In a Nutshell: What Happened to Palm Beach Research Group?

Palm Beach Research Group shuttered in 2024 amid bad press and lawsuits surrounding its gurus, including crypto figure Teeka Tiwari. While you can’t subscribe to the Palm Beach Confidential newsletter anymore, there are plenty of other great resources if you want to find solid investing ideas — like WallStreetZen, which offers a free newsletter, stock research tools, and paid services including Zen Strategies, which gives you access to 11 portfolios of 7 stocks, each aligned with a specific trading strategy. Keep reading for the full story…

What Happened to Palm Beach Research Group?

Palm Beach Research Group (PBRG) officially closed in early 2024 following the winding down of its parent company, Legacy Research Group. But in reality, it lost most of its credibility years before this formal death date.

Starting in 2022, the US Securities and Exchange Commission (SEC) filed charges against PBRG’s analyst, Jonathan William Mikula, for his role in a fraudulent scheme.

The SEC alleged that Mikula promoted specific securities to subscribers as unbiased recommendations while secretly receiving stashes of cash.

Following the SEC’s charges and an internal investigation, Legacy Research also revealed some red flags surrounding PBRG’s star editor Teeka Tiwari.

Tiwari was working as a consultant with the firm DeFi Technologies Inc. and allegedly recommending stocks in the company’s playbook to PBRG members.

According to Legacy Research’s parent, MarketWise, these revelations “irrevocably damaged” PBRG’s reputation, eventually leading to its closure.

Multiple complaints on the Better Business Bureau (BBB) also suggest that anyone with a lifetime PBRG subscription only received “credits” to comparable newsletters on MarketWise rather than full refunds.

What is Palm Beach Research Group?

The Palm Beach Research Group was a financial publication agency founded in 2011. Interestingly, PBRG’s HQ was actually in Delray Beach, but they probably thought nearby Palm Beach sounded classier.

In any case, this group was particularly well-known for newsletters like Teeka Tiwari’s “The Palm Beach Letter” and “Palm Beach Confidential,” both of which emphasized alternative investments like cryptocurrency.

One reason this group was extra appealing to self-directed investors was its connection to former Lehman Brothers exec Teeka Tiwari.

PBRG positioned itself as a provider of “asymmetric investing” strategies via subscriptions, all of which aimed to generate big returns from small initial investments.

Who Owns Palm Beach Research Group?

Palm Beach Research Group was a subsidiary of a subsidiary. More specifically, Legacy Research Group owned PBRG, and MarketWise owned Legacy Research Group.

MarketWise is a publicly traded holding company that operates a large portfolio of financial research and publishing businesses, including Stansberry Research and Brownstone Research.

Key Offering: Palm Beach Confidential

One of PBRG’s flagship subscriptions was the “Palm Beach Confidential,” which focused mainly on crypto and blockchain-related investment ideas.

The self-appointed web3 wizard Teeka Tiwari headed this newsletter with his particular brand of high-risk/high-return investing.

Part of Tiwari’s strategy was to point out relatively small cryptocurrencies that had the potential for eye-boggling gains with little money down.

Content in this newsletter often included new investment recommendations, buy and sell alerts, and regular market updates. Tiwari and his research team presented their recommendations as the result of in-depth analysis.

When it was running, a subscription to Palm Beach Confidential cost $5,000 per year.

What Happened to Palm Beach Confidential?

As Legacy Research Group declined, all of PBRG’s newsletters went the way of the dinos (i.e., extinct).

Because of all the lawsuits and scandals surrounding Tiwari and Mikula, MarketWise decided to end PBRG and transition people who subscribed to “Palm Beach Confidential” to other investment newsletters under the company’s umbrella.

What Happened to Teeka Tiwari?

Following the controversies that led to the winding down of PBRG, the relationship between Teeka Tiwari and MarketWise has been strained at best.

Since these events, Tiwari parted ways with Legacy Research and now appears to be operating his own financial newsletter service under his name, still branding himself as one of the biggest brains in blockchain.

In 2024, MarketWise filed a lawsuit against Tiwari over yet another scandal. In this lawsuit, MarketWise alleged Tiwari gained unauthorized access to customer lists after his separation and used them to solicit subscribers for his new separate publications.

