You’ve probably seen the ads: automated trading bot boasting a 90% win rate that can trade while you sleep.

Tempting, right? Before you wire money to an algorithm, let me share what the facts reveal in this comprehensive Stock Hero review. After testing the platform extensively, I’ve uncovered both impressive capabilities and concerning limitations that potential users should know about.

The Bottom Line: Is Stock Hero Worth It?

After weighing its no-code bot builder, plentiful backtesting, and that much-marketed 90% historical win rate, I believe Stock Hero can be a powerful — but narrowly focused — tool for active DIY traders who are comfortable letting algorithms run wild. It’s best for tinkerers who want to automate their own ideas and can stomach short-term volatility.

If you’d rather lean on decades of human experience (with AI as a helper, not a pilot), Zen Investor’s human-first, AI-assisted research may be the safer fit.

Prefer a human analyst who still harnesses AI?

Zen Investor is a stock-picking service that gives you the best of both worlds, employing both an artificial intelligence and a human touch.

The service is helmed by Steve Reitmeister, former Editor in Chief of Zacks.com and a market veteran with 40+ years of stock trading experience.

As part of his selection process, each potential stock is screened through the Zen Ratings system, a proven model that boasts a track record of average annual returns of 32.52% for A-rated stocks — including a cutting-edge AI Rating.

Check out Zen Investor

What Is Stock Hero?

Stock Hero is a cloud-based AI trading platform that promises to turn any strategy into an automated bot — with zero coding — and to deliver “~90% win rates” for its flagship Sigma Series strategies. This Stock Hero AI review will show you where that promise holds up — and where it wobbles.

Related reading: The Best AI Trading Bots in 2026

The “~90% win rate” claim specifically applies to the platform’s Sigma Series strategies and is “based on actual live trades for all users” according to Stock Hero’s website. This doesn’t apply to all marketplace bots or strategies you might create yourself.

Stock Hero is owned by Novum Global Ventures, a fintech and investment group founded in 2018, and operates under the wider TradeHeroes.ai umbrella which includes other trading platforms like CFDHero, ForexHero, and CryptoHero.

The company targets:

- Beginners – Rent pre-built bots in a “Marketplace” and paper-trade first.

- Experienced quants – Drag-and-drop indicator logic, plus TradingView webhook triggers.

- Busy professionals – “Set-and-forget” automation that claims to run 24/7.

Key Features of Stock Hero

Stock Hero’s platform combines several powerful features designed to make algorithmic trading accessible to traders with varying levels of experience. While the interface is streamlined for simplicity, the underlying technology supports sophisticated trading strategies.

Let’s examine each core feature to understand how they work together to create an end-to-end automated trading system.

