AI investing apps can make it easier to do things like find stocks to buy, balance your portfolio, and more. It’s not hard to see the time and energy-saving appeal.

However, not all AI apps are equal. It wouldn’t be too hard for an unknown provider to slap the words “AI-Driven” on a half-baked investment app and hope users just come to them. Such an app is likely to drive users to investment ruin.

To avoid that, let’s sort out the truth about the best AI Investing apps, filter out the best from the rest, and talk about how you can best use them. Here are the best 5 apps we’ve tried:

1. Zen Ratings

Cost: Free, though a WallStreetZen Premium account will help you make the most of them for $19.50 per month (billed yearly).

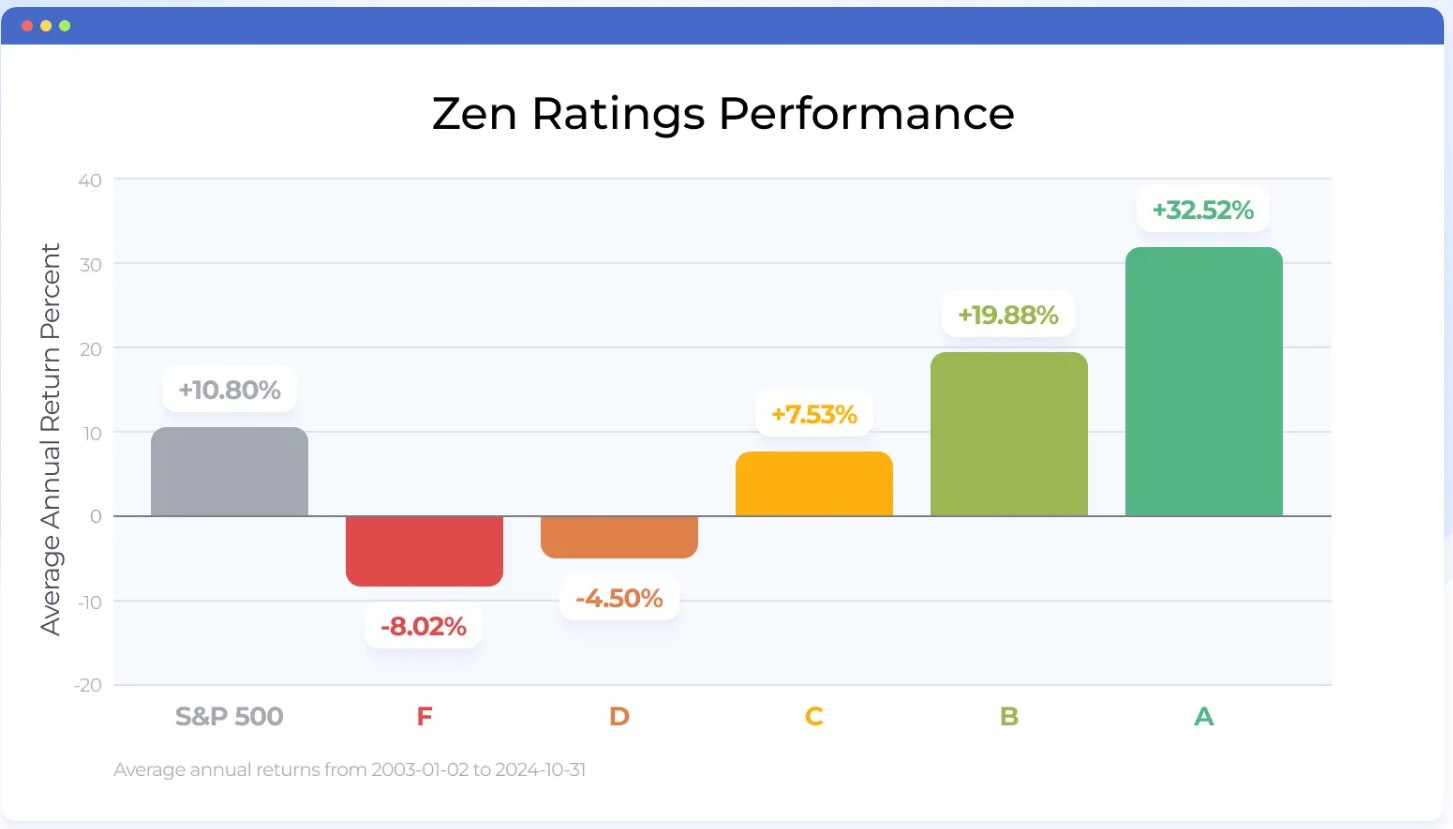

Zen Ratings is WallStreetZen’s proprietary rating system for determining which stocks you should consider, with top stocks outperforming the market by more than 3 to 1 (see above image). Each stock is given an overall letter grade; stocks with an A rating have historically delivered 32.52% annual returns.

