Overall Verdict: Is Weiss Ratings Worth It in 2026?

After thoroughly examining the Weiss ratings approach, user feedback, and track record, here’s my take: Weiss Ratings can be a worthwhile tool for investors who enjoy DIY stock research — but there’s a very steep learning curve. If you’re looking for a simpler and more intuitive platform, you may prefer WallStreetZen’s easy-to-understand Zen Ratings system.

And if you want stocks chosen for you, Zen Investor is an affordable alternative. For $99 per year ($79 for a limited time, using links in this post), you can access a portfolio of stocks sourced using powerful AI tools combined with the human expertise of a 40+ year market veteran.

A Brief Summary of This Weiss Ratings Review

I’ll sum up this Weiss Ratings review succinctly below — and then I’ll go into more detail in the succeeding paragraphs.

Weiss shines if you:

- Want truly independent analysis

- Have time to master their complex rating system

- Prefer digging into fundamentals over quick trades

- Need coverage across tons of different investments

Their biggest wins:

- Zero financial ties to the companies they rate

- Massive coverage (53,000+ securities tracked daily)

- Sophisticated analysis using over 1,000 different metrics

- Comprehensive crypto ratings for 768 digital assets

But here’s where they stumble:

- The platform’s harder to navigate than a corn maze

- Pricing is not straightforward — while they do offer a free plan, most plans worth your while cost $200 or more per year

- Their ratings often change after the big price moves happen

- Limited help on when to buy or sell

- Crypto picks have been hit or miss for many users

What is Weiss Ratings?

Martin Weiss launched his rating company in 1971, and it has grown into one of the most comprehensive independent financial analysis firms. The platform analyzes over 53,000 securities daily, which include stocks, cryptocurrencies, and exchange-traded funds.

Here’s what caught my attention in the process of writing this Weiss ratings review: most rating agencies receive compensation from the companies they rate. Weiss doesn’t. They refuse any money from the firms they analyze, which keeps their recommendations independent.

Add in their flagship Safe Money Report and crypto coverage spanning 768 digital assets, and you’ve got something unique in the investment world.

But let’s be honest. If you want to keep things simple, WallStreetZen’s tools might be a better bet:

For DIY investors:

Our Zen Ratings system evaluates each stock on 115 factors proven to drive growth in securities. This evaluation is distilled into a letter grade; you can also dig deeper and see Component Grades for 7 key areas to see where a stock shines (or doesn’t shine).

