The Bottom Line: Is Optimus Futures Worth It?

If you are a high-volume scalper or day trader looking to move away from “gamified” apps and into professional futures trading, Optimus Futures is a top-tier contender in 2026

They offer what is arguably the most cohesive “all-in-one” experience by giving you the premium Optimus Flow platform for free — a tool that usually costs monthly subscription fees elsewhere.

But there is a catch.

This Optimus Futures review wouldn’t be complete without mentioning that this broker is a specialist. If you are looking to trade stocks, ETFs, or Options on Apple, you are in the wrong place.

However, if you are strictly focused on Futures and crave low latency and low margins, Optimus provides an infrastructure that generalist brokers like E*TRADE simply cannot match.

Optimus Futures: The Pros & Cons

The Good (Bullish) | The Bad (Bearish) |

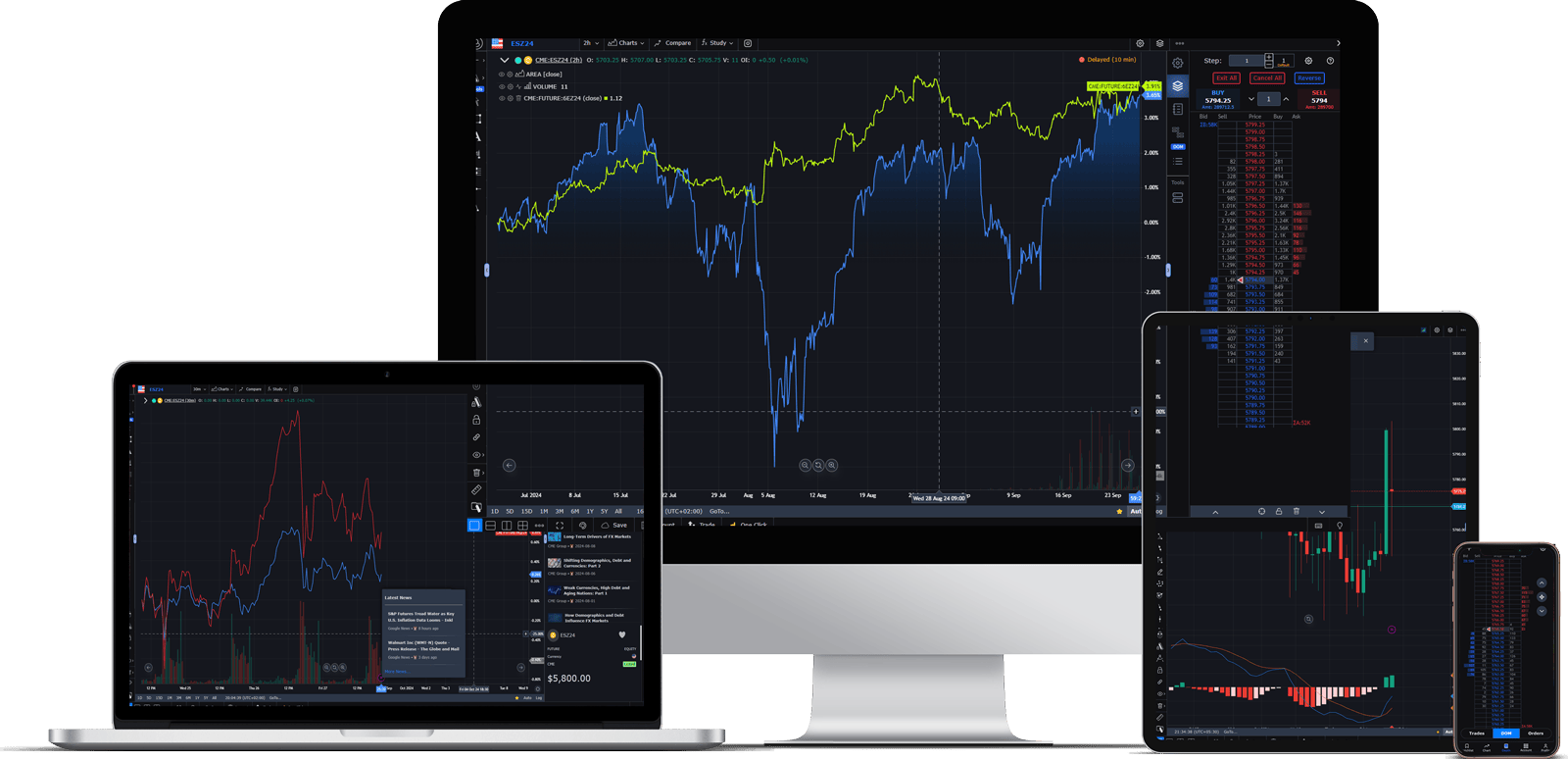

Unified Ecosystem: Optimus Flow syncs your workspace seamlessly across Desktop, Web, and Mobile. | Asset Limitations: Strictly for futures. You cannot trade stocks, ETFs, or vanilla options here. |

Scalper-Friendly Margins: Low intraday margin requirements tailored for high-frequency traders. | Steep Learning Curve: The professional interface (DOM, TPO) is dense and can overwhelm total beginners. |

Institutional Risk Tools: Auto-liquidation and max daily loss limits act as built-in safety nets. | Overnight Margin Jumps: While intraday margins are low, holding positions past 5:00 PM ET requires full exchange margin. |

Global Access: Direct access to major international exchanges (Eurex, etc.), not just US indices. |

What is Optimus Futures?

While less famous than the retail giants like Schwab, Optimus Futures has quietly built a reputation as a “Futures Trader’s Broker.”

Unlike some other brokers, which offer both standalone platforms and a brokerage (sometimes confusing new users on which to choose), Optimus acts as a concierge into the futures world.

They provide the Optimus Flow platform (a white-label of the powerful Quantower) as their signature interface, tailored specifically for speed and order-flow analysis.

Optimus Futures Accessibility

One area where Optimus scores higher than legacy brokers is its Unified Execution Environment.

