Everyone’s talking about the Dub app — a trading platform that lets you copy politicians’ stock picks (Nancy Pelosi stock tracker, anyone?) and follow hedge fund moves in real-time. But you might be wondering if this copy trading app works or if it’s just hype that’ll drain your account.

I’ve spent weeks testing this platform, reviewing SEC filings, analyzing user complaints, and comparing it to competitors like Public and Robinhood.

In this article, I’ll break down how the platform works, explain the unusual anime connection people keep asking about, and show you exactly how it compares to major competitors.

Is the Dub App Legit + Worth It?

Dub is legit, but it’s not for everyone.

The platform operates through DASTA Financial, a registered broker-dealer with SEC approval and FINRA membership, the same regulatory setup that protects you at Fidelity or Schwab.

Fans of Dub love the slick interface and responsive customer service (the COO actually responds to complaints personally). The copy trading works as advertised.

Here’s the catch: you need serious money to make it work. With an annual fee of $89.99 plus a $100 minimum deposit, smaller investors are squeezed. If you’ve got $2,000 in your account, that fee eats nearly 5% of your potential returns before you even start.

But when it comes down to it, eToro beats Dub for most people. Its CopyTrader feature is Dub’s closest competitor, and there’s no additional fee to use it.

CopyTrader focuses on mirroring trades, with plenty of social interaction. Thanks to a longer track record in copy trading and a relatively simple entry to the platform, it’s an excellent alternative.

What is Dub App?

Dub App calls itself “Instagram for investing” and that’s actually pretty accurate. Instead of following celebrities, you follow successful investors and automatically copy their trades.

DASTA Inc launched the platform in early 2023 with a simple idea: Most people suck at picking stocks, so why not copy the pros? You browse portfolios from politicians, hedge fund managers, and top traders, then pick which strategies to mirror.

Stock Picks That Don’t Suck — For Less $ than Dub

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

This stock-picking newsletter is typically $99 per year — but for a limited time you can gain access for $79/year. Get started with Zen Investor today

