The Internet is awash with stock market analysis. With so many financial newsletters and reports swirling around cyberspace, you can quickly lose your mind trying to decide who’s a real-deal resource.

Paradigm Press positions itself as one of these Wall Street thought leaders, but does it have an accurate pulse on global equities?

Before signing up, consider the latest Paradigm Press reviews and whether this newsletter offers an intel edge.

Is Paradigm Press Legit? The Bottom Line

Personally, while I believe Paradigm Press is legit, it’s not the most attractive financial newsletter. Why?

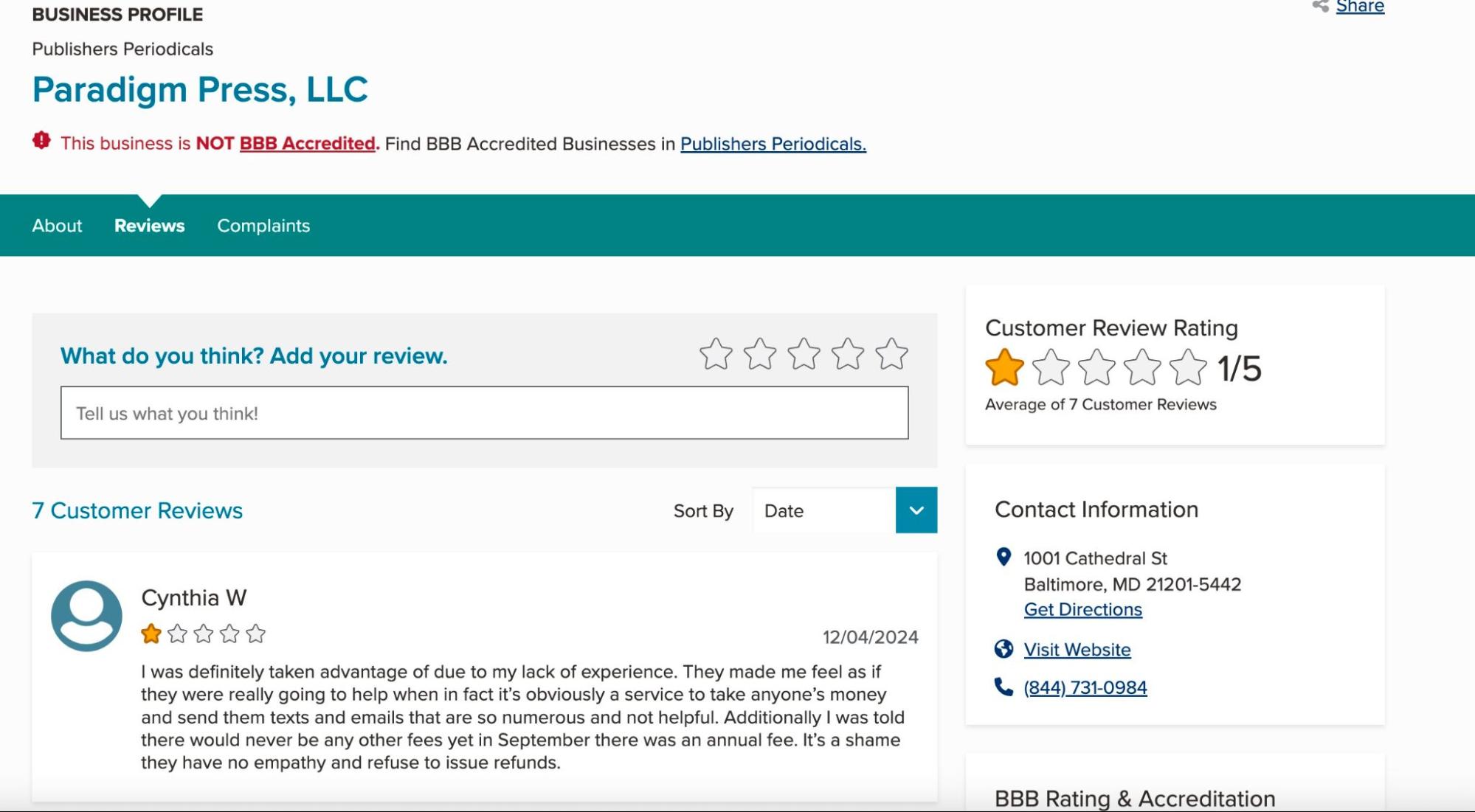

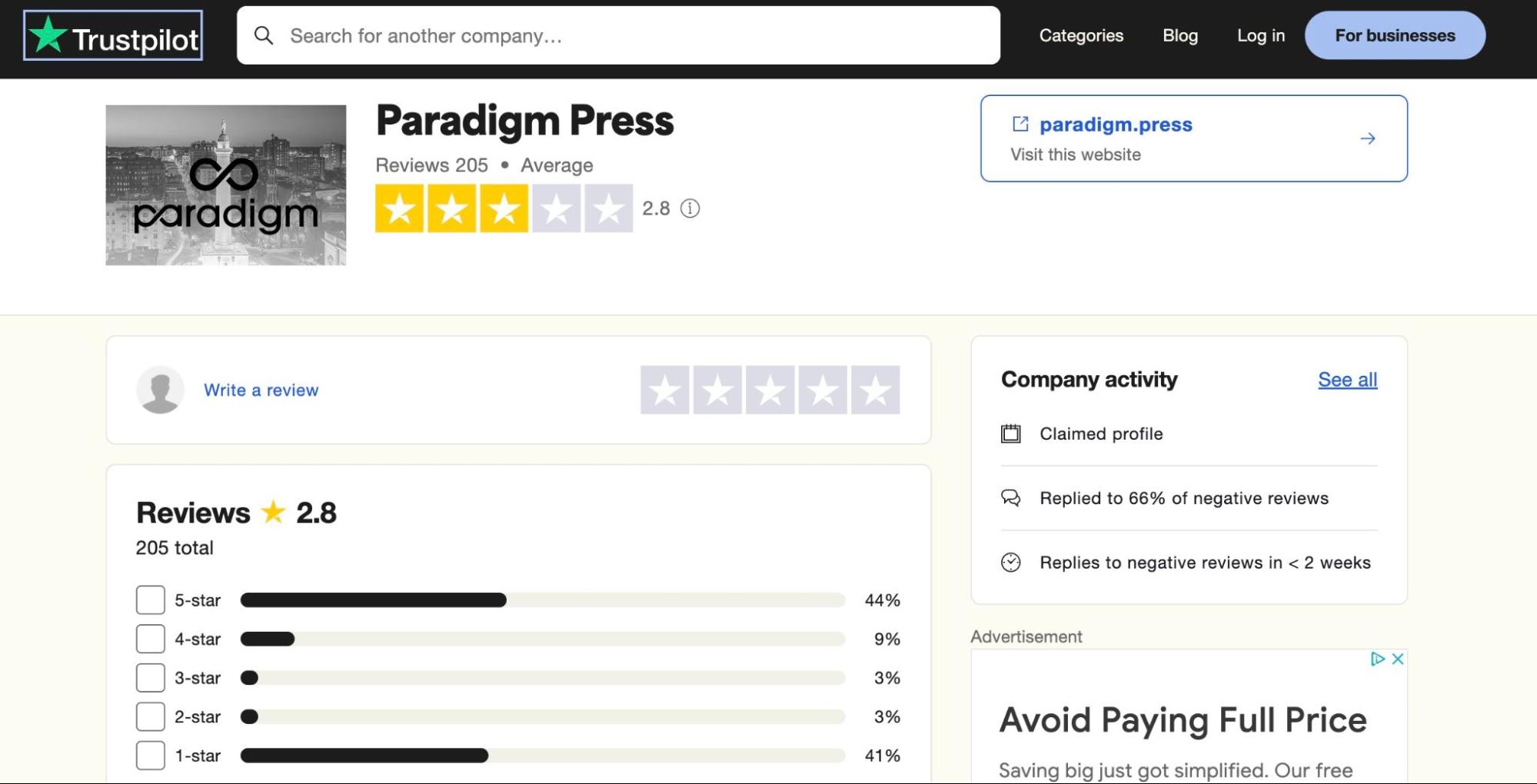

For starters, there are many Paradigm Press complaints on Trustpilot and the Better Business Bureau (BBB). Not a great start.