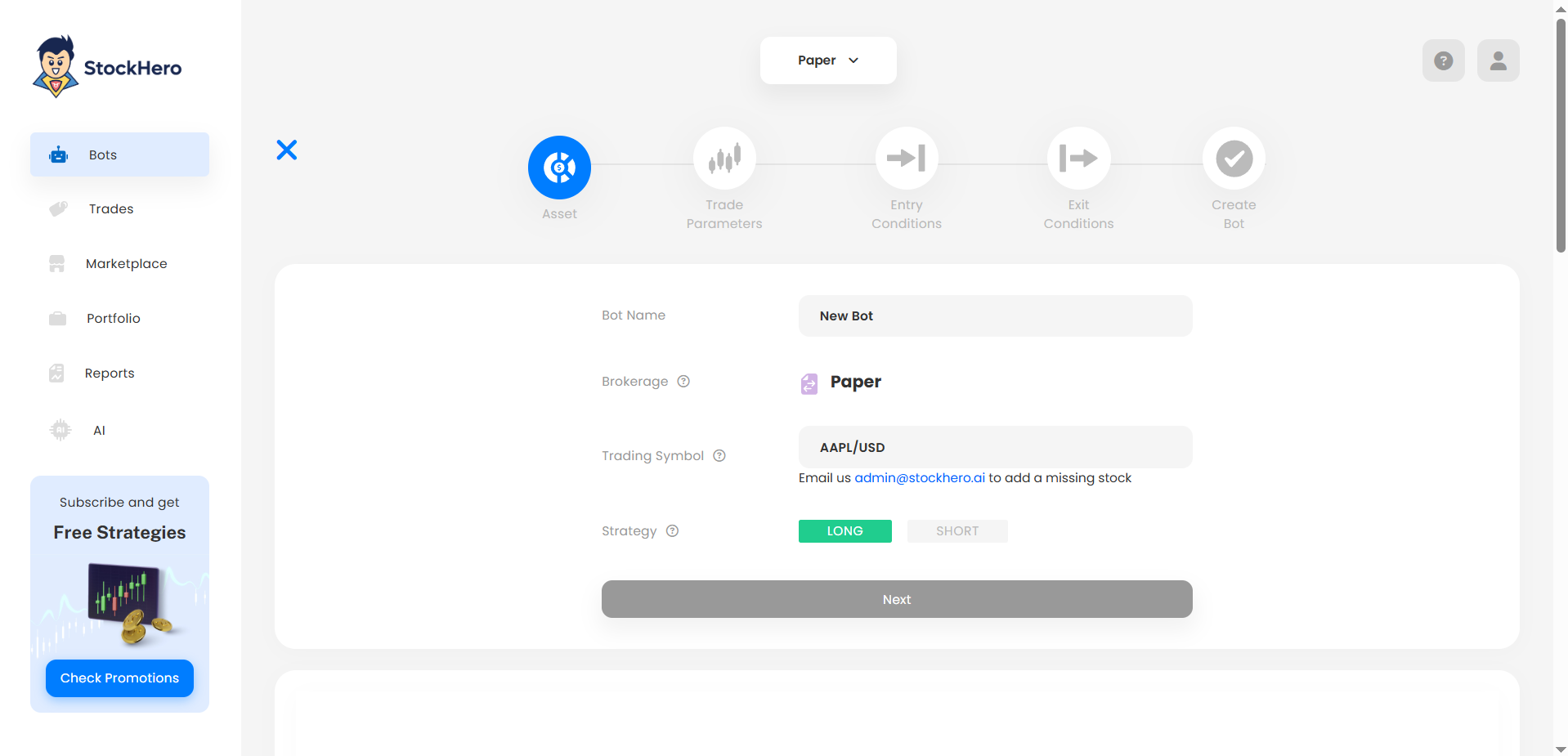

Bot Builder

- No-code flow-chart interface—drag RSI, MACD, Bollinger Bands, price levels, or custom TradingView alerts.

- Long/short logic with trade-frequency choices (1-minute to daily).

- Risk parameters: position sizing, stop-loss, take-profit.

Stock Hero’s Bot Builder is designed to turn trading strategies into automated bots without requiring coding knowledge. The drag-and-drop interface allows users to incorporate various technical indicators, set risk parameters, and define trade frequency ranging from 1-minute to daily timeframes.

According to Stock Hero’s documentation, the platform supports various advanced bot types including DCA (Dollar-Cost Averaging), Grid, Momentum, Trailing Take-Profit, and Quick-Start templates.

These tools are designed to help traders implement sophisticated strategies without programming expertise.