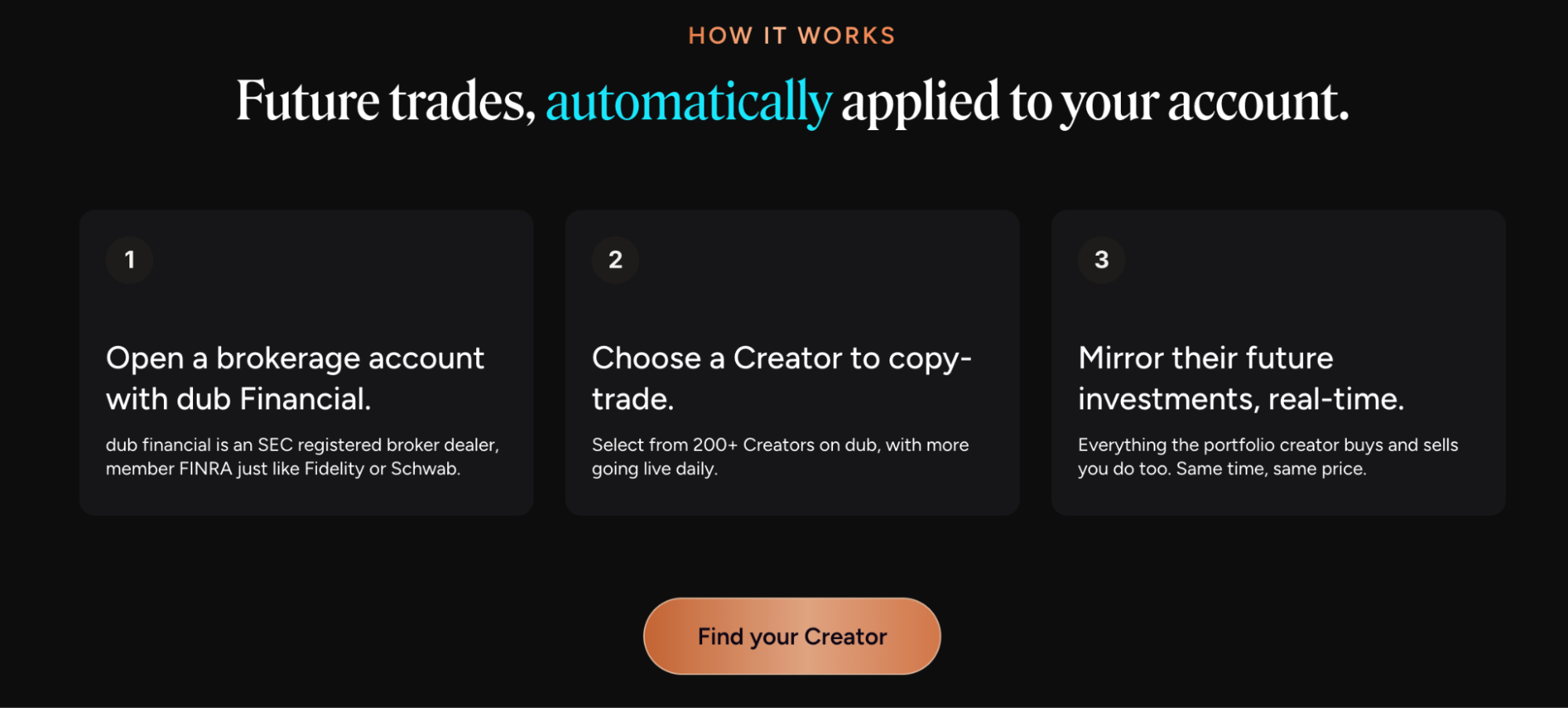

How It Works

The Dub investment app monitors your chosen investor’s moves and copies them instantly in your account. When they buy Tesla, you buy Tesla. When they sell Amazon, you sell Amazon.

The social element lets you read why investors make certain moves. You’re not just blindly copying, you’re learning from their commentary and market analysis.

So, when Nancy Pelosi buys a stock, you buy it too. Cool, right?