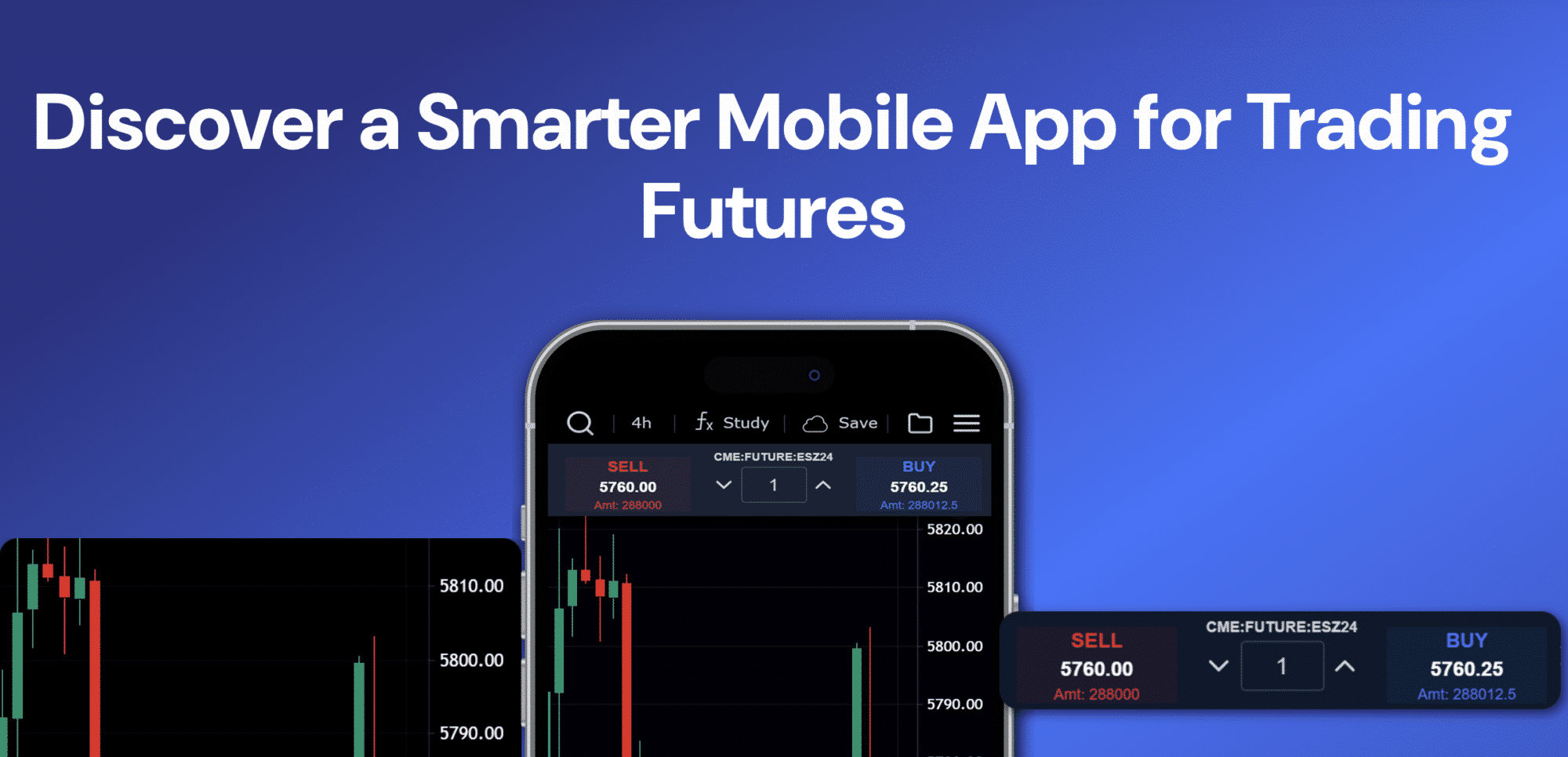

Many brokers force you to choose between a powerful desktop app or a weak mobile app. Optimus Flow syncs your workspace across Desktop, Web, and Mobile.

- Desktop: Professional DOM and TPO charts.

- Mobile: Robust order entry that syncs with the desktop. If you enter a trade on your PC, you can manage it instantly from your phone.

Optimus Futures Key Offerings

1. The Optimus Flow Platform

This is the “Killer App.” Most brokers charge extra for a platform of this caliber.

