You came here with a simple question:

What’s the Best AI Stock Screener?

Here’s our take:

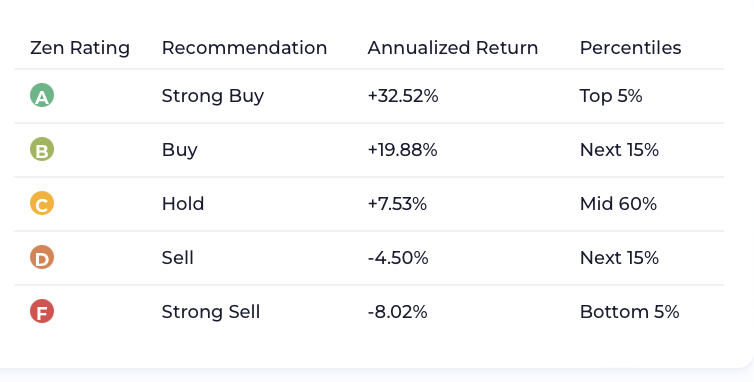

Zen Ratings stands out among AI stock screeners, with market-beating results: stocks rated “A” using this system have historically generated an average annual return of 32.52%.

Not only does this quant ratings system include an AI model with 20+ years of neural model training, but it also includes over 100 traditional due diligence checks in six key areas proven to drive stock growth for the long haul: Financials, Growth, Momentum, Safety, Sentiment, Value.

In short: Not only does it leverage the awesome power of AI, but a thorough review that incorporates tried-and-true analysis.

It’s free to get started with Zen Ratings; if you find as much value in the service as we think you will, it’s just $19.50/month for a Premium subscription, a lot more affordable than most AI stock screeners out there. You can try it stress-free with a 2-week trial for just $1. See plans here.

Now, let’s take a closer look at Zen Ratings and more AI stock screeners to consider:

The Top 6 AI Stock Screeners in 2026

1. Zen Ratings

- Overall Rating: 4.5 / 5

- Cost: Basic plan available for free; $1 for a 2-week trial; Premium plan available for $19.50 per month if billed annually. See plans

- Track record: Average annual return of 32.52% for stocks rated A, 19.88% average annual return on B rated stocks

Zen Ratings operates by evaluating more than 4,600 equities on the grounds of 115 proprietary factors, split up into 7 Component Grade ratings, each day.

Once that’s done, the top 5% of equities receive a Zen Rating of A — while those between the 95th and 80th percentile receive a B rating.

Why is this important? Rigorous backtesting has determined that a portfolio consisting of A-rated stocks would have provided an average annual return of 32.52% starting in 2003.

In contrast, a portfolio consisting solely of B-rated stocks would have provided a lesser, but still impressive (and market-beating) return of 19.88% per year.

Here’s the kicker — Artificial Intelligence is one of the 7 Component Grade ratings. To derive an AI rating, the system uses a neural network trained on more than 20 years of fundamental and technical data.

Related reading: How Can AI Help My Stock Investing?

Before the addition of the AI Component Grade rating, stocks with a Zen Rating of A provided an average annual return closer to 28%.

The AI rating incorporates various cross-validation techniques to avoid overfitting — in this instance, honing in too much on equities that performed well only in specific circumstances.

Now, let’s take a minute to discuss the mechanics of the screener itself. Since it covers roughly 4,600 stocks, even focusing on the top 5% would leave an investor with roughly 230 equities to analyze.

This is where the granularity of the Zen Ratings system comes into play — as the Component Grade ratings allow investors to quickly find stocks that are strong in the areas that appeal to them — whether that be, for instance, Value, Growth, Sentiment, or Momentum.

This ability to narrow down the search and hone in on what fits your particular criteria or strategy is, at the end of the day, why I think Zen Ratings is the best AI stock screener on the market today.

Everything we’ve mentioned up to now is geared toward the DIY side of the aisle — but if you’re interested in a more guided, human touch, our Editor-in-Chief, Steve Reitmeister, puts his decades of market experience to good use by constructing the exclusive 18-stock strong Zen Investor portfolio by leveraging both his own expertise and the outlook of top-rated Wall Street researchers.

What you get with a Premium membership:

