Day trading has the magnetic pull of a get‑rich‑quick fairy tale … and Investors Underground (IU for short) has been one of the biggest names in the space since 2008.

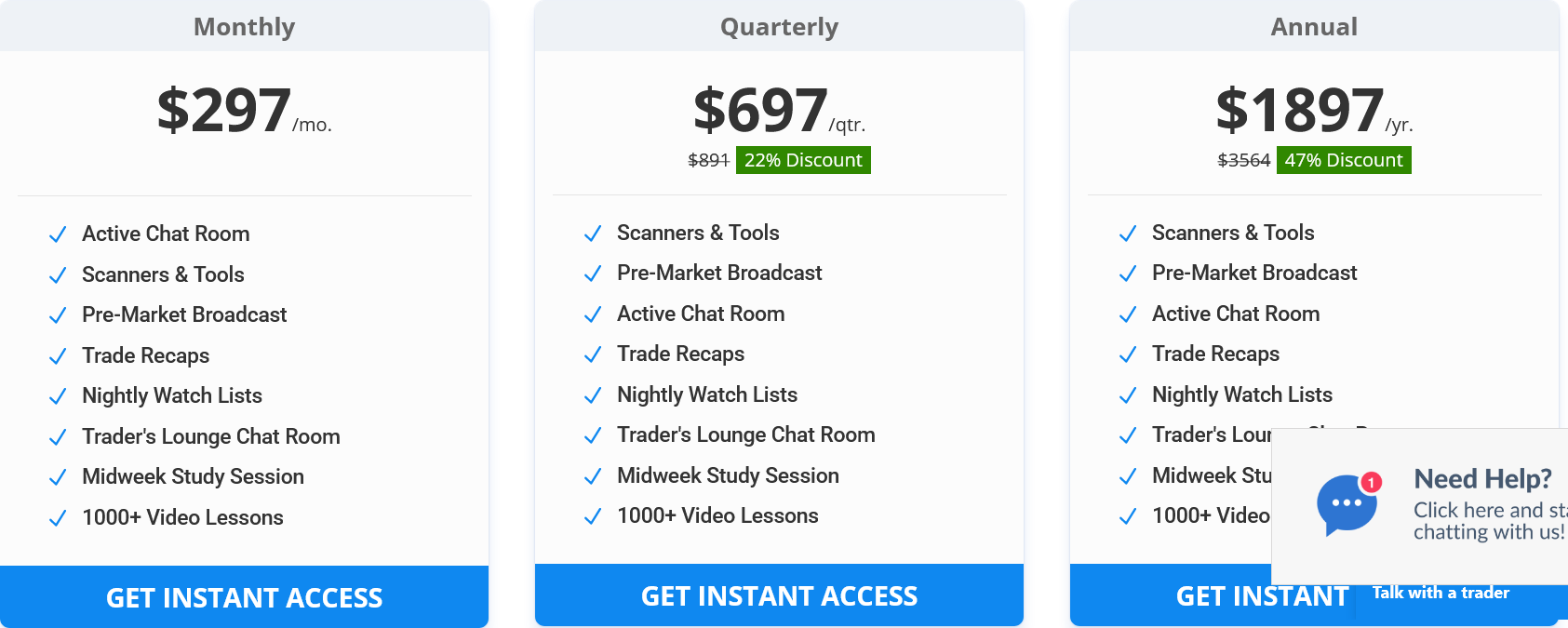

They charge $297 a month (or $1,897/yr) for their flagship membership … which begs the question: Is the Investors Underground strategy worth it?

I’ll tell you everything you need to know in the sections below.

Day‑trading not really your flavor? Skip the scalp‑fest and check out Zen Investor for slower, fundamentals‑first stock picks that don’t require watching your monitor 24/7. Here’s what you get with membership:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Key Features of Investors Underground

IU tries to be a one‑stop shop for active traders. Their value prop boils down to three major pillars:

- Chat Rooms – The heartbeat of the community … an idea-generation for daily trading opportunities.

- Courses – Structured education recorded by real traders. A combined 25+ hours of content.

- Tools & Scanners – Custom tech to spot momentum in real time. Scanners and filters to identify, research, and trade the best opportunities.

Let’s zoom in and take a closer look at each.

1. Chat Rooms

Most online trading “chat rooms” are just stream‑of‑consciousness tweet storms.

