Are you looking for a comprehensive investing platform that provides in-depth financial analysis? You’ve probably come across GuruFocus in your research.

The value investing platform has built a reputation among fundamental analysts and long-term stock pickers, particularly those who follow the Warren Buffett school of thought.

But is a GuruFocus review worth your time — and its hefty price tag?

I’ll break down everything you need to know about GuruFocus – from its unique features and reliability to how it compares to more affordable alternatives.

By the end, you’ll know who benefits most from this platform and whether you should sign up for the subscription or look elsewhere.

To Sum It Up: Is GuruFocus Worth It?

GuruFocus is a legit and useful service. However, it can be hard to navigate for newer investors and the price tag is steep — $424/year as a starting point to unlock the best features.

As such, I probably wouldn’t recommend GuruFocus to most investors — I’d suggest starting with WallStreetZen, where you can get both a Premium subscription ($19.50/month, $234/year) as well as a subscription to the Zen Investor stock-picking newsletter ($79 for a limited time) for a far lower yearly investment.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is GuruFocus?

GuruFocus wasn’t born in a typical Wall Street environment. It was created in 2004 by Dr. Charlie Tian, who holds a Ph.D. in physics, not finance.

After suffering losses during the dot-com bubble burst, Dr. Tian became fascinated with the methods of legendary value investors like Warren Buffett and Benjamin Graham.

This led him to create a platform that tracks the public portfolio moves of renowned investors – the “Gurus.” The concept was simple yet powerful: why start your investment research from scratch when you could begin by studying what the masters are buying and selling?

Over time, GuruFocus evolved beyond just tracking Guru trades. It’s now a comprehensive research platform incorporating extensive financial data, proprietary valuation tools, and educational content targeted primarily at:

- Value investors focused on fundamentals

- Long-term stock pickers managing their portfolios

- Financial advisors seeking detailed analysis and idea generation

- Investors who want to emulate successful value investing strategies

What separates GuruFocus is its deep commitment to the value investing philosophy. It isn’t a platform for day traders or technical analysis enthusiasts – it’s designed for investors who care about financial statements, intrinsic value, and long-term business quality.

Key Features of GuruFocus

Let’s take a look at some of the key features of GuruFocus.

