Looking for an investment advisor to guide your portfolio? There are plenty of reasons why Fisher Investments might be on your list. But is it right for you?

The firm is famous for its hands-on, customized investment approach. But world-class service comes at a cost. In this review of Fisher investments, you’ll learn whether or not it’s worth the fees.

We’ll explore the firm’s pros and cons, investment philosophy, and exactly what kinds of fees are assessed. By the time you’re finished reading this Fisher Investments review, you’ll know whether or not it’s a good fit for you and your money.

And if it’s not, I’ll share some high-quality alternatives that could save you money. Let’s go…

Looking for a lower-cost alternative?

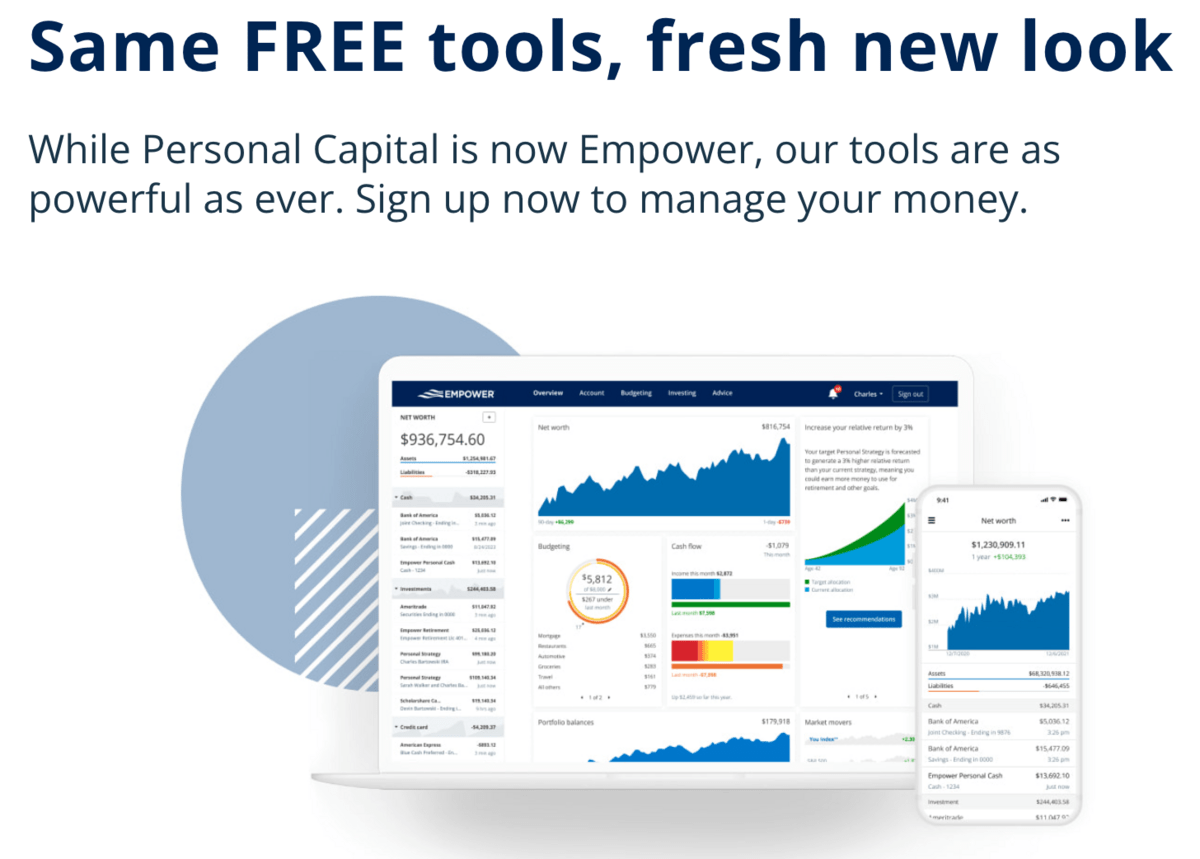

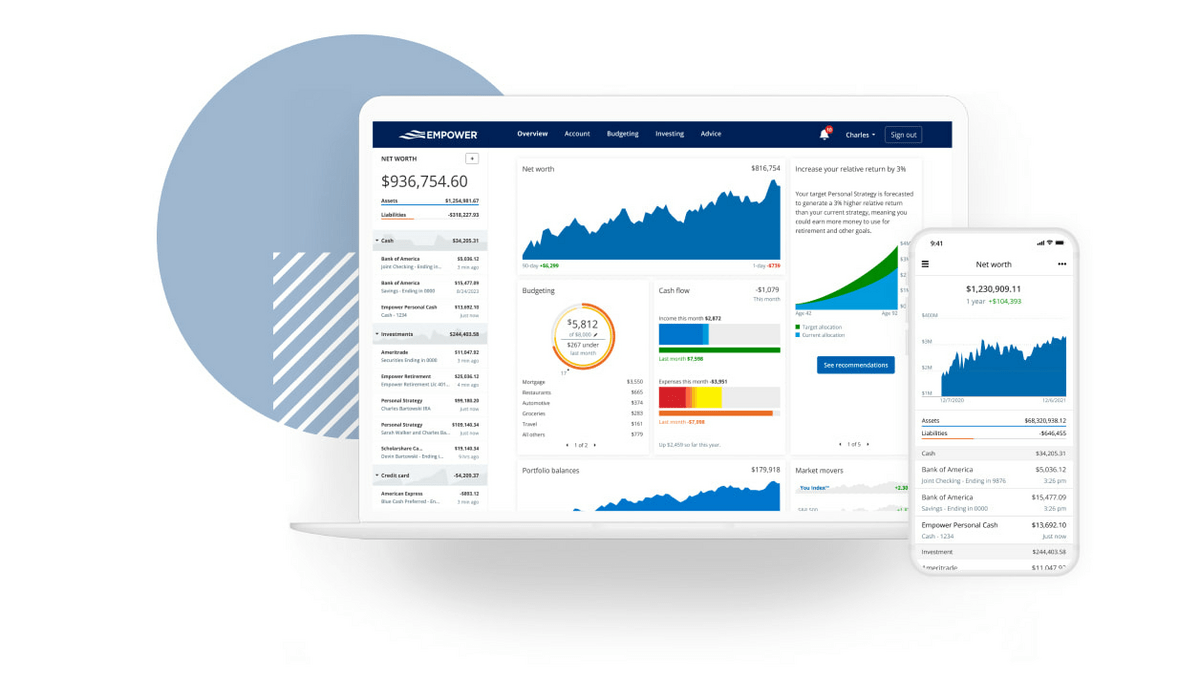

Empower (formerly Personal Capital) offers wealth management services at significantly lower fees than Fisher Investments. Here’s why Empower might be a better option for some investors:

- Where Fisher Investments’ target customer has a portfolio of $500K+, Empower offers financial services starting at $100K and up.

- Fees start at 0.89% for up to the first million dollars invested, but go down to as low as 0.49% depending on account size. That’s significantly less than Fisher Investments’ 1.25% fee. Say your account is $1 million. With Empower, you could save as much as $36,000 over ten years in fees alone.

Fisher Investments Review: Is It Worth the Fees in 2025?

The Bottom Line: Fisher Investments may be worth the fees for a specific subset of investors with over $1 million in 2025. But you want to make sure you meet very specific criteria.

The target investor:

- Has a high net worth.

- Wants a hands-off approach.

- Has $1 million+ to invest.

If that doesn’t sound like you, then Fisher Investments probably isn’t a good fit. Even if you do fit those criteria, you might want to explore other options.

Why?

Because Fisher Investments fees are fairly high — annual fees range from 1 to 1.5% while many online advisors range from 0.25 to 0.5%.

Free financial resources like Empower (Personal Capital) and low-fee online robo-advisors like Betterment (U.S.) and Wealthsimple (Canada) have democratized investing, allowing investors with any level of knowledge and experience to start investing on autopilot with low fees and minimums.

So ultimately, if you have a small amount to start and don’t need access to an investment professional, Fisher Investments may not be the best option for you.

Keep reading the Fisher Investments review to learn more and discover some lower-fee alternatives…

What is Fisher Investments?

Fisher Investments is one of the world’s largest private, fee-only investment advisors. They manage over $197 billion and assets and serve 100,000 clients globally — a mix of private individuals, small to mid-sized businesses, and global institutions.

