If you’ve got $30,000 burning a hole in your pocket, you’ve come to the right place. Before you decide to spend it all on a new car or on an extravagant vacation, let me help you invest it responsibly.

The internet has made it easier than ever for regular people like you and me to invest in all sorts of things. That’s great, but it can also be overwhelming. Should you put all of it in the stock market? Go in on an investment property with some friends? Or maybe you should get into that cryptocurrency stuff you’ve heard so much about.

Not so fast. Here are my recommendations for the nine best ways to invest $30,000.

Where to Invest $30k in 2026

Before I jump into the specifics of where to invest 30k, I want to take a second to emphasize that there is no single best way to invest 30k.

How to invest 30,000 dollars depends on your goals and financial situation and will be different for everyone. Emphasis complete.

The Expected Returns listed in this article are based on historical data and/or company-stated target returns. Actual results may vary. This article should not be taken as investment advice. No investment offers a guarantee of returns. Your capital is at risk.

1. High-End Artwork (Masterworks)

- Risk level: Medium to high

- Expected returns: Varies; investors have realized 10.4%, 21.5%, and even 35% net returns from their sold artworks.

Let’s start with something fun: investing in artwork. It’s hard to overstate the benefits of investing in fine art. It gives your portfolio diversification beyond what you can get by sticking with more traditional investments and opens the door for extreme growth.

But I don’t have $50 million to invest in a Picasso or Monet, I hear you say. Not to worry! Masterworks makes investing in high-end artwork unbelievably easy. You don’t need to have tons of money and you don’t have to worry about all the annoying parts of art investing, like storing and maintaining priceless paintings. (Currently, the app does have a waitlist — you can skip it by using this link.)

Here’s how it works. Masterworks lets you buy shares of high-end artwork. The process is directly analogous to buying shares of a company in the stock market.

My favorite thing about investing in artwork through Masterworks is that you give your portfolio the potential for serious gains — gains that are uncorrelated to your other investments, I might add.

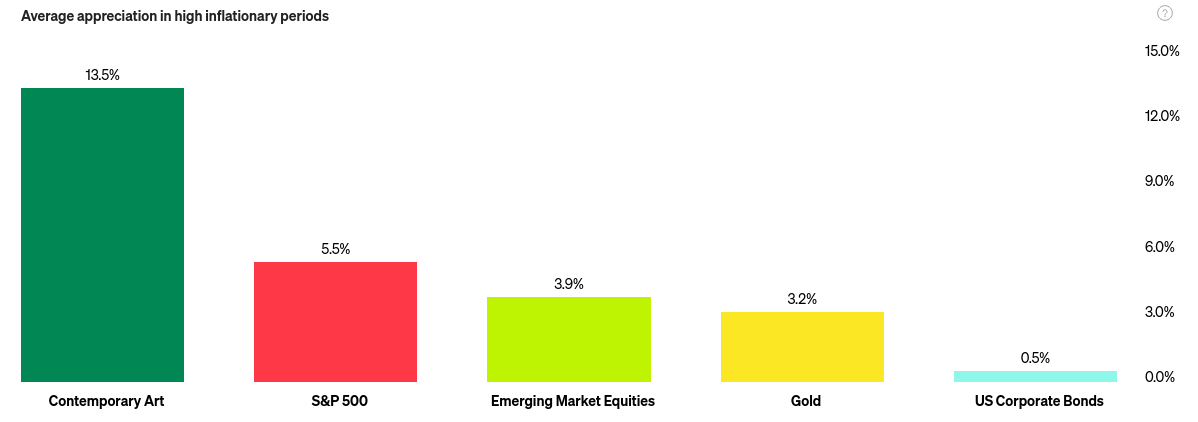

Now is an especially good time to check out Masterworks because contemporary art has traditionally performed well in inflationary environments, outstripping the S&P 500, emerging markets, and even classic inflation hedges like gold.

2. Stocks + ETFs

- Risk: Medium to high

- Average returns: 4%–30%+

Investing in stocks and exchange-traded funds (ETFs) is extremely versatile, so you can fine-tune your allocations to fit your risk profile and investment goals.