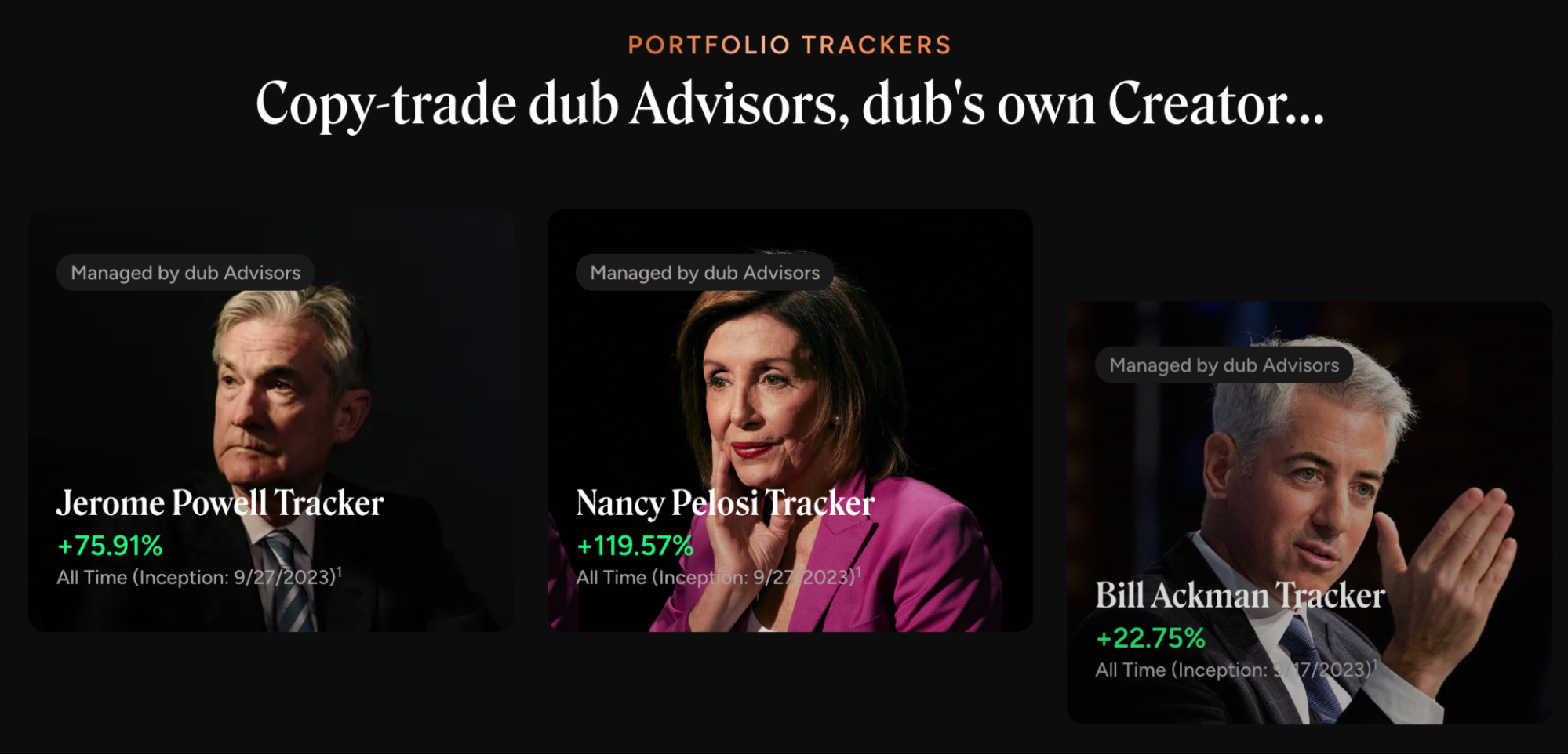

But there’s a problem with the Dub trading app review data. Most politician portfolios rely on 13F filings that can be three months old. It means in some cases, you might be copying trades long after the smart money has moved on.

Side Note: Dub App Anime Confusion

When I first heard of Dub (the app), I kept on seeing results for “Dub app anime” showing up on my feed. There’s no connection between the trading platform and anime streaming.

The confusion comes from similar names. “Dub anime” refers to Japanese shows dubbed in English (think Crunchyroll or Funimation).

The Dub investment app gets its name from “dubbing” or copying investment strategies, basically creating a “dub” of someone else’s portfolio.

Two completely different things that happen to share similar terminology.

Is Dub App Legit?

Yes, and let me show you why I’m confident about this.

DASTA Inc built a proper regulatory structure around their copy trading platform. They’ve got coverage in major publications like The Wall Street Journal, Forbes, and Fox News. That’s not something scam companies typically achieve.

The company raised $30 million in Series A funding, bringing total funding to $47 million. Legitimate VCs don’t throw money at sketchy operations.

Who Actually Owns It

DASTA Inc runs two licensed subsidiaries:

- DASTA Financial handles all trades as the registered broker-dealer. They’re responsible for executing trades, maintaining accounts, and following securities regulations.

- DASTA Investments (operating as “dub Capital”) manages the politician-tracking portfolios as an SEC-registered investment advisor.

This setup mirrors how established financial companies operate. They didn’t try to cut corners or operate in regulatory gray areas.

Security and Protection

The Dub app uses the same protection you’d get at major brokers:

- SIPC insurance up to $500,000 per account

- AES 256-bit encryption for data protection

- Bank-level security protocols

- Regular regulatory examinations

Your money gets the same treatment as funds at Fidelity or Schwab.

Dub Trading App Review: Key Features

I’ve tested the Dub app extensively, and here’s what you actually get for your money.

The Interface

The app feels more like Instagram than E*TRADE. Everything’s visual, intuitive, and designed for your phone. You can browse investor profiles, check performance metrics, and set up copy trading without getting lost in menus.

The dashboard shows your copied strategies, portfolio performance, and available investors to follow. It’s clean and uncluttered, a refreshing change from complex trading platforms.