Second, compared with other reputable financial publications, Paradigm Press doesn’t offer great value for the money.

And to be honest, Paradigm Press has so many subscription options that it’s hard to know what’s what. Instead of offering everything in a single package, there are dozens of choices, which can be overwhelming for newcomers.

If you want a simpler way to analyze the market and spot promising stocks, Zen Investor is the way to go. For just $99 per year ($79 for a limited time, using the links in this post), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Paradigm Press Newsletters

Paradigm Press isn’t just a standalone stock newsletter.

While the name may suggest a singular publication, this site offers multiple publications by authors with different areas of focus.

Author and analyst Jim Rickards’ newsletters are the most popular, but there are many others to consider.

The site organizes its newsletters into the following broad categories:

- Big Ideas

- Technology and Crypto

- Trading and Private Investments

- Income

Within the Big Ideas category, you’ll find multiple Jim Rickards newsletters.

Before we continue the review, let’s take a quick pause to talk about Rickards himself.

Hey. We have a free newsletter. And it’s good.

For regular investing ideas and Strong Buy alerts related to market-moving news, subscribe to our FREE newsletter, WallStreetZen Ideas.

Who Is Jim Rickards?

Who is this Jim Rickards, who is so central to Paradigm Press?

While he may not get as much air time as Peter Schiff, Rickards has a similar “gold bug” philosophy and an “end is nigh” vibe with his fears of a global financial collapse.

Early in his career, Rickards worked at high-level positions in international finance at institutions like Citibank and on Wall Street.

He even got clearance to advise high-level officials at the Pentagon and CIA.

Perhaps as a result, Rickards isn’t shy about expressing his views on the vulnerabilities of the US dollar.

Many of his best-selling books — including Currency Wars and The Death of Money — tackle the USD’s demise head-on.

Rickards also has ties to a neoconservative think tank called The Center on Sanctions and Illicit Finance.

Considering Rickards’ views deeply impact programs on Paradigm Press, it’s a good idea to check out his ideas before diving into Rickards Strategic Intelligence reviews.

After all, if you don’t agree with Rickards’s analytical framework upfront, it doesn’t make much sense to spend any time researching Rickards Strategic Intelligence reviews.

OK, let’s get back to the Paradigm Press newsletters, starting with the popular Rickards-helmed options.

“Big Ideas” Newsletters

Arguably, the top pick in Big Ideas is Rickards Strategic Intelligence, which gives you a peek into Rickards’ brain via briefings, updates, and videos.

Rickards’ analysis is based on the appropriately complex-sounding “complexity theory,” and he gives you the scoop on what assets he foresees performing best in the current environment.

It’s currently $299.99 per year for Rickards Strategic Intelligence or $500 for the “Pro” version (which includes more alerts and details from partner analyst Dan Amoss)

Other Big Ideas offerings include:

- Crisis Trader with Jim Rickards: ($5,000 per year) Provides insights into corporations and banks with stinky balance sheets and how you can profit from their demise.

- Jim Rickards’ Insider Intel: ($5,000 per year) Promises to reveal stocks trending with Wall Street insiders thanks to an in-house “I-3 Indicator.”

- Real Estate Trend Alert: (Price not mentioned) Find out how to get involved in the real estate sector with the help of analyst Ronan McMahon.

- Rickards Uncensored: ($500 per year) Want to hear more from Rickards? This option gives you access to live Zoom sessions for a more interactive approach to investing.