Guru Trades Tracking

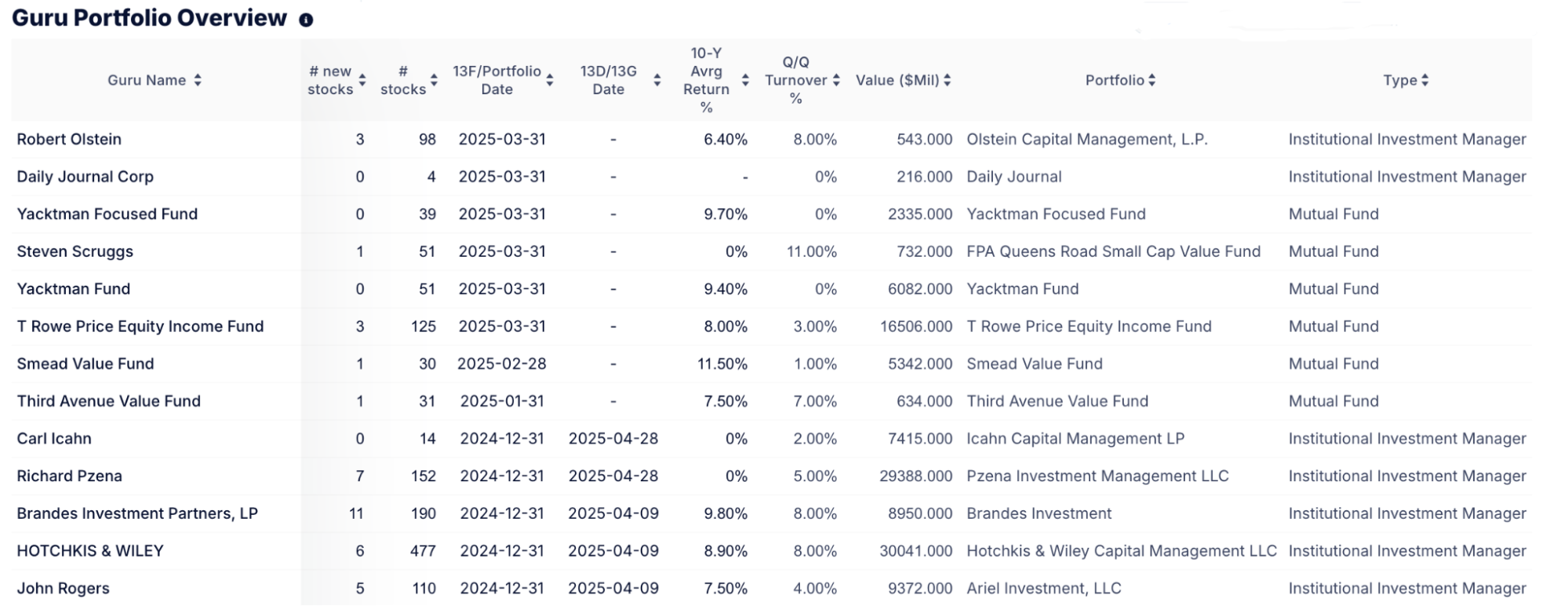

True to its name, one of GuruFocus’s core features is its comprehensive tracking of investment “Gurus.” The platform aggregates data from regulatory filings, to show what prominent investors buy and sell each quarter.

This feature allows you to:

- Browse individual Guru portfolios (from Warren Buffett to smaller, specialized fund managers)

- Screen for stocks based on Guru ownership or recent activity

- See the consensus among multiple Gurus on particular stocks

While insightful, it’s essential to remember that 13F filings have limitations. For example, the filings reflect positions from 45 days prior and do not include short positions or all types of investments.

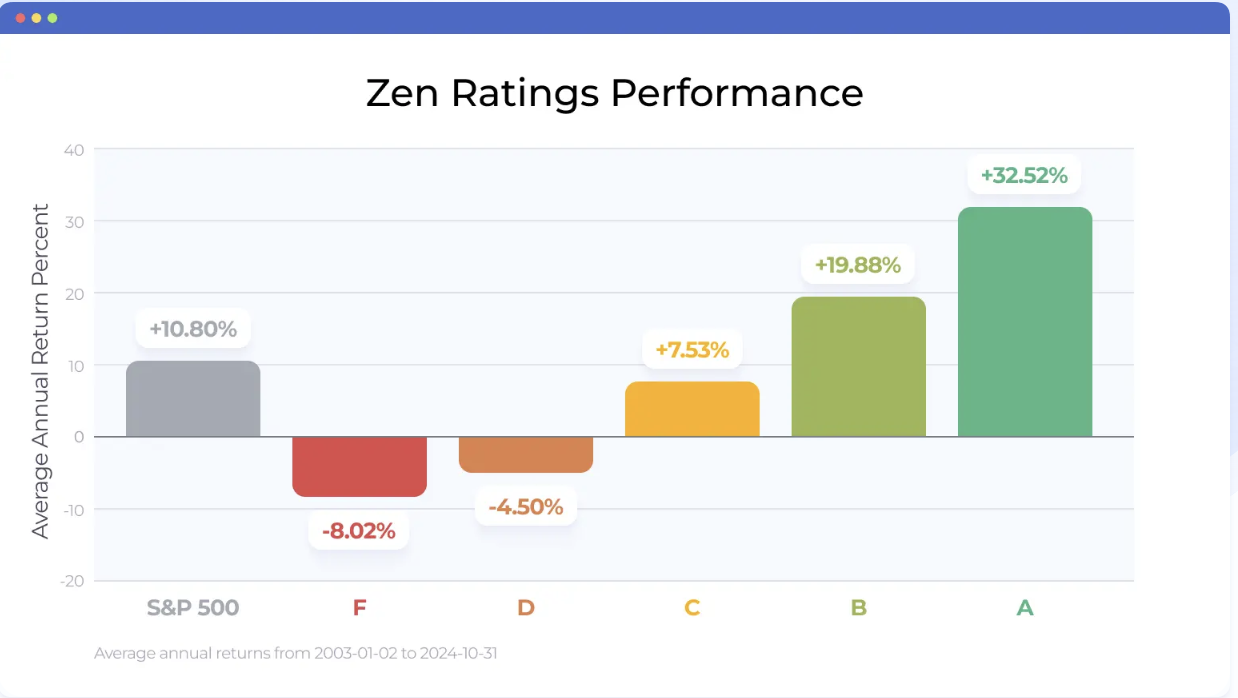

If you’re not confident in your ability to understand and utilize this information, a tool like WallStreetZen’s Zen Ratings system might be more in line with your skill level.