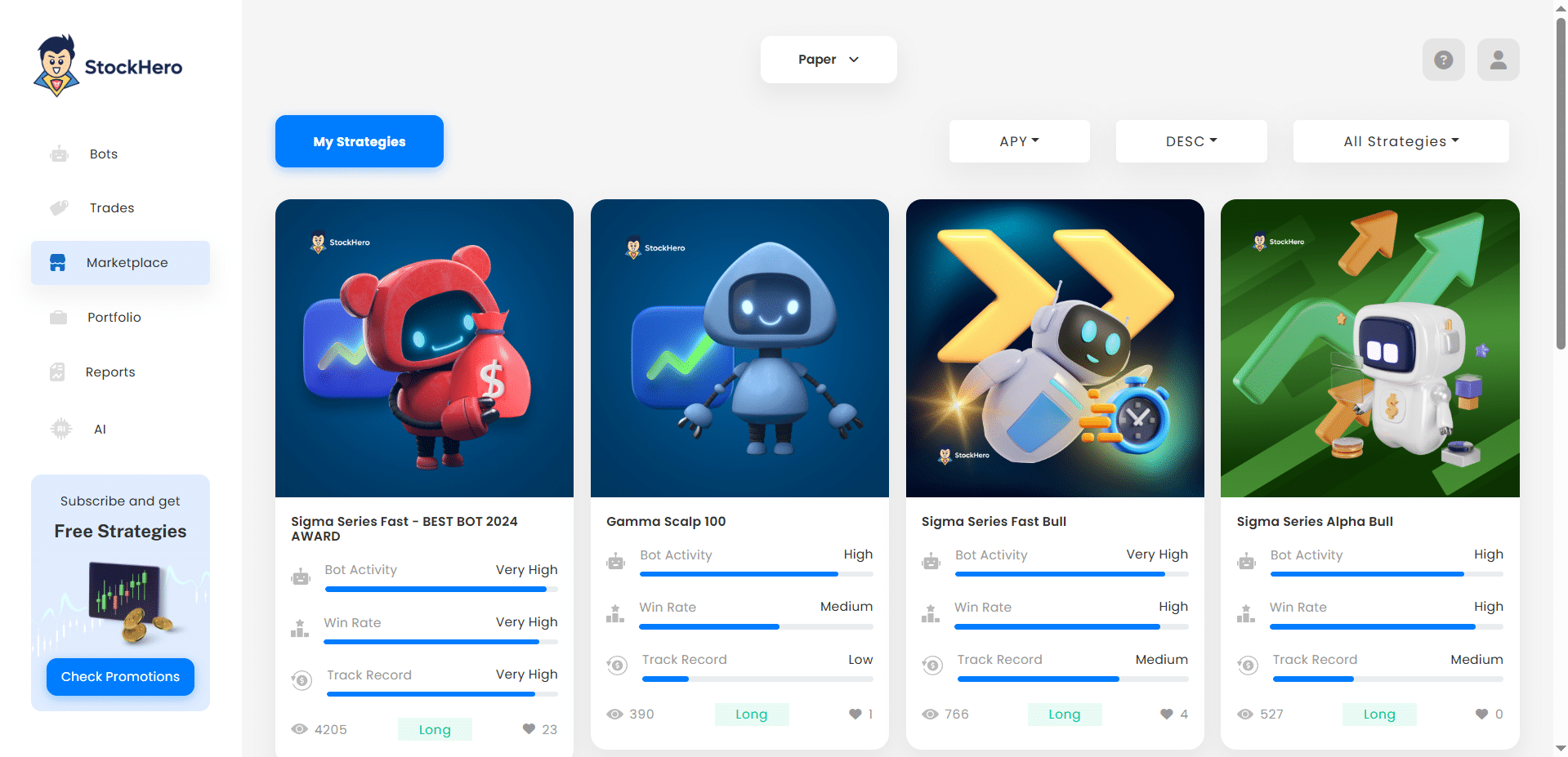

Bot Marketplace

- Browse dozens of vetted bots with stats (win %, Sharpe, drawdown).

- Rent a bot from a top performer to skip trial-and-error.

- Revenue share means creators stay incentivized.

The Bot Marketplace is available to Premium and Professional tier subscribers only. Users can rent pre-built strategies on monthly, quarterly, or yearly plans.

Related reading: The Best AI Trading Bots in 2026

Strategy creators earn recurring revenue from rentals, and their templates are hidden. According to Stock Hero’s documentation, if a subscription or rental payment lapses, all derivative bots are immediately deactivated.

While many Stock Hero reviews focus heavily on the platform’s marquee features, the marketplace’s quality control is an often overlooked strength that deserves attention.

The marketplace functions as a curated ecosystem, with Stock Hero maintaining a closed system where no third-party code uploads are permitted — all marketplace bots are built with internal tooling.

Backtesting

- Unlimited historical runs (up to 100K candles on the Pro plan) with metrics such as Sharpe Ratio and Max Drawdown.

- One-click forward-test in a sandbox before going live.