If you’re looking for the best AI investing apps to give you information and help you make your own informed decisions, you won’t find a better option.

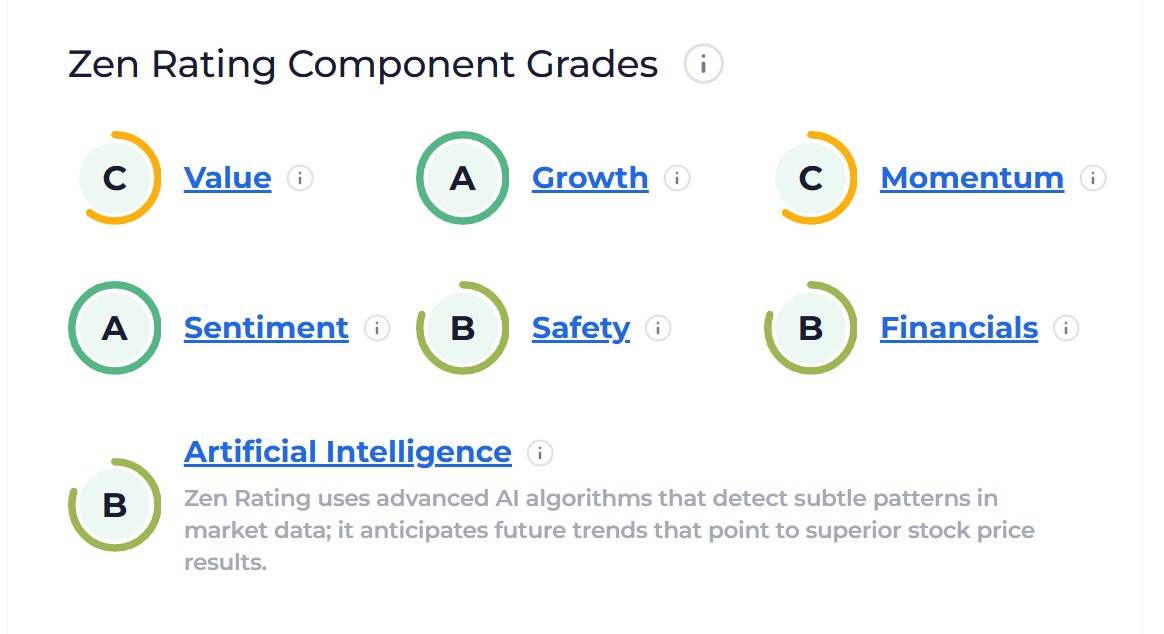

How does it work? Ren Ratings judges stocks by 115 factors spread amongst seven different component categories.

Notably, one of these is an AI factor that uses an advanced AI model to check movements within stock prices and identify stocks with high potential (that other analysts and systems might miss).

But what really makes the Zen Ratings system stand out is its thoroughness. It doesn’t just input an AI algorithm and call it a day. The AI factor is countered by 6 additional Component Grades, so you can see how a stock fares across a variety of reviews.

Strengths of Zen Ratings:

- It uses 115 unique factors to judge nearly 4,600 stocks, determining which ones have the most potential for your portfolio.

- Component grades (including a special AI component grade) to help you judge whether a stock is right for your portfolio, risk tolerance, and needs.

- A system that identifies top stocks that may outperform the market. A-rated stocks have produced an average annual return of 32.52%.