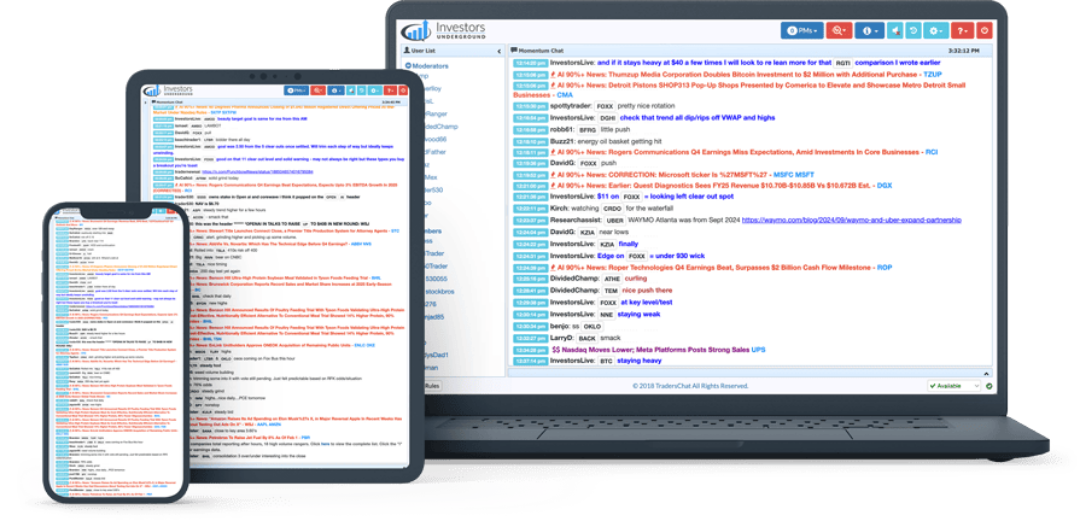

But IU’s chat is closer to a trading terminal.

Here’s why:

- Ticker Tagging automatically highlights symbols, so you don’t miss a hot mention.

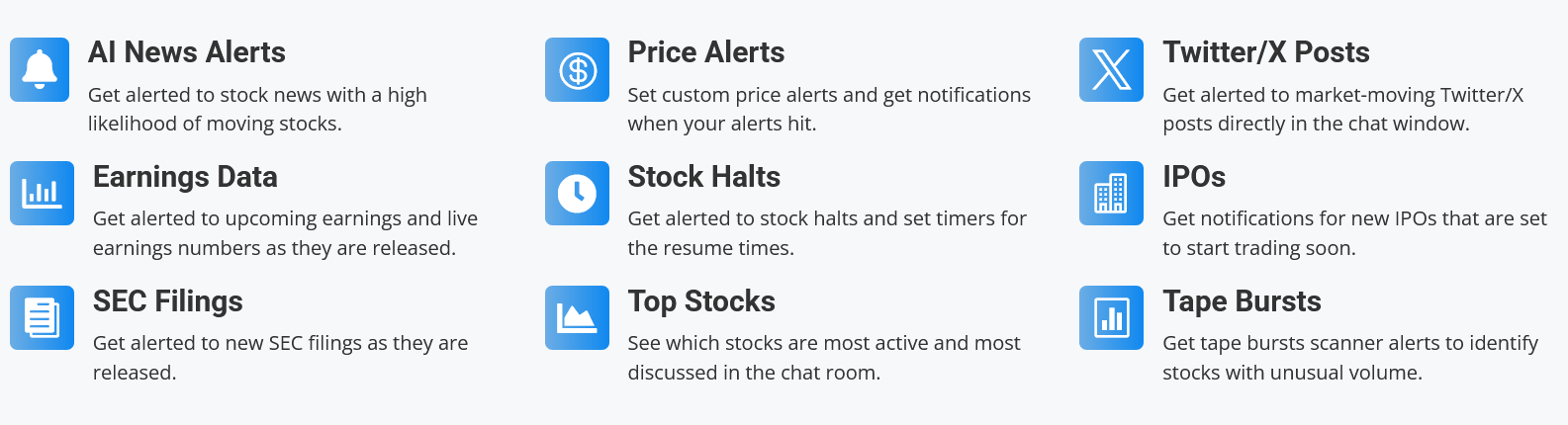

- Integrated News & Data Feeds – SEC filings, AI‑curated news, earnings pops, even tape‑burst alerts flow straight into the same window:

- Voice & Video Broadcasts – Lead mentors hop on mic pre‑market to outline game plans, then call out moves in real time.

- Custom Filters & Audio Alerts so you can silence the noise and only hear when $NVDA or $TSLA breaks your level.