Palm Beach Resource Group Reviews

With so many questionable activities happening in PBRG’s leadership, it would be odd to see glowing reviews on third-party sites.

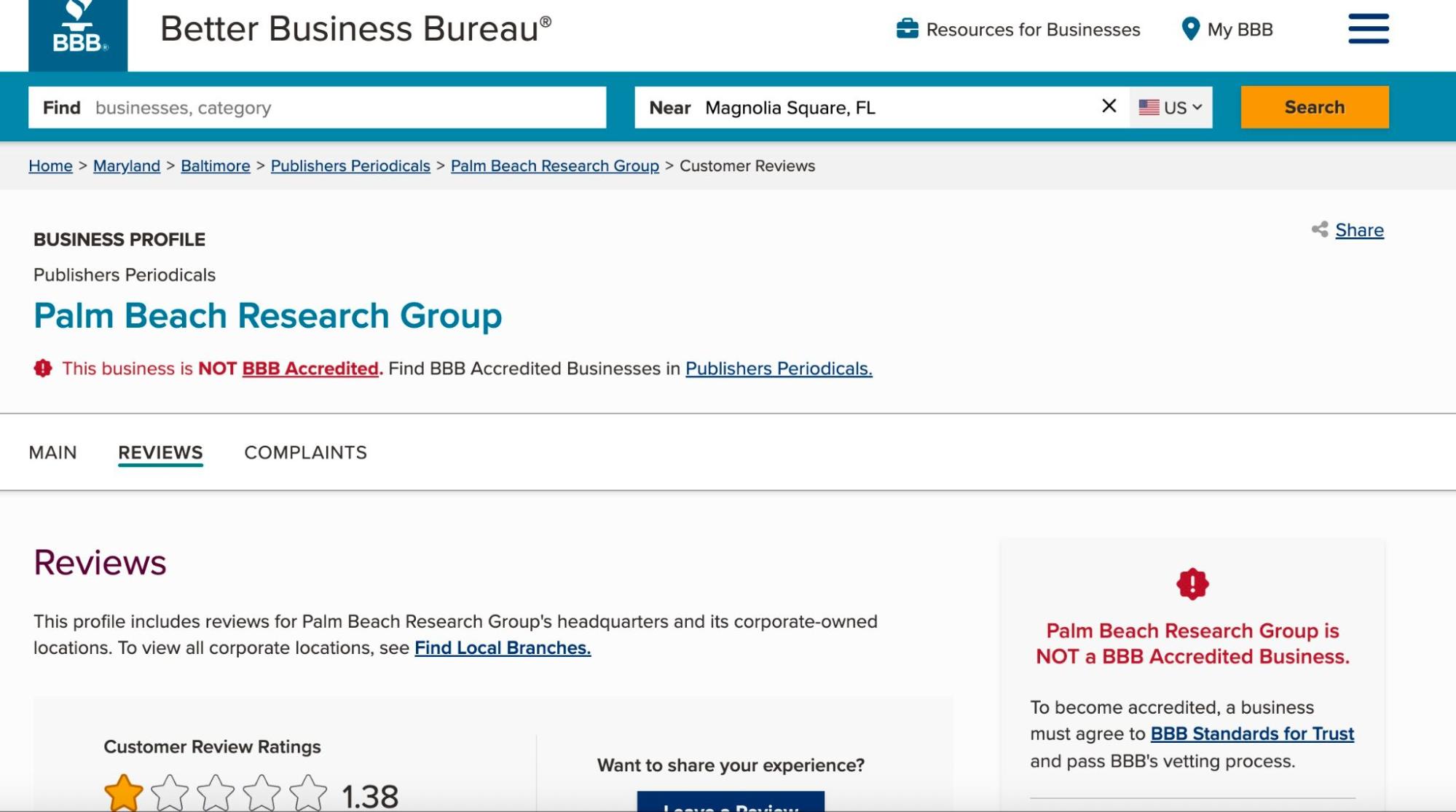

And, when you look at the comments on PBRG’s BBB page, it’s clear people aren’t happy.