- Full list of A-rated stocks

- Versatile screener that covers more than 4,600 equities

- Consistently-updated list of Zen Rating upgrades / downgrades

- Strong buy picks from top-performing Wall Street analysts

- Latest analyst forecasts

2. TrendSpider

- Overall Rating: 4.5 / 5

- Cost: Starts at $54 per month

- Track record: Depends on trading strategy

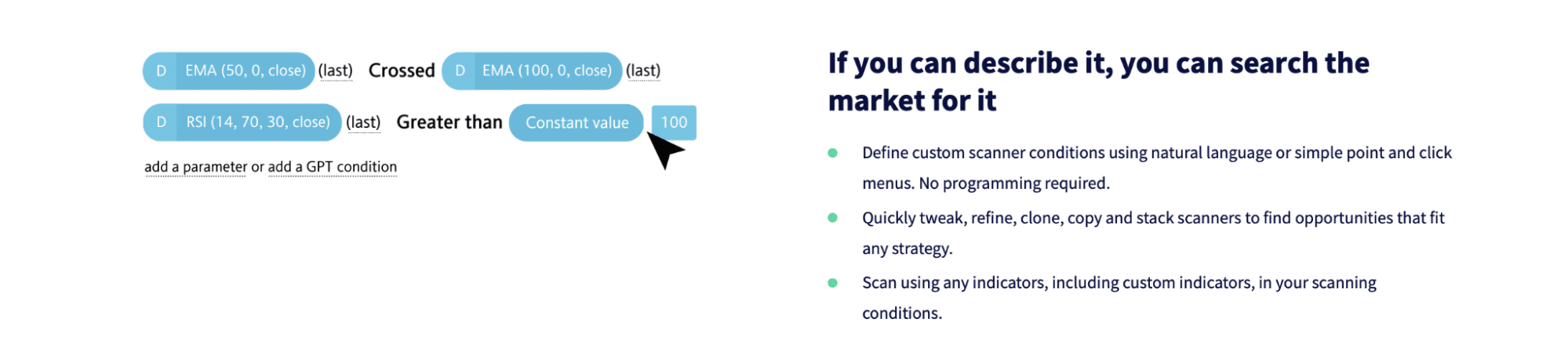

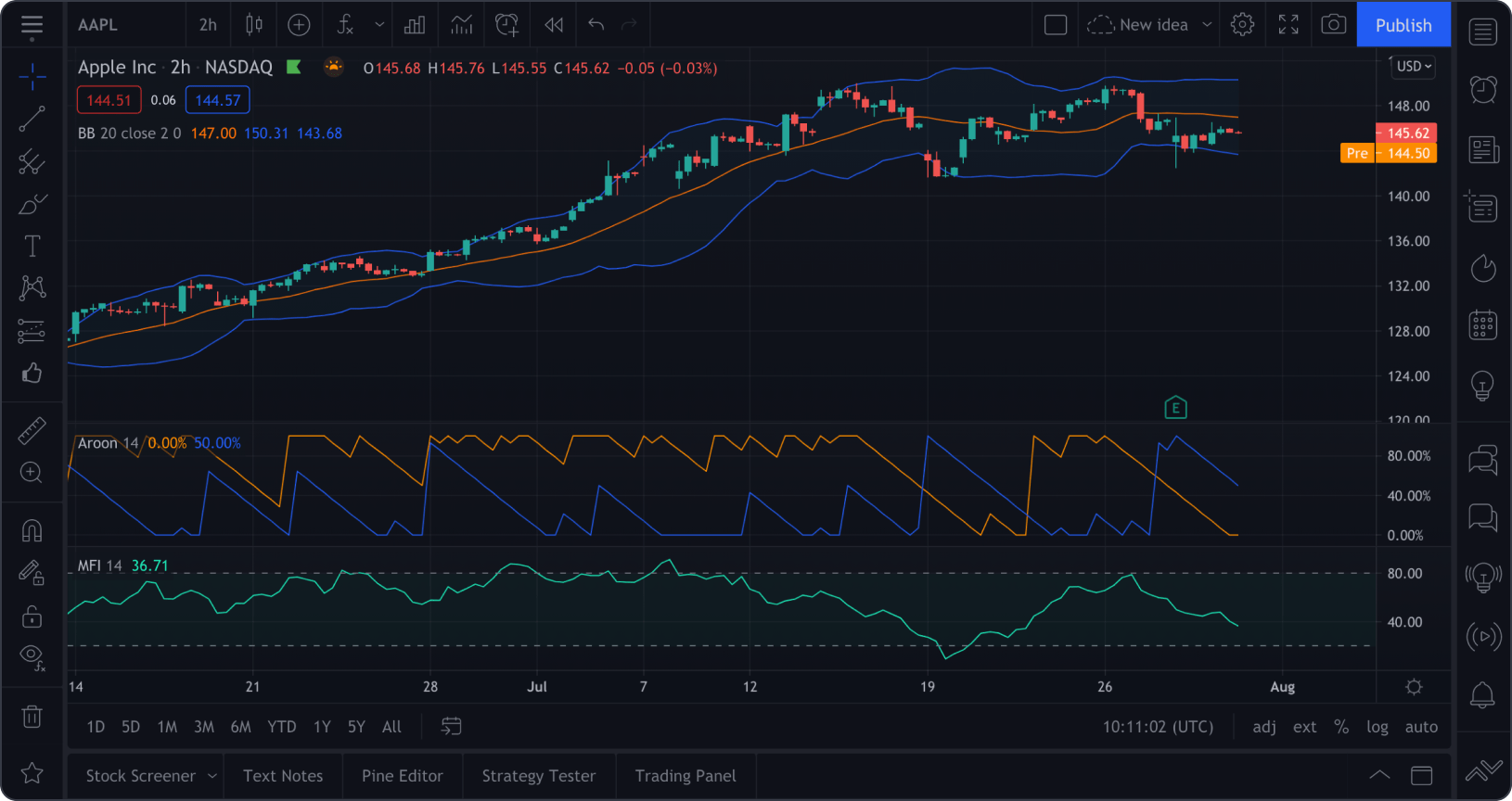

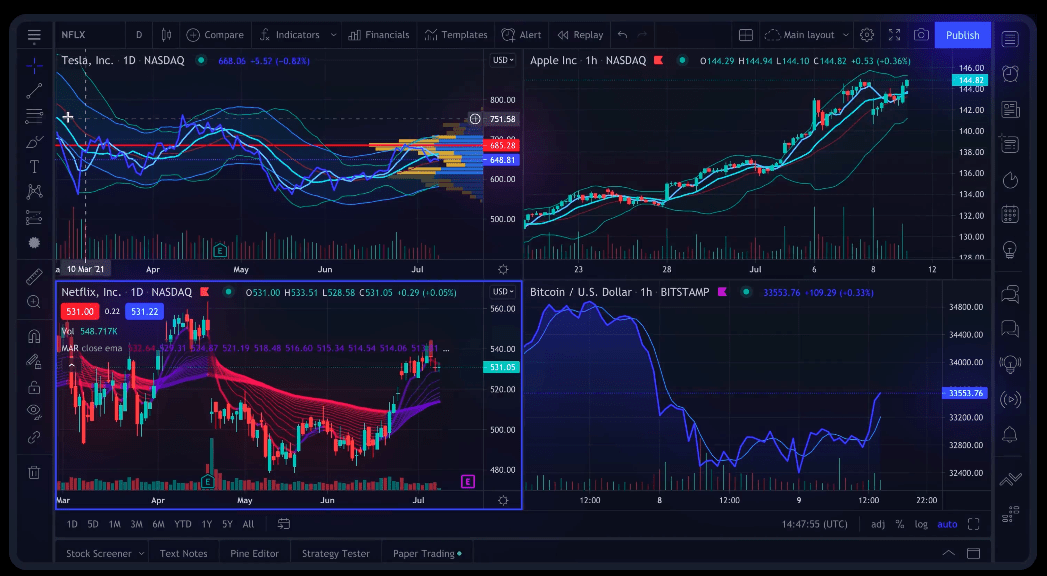

TrendSpider is one of the most comprehensive and advanced AI stock screeners on the market, and it caters primarily to traders heavily reliant on technical analysis.

Although the platform’s artificial intelligence features are varied and tackle a variety of use-cases, the gist is always the same — saving time through automation.

Users can leverage automated multi-timeframe analysis to detect trends, charting tools that draw support and resistance zones automatically, a bevy of backtesting tools, more than 700 automatically-generated smart watch lists, as well as TrendSpider’s AI Strategy Lab, which identifies entry signals. The latter is prominently featured in our blog post about the best AI stock predictors.

There’s also a degree of versatility at play in terms of how approachable an AI stock scanner TrendSpider is.

Beginners or those with little in the way of technical knowledge can “talk” to the screener — simply describe a particular condition (for example, EMA 50 crosses EMA 100), and narrow down their search — while veterans can use and tweak pre-built machine learning models or create their own ones.

To boot, TrendSpider also offers traders the ability to create an automated trading bot — and although there’s always a degree of caution that should be exercised, on the whole, it wouldn’t be too much to say that the platform allows you to automate just about every step of the trading process.

Related reading: The Best AI Trading Bots in 2026

There’s a strong argument to be made for TrendSpider as the best AI stock screener on the market — however, we’d have to give the edge to Zen Ratings, purely on the basis of price and intuitiveness — but if automation is what you’re after, TrendSpider is the way to go.

What you get with membership:

- Automated support and resistance charting

- Multi-timeframe analysis

- Backtesting tools

- The ability to create an automated trading bot (5 to 50 in total, depending on plan)

- 1-minute charting

- Depending on the particular plan, 1 to 3 yearly 1 on 1 training sessions

- Automated chart pattern recognition

3. Trade Ideas

- Overall Rating: 4.0 / 5

- Cost: Starts at $89 / month

- Track record:

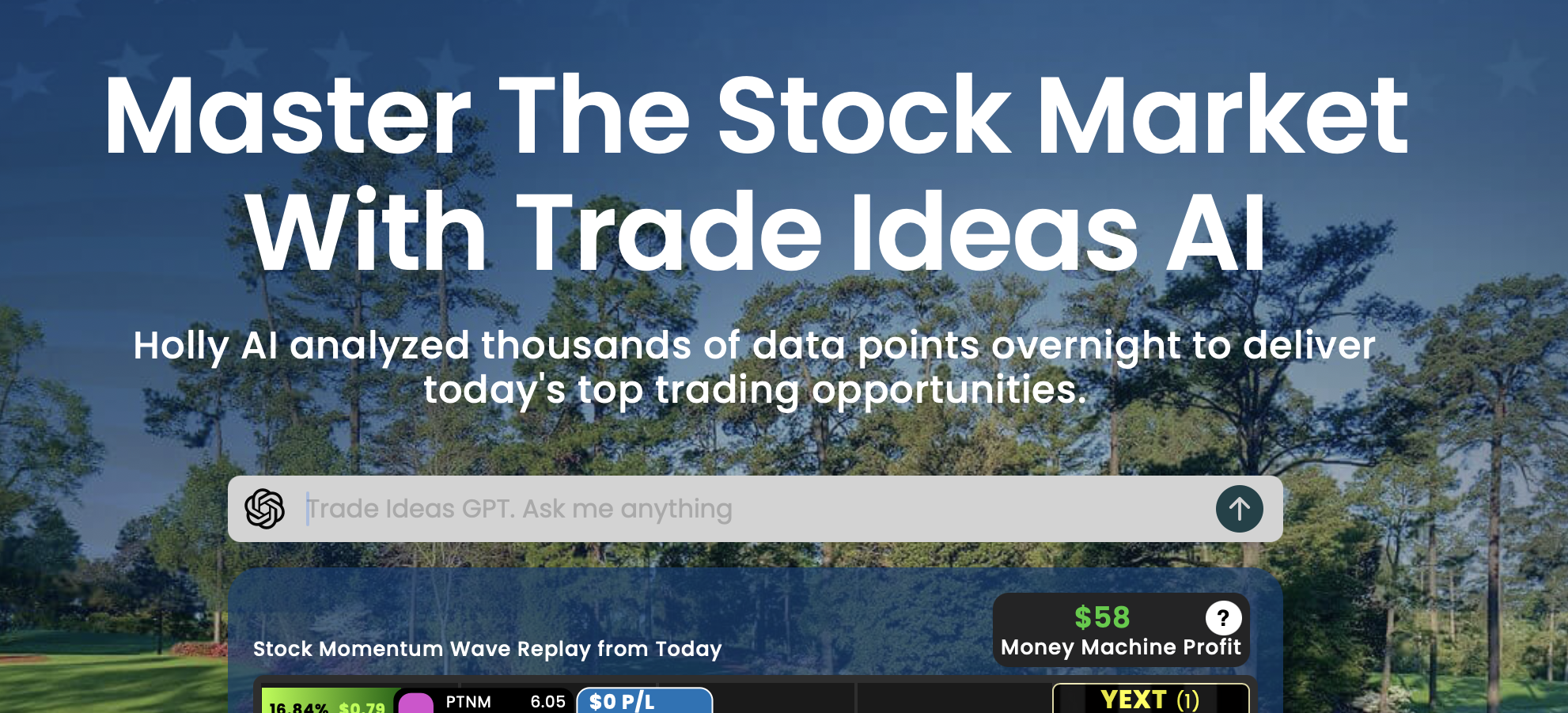

Trade Ideas is a stock screener AI that syncs up with your brokerage of choice, allowing for 1-click trading directly from the chart — which, in turn, lets you focus on Holly’s recommendations without it feeling like too much multitasking.

Who is Holly? The platform’s virtual assistant, based on ChatGPT architecture.

Holly monitors market data constantly, and runs thousands of backtests with dozens of strategies once the trading session has ended to provide you with a wide variety of ideas as soon as you log on.

Holly utilizes 60 curated algorithms — but there’s a small catch. The entire platform is based around short and medium-term trades.

Related reading: Trade Ideas Review: Is the AI Stock Screener Legit?

While the assistant’s recommendations will be of great use to day traders and swing traders, as they include detailed risk assessment, stop-loss and take-profit recommendations, long-term investors likely won’t derive much benefit from this particular AI stock screener.

With that being said, if short-term trading is more your style, you will get your money’s worth for the admittedly steep price.

Holly crunches an incredible amount of information, factoring in price and volume data, a variety of technical indicators, and even fundamental data such as earnings, news sentiment, and industry performance.

Depending on the degree of customization you’re after, you can either opt for the platform’s curated trade ideas or customize parameters to your own liking. Find out more in our detailed Trade Ideas review.

What you get with membership:

- Real-time market data

- Up to 10 charts on 1 screen, with customizable layouts

- Paper trading account

- 1-click trading

- Virtual assistant Holly

- 20 curated trading templates

- Customizable stock screening filters

4. Tickeron

- Overall Rating: 4.5 / 5

- Cost: Free plan available, but quite limited. Paid plans start at $30 / month if billed annually

- Track record: Varies — up to 85% in the case of the platform’s tech and semiconductor stock trading bot

Tickeron is a trading platform that includes a robust stock screener AI. While there are plenty of interesting automation tools here — customizable virtual agents, for example, Tickeron’s biggest strength is its chart pattern recognition feature, which scans thousands of stocks and ETFs each minute in order to find trading signals.

Moreover, the AI stock scanner also attaches a success probability and certainty rating to each identified pattern — further narrowing down the search of prospective traders.