- The Situation Report with Jim Rickards: ($5,000 per year) This report focuses on macroeconomics but uses a technique known as the “Kissinger Cross” to take advantage of market chaos.

Outside of the Big Ideas bubble, you can branch out to more specific sectors or topics.

Technology & Crypto Newsletters

For those most interested in tech investing, James Altucher is the leading man on Paradigm Press.

This hedge fund manager writes about techie topics — alongside other analysts — in publications like Investment Network ($299.99 per year) and Paradigm Mastermind Group ($5,000 per year).

There’s also a $5,000-per-year James Altucher’s Early-Stage Crypto Investor for all of you degen altcoin hunters.

Speaking of high-risk strategies, the Trading and Private Investments category has the most time-sensitive info for day or swing traders.

As a side note — if you’re interested in short-term trading, I have another resource to suggest: Stock Market Guides. One of their top-performing services is their Swing Trade Stock Alerts — where you get regular alerts about stocks that fit a variety of swing trading strategies, all delivered with backtested results and suggested entry and exit points.

With a track record of 79.4% returns on their swing trading alerts, this $69 / month service is reliable — and a heck of a lot cheaper than Altucher’s $5k/year membership.

Trading and Private Investments Newsletters

These reports include the AI-powered Altucher’s True Alpha ($5,000 per year), Microcap Millionaire ($10,000 per year), and The Maverick ($5,000 per year).

Income Newsletters

Lastly, stick with the Income tab for those who want to take a passive approach to investing.

These publications — including Lifetime Income Report ($299 per year) and The Income Alliance ($5,000 per year) — are geared towards people who want a steady cash stream from more predictable strategies like dividends.

Are Paradigm Press Newsletters Worth the Cost?

Considering the wide variation in pricing and topics, it’s tough to say whether one of Paradigm Press’s publications is worth it.

For example, if your forte is real estate, then the Real Estate Trend Alert might be a relevant and worthwhile subscription. Those more interested in riskier strategies may be keen on tech or crypto publications.

But in my opinion, it may be hard to justify the higher-than-average price tag for many of these reports.

In some cases, you’ll be shelling out $5,000 or even $10,000 just to get this info. So, you’d better believe you need a moonshot payday to get back this initial investment.

Also, judging by the Paradigm Press reviews on third-party websites, many people aren’t happy with the quality of these reports.

Currently, Paradigm Press reviews are at an average of 2.8 stars on Trustpilot and 1 star on the BBB.

Keep in mind that Paradigm Press isn’t an accredited BBB business.

Many of the Paradigm Press complaints center around the poor quality of analysis and potential bias from Rickards’ conservative political persuasion.

To their defense, Paradigm Press responded to a few of these complaints offering to reach out for assistance or refunds.

But with all the other options out there — and the lackluster Paradigm Press reviews online — it’s hard to argue the steep price is worth the risk.

Pros and Cons of Paradigm Press

Pros | Cons |

|---|---|

Respected team of published analysts: Whether you agree with their views or not, the writers and editors at Paradigm Press have credibility with multiple prior publications, high-profile roles, and media appearances. | Multiple negative reviews: The majority of Paradigm Press reviews on the BBB and Trustpilot aren’t so hot. Many Paradigm Press complaints center around the inferior quality of their reporting and issues with customer care and payments. |

Wide range of choices: Some may feel Paradigm Press offers too many subscriptions, but this variety of offerings gives people more choices depending on their preferred strategies or budget. | Potential bias: Jim Rickards is known for his conservative views on the market that inform his stance on safe haven assets like gold. This investing style influences Rickards’ strategy, which may not be suitable for people who have a different opinion on global economics. |

Multiple media formats offered: Don’t feel like reading a ton of articles? Paradigm Press has plenty of other ways to absorb information, including videos and Zoom calls. | Expensive: There are a few Paradigm Press courses in the $229.99 range, but many cost upwards of $500, $5,000, or even $10,000 per year. Even at $229.99, this puts Paradigm Press at a very high end versus more established competitors. |

Alternatives to Paradigm Press Newsletters

If you’re not impressed by Paradigm Press’s subscriptions, there are plenty of other newsletters centered on the stock market.

