Scale AI is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Scale AI who want to sell their shares.

Sign up with Hiive here and get access to Scale AI before its IPO.

The artificial intelligence narrative has dominated Wall Street for the last two years. Everyone knows the big-name companies — but there are plenty of companies are flying under the radar in this disruptive segment. Like Scale AI.

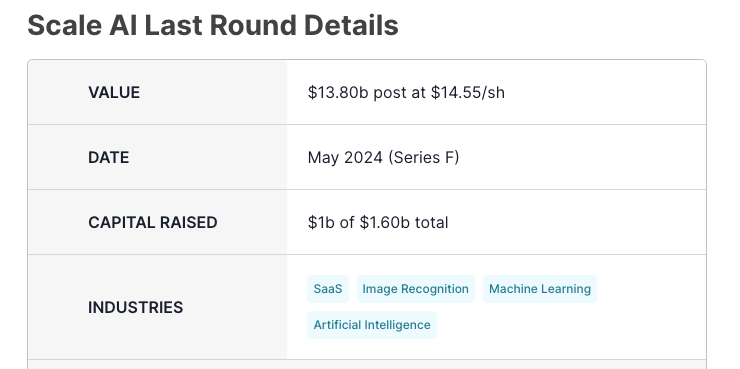

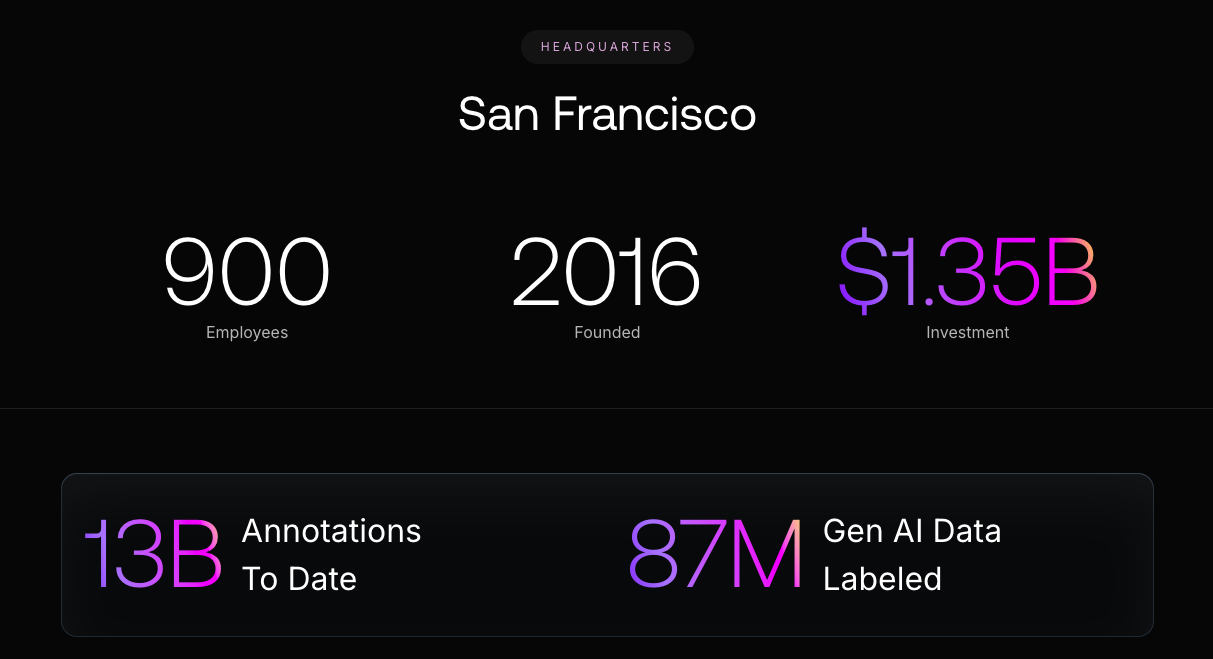

Founded in 2016, Scale AI raised $1 billion last May, valuing the start-up at $13.8 billion, up from $7.3 billion in 2021. And let’s talk about the impressive Scale AI valuation. As of early 2025, the AI infrastructure company has raised a total of $1.6 billion over the last nine years.