While most chart patterns appeal to short-term and medium-term traders, Tickeron also features a Trend Prediction Engine.

This AI-powered tool that leverages both historical and real-time data to ascertain the likelihood of a trend continuing or reversing — which will most likely appeal to traders operating with a longer time-horizon in mind.

With regard to pricing, there is a free plan available — unfortunately, this isn’t a free AI stock screener, as the free plan only supports basic functionality.

Moreover, almost every feature mentioned in this review (as well as in our longer, more detailed review of Tickeron) has a standalone price — so you’re free to mix and match what features you like, although the costs can rack up quite quickly.

What you get with membership:

- Automated stock chart pattern recognition with probability and certainty rating

- Virtual agents for automated trading

- Free plan available

- Trend prediction engine

- Portfolio optimization

5. Seeking Alpha Premium

- Overall Rating: 4.0 / 5

- Cost: Available for 1 month at $4.95, renews at $299 / year)

- Track record: Varies depending on trading strategy

Right off the bat — Seeking Alpha Premium, like FINVIZ, is not an AI stock screener per se — but it has recently rolled out an interesting artificial intelligence feature that might be worth considering.

Seeking Alpha’s Virtual Analyst reports aim to answer two simple yet important questions — should I own this stock, and what are the most important things I should know about it.

Here’s how it works — the reports factor in a stock’s key attributes, like value, momentum, and growth potential, based on Seeking Alpha’s own sources, and use AI to summarize the most important talking points regarding a stock from Wall Street.

These reports are updated when new quantitative data becomes available or a stock receives updated coverage from an analyst.

While Seeking Alpha Premium’s AI reports, on the whole, don’t offer the depth of insight that some of its competitors do, there’s still a lot of utility in being able to check out the ratings to see whether or not a stock you’re interested warrants further research.

With all of that said, it’s only fair to note that this is just part of Seeking Alpha’s toolkit — for a more in-depth overlook, check out our Seeking Alpha review.

What you get with membership:

- AI-powered reports summarizing financial metrics and analyst outlook

- Access to a community of 7,000 contributors producing more than 10,000 articles a month

- Seeking Alpha’s proprietary rating system

- Earnings call transcripts

- Regular, non-AI stock screener

Looking for a Non-AI Stock Screener? Try These

I recognize that not everyone’s into AI screening stocks for them — if that sounds like you, consider these two bonus entries:

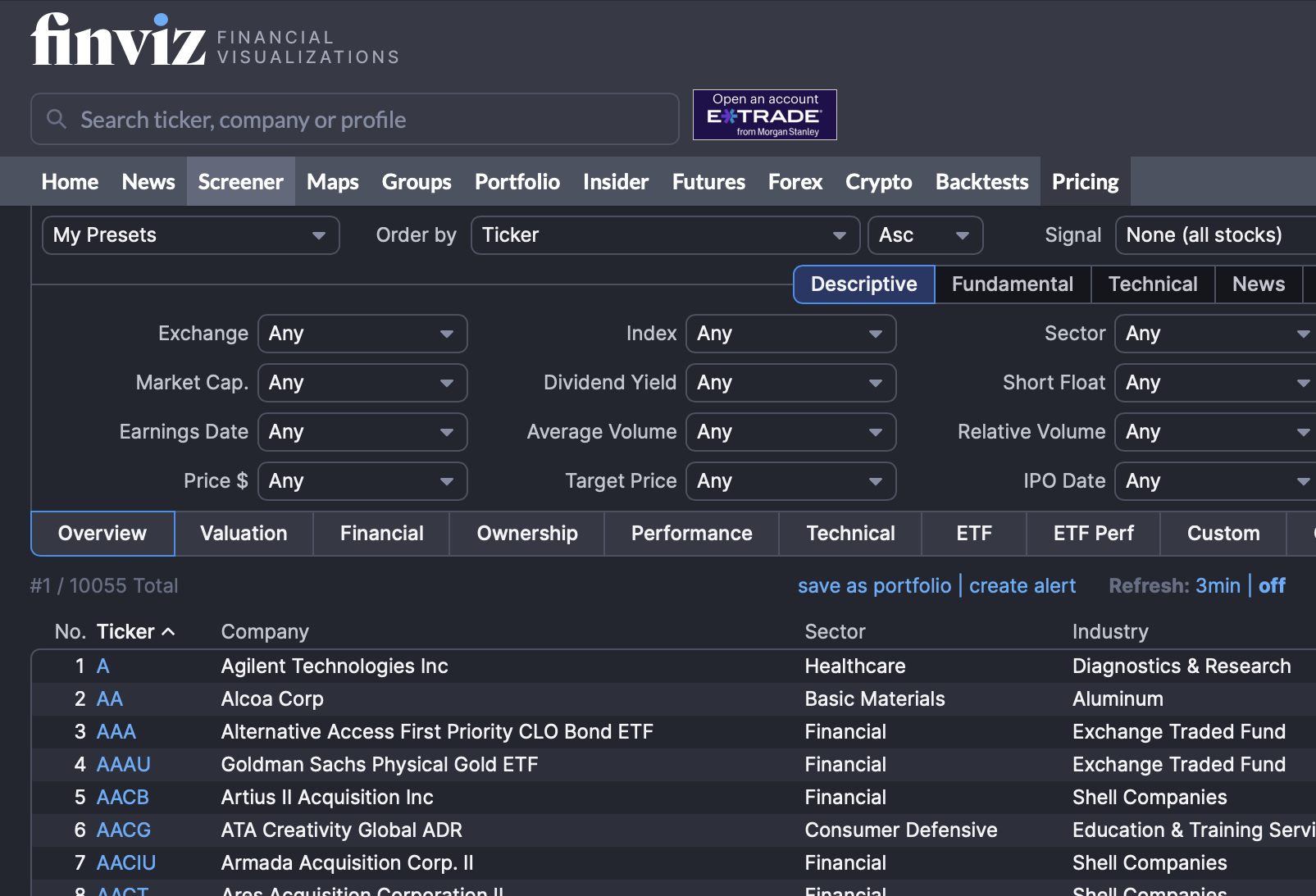

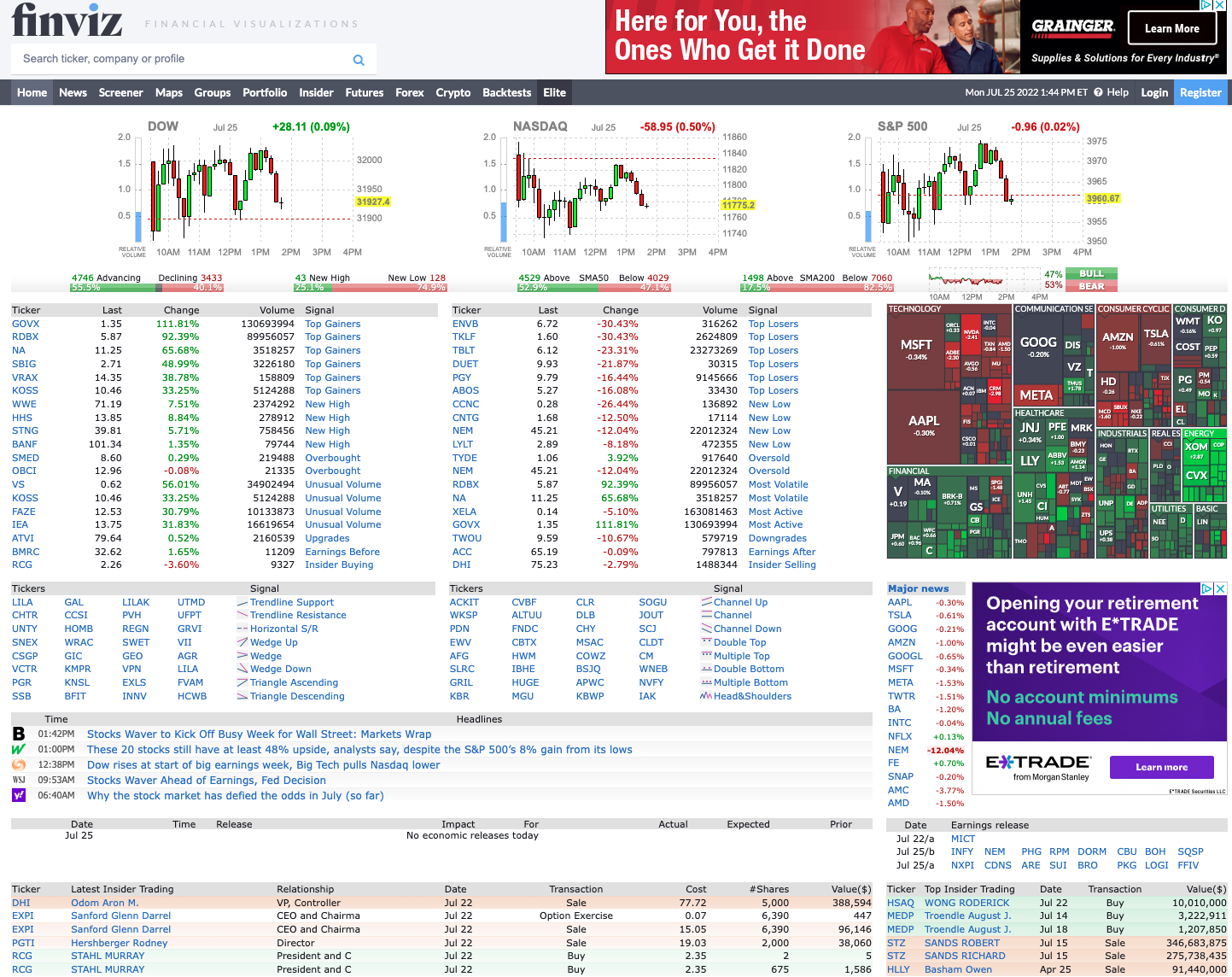

Finviz

- Overall Rating: 3.5 / 4

- Cost: Free plan available, premium plan available for $24.96 / monthly if billed annually

- Track record: Depends on strategy

Finviz is perhaps the most widely used free stock scanner on the market, with roughly 20 million monthly users. Only a small minority opt for the platform’s premium plan — but that’s not a bad thing.