What You Can Trade

The Dub app focuses on U.S. stocks and ETFs. That’s it. No options, no crypto, no international stocks, no bonds. The platform supports fractional shares, so you can copy strategies even with smaller accounts.

This limitation means you can’t copy truly diversified portfolios. If your chosen investor holds bonds or international stocks, you’re only seeing part of their strategy.

To dig more into this topic, I invite you to check out our article on how to build a DIY Ray Dalio portfolio. As you’ll see, it includes way more than just stocks — it includes alternative assets to help diversify and “weather” the storm of ever-changing market conditions. And that type of portfolio requires more than just an app like Dub.

Even if you don’t want to follow Dalio specifically, the aforementioned post emphasizes the importance of diversification.

Beat the market in just 10 minutes a month

With Dub, you don’t necessarily get much choice. For an option that gives you the power to choose but doesn’t take up a ton of your time, consider Zen Strategies. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48.01%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund. Plus, there’s a 50% off launch offer.

The Social Features

Each investor has a detailed profile showing their background, philosophy, and track record. Many provide regular commentary explaining their moves and market outlook.

The politician portfolios (managed by Dub Advisors) track public financial disclosures. For example, you can follow Nancy Pelosi’s trades on the Nancy Pelosi tracker, or see what other members of Congress are buying and selling.

Related Reading: The Best 6 Nancy Pelosi Stock Tracker Apps

Fee Structure

The Dub app keeps fees simple:

- $89.99 per year or $9.99 per month

- $100 minimum deposit

- Zero trading commissions

- No hidden fees or markups

That transparency is refreshing, but the subscription cost hits hard if you don’t have substantial funds invested.

Another consideration is that even on a slick app, it’s a smart idea to do your own research on stocks before you buy.

For instance, even if you’re confident that the Nancy Pelosi tracker will yield winners, you should probably do a little bit of due diligence before investing your hard-earned cash.

WallStreetZen’s tools can help you vet potential investments.

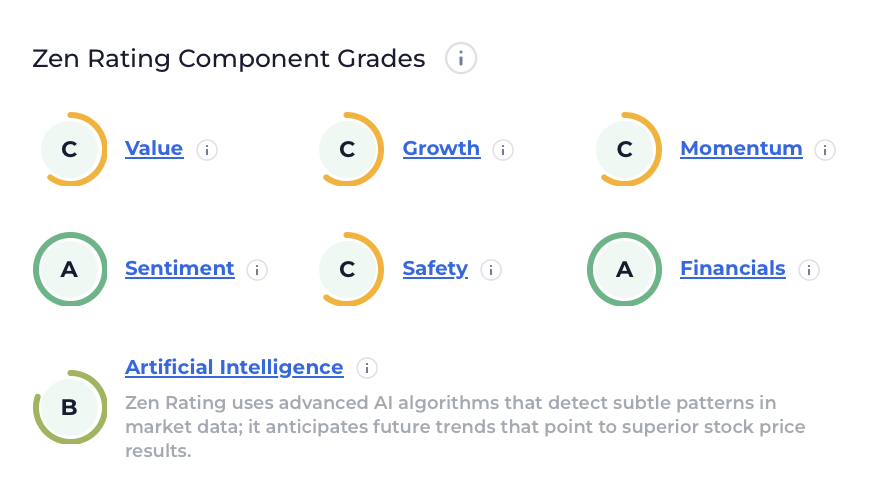

For example, the Zen Ratings system allows you to enter any ticker and see a letter grade, which represents how the stock fares on a rigorous 115-factor review.

So, say that you see Nancy Pelosi just added to her position in Google parent company Alphabet (NASDAQ: GOOGL). You can enter the ticker in WallStreetZen and see its overall grade — at writing, it’s a B (Buy), meaning it’s in a class of stocks that have historically generated 19.88% annual returns. Not bad.

You can also review its specific strengths and weaknesses via Component Grades:

Sentiment and Financials are strong, indicating it might be getting some Smart Money attention. The AI Component sifts through mountains of data to anticipate future trends.

Reviewing stocks through a system like this can help ensure your safety when investing on an app like Dub.