Individual stocks offer higher risk but also come with higher returns. Depending on your goals, you might want to allocate more or less to individual stocks and put the rest in ETFs or index funds.

YOLOing all of your cash into Tesla (NASDAQ: TSLA) isn’t the best way to invest 30k, but the freedom to mix and match risky investments with safer ones is one of the biggest benefits of putting your money in stocks.

A safer option is to choose an assortment of ETFs, which are automatically diversified for you to various extents.

Need an education on ETFs? Check out this article, which includes a review of the best ETF brokerages.

There are many different kinds of ETFs. Some track sectors like banking or semiconductors, while others give you exposure to more specific niches like precious metals or renewable energy. The broader the scope of the ETF, the less risky it is, generally speaking.

A safer option still is putting your 30k in index funds that track large swaths of the stock market — or even the entire stock market, as is the case with funds like VTI or VTSAX. These are the most diversified and simplest ways to invest in stocks if you just want to “set it and forget it.”

If you’re looking for a broker recommendation to start your stock investing journey, I wholeheartedly recommend eToro. The company is one of the most popular online brokers and offers zero-commission trading, access to options, and easy account management through the eToro mobile app.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

3. Real Estate

- Risk: Medium

- Average returns: 8%–12%

If you want to know how to invest 30k for passive income, I have two words for you: real estate.

A sum of $30,000 might not be enough to own your own investment property, but it’s more than enough to get into real estate investing.

These days you don’t need tons of capital to invest in real estate thanks to crowdfunding companies like Fundrise (which also offers access to other assets, like private credit) and Arrived Homes.

Arrived Homes lets you own a piece of a rental property to earn some of the rental income each month. This is a fantastic way to get into real estate investing without actually buying property yourself.

REITs are also a great way to get exposure to real estate. They make it easy to diversify your real estate portfolio and are as easy to buy as any other stock or ETF. REITs are one step further removed from owning your own rental property, but they’re the easiest way to get into real estate investing, in my opinion.

Fundrise offers access to proprietary eREITs, but you can use eToro for REITs alongside the rest of your stock portfolio.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

4. High-Yield Savings Account

- Risk: Low

- Average Returns: 4.00%–5.00%

HYSAs are the perfect place to keep your emergency fund or money you’re saving for a specific reason, like the downpayment for a house. They’re safe — FDIC insured up to $250,000 — and offer way better APYs than traditional savings accounts, making them a best way to invest 30k without risk.

The best HYSAs let you take money out at will, which gives them a big advantage over similar options like CDs or Bonds for emergency funds. An emergency fund that locks your money behind early withdrawal penalties isn’t that useful.