This quant ratings system distills 115 factors proven to drive stock growth into a single, easy-to-read letter score.

Within the overall letter score, you’ll find sub-scores called Component Grades. These let you look at things like Sentiment, which considers factors like analyst revisions, insider activity, and short interest. Essentially, it lets you see what “Smart Money” is following in a quick and easy way.

So instead of filtering through 13Fs, you can simply look at the Sentiment score and get a simpla analysis that weighs several other factors into the grade.

Stock Screener

The GuruFocus stock screener is the platform’s most powerful tool for serious value investors. It offers extensive filtering capabilities tailored to fundamental analysis:

- Standard metrics include P/E ratio, dividend yield, and market capitalization, among others.

- Financial strength indicators: Altman Z-Score (bankruptcy risk), Piotroski F-Score (financial health)

- Valuation metrics: PEG ratio, price-to-free-cash-flow, EV/EBITDA

- Guru ownership filters: Screen for stocks owned by specific investors

- Pre-built strategy screeners, such as Buffett-Munger and Peter Lynch etc.

The depth of filtering options is impressive, especially in higher-tier subscriptions that unlock advanced screening capabilities, including the use of custom formulas and screens based on historical data.

If navigating these screens seems tedious, you may want to consider WallStreetZen’s clean and easy stock screening tool. With it, you can zero in on the factors that matter most to you — for example, say you want to find stocks that are an excellent value but also have solid fundamentals.

One easy way to do that would be to filter by stocks with an overall A rating from the Zen Ratings, then to further filter by stocks that only have an A or B rating for Value. Using this simple screen, you can locate stocks that fit your criteria and have solid fundamentals.