Dub Trading: Who Is the Ideal user?

The ideal Dub App user has at least $5,000 to invest, struggles with stock research, and wants to learn from successful traders. You should be comfortable with technology and willing to pay for automated investing convenience.

If you have a small account, prefer full control over your trades, or want access to bonds and crypto, you’ll find better options elsewhere. I’ll show you those alternatives next.

Dub Trading vs. Competitors

eToro (U.S. version)

eToro is Dub’s closest competitor, focusing on copy trading with more social interaction.

What eToro Offers: CopyTrader™ system, extensive social features, and longer track record in copy trading.

eToro’s CopyTrader is the best way to start copy trading in 2026.

Copying traders on eToro is straightforward. There’s an extensive list of experienced traders you can choose to copy; not only can following an experienced trader can be much safer, but it can also teach you along the way. Following and analyzing pro traders’ moves can help you understand what worked about the strategy so you can potentially add it to your own repertoire moving forward. (You can read more in our eToro CopyTrader review.)

Where eToro Wins: Better for social interaction and copying individual retail traders; no added fee to use the CopyTrader feature

Where Dub Wins: Better access to institutional strategies

Public

Public pivoted from social trading to AI-powered investing after discontinuing social features in June 2025.

What Public Offers: 6.4% locked-in bond yields, 4.1% cash APY, AI analysis powered by GPT-4, options trading with rebates, and cryptocurrency access.

Fee Comparison: Public offers commission-free trading without subscription fees. Their premium tiers cost less than Dub’s $89.99 annual fee.

Where Public Wins: Better for comprehensive investing, multiple asset classes, and AI-powered analysis. The high-yield cash account alone might beat Dub’s copy trading returns.

Where Dub Wins: Better for copying specific politicians or successful individual investors.