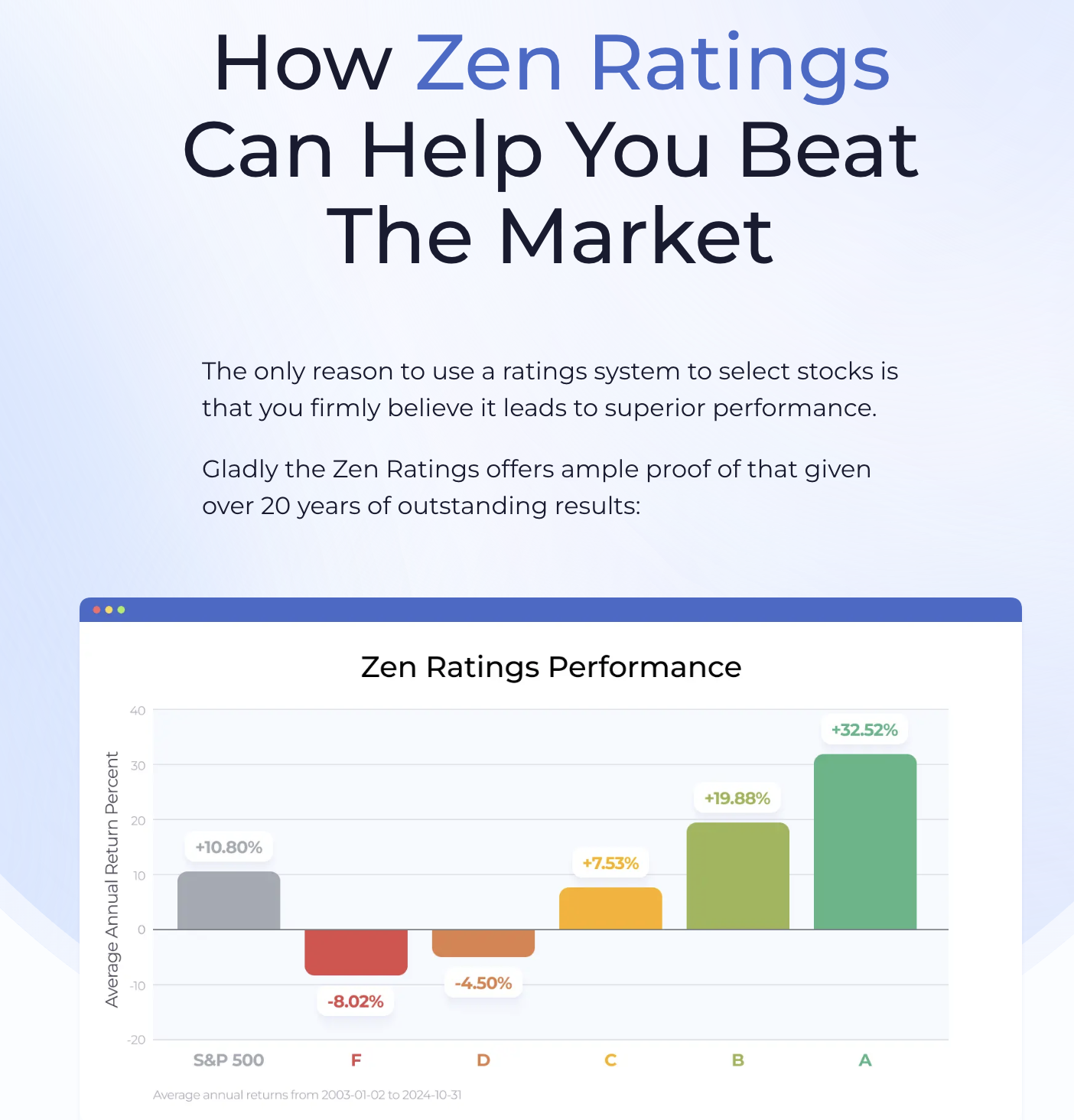

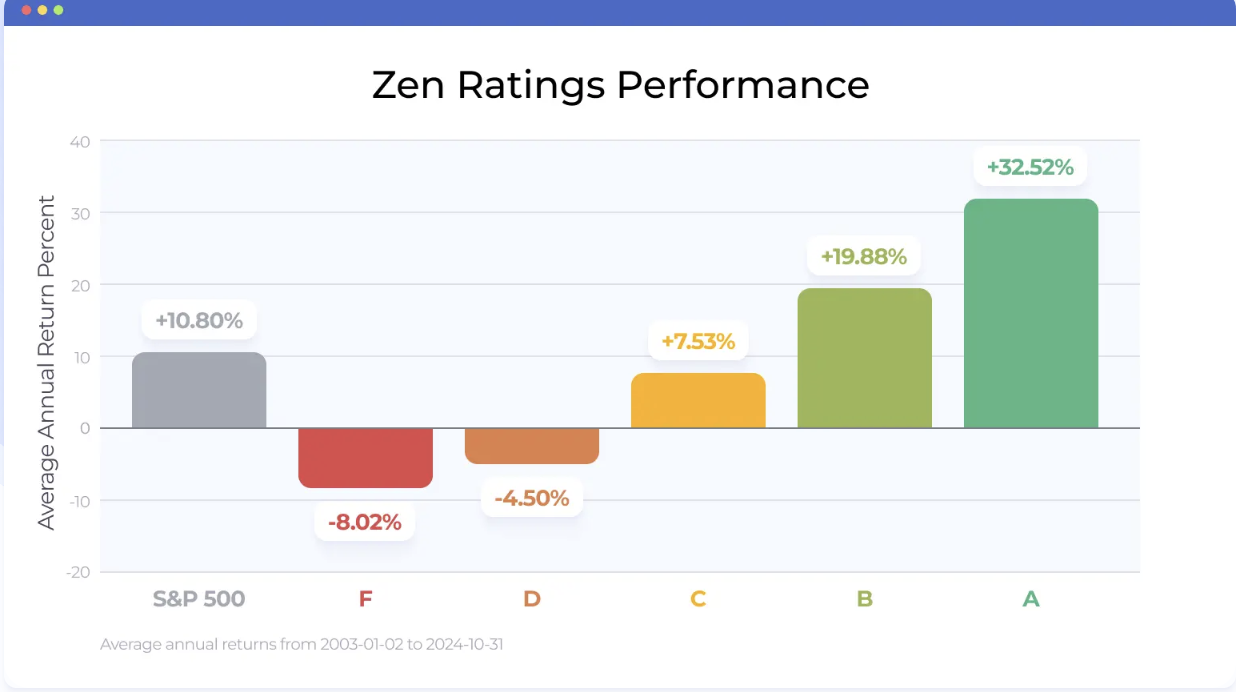

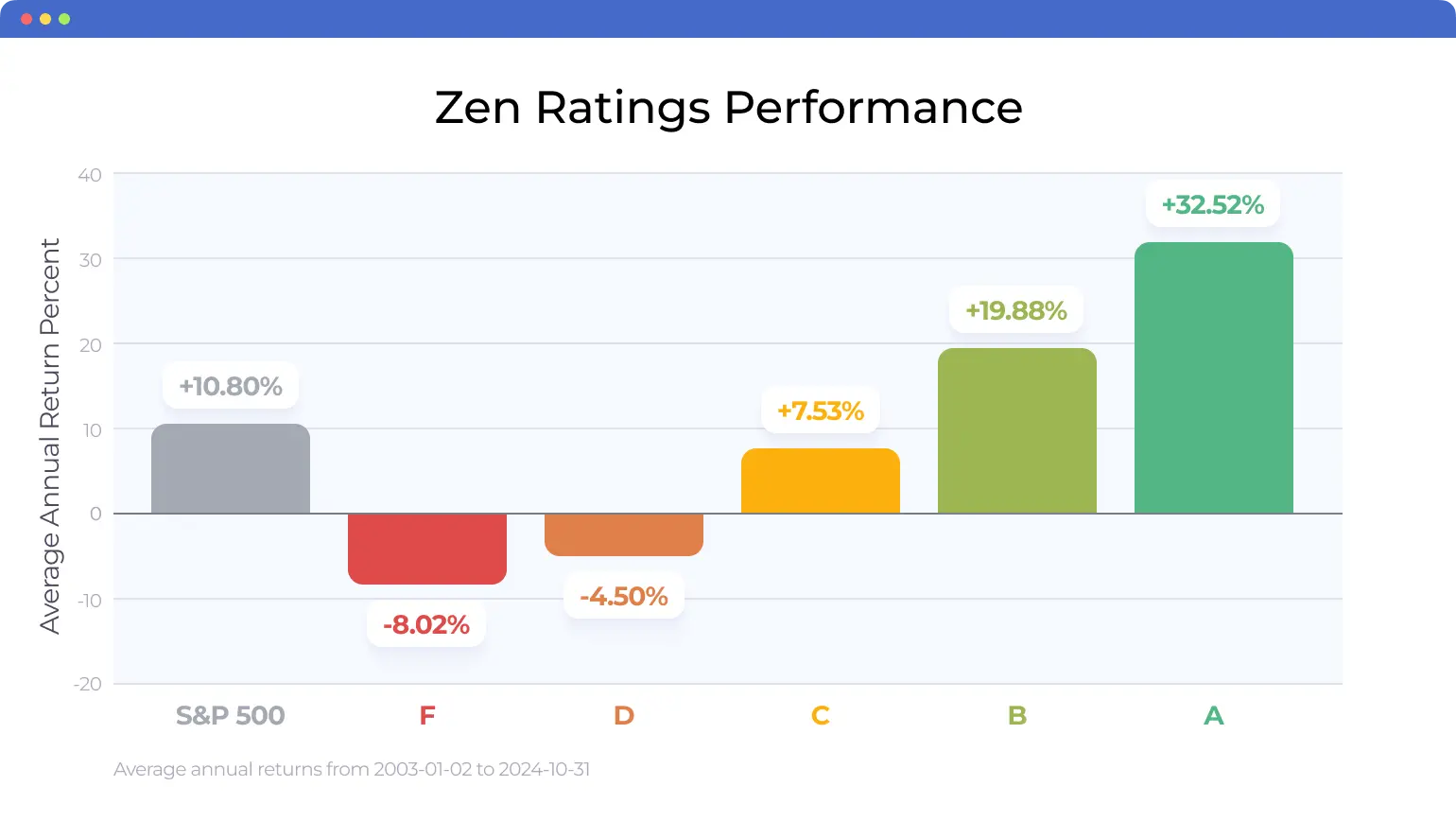

It’s simple, easy to use, and it’s an effective ratings system — as evidenced by a track record of 32.52% historical returns for stocks rated “A” using the system. Go ahead — click over to WallStreetZen now and enter any ticker you’re curious about. I’ll wait.

For more passive investors: Our Zen Investor makes things even easier. This stock picking service leverages the Zen Ratings system including advanced AI analysis but adds a human portfolio management layer — in essence, handling all the heavy lifting for you.