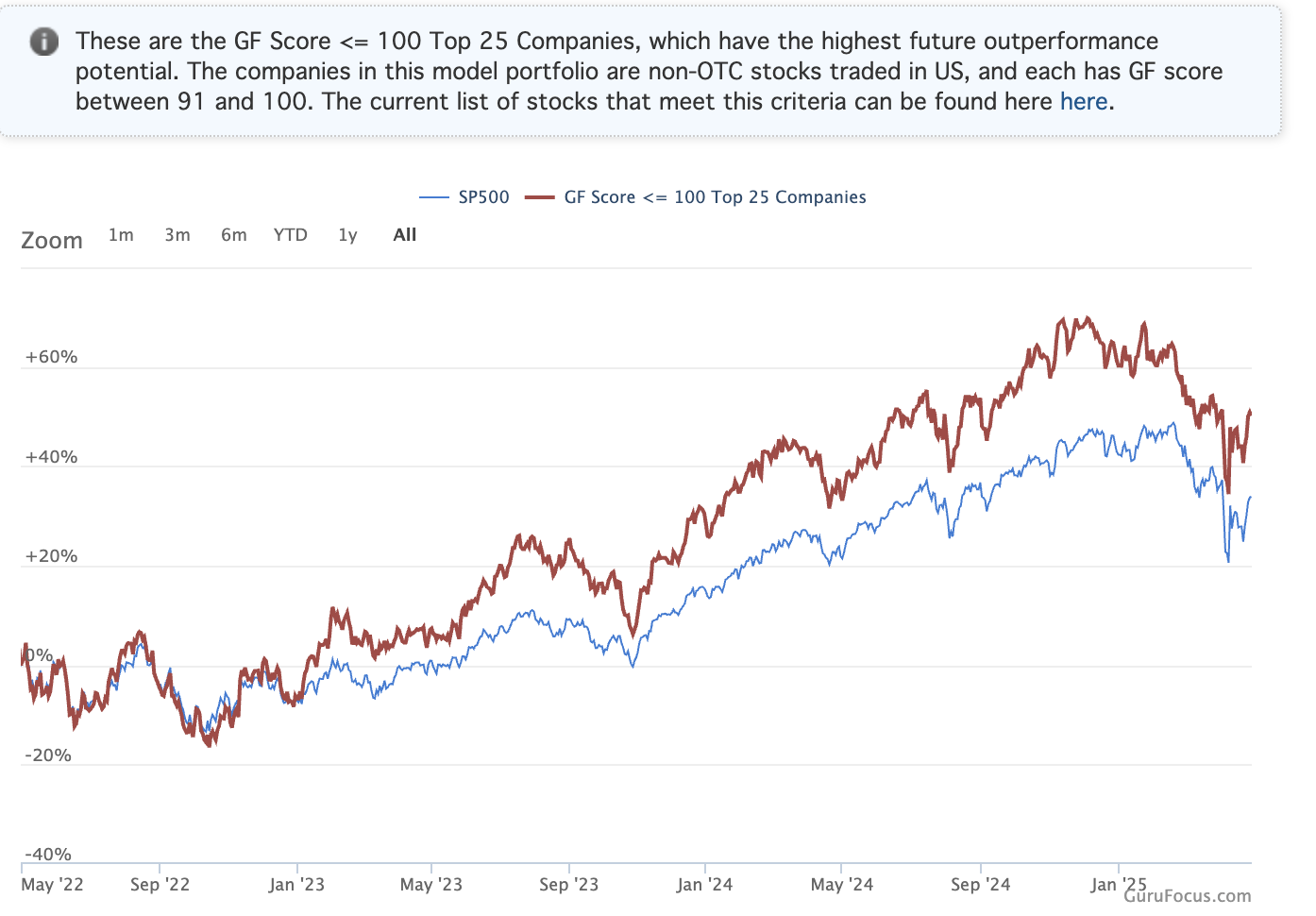

GF Score & GF Value

GuruFocus offers two proprietary metrics that attempt to simplify complex stock evaluation:

GF Score: A ranking system (0-100) that assesses a stock’s potential based on five key aspects:

- Financial strength

- Profitability

- Growth

- GF Value rank

- Momentum

GF Value: GuruFocus’s estimate of a stock’s intrinsic value, calculated using:

- Historical trading multiples

- The company’s past business growth

- Adjustments for estimated future performance

These tools aim to provide a quick snapshot of a company’s quality and valuation, though they shouldn’t replace your due diligence.

GuruFocus provides extensive historical financial data, with the depth varying by subscription tier:

- Premium: 10 years of data

- Premium Plus: 20 years

- Professional/Modernized: 30+ years (where available)

This data is presented through interactive charts that allow you to visualize price history alongside fundamental metrics, valuation indicators, and the proprietary GF Value line.

Warning Signs & Financial Strength Metrics

For risk-averse investors, GuruFocus incorporates automatic warning flags based on analyses like:

- Beneish M-Score (for detecting potential earnings manipulation)

- Unusual patterns in financial statements

- High debt levels or declining profitability

These warning signs are displayed on company pages, helping investors identify potential red flags before diving deeper.

Of course, for a far simpler view of stocks to avoid, you could also check out WallStreetZen’s “Top Stocks to Sell Now” Screener.

Portfolio & Watchlist Tools

GuruFocus allows users to:

- Track their holdings

- Monitor specific stocks of interest

- Receive alerts based on price movements or other criteria

Higher-tier subscriptions unlock advanced portfolio analysis capabilities, including simulating how your portfolio would perform if you followed specific Guru strategies. However, I don’t find anything about the watchlist or portfolio tools to be any more advanced than WallStreetZen or Stock Rover’s offerings.

Is GuruFocus Accurate?

A common question among potential subscribers is, “Is GuruFocus a reliable source?” GuruFocus sources its raw financial information from regulatory filings and reputable third-party providers, which is standard industry practice.

User feedback on forums like Reddit’s r/ValueInvesting community often praises the platform’s data accuracy, with comments like “I rarely, if ever, find errors in the data.”