The latest funding round was led by Accel and brought in notable new investors, including

- Amazon (NASDAQ: AMZN)

- Meta (NASDAQ: META)

- Cisco (NASDAQ: CSCO)

- Intel (NASDAQ: INTC)

- AMD (NASDAQ: AMD), and

- ServiceNow (NYSE: NOW)

Bet you’ve heard of a few of those companies, right?

Existing investors like Nvidia (NASDAQ: NVDA), Tiger Global Management, and Y Combinator also participated, demonstrating confidence in the company’s growth trajectory.

What is Scale AI?

Scale AI provides essential data for training sophisticated AI applications. It has developed multiple offerings, including the Scale Data Engine and Scale Donovan, tools that support everything from autonomous vehicles to generative AI applications.

Scale AI’s client list includes Lyft (NASDAQ: LYFT), Toyota, Airbnb (NASDAQ: ABNB), and even certain U.S. Government agencies. Its ability to provide high-quality annotated data through human contractors and ML algorithms has made it an indispensable partner in the AI ecosystem.

Scale AI has evolved beyond its origins in autonomous driving data labeling to become a crucial player in the AI ecosystem.

Under CEO Alexandr Wang’s leadership, Scale AI has made significant inroads into the public sector. It secured a Department of Defense contract and deployed a decision-making platform on classified U.S. government networks.

But potential investors must be aware of a catch. While Scale AI’s impact on the tech world is clear, getting a piece of the company isn’t as straightforward as opening your trading app.

So, let’s dive into how to invest in Scale AI stock.

Can You Buy Scale AI Stock? Is Scale AI Publicly Traded?

If you want to buy Scale AI stock, you will be disappointed. As a privately held company, Scale AI’s shares are not available to trade on the NYSE or NASDAQ.

However, that does not mean you’re out of options when it comes to how to invest in Scale AI. Let’s discuss how both accredited and non-accredited investors can seek to gain access.

How to Buy Scale AI as an Accredited Investor

Scale AI is not publicly traded, but accredited investors can still buy its stock through the private-market investing platform Hiive.

Hiive is a marketplace where accredited investors can buy shares of private companies before they go public. The platform connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares with qualified buyers.

Hiive offers access to over 2,000 pre-IPO companies, including Scale AI. Each listing comes from a separate seller who sets the asking price and the number of shares. Sellers are typically current or former employees but could also be angel investors or venture capital firms.

With no buying fees and the ability to negotiate directly with sellers, Hiive offers a streamlined way to invest in Scale AI before it goes public.

Buyers can place bids, negotiate with sellers directly, or accept an asking price as listed.

Sign up with Hiive today to see the complete order book for Scale AI, including all asking prices, bids, and most recent transactions. You can also add Scale AI to your watchlist to get notified about new listings or trades.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

How to Buy Scale AI as a Retail Investor

If you’re a retail investor looking to buy Scale AI stock, you won’t be able to invest in the company directly now.

However, several indirect ways exist to gain exposure to the AI data infrastructure space where Scale AI operates. For instance, you can invest in publicly listed AI companies like Meta Platforms (NASDAQ: META) that have provided funding to Scale AI.

Before we discuss that, a bit of background…

Who Owns Scale AI?

Scale AI was founded in 2016 by Alexandr Wang, who serves as the company’s CEO. Wang began his tech career at 17, working as a full-time engineer in Silicon Valley for companies like Addepar and Quora before founding Scale AI. He started Scale AI at just 19 years old after dropping out of MIT.

His stake in the company helped make him the world’s youngest self-made billionaire.