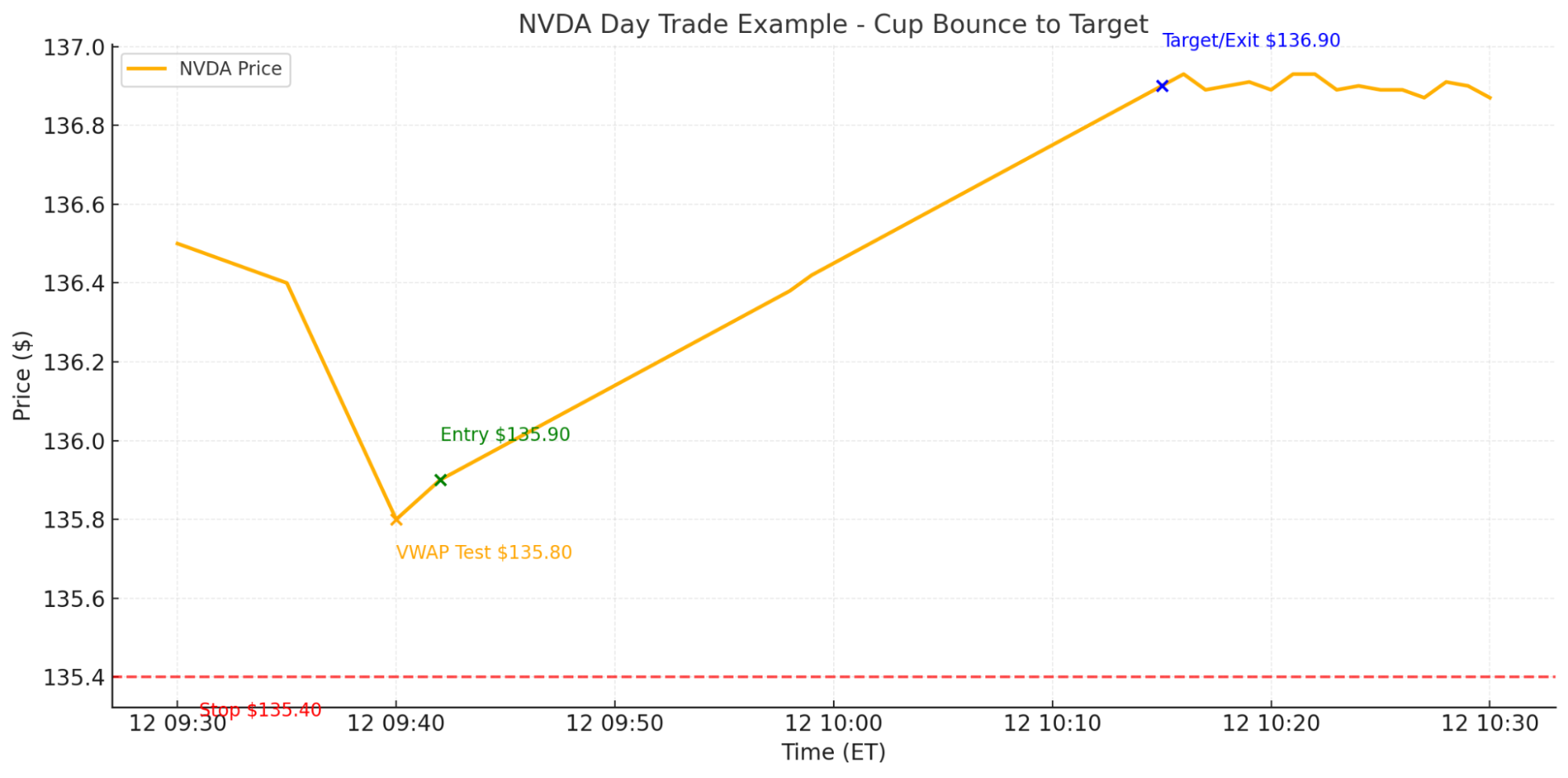

- DOM (Depth of Market): One-click trading designed for scalpers who need to enter and exit in seconds.

- Volume Analysis: Includes TPO and Order Flow tools out of the box, which are essential for modern futures strategies.

2. Institutional-Grade Risk Management

For newer traders, leverage is dangerous. Optimus differentiates itself with automated risk protocols.

- Max Daily Loss Limit: You can set a hard cap (e.g., $500). If you hit it, the system flattens you.

- Auto-Liquidation: A safety net to prevent account blow-ups during emotional trading spirals.

3. Pricing & Margins

Optimus competes aggressively on price. They offer low day-trading margins (as low as $50 for Emini S&P micros) and a tiered commission structure that rewards high volume.

Optimus Futures Reviews: What Are Real Users Saying?

The Praise:

Users on Google, Trustpilot and TradingView consistently cite Customer Support as the primary differentiator. Unlike large firms where you are stuck in chatbot loops, Optimus clients report being able to reach a knowledgeable trade desk quickly.

- Verified User: ” Optimus Futures has made my trading online a great experience. Everyone there is top notch. Would easily recommend to everyone.”

The Complaints:

The learning curve is the most common grievance. Optimus Flow is a professional tool, and beginners moving from Robinhood often find the interface “dense” or “overwhelming” at first glance.