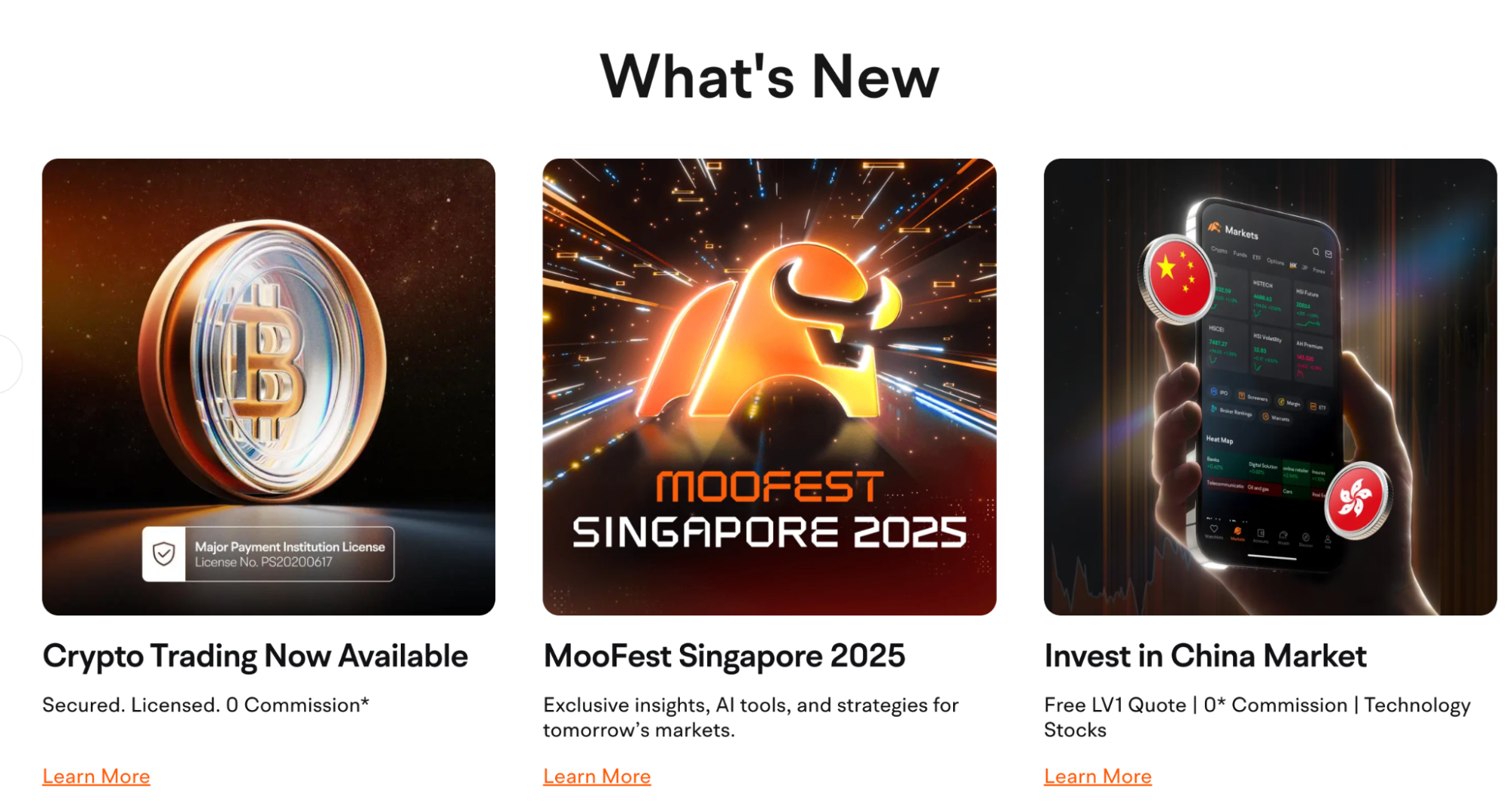

Moomoo

Moomoo targets serious traders with professional-grade tools and an impressive promo:

What Moomoo Offers: Level II market data, advanced charting, technical analysis tools, and extended trading hours.

Where Moomoo Wins: Better for developing your own trading skills and earning high yields on cash.

Where Dub Wins: Better for automated decision-making without learning complex analysis.