Scale AI has attracted numerous high-profile investors through multiple funding rounds.

Recent investors include:

- Accel (Lead investor in Series F)

- Amazon

- Meta

- Cisco Investments

- Intel Capital

- ServiceNow Ventures

- AMD Ventures

Existing investors maintaining significant stakes include Y Combinator, Index Ventures, Founders Fund, Coatue, Thrive Capital, Spark Capital, Nvidia, and Tiger Global Management.

Does Meta Own Scale AI?

While Meta (formerly Facebook) is an investor in Scale AI, having participated in the company’s $1 billion Series F funding round, it does not own Scale AI outright.

Meta and Scale AI have a primarily investor-strategic partnership relationship. Meta’s investment in Scale AI makes strategic sense, given both companies’ interests in advancing AI technology, particularly in data labeling and model training.

However, Meta’s stake represents just one piece of Scale AI’s diverse ownership structure, which includes numerous other tech giants and venture capital firms.

3 Alternatives to Scale AI for Retail Investors

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

While retail investors cannot purchase Scale AI stock directly, they can still gain exposure to the AI megatrend in 2025 by investing in companies that work with Scale AI or operate in similar markets.

For instance, Microsoft (NASDAQ: MSFT) is a Scale AI customer and has invested in AI infrastructure. Here’s a little more info, plus 2 more alternatives you can consider right now.

If you’re interested in exploring any of the stocks below, just click on the ticker symbol for each respective stock to see its Zen Rating, a letter grade assigned to each stock based on a comprehensive review of 115 factors proven to drive stock growth.

You can also see 7 Component Grades for each stock to further drill into areas of strength and weakness.

Microsoft Corp. (NASDAQ: MSFT)

Among the largest companies globally, Microsoft (NASDAQ: MSFT) leads several segments, including enterprise software, cloud computing, and gaming.

Here’s the 1-year chart for MSFT:

Moreover, Microsoft has a sizeable stake in OpenAI, offering investors diversification and an early-mover advantage. The tech giant continues to invest heavily in AI and data centers, which should help it increase future revenue and cash flows.

Microsoft has partnered with Scale AI to help businesses deploy custom artificial intelligence applications on its Azure cloud platform.

The collaboration brings Scale AI’s Enterprise Generative AI Platform (EGP) to Azure, providing tools for companies to customize large language models and build AI applications.

Scale AI’s platform offers tools for fine-tuning models, implementing retrieval-augmented generation, and providing testing services. The partnership should help reduce the time and complexity of bringing AI applications to production.

Amazon.com (NASDAQ: AMZN)

An investor in Scale AI, Amazon.com (NASDAQ: AMZN) is the largest e-commerce company globally. It also leads the public cloud infrastructure market and is the third-largest digital advertising platform after Google and Meta.

Here’s the 1-year chart for AMZN:

Amazon is part of several expanding addressable markets and is focused on improving profit margins amid higher interest rates, inflation, and other macro headwinds.

As stated above, Amazon and Meta led the $1 billion funding round for Scale AI in 2024. The investment could help Amazon enhance its AI capabilities across operations, including optimizing logistics and personalizing shopping experiences.

The move comes as Amazon competes with rivals like Microsoft and Google in the AI space while working to make its cloud infrastructure more efficient and sustainable.