The Reality Check:

Optimus Futures is not for the passive investor. It is a Ferrari engine; if you don’t know how to drive manual, you might stall. But for those willing to learn the platform, the execution speed is class-leading.

Optimus Futures Pricing

- Platform Fee: FREE (Optimus Flow is included for funded customers).

- Commissions: Tiered volume discounts. Micro contracts can go as low as $0.05/side (plus exchange fees).

- Account Minimum: $500 (though $2,000+ is recommended for proper risk management).

- Inactivity Fees: None.

Optimus Futures vs. NinjaTrader vs. TradeStation

Choosing the right futures broker depends entirely on your strategy. Here is how Optimus stacks up against the heavyweights:

Optimus Futures

- Best For: Pure scalpers and day traders who want a premium platform (Optimus Flow) for free.

- The Edge: Superior customer support and “plug-and-play” execution. You don’t need to be a coder to set it up.

- The Downside: Futures only. You cannot trade stocks or options here.

NinjaTrader

- Best For: Automated traders and coders.

- The Edge: Their “NinjaScript” ecosystem is unmatched for building custom bots and algos.

- The Downside: The interface can feel dated compared to modern apps, and the brokerage/platform split can be confusing for beginners.

TradeStation

- Best For: Multi-asset traders.

- The Edge: You can trade futures, stocks, and options all from one account.