Founder Ken Fisher made a name for himself writing the “Portfolio Strategist” column for Forbes, which ran from 1984 to 2016. Over the years, Fisher has also written 10+ books on investment management.

How Does Fisher Investments Work?

Personal Wealth Management services from Fisher Investments begin with a deep dive into all the contributing factors to your financial situation.

First, you’ll meet your Investment Counselor and discuss what your assets need to achieve over a specific time period. To determine a tailored portfolio strategy, you’ll discuss:

- Investment objectives: What goals do you have for your assets?

- Time horizon: How long do you need your assets to work for you?

- Restrictions: Will you need to draw income from the portfolio?

- Tax considerations: How can you protect your wealth from taxes?

- Outside assets: Do you have assets managed outside of Fisher?

- Risk tolerance: What’s your comfort level related to market volatility?

Next, your Investment Counselor will help to choose a custodian like Schwab, Fidelity or UBS. From there, the new portfolio can be implemented.

Services Offered

Here are some of the services offered by Fisher Investments:

- Portfolio management: The Investment Policy Committee (IPC) monitors the global market and economic factors to capitalize on opportunities while taking your personal objectives into consideration.

- Financial planning: Fisher Investments takes a holistic approach that involves setting personal goals, defining a time horizon, emergency planning, and understanding your spending.

- Annuity evaluation: Annuities have been known to overpromise and underdeliver. Your Investment Counselor will help evaluate if policies are in alignment with your goals.

- Tailored solutions: Fisher Investments helps you develop a tailored retirement strategy and offers active, high-touch client service to keep you informed and on track.

Target Clientele

Fisher Investments does work with small to midsize businesses and financial institutions, but their main client base is high-net-worth individuals looking for a customized asset allocation portfolio with ongoing advisor support.

To become a Fisher Investments client, you need to have available assets of $1 million+, but there’s also a WealthBuilder account option with a $200,000 minimum (approved on a case-by-case basis).

Investment Philosophy

At Fisher Investments, you’re not just a customer. You’re an individual investor with long-term goals. Individuality requires customization and an adaptive approach.

Several key principles drive what they call “The Fisher Difference”:

- Independence: Fisher Investments is privately-held. Clients come first because there are no shareholders.

- Structure: A fee-only setup eliminates any hidden fees or commissions and allows the company to differentiate between sales and client services.

- Investment Expertise: A five-member Investment Policy Committee (IPC) monitors key economic drivers to drive decisions for client portfolios.

- Top-down investment approach: More emphasis on macroeconomic factors as opposed to a bottom-up approach where picking individual stocks is the main driver.

That top-down approach helps Fisher Investments approach the market in a way that can help them adapt based on the current market.

The chart below demonstrates year-over-year uncertainty in the capital markets and proves that future performance can’t always be predicted by the past.

Fisher Investments Fees

Fisher Investments charges a simple advisory fee based on assets under management.

- Fisher Investments fees range from 1 to 1.5%, which is comparable to other actively-managed investment advisors.

When you consider that robo-advisors like Betterment (U.S.) and Wealthsimple (Canada) range from 0.25 to 0.5% annually, that’s pretty high.

Although Fisher Investments’ fees are high, they are transparent, and they justify their fees by taking a hands-on customized approach to portfolio management. Many other active management services have hidden commissions and product fees in addition to the annual advisory fee.

Fisher Investments Pros and Cons

Pros | Cons |

Custom goal-driven portfolio selection | Limited to high-net-worth individuals |

Transparent fee structure | High account minimums |

Solid long-term investment option | High fees compared to robo-advisors |

The Problem with Fisher Investments

Albert Einstein is reported to have said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Just as interest can compound in your favor, fees over time can compound out of your favor.

For instance, say your fee with Fisher Investments is 1.25%. That might not sound like a lot.

But if you invest $1 million with Fisher Investments…

- Your annual fee would be $12,500.

- Over five years you’re looking at $62,500.

That’s a lot of money that could have been put into potentially interest-earning investments.

Lower-fee investing alternatives

Empower (Personal Capital) offers wealth management to customers with a starting balance of at least $100K — far lower than Fisher Investments’ target customer of $500K+.