If you’re trading part‑time, the replays and full chat history come in clutch. You can scan what happened at lunch or after work without staring all day.

And the user interface for the chat works seamlessly across all your devices:

2. Courses

IU sells its core education via 3 courses that are all sold together (they don’t break them apart).

Here’s a high level overview of each:

Course | Length | Focus |

|---|---|---|

Textbook Trading | 8+ hours | Foundational patterns & risk management |

Tandem Trader | 12+ hours | Live, tick‑by‑tick trade recordings & advanced shorts |

Swing Trading | 6+ hours | Multi‑day setups, indicators & overnight risk |

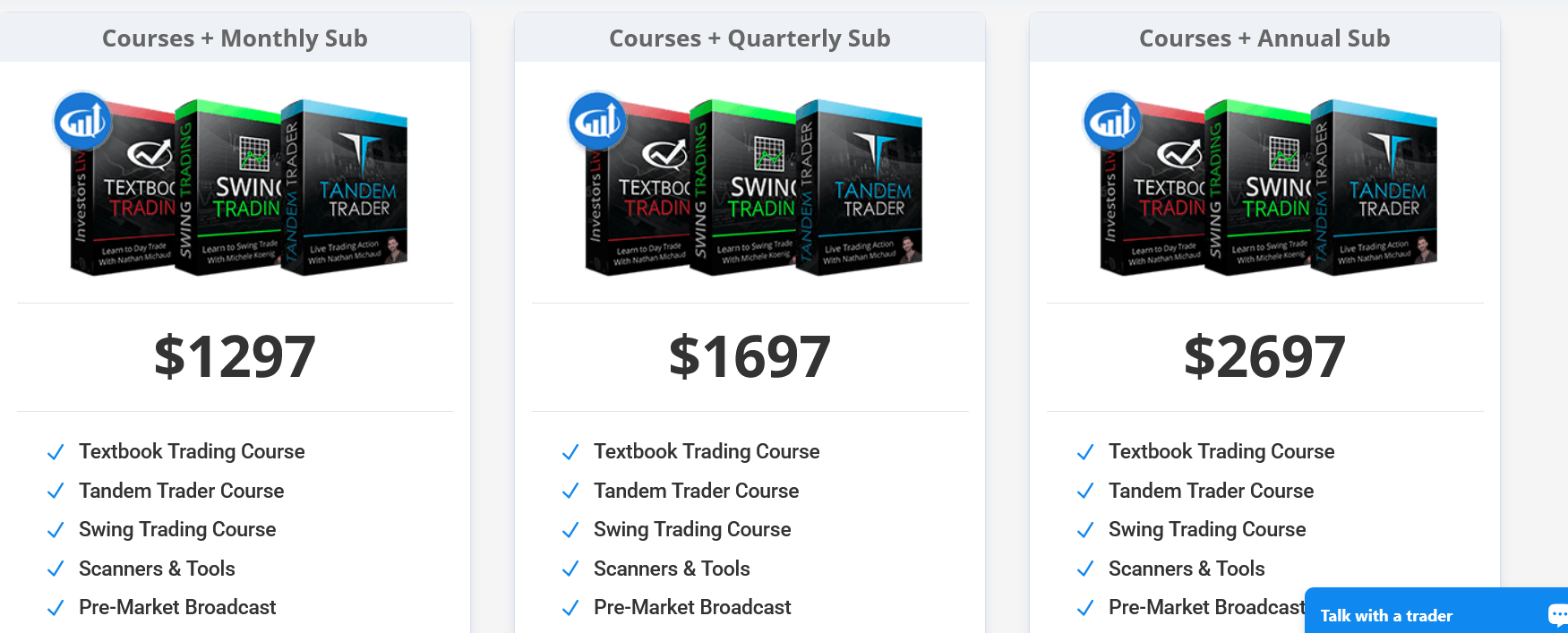

To access any of the courses, you’ll need to buy all three along with a monthly, quarterly, or annual subscription to the tools and community:

Yes, it’s steep … but you own the material for life, and Investors Underground reviews say the first hour of Tandem Trader alone paid for itself:

I’ll go into more detail on what’s included in each course below.

3. Proprietary Tools & Scanners

An IU membership includes tools and scanners so that you don’t need multiple subscriptions.

Here’s what single membership subscription gets you:

- Pre‑Market & Intraday Momentum – Filters by float, gap %, volume, you name it.