Uplevel Zen Ratings With a Zen Investor Membership

Zen Ratings is a fantastic tool that helps investors leverage AI to make smarter investment decisions. However, if you feel that you need more guidance choosing high-quality stocks, you may want to augment its AI superpowers with a human touch.

Zen Ratings is part of the four-step evaluation process for Zen Investor, our stock-picking newsletter. However, before a stock is added to the portfolio, it also goes through a few more due diligence checks — and it has to get a thumbs-up from Zen Investor Editor in Chief Steve Reitmeister, who has over 40 years’ investing experience.

Here’s the chart for a recent addition to the portfolio, Wix.com (NASDAQ: WIX). Even with the recent dip, it’s still up about 20% since it was added to the portfolio.

What You Get with Membership:

- Access to an unlimited watchlist and updates that you can use to make changes to your portfolio with confidence.

- A system that can tell you at a glance which stocks are worth considering for your portfolio and why.

- A constantly-improving platform that regularly learns to improve its selections and recommendations.

2. TrendSpider

Cost: Varies depending on plan from $54-$199 per month.

If you’re looking for a complex array of tools, information, and real-time data to keep you informed on your investment picks (including crypto), then TrendSpider could be the AI Investing App for you.

It is a trading platform specializing in technical analysis and fundamental charts to help traders perform market research.

However, note that TrendSpider is not the cheapest option, you will have some limits depending on your plan, and for new investors it all might be a bit too much. Yet if you’re an investor who wants every last detail and option, and isn’t afraid to pay for it, TrendSpider might be the app for you.

And how does it use AI for investing? Trendspider has its own feature that allows users to train their own custom AI models. Models can be trained on several markets, with any inputs, over any timeframe.

If you love experimenting and working with AI yourself, you could spend weeks or more working with this feature.

Strengths of TrendSpider:

- You can easily and quickly test strategies without committing to them.

- Years of historical data and more information on stocks than most traders will know what to do with.

- One of the best technical analysis platforms you can find, now enhanced by AI tools.

What You Get with Membership:

- AI tools built into the system tools and backtesting.

- Market scanning and tracking, multiple trading bots, and plenty of active alerts on stocks.

- Advanced charting tools, automated analysis, and automated trendline detection.

3. Trade Ideas

Cost: Trade Ideas Premium (which includes AI Signals) costs $2136 annually or $254 monthly.

Trade Ideas is a longstanding trading platform meant to identify top opportunities, trends, and performers in the stock market. Users have a host of signals and options at their disposal, and they regularly implement new features and technology to provide the best opportunity for users.

As part of that new technology, there is a virtual assistant (Holly) and use of artificial intelligence that will comb through past data and find trends and patterns that it thinks will be useful to its subscribers.

Holly has dozens of curated algorithms and is an AI assistant focused clearly on trading, regularly reviewing strategies.

While it is expensive, those who trade regularly and frequently will find that the saved time will be worth it, and experienced traders will find that they get everything they need with the premium plan.

Strengths of Trade Ideas:

- A virtual assistant that can answer your trading questions in a conversational manner.

- All of the standard features you could want from a trading platform.

What You Get with Membership:

- Scans, filters, and alerts to all at once filter out the noise while keeping you informed about trends and news that you need to make the right calls.

- AI backtesting and support in the form of Holly, an AI assistant built with trading in mind.

- Real-time information and data. Additionally, users can utilize a variety of charting features.