PBRG currently has an average 1.38-star rating and 30 complaints filed against it on the BBB over the past three years.

A common theme in these BBB comments is how PBRG didn’t refund customers their money after it folded. Instead, they gave users “credits” to other MarketWise publications, which subscribers weren’t keen on using after the sour taste they had for PBRG.

Besides the way MarketWise handled PBRG’s fallout, many people also said they lost money on the crypto positions supposed gurus like Tiwari recommended.

Although PBRG gets a C+ rating for its responsiveness on the BBB, they don’t have an accredited BBB status, and there are also negative comments on other sites like Reddit and Yelp.

Did Palm Beach Research Group Close?

After MarketWise’s internal investigation into what happened at Palm Beach Research Group, it decided this brand was beyond repair.

In response to these revelations, MarketWise shut down Legacy Group in 2024, which meant Palm Beach Research Group closed along with it.

Palm Beach Research Group Lawsuit Update

The first legal action against Palm Beach Research Group took place in 2022 when the SEC and federal prosecutors filed charges against Jonathan William Mikula, a former analyst at PBRG.

The SEC’s complaint alleged that Mikula engaged in a fraudulent scheme by secretly receiving payments to promote low-quality stocks to PBRG’s subscribers.

He allegedly presented these recommendations as independent and unbiased advice, but he was receiving a kickback.

As MarketWise investigated this issue further, it discovered that star editor Teeka Tiwari also had troubling connections as a “consultant” to the Canadian firm DeFi Technologies.

Many of the companies in DeFi Technologies’ portfolio were also key recommendations to PBRG members, which triggered even more scandal and led to the eventual downfall of PBRG.

After Tiwari split in 2024, MarketWise filed a lawsuit against him in a US District Court, alleging he gained unauthorized access to customer lists to solicit subscribers for his own competing publication.

Alternatives to Find High-Potential Investments

The scandals at Palm Beach Research Group give financial newsletters a scammy image, but there are reputable resources self-directed investors can use.

If you want some extra information or investment ideas, work with a brand that has a transparent record for providing high-quality and unbiased tools.

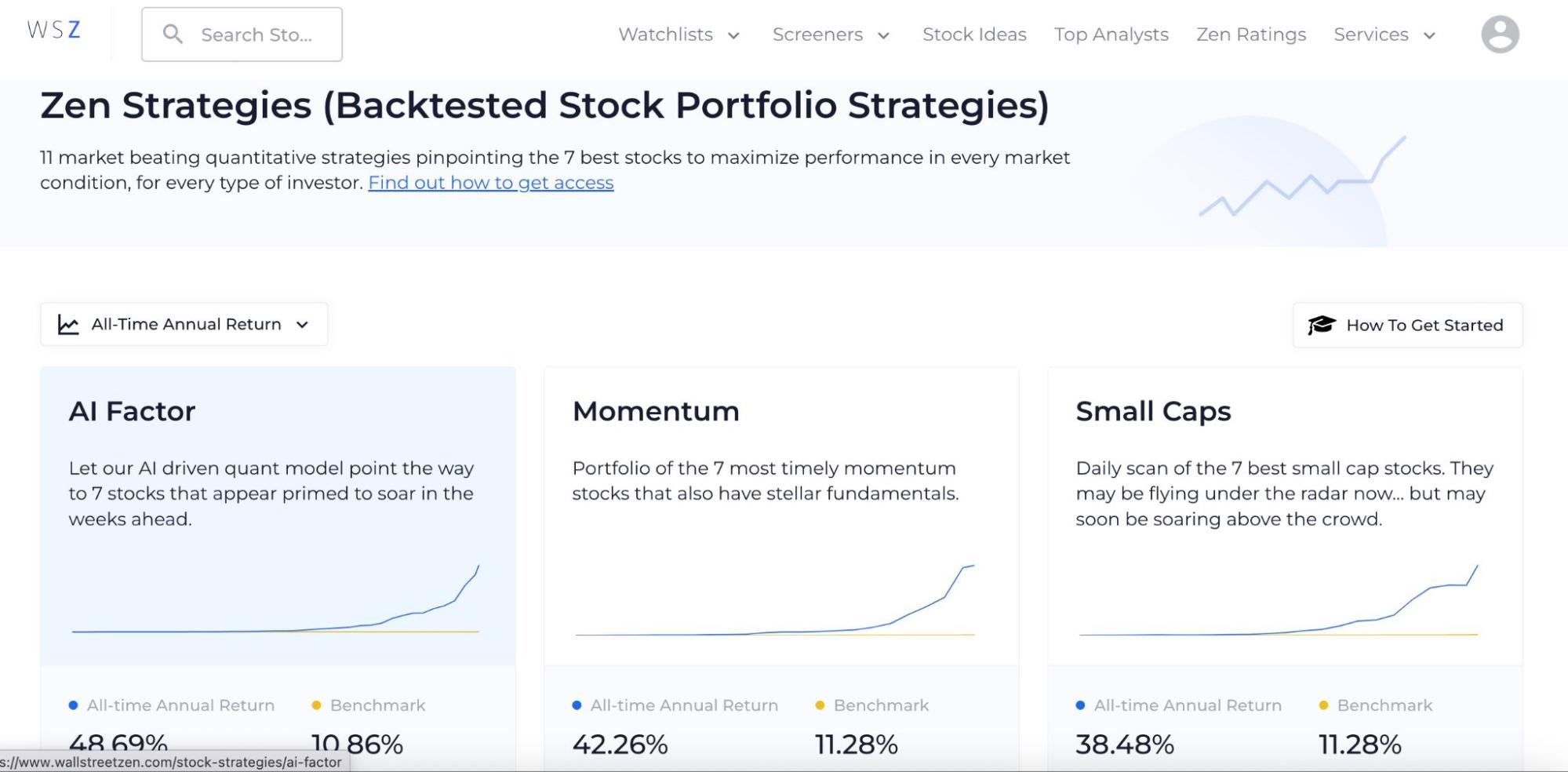

1. Zen Strategies

Let’s get real: Screening stocks is stressful.

Not only does it take a long time to narrow down promising companies, but how the heck do you choose from the dozens of names you’ve identified?

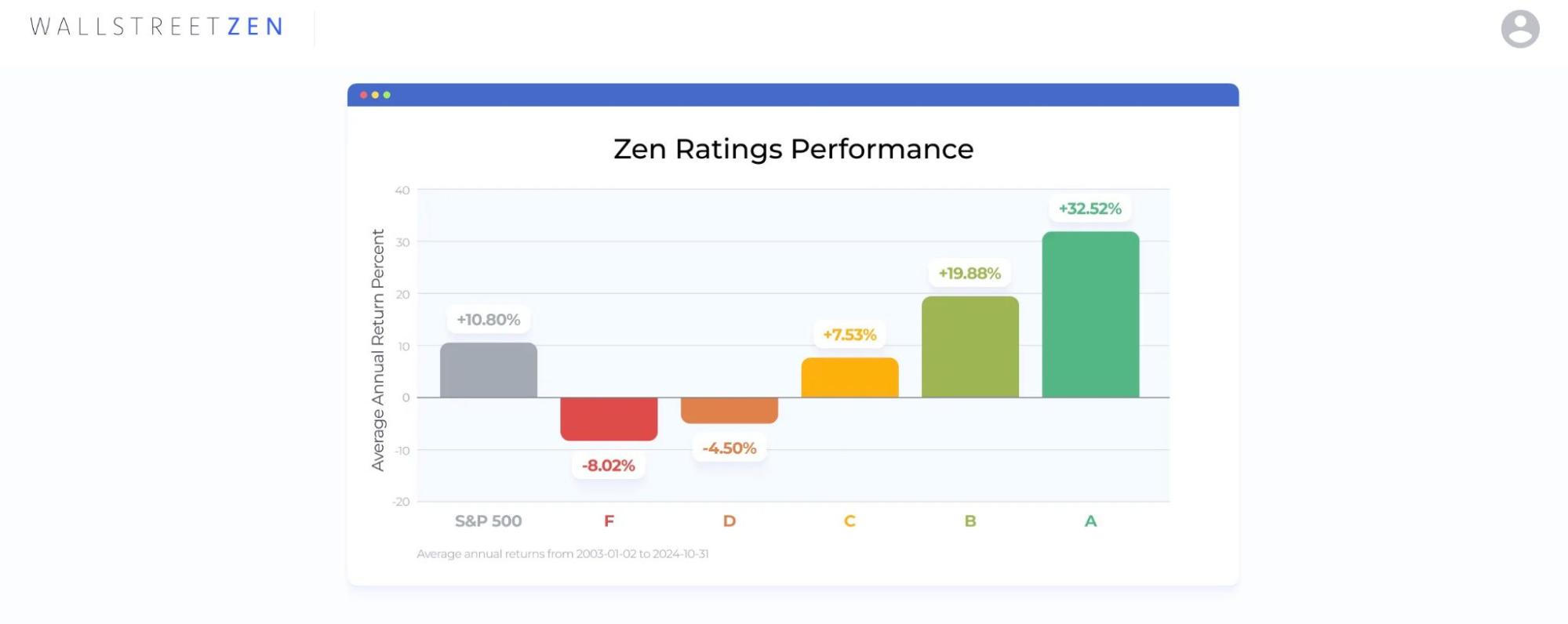

We noticed this with our Zen Ratings system, which returns an average of 35.25% for top-rated (A, or Strong Buy) stocks. However, there could be upwards of 900 buy-worthy stocks on this list every day.

To take some of the stress out of looking through these stocks, we recently released our Zen Strategies offering.

With a Zen Strategies subscription, you get access to 11 different portfolios, each with a different area of focus and a shortlist of seven stocks.

Whether you’re all about steady income with dividends, long-haul investing in large caps, or fast momentum trades, there’s a Zen Strategy that will help you spot attractive ideas in any market environment.

And we have data to back up these claims.

For instance, even during the bear market of 2022, our Momentum Strategy posted a 38.50% return, and portfolios like Growth and Large Caps saw respective gains of 17.51% and 13.36%.

So, if you’re looking for a proven and simple way to spot promising stocks, consider joining Zen Strategies.

2. Zen Investor

Are you a stock picker that’s strapped for time?

Are you tired of DYOR?

If so, why not let WallStreetZen sift through high-potential stocks and deliver them to your inbox?

That’s precisely what you get with a Zen Investor subscription.

For the greatest odds of success, our potential stock picks first undergo an exhaustive AI-powered screening, including a 115-factor test, to uncover only the brightest gems in the current market.

But our analysis doesn’t stop there. Wall Street veteran Steve Reitmeister also brings his keen eye to the recommended stocks and selects what his 20-year-plus experience tells him has the traits of an outperformer.

Besides detailed reports on two high-conviction stocks every month, Zen Investor subscribers get to hear from Steve Reitmeister on the current state of the market.

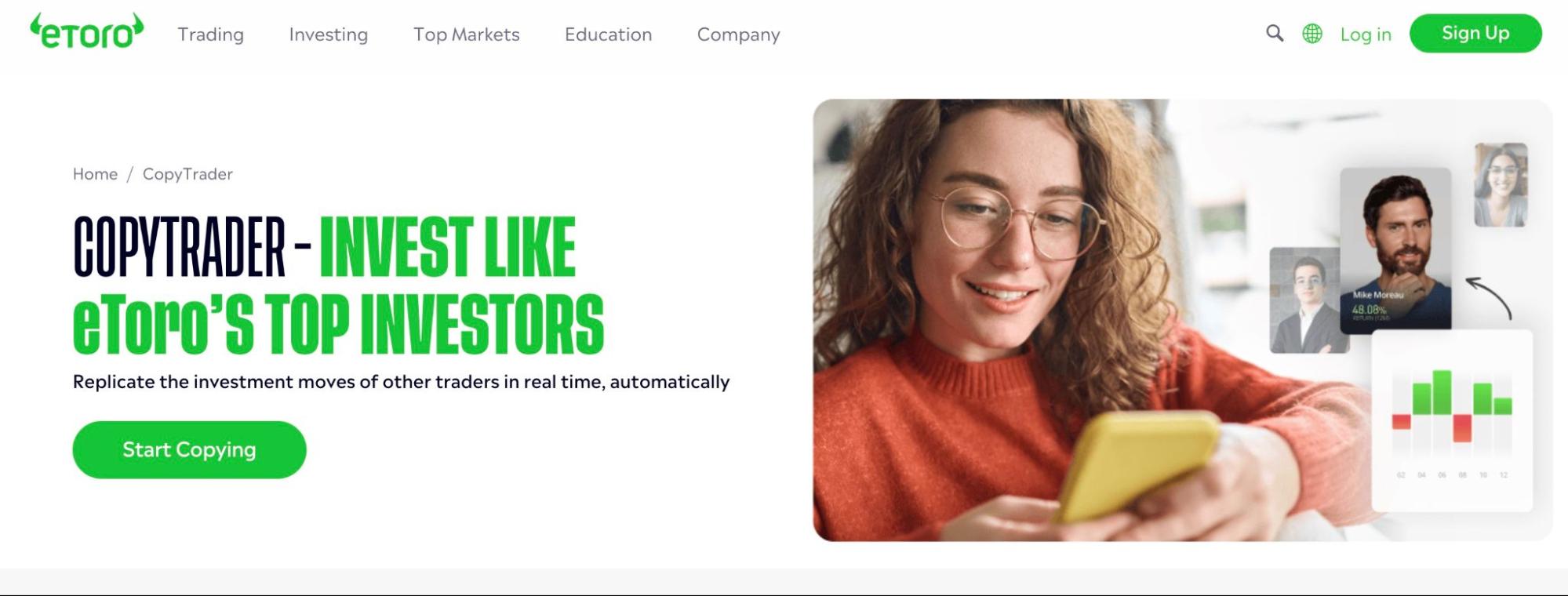

3. eToro CopyTrader

Alternatively, you could follow what top-rated traders are doing with eToro’s CopyTrader.

The Israeli-based brokerage eToro has become a global sensation for social trading.

Besides buying stocks or ETFs, anyone with an eToro account can scroll through a lively feed and see how other traders are positioning their portfolios.

To take things one step further, you could also use the eToro CopyTrader feature for a passive approach to trading.

As the name suggests, CopyTrader literally copies the moves of another eToro trader, so you get to share in all the profits — or experience the mistakes — they make.

But don’t worry about sending money to someone totally random on eToro. Everyone offering an eToro CopyTrader account has a track record you can verify, so you know the risk level and their prior wins and losses.

As a plus, eToro is a commission-free brokerage, and you get exposure to multiple assets like stocks, ETFs, and crypto.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Final Word:

What happened to Palm Beach Research Group isn’t something any self-directed investor wants to see.

As investigations show, company leaders weren’t recommending stocks based on unbiased research, and subscribers who trusted Legacy Research with their money weren’t able to get refunds.

The best we can learn from this unfortunate situation is to be extra skeptical about buying financial newsletters. If you can’t find a transparent track record and reliable third-party reviews, be extra cautious.

FAQs:

What happened to Palm Beach Research Group?

After an SEC lawsuit in 2022 and subsequent investigations, the parent company, MarketWise, decided to end Palm Beach Research Group's operations. By 2024, PBRG was officially over. Investors seeking reputable investment inspiration should turn to trusted platforms like WallStreetZen.

What happened to Teeka Tiwari?

Although Teeka Tiwari is no longer a part of MarketWise and faces a lawsuit from his former employer, he still has his own investment intelligence platform focusing on cryptocurrency.

Is Palm Beach Research Group legit?

No, Palm Beach Research Group wasn't a legit company because some researchers working for the brand only recommended companies they had financial ties to through their consulting activities. However, services like WallStreetZen and eToro's CopyTrader are worthy alternatives.

What is better than Palm Beach Research Group?

WallStreetZen's Zen Investor is a better alternative for self-directed investors that offers two stock picks per month that go through extensive AI screenings and meet the expectations of former Zacks.com editor-in-chief Steve Reitmeister.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.