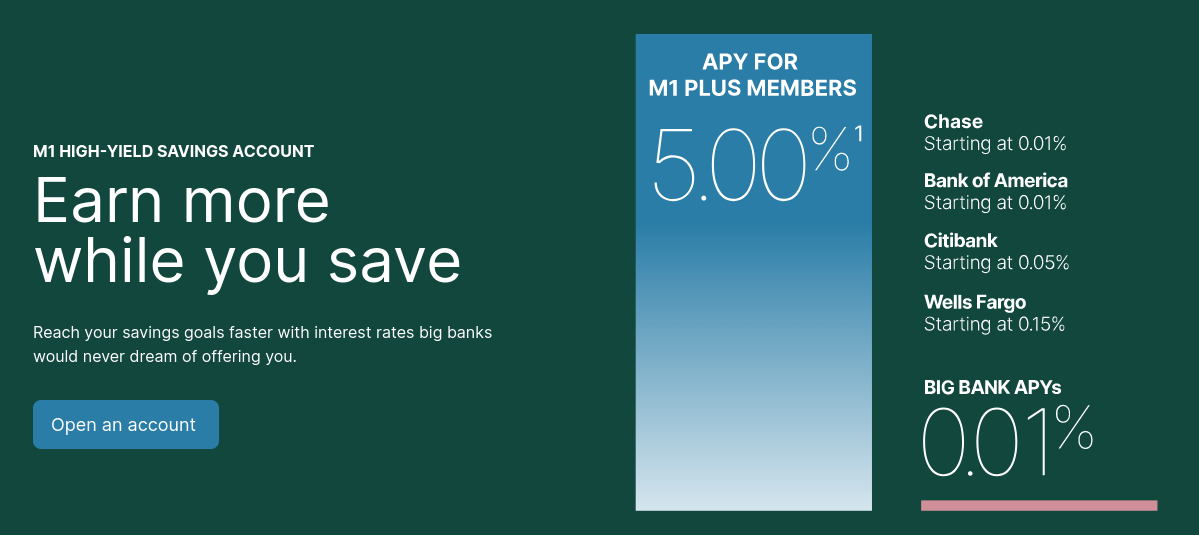

My favorite HYSA is M1 Finance’s HYSA. It blows other HYSAs out of the water with 5.00% APY and no minimum deposit or balance requirements. If you’re saving money on a relatively short timescale — say, 1–3 years — M1 Finance’s HYSA is where to invest 30k.

6. Pay off Debt

I know; this one isn’t as much fun as the other options I’ve covered so far, but it’s important for your future financial health.

Paying off your debt, especially any high-interest debt you have, like credit card debt, should be high on your priority list. Trying to grow your net wealth and become financially stable when you have a lot of debt is like paddling against the current.

Your progress will be limited, and anything that disrupts your finances, like a health emergency or unexpected house repair, will cause you to fall behind again quickly.

Prioritize your highest-interest debt first. If something goes wrong and prevents you from making payments for a while, this is the debt that will hurt the most.

A simple way to save more…

Reducing unnecessary expenses can help you pay off debt faster. Rocket Money can help you find the expenses that could be eating a hole in your wallet — and help you get rid of them. Plus, it can help you manage your bills, build a budget, check your credit history, and even get lower rates on existing bills.

7. Bonds

- Risk: Low

- Average returns: 1.00%–3.00%

Bonds aren’t fun to talk about, but they’re an essential part of any investment portfolio. Bonds don’t experience explosive growth like tech stocks, nor do they have impressive charts when you zoom out to longer timeframes the way blue chip stocks do.

What they offer is stability in your portfolio. The higher the percentage of your portfolio you allocate to bonds, the lower your portfolio’s volatility will be. For you nerds out there, that means higher Sharpe and Sortino ratios.

The classic recommendation for bond allocations is a percentage equal to your age. This is easy to remember but not the best choice for everyone.

If you’re more risk tolerant, you should lower your bond allocation relative to your age, while people who want safety and stability should bump it up slightly.

8. Save For the Future

This one is a bit different from the rest. Rather than discuss another investment vehicle, I want to talk about how to save money for the future.

Saving for the future means different things to different people. To some, it means building up a nest egg to prepare to buy a home and have children. For others, it means squirreling away money for an early retirement.

No matter what your future holds, the best advice I can give you about saving for the nebulous future is to take advantage of tax-advantaged accounts whenever you can. If you’re saving for your kid’s college education, open a 529 plan. If you’re investing to set yourself up for a nice retirement, max out your 401k and open up an IRA.

Acorns is a great all-in-one app that can help you save and invest — for your future, and your children’s.

Acorns Early is a great way to help your kids out by saving for their future. The company offers UTMA/UGMA accounts and 529 plans that are easy to manage right from your phone. I recommend checking them out if you’re looking for ways to invest for your kids.

By intelligently using tax-advantaged investments, you can decrease your current tax burden either now or in the future. Lowering your taxes means more money to play with, which you can put towards the other investments I discussed above or use to give your emergency fund more cushion.

9. Gold

- Risk: High

- Average Returns: 5.00%–20.00%

Investing in different asset classes that are uncorrelated or loosely correlated is one of the best ways to protect your portfolio from prolonged downswings. Investing in gold is a classic way to add an uncorrelated asset to your stock portfolio.