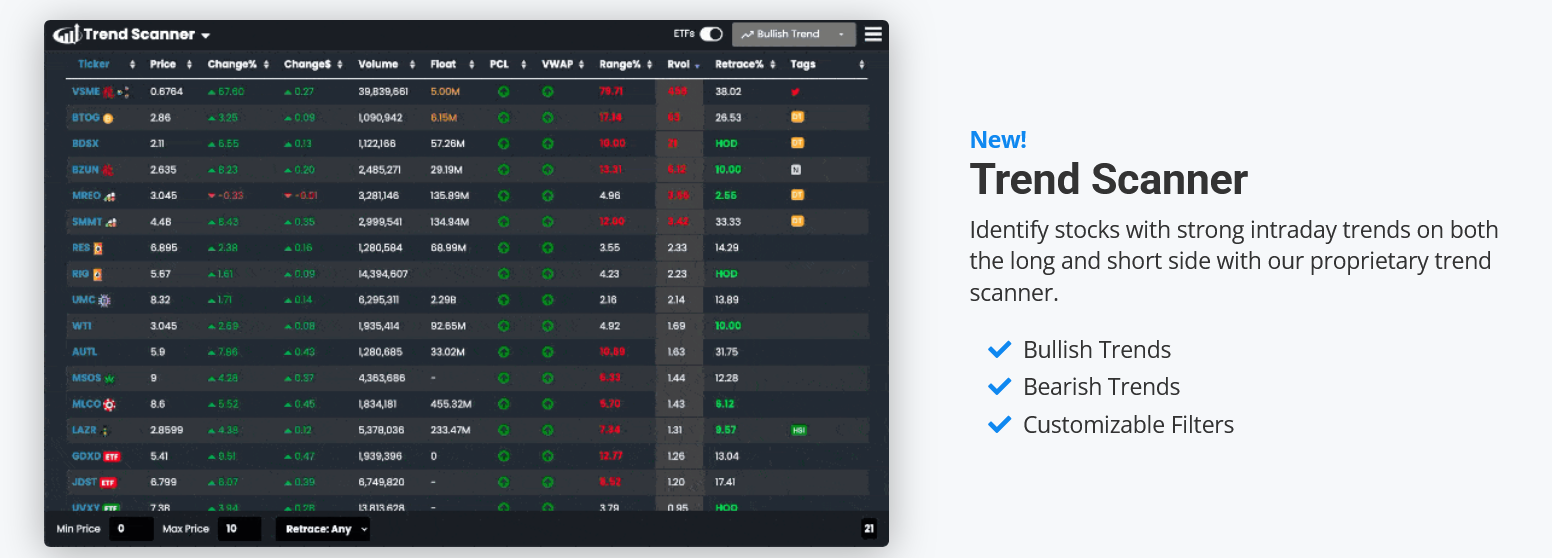

- Trend Scanner – Spots intraday bull/bear trends.

- Most Active & HOD/LOD lists – These real‑time tables are invaluable to traders because they spotlight:

- Most Active: the tickers with the highest trading volume right now, and

- HOD/LOD (High of Day / Low of Day): stocks printing fresh intraday highs or lows, so you can immediately zero in on the day’s strongest momentum movers (long or short).

- Unlimited Price Alerts, VWAP dings, halt timers, IPO alerts – everything you’d expect from pro software.

You can also easily scan for bearish or bullish trends, or create your own screens and filters:

For context, separate scanner platforms like Trade‑Ideas can run $100–$200/month alone for a single tool or way fewer tools. IU rolls all their scanners and tools into the base membership, which softens that $297/mo sticker shock. And the savings are significant (nearly 50% off) if you love the tools and decide to go for a yearly subscription:

Who’s Behind Investors Underground?

Nathan Michaud (better known on Twitter as @InvestorsLive) founded IU in 2008 after cutting his teeth in the wild west of penny stocks. He’s been trading since 2003, so over 20 years.

He trades transparently, livestreaming executions and posting nightly recaps that cover both wins and losses. His favorite mantra is “respect your risk,” a philosophy that permeates all IU education.

Many successful Twitter and YouTube traders cite Nate’s Textbook Trading course as their on‑ramp to profitability in Investors Underground reviews:

In an industry overrun with arm‑chair gurus, it’s refreshing that Nate still trades live with his own cash every day.

Nate also prides himself on how easy he is to access for members, saying:

“I’m only one private message away, and subscribers can count on a response to their question within eight hours 97 percent of the time. Additionally, we’re at it with a member-driven Q&A during our anything-goes weekend Webinar.”

Who Is Investors Underground For?