Empower’s fees are also far lower, starting at 0.89% (as little as 0.49% for larger account sizes). Compared to Fisher Investments’ average fee of 1.25%, that can make a big difference. Think of it this way…

- Just above, we mentioned how if you invested $1 million with Fisher Investments, your average annual fee would be $12,500 — or $62,500 over five years.

- With Empower, your average annual fee would be $8,900 — or $44,500 over five years.

So, to wrap up this review of Fisher Investments …

The annual fees are simply not reasonable for most investors.

Fisher Investments Alternatives:

Lower-fee investing alternatives

- Robo-advisors: Betterment (U.S.) and Wealthsimple (Canada)

- Self-directed portfolio management: Empower (Personal Capital)

1. Self-Directed Investing

Empower offers a little bit of everything: free financial tools, PLUS low-fee wealth management over $100K.

Empower provides all of the following for FREE:

- An investment checkup tool to help you assess your current portfolio risk, analyze past performance, and model asset allocation

- A retirement calculator that can estimate your future net worth based on your current habits, then provides custom withdrawal rates based on your expenses.

- A budget planner

But it also offers wealth management services along the lines of Fisher Investments.

If you have a portfolio with $100,000 or more, you can get a free consultation; simply reach out and an Empower advisor will reach out to you via email. Their guiding principle? Bespoke, tailored portfolios. Together, you and your advisor create a plan that aligns with your goals and stage in life.

They’re able to help with common investing objectives:

- Building a more tax-efficient portfolio

- Cash flow insights, and targeted budgeting solutions

- An approach rooted in diversification.

Plus, as noted earlier, Empower’s wealth management fees start at 0.89% for up to the first million dollars invested, but go down to as low as 0.49% depending on account size — much lower than Fisher Investments’ 1.25% fee.

2. Robo-Advisors

Robo-advisors are another alternative to active investment management. They use algorithms to create a portfolio and put it on autopilot.

Robo-advisors like Betterment (U.S.) and Wealthsimple (Canada) have emerged as solid alternatives for investors looking for simple, hands-off investing with minimal fees.

What kind of fees? Typically, robo-advisor fees range from 0.25 to 0.5%, compared to Fisher Investments’ 1 to 1.5% fees for active management.

Granted, you won’t get the personal attention you would with a personal advisor. However, robo-advisors are a great option for investors who are starting small since they lower

the barrier to entry for the everyday investor by limiting fees and account minimums.

3. Other Financial Advisors

Another potential alternative? Online financial advisors are a great option for beginner investors of all levels of wealth.

An online financial advisor gives you a hands-on approach without the cost of a traditional actively managed service like Fisher Investments. Fees can range between 0.5 to 1%.

There may be required account minimums, but typically they’re far less than the Fisher Investments requirements.

Some online financial advisors I like? Merrill Lynch, Charles Schwab, and Vanguard.

Of course, account minimums and fees can vary depending on your situation. Be sure to read the fine print to verify account minimums and fee structures before you get started.

Final Word: Review of Fisher Investments

Fisher Investments offers a lot of great services for long-term investors looking for a customized portfolio strategy and dedicated access to an advisor. However, their account requirements and exceptionally steep annual fees rule them out for the majority of investors.

If you’re looking for a more accessible and less expensive option, consider Empower (Personal Capital) or robo-advisors like Betterment (U.S.) and Wealthsimple (Canada), or an online financial advisor.

FAQs:

Is Fisher Investments a good idea?

Fisher Investments offers world-class service. But because account minimums and annual fees are extremely high, many investors instead opt for self-directed investing tools, robo-advisors, or online financial advisors.

What is the average return on Fisher Investments?

Each client portfolio is customized based on a number of factors. The average return will vary based on individual, business and institutional accounts.

What percentage does Fisher Investments charge?

Tiered annual advisory fees range from 1 to 1.5%. The more money invested, the lower the annual fee. Aside from an annual fee, Fisher Investments does not charge any additional fees or commissions.

Who is better than Fisher Investments?

The best financial advisor depends on your individual needs. Alternatives include self-directed investing tools like Empower (formerly Personal Capital), robo-advisors like Betterment (U.S.) and Wealthsimple (Canada), or an online financial advisor.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our December report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.