Stock Hero offers unlimited backtesting on all subscription plans, a feature that sets it apart from some competitors that limit the number of tests users can run. The depth of historical data varies by plan:

- Lite: >6,000 candles

- Premium: >20,000 candles

- Professional: >100,000 candles

The platform provides standard risk metrics like Sharpe Ratio and Maximum Drawdown to help users evaluate strategy performance beyond simple win rates. After backtesting, users can forward-test strategies in a paper trading environment with real-time market data before deploying with real capital.

Many Stockhero AI review assessments overlook the importance of these metrics, but they’re crucial for evaluating whether a strategy is likely to perform in live markets or is merely overfitted to historical data.

Stock alerts with a backtested edge…

A great alert system can help give you an all-important edge in the market.

Our favorite service? Stock Market Guides.

No, it’s not AI-powered, but its powerful algorithm helps you identify opportunities that have a historical track record of profitability in backtests.

For every trade setup, they show you that exact setup has performed historically. Does it work? Well, consider the service’s track record: As of May 2025, Stock Market Guides’ stock alert service has delivered an average annualized return of 43.1%.

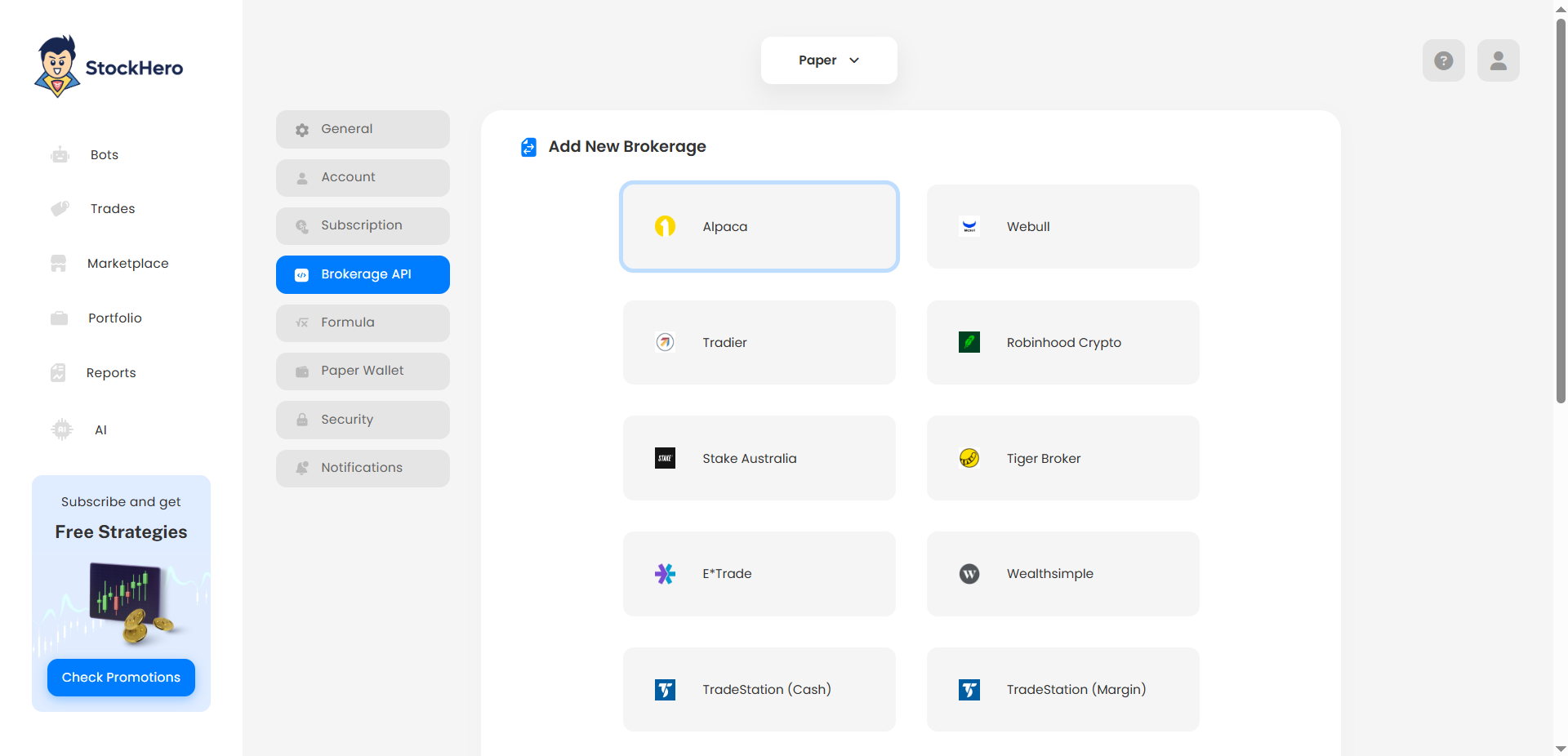

Broker Connectivity

- Native automation for TradeStation now, plus beta-level support for brokers like E*Trade, Webull, Alpaca, Wealthsimple (Canada), Stake (Australia), Tradier, and others. TD Ameritrade is on the roadmap.

For users without compatible brokers, Stock Hero can function as a “signal provider,” generating alerts that traders can manually execute at any brokerage.

Stock Hero highlights its integration with TradeStation, which offers new customers up to $5,000 in promotional cash bonuses based on the amount deposited.

TradingView Integration

Use any TradingView signal (Pine Script alert → webhook) as a trigger to fire orders through Stock Hero—perfect for chartists.

Stock Hero integrates with TradingView through webhooks, allowing users to execute trades based on custom TradingView alerts. This feature is particularly valuable for traders who already use TradingView for technical analysis and want to automate execution of their strategies.

The TradingView integration is available to Premium and Professional subscribers and expands the platform’s capabilities beyond its built-in indicators. Users can leverage Pine Script (TradingView’s programming language) to create custom signals that trigger Stock Hero bots.

Who Should Use Stock Hero?

A common question in Stock Hero reviews is exactly who benefits most from this type of trading platform. Let’s break it down by trader profile:

Skill level | Fit | Why / Why Not |

True beginner | Maybe | Paper trading is safe, but limited education means you’ll learn by losing real money. |

Intermediate DIY trader | Best fit | You already test ideas and want automation without code. |

Advanced quant | Good secondary tool | API depth is lighter than enterprise-grade platforms. |

Passive investor | Poor fit | Algo scalping diverges from buy-and-hold goals. |

Stock Hero’s platform is most suitable for intermediate DIY traders who already understand basic trading concepts and want to automate their strategies without learning to code.

The platform offers a paper trading environment for beginners to practice without risking capital, but the learning curve may be steep without extensive trading knowledge.

Advanced quantitative traders might find Stock Hero useful as a secondary tool, but its capabilities may be more limited than enterprise-grade platforms that offer more customization options and data access.

The platform’s focus on technical indicators and short-term trading makes it less suitable for passive investors focused on long-term, buy-and-hold strategies.

Stock Hero does offer white-glove onboarding services for Premium and Professional tier subscribers, which could help bridge knowledge gaps for less experienced users.

According to the company, customer support is available 24/7 across multiple channels including chat, email, web form, WhatsApp, and Telegram.

Looking for human expertise instead of AI trading?

While Stock Hero focuses on automated algorithmic trading, many investors prefer having experienced human analysts making investment decisions. Zen Investor offers a different approach for a fraction of the cost of Stock Hero. For just $99/year ($79 using the links in this post!) you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Pros and Cons of Stock Hero

Pros | Cons | |

Platform | Modern UI, fully web-based, works on mobile. | No desktop pro terminal. |

No-code builder | Fast strategy prototyping. | Complex logic gets messy. |

Backtests | Unlimited on all paid tiers (rare). | Data limited to supported U.S. equities/ETFs. |

Marketplace | Rent proven bots; see live stats. | Hard to verify third-party track records. |

Pricing | Starts at $29.99/mo—cheaper than many AI rivals. | Lite plan supports only one active bot & TradeStation. |

Education | — | Sparse tutorials; no structured course library or training track. |

Broker range | Expanding beyond TradeStation. | Still no crypto on main Stock Hero (use sister site CryptoHero). |

Stock Hero’s platform is fully web-based with iOS and Android native apps available, allowing users to monitor and manage trading bots from any device. There’s no need for a Virtual Private Server (VPS) as the service runs entirely in the cloud.

