Can ChatGPT Help With Investing?

Yes. Absolutely. But you shouldn’t trade ChatGPT stock picks blindly.

For superior AI-assisted stock picks, you should focus on platforms specifically designed for finance, with AI models that have been trained to look for markers of growth potential. WallStreetZen’s Zen Ratings system and Fiscal.ai are examples of high-quality AI-assisted stock research platforms.

Ideally, ChatGPT can help support your research on one of these platforms — but you shouldn’t use it as a stand-alone stock-picking service.

I’ll explain everything below — let’s dig into how to use ChatGPT to invest smarter.

Market-Beating AI Stock Picks — Verified By a Veteran (Human) Investor

With a Zen Investor subscription, you gain access to an AI-powered stock-picking system — with stock picks that are further vetted and hand-picked by a human. For just $99 per year (or $79 for a limited time, using this link,), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Each selection undergoes a careful review of 115 factors proven to drive growth in stocks, including proprietary AI algorithms, using our Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary

Why Use ChatGPT for Investing?

Using ChatGPT for investing works best when you treat it as step one in your research process, not the final word. However, it may be helpful to talk about what it CAN offer:

- Speed and accessibility. You can explore different investing strategies — value, growth, dividend, momentum — in minutes rather than hours. I often use it to decode analyst jargon or summarize complex financial reports.

- Educational powerhouse. New to investing? ChatGPT can explain concepts at your level without the intimidation factor. Experienced investor? Use it to explore unfamiliar sectors or international markets.

- Idea generation. Stuck in analysis paralysis? Ask ChatGPT for stocks that meet specific criteria. It’s excellent for getting your creative juices flowing. But don’t just accept what ChatGPT says blindly. Always back it up with research using a trusted platform like WallStreetZen. That leads to the next point I want to make…

Understanding ChatGPT’s Limitations With Stocks

ChatGPT excels at explaining complex financial concepts in plain English. Need to understand what a P/E ratio means? It’ll break it down perfectly. (Side note: You could also read our blog post: What is a Good P/E Ratio for a Stock?).

Want to know the difference between value and growth investing? ChatGPT can explain both strategies clearly.

But here’s what ChatGPT can’t do: access live market feeds or replace proper due diligence.

Furthermore, due to the lower quality of data it has access to, its information may be outdated or misleading and should always be verified for accuracy. Think of it as a research assistant, not a financial advisor.

Happily, there are AI-assisted platforms that do specialize in financial topics and even stock-picking advice. Let’s talk about them.

(P.S. For daily market insights including a weekly list of 5 Strong Buy Stocks, subscribe to our FREE newsletter, WallStreetZen Ideas)

The Solution: Pair ChatGPT With Targeted Investing Tools

I’ll explain how to use ChatGPT to look for stocks below. But I need to reiterate that ChatGPT is at its best when you can use specific investing tools to optimize your research.

Here are some of my favorites:

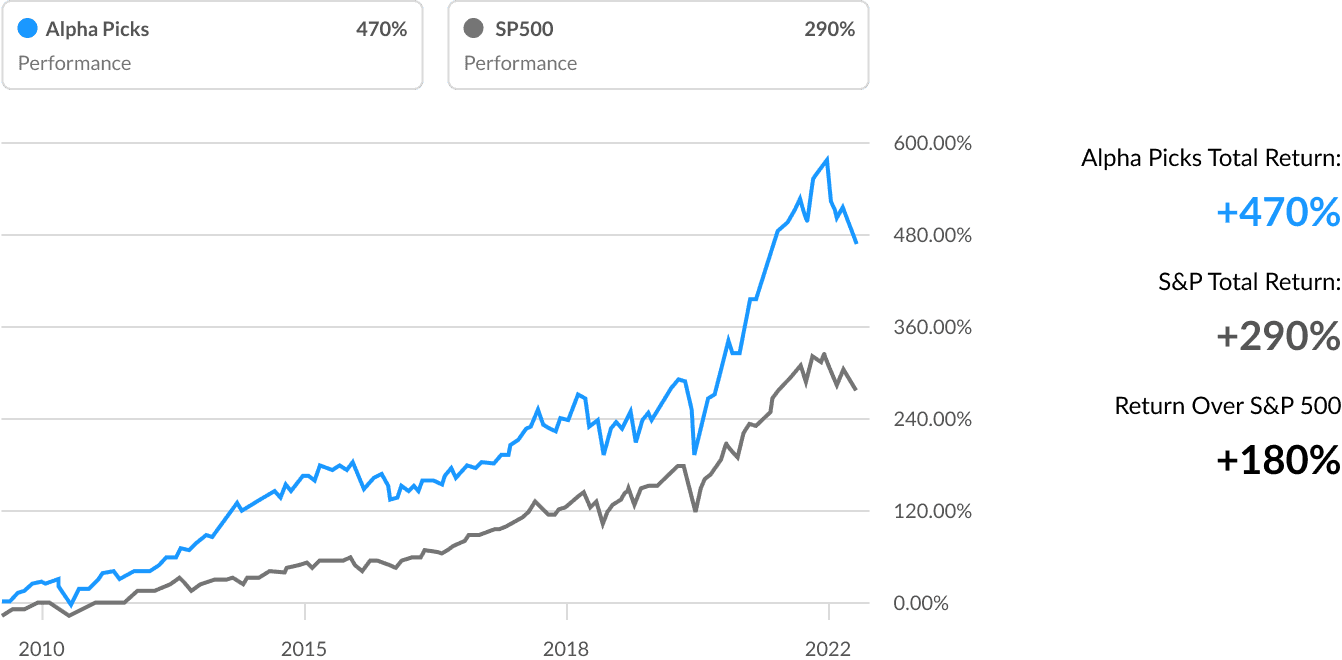

WallStreetZen — My go-to for fundamental research. The Zen Ratings system includes AI in its 115-factor evaluation alongside traditional due diligence checks. Perfect for verifying ChatGPT’s suggestions with real data. And it works — stocks rated “A” using this system have historically delivered 32.52% annual returns.

Seeking Alpha — Essential for analyst commentary and earnings transcripts. When ChatGPT suggests a stock, I always check what professional analysts are saying on Seeking Alpha.

Fiscal.ai (formerly FinChat.io) — This AI-powered platform provides real-time financial modeling. It’s like ChatGPT’s more sophisticated cousin for serious financial analysis.

TradingView — Critical for technical analysis and charting. If you’re timing entries or exits, this complements ChatGPT’s fundamental insights perfectly.

TipRanks — Tracks analyst forecasts, insider trades, and hedge fund activity. Great for seeing what the smart money is actually doing with ChatGPT’s suggestions.

How to Use ChatGPT for Stocks: 3 Best Prompts & Examples

Pro tip: The more specific your prompts, the better your results. Instead of “give me good stocks,” try “suggest 3 healthcare stocks with strong balance sheets and growing dividends.”

Getting good results from ChatGPT for stocks depends on asking the right questions. Here are some example prompts that would be interesting to both beginner and advanced-level investors.