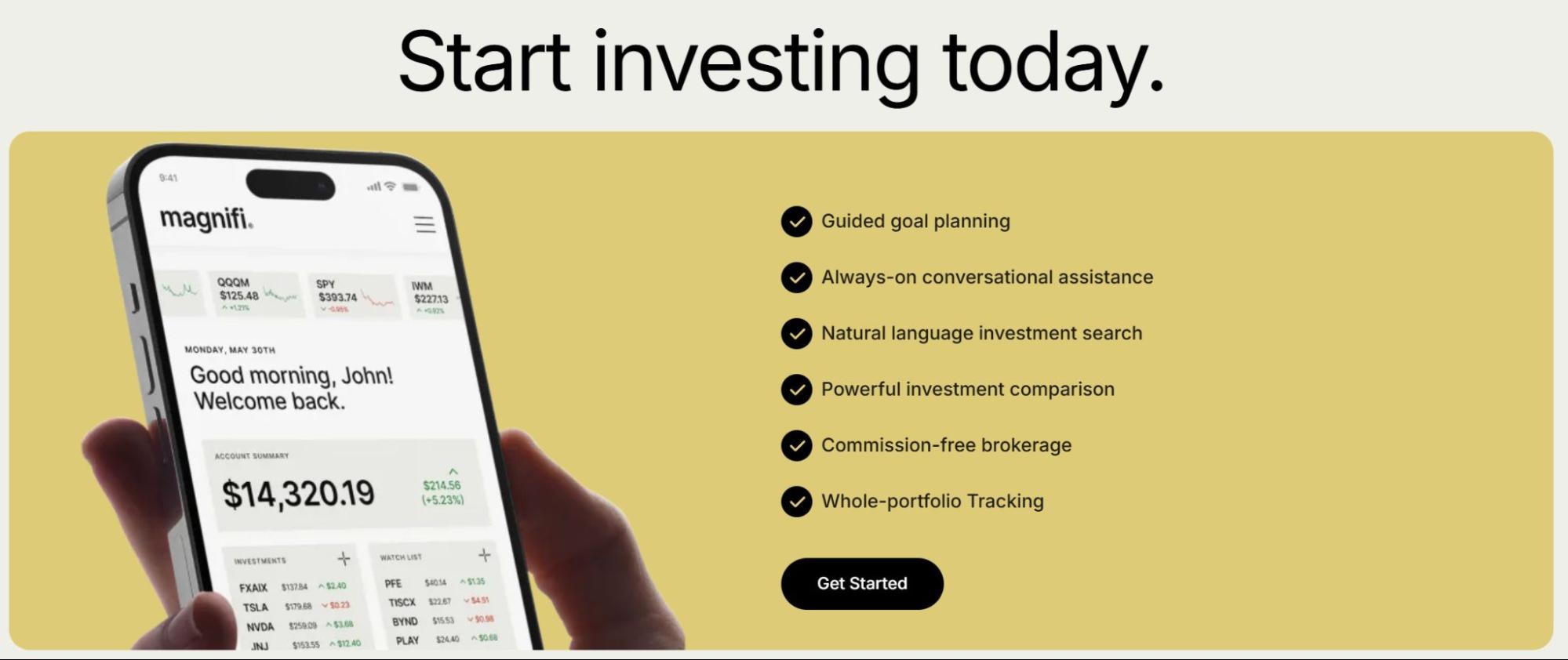

4. Magnifi

Cost: $132 per year or $14 per month.

While other investing apps we’ve mentioned here are focused on tracking stocks and finding the best opportunities for traders, Magnifi is more about the holistic approach, using AI to analyze portfolios and recommending options based on its findings for users.

Experienced traders might not find what they’re looking for here, but average investors or someone who is nervous about the makeup of their portfolio will find a lot in Magnifi.

Strengths of Magnifi:

- Extremely affordable for an AI trading app.

- A portfolio-centric approach that is excellent for average traders and beginners.

What You Get with Membership:

- AI analysis and insights across your investment accounts

- Goal planning and assistance.

5. Fiscal.AI (Formerly FinChat)

Cost: Limited free plan; Most features are unlocked with either a Plus account for $24 or a Pro account for $64/month. See plans

Fiscal.ai (formerly FinChat) is an AI-powered investment research platform designed as the ultimate financial research assistant.

It’s sort of like ChatGPT, but specifically designed for investors. It helps take the time-consuming process of gathering and interpreting financial data by distilling mountains of data into easy-to-digest intel on stocks.

While it feels conversational — you just ask the platform whatever questions about stocks, sectors, and trends that you’d like — behind the scenes it’s pretty impressive, working with institutional-grade financial data (sourced from S&P Market Intelligence) to deliver fast and accurate answers.