I’d feel wrong not to include FINVIZ in any list of stock screeners — I’ve used it plenty myself, and it’s quite ubiquitous, FINVIZ is not an AI stock screener, whether you opt for the free version or the paid version.

That’s not to say that it is bereft of automation or timesaving features. FINVIZ has a robust backtesting engine, dynamic heatmaps, and automated chart pattern recognition — but as useful and responsive as those are, none of them technically fall under the AI umbrella.

Sure, there are a few automation features here and there — there’s a chart pattern recognition feature and a robust backtesting engine, but neither uses AI.

You see, Finviz offers a wide variety of powerful tools for free. The premium plan features real-time data, multi-layout and intraday charts, as well as more far-reaching fundamental data.

On the whole, however, apart from a rather niche group of day traders and swing traders, the free version of FINVIZ is more than satisfactory — with a significant caveat in the form of the platform’s numerous ads.

In terms of the stock screener, it’s quite thorough, and allows users to filter and sort equities by a wide variety of factors, grouped into three categories:

- Descriptive (exchange, market cap, stock price)

- Fundamental (Price-to-earnings (P/E), debt, return on equity)

- Technical (indicators such as moving averages (MA) and relative strength index (RSI))

While it doesn’t fit the bill of a free AI stock screener, there’s a reason why FINVIZ is so popular — it’s free, features first-class visualization tools, and offers an accessible way to construct as many as 50 portfolios.

The premium version might not be your cup of tea — but it’s quite likely that you can benefit from including FINVIZ in your toolkit in some capacity.

What you get with membership:

- Stock quotes, charts, and screener data (delayed or real-time, depending on plan)