Whether you prefer to invest some of your $30,000 in physical gold or a gold ETF like GLD is up to you. Gold ETFs are easier to add to your investments through your broker, while physical gold is guaranteed to track the price of gold since, well it IS gold.

If you think you might want to invest in physical gold, Silver Gold Bull is my go-to recommendation for buying gold online. The company sells gold bullion and gold coins, as well as a selection of other precious metals like silver, platinum, and copper.

Plus, here are some of our other favorite platforms:

BONUS: How to Invest $30K: What About Crypto?

- Risk: Very high

- Average returns: -50.00%–50.00%+

Crypto is a bit of a sticky wicket. I hesitate to recommend putting a significant fraction of your 30k in crypto because it’s so volatile and unpredictable. The potential for tremendous returns is unmatched by any other investment vehicle, but the chances of watching your investment go up in smoke are just as high.

If you want to explore crypto, I recommend sticking to the big guns like Bitcoin and Ethereum. I would also limit your allocation to 1%–2% of your total investment, so $300–$600 for a 30k investment.

The best platform for crypto…

eToro constantly comes up on “best of” lists across the globe: best crypto exchange UK, best crypto exchange Australia, and so on. Here’s why:

- 80+ coins, including Bitcoin, Ethereum, XRP + more

- Competitive trading rates.

- Secure storage with 2F authentication

- A CopyTrader feature where new crypto investors can follow experienced traders

- Smart Portfolios — pre-selected groups of crypto types, and low fees.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Best Way to Invest $30K: What About Allocation?

I gave you a lot of options for where to invest 30k, but I didn’t talk about allocation. It’s hard to give specific allocation recommendations without knowing your situation, but there are some general rules you can follow.

First, you have to decide on your risk tolerance. If $30,000 is not that much money to you and you’re comfortable taking a bit of risk, the best way to invest 30k is to put it in stocks.

A diversified basket of stocks gives you a lot of upside and flexibility if you want to change gears down the road. If you’re looking for how to invest 30k wisely instead and don’t have a big appetite for risk, stick with ETFs or index funds.

Second, decide if you’re looking to preserve capital or generate income. Preserving capital is traditionally done through bonds or HYSAs while investing 30k for passive income is done most easily through real estate.

Finally, if you have a specific goal you’re saving money for in the near future, like a house purchase, keep things simple and put the money in an HYSA and call it a day.

Final Word: How to invest $30k

How to invest 30k wisely depends on your current financial situation and your long-term investing goals. I tried to include something in this guide for everyone, whether you’re looking for the absolute best way to invest 30k or something more specific, like how to invest 30k for cash flow. There’s no one best answer, so don’t overthink it.

If you’re looking for how to invest 30k in real estate, my best advice is to look into crowdfunding platforms like Arrived Homes. If you prefer REITs, choose a broker like eToro where you can purchase REITs, ETFs, or individual stocks all in one place.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs:

How can I double 30K?

The best way to double 30k is to have patience. Doubling your money amounts to a 100% gain, which historically takes the S&P 500 about 10 years, on average. Doubling 30k more quickly than that requires you to take on more risk by investing in individual stocks or experimenting with derivatives like options.

Is 30K in savings good?

It depends, but 30k in savings is more than most people have saved. If you already own a house and have a retirement plan, having an additional 30k saved is great. It’s enough to cover most people’s expenses for six months to a year if they lose their job and can also be used to finance home improvement projects, car repairs, and other unexpected expenses.

How to safely invest $25,000?

The safest way to invest $25,000 is to put it in a HYSA. HYSAs are FDIC-insured up to at least $250,000, which means your money won’t evaporate, even if the bank holding your funds goes under. Other safe investments include bonds, CDs, and — to a lesser extent — index funds.

How much money do I need to invest to make $3000 a month?

It depends on where you put your money. Investing in a rental property in some high-cost-of-living areas can earn you $3,000 a month, but takes an initial investment of $300,000 or requires you to take out a second mortgage. Investing in the S&P 500 — which has an average annual return throughout its history of around 7% — would require you to invest more than $500,000 to reach an average return of $3,000 per month.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.