Full‑time day traders will get the most from IU because they can park the chat on a second monitor and mirror high‑conviction momentum plays.

Active swing traders also find value; the mentors publish nightly watch lists with clear entry and exit zones.

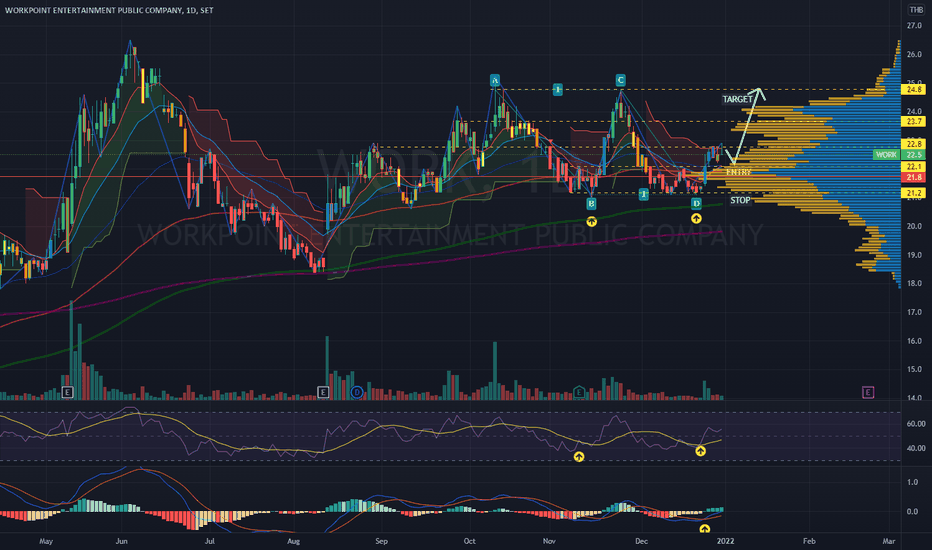

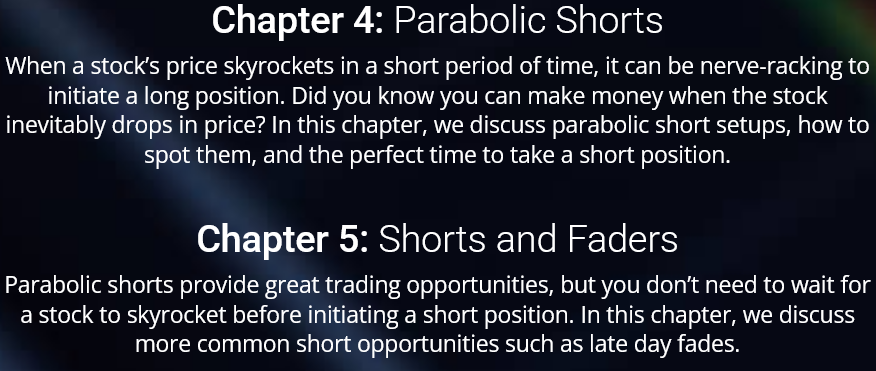

Short sellers benefit from advanced gap‑up and parabolic‑fade strategies—Tandem Trader is essentially a masterclass in controlled shorting, especially in chapters 4 and 5:

Finally, serious beginners who crave mentorship will appreciate IU’s structured curriculum and weekly study sessions, which are far faster than piecing together random YouTube clips.

By contrast, passive investors, buy‑and‑holders, or anyone who can’t watch the first hour of market action will likely feel overwhelmed with such an active strategy.

Day Trading Education

Again to access any of the courses, you’ll need to buy all three along with a monthly, quarterly, or annual subscription to the tools and community:

It’s not cheap, but you also have to consider the learning advantage your getting here. IU doesn’t drip‑feed you random YouTube clips. Instead, it offers these three in‑depth video courses that you purchase as a single bundle, then revisit on demand whenever you need a refresher. Here’s what’s included in each:

Textbook Trading – The All‑In‑One Day Trading Course

- 8+ hours of streaming video that you can replay as many times as needed.

- Market basics made simple—candlesticks, Level 2, float, scanners, brokers, and risk math.

- Actionable chart patterns such as ABCD, red/green flips, morning faders, and OTC breakouts.

- Real trade examples so theory instantly translates into practical execution.

- Lifetime reference value—each rewatch reveals new nuance once you have live trades under your belt.

Tandem Trader – Watch Professional Day Trading In Real Time

- 12+ hours of tick‑by‑tick footage—no cherry‑picked highlights, just raw screen capture.