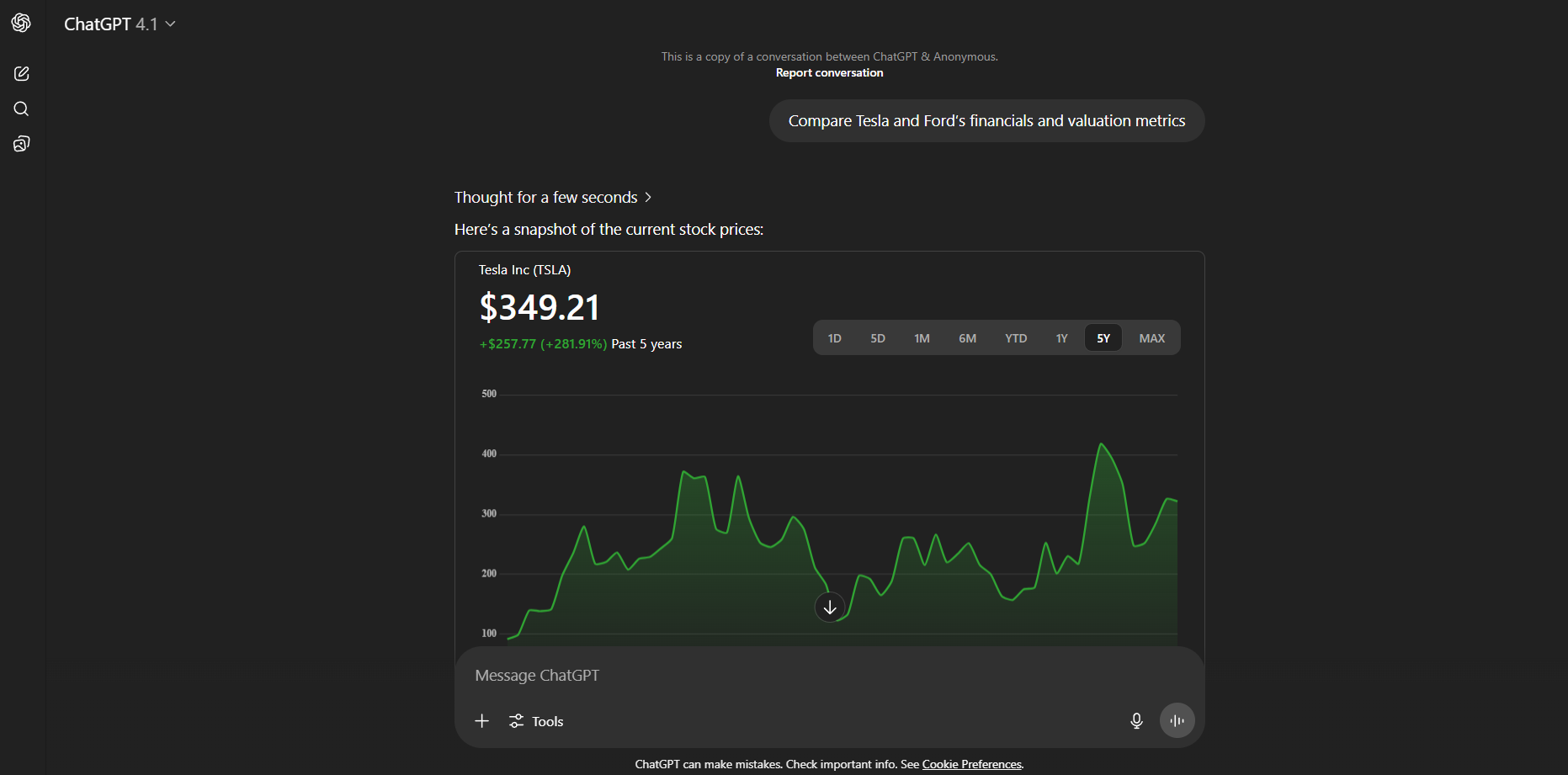

1. Comparative Analysis

“Compare Tesla and Ford’s financials and valuation metrics.”

After providing a decent comparison of both companies, ChatGPT provided the summarized response:

“Tesla is priced as a tech growth leader with a fortress-like balance sheet and high profitability—investors expect revolutionary future upside. Ford, meanwhile, is a traditional automaker: lower risk, lower return, but with durable earnings and strong cash flow, reflected in modest valuation multiples.”

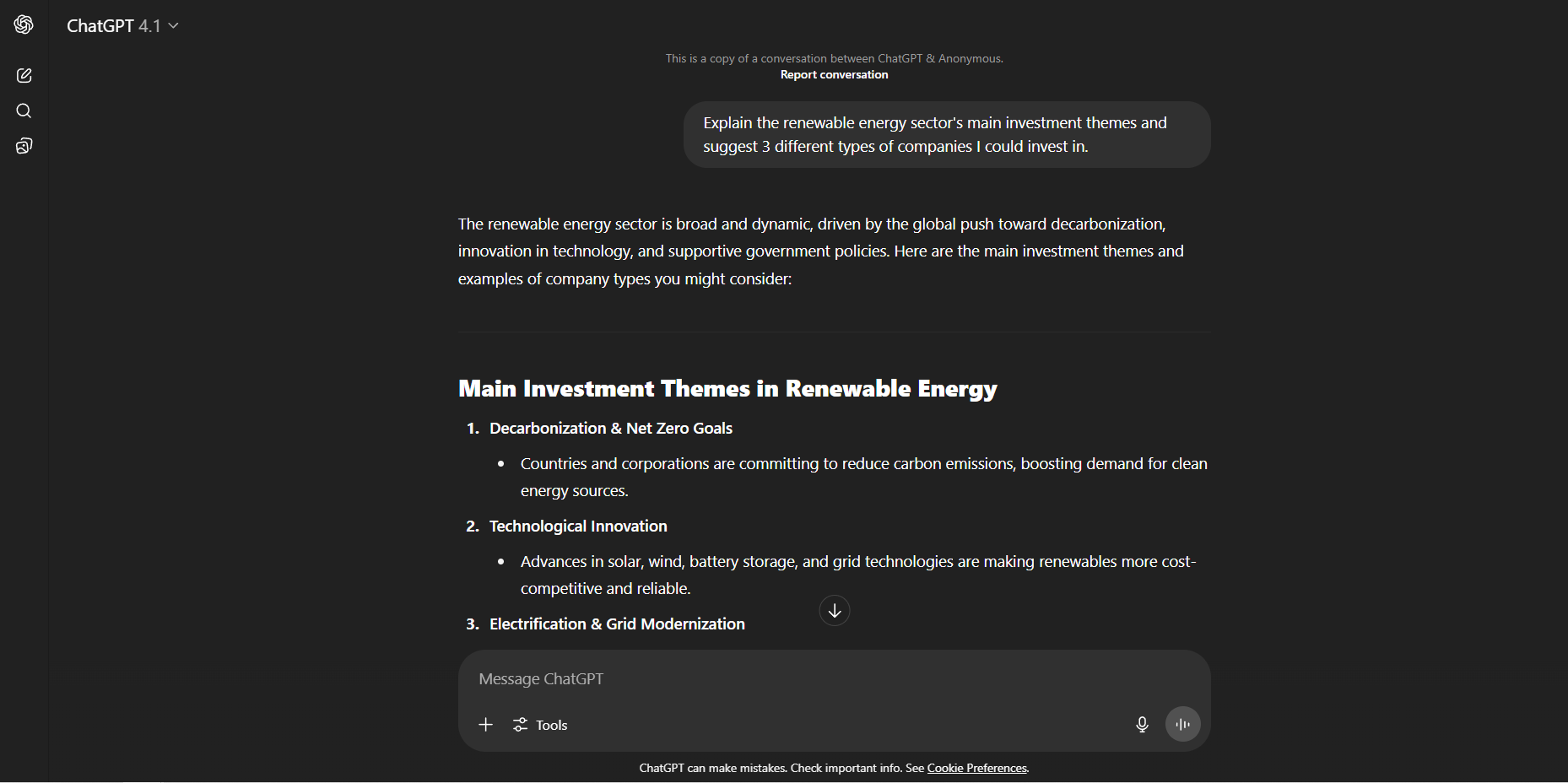

2. Sector Exploration

“Explain the renewable energy sector’s main investment themes and suggest 3 different types of companies I could invest in.”