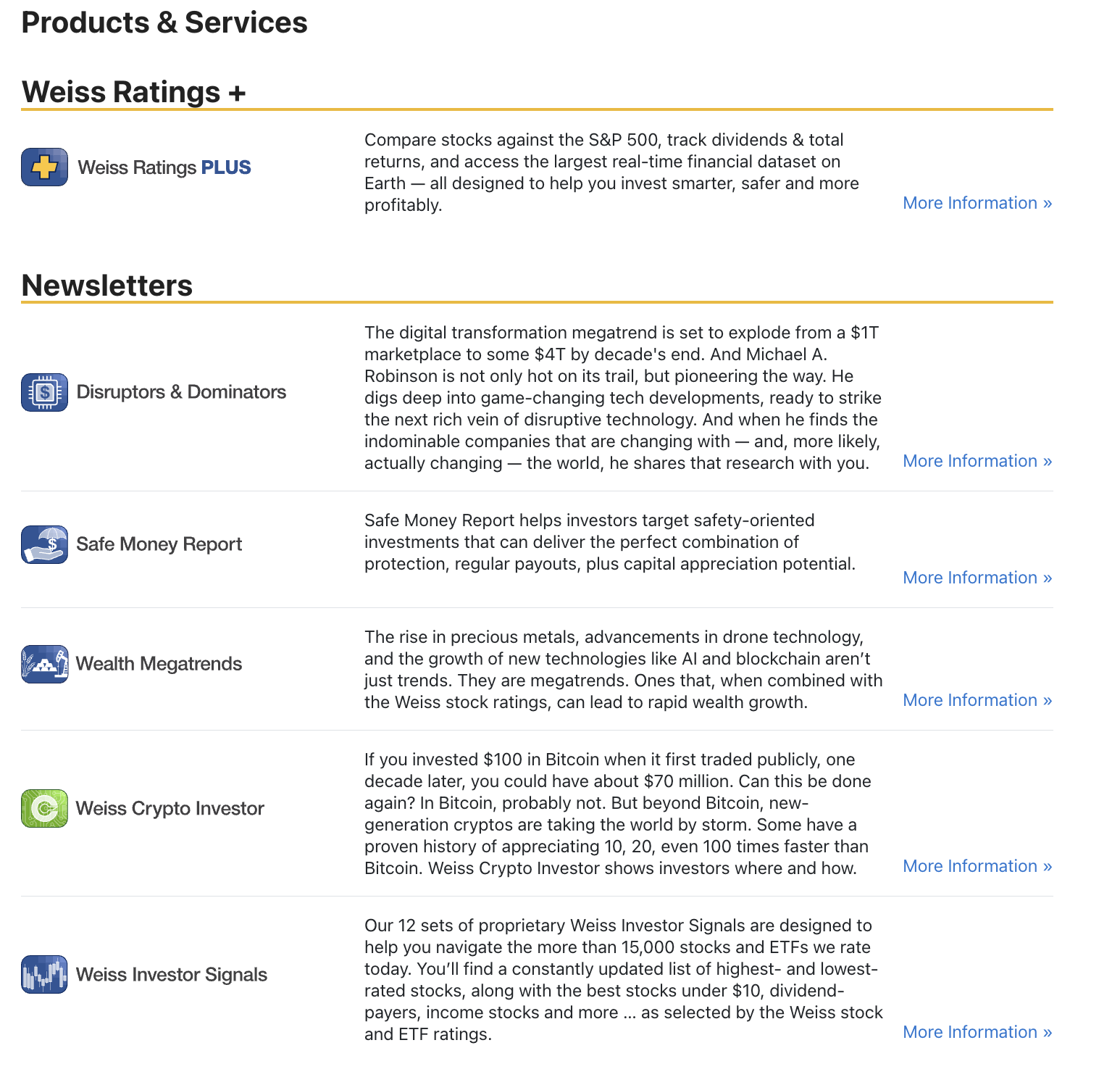

Weiss Ratings Products + Services

Main Features

Weiss stands out by refusing to play the typical Wall Street game. While other firms accept money from companies they rate, the Weiss ratings system says “no thanks” and maintains its analysis as unbiased as possible.

They crunch numbers on everything from penny stocks to Bitcoin using algorithms that process millions of calculations every day.

Martin Weiss brings serious credibility here. He’s been calling out financial problems before they hit the headlines for decades. Do you recall when the banking system began to collapse in 2008? Weiss was warning people years earlier.

You’ll get daily and weekly reports that don’t just say “buy this, sell that.” These reports explain what’s happening in the markets and teach you to think like a professional analyst. That’s worth something, even if you don’t follow every recommendation.

The Weiss coverage spans the whole investment universe. Traditional stocks and ETFs? Check. Weird crypto projects? They rate those too.

User Accessibility

Let’s talk about the elephant in the room: this platform isn’t exactly user-friendly. I’ve heard from numerous subscribers who spent weeks trying to figure out how to navigate the system.

The main dashboard presents a wealth of information at once, including ratings, reports, screening tools, and portfolio trackers. So, users coming from simpler platforms often feel overwhelmed initially.

Unlike services that use basic star ratings, Weiss created their grading system with multiple sub-categories. You’ll see overall grades, as well as separate scores for different aspects of performance and risk. Powerful? Absolutely. Intuitive? Not so much.

Most subscribers tell me they needed a month or two before feeling comfortable with the system. That’s fine if you’re committed to learning, but frustrating if you’re looking for quick answers.

The mobile experience doesn’t capture everything either. You need a desktop to access all their tools and reports effectively.

An easier-to-follow (and more affordable) alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Weiss Ratings’ Rating System

Stock Analysis Framework

The Weiss stock ratings approach builds its analysis around both making money and not losing it, a combination that many services overlook. They dig deep into company financials, looking beyond the surface numbers that fool amateur investors.