The unlimited backtesting feature on all subscription tiers is notable, though the depth of historical data varies by plan level. Stock Hero’s platform focuses primarily on stocks, ETFs, and futures, with sister platforms handling cryptocurrency, forex, and CFDs under the same parent company.

For users interested in cryptocurrency trading, Stock Hero directs them to CryptoHero, their dedicated crypto platform that presumably offers similar functionality but tailored to crypto markets.

The broker connectivity limitations may be significant for users committed to platforms that aren’t fully integrated. While TradeStation is the recommended native integration, other brokerages are available through beta connectors or as signal-only options requiring manual execution.

Stock Hero also offers a range of educational resources, including a written user guide, a modest collection of video tutorials, and occasional blog posts with setup tips and strategy ideas.

However, it lacks a structured learning path or curriculum to help users progress from beginner to advanced proficiency.

There are no interactive modules, quizzes, or certification programs, which may leave newer traders relying heavily on trial and error. For users seeking a more hands-on or guided learning experience, this sparse educational support could be a limitation.

A comprehensive Stockhero review wouldn’t be complete without examining the platform’s pricing structure, which offers tiered options to accommodate different trading needs and budgets.

Stock Hero Pricing 2026

Plan | Monthly | Annual (-20%) | Bots | Key Unlocks |

Lite | $29.99 | $299.99 | 1 | Unlimited backtests, TradeStation only, free Sigma Series Alpha bot after trial. |

Premium | $49.99 | $499.99 | 15 | Marketplace access, TradingView, multi-broker support, AI ChatBot, White-Glove onboarding, promo: free Sigma Series Alpha Pack. |

Professional | $99.99 | $999.99 | 50 | 1- & 5-min trading, grid bot, SMS, extended hours, all Marketplace bots free (≈$10K value). |

Stock Hero offers a 14-day free trial on the Lite plan, and all plans auto-renew. The company uses a flat-fee SaaS model with no order-flow payments or profit-sharing with brokers. According to Stock Hero’s terms, subscriptions are charged in advance, and while cancellations prevent renewal, prior payments are non-refundable.

The Lite plan’s limitation to a single active bot and TradeStation-only integration may be restrictive for users wanting to diversify strategies or use different brokers.

The Premium tier adds significant functionality with Marketplace access, TradingView integration, and white-glove onboarding services.

The Professional tier provides the most flexibility with 1-minute trading frequency (compared to 5-minute minimum on lower tiers), extended hours trading capabilities, and free access to all Marketplace bots.

According to Stock Hero, this represents approximately $10,000 in value for the Marketplace bots alone.

For users who purchase the Professional Annual plan, Stock Hero offers lifetime access to all current and future marketplace bots, potentially increasing the long-term value of the subscription.

Alternatives to Stock Hero

Platform | Price | Best For | How It Differs |

Premium $60/mo; Plus $150/mo | Long-term investors who want human guidance plus AI screening. | Curated portfolios & newsletters; no auto-bot execution. | |

Standard $89/mo; Premium $178/mo | Day-traders who need real-time scans & Holly AI swing signals. | Rich desktop client; brokerage autotrading. | |

Standard $53.50/mo; Enhanced $97.75; Advanced $149.25 | Pattern-hunters who like visual AI “robots” and accuracy stats. | Charges per-robot credits; steeper learning curve. | |

Essential $39/mo; Elite $79; Elite Plus $179 (annual) | Chartists wanting automated trendline detection & multi-time-frame backtests. | Provides bots but emphasizes technical analysis, not full automation. | |

$4.95 first month, then $299/yr | Fundamental investors needing AI-summarized reports on any U.S. stock. | Research-centric; does not execute trades. |

These alternative platforms serve different trading styles and investment approaches:

Zen Investor

Zen Investor focuses on long-term investing with human guidance supplemented by AI screening. Unlike Stock Hero’s automated execution approach, Zen Investor provides curated portfolios and newsletters without auto-bot execution, making it more suitable for investors focused on fundamental analysis and longer holding periods.

Trade Ideas

Trade Ideas targets day traders with real-time scanning capabilities and its Holly AI for swing trading signals. It offers a rich desktop client with broker autotrading integrations, potentially providing more robust scanning tools than Stock Hero.