- 50 stock screener presets for the free plan, 200 for the premium plan

- 50 portfolios for the free plan, 100 for the premium plan

- Financial statements going back 3 years / 8 years on the paid plan

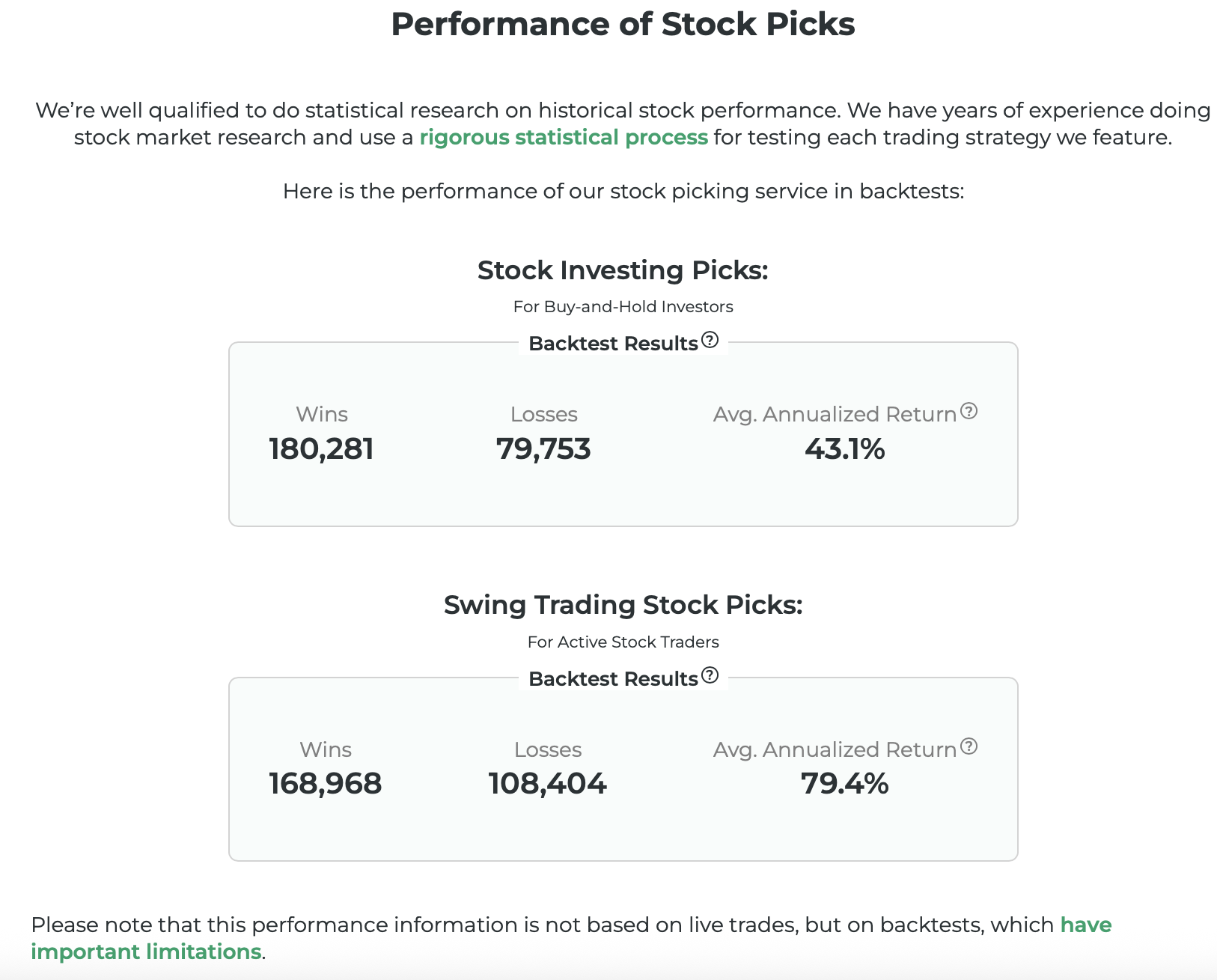

Stock Market Guides

- Overall Rating: 4.0 / 5

- Cost: Starts at $19 / month, up to $69 / month

- Track record: Varies depending on trading strategy (43.1% for stock picks, 79.4% for swing trade alerts, 150.4% for options trade alerts, on an annualized basis according to backtests)

Last but not least, I think it’s a good idea to include Stock Market Guides as our last entry for today — despite it not being a pure-play AI stock screener.

Here’s how it works — the team behind Stock Market Guides spent years backtesting a wide variety of strategies to narrow the search down to a few select, profitable approaches.

With the backtesting taken care of, they constructed a system that alerts users whenever a high-percentage trade opportunity arises.

The approach isn’t revolutionary, but it works. Our editor gave the app a test drive and had high praise for it — for a more in-depth account of the service’s pros and cons, I recommend checking out our in-depth Stock Market Guides review.

In short — the claimed performance holds up, the customer support is great, and Stock Market Guides is quite fairly priced. You can choose between stock picks, swing trade alerts, and options trade alerts — but keep in mind that, in all 3 cases, the focus is primarily on active trading, so passive investors likely won’t derive much benefit from the platform.

As a neat bonus, each of the scanners offered by Stock Market Guides has a free version, and while they don’t come with alerts, they still offer value by highlighting when stock chart patterns form.

What you get with membership:

- Stock, swing trade, and options trade alerts

- Free plan with chart pattern recognition available

- Backtested strategies with solid historical performance

Should I Use an AI Stock Screener?

It’s impossible to overstate the influence that Artificial Intelligence has had on financial markets. However, people tend to focus on the ground-level changes — and sure, while the effects that AI has and will continue to have on the way most every industry operates are significant, AI has also changed the way investors approach stock research.

AI stock screeners are becoming ubiquitous — there’s no argument against the fact that having a tool at your disposal that draws on large datasets and provides reactive, up to date analysis is essential for keeping up with the competition.

With that being said, not every AI stock scanner is — so I’ve taken the liberty of reviewing some of the best, focusing on the costs, features, and track record of each.

Final Word: The Best AI Stock Screeners

While they’re a relatively recent phenomenon, AI stock screeners have already made their mark on retail investing.

With that being said, there are some clear limitations still in effect. None of these tools are perfect, and due diligence is still essential. Most (but not all) of the platforms and tools I’ve reviewed here are geared toward short-term and medium-term setups, so buy-and-hold investors won’t see as drastic or immediate of an improvement as stock traders will.

Lastly, there is still an accessibility barrier. If you’re looking for a free AI stock scanner, you’re not really left with many credible options. While that may very well change in the future, readers should definitely consider whether their budgets and their investing strategies mesh well with what is currently on offer.

FAQs:

Is there an AI stock screener?

Yes — there are quite a few AI stock screeners such as Zen Ratings, TrendSpider, or Tickeron that leverage machine learning, neural networks, and similar technologies to improve analysis, provide stock picks, or send out trade alerts.

Which AI is best for stock analysis?

In terms of pure-play stock analysis, Zen Ratings is the strongest contender, as it breaks down how a stock stacks up to the rest of the market in terms of seven proprietary categories — including an AI-powered factor that is based on a neural network trained on more than 20 years of fundamental and technical data.

However, we have to be fair — if you’re looking for short-term, technical setups, then TrendSpider or Trade Ideas will likely be a better fit for you.

Is there an AI for picking stocks?

Yes — while most AI stock screeners focus on identifying trading opportunities, the way that platforms like Zen Ratings, Tickeron, and Trade Ideas operate is much more in line with the traditional model of stock picking.

Is there an AI that tells me when to buy stocks?

Yes — in fact, most AI stock screeners, as we’ve mentioned, focus on short-term setups, and operate by sending out alerts to tell users when the opportune time to buy a stock has arisen.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.