Their system examines balance sheets, income statements, and cash flow with a fine-tooth comb. They want to know if a company can survive tough times, not just whether it’s growing fast right now.

What they look at:

- Financial strength and how real the earnings are

- Performance compared to other stocks and market averages

- Risk factors across multiple categories

- Whether the current price makes sense

- Management quality and competitive advantages

You’ll get letter grades from A (strong buy) down to D (get out now), with plus and minus modifiers for more precision. The Weiss stock ratings also break down into growth potential, income generation, and safety, which is handy for different investment goals.

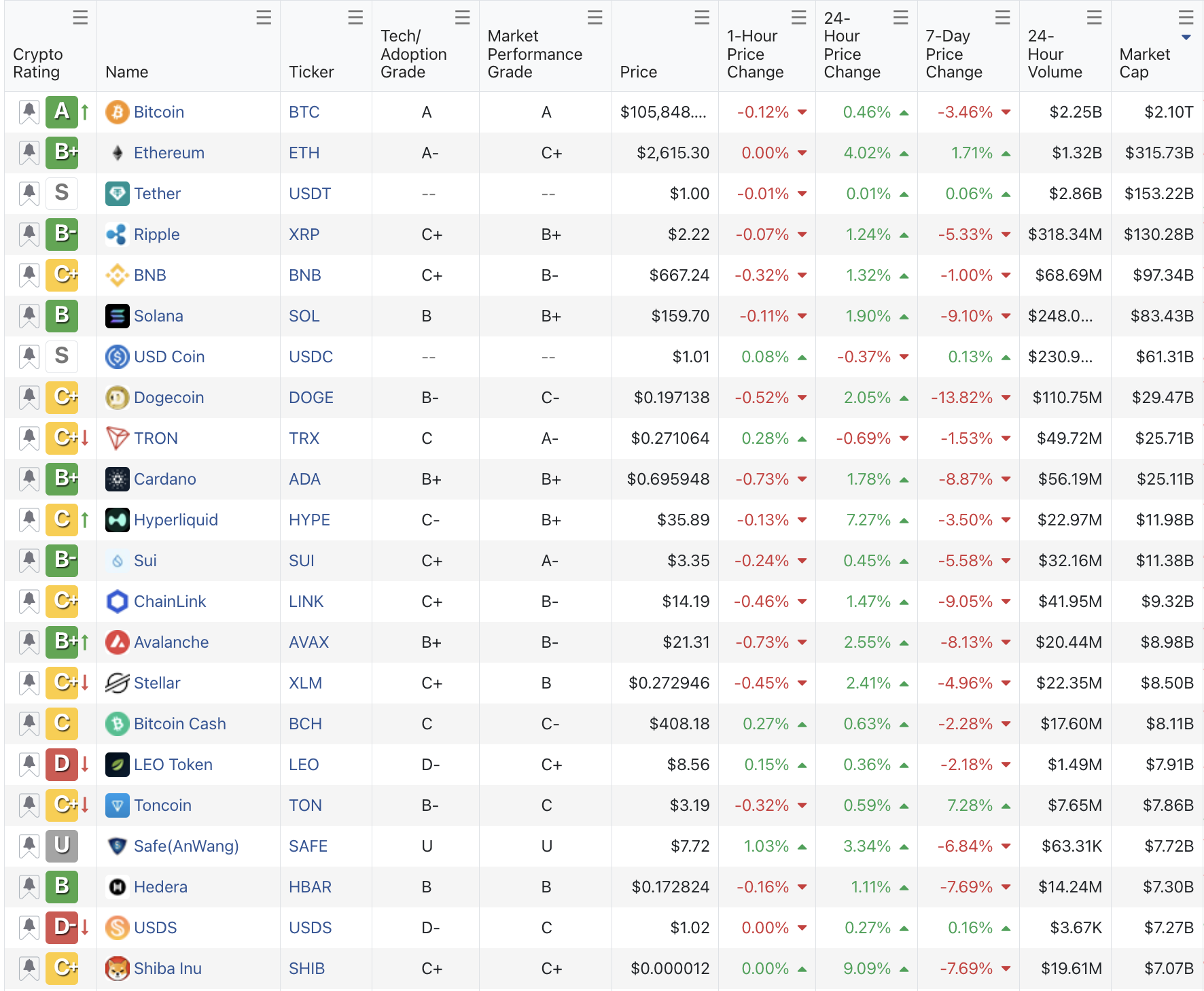

Weiss Ratings Crypto Analysis Framework

Here’s where things get interesting. The Weiss crypto ratings have developed one of the most sophisticated crypto rating systems available, and they don’t just rely on price charts, as most people do.

Juan Villaverde leads their crypto team, and he breaks down analysis into two parts: the technology behind each coin and its performance as an investment.

