Tala is not publicly traded, but accredited investors can still buy its stock.

Hiive is a marketplace where accredited investors can buy shares of private companies before they go public.

Sign up with Hiive and get access to Tala stock before its IPO.

Fintech company Tala has a bold mission — to make affordable lending easy and accessible to “traditionally underbanked” people around the world.

Since its founding in 2011, the company has blossomed into a well-reviewed worldwide lender with millions of customers, investors like PayPal, and partnerships with companies like Visa.

If you’re an investor, you might be wondering how to buy Tala stock and benefit from this company’s unique vision and growth.

While the company’s still private, there are ways that retail and accredited investors may be able to gain access to the company and sector. Read and learn…

Tala: The Basics

Tala is a digital financial services company that aims to help people who might otherwise not have access to lending. Their user-friendly app makes underwriting easier for those who have little or no credit history.

Here are a few things to know about Tala:

- Tala provides loans to people in underserved areas including but not limited to India, Kenya, Mexico, and the Philippines.

- Loans are fairly small — $10 to $500 — and can be approved in as little as 10 minutes, with rates that can be as low as 4%.

- Reviews are good — Tala has 4.5+ out of 5 stars on Google Play, and over 1 million 5-star reviews.

- At writing, Tala has dispersed over $3.4 billion to over seven million customers.

- In 2021, Tala was valued at $800 million.

Interesting, right? Now, let’s talk about how accredited investors can look for similar opportunities on Hiive and other avenues for retail investors to explore…

Can You Buy Tala Stock? Is Tala Publicly Traded?

Short answer: No, not directly.

Tala is a private company — there’s no Tala stock price chart. There’s no Tala stock symbol.

At this time, there’s no serious talk of an IPO, so there’s unlikely to be a Tala stock in the immediate future.

However, there are other ways that both accredited and retail investors can gain exposure. Keep reading…

How to Buy Tala as an Accredited Investor

Hiive is an investment platform that connects shareholders of private, VC-backed companies with accredited buyers. There are over 2,000 pre-IPO companies available on Hiive, including Databricks, Epic Games, and Tala:

At writing there is just one listing; each listing is created by sellers who set their own asking prices and quantity of shares offered. Sellers are typically current or former employees, but could also be angel investors or venture capital firms.

Buyers can place bids and negotiate directly with the sellers, or accept an asking price as listed.

Register for Hiive and see the complete order book for Tala (including all asking prices, bids, and most recent transactions).

How to Buy Tala as a Retail Investor

Right now, it’s not possible to log on to your favorite trading platform and buy shares of Tala stock. However, that doesn’t mean the company is completely inaccessible. We’ll get to alternatives to how to buy Tala stock in a minute. But first…

Who Owns Tala?

Tala was founded by Shivani Siroya, who acts as the company’s chief executive officer. The company also has a number of investors, including but not limited to Lowercase Capital and PayPal (NASDAQ: PYPL).

Does PayPal Own Tala?

PayPal does not own Tala. However, it is connected to the company.

PayPal (NASDAQ: PYPL) made its first strategic investment in Tala in 2018. The amount was not disclosed; funds were said to be used to improve the company’s technology and reach.

How to Invest in Tala Stock as a Retail Investor

Retail investors cannot buy shares of Tala stock. However, they can seek out like-minded and adjacent opportunities. Here are some potential starting points:

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Consumer Finance Stocks

While Tala’s business model is unique, there are plenty of other companies in the consumer finance space that could benefit from the same economic factors that lead to further growth for Tala, including:

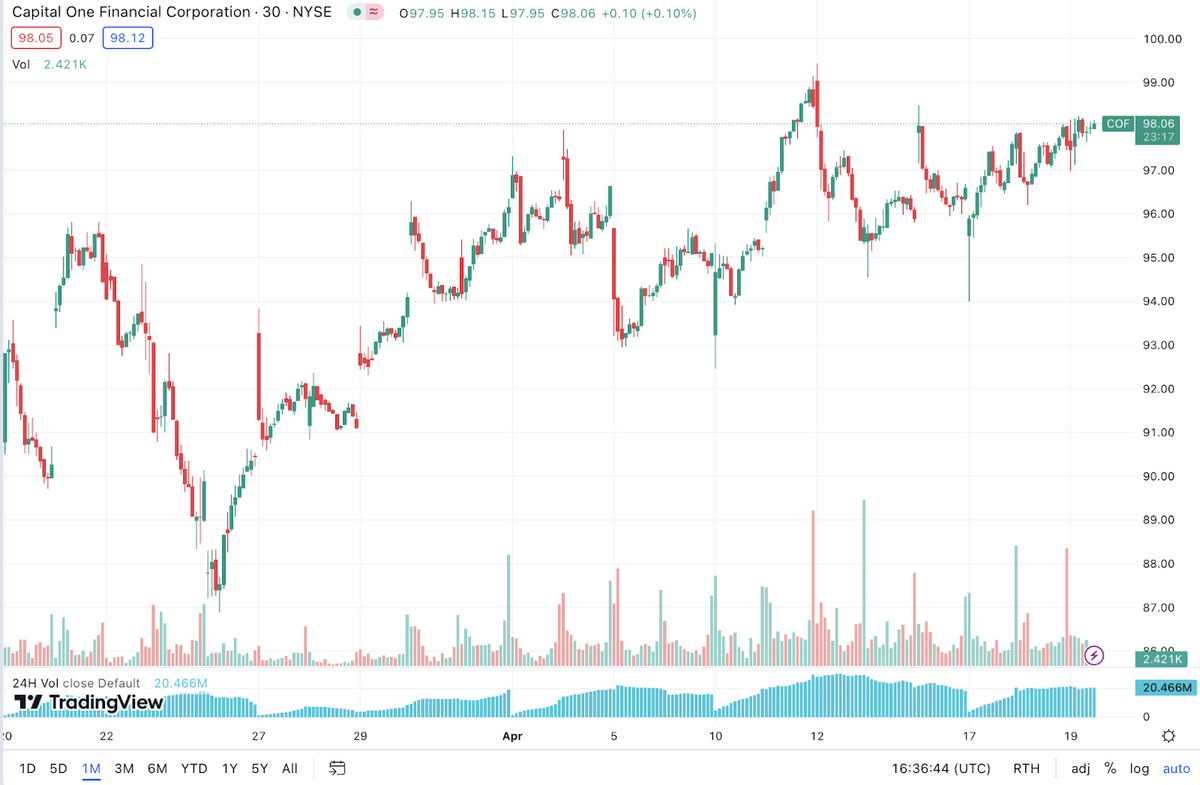

- Capital One (NYSE: COF) — 1-month chart below

- Rocket Companies (NYSE: RKT)

- SoFi (NASDAQ: SOFI)

Tala Investors

The majority of Tala’s investors are private. However, at least one notable investor is a public company:

- PayPal (NASDAQ: PYPL)

Tala Partners

Notably, Tala partnered up with Visa (NYSE: V) in 2021 to develop a crypto solution. Keep an eye out for press releases announcing future partnerships with public companies, as they could provide exposure to Tala.

How to Buy the Tala IPO

Here are the steps on how to buy Tala stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Tala

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Tala Stock Price Chart

No matter how hard you Google, you won’t find a Tala stock price chart since the company’s not public.

If you are an accredited investor and want to check out the company on Hiive, here is the current aggregate price chart:

If you’re a retail investor, let’s take a look at some compelling visuals to help you suss out the company. For example, in the below chart, you can see some exciting projections for the global consumer finance market:

And in this chart, you can see projections for a surge in smartphone usage in emerging markets, which could increase Tala’s customer base:

It’s not easy to do something new and exciting in the world of consumer finance — but Tala has done and continues to do just that. The company could provide exciting opportunities for investors.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy Tala stock?

Tala is a private company. As a retail investor, you cannot buy stock shares. However, private companies do occasionally become available to accredited investors on sites like Hiive.

How much is Tala stock?

There is no Tala stock price on the public markets. Since the company is private, stock shares are not available to the public at this time. However, accredited investors can can gain access to private market share prices via Hiive.

What is Tala stock symbol?

There is no Tala stock symbol at this time. The company is private, and is not listed on the stock exchange.

Who owns Tala stock?

Stakeholders in Tala include Shivani Siroya, who acts as the company’s chief executive officer, as well as the company’s investors, including but not limited to Lowercase Capital and PayPal (NASDAQ: PYPL).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.