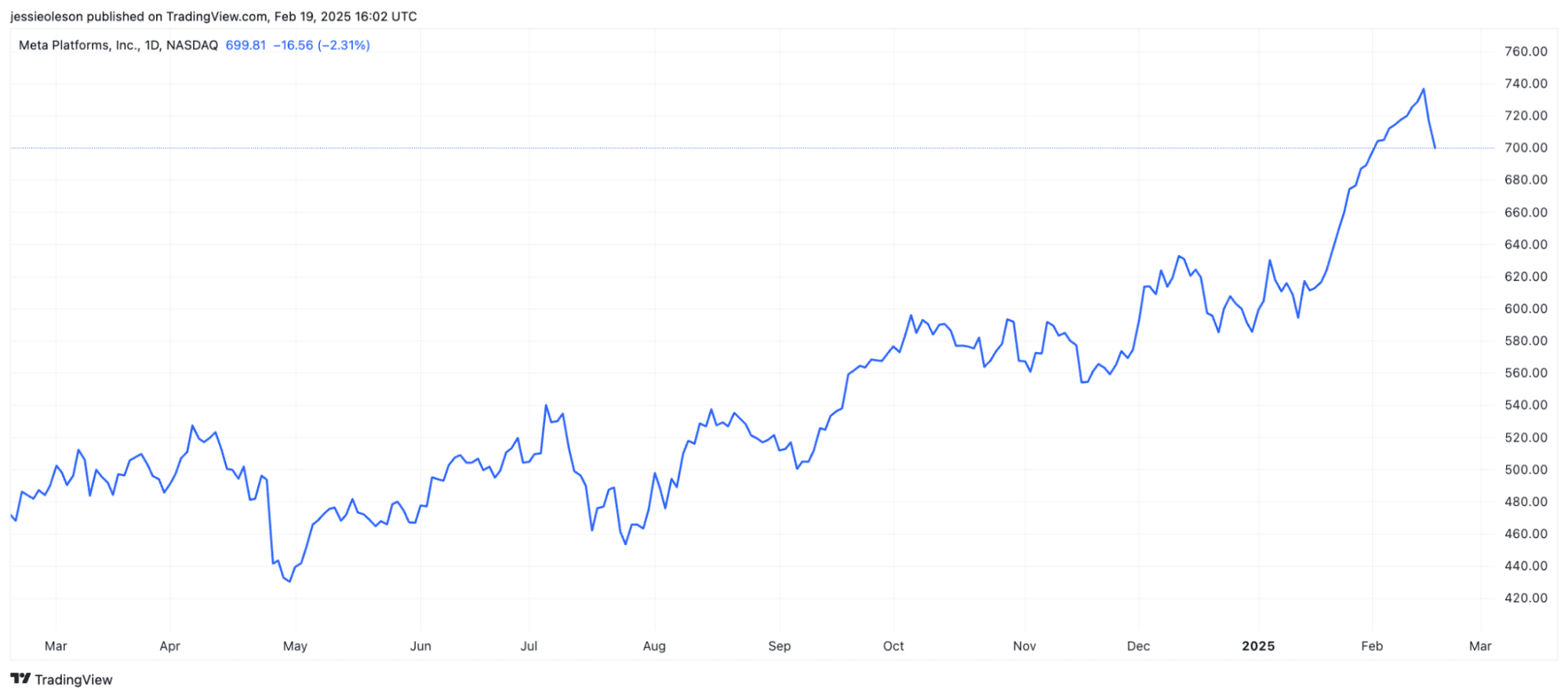

Meta Platforms Inc. (NASDAQ: META)

The third stock on the list is Meta Platforms Inc. (NASDAQ: META), the largest social media company in the world. It owns and operates Facebook, Instagram, Messenger and WhatsApp.

Here’s the 1-year chart for META:

As previously mentioned, it’s also an investor in Scale AI, having contributed to the company’s most recent funding round.

Not only does META offer indirect access to Scale AI, but it may be an intelligent AI investment overall.

With access to vast amounts of user-generated data and a highly engaged audience, Meta Platforms is well-positioned to train and deploy multiple AI products in the upcoming decade.

Meta has teamed up with Scale AI to boost its open-source AI model Llama 2, making it easier for businesses to customize the technology for their specific needs, the companies announced Tuesday.

Scale AI, which was named a Launch Partner for Llama 2, will provide tools and expertise to help enterprises fine-tune the model using their proprietary data.