Starting the conversation with prompts like these is a great way for exploring new sectors you’re unfamiliar with. Click the link to see how ChatGPT responded.

3. Risk Assessment

“What are the main risks investors should consider before buying bank stocks, and how can I evaluate those risks?”

Even though this is a pretty basic question, getting broad educational answers like these is invaluable for beginner investors starting out their due diligence and researching potential asset classes to invest in.

The trick is asking follow-up questions. If ChatGPT suggests a stock, ask “What metrics should I check to verify this is actually undervalued?” or “What recent news might affect this company’s prospects?”.

ChatGPT Stock Picks: Can You Trust Them?

Here’s the uncomfortable truth about ChatGPT stock picks: they’re conversation starters, not investment recommendations.

I’ve tested ChatGPT’s stock suggestions extensively. Sometimes they’re brilliant — identifying genuinely undervalued companies with solid fundamentals. Other times, they’re based on outdated information or miss crucial recent developments.

A stock-picking service with a proven track record like Zen Investor will win just about every time.

The fundamental problem: ChatGPT isn’t an actual financial advisor or real-time data provider. It can’t know that a company just missed earnings, announced a CEO change, or faces new regulatory challenges.

What you’ll often find is that the reasoning behind the suggestions is sound, but the current financial metrics or stock performance might tell a different story.

I treat ChatGPT’s stock picks like tips from a smart friend — worth investigating, but never worth buying blindly.

Try this: Ask ChatGPT for 3 undervalued tech stocks, then check those names on WallStreetZen to verify the actual data.

How I Use ChatGPT for Investing…

I’ve found ChatGPT particularly useful for summarizing earnings reports, comparing companies side-by-side, and generating initial stock ideas based on specific criteria. It’s like having a knowledgeable finance buddy available 24/7.

However, when it comes to choosing stocks to invest in, I like to stick with apps that focus on finance — in particular, I make use of WallStreetZen.

My workflow: ChatGPT generates ideas → WallStreetZen for fundamental analysis → TradingView for technical confirmation → final decision → Execute trade on eToro (if applicable)

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Investing With ChatGPT: Advanced Strategies

Once you master basic prompts, investing with ChatGPT becomes significantly more powerful with these advanced techniques:

Timing & Price Context

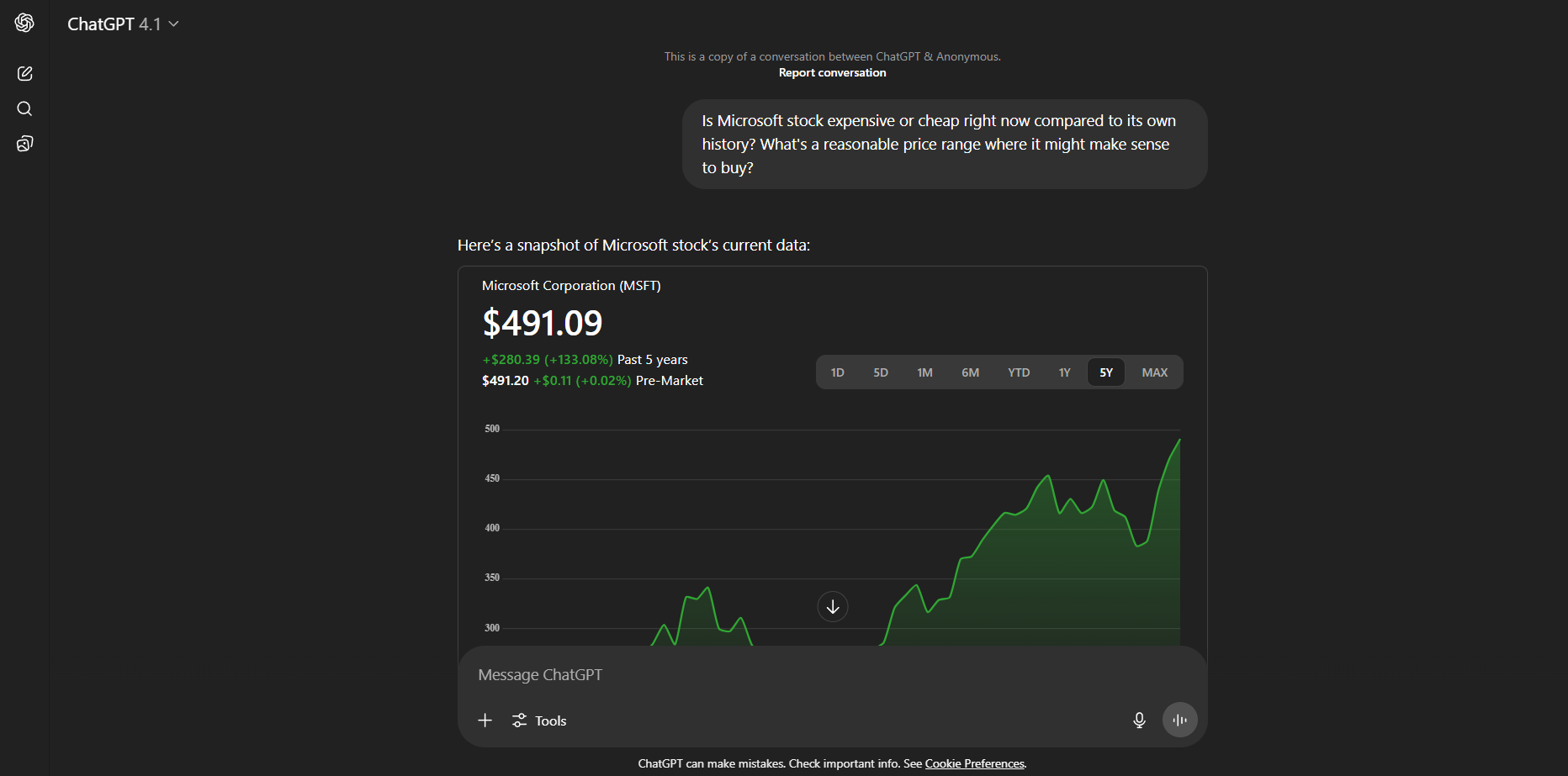

“Is Microsoft stock expensive or cheap right now compared to its own history? What’s a reasonable price range where it might make sense to buy?”

After providing a price chart and explanation of its reasoning, ChatGPT (Model 4.1) provides the following summary:

“Microsoft is currently trading at a historically high valuation, reflecting strong investor conviction in its AI-driven future. If you’re moderately bullish, waiting for a pullback into the $475–$500 range makes sense.

If you’re seeking a safer entry and are willing to be patient, $425–$475 would be a more conservative zone providing value and upside potential.”

This type of prompt is invaluable for avoiding emotional buying at peaks. Rather than asking ‘should I buy now?’ (which gets generic advice), you’re asking ChatGPT to contextualize current prices against historical patterns.

Pro Tip: Use this before any major purchase — then verify the price ranges using tools like TradingView or your broker’s charts. The key insight isn’t the exact numbers, but learning to think in terms of price context rather than absolute prices.

This approach forces you to consider valuation discipline instead of chasing momentum. Most retail investors buy at highs because they don’t understand historical context — this prompt fixes that blindspot.