- The Downside: Higher margin requirements and a more complex fee structure than discount futures brokers.

How Do You Know If Optimus Futures Is A Good Fit?

Optimus Futures is a compelling trading platform in many respects, but it’s only for a specific breed of traders. As a prerequisite, futures contracts need to be part of your trading strategy, since you can’t swap shares, ETFs, or options on this platform.

If you’ve ticked the “futures fanatic” box, you’ll need to evaluate your trading style and time horizon. Remember that Optimus Futures shines for its intraday margin rates, so if you hold overnight, you’re missing out on one of this platform’s major perks.

That doesn’t mean you can’t get a lot of use out of Optimus Futures if you’re a swing trader, but it’s definitely more appealing for day traders.

A lot of people who really dig Optimus Futures are scalpers who focus on products like E-mini S&P 500 futures (ES) or E-mini Nasdaq-100 futures (NQ). The combination of low intraday margin requirements and the speed and depth of data on Optimus Flow makes it easier to capitalize on multiple 2-tick – 10-tick moves in these highly liquid contracts.

But that doesn’t mean you need to be a professional index scalper right off the bat to get a lot of use out of Optimus Futures. If you’re someone who finds that the basic charts and features on retail apps like Robinhood or Webull are bringing you down, Optimus is the logical next step into the “Major Leagues.”

Just keep in mind that Optimus Futures is an unabashedly pro platform, so there will be a bit of a learning curve if you’re transitioning from more user-friendly brokerages. As long as you’re keen to take your futures trading to the next level, an Optimus account could reward you with more data, lower fees, and exceptional intraday margin rates.

Final Word

If you are tired of paying platform fees and want a broker that actually answers the phone, Optimus Futures is a Strong Choice. If you need to trade Stocks and Options alongside your Futures, look elsewhere.

Disclaimer: Futures trading involves a substantial risk of loss and is not suitable for every investor. Past performance is not indicative of future results.

FAQs:

What are the commissions for Micro Futures at Optimus?

Optimus Futures is priced for volume. Commissions for Micro contracts (like MES and MNQ) start at $0.25 per side (plus exchange and NFA fees) and can go as low as $0.05/side. They use a tiered structure, meaning the more you trade, the lower your rate goes. This is significantly cheaper than most general brokerages that charge flat fees regardless of volume.

How much leverage does Optimus Futures offer?

Optimus provides aggressive leverage for intraday traders through Day Trading Margins.

- Day Trading: You can trade contracts like the Micro S&P 500 (MES) with a fraction of the full contract value (often as low as $50 or $100 per contract depending on current volatility).

- Overnight: If you hold positions past the 5:00 PM ET close, the margin requirement increases to the full Exchange Margin set by the CME.

Note: Leverage increases both potential profits and potential losses.

What is the minimum deposit to open an account?

Optimus Futures is very accessible for retail traders. You can open an account with as little as $500 to start trading Micro Futures.

However, we generally recommend starting with at least $2,000 to give your strategy enough breathing room to absorb normal market volatility.

Is the Optimus Flow platform free?

Yes, for most funded accounts. Optimus Futures typically includes their signature Optimus Flow platform (Desktop, Web, and Mobile) at no monthly cost when you execute your trades through them.

You only pay for the market data feed (e.g., CME Top of Book), which is a pass-through cost from the exchange.

Does Optimus Futures have "Hidden Fees"?

No. They are known for transparency. There are no "inactivity fees" if you take a break from trading.

All costs—including Exchange Fees, NFA Fees, and Data Fees—are clearly itemized on their pricing page so your statement never has surprises.

Does Optimus Futures have good customer support?

Yes, they are widely recognized as a leader in support quality. Optimus Futures maintains high user ratings on Trustpilot and TradingView, largely due to their knowledgeable trade desk.

Clients consistently cite the ability to reach a human expert quickly, whether for technical platform help or account for questions as a primary reason for choosing them over larger, impersonal competitors.

Disclaimer

Futures trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Futures are leveraged products, which means small market movements can result in significant gains or losses. You may lose more than your initial investment. Only capital that can be afforded to be lost without affecting one’s financial condition should be used for futures trading. Carefully consider your financial situation, experience level, and risk tolerance before participating in the futures markets.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.