Technology side covers:

- How well the blockchain works

- Whether people are building useful things on it

- How fast are transactions processed

- Whether the development team knows what they’re doing

Investment side examines:

- Price trends and volatility patterns

- Trading volume and market dynamics

- Risk of manipulation or regulatory problems

The Weiss crypto ratings encompass 768 different cryptocurrencies, utilizing the same A-D scale. Weiss claims their crypto picks averaged 328% gains, although I’d take any performance claims with some skepticism until the whole methodology is revealed.

Unbiased Methodology

This is Weiss’s secret sauce. Most rating agencies have conflicts of interest that are so apparent, you could drive a truck through them. A company pays for a rating, and the agency delivers a favorable review, which is, to say the least, shocking.

Weiss flipped that script. No payments from companies. No gifts. No fancy dinners. Their analysts get paid the same whether they recommend a stock or trash it.

How do they stay independent?

- Zero compensation from any company they rate

- Everything’s transparent, and you can see their methodology

- Analysts aren’t rewarded for pushing specific investments

- They’ll give negative ratings to popular stocks if the numbers don’t work

- Long-term reputation matters more than keeping subscribers happy

Weiss Ratings vs. DIY Investing

Factor | Weiss Ratings | DIY Approach |

Time Needed | Medium (Need to check reports and rating) | High (Research Everything Yourself) |

Skill Level | Medium (Learn the system) | High (Master analysis methods) |

Annual Cost | $199 + subscription | Lower cash cost, higher time cost |

Coverage | Over 53,000+ securities | Whatever you can manage |

Control | Follow Weiss methodology | Complete freedom |

Consistency | Standardized approach | Depends on your discipline |

Advantages

The biggest benefit of working with Weiss is that you save time. Instead of spending your weekends analyzing balance sheets, you get professional-grade research delivered daily. For busy professionals, that’s enormous value.

You simply can’t match their coverage on your own. Tracking thousands of stocks and hundreds of cryptocurrencies requires databases and expertise that are costly to access independently.

Their crypto insights shine here. Most individual investors don’t understand blockchain technology well enough to evaluate whether a project has real potential or it’s just marketing hype. Weiss’s technical analysis fills that gap.

Risk assessment saves portfolios. They spot red flags in company financials that individual investors often miss. That early warning can prevent major losses that devastate personal portfolios.

Drawbacks of Weiss Ratings

Here’s the frustrating part: their ratings often change after the significant price moves have already happened. Users constantly complain that by the time Weiss upgrades a stock, it has already risen 20%.

The platform feels like rocket science when you first log in. All those rating categories and analytical layers overwhelm people who just want simple buy/sell guidance.

A one-size-fits-all approach doesn’t work for everyone. You can’t adjust their analysis to match your risk tolerance or specific investment goals.

Crypto performance has been mixed based on user reports. Some people made money following their picks, others didn’t. The crypto market moves so fast that even sophisticated analysis struggles to keep up.

Zen Investor Advantage

Zen Investor addresses the primary issue with rating services: translating analysis into actionable investment decisions. Instead of giving you ratings to interpret, they manage portfolios for you.

Why this matters:

- No learning curve

- Better pricing at $99/year ($79 for a limited time, using links in this post) vs. Weiss’s $199+ annually

- Professional management with regular rebalancing

- AI meets human judgment through its 115-factor analysis model

- Strong track record: As part of the 4-step process used to select stocks for the portfolio, Editor-In-Chief Steve Reitmeister uses the Zen Ratings system — a quant ratings system with a proven track record (“A” rated stocks have historically averaged +32.52% annually)

You get quantitative analysis combined with human oversight. The AI crunches numbers while portfolio managers make strategic decisions.

Weiss Ratings Pricing: Is it a Good Value?

Plan Options

Weiss offers a basic free tier that gives you limited ratings and research. Think of it as a test drive before committing to paid services.

Weiss Ratings Plus includes the premium features:

- Real-time alerts when ratings change

- Advanced screening tools to find opportunities

- Detailed research reports and analysis

- Access to the Safe Money Report

- Full crypto coverage for 768 digital assets

- Portfolio tracking tools

- Phone and email support

They don’t publish exact pricing, but expect to pay $199 annually for the full service.

For investors managing six-figure portfolios, the subscription cost represents pocket change if it prevents one major mistake or finds one great opportunity.

Value depends on several factors:

- Time savings matter if your time is valuable professionally

- Comprehensive coverage would cost thousands to replicate independently

- Learning value beats expensive investment courses

- Crypto expertise isn’t easy to find elsewhere

But smaller investors might struggle to justify the cost. If you’re working with $10,000 and paying $200 or more annually for research, it significantly eats into your returns.

Passive index investors are unlikely to find much value here either. Why pay for individual stock analysis if you’re buying the whole market anyway?