These Paradigm Press alternatives could offer more straightforward stock picks at attractive subscription rates.

Zen Investor – Best for Investors Who Want to Keep it Simple

Cost: $99 for 1 year ($79 using the links in this post), $190 for 3 years, $197 for 5 years

You’ve probably heard the phrase, “Keep it simple, stupid!”

Well, that’s Zen Investor’s goal when sending stock picks to our members. Minus the “stupid” part, because the service follows a simple — but intelligent — formula.

It follows a four-step process that takes account of a company’s fundamentals to figure out whether it’s a worthy investment.

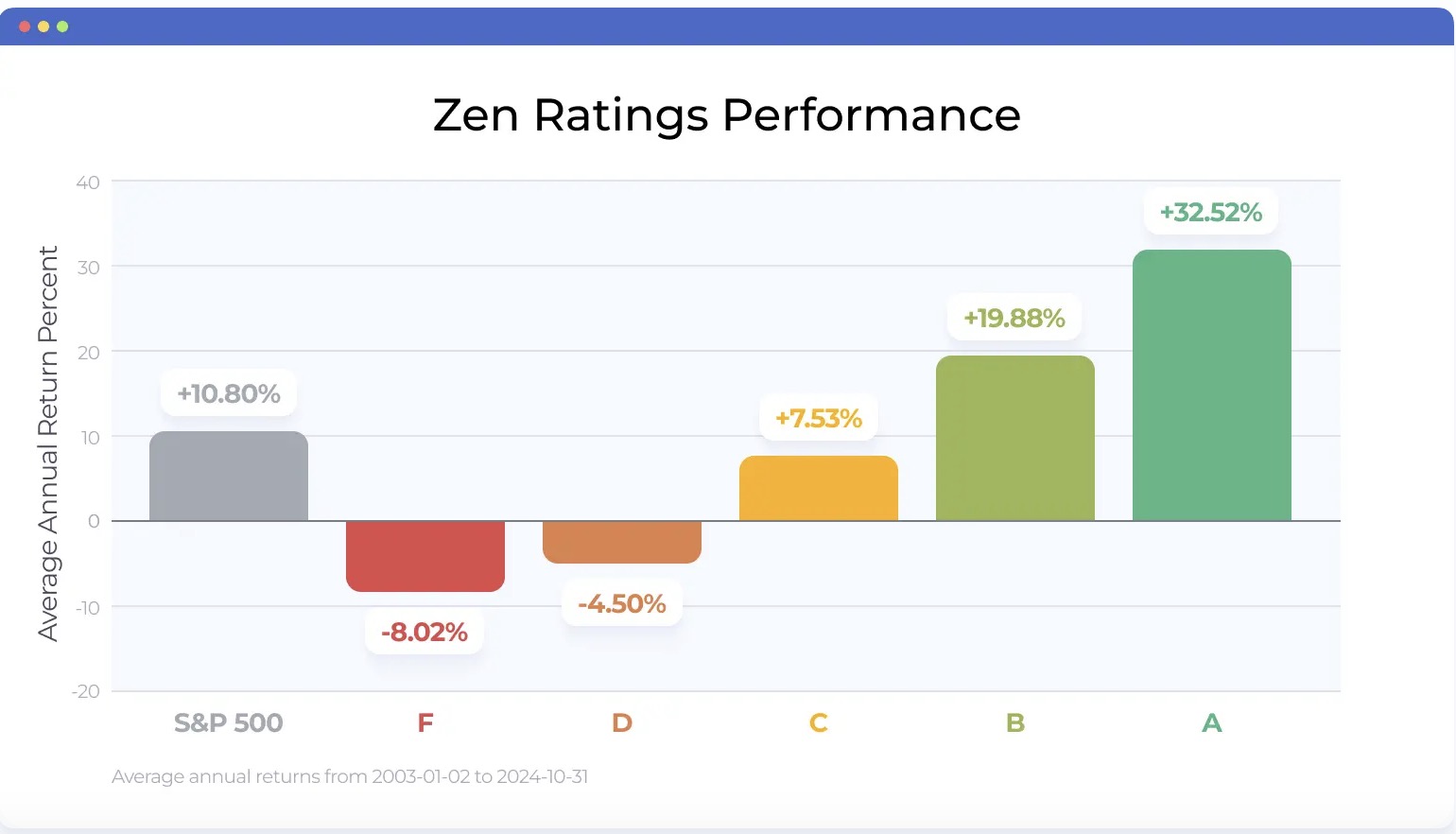

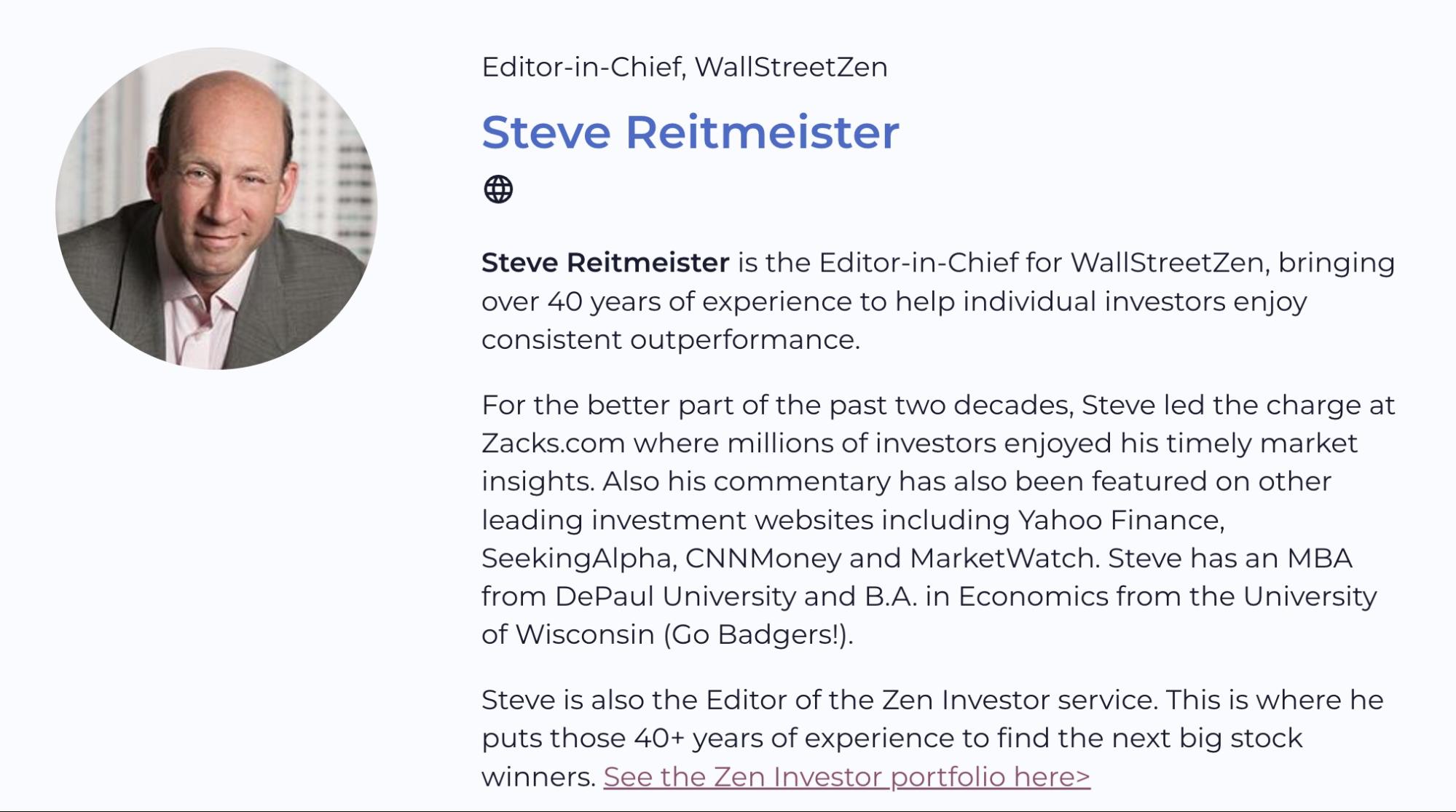

As part of that 4-step process, Zen Investor Editor in Chief Steve Reitmeister reviews every potential stock using our proprietary Zen Ratings system — a system where A-rated stocks have historically generated 32.52% annual returns.

Reitmeister only chooses A or B-rated stocks for the Zen Investor portfolio.

With over four decades of experience on Wall Street — particularly at publications like Zacks.com — Mr. Reitmeister has an exceptional intuition for promising stock ideas.

At just $79 for first year charter members (typically $99), Zen Investor is the most competitively priced professional stock picking service online.

So, if you want a straightforward stock picking service, consider becoming a Zen Investor subscriber.

Motley Fool Epic – Best for Investors Who Want an All-in-One Resource