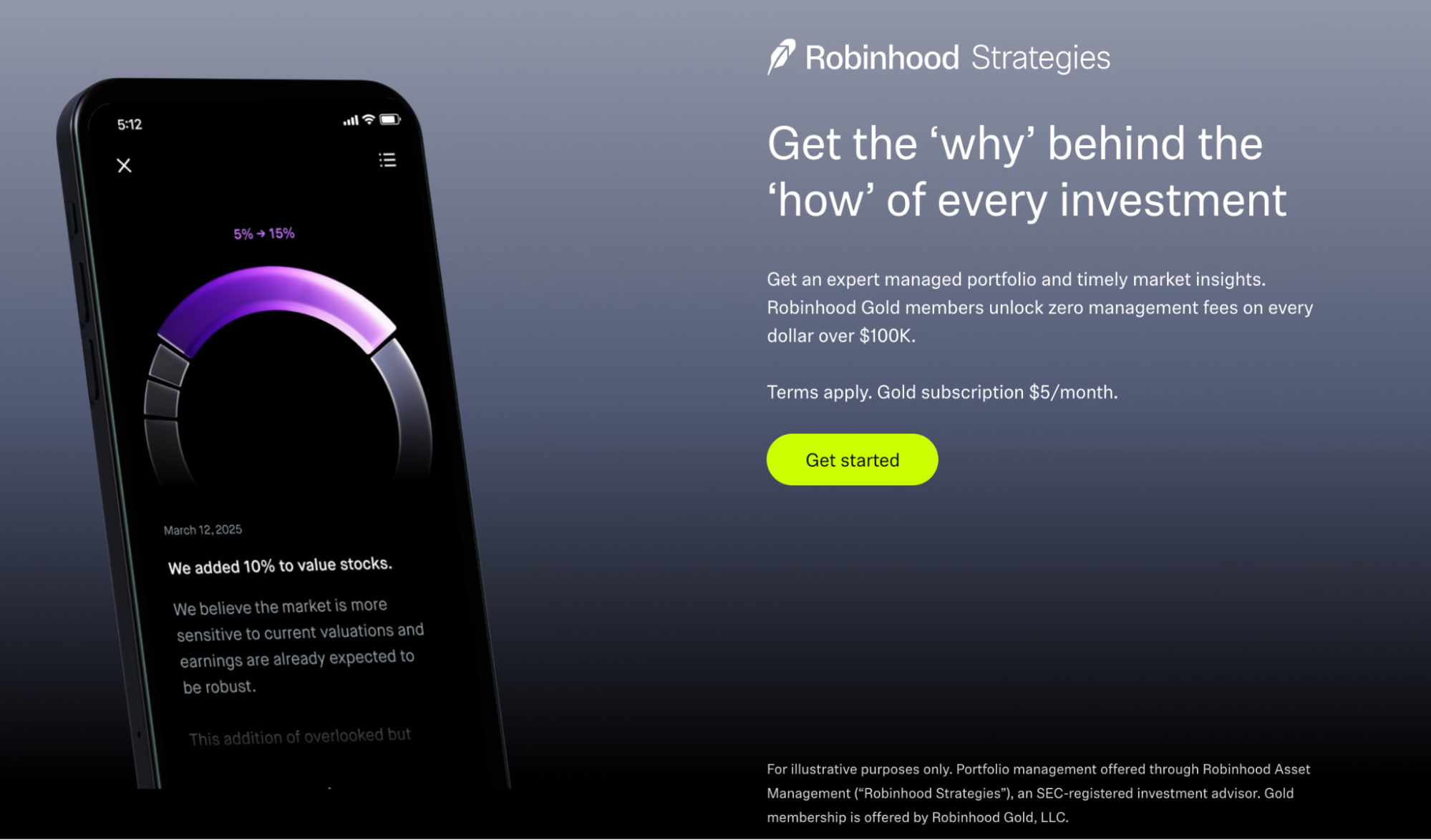

Robinhood

Robinhood pioneered commission-free trading and now offers both mobile and desktop platforms.

What Robinhood Offers: Stocks, ETFs, options, crypto trading, and managed portfolios through Robinhood Strategies. Robinhood Gold costs $5/month and includes 4% APY on cash.

Fee Comparison: Robinhood Gold at $60/year beats Dub’s $89.99 annual fee while offering more features.

Where Robinhood Wins: Better for crypto exposure, desktop trading, and lower-cost managed portfolios.

Where Dub Wins: Better for copying politician trades and seeing specific investor decision-making.

Acorns (to a lesser extent)

Acorns automates investing through spare change round-ups and managed ETF portfolios.

What Acorns Offers: Automatic round-up investing, professionally managed ETF portfolios, and savings features.

Where Acorns Wins: Better for completely passive investing and building saving habits.

Where Dub Wins: Better for learning specific investment strategies and stock selection.

Top Alternatives to Dub App

App | Best For | Key Features | Social/Community Features | Commission-Free Trades |

Public | Social investing & transparency | Fractional shares, community portfolios, zero PFOF | ✅ Yes | ✅ Yes |

Robinhood | Beginners & casual traders | Options & crypto trading, sleek UI, margin accounts | 🚫 No | ✅ Yes |

Moomoo | Serious traders & real-time data | Level II quotes, pro-level tools, customizable UI | 🚫 No | ✅ Yes |

eToro (U.S.) | Copy trading & global exposure | Copy top investors, access global markets, crypto + stocks | ✅ Yes | ✅ Yes (limited U.S. offering) |

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Pros and Cons of Dub App

What Works Well

- Unique Access: You can follow politician trades and institutional strategies that were previously impossible for retail investors to access.

- Great Design: The interface beats most trading apps. It’s intuitive, visually appealing, and perfect for beginners.

- Excellent Support: The COO personally handles user issues. That level of executive involvement is rare in fintech.

- Educational Value: You learn while your money works through creator commentary and performance analysis.

- Proper Licensing: Full regulatory compliance gives you the same protections as major brokers.