Compared to financial advisors charging 1-2% of assets annually, Weiss is a bargain for hands-on investors who want professional analysis without relinquishing control.

Alternatives to Weiss Ratings

1. Motley Fool Stock Advisor

Price: $99 first year ($74.50 for a limited time only, using links in this post, then $199 annually

What you get: Two new stock picks monthly with detailed reasoning, access to all current recommendations, position updates, and solid educational content. They focus on long-term growth investing with multi-year holding periods.

The Fool’s educational approach helps you understand their investment philosophy and follow their recommendations. Less complex than Weiss but more limited in scope. For more info, check out our detailed Motley Fool Stock Advisor review.

2. Morningstar

Price: $249 annually for Morningstar Investor — Get $50 off using this link

What you get: Deep fundamental analysis, proprietary rating systems, portfolio tools, and extensive mutual fund/ETF coverage. They excel in traditional investment research, with a particular strength in fund analysis.

Morningstar also has some nifty tools like the Portfolio X-Ray, which lets you take a deep dive into your holdings, including your current allocation, sectors you’re invested in, and more. It can be pretty eye-opening to see areas that you may have been missing and/or how little or well diversified you are.

Morningstar provides institutional-quality research — and its Investor subscription (formerly Premium) offers an excellent suite of tools that can help you make more informed investing decisions.

3. The Oxford Communique

Price: Premium subscription is $249 — get it for $99 for a limited time using links in this post

What you get: Conservative investment newsletter, recommendations across multiple asset classes, wealth-building education, and community access. They emphasize asset protection and steady returns over aggressive growth.

Suitable for older investors prioritizing capital preservation, but may have limited appeal for younger, growth-oriented investors. For more, check out our detailed review on the service’s parent company in our Oxford Club review.

4. Zen Investor

Price: $99 / year ($79 for a limited time, using links in this post)

What you get: An AI-enhanced portfolio managed by Steve Reitmeister, former Editor-In-Chief of Zacks.com and a 40+ year investing veteran, using 115-factor analysis to identify top opportunities. No rating interpretation needed as it manages everything from stock selection to rebalancing.

Combines sophisticated analysis with human portfolio management. Ideal for investors seeking professional results without the complexity.