Cost: $499 per year (Get $200 off using the links in this post)

Since its launch in 1993, the Motley Fool has become a household name in the investment community.

Why is this brand so powerful?

Simple: Its strategies have proven to be profitable!

For instance, Motley Fool Stock Advisor, one of the four Motley Fool scorecards you get with an Epic subscription, has delivered impressive, market-beating returns since its inception:

But with Epic, you get even more — to be precise, access to Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor, along with a bunch of cool stock research tools and resources.

On top of five monthly stock picks, Motley Fool Epic provides features to better analyze stocks, including Fool IQ+, quant projections, and an exclusive podcast. Check out our full Motley Fool Epic review.

While Motley Fool Epic’s price is steeper, many feel it deserves the premium for its reputation and the wide range of tools.

Stock Market Guides – Best for Investors Who Just Want Great Stock Picks

Cost: $69 per month

If you’re less concerned with studying the market and just want the straight scoop on hot stocks, then Stock Market Guides may be an attractive option.

This subscription service uses a proprietary backtesting algorithm to review historical performance and figure out valuable stock and options ideas.

The nice things about Stock Market Guides are its speed and simplicity.

Once this service recognizes high-quality trades, you’ll instantly get a message complete with all the info you need in a cute little box.

For anyone looking for a no-frills stock picking service, consider taking a closer look into Stock Market Guides.

Final Word on Jim Rickards’ Paradigm Press

If we’re solely judging by the third-party reviews, Paradigm Press isn’t the best option for market research.

While the Paradigm Press team is legit and offers many different investment intel reports, it’s simply not as competitive as most alternatives.

Not only does it cost more for a Paradigm Press report, there’s less of a transparent track record, and most Paradigm Press reviews aren’t great.

For most investors — especially those who want a more reputable and affordable option — trying plans like Zen Investor is a better bet.

FAQs:

What is Strategic Intelligence?

Strategic Intelligence is the flagship newsletter offered as a subscription in Paradigm Press. This particular offering focuses on "big ideas" in global finance with analysis from Jim Rickards.

Are there better alternatives to Paradigm Press?

A few Paradigm Press alternatives some may consider "better" include Zen Investor, Stock Market Guides, and Motley Fool Epic.

Is Jim Rickards Legit?

Jim Rickards is a legit financial analyst with years of experience working at high-level banks and government institutions.

What are the common complaints about Paradigm Press?

Common Paradigm Press complaints center around the lack of depth in their analysis, poor customer service, and accusations of unauthorized credit card payments.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.