Many users appreciate the depth of fundamental data available, comparing it favorably to competitors in terms of information and historical context.

However, there are some reliability considerations:

- Guru tracking limitations: The data comes from publicly available filings that are reported with a delay. Gurus may have already bought or sold positions between the filing date and when the data becomes public.

- Proprietary metrics: Tools like the GF Score and GF Value are based on GuruFocus’s internal models and historical data analysis. While helpful as analytical aids, they shouldn’t be treated as infallible predictors.

- Global data coverage: Data reliability and comprehensiveness vary by region, with the U.S. market having the most robust coverage.

In summary, is GuruFocus reliable? For its core financial data, users should understand the limitations of its proprietary metrics and Guru tracking features.

GuruFocus Pricing

One of the most significant considerations when evaluating GuruFocus is its price point, which is significantly higher than that of many competitors. The platform operates on a tiered subscription model:

- Free: Limited access to get a basic feel for the platform

- Premium: $424/year (U.S. market only, 10 years of financial data)

- Premium Plus: $1,273/year (adds Europe, Canada, Asia; 20 years of data)

- Professional: $2,323/year (global coverage; 30+ years of data; Excel Add-in, API)

GuruFocus offers a 7-day free trial and a 30-day money-back guarantee, allowing users to test the platform before committing to a sizable investment.

The difference in regional coverage between tiers is particularly notable. The base Premium plan focuses strictly on U.S. stocks, requiring a substantial price increase to access international data.

When investors search for “GuruFocus stock” information, they typically look for the platform’s stock analysis capabilities. GuruFocus offers comprehensive tools for evaluating stocks, including:

- Stock Summary Pages: Detailed overviews with financial metrics, valuation indicators, and proprietary scores.

- Industry Comparison: Tools that compare a stock’s metrics against industry peers.

- DCF Calculator: A discounted cash flow model to estimate intrinsic value.

- Insider Trading: Tracking of company insiders’ buying and selling activity.

The GuruFocus stock analysis tools are powerful for value investors seeking thorough fundamental research. However, the depth can be overwhelming for beginners, and the most valuable features are locked behind higher subscription tiers.

GuruFocus Vs. Competitors

GuruFocus has a lot to offer — but it’s also kind of expensive. If it’s more than you want to spend, consider some of these excellent alternatives:

GuruFocus Vs. WallStreetZen

Price: WallStreetZen is significantly more affordable, with Premium priced at around $234/year (billed annually at $19.50/month), compared to GuruFocus Premium at $424/year. You can also give the platform a try for just $1 — and WallStreetZen also offers a robust free tier.

How they compare: WallStreetZen positions itself as a more intuitive and user-friendly platform that makes fundamental analysis accessible to individual investors.

Its automated Zen Score provides quick multi-factor stock analysis, while the Top Analysts feature tracks Wall Street analysts with proven track records.

While GuruFocus offers unparalleled depth in historical data and Guru tracking, it can feel overwhelming and data-intensive. WallStreetZen simplifies the research process with clean interfaces and actionable insights, making it ideal for investors who want robust analysis without the complexity or high cost.

As a bonus? WallStreetZen also offers a stock-picking newsletter, Zen Investor. With the service, you gain access to a portfolio of high-potential stocks screened using the Zen Ratings system and hand-picked by 40+ year market veteran Steve Reitmeister (former Editor-in-Chief of Zacks.com).

For less than the cost of 1 year of GuruFocus, you could get both a Premium membership and a year-long subscription to Zen Investor ($99/year, or $79 using the links in this post).

GuruFocus Vs. Stock Rover

Price: Stock Rover plans range from approximately $80/year (Essentials) to $280/year (Premium Plus), substantially cheaper than GuruFocus’s $424+ pricing.

How they compare: Stock Rover excels with its powerful stock screener, robust portfolio analysis tools, and comparison capabilities. It offers up to 700+ metrics in higher tiers but focuses primarily on North American markets.

Related Reading: Check out our Stock Rover review

GuruFocus differentiates itself with Guru tracking, longer historical data, and broader global coverage in higher tiers. Stock Rover is compelling for investors focused on North American stocks who value advanced screening at a lower price point.