Portfolio Fit Assessment

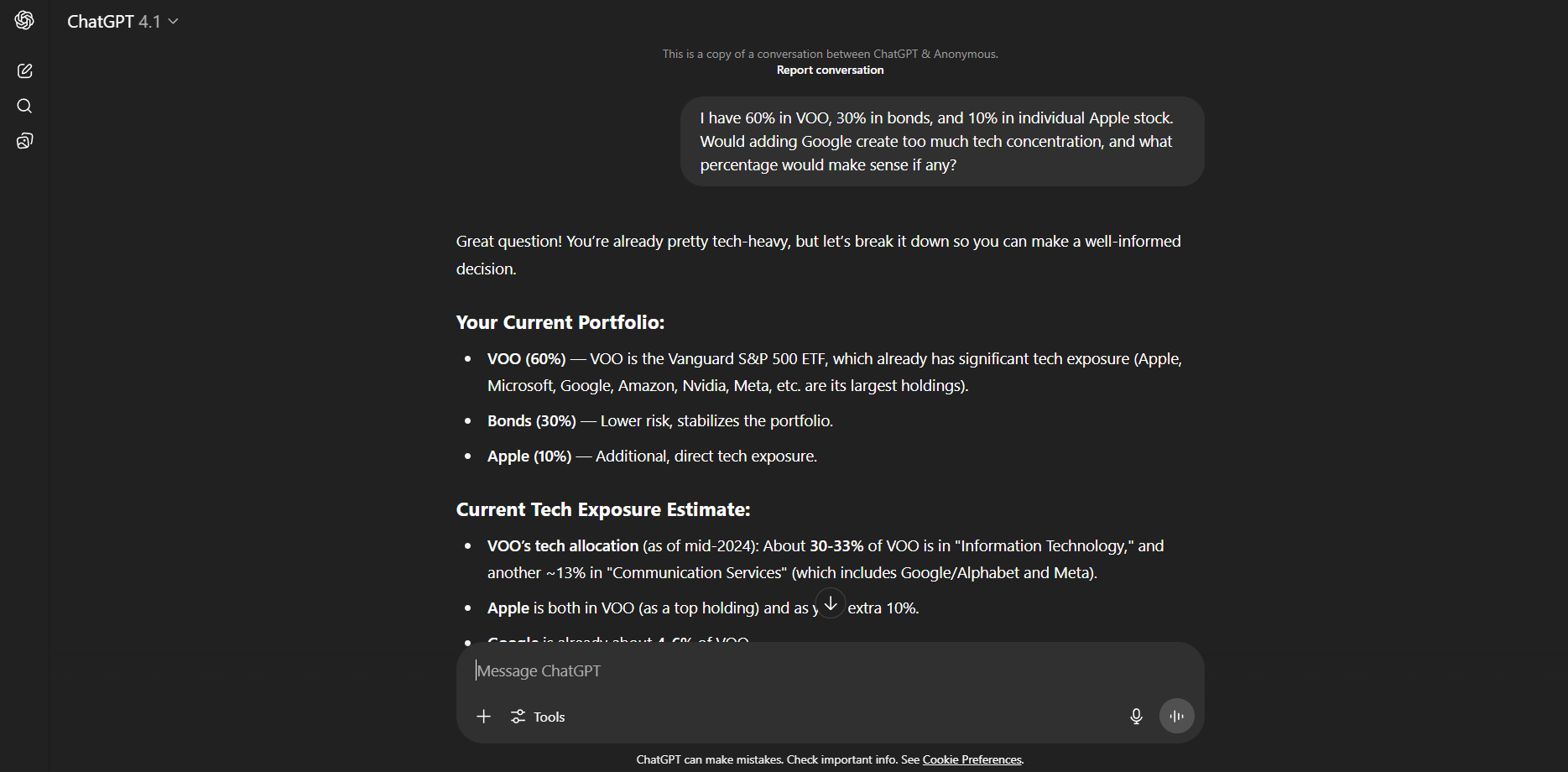

“I have 60% in VOO, 30% in bonds, and 10% in individual Apple stock. Would adding Google create too much tech concentration, and what percentage would make sense if any?”

After providing detailed reasoning regarding this simple query, ChatGPT provided the following summary:

“Yes, it does increase your tech concentration.

If you want to add Google, keep it under 3%, or shift your Apple position instead of adding more tech.

Remember: There’s nothing wrong with a tech tilt if it matches your risk tolerance and goals, but it’s good to be aware of your exposure!”

This demonstrates ChatGPT’s strength in portfolio-level thinking that many investors skip. Most people research individual stocks in isolation, but this prompt forces you to consider concentration risk and overall balance. The 3% suggestion isn’t gospel — it’s a starting point for your own analysis.

The real value here is developing systematic thinking about portfolio construction. Instead of collecting random “good stocks,” you’re building a coherent strategy that manages risk across positions.

Prefer to have a portfolio hand-picked for you?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. For just $99 per year ($79 using links from this post), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Portfolio Construction

“Design a defensive portfolio for someone with $50,000 who’s 5 years from retirement, focusing on dividend yield and capital preservation.”

ChatGPT excels at big-picture asset allocation thinking that considers multiple variables simultaneously — age, risk tolerance, time horizon, and goals. This type of prompt gives you a structured framework to evaluate whether your current portfolio actually matches your situation.

Use these responses as starting points for deeper research into specific asset classes and ETFs. The framework matters more than the exact percentages — it teaches you to think systematically about portfolio balance.

Pro Tip: Try variations like “aggressive growth portfolio for 30-year-old” or “inflation-hedged portfolio for retirees” to explore different allocation strategies.

Scenario Analysis

“How might rising interest rates affect REITs, and what should REIT investors watch for in 2025?”

This prompt type turns ChatGPT into your macro research assistant. While the initial response gives you the framework, the real value comes from follow-up questions like “What specific metrics should I track?” or “How have REITs performed in previous rate cycles?”

This approach helps you think systematically about external factors that could impact your holdings — something individual stock analysis often misses. Smart investors anticipate macro changes rather than react to them.

Pro Tip: Always ask follow-up questions to drill deeper into the implications for your specific holdings.