TrendSpider

TrendSpider offers automated trendline detection and multi-timeframe backtesting capabilities, making it particularly valuable for chartists. While it provides some bot functionality, its primary focus is on technical analysis rather than full trade automation like Stock Hero.

Need AI-driven charting instead of full autotrade?

Seeking Alpha’s Virtual Analyst

Seeking Alpha’s Virtual Analyst takes a fundamentally different approach by focusing on AI-summarized research reports rather than trade execution. This makes it complementary to technical trading platforms for users who want to incorporate fundamental data into their decision-making process.

Risks of Trading With Stock Hero

- Over-fitting: A 90% backtest win rate can crumble once market conditions change.

- Latency & slippage: Cloud bots rely on broker APIs; fills may differ from simulated trades.

- Black-box logic: Marketplace bots rarely expose full rules, so performance can’t be audited.

- Regulatory surprises: FINRA has begun scrutinizing “social-copy” algos; compliance matters.

These risks are important considerations for anyone using algorithmic trading platforms. Overfitting occurs when a strategy is too closely tailored to historical data and fails to perform in current market conditions. Latency and slippage can cause real-world performance to differ from backtested results due to execution delays and price differences.

The black-box nature of many marketplace bots means users may not have visibility into the complete logic behind a strategy, making it difficult to evaluate why performance might change. Additionally, regulatory concerns are emerging as agencies like FINRA increase scrutiny of copy-trading models and algorithmic strategies.

If these risks seem concerning, a hybrid model—human analyst first, AI second—like Zen Investor or Seeking Alpha’s Virtual Analyst—can provide a more balanced approach than pure automation.

Final Word: So, Is Stock Hero Worth It?

For hands-on traders chasing short-term edge—and willing to nurture their bots—yes, Stock Hero offers flexibility at a competitive price compared to many AI competitors. The platform democratizes algorithmic trading by removing coding requirements and providing a visual interface for strategy creation.

Yet if you want a plug-and-play service that blends market context, macro outlook, and human judgment, stick with a human-led alternative such as Zen Investor, then layer AI tools around that core.

Either way, treat every algorithm — including Stock Hero’s — like an intern: brilliant potential, but someone (you) must supervise.

FAQs:

Is Stock Hero good for beginners?

Stock Hero offers a paper trading environment that simulates real market conditions without risking actual capital.

This allows beginners to test strategies and learn the platform before committing real money.

However, the platform assumes some knowledge of trading concepts and technical indicators, which may present challenges for complete novices.

Can I create custom trading strategies on Stock Hero?

Absolutely. The no-code Bot Builder lets you combine popular indicators and TradingView alerts.

Stock Hero's visual interface supports technical indicator-based strategies without requiring programming knowledge.

The platform allows users to combine various indicators and parameters to create customized trading approaches that align with their specific trading goals and risk tolerance.

Can I use Stock Hero for cryptocurrency trading?

Not in the main app, but its sister product CryptoHero handles crypto markets.

Stock Hero focuses on stocks, ETFs, and futures trading. For cryptocurrency trading, users need to use CryptoHero, which is part of the same TradeHeroes.ai family of products.

CryptoHero presumably offers similar functionality to Stock Hero but is tailored specifically for cryptocurrency markets.

What exchanges can I link to Stock Hero?

TradeStation for full automation today; beta connectors for E*Trade, Webull, Alpaca, Wealthsimple (CA), Stake (AU), Tradier, and more, with TD Ameritrade and several other providers coming soon.

TradeStation is the primary recommended broker with full integration. The platform also offers beta API connections to several other brokers, with varying levels of integration quality and reliability.

For users of unsupported brokers, Stock Hero can function as a signal provider, generating alerts that can be manually executed.

Are Stock Hero reviews generally positive?

Most Stock Hero reviews highlight the platform's intuitive interface and automation capabilities as strengths.

However, as our Stockhero AI review points out, the limited educational resources and potential for overfitting strategies are commonly noted concerns.

Reviews tend to be more positive from intermediate traders who already understand market fundamentals and use Stock Hero as a tool rather than a complete trading solution.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.