GuruFocus Vs. TipRanks

Price: TipRanks offers Premium (~$360/year) and Ultimate (~$600/year) plans, making it more affordable than GuruFocus’s higher tiers.

How they compare: While GuruFocus centers on fundamental data, historical analysis, and value investing principles, TipRanks aggregates alternative data points such as Wall Street analyst ratings, insider trading activity, hedge fund transactions, and news sentiment.

Related reading: Check out our TipRanks review

TipRanks appeals to investors who value consensus opinions and timely signals, while GuruFocus caters to those focused on long-term intrinsic value and financial statements.

GuruFocus Vs. Seeking Alpha

Price: Seeking Alpha Premium costs around $299 per year (get a free trial + $30 off using the links in this post), making it cheaper than GuruFocus Premium.

How they compare: Seeking Alpha’s strength lies in its vast library of crowdsourced investment research articles and community interaction, as well as its proprietary Quant Ratings.

GuruFocus, while offering some articles, is primarily a data and analytics platform focused on structured financial information and Guru tracking.

Seeking Alpha is ideal for investors who want diverse perspectives and qualitative analysis alongside quantitative tools, while GuruFocus better suits those who prefer to conduct in-depth quantitative analysis.

Final Word: Is GuruFocus Worth It?

After thoroughly analyzing this GuruFocus review, whether it’s worth the investment in 2026 depends heavily on your specific investor profile.

GuruFocus is likely worth it if you are:

- A dedicated value investor managing a substantial portfolio

- A professional analyst requires decades of historical financial data

- Someone who places a high value on emulating specific “Guru” strategies

- An investor needing comprehensive global market data (in higher tiers)

- Willing to pay a premium for depth of information over usability

GuruFocus is probably NOT worth it if you are:

- A beginning or casual investor with a limited budget

- Primarily focused on the U.S. market

- Someone who values intuitive interfaces and simplified analysis

- Looking for consensus analyst opinions or community perspectives

- Managing a smaller portfolio where the subscription cost represents a significant expense

A significant drawback of GuruFocus is unquestionably its price. Starting at $424 per year for U.S.-only data and quickly escalating to thousands for global access, it represents a substantial financial commitment that is hard to justify for many individual investors.

For those finding the cost prohibitive or the platform overly complex, WallStreetZen offers a compelling alternative with its user-friendly approach, automated analysis, and significantly lower price point.

It delivers the essentials of fundamental analysis without overwhelming users with excessive data or complexity.

Ultimately, GuruFocus remains a powerful, albeit expensive, tool for a specific niche: highly dedicated, data-driven value investors who need deep historical financials and place significant emphasis on Guru tracking.

For the broader audience of individual investors seeking affordable, actionable insights, more cost-effective alternatives like WallStreetZen will likely provide better value in 2026.

FAQs:

How credible is GuruFocus?

GuruFocus is generally considered credible for fundamental financial data, sourcing information from standard regulatory filings and reputable data providers. User feedback suggests the core data is accurate.

Is a GuruFocus subscription worth it?

Whether GuruFocus is worth its high subscription cost ($424/year, starting for US-only Premium, up to nearly $ 5,000/year for global access) depends on your needs.

The price might be justifiable for dedicated value investors or professionals managing large portfolios who require deep historical data and extensive international coverage.

What is better than GuruFocus?

The "best" platform depends on your specific needs. For instance, WallStreetZen is excellent for a more affordable and user-friendly platform with strong analyst tracking and automated fundamental analysis.

How much does GuruFocus cost?

GuruFocus has several subscription tiers (prices as of early 2025): Premium ($424/year, U.S. data), Premium Plus ($1,348/year, adds Europe/Canada/Asia), Professional ($2,398/year, global data, advanced tools), and Modernized ($4,997/year, international, multi-user). A limited free version and a 7-day trial are also available.

Can I buy GuruFocus stock?

No, GuruFocus stock is not available for purchase on public exchanges. GuruFocus is a privately held company founded by Dr. Charlie Tian and has not conducted an initial public offering (IPO).

Is GuruFocus DCF reliable?

The GuruFocus DCF calculator is a helpful framework, but like any DCF model, its reliability depends entirely on the inputs and assumptions used.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.