Fiscal.AI’s service area is massive: It covers over 100,000 global public companies, with exceptionally detailed segment and KPI data for approximately 2,000 companies. This means you can explore just about anything, from large-cap companies to penny stocks, and even global markets.

Strengths of Fiscal.AI

- Great AI experience – this AI is designed specifically for financial inquiries, so you won’t just get generic responses.

- Great data – Fiscal.AI delivers institutional-grade data to everyday investors. No need for a Bloomberg terminal!

- Extensive coverage – Fiscal.AI covers over 100k companies

What You Get with Pro Membership:

- 500 AI Copilot prompts per month

- 10+ years of annual financial data and 12+ quarters of financial data

- 12+ years of annual KPI data and 16+ quarters of quarterly KPI data

- Unlimited dashboards with up to 250 rows each

- Access to 10 events (earnings calls, transcripts, slides, and filings)

- 3 years forward annual estimates and 5 quarters forward quarterly estimates

- Enhanced analyst data, including revisions

BONUS: Stock Market Guides

There’s one more honorable mention: Stock Market Guides.

Stock Market Guides is an effective, affordable service that provides trade alerts, suggested time frames, and strategies for investors. As of early 2025, Stock Market Guides boasts an average annualized return of 79.4% for stock picks.

While it isn’t AI, it is algorithmically driven, meaning that many of the same principles apply. If you’re not certain about AI but want a system that objectively looks at data and trends to provide information, you should look into Stock Market Guides.

If you want to learn more, you can read about it in this review.

What To Look for in AI Investment Tools

When looking at AI investment tools, you want to find qualities or traits in the tool that play to the natural strength of AI – its ability to make recommendations without emotion or bias.

AI doesn’t care if a stock has a big media presence name like META or NVIDIA. It won’t listen to PR departments. It looks at the trends and the facts.

The more data-driven a platform is, the better it will be able to perform to the strengths of AI. Consider the factors it uses and the number of factors it takes into consideration.

However, on top of that key trait, you should look at:

- Whether a platform actively creates portfolios for you and whether it provides easily accessible information on individual stocks. Furthermore, how many stocks does it cover?

- Does It use real-time trading signals to help it make recommendations?

- How much data it allows you to see, as well as how much it lets you know about its decision-making process.

- If it offers a score or grade for stocks, it should provide more information on how it determines those grades and weighs different factors.

Final Word:

AI is constantly evolving, and these and other AI apps are trailblazing a path into the investing unknown, leading users with ego-free and data-driven decision-making.

Don’t worry about the marketing and don’t worry about the hype from specific stocks. With these apps, you can just focus on clear recommendations and portfolio management.

Just remember that while AI can guide you, you may not want to trust it completely yet. There’s always a human element to investing, and what’s best in general according to the AI investing app might not be best for you.

Use your best judgment when taking recommendations from any of the AI investment apps above, and use advice in the context of your own situation.

The best pick for most readers will be Zen Ratings alongside Zen Investor based on its careful selection of criteria, its component grades, and its wide range of stocks covered.

However, if you have specific needs, try out one of the other options above. Many selections have free trials, so don’t be afraid to try a few out and see what works best for you and your goals.

FAQs:

What is the best AI to invest in?

The best AI or AI company to invest in will be different depending on the investor’s needs, the amount of money to invest, and the amount of risk tolerance the investor has. Stock research systems like WallStreetZen's Zen Ratings leverage AI to help you find better stock picks.

What is the best AI investing app?

The best AI investing app will depend on what the person is looking for in their portfolio, how much risk they are willing to take on, and additional factors. We consider WallStreetZen's Zen Ratings a great choice for the average person looking for recommendations.

Are there any good AI investing apps?

There are several good AI investing apps, including Trade Ideas, Magnifi, and WallStreetZen's Zen Ratings. Each has its strengths and it’s recommended to do additional research before deciding on one for yourself.

Which AI trading platform is best?

The best AI trading platform will depend on the user’s individual needs, but WallStreetZen's Zen Ratings, Trade Ideas, and Magnifi are great options to look at first.

Is there AI for investing?

There is AI for investing. Traders and investment professionals have long used algorithms and AI to identify worthwhile stocks.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.