What’s Not as Great

- Expensive for Small Accounts: The $89.99 fee devastates returns if you don’t have substantial funds invested.

- Limited Assets: No crypto, options, bonds, or international stocks. You’re only seeing part of most investment strategies.

- Stale Data: Politician portfolios rely on quarterly filings that can be months old. You’re copying yesterday’s trades.

- Incomplete Pictures: Public filings don’t show short positions or derivatives. You’re missing crucial strategy components.

- No Performance Guarantees: Past success doesn’t predict future results. Even great investors have losing streaks.

User Feedback and Ratings

Apple App Store users praise the interface and customer service. Reviews consistently mention the “intuitive design” and “responsive support team.”

Google Play shows mixed feedback. Users like the UI but complain about functionality limits and high fees. One review: “UI is good. Functionality is poor. Pay almost $100 for the year after a $100 trial.”

Trustpilot gives Dub a 3.6-star rating. Positive Dub app reviews highlight exceptional customer service. Negative reviews focus on delayed 13F data and questionable long-term value.

Dub app complaints typically center on cost-effectiveness rather than platform functionality. Users question whether copying three-month-old trades provides real value.

The copy trading works technically as trades execute accurately and on time. The platform maintains good uptime and responsiveness.

Performance concerns relate to investment results rather than technical issues. Several users noted that by the time politician trades are copied, market movements have reduced potential benefits.

Users with larger accounts ($10,000+) view the subscription fee as reasonable. Those with smaller accounts frequently cite Dub app cost as prohibitive.

Who Should Use Dub

The Dub app works best for investors who:

- Have $5,000+ to invest

- Want to learn from successful traders

- Prefer automated investing over research

- Are specifically interested in politician trading patterns

- Value educational content and transparency

Skip Dub if you:

- Have smaller account balances

- Want crypto, bonds, or international exposure

- Prefer full control over trades

- Focus on passive index investing

- Want the lowest possible costs

Final Verdict: Should You Try Dub?

Is Dub App legit? Yes. The platform operates under proper oversight and delivers promised services.

Is Dub App worth it? Only for specific investors with sufficient capital and clear interest in copy trading.

That’s because it’s expensive and limited. The $89.99 annual fee makes sense only if you have substantial funds invested. The focus on U.S. stocks and ETFs means you’re missing key portfolio components.

Most people will get better value from Public’s AI analysis and high-yield accounts or Robinhood’s comprehensive platform with crypto access.

If you’re curious about Dub App and meet the ideal criteria, try the 7-day free trial.

For everyone else, consider some of the other platforms listed in this post.

The Dub app represents innovation in copy trading, but it’s a specialized tool for specific investors rather than a universal wealth-building solution.

FAQs:

Is the Dub trading app safe?

Yes, the Dub trading app is safe. DASTA Financial operates as a registered broker-dealer with SEC approval and FINRA membership.

User accounts get SIPC insurance up to $500,000, and the platform uses bank-level encryption. You get the same protections as major brokers.

Is the Dub trading app an AI company?

No, Dub focuses on copy trading rather than AI. The platform uses automation for trade execution and portfolio tracking, but its core value is copying successful investors' strategies. Think social investing, not artificial intelligence.

What are the fees on Dub App?

Dub App charges $89.99 annually or $9.99 monthly for full access. Individual trades are commission-free. You need a $100 minimum deposit to start. No hidden fees or markups as the subscription covers everything.

Can beginners use the Dub App easily?

Yes, Dub App is designed for beginners. The interface resembles social media more than complex trading platforms. However, beginners should understand that copy trading still involves market risk, and the subscription fee can hurt returns on smaller accounts.

How does the Dub app work?

Dub App monitors your chosen investors' trades and copies them automatically in your account. When they buy or sell, you do the same at identical prices and timing. You browse portfolios, pick strategies to copy, and allocate funds accordingly.

Is the Dub app a scam?

No, Dub App is not a scam. The platform operates through properly licensed companies with SEC registration and regulatory oversight.

The company has received legitimate venture funding and maintains transparent operations. However, there's no guarantee of investment profits.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.