Sector Rotation

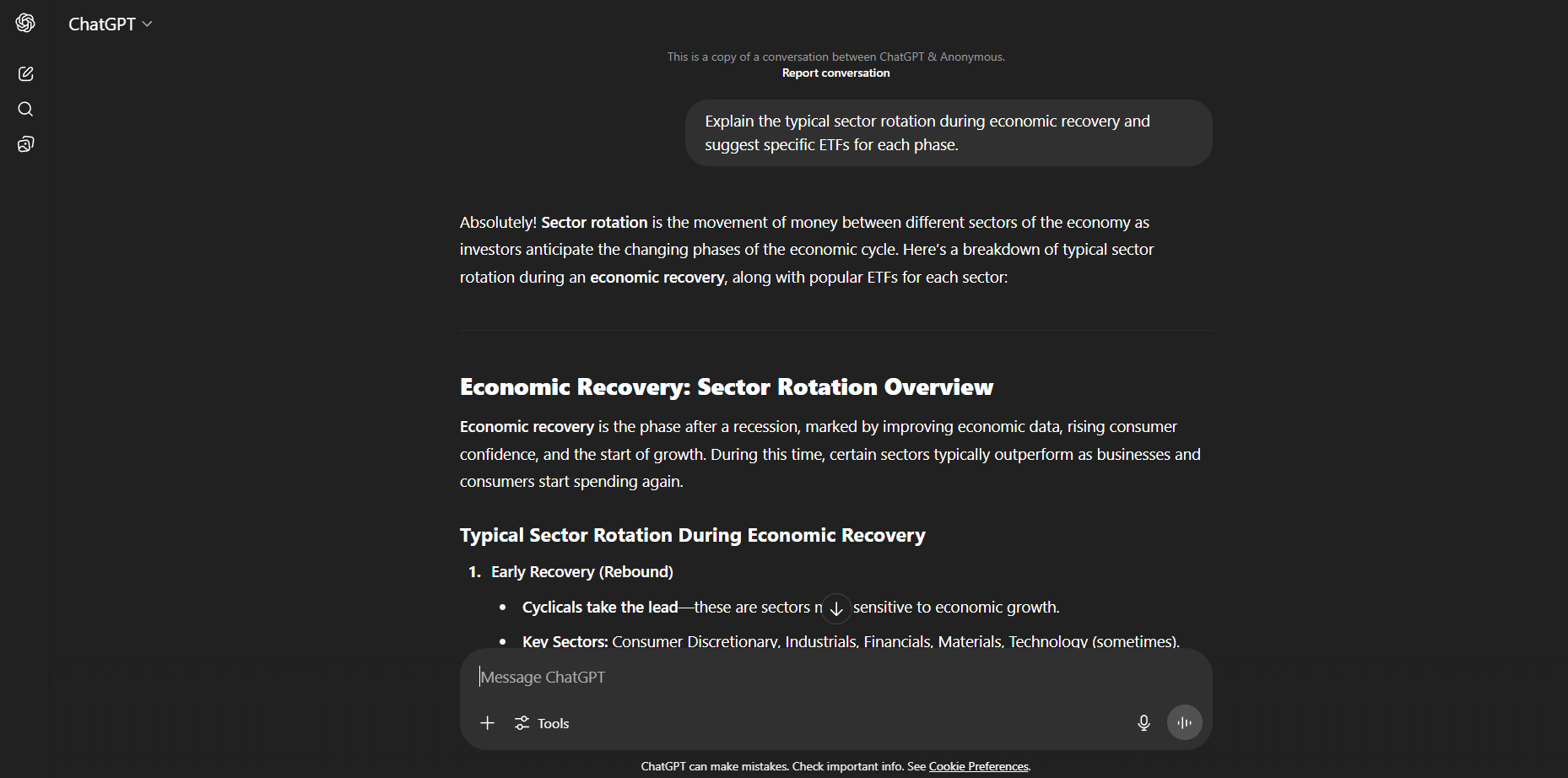

“Explain the typical sector rotation during economic recovery and suggest specific ETFs for each phase.”

Understanding sector rotation patterns helps you position your portfolio for different economic phases rather than chasing last quarter’s winners. ChatGPT provides the theoretical framework — your job is applying it to current market conditions.

The key insight here isn’t timing the market perfectly, but understanding that different sectors thrive in different environments. This knowledge helps you avoid major allocation mistakes during economic transitions.

(Oh, and by the way — if allocation is a topic of interest to you, you may enjoy our post on how to construct a DIY Ray Dalio portfolio.)

Pro Tip: Use this knowledge to gradually rebalance toward sectors that typically outperform in the next economic phase, rather than making dramatic all-at-once shifts.

International Exposure

“Compare investing in European stocks through ADRs versus European ETFs, including tax implications.”

This type of comparative analysis showcases ChatGPT’s ability to break down complex investment decisions with multiple variables. International investing involves tax implications, currency risk, and structural differences that most investors don’t fully understand.

The real value is learning to systematically evaluate trade-offs rather than making decisions based on incomplete information. ChatGPT helps you identify all the factors you should research before committing capital.

Pro Tip: Use similar prompts for other complex decisions like “REIT vs dividend stocks for income” or “individual bonds vs bond ETFs.”

Advanced Tips for ChatGPT Stock Research

Ready to take your ChatGPT investing research to the next level? These advanced techniques will help you get more precise, actionable insights from your prompts.

Prompt Engineering for Better Results

Be specific about timeframes: Instead of “Is Tesla a good investment?” ask “What factors should I consider when evaluating Tesla’s prospects over the next 2-3 years?”

Request multiple perspectives: “Give me both the bull and bear case for investing in cloud computing stocks right now.”

Ask for quantitative criteria: “What financial ratios indicate a strong dividend stock, and what are the ideal ranges for each?”

Ask ChatGPT to fact-check itself: After getting an initial response, follow up with “Can you double-check that analysis and point out any potential weaknesses in your reasoning?” or “What assumptions in your response might be wrong?”

Verify sources and timestamps: When ChatGPT mentions studies, reports, or data, ask “What’s the source and date for that information?” ChatGPT often references outdated information without clearly indicating when it’s from. Better yet, check the sources on your own, using the links ChatGPT often provides along with its response.