- Level 2 mastery that teaches you to spot hidden buyers and shakeouts before they appear on the chart.

- Parabolic shorts and late‑day fades broken down frame by frame.

- Scanning strategies that demonstrate how Nate builds and updates his watch list as catalysts hit.

- Trader interviews with other IU mentors who share how they found consistency.

Swing Trading Course – Time‑Tested, Multi‑Day Strategies

- 6+ hours of video content that streams instantly on any device.

- Methodology and mindset for traders who prefer a slower, less stressful pace.

- Bullish and bearish chart patterns—flags, wedges, head‑and‑shoulders, and breakdowns.

- Key price levels using support, resistance, moving‑average confluence, and Fibonacci extensions.

- Trade management playbook covering alert setting, scaling exits, and managing overnight gaps.

You can see pricing and more details about what’s included in each course bundle here.

Risks and Downsides

Trading can be powerful, but it’s also harder than many people believe. So let’s not sugarcoat it.

Most retail traders lose money, and short selling can amplify losses without an effective stop.cEven so‑called “part‑time” traders must devote time to pre‑market prep, first‑hour focus, and nightly study.

Also keep in mind that in the United States, one of these is the Pattern Day Trader rule, which limits margin accounts under $25,000 to three day trades in a rolling five‑day window.

Remember IU’s rapid‑fire approach works best once you clear that threshold or trade through a non‑U.S. broker.

Alternatives to Investors Underground

Day trading isn’t the only way to grow your portfolio. These alternatives offer long-term strategies, diversified stock picks, and lower stress — perfect for part-time investors or anyone who doesn’t want to sit in front of trading screens all day.

Zen Investor

Who it’s for: Long-term investors who want a research-driven, hands-off approach.

Cost: $99/year ($79/year using this link!), $190 for 3 years, $197 for 5 years.

Why We Chose It:

Zen Investor helps you avoid the emotional rollercoaster of day trading by focusing on high-quality stocks with strong fundamentals. Our proprietary Zen Rating system analyzes 115 growth factors, helping you build a resilient, diversified portfolio of 20-30 stocks. This is ideal for investors who want reliable growth without spending hours glued to market screens.

Seeking Alpha

Who it’s for: DIY investors looking for independent stock research and crowd-sourced analysis.

Cost: Free for 14 days, then $2999/year (Get $30 off using this link)

Why We Chose It:

Seeking Alpha offers unmatched access to expert and community-driven research across thousands of stocks. You’ll get detailed financial breakdowns, earnings call transcripts, and quant ratings to help guide your decisions. It’s perfect for investors who want to dig deeper into the “why” behind stock movements without paying for pricey advisory services.

Final Word:

If you’re committed to mastering day trading or aggressive swing trading and can show up consistently, Investors Underground delivers real value for its $297 monthly price for all of its tools, and with its bundled course offerings.

It won’t guarantee profits (nothing does) but it supplies the tools, mentorship, and feedback loop required to tilt the odds in your favor.

Serious part‑time traders who respect risk and put in the work can justify the cost. Those seeking a more relaxed investment style might prefer services like Zen Investor or Seeking Alpha.

Happy trading—and remember, always respect your risk.

FAQs:

Is Investors Underground legit for day trading?

Yes, Investors Underground is a legit platform for day trading, offering a well-established community with one of the most active live trading rooms and highly rated educational content.

Based on our Investors Underground review, it’s especially popular for its real-time trade ideas. The Investors Underground strategy is focused on momentum and short-term setups.

How much does Investors Underground cost in 2025?

In 2025, an Investors Underground membership costs $297 per month or $1,897 annually, with bundle options available that include their day trading courses and access to their popular trading chat rooms.

Many traders believe the cost is justified for the level of mentorship and market resources provided.

Are Investors Underground’s day trading courses worth it?

Investors Underground’s day trading courses are worth it if you’re serious about mastering proven strategies, especially with their Textbook Trading and Tandem Trader programs that provide real trade examples and chart pattern education.

As you can see in our Investors Underground review, these courses are frequently recommended for both beginners and traders looking to refine their skills using the Investors Underground strategy.

Is Investors Underground good for small account traders?

Yes, Investors Underground is a good choice for small account traders looking to learn and access one of the most active live trading rooms in the industry.

However, as we say in our Investors Underground review, it’s important to stay mindful of risks, as small accounts can be more vulnerable in the fast-paced setups shared in their trading chat rooms.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.