6% in fees during year one. The sweet spot targets investors with $5,000+ following one or two portfolios maximum.

Credit where it’s due. Autopilot stays transparent about pricing: “No hidden costs, it’s a flat subscription fee.”

eToro offers a CopyTrader feature — and there’s no additional fee to use it.

CopyTrader focuses on mirroring trades, with plenty of social interaction. Thanks to a longer track record in copy trading and a relatively simple entry to the platform, it’s an excellent way to explore copy trading before you shell out the big bucks.

Autopilot App Reviews: What Are Real Users Saying?

With 4.6 stars from 10,500+ App Store ratings, Autopilot generally gets positive feedback. It ranks #127 in Finance, beating many established competitors.

What Users Love: People praise the educational value and stress-free investing. One detailed review said: “This app makes info digestible and informative. I’m making educated decisions instead of emotional ones.” Many appreciate avoiding panic selling and FOMO buying.

Common Autopilot app review complaints: Several issues pop up repeatedly:

- Sneaky pricing: Subscription fees aren’t prominently displayed upfront

- Surprise minimums: Users discover the $500 requirement when trying to invest

- Technical glitches: Connectivity problems with brokerages through Plaid

- Support struggles: Hard to reach customer service without sharing extensive account data

Performance Reality Check: Users note their returns don’t precisely match the returns of the investors they’re copying. Timing differences and disclosure delays affect results, especially with politician trades.

Despite complaints, overall sentiment stays positive. Most negative Autopilot app reviews focus on pricing rather than core functionality.

Autopilot Vs. the Competition

There are several programs out there that offer alternatives. I’ll detail several below.

Platform | Automation Level | Fees | Unique Features | Best For |

|---|---|---|---|---|

Autopilot | Full copy trading | $100/year per portfolio | Politician tracking | Copy trading enthusiasts |

Social copy trading | Spreads + fees | Social features, crypto | International trading | |

Stock alerts | Tax-loss harvesting | Retirement planning | ||

Automated picks (you execute and rebalance) | $997/year | Stock portfolios vetted by a proprietary market-beating ratings system | DIY investors looking for curated picks |

Key Differences:

eToro’s CopyTrader

eToro‘s CopyTrader allows you to follow the trades of fellow investors. To the best of my knowledge, there is no Pelosi tracker on eToro at this time. However, if what appeals to you most about Autopilot is the ability to follow and mirror trades, this might be a good (and potentially lower-cost) starting point.

Stock Market Guides

If you’re less committed to following specific investors and more interested in solid stock picks with regular frequency (several per week), Stock Market Guides is what you’re looking for.

Stock Market Guides is a comprehensive stock screening and alert service. No, they don’t have flashy investors to follow, but their picks are solid — their swing trading stock picks ($49/month) have enjoyed a 79.4% average annualized return in backtests.

Zen Strategies

WallStreetZen’s Zen Strategies offers curated portfolios of stocks, updated daily. With your subscription, you gain access to 11 different portfolios, ranging from Buy the Dip to Momentum to Value to higher risk/higher reward strategies like Stocks to Short.

All of the stocks are selected using WallStreetZen’s 115-factor Zen Ratings system — stocks rated Strong Buy using this system have historically delivered 32.52% annual gains.

The portfolios themselves have an excellent track record, too — below, you’ll see the all-time annual returns of the AI factor portfolio, which features stocks chosen with the assistance of a proprietary AI algorithm.

Autopilot’s unique advantage is transparent, real-time copying of specific identifiable investors, particularly politicians.

Pros and Cons

Pros | Cons |

Easy access to successful investor portfolios | Expensive for small portfolios (can be 10%+ annually) |

Fully automated trading with no money transfer required | Per-portfolio fee structure adds up quickly |

Educational value for beginners | $500 minimum per portfolio |

Transparent performance tracking | Returns may not match exactly due to timing |

Bank-level security through Plaid | Limited free version |

Unique politician tracking feature | Customer support accessibility concerns |

Who Is Autopilot Best For?

Ideal Candidates:

- Busy professionals with $2,000+ to invest

- Copy trading enthusiasts who value automation

- Beginner investors wanting to learn from successful traders

- Fans of political trade tracking

- Tech-savvy hands-off investors

- Those seeking alternative strategies beyond index funds

Not Ideal For:

- Cost-conscious investors (traditional robo-advisors are cheaper)

- Active traders who prefer control

- Investors with small portfolios (under $2,000)

- DIY investors who enjoy research

- Risk-averse conservative investors

- Those wanting broad international diversification

Conclusion: Should You Try Autopilot?

Autopilot is a well-executed platform that delivers on its promise of automated copy trading, but it’s not for everyone.

The platform excels when you have: sufficient capital ($2,000+), genuine interest in copy trading, and willingness to pay premium fees for convenience and access to unique strategies like politician tracking.

However, the economics don’t work for smaller investors or those seeking broad diversification across multiple strategies due to the per-portfolio fee structure.

My recommendation: Consider Autopilot if you have at least $2,000, you’re specifically interested in copy trading, and you understand you’re paying a premium for convenience. Start with one portfolio (probably Pelosi Tracker) to test the platform.

If cost is a primary concern, consider eToro’s CopyTrader, or look into one of the other services mentioned above — Stock Market Guides for stock picks, or Zen Strategies for curated portfolios.

The bottom line: Autopilot is a premium service with premium features at premium prices. For the right investor with sufficient capital and realistic expectations, it can be valuable. For everyone else, more cost-effective alternatives exist.

FAQs:

How much does the Autopilot investment app cost?

Autopilot costs $29 per quarter or $100 per year per portfolio, with a $500 minimum investment per portfolio. Following multiple portfolios requires separate fees for each.

What does the Autopilot investment app do for you?

Autopilot automates portfolio copying from successful investors and politicians. It connects to your brokerage account and automatically executes proportional trades when your chosen "pilot" makes moves.

Is Autopilot safe to connect to my brokerage?

Yes, Autopilot uses bank-level security through Plaid and is SEC-registered. Your funds stay in your brokerage account and Autopilot only sends trade notifications.

What is better than the Autopilot app?

M1 Finance offers free automated investing, Betterment provides robo-advising for 0.25% annually, and eToro offers social copy trading. The best alternative depends on your specific needs and budget.

Can you make money with the Autopilot app?

Potentially, but there are no guarantees. Returns depend on your chosen pilots' performance, and past results don't predict future outcomes. Your actual returns may differ from pilots due to timing and scaling differences.

What is the most popular portfolio on Autopilot?

Autopilot's most popular portfolio is The Pelosi Tracker, which follows Nancy Pelosi's disclosed stock trades. It was built by the team behind the viral Pelosi Tracker social media account.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.