Understand when you’re getting training data vs. real-time info: If ChatGPT doesn’t mention searching the web or accessing current data, assume you’re getting information from its training cutoff, which can often be based on outdated information.

Pro Tip: Treat ChatGPT like a research intern who’s smart but needs supervision. Always verify timely information through platforms like WallStreetZen or recent financial news before making investment decisions.

Common Mistakes When Using ChatGPT for Investing

Here are some common mistakes investors make when using ChatGPT for investing:

Mistake #1: Taking suggestions as gospel. As stated above, always verify everything through reliable financial platforms and reputable news sources.

Mistake #2: Asking vague questions. “Good stocks to buy” gets mediocre results. “Undervalued dividend aristocrats with strong balance sheets” results in a much better selection.

Mistake #3: Not providing enough context. ChatGPT can help, but only if you share relevant details about your situation, income, and goals.

Mistake #4: Ignoring recent developments. ChatGPT’s training data has limits. Always check recent news and earnings before acting on suggestions.

Mistake #5: Treating it as your only research tool. ChatGPT excels at idea generation and education, but can’t replace comprehensive financial analysis platforms.

Pros and Cons of Investing With ChatGPT

Here’s where ChatGPT shines, and where it falls short:

Pros | Cons |

Available 24/7 for instant research help | No access to real-time market data |

Excellent at explaining complex concepts | May have outdated or incomplete information |

Great for brainstorming and idea generation | No legal or fiduciary responsibility |

Helps beginners learn investing fundamentals | Requires verification through other tools and resources |

Free to use with detailed explanations | Cannot execute trades or provide timing |

Can analyze multiple scenarios quickly |

The Reality Check

I’ve been using ChatGPT for various purposes — including investing for many years now, and the pros definitely outweigh the cons — when you use it correctly.

The biggest advantage? It democratizes financial education. Complex investing concepts that used to require expensive courses or financial advisors are now accessible to anyone.

The biggest risk? Overconfidence. ChatGPT can make you feel like an expert quickly, but relying on raw, unvetted information without the actual knowledge and proper verification tools is dangerous in the stock market.

AI portfolio guidance — and more

If building an intelligent portfolio is your objective, you could be up and running with Zen Strategies in 10 minutes a month. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48.01%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund. Plus, there’s a 50% off launch offer.

Final Thoughts: Is ChatGPT a Good Investing Companion?

ChatGPT for investing is an excellent research assistant — not a replacement for thorough analysis.

After using it extensively, I can confidently say it’s revolutionized how I approach investment research. The speed of idea generation and concept explanation is game-changing, especially for exploring new sectors or strategies.

But — and this is crucial — it works best when paired with verified data from trusted platforms like WallStreetZen, Seeking Alpha, and TradingView.

My recommendation? Start with a few simple prompts today. Ask ChatGPT to explain a concept you’ve always wondered about or generate some stock ideas based on your interests. Then take those ideas and run them through proper analysis tools.

The combination of ChatGPT’s flexibility with real financial data is incredibly powerful. Just remember: in investing, verification is everything.

Next step: Try asking ChatGPT for 3 stocks in a sector you’re curious about, then use WallStreetZen to check their actual fundamentals and ratings.

FAQs:

What is the best way to use ChatGPT for investing?

The best way to use ChatGPT for investing is as a research assistant and educational tool, not a source of final investment decisions. Always verify its suggestions with reliable financial data platforms like WallStreetZen or Seeking Alpha before making any investment decisions.

Can ChatGPT predict the stock market?

ChatGPT can attempt to make stock market predictions, but you shouldn't blindly rely on them. ChatGPT stock picks are based on pattern recognition from training data, not the specialized analysis that market experts use. Always back up any "predictions" with facts from a trusted stock research platform like WallStreetZen.

Large language models like ChatGPT are fundamentally different from human reasoning — they'll present predictions confidently even when the information is outdated, incomplete, or completely inaccurate.

ChatGPT can help you understand market concepts and generate ideas for research, but treating its predictions as reliable forecasts can be dangerous.

Investors should always do their own research and verify any AI-generated predictions through reliable tools and expert analysis before making investment decisions.

Does ChatGPT give personalized financial advice?

ChatGPT does not provide personalized financial advice and explicitly states it's not a licensed financial advisor. When using ChatGPT for investing, treat its responses as educational information and general ideas rather than advice tailored to your specific financial situation, risk tolerance, or investment goals. Always back up any stock picks from ChatGPT with traditional research tools like WallStreetZen.

Is ChatGPT good for picking stocks?

ChatGPT can generate stock ideas and explain the reasoning behind potential picks, but you shouldn't rely on chatgpt stock picks alone. Its suggestions are based on general knowledge that may be outdated and don't include real-time financial data. A winning combo is combining the ChatGPT prompts in this post with traditional fundamental checks with a system like WallStreetZen's Zen Ratings.

Use ChatGPT for initial ideas, then verify everything through comprehensive financial analysis tools like WallStreetZen to check the fundamentals before you invest.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.