Need more help finding great stocks to invest in?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. For just $99 per year ($79 using links from this post), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How to Buy the Scale AI IPO

Here are the steps on how to buy Scale AI stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Scale AI

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Scale AI Stock Price Chart

As shares of Scale AI aren’t traded, there isn’t a Scale AI stock price or a stock price chart.

However, you can use publicly available information to analyze the company’s impressive growth trajectory in the near term.

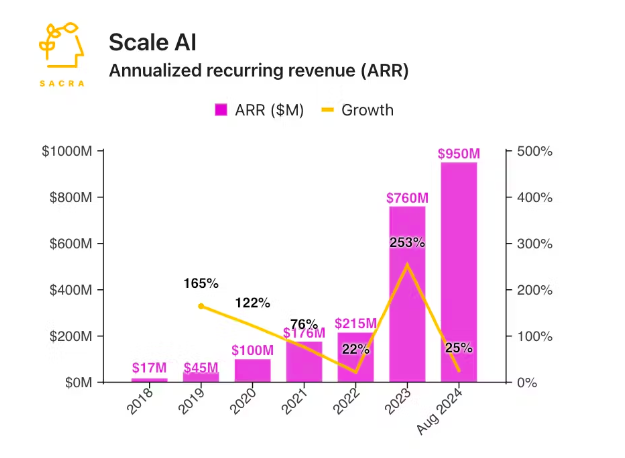

In August 2024, Scale AI almost surpassed $1 billion in annual recurring revenue (ARR). Its ARR stood at $950 million, up from $760 million in 2023 and $215 million in 2022.

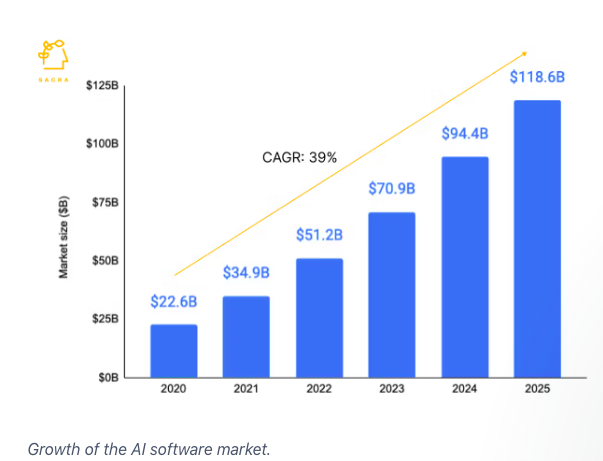

The growth story for Scale AI is far from over. The AI software market is forecast to reach $118.6 billion in 2025, up from $94.4 billion in 2024.

Conclusion

Scale AI is at the forefront of the AI infrastructure revolution as it trains and develops AI applications across various industries. Its growth trajectory remains compelling, given an impressive list of customers that range from tech giants to government agencies,

Whether through direct pre-IPO investment for accredited investors via Hiive, or indirect exposure through public companies, Scale AI remains an essential player in the future of artificial intelligence.

FAQs:

How can I buy Scale AI stock?

Scale AI is still privately held, so its stock isn't publicly available. While accredited investors can purchase shares through Hiive, a pre-IPO marketplace platform, retail investors must wait until the company decides to go public.

How much is Scale AI stock?

Since Scale AI is not publicly traded, the Scale AI stock stock price is not available for reference. However, the company's most recent funding round in 2024 valued it at $13.8 billion, nearly double its 2021 valuation of $7.3 billion.

What is the Scale AI stock symbol?

There is no Scale AI stock symbol as it is privately held. A stock symbol will only be assigned when the company lists its shares on a public exchange like the NYSE or NASDAQ.

Who owns Scale AI stock?

Scale AI's ownership is distributed among several key stakeholders, which includes the Founder and CEO Alexandr Wang. Other major stakeholders include prominent investors such as Accel, Amazon, Meta, Cisco Investments, Intel Capital, and ServiceNow Ventures.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.