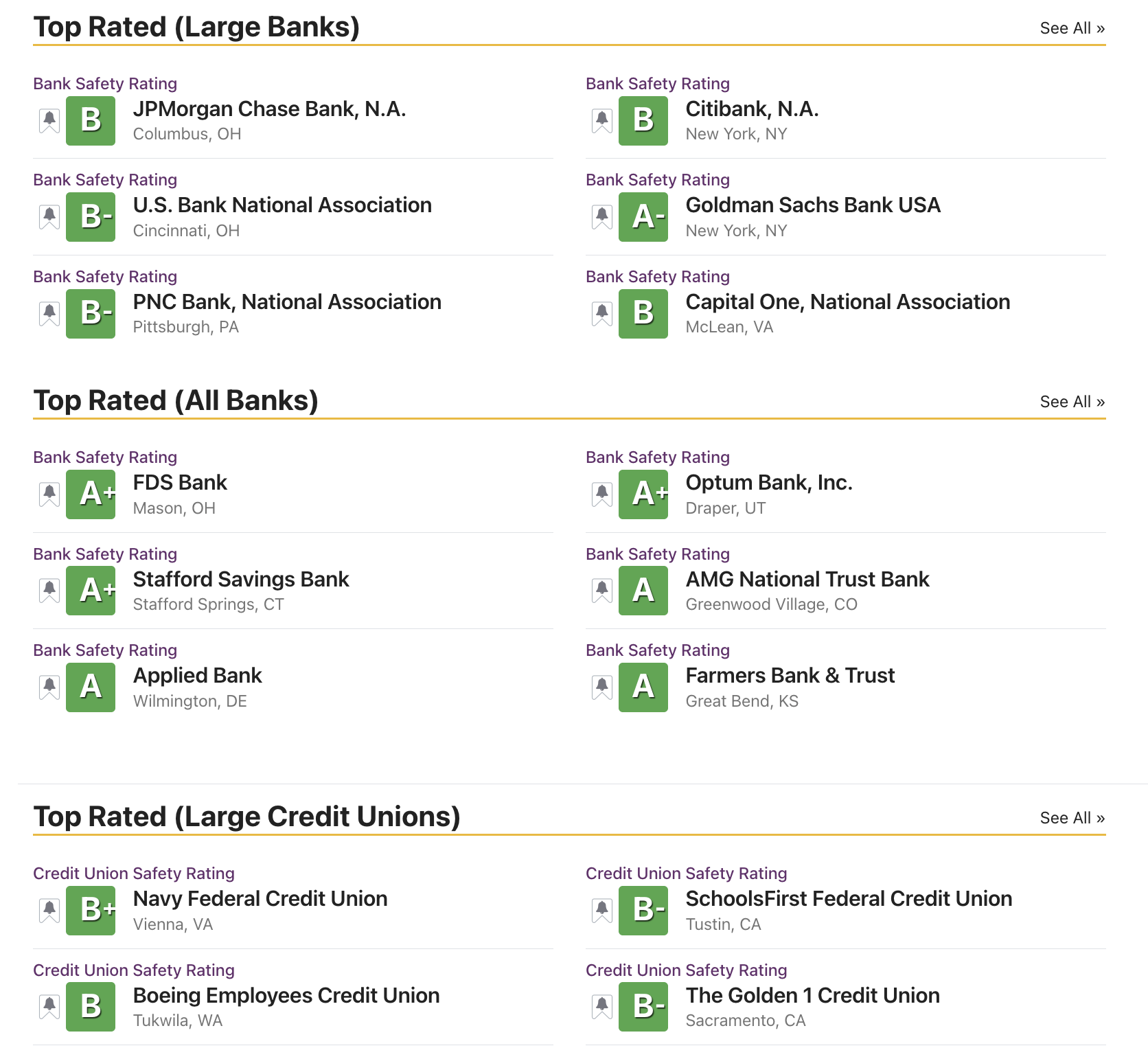

Is Weiss Ratings Reliable?

User Perspectives

Trustpilot shows 4.7 out of 5 stars based on 480 reviews, which appears impressive at first glance. Digging deeper into this Weiss ratings review reveals some patterns worth knowing about.

Users praise:

- Excellent customer service that knows their stuff

- Easy cancellation without aggressive sales tactics

- Educational value that teaches investment principles

- True independence from corporate influence

- Willingness to go against popular opinion

Common complaints:

- Timing issues as ratings change after price moves

- Platform complexity requires a serious learning commitment

- Indicators lag market action too much for active trading

- Crypto recommendations haven’t consistently delivered

- Marketing creates unrealistic expectations about easy profits

Weiss Ratings Performance Record

Weiss makes bold claims about their track record. They say “Buy” rated stocks averaged over 303% returns across 22 years, factoring in losers. That’s impressive if accurate and achievable in practice.

Their crypto claims of 328% average gains sound amazing, but raise questions. Crypto markets are so volatile that even great analysis can be quickly outdated by news or regulatory changes.

The Wall Street Journal reportedly found that Weiss stock ratings outperformed other services, providing some independent validation. However, specific methodology details aren’t readily available.

Reality check factors:

- Performance calculations might not reflect real-world implementation challenges

- Results likely assume perfect timing and execution

- Individual investor experiences vary dramatically

- Crypto claims might reflect lucky timing during bull markets

Final Word:

This Weiss ratings review reveals a service that delivers genuine value for the correct type of investor, but it’s not for everyone. The platform’s independence and comprehensive coverage create significant advantages for research-focused investors willing to invest the time in learning.

Weiss works best for:

- Serious investors managing substantial portfolios

- People who enjoy fundamental analysis

- Those valuing independence over convenience

- Investors with time to master complex systems

Look elsewhere if you:

- Want simple, actionable guidance

- Need precise entry/exit timing

- Prefer spending time on other things

- Want professional portfolio management

For most investors, Zen Investor provides a more effective path forward. It provides professional management with AI enhancement at a lower cost, eliminating the complexity while potentially delivering superior results.

The Weiss ratings can enhance investment decisions for committed users, but success requires realistic expectations and significant effort. It’s a tool, not a magic bullet for investment success.

FAQs:

Are Weiss Ratings’ Crypto Predictions Accurate?

Weiss claims an average gain of 328% on crypto trades, which sounds impressive but comes with significant caveats. While they analyze 768 cryptocurrencies using sophisticated methods, user experiences with their crypto picks are mixed.

Is Weiss Ratings Plus Worth It?

Weiss Ratings may be worth it for serious investors with large portfolios who'll actively use the advanced features. The real-time alerts, screening tools, and detailed research provide value that's expensive to replicate independently. However, most part-time investors would be better off with more competitively-priced stock research tools like WallStreetZen, which includes the Zen Ratings system, a quant rating tool that evaluates stocks on 115 factors proven to drive long-term growth.

Is Martin Weiss legit?

Yes, Martin Weiss is legit. He founded his company in 1971 and has built a solid reputation for independent analysis over the past 50 years.

What’s the best Weiss Ratings newsletter?

The best Weiss Ratings newsletter for you depends on your goals. The Safe Money Report is well-suited for conservative investors focused on capital preservation, making it ideal for retirees. Crypto investors prefer Weiss Crypto Daily for specialized digital asset analysis. As a free alternative, consider subscribing to WallStreetZen's FREE newsletter, which includes Strong Buy picks, a weekly